I am a natural gambler always looking for aggressive ways to make money in the stock market but you don’t have to be so gung-ho and a more conservative approach can still deliver mouth-watering returns.

There are two UK investment trusts which have delivered fabulous returns in the new millennium. We are talking about gains of 20-fold in the last 20 years and with an approach that promises continuing strong gains for the foreseeable future.

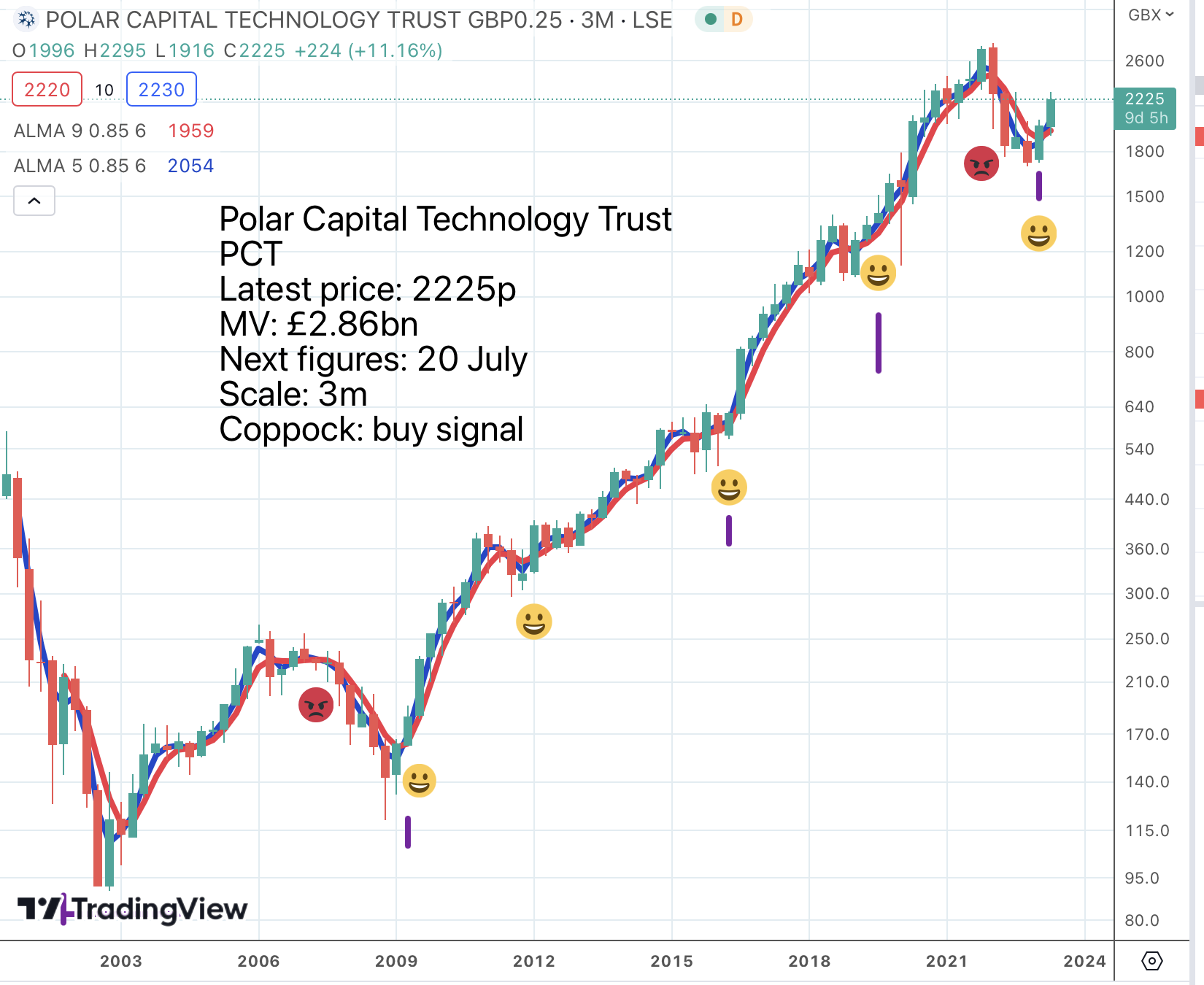

The timing looks excellent as both of these trusts have just given a double whammy buy signal using my indicators.

Table of Contents

Unlike most ETFs, Polar Capital Technology Trust, is actively managed by a team with great in-depth knowledge of the sector. You can learn a lot about what is happening in the world of technology by reading their reports and their regular blogs.

Unlike me, as least explicitly, they don’t take decisions based on charts but on the analysis that they are doing and the companies they visit. We seem to end up in similar places but horses for courses, their approach works for them and the results are impressive.

I never pretend that my approach is suitable for widows and orphans but they probably think their’s is and why not.

The chart is shown above and my little golden smileys and vertical purple Coppock lines have worked well. I am not sure how much the two red frownies would have saved you but they would have spared you some anxiety and that is important because otherwise you might sell at the bottom and that you would regret.

ATT has just the chart you would expect for a technology focused trust if the world is in an unfolding, and even accelerating, technology revolution. It is a long-running uptrend punctuated by regular consolidations and corrections. After each of these the shares go on to reach new highs and that is the best expectation after the latest correction.

Technology is an Evolutionary Process

I have just been reading an amazing article, written seven years ago since when there have been further amazing developments culminating in generative AI, explaining why the pace of technological change accelerates exponentially.

According to the law of accelerating returns, the pace of technological progress—especially information technology—speeds up exponentially over time because there is a common force driving it forward. Being exponential, as it turns out, is all about evolution

Let’s begin with biology, a familiar evolutionary process.

Biology hones natural “technologies,” so to speak. Recorded within the DNA of living things are blueprints of useful tools known as genes. Due to selective pressure—or “survival of the fittest”—advantageous innovations are passed along to offspring.

As this process plays out generation after generation over geological timescales, chaotically yet incrementally, incredible growth takes place. By building on genetic progress rather than starting over, organisms have increased in complexity and capability over time. This innovative power is evident nearly everywhere we look on Earth today.

Biology’s many innovations include cells, bones, eyes, thumbs, brains—and from thumbs and brains, technology. According to Kurzweil, technology is also an evolutionary process, like biology, only it moves from one invention to the next much faster.

Civilizations advance by “repurposing” the ideas and breakthroughs of their predecessors. Similarly, each generation of technology builds on the advances of previous generations, and this creates a positive feedback loop of improvements.

Kurzweil’s big idea is that each new generation of technology stands on the shoulders of its predecessors—in this way, improvements in technology enable the next generation of even better technology.

Because each generation of technology improves over the last, the rate of progress from version to version speeds up.

Staggering Implications as Technology Accelerates

Kurzweil wrote in 2001 that every decade our overall rate of progress was doubling, “We won’t experience 100 years of progress in the 21st century—it will be more like 20,000 years of progress (at today’s rate).”

We’re only 15 years into the 21st century and the progress has been pretty stunning—the global adoption of the Internet, smartphones, ever-more agile robots, AI that learns. We sequenced the first human genome in 2004 at a cost of hundreds of millions of dollars. Now, machines can sequence 18,000 annually for $1,000 a genome.

Singularity Hub, 22 March 2016

Against this background it is no surprise that two actively managed UK investment trusts, totally focused on technology, are doing so well.

Perfect for Widows & Orphans

ATT’s top 10 holdings are a who’s who of the companies driving this revolution.

If you have been reading Quentinvest Alerts, even just in 2023, you will know all about these shares. The only newcomer is ON Semiconductor Corporation, which I learned has just joined the Nasdaq 100 index.

Onsemi is a 3G classic with a great story and a great chart. I am going to add it to the QV Benchmarks list although recommending the shares is not really the purpose of this alert.

Active v Passive

QQQ, which tracks the Nasdaq 100, is the ultimate benchmark stock, and has done very well, especially since 2009. On this very long term chart (6m candlesticks) we don’t have a golden cross yet on the moving averages but it looks as though it is coming. We do have the 3m+Coppock double whammy buy signal.

The top 50 shares in QQQ make a great list and immediately explain why the shares are such a class investment. This fund is market weighted so the shares choose themselves so there is no expensive management team to pay for.

If we compare performance since 2009 we get up 15 times for QQQ, 16 times for ATT and 18 times for PCT, which is not bad going for the active funds.

Strategy – Great for £-Cost Averaging

These are all great shares for a programme of regular investing and investing into red frownies also makes sense because the secular trend is so powerfully higher. Imagine if we are at the dawn of the space age the appetite for more powerful technology is going to be insatiable and only gigantic corporations will be able to cope with the costs involved. Musk, Bezos and company will need to be trillionaires if they are going to conquer space, meld their brains with robots, live in virtual worlds and all the other incredible wonders which may be coming.

Share Recommendations

Allianz Technology Trust. ATT. Buy @ 256p

Polar Capital Technology Trust. PTT. Buy @ 2180p

Invesco QQQ. QQQ. Buy @ $363.50