Well-judged acquisitions can have a dramatic effect on growth and we are seeing this in action with one of my favourite must-own companies. In the latest quarter this company reported growth in its skin care division of 127pc yet it still has only a tiny market share. It has just made an acquisition which will instantly double that share, while still leaving a huge amount to go for.

Table of Contents

This is what one analyst said about the deal.

E.l.f. Beauty’s deal to take over Naturium, which represents the cosmetics company’s largest acquisition to date, fits well into its portfolio, Bank of America analysts say in a research note. E.l.f. has just 1.5pc of market share of skin care, so Naturium would help e.l.f. increase its scope. Bank of America raises its FY24 adjusted Ebitda estimate to $225m from $216m previously and lifts its target price to $165 from $155. “We continue to view margin guidance as conservative given benefits from mix and lower transportation costs, partially offset by higher marketing spend at 22pc-24pc of F24 sales,” analysts say.

Dow Jones Newswires, 30 August 2023

Strategy – Keep Buying ELF Which is a Kamikaze Classic

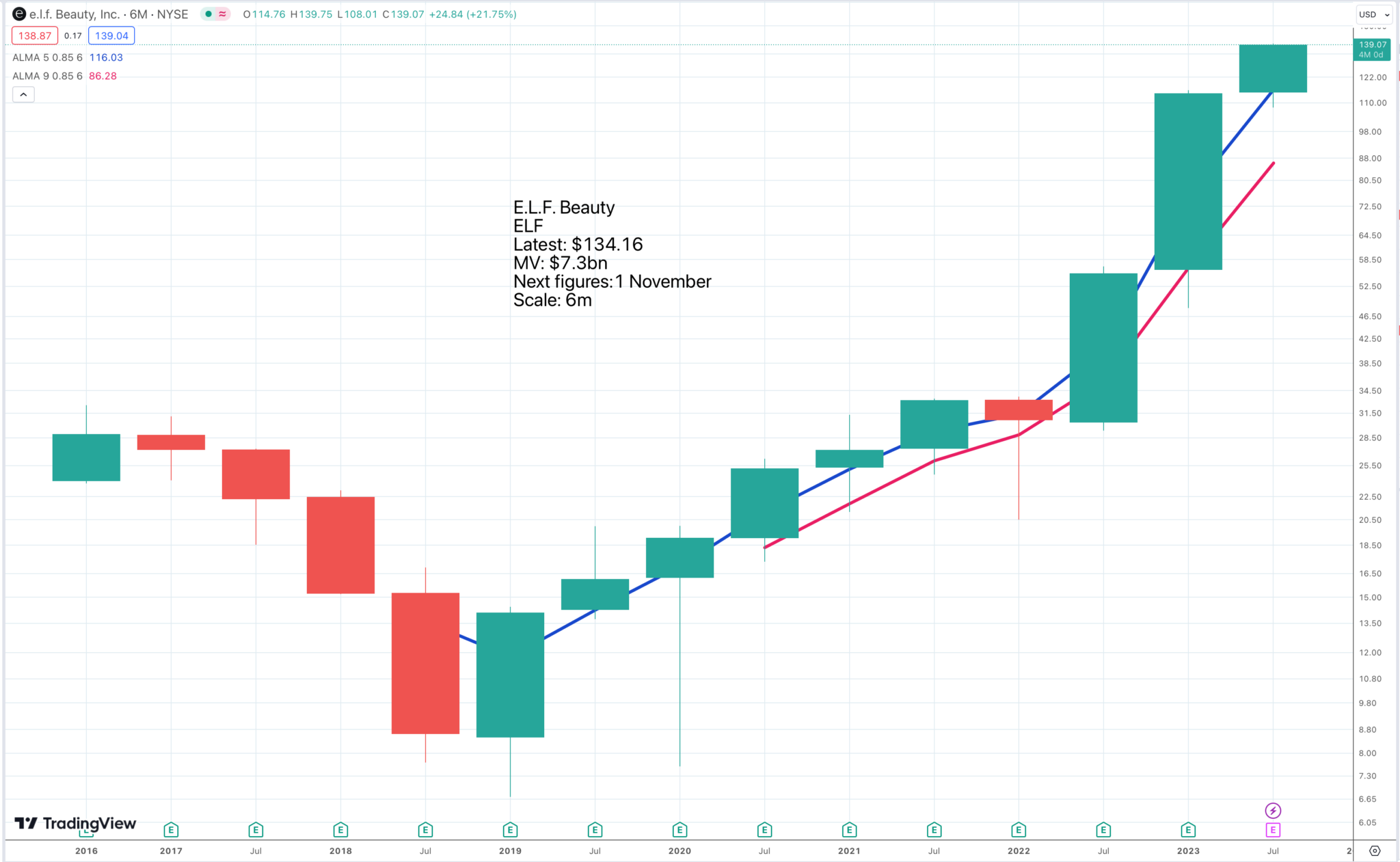

I love the chart above which shows an explosive breakout from six years of sideways trading. As I have noted in the past, 2019 (the low point on the chart) saw some key management appointments, which led to a huge acceleration in marketing spend, which has in turn driven an explosive acceleration in growth.

ELF is disrupting the US beauty market with its focus on value, innovation and 21st century marketing with incredible followings in social media platforms such as TiK Tok. The last three quarters have seen a spectacular growth surge which may well not be over yet.

We’re off to an incredibly strong start this fiscal year, delivering Q1 results well ahead of expectations.

In Q1, we grew net sales by 76pc, increased gross margin by 280 basis points and delivered $74m in adjusted EBITDA, up 135pc.

Across categories and geographies, the three fundamental drivers of our business remain the same. Our value proposition, powerhouse innovation and disruptive marketing engine.

We have a unique ability to deliver Holy Grail products taking inspiration from our community and the best products in prestige and bringing them to market, delivering high quality at an extraordinary value.

While beauty is a category of comparatively low barriers of entry, very few brands have been able to scale. For context of over 1,800 cosmetics and skincare brands tracked by Nielsen, only 58 have surpassed $25m in annual retail sales over the past three years, and only 28 are greater than $100m.

……we believe the unique combination of our areas of advantage form our competitive moat and fuel our ability to win in fiscal 2024 and beyond.

Tarang Amin, CEO, E.L.F. Beauty, Q1 2024, 1 August 2023

Share Recommendations

E.L.F. Beauty. ELF Buy @ $138.5

My own feeling is that the next stop for ELF shares is $200.