Artificial intelligence and machine learning are driving a new wave of stock market success

I spend my days looking at stocks but only one kind. The common factor in all the shares that I look at is that they are 3G (great chart, great growth, great story). If they are not a cursory look sends them to the not-interested pile. Life is too short to invest in anything but the best.

I am increasingly noticing something else, which is the growing importance of artificial intelligence and machine learning. More and more successful businesses are using AI and ML to drive their businesses and be a key part of the products and services they offer to their customers.

Jeff Bezos says A.I. is in a ‘golden age’ and solving problems that were once in the realm of sci-fi. I don’t have his expertise but this is certainly my impression too from seeing how many companies are talking about it and its impact on their business. There are more and more companies now like Upstart Holdings which is explicitly using artificial intelligence to disrupt and dramatically improve the operation of credit markets. Similar things are happening in many fields.

One reason it is happening now is that it is becoming possible. There are no semiconductor stocks in this month’s list of Great Charts recommendations but I am a huge bull of semiconductor stocks of which there are a number in the QV for Shares portfolio and indeed in my own portfolio. You only have to read the latest presentation from Nvidia or numerous other cutting edge semiconductor related businesses to realise that there are an incredible number of exciting things going on of which the roll out of 5G is just one.

This dramatic increase in computing power is making many things possible including dramatic advances in the capabilities of AI and ML. I have just been reading Wikipedia on AI and ML. No surprise it turns out to be much more complicated that I thought. For example, there is a distinction between general AI, which is the idea of a supercomputer with generalised AI problem solving abilities. As Besos pointed out in an interview we are so far from creating such a machine that it is far too early to worry about whether it will be a force for good or bad.

What we do have increasingly is task-specific narrow AI which can contribute to solving a narrow set of problems like credit evaluation. Google Search is a form of AI as are Tesla’s efforts to develop autonomous vehicles and speaking devices like Siri and Alexa. There is even something called the AI effect by which once we learn to use AI to do something it becomes so routine it is no longer considered AI.

What does seem to stand out is that after numerous false starts 2015 has become a watershed in the application of AI to solving practical problems. You can see this in the progress being made by Upstart Holdings. They explicitly describe their business as “Upstart is an AI lending platform partnering with banks to improve access to affordable credit.” The company was founded in 2012 by high level managers from Google. In 2014 the group began offering personal loans based on AI evaluations of credit risk with the actual funding supplied by third parties including banks.

As CEO and co-founder, Dave Girouard, explains the platform feeds off data. The more loans they make the more the algorithms learn and the better the lending decisions they can take in a powerful virtuous circle. This has led to explosive growth in the business. Sales are projected to grow from $164m for calendar 2018 to $738m for 2021 and forecasts of $1.368bn by 2023 look conservative.

Upstart’s share price has been skyrocketing but I can see why. It is not just the phenomenal growth but the potential of what they are doing. The company has done something no traditional bank ever bothered to do. It has developed a way for Spanish speakers to make their loan applications in Spanish. Spanish is spoken by 559m people in the world of whom maybe 10pc are living in the US. It is a huge potential market.

A second key initiative is to offer loans addressed to the auto buying market which the company says has similar inefficiencies to the personal loan lending market but is six times larger. It is no wonder people are getting exciting about the shares but Upstart is not the only company generating excitement from offering AI to solve problems for their customers and improve the experience.

AI thrives on data. The more data you feed into the computers the more the machines learn and the better the results. It is beginning to seem that everybody is starting to jump on this bandwagon. Zoominfo Technologies (ZI) supplies data to help sales teams identify their targets and be sure they have up to date information about them. ZI (not to be confused with the video communications company with a similar name) is basically a sophisticated data gathering operation.

ZI highlights the interchangeability of AI and automation in many business processes. “Chorus [a recent acquisition] simplifies the process of onboarding and training new reps by highlighting best sales practice, automatically recommending top-scoring calls, curating a library of calls on similar topics, benchmarking metrics such as talk to listen ratios or filler words, and surfacing new objections. This allows sales leadership to onboard new reps faster, increase productivity, and drive continuous improvement. Chorus also accelerates our move into the engagement application layer, where sales and marketing teams are leveraging our world-class intelligence to connect with buyers via phone, email, chat, and video meetings in a more automated and efficient way. We know that when we integrate it into our modern go-to-market platform, our customers find increased value in our company, contact, and intent data.”

Chorus is a great move for ZI because it simultaneously improves their offering, adds customers and adds a whole layer to their offer by involving them in the costly and time saving processing of hiring and onboarding new sales staff. Latest results from the company were strong and it is no surprise the shares are breaking strongly higher on the charts.

Tesla is not in the list of recommendations in this issue. I am waiting for the next clear and distinct chart signal to pounce. But Tesla boss, Elon Musk, recently had something typically controversial to say about robots. In his presentation he even have an appropriately dressed human moving robotically around the stage to help us visualise what he thinks is coming with more than a helping hand from Tesla. Forget about work, he says, at least manual work, because robots are going to do that. Why not, I suppose. They already vacuum my floors and may soon be mowing my lawns.

Tesla may presently be more talk than action when it comes to robotics but there is exciting stuff going on. There is a giant Japanese company called Keyence, not featured in this issue of Great Charts but it is in the QV for Shares portfolio, which is doing exciting things with automation. Keyence doesn’t mention AI in their latest annual report but you can bet that it is coming. “Sensors, found in millions of applications, provide the positioning information essential for factory automation. There could be no automation of assembly lines without sensors. Keyence has consistently aided the automation revolution by developing superior sensor solutions.” As noted my impression is that automation and AI are becoming similar sides of the same coin.

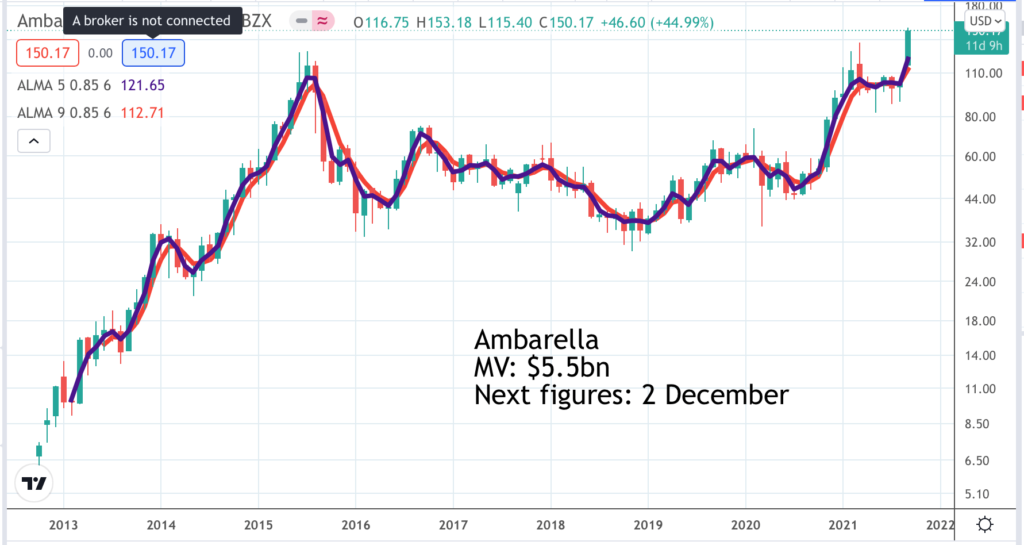

Another company playing a central role in the gathering AI revolution is Ambarella.

Ambarella first made its name as a supplied of low power SoC (system on a chip) vision systems to consumer business like GoPro. When GoPro’s growth lost steam Ambarella slowed too and its shares fell back sharply. Since then the business has been reinvented with 90pc of sales going to automotive and security applications. Ambarella has introduced me to a new acronym, AIoT, which stands for a blend of artificial intelligence and internet of things.

I am becoming increasingly excited about the potential of Ambarella. The chart looks amazing, consistent with a multi bagger advance from here and this is what CEO and founder, Fermi Wang, says about prospects. “While the significant industry wide supply-chain challenges persist, we expect FY2022 to represent a major inflection in our business, and we are excited about our future.”

There is a further transformation going on at Ambarella. It is not just the customer base that is changing. “Since introducing our CV [computer vision] SoC family to the market, we have had more than 240 unique customers purchase engineering parts, and or development systems, with almost 60 unique customers achieving production status in the first half of this year. Even at this early stage of our transformation, we are realizing a revenue mix that is of a higher quality and with more diversification.”

They couldn’t be much more specific about what is happening.

“In conclusion, we are leading a significant shift in how cameras are used and providing the corresponding step function increase in processing performance. In addition to human viewing, all through a lens of a camera, data can be collected and then processed on our SoC, enabling new levels of safety, security, and efficiency through a partial or complete level of automation across multiple industries. This processing we will provide is occurring in purpose-built IoT endpoints, not in servers, where it’s fundamentally different and more expensive SoC architecture is used.

The global economic picture is strong. New stimulus programs are in the works, like infrastructure build in the U.S. Supply side cyclical dynamics are extended. But to be clear, the inflection you are seeing with Ambarella, what gets us most excited is how we are driving AI into numerous IoT endpoint verticals and how we are demonstrating we can capitalise on this tremendous growth opportunity to drive shareholder returns. The demand for deep learning in AIoT endpoint is a new and a critical phase of the digital transformation that is just beginning to impact to so many verticals. Our confidence in our long-term prospects is high. We expect to achieve record revenue in fiscal year ’22, ahead of the $360m revenue in fiscal year in [Inaudible] and we remain comfortable that CV revenue will be at least 25pc of total revenue this year.“

Ambarella epitomises what I am looking for in a stock – great chart, great growth, great story and a massive ‘something new’ transformation taking the business aggressively into new markets.

More and more with technology and digital transformation stocks you find that the story is about artificial intelligence. Shutterstock is an online supplier of images from a vast library. It sounds like an online version of an old school business and as recently as March 2020 the shares were trading at a third of the peak levels reached in January 2014. AI is changing all that as we can see from their comments in the latest quarterly report.

“In broad terms, Shutterstock.AI will offer two discrete solutions, predictive performance and computer vision solutions. The acquisitions we announced this morning relate to our predictive performance offering, which will be rolled out to both e-commerce and enterprise customers gradually over the next six to 12 months. We believe that our predictive performance offering will address a major customer pain point by delivering actionable data-driven recommendations. These recommendations will be embedded in a comprehensive yet intuitive workflow that enables customers to test, analyze and optimize their content prior to deployment.

With these acquisitions, Shutterstock will be able to score our content library to predict performance. As a result, marketers will no longer be guessing or solely using intuition in selecting their content for campaign or other marketing purposes, but rather, they will have predictive insights baked into our offering. This means that Shutterstock customers can pick and choose within our content library with the benefit of predictive insights that will help drive performance for them. These insights will be delivered via either general models, which will not rely on any customer-specific campaign data or custom models, which will leverage an individual customer’s historic campaign data. Lastly, the Shutterstock predictive performance solution does not rely on third-party cookie-based identity data, since it relies on contextual targeting.”

Nor is it going to finish there.

“I want to turn to computer vision. Helping AI models see and understand digital imagery is a large and growing market. Today, a number of our customers are looking to train their own AI models for use cases such as self-driving cars and robotics. To that end, Shutterstock’s computer vision offering leverages and commercializes our extensive dataset, which includes a collection of more than 400m images, videos, music tracks and 3D models, and associated metadata. In short, Shutterstock has built a proprietary process for tagging assets over our 17-year history, which gives us one of the richest datasets in the marketplace, which we continue to enrich.”

The conclusion as with so many business harnessing the power of AI to improve their offerings is growing excitement about prospects.

“We could not be more excited about the potential of Shutterstock.AI and the unique offering we will bring to market, garnering us access to a large and fast growing market. Furthermore, we expect to bring several more exciting innovations to market this year around tools and creative workflows that we think our customers will love, while continuing to provide Shutterstock customers access to fresh and relevant content, which will soon be uniquely augmented with data and insights to drive performance.”

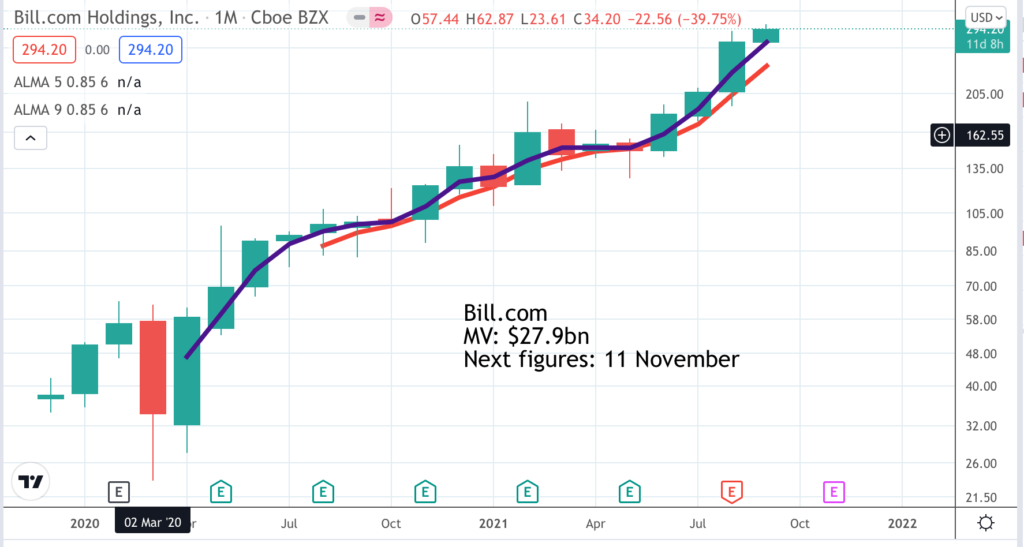

Another exciting white collar automation company, Bill.com, already plays a big part in its customers’ lives. “In fiscal 2021 Bill.com helped more than 120,000 customers and 3.2m network members automate their financial operations and made it even easier for them to connect and do business. In the fourth quarter our customers completed $42bn in TPV [total payment volume] on our platform reflecting an annualised run rate of nearly $170bn. Our customers and network members increasingly adopted our e-payment offerings which enabled them to get paid faster and make payments more conveniently.“

Bill.com recently announced its first acquisition. “Divvy has built a sophisticated software solution that combines budgeting and expense management tools with smart corporate cards.” Bill.com CEO, Rene Lacerte, says “When we are fully integrated, we will provide SMBs [small & medium sized businesses] with a one solution on one platform for all of their B2B [business to business] spend.”

The group is also moving into another area of invoicing. “In July, we announced our plans to acquire Invoice2go, a leading mobile-first accounts receivable solution used by more than 225,000 small businesses including sole proprietors and freelancers in the US, Australia, Canada the UK and more than 150 other countries.”

As Lacerte says “Many of Invoice2go’s customers are service-based businesses, such as plumbers, electricians and contractors. The services economy is still in the early stages when it comes to digital transformation and the shift to online and mobile payments. Invoice2go and Bill.com are jointly in position to capture share of this large market opportunity. Unlike physical product and brick-and-mortar businesses, many service-based SMBs still require paper checks for payments. But this is quickly changing.”

It’s a huge opportunity. “There are more than 20m small businesses globally and millions more sole providers in the markets that Invoice2go serve. In addition, this acquisition opens up significant opportunities for us to transition businesses to electronic payments on our platform. We believe that we can capture a meaningful share of those payments, given our value proposition and the need for businesses to digitize and automate their financial operations.”

Bill.com will already be using AI and ML to help automate and improve their customers’ operations but may still be just getting started on an incredibly technology-driven journey.

Stockmarkets, especially the US stock market, are full of exciting stories like the ones above. These help explain why the indices generally are tracking higher. So much of what is happening is about growth and innovation. Macroeconomic fears can set the market back and trigger waves of profit-taking but they never last long because of the powerful secular drivers pushing share prices higher.

All you need to do to surf the wave is build your own great portfolio. QV and the eco system of publications that make up the package, Great Stocks, Great Charts and regular QV Alerts all based on a growing portfolio of exciting 3G stocks are your road to doing this.

Affirm. AFRM. Buy @ $105.5.

Ambarella. AMBA. Buy @ $143

Asana. ASAN. Buy @ $113

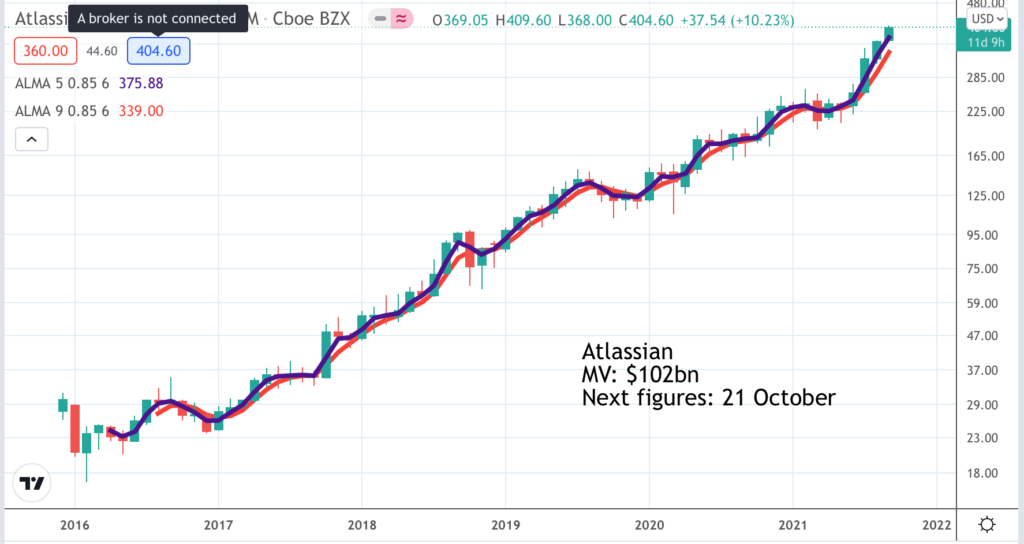

Atlassian. TEAM. Buy @ $394

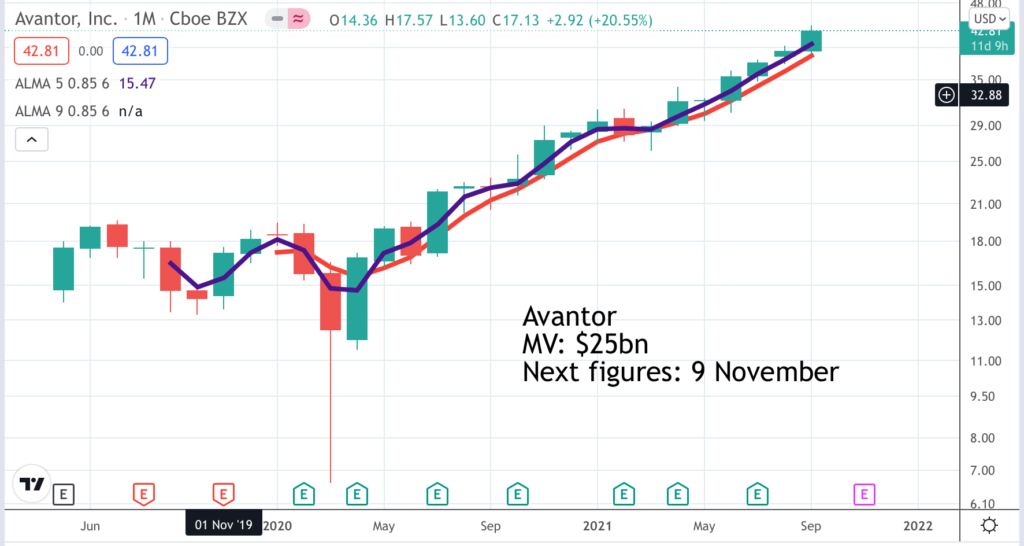

Avantor. AVTR. Buy @ $42.00

Bill.com. BILL. Buy @ $279

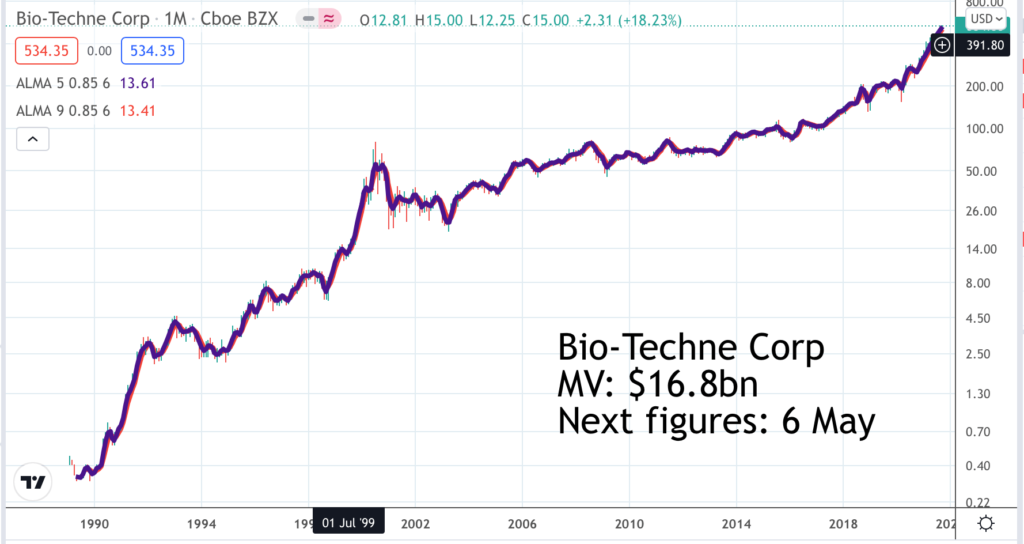

Bio-Techne. TECH. Buy @ $518

Charles River Laboratories. CRL. Buy @ $432

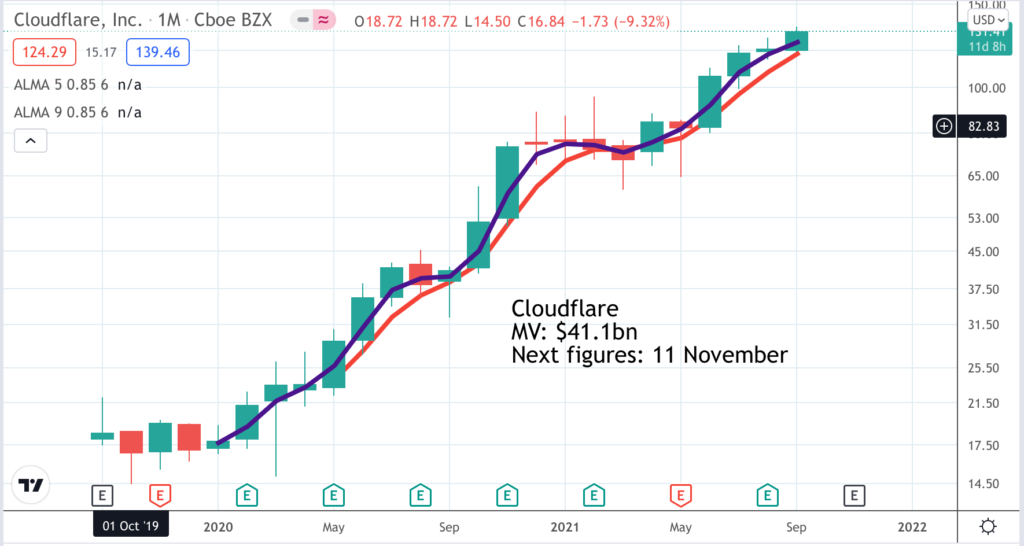

Cloudflare. NET Buy @ $125

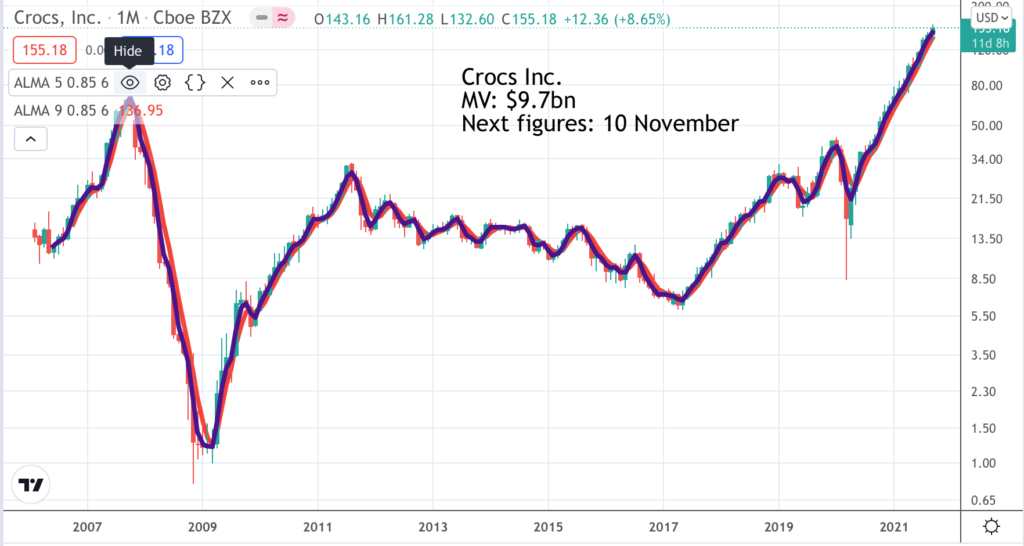

Crocs International. CROX. Buy @ $146.50

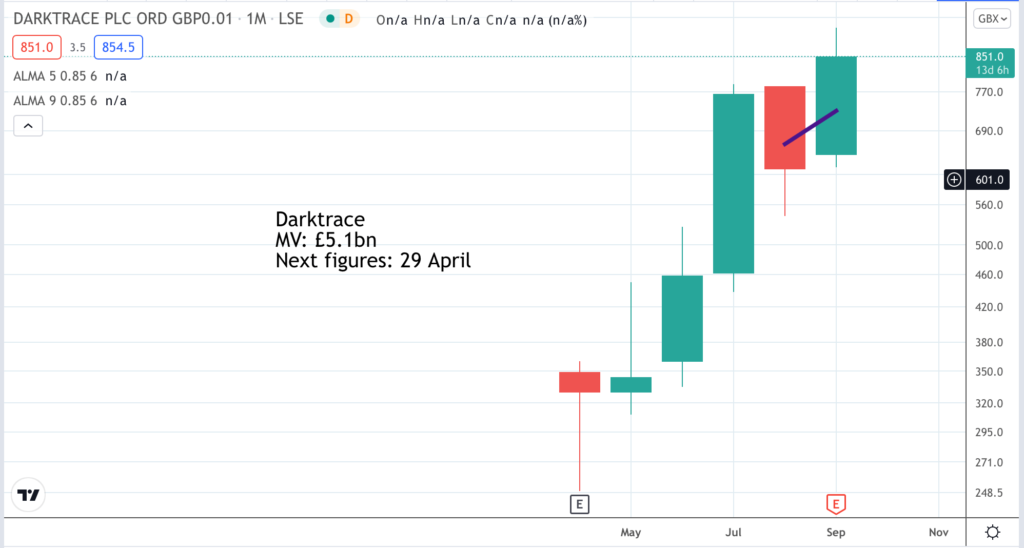

Darktrace. DARK. Buy @ 856p

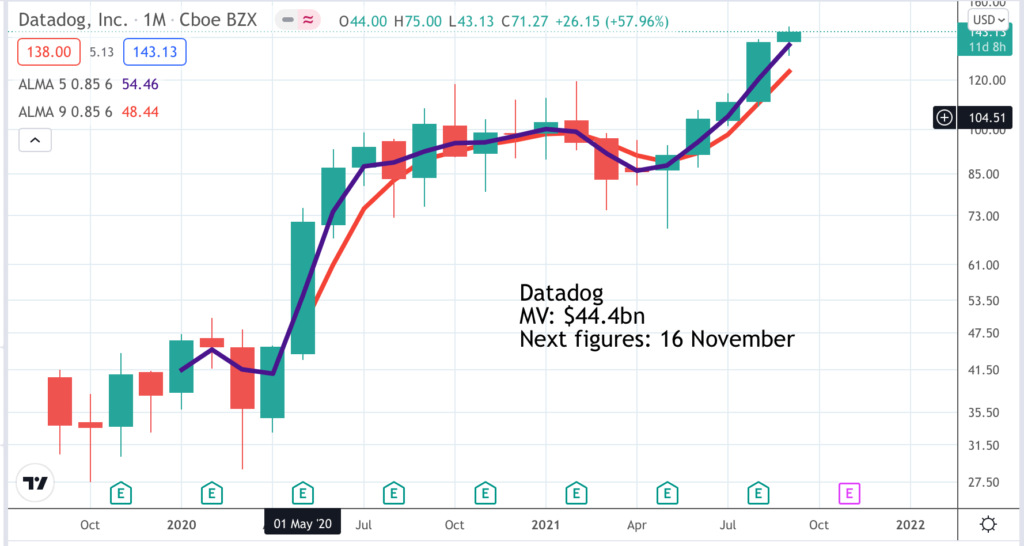

Datadog DDOG. Buy @ $138

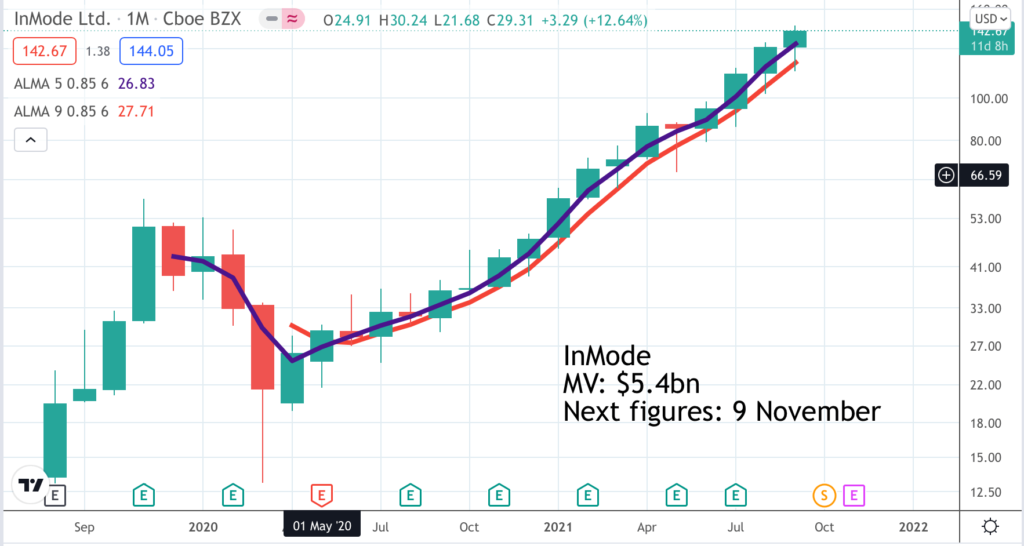

InMode. INMD. Buy @$131

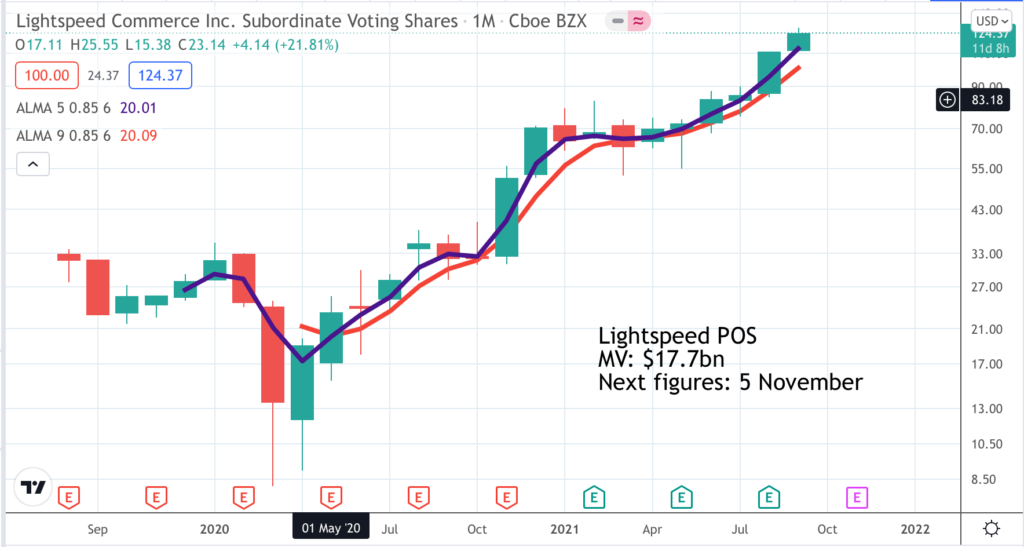

Lightspeed. LSPD @ $117

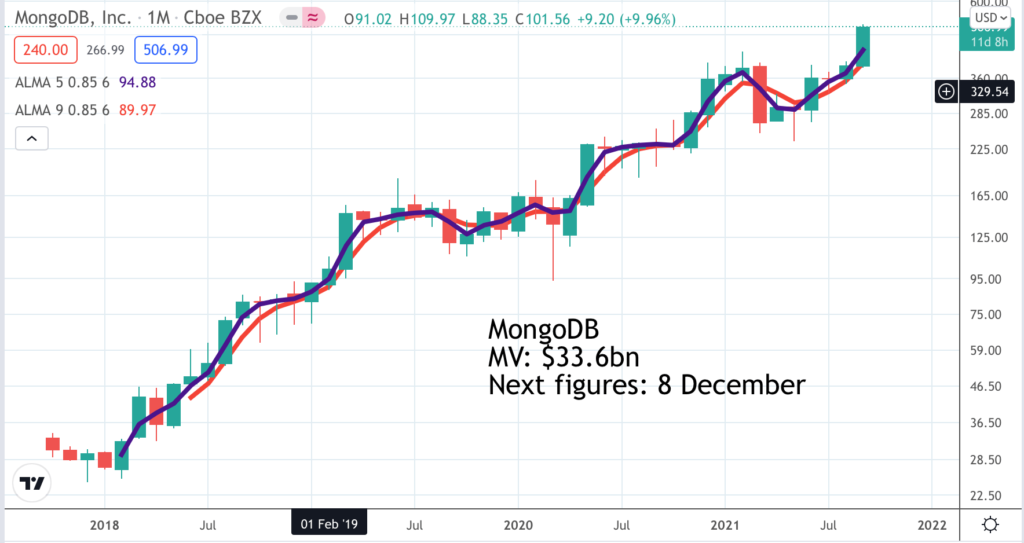

MongoDB. MDB. Buy @ $485

Shutterstock. SSTK. Buy @ $116

Snowflake. SNOW. Buy @ $311

Affirm AFRM. Buy @ $105.5

Affirm is one of a new breed of fintech companies which is using technology to transform the way people pay for things. The most striking manifestation of this is a phenomenon called buy now pay later (BNPL) where people pay for relatively low value items in four fortnightly instalments on which no interest is charged. The people who do pay are the merchants on the platform but they are happy to do so because they sell more goods at full price and build stronger relationships with their customers so everybody wins. There are regular moans about people being lured into debt but all the signs are that BNPL is a vast improvement on credit cards which are slowly but surely dying a death. Affirm also allows customers to buy larger items over longer periods with interest charged but the mantra is no fine print, complete transparency and no compounding interest to drag people into endless debt spirals. Affirm has done deals with Shopify and Amazon which are bringing huge numbers of merchants onto the platform and has ambitious plans to use its growing customer base to introduce more innovative financial products. And there’s more. Max Levchin says:- “What most excites me about the year ahead is the Affirm Debit+ card, which is currently in the hands of several hundred people. We’ve worked very hard to create a product designed to meet the bar of convenience set by the best cards people have in their wallet today. But, we didn’t stop there. Our team has designed and developed the most meaningful innovation to the debit card since its introduction more than 50 years ago, putting unparalleled choice and flexibility directly into the hands of the consumer.”

Ambarella AMBA. Buy @ $143

Ambarella has a history of making small SoCs (systems on chips) to help handheld photographic devices like the GoPro work well. It has increasingly translated these capabilities into low energy consumption chips for security systems and automative applications. These are huge markets offering huge opportunities for the group. Ambarella is also generating a growing slice of revenue from what it calls computer vision (CV). This is what IBM had to say about CV. “Computer vision trains machines to perform these functions [of the human eye], but it has to do it in much less time with cameras, data and algorithms rather than retinas, optic nerves and a visual cortex. Because a system trained to inspect products or watch a production asset can analyze thousands of products or processes a minute, noticing imperceptible defects or issues, it can quickly surpass human capabilities. Computer vision is used in industries ranging from energy and utilities to manufacturing and automotive – and the market is continuing to grow. It is expected to reach US$48.6bn by 2022.” CEO, Fermi Wang says “But to be clear, the inflection you are seeing with Ambarella, what gets us most excited is how we are driving AI into numerous IoT endpoint verticals and how we are demonstrating we can capitalize on this tremendous growth opportunity to drive shareholder returns.” He further notes that “we remain comfortable that CV revenue will be at least 25pc of total revenue this year.”

Asana ASAN. Buy @ $113

Asana is another of these incredibly fast growing US enterprise software companies. It is a leading work management platform that helps teams orchestrate their work, from daily tasks to strategic initiatives. Asana adds structure to unstructured work, creating clarity, transparency and accountability to everyone within an organization—individuals, team leads and executives—so they understand exactly who is doing what, by when. This offering is resonating strongly with their market place. “We had another great quarter in Q2. We accelerated revenues, accelerated enterprise customer growth and increased dollar-based net retention rates across the board. Revenues of $89.5m grew 72pc year-over-year, accelerating 11 percentage points versus Q1. This is a very significant acceleration and the third quarter in a row of acceleration. We are now at a $358m GAAP revenue run-rate.” The net expansion rate is incredible. “It increased over 125pc for customers spending $5,000 or more on an annualised basis, for customers spending $50,000 or more on an annualised basis it increased over 145pc and our overall dollar-based net retention rate increased over 118pc.” There is also the prospect of ever accelerating innovation. “The investments in our product strategy and the Work Graph are paying off, and this is just the beginning.” Last but not least “our NPS (net promotor scores) are the highest we’ve seen to date.” This is a company with every reason to be excited.

Atlassian. TEAM. Buy @ $394

The big thing that is happening at Atlassian is its evolution from a software licensing business to a cloud computing software as a service business. This transformation has delivered amazing results for larger businesses such as Microsoft and Adobe and is showing every sign of being highly beneficial for Atlassian. This is how Q4 2021 performance (to 30 June) was described by the joint CEOs. “Q4 was a great quarter – a ripper, as we Aussies would say. We generated $560m in revenue, up 30pc year-over-year, and achieved subscription revenue growth of 50pc year-over-year. We added over 23,000 net new customers and the pace of cloud migrations continues to build, increasing more than 2x year-over-year. There’s still a lot to get after on this multi-year journey, but we finished FY21 proud of our resilience and what we’ve accomplished together as a team. Those accomplishments include surpassing 200,000 customers and $2bn in revenue, adding over 1,500 new Atlassians to the team, and building five new products on top of our rapidly-advancing cloud platform. Plus, we’re launching into FY22 equipped with a full ladder of cloud editions – Free, Standard, Premium, and Enterprise – designed to meet the needs of virtually any customer.” Atlassian is something like a larger version of Asana helping teams work more effectively together which is more and more people in a developer driven work from home world. Another feature of Atlassian is huge focus on r&d to drive constant product improvement and win new customers.

Avantor. AVTR. Buy @ $42.00

“Our offerings are powering innovation from scientific discovery to scale-up and commercial delivery. We further embed ourselves in our customers’ workflows through our robust service capabilities. The strengths of our model include, high recurring revenues, customised solutions, robust ecommerce platform, strong cash flow generation, enduring customer relationships and subject matter expertise.” Avantor does many things so it is hard to focus exactly on what they do but there is a strong emphasis on supplying health care. Biopharma is over 50pc of revenue and life sciences in total is 70pc with the balance from advanced technologies and education and government. A feature of the company is that it is highly acquisitive. They recently bought Masterflex with annual revenues of $300m which is a market leader in peristaltic pumps (used for pumping a variety of fluids). Michael Stubblefield became CEO in 2014 and the company seems to have acquired a new sense of energy and purpose from that date. Trading is strong presently “In the second quarter, we achieved 20.5pc organic revenue growth and our core growth rate improved for the fourth consecutive quarter to 18.5pc.” And looks set to continue. “Looking ahead, we expect the momentum in our base business to continue driven by strong fundamentals across all of our end markets. Revenues in July have kept pace with first half results and our order book for long cycle proprietary materials continues to grow. We are again raising our 2021 full year guidance.”

Bill.com. BILL. Buy @ $279

Bill.com specialises in white collar back office automation. “With our powerful platform our customers and network members are able to simplify and automate their operations, get paid faster and better manage their cash flow. We expanded our footprint enhancing our go-to-market capabilities. We also acquired Divvy a leader in spend management to help businesses better control their spend with budgeting tools like expense management software and smart corporate cards.” Divvy looks like an important acquisition. “Divvy has built a sophisticated software solution that combines budgeting and expense management tools with smart corporate cards. Our customers have been asking for this type of solution, and Divvy’s spending businesses have also been asking for a bill pay solution. We’ve been working with the Divvy team for about 90 days now and our belief in the team and the vision of what we can build together only gets stronger. When we are fully integrated, we will provide SMBs [small & medium sized businesses] with one solution on one platform for all of their B2B [business to business] spend.” They have some big fans. “Dan Luthi, COO of Ignite Spot Accounting Services said:- “Bringing Bill.com and Divvy together can create an enormous foundation for our customers. Businesses will fully manage their complete expenses, payables and cash outflow in one single system. I love that Bill.com is so simple to use by customers that are not tech savvy. Customers are always looking for super simple value-added tools to help them take the technological leap. Divvy creates the same benefit for expense controls without the client having to know anything about tech or finance. The simplicity is what makes these tools so wonderful.”

Bio-Teche. TECH. Buy @ $518.

The standout feature of Bio-Techne is that 82pc of the business is consumables. Stuff like tissue pathology and liquid biopsies. It’s also global with 57pc of sales in The Americas, 25pc in EMEA (Europe, Middle East & Africa) and 18pc in APAC (Asia-Pacific). The group has four strategies for expansion – geographic expansion, core product innovation, gap-filling m&a and market expansion and culture creation and talent. Its markets are specialised but still large and growing. I totted them up to $20bn, growing at rates between mid-single digits and 20pc and the group’s levels of penetration are low, ranging between one and 10pc. In Q1 2021 they opened a new 61,000 sq ft GMP [good manufacturing practices] protein facility to meet cell and gene customer therapy needs. This is a company which never exactly hits the ball out of the park but every year sees good growth driving the shares relentlessly higher. They project sales reaching $1.5bn in 2025 compared with $358m in 2014 but looking at what is going on I think those numbers could prove conservative. Latest results showed much faster growth. “With 39pc organic growth in the quarter, the fourth quarter closed out a record year for Bio-Techne, where we achieved 22pc organic growth for the full 2021 fiscal year.” And the company says:- “With robust research demand from biopharma end markets and expectations for a favorable government research funding environment, we believe a multiyear research tsunami is upon us.“

Charles River Laboratories. CRL. Buy @ $432

Still on the theme of companies which provide the tools which enable biopharma companies to develop new drugs, Charles River Laboratories’ core business is the supply of laboratory animals for testing, which I am sure will leave some readers feeling queasy. In their defence, so far nobody has found another way and all the later stage trials are on humans. We can’t just experiment with new drugs on the general population. However CRL is making great efforts to diversify its business and widen the range of services which it provides. “The strength of our leading non-clinical portfolio was clearly demonstrated in our second quarter financial performance. Robust industry fundamentals are leading to unprecedented client demand across most of our businesses, and we’re extremely well-positioned to succeed in this environment. Second quarter organic revenue growth was in the mid-teens, even after normalising for last year’s COVID-19 impact and exceeded the long-term low double-digit target that we recently provided at our Investor Day in May.” As they say:- “Our comprehensive portfolio of oncology, CNS, early discovery and antibody discovery capabilities, which we recently enhanced through the Distributed Bio and Retrogenix acquisitions, is resonating with clients, and clients are increasingly choosing to outsource — to integrated Discovery partners like Charles River.” My feeling is Charles River is on a path to sustained accelerating growth.

Cloudflare. NET. Buy @ $125

Internet infrastructure and security business Cloudflare has just had an amazing quarter. “We had our strongest quarter as a public company. In Q2, we achieved revenue of $152m, up 53pc year-over-year. Our revenue growth continued to accelerate as we saw strength across all customer segments. In particular, we added a record of 143 large customers those that pay out more than $100,000 per year and ended the quarter with 1088 large customers, 19pc of the Fortune 1000 are now paying customers and we continue to see particular strength across our enterprise business. Our expansion rate also improved over Q1 with our dollar based net retention reaching a 124pc in Q2. Even with the strong revenue and customer growth, our gross margin improved to 78pc, up 120 basis points year-over-year. If there were a theme for the quarter, it was Cloudflare winning the business of the largest and most sophisticated companies and organisations in the world.” Just as a reminder a key reason why these enterprise software businesses keep growing so fast is that they spend heavily on sales and marketing and research and development. They only doing this because they have such a great opportunity and are determined to take it but in the latest quarter Cloudflare had sales of $152m, made gross profits of $117m and spent a combined $117m on sales and marketing and research and development. It is this spending which turbocharges the recruitment of new customers and provides the innovation which keeps the net expansion rate so high. NER at 124pc means Cloudflare is growing sales by 24pc even before it has landed any new customers. Don’t expect profits anytime soon. “Cloudflare is optimized for innovation and we plan to continue to launch new products, add more customers relentlessly execute and reinvest in growth for the foreseeable future.”

Crocs International. CROX. Buy @ $146.5

Everybody knows about Crocs ubiquitous and wonderfully colourful shoes which have definitely been having a moment since 2017. As part of its commitment to being a zero carbon company by 2030 the company is introducing a new bio-based material for its iconic shoes early in 2022. The business is in fire. “Turning to the highlights of the second quarter of 2021. Revenues nearly doubled versus prior year to $641m and increased 79pc from 2019. Revenue growth was strong across all regions, with the Americas up 136pc and on a constant-currency basis, EMEA up 53pc and Asia up 27pc. Sandals, one of our long-term growth pillars, grew by 57pc in the second quarter and 38pc for the first half. Digital sales grew by 25pc versus prior year and an impressive 99pc versus 2019 to represent 36pc of revenues. Everything they touch seems to be turning to gold. “Clogs sales were outstanding, increasing 101pc year over year to represent 74pc of total footwear revenues versus 68pc last year. We continue to innovate and are encouraged by the initial results of our new platform and seasonal colors and prints. Sandal sales were a standout, increasing 57pc for Q2 and 38pc for the first half, driven by our Classic Slide and Classic Sandal but both feature personalisation, as well as Brooklyn and Tulum franchises. Jibbitz sales were once again exceptional, more than tripling for the quarter versus last year. The global personalization megatrend continues.” Jibbitz are apparently the best way to create a customised design on Crocs. They say “we remain incredibly optimistic about our business and have substantially raised full-year 2021 guidance.”

Darktrace DARK. Buy @ 856p

Darktrace “is a world leading provider of AI for the enterprise, with the first at scale deployment of AI in cyber security, and a pioneer of autonomous response technology. Created by mathematicians, our platform uses machine learning and AI algorithms to neutralise cyber threats across diverse digital estates, including the cloud and networks, IoT and industrial control systems.” This gives us an idea of what they do it not how they do it. It sounds amazing. “Our self-learning technology requires minimal set-up, quickly identifying threats that have breached the perimeter, including threats exploiting previously unknown vulnerabilities, and insider threats. With deep expertise in mathematics and machine learning, as well as operational experience defending critical organisational assets, Darktrace seeks to empower enterprises to defend their systems against the most silent and sophisticated cyber threats.” The company already has considerable scale “Darktrace currently serves over 5,600 customers in over 100 countries, with more than 1,600 employees globally. We are headquartered in Cambridge, UK.” And latest results show that it is growing fast. The company recently closed its largest deal in history. Customers grew 45pc to 5,600 while the r&d team grew 48pc. Since 2018 sales have grown from $79m to $281m with virtually all revenue recurring. CEO Poppy Gustafsson, describes Darktrace’s software as “built from the ground up to defend across the entire attack spectrum.” It sounds amazing. Darktrace is a newcomer to the QV for Shares portfolio.

Datadog. DDOG. Buy @ $138

Datadog is one of a number of exciting French-led enterprise software companies. It was founded in 2010 by Olivier Pomel and Alexis Le-Quoc and has an office in Paris although it is based in New York. The pair were previously working at After Wireless Generation. After Wireless Generation was acquired by NewsCorp, the two set out to create a product that could reduce the friction they experienced between developer and systems administration teams, who were often working at cross-purposes. They built Datadog to be a cloud infrastructure monitoring service, with a dashboard, alerting, and visualizations of metrics. As cloud adoption increased, Datadog grew rapidly and expanded its product offering to cover service providers including Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform, Red Hat OpenShift, VMware, and OpenStack. It has continued to grow at a blistering pace. “For a quick review of the quarter, revenue was $234m, an increase of 67pc year over year and 18pc quarter over quarter and above the high end of our guidance range. We ended the quarter with 1,610 customers with an ARR [annual recurring revenue] of $100,000 or more, up from 1,015 in the year-ago quarter. Those customers generate about 80pc of our ARR. We have about 16,400 customers, which is up from about 12,100 last year. We also continued to be capital efficient with free cash flow of $42m. And our dollar-based net retention rates continued to be over 130pc as customers increased their usage and adopted our newer products.” It is no surprise they say “we are extremely excited about the opportunities we see to democratize data and help customers increase visibility and manage complexity.”

Inmode. INMD. Buy @ $131

Nobody talks about having plastic surgery but it is obvious that many people have it and if the procedures were non-invasive those numbers would increase dramatically. This is what is on offer from InMode. This is what they say. “InMode develops, manufactures, and markets platforms that harness novel radio-frequency (RF) based technology that strives to enable new emerging minimally-invasive procedures and improve existing surgical procedures. InMode has leveraged its medically-accepted RF technologies to offer a comprehensive line of platforms that will enable us to capitalise on a multi-billion dollar market opportunity across several categories of surgical specialty such as plastic surgery, gynecology, dermatology, ENT’s and ophthalmologists.” It is certainly delivering on the corporate front. “For the second quarter of 2021, InMode is happy to report record revenues of $87.3m, an increase of 184pc compared to the second quarter of 2020. Also this quarter, net income on a GAAP basis reach $40.9m and $43.9m on a non-GAAP basis. During Q2 2021, sales of capital equipment accounted for 89pc of our total revenue, the remaining 11pc was derived from consumable and services, representing $9.5m of our total revenue, a 22pc increase compared to last year. Quarter by quarter, over the past year, InMode consistently posted sales of a record number of consumables. From Q2 2020 until today, sales of consumables have more than doubled.” The company is also looking to expand its horizons. “Presently, InMode’s R&D pipeline is comprised of dozens of projects in our traditional area of activity in aesthetic surgery, as well as in gynecology, ophthalmology, and ENT, and more”

Lightspeed PoS. LSPD. Buy @$117

Lightspeed CEO, Dax DaSilva, started his latest earnings meeting in typically American gang-ho fashion. “Before I get started, I just wanted to welcome everyone from NuORDER to the Lightspeed team. Together, Lightspeed and NuORDER are going to redefine how suppliers and retailers interact with each other and revolutionize supply chain management in the industry. I could not be more excited about the opportunity that awaits us all.” NuORDER is a leading B2B e-commerce platform helping brands deliver a seamless, more collaborative wholesale process, where buyers can browse products, plan assortments and make smarter buys in real-time. You can see why Lightspeed’s management are excited. Latest results were phenomenal. “Total revenue was up 220pc year over year with organic software and payments revenue up 78pc. The company now maintains over 150,000 retail and hospitality locations globally. GTV [gross transaction volume] was strong, growing 203pc year over year to $16.3bn. Organic GTV growth was 91pc. Payments penetration continues to increase with approximately 10pc of our GTV processed through our payment solutions.” There is an element of bounce back here because Lightspeed’s business is heavily focused towards events and hospitality but equally there is still plenty of bounce to come. DaSilva says “the potential for Lightspeed as a true one-stop commerce platform has never been greater and the probability of success has, in my mind, never been higher.”

MongoDB. MDB Buy @ $485

MongoDB is another of those US enterprise software companies that has an amazingly sustained ability to deliver strong growth. In the last seven years as CEO, Dev Ittycheria, says:- “We went from being a small private company with an interesting technology to disrupting one of the largest markets in all of software. Along the way, we changed how open source software is licensed, we introduced a new cloud service that required us to both partner and compete with the largest cloud providers, and we grew revenues 20-fold with a compound annual growth rate of over 50pc. I’m incredibly grateful to all the amazing people at MongoDB and to our customers and partners around the world who made this happen. As proud as I am of the amazing journey we’ve had, I’m even more optimistic today about our opportunities ahead.” American companies are always ‘just getting started’. “Looking quickly at our second-quarter financial results, we generated revenue of $199m, a 44pc year-over-year increase and above the high-end of our guidance. We grew subscription revenue 44pc year over year. Atlas revenue grew 83pc year over year and now represents 56pc of our revenue, and we had another strong quarter of customer growth, ending the quarter with over 29,000 customers.” Data and data bases play a key role in digital transformation and MongoDB has a document based platform for database management with great appeal to developers. As Ittycheria puts it:- “First, MongoDB’s document model is designed around how developers think and code unlike legacy data technologies. This enables developers to be far more productive and build applications faster as compared to any other technology. Second, MongoDB’s document model is a superset of other data models – tabular, key value, time series, graph, and other kinds of data relationships can be easily created using documents.”

Shutterstock. SSTK. Buy @ $116

Shutterstock may be familiar to some readers as the supplier of online images from a vast and growing library. This is the core of the company but Shutterstock is a business in the throes of an AI-enabled transformation. This change is partly based on acquisitions. “With these acquisitions, Shutterstock will be able to score our content library to predict performance. As a result, marketers will no longer be guessing or solely using intuition in selecting their content for campaign or other marketing purposes, but rather, they will have predictive insights baked into our offering. This means that Shutterstock customers can pick and choose within our content library with the benefit of predictive insights that will help drive performance for them.” I am increasingly seeing this idea of moving away from intuition to data driven insights in connection with AI. Also on the agenda is computer vision. “Helping AI models see and understand digital imagery is a large and growing market. Today, a number of our customers are looking to train their own AI models for use cases such as self-driving cars and robotics. To that end, Shutterstock’s computer vision offering leverages and commercialises our extensive dataset, which includes a collection of more than 400m images, videos, music tracks and 3D models, and associated metadata.” The company is already doing well. “The result for Shutterstock was revenue growth of 19pc in the second quarter and constant currency organic revenue growth of 12pc, a meaningful acceleration. Subscriber KPIs were exceptional with subscriber count growing 44pc and subscriber revenue growth of 25pc. E-commerce was up 23pc in Q2 2021 driven by balanced growth across image, footage and music, as well as the strong performance of TurboSquid 3D.” The unsurprising conclusion. “We could not be more excited about the potential of Shutterstock.AI and the unique offering we will bring to market, garnering us access to a large and fast growing market.“

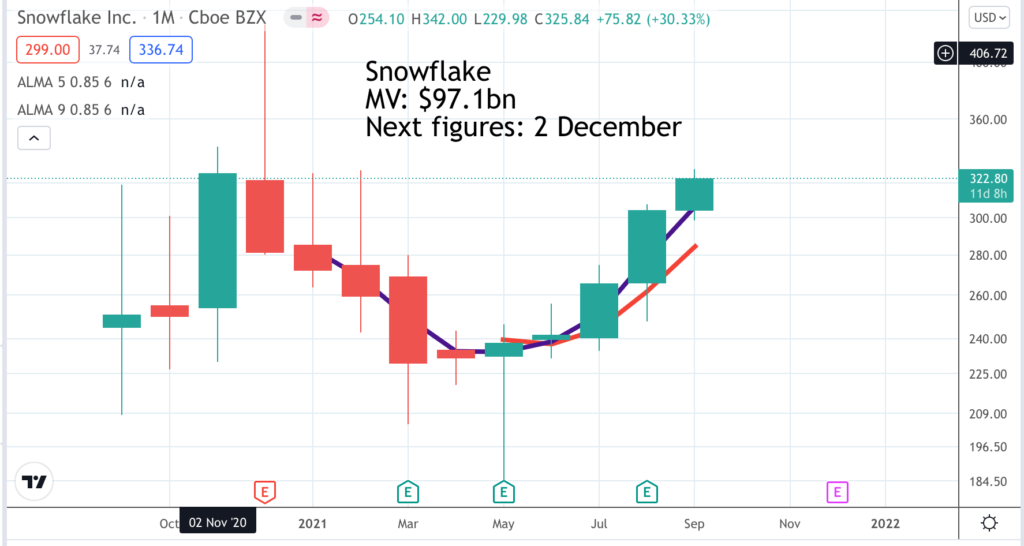

Snowflake. SNOW. Buy @ $311

Like MongoDB but different, Snowflake is an enterprise software company, already valued at nearly $100bn, which is all about data. Snowflake offers a cloud-based data storage and analytics service, generally termed “data warehouse-as-a-service”. It allows corporate users to store and analyze data using cloud-based hardware and software. Snowflake has run on Amazon S3 since 2014, on Microsoft Azure since 2018 and on the Google Cloud Platform since 2019. The company is credited with reviving the data warehouse industry by building and perfecting a cloud-based data platform. It was able to separate computer data storage from computing before Google, Amazon, and Microsoft. This capability is driving very strong growth. “We saw continued momentum in Q2 with 103pc year-on-year growth to $255m of product revenues, reflecting strength in Snowflake consumption. The remaining performance obligations grew to $1.5bn, indicating strength in sales. For the first half of fiscal ’22, total revenues were $501m, up 107pc year on year. As the net revenue retention rate reached 169pc, we also saw non-GAAP product gross margin and operating margin efficiency improved to 73.6pc from negative 8pc, respectively.” The company is also driving innovation with the announcement of a new developer experience called Snowpark. “Powered by Snowflake is designed to accelerate the delivery of differentiated applications on Snowflake by supporting developers across all stages of the application journey in Snowflake’s data cloud. Today, there are over 80 Powered By partners, including founding members, BlackRock, Adobe, Lacework, Observe, and OppLoans. Increasingly, application providers are enabling their apps to operate directly against their customer Snowflake accounts, meaning no data needs to be copied or replicated, simplifying data governance while accelerating the network effect of the data cloud.”