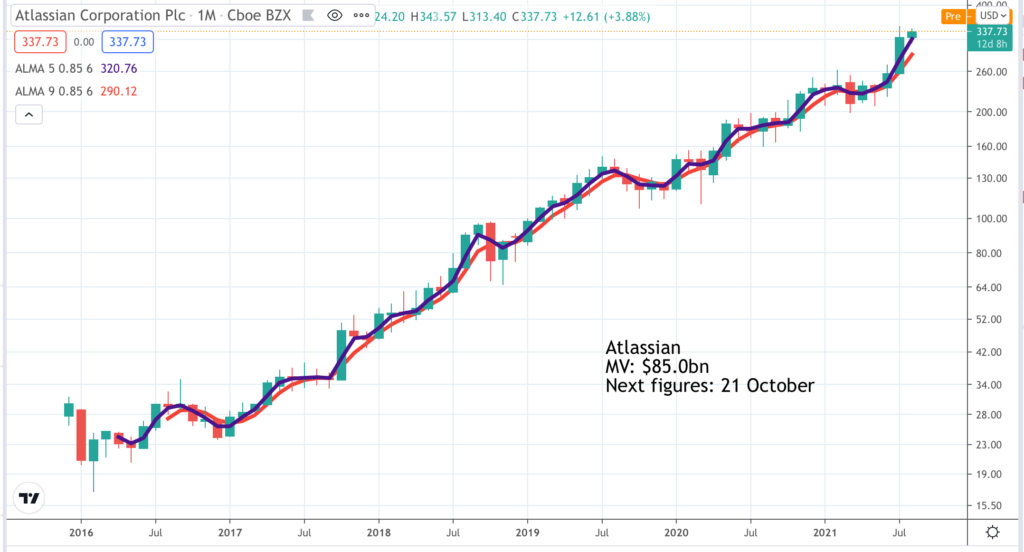

Atlassian. TEAM. Buy @ $335 Times recommended: 15 First recommended: $110 Last recommended: $329

“As the world digitizes, companies are realizing that technology is the true competitive advantage. Every company will either become a digital company or perish. At the same time, cheap capital is fueling this once-in-a-lifetime technology investment boom. Because technology is built by people, the combination of these factors creates a much tighter, more expensive market for the best talent. We believe this will be the case for a long time and will be incredibly challenging for many companies to navigate.

For Atlassian, these twin forces of digital transformation and the technology boom mean the opportunities in front of us have never been greater. Hence, even more than last year, we are going to continue to play offense in FY22. Our uniquely efficient business model and historical capital efficiency allow us to hire ambitiously and continue investing in our strongest asset: our people.”

The quote above doesn’t just apply to Atlassian. It applies to any successful enterprise technology company. They are the businesses providing the tools that enable the digital transformation that all companies must make or perish as they say above.

Australian-based Atlassian is a key player in this market going head to head with such powerful US businesses as Microsoft and ServiceNow. These last two companies are bigger than Atlassian but with a market value over $80bn the gap is closing.

Atlassian was founded in 2002 by two Aussie entrepreneurs, Mike Cannon-Brookes and Scott Farquhar, who are still only in their early forties so full of ambition to keep gunning for further world conquest.

Atlassian’s big project is to help its customers reinvent the way people work together. This is a huge project and means their addressable market, rather like Datadog, see previous alert, is everybody. They have a growing range of products but these are grouped around three key areas. The company calls these agile development, ITSM (IT service management) and work management for all.

The stock market code for the company is TEAM and a key rival is Microsoft’s Teams software, which gives you a powerful clue to the market they are addressing. It also tells you a lot about how corporates have changed. Back in the day when I started analysing companies they were still built around officers and men, head office and factory workers, white collar and blue collar, bosses and bossed.

In the world of software this has changed dramatically. Everybody is a key worker, starting salaries are often into six figures and everybody from CEO and founder to latest hiring expects to work collaboratively, often now from home. It is a different world and requires a lot of thought to make it work. This is the task which Atlassian has set itself and explains why it plays such a key role for its customers.

An important innovation at Atlassian is that they use their web site and their partner channel to sell their software. The money they save on direct sales and marketing, the biggest cost at many software companies, they spend on r&d and keeping prices low. The idea is to offer such outstanding value for money that the products sell themselves.

“Atlassian works with over 700 Solution Partners and Global Alliance Partners who provide a higher-touch sales and rollout experience and drive over one-third of its total revenue. Cloud sales from channel partners are up 300pc”

As with Upstart, see earlier alert, the company is developing software which its customers, often very large businesses like Amazon, could, in theory, develop themselves. However this would be expensive. It makes sense to outsource the job to a specialist like Atlassian which does nothing else and hired 1,500 people in the last year alone, mostly for its r&d department.

There is another exciting thing which is happening at Atlassian. Because the company launched its first product in 2002 it began life as a traditional software company selling licenses and upgrades. This is now an old-school way of doing things and the group is making the transition to the cloud. It is doing this with great success as noted in Cannon-Brooks’s latest shareholder letter for the year to 30 June 2021.

“Building a world-class cloud platform and migrating our installed base of server customers continues to be our primary focus. Our momentum stayed high in Q4, with large customer cloud migrations (1000+ users) up 70pc quarter-over-quarter? , and cloud revenue up 47pc year-over-year.”

This is not only a more customer-friendly way of doing business but also a facilitator of faster growth in the future.

“Our platform provides both a strong foundation for our current products and an accelerant for delivering new products and features.”

As well as the channel partners who work with the sales effort, Atlassian works with what it calls marketplace partners or developers. They play a key role in developing apps to customise Atlassian’s platforms for the many uses customers have for them. This is becoming a significant operation.

“Over 25,000 developers contribute to the Atlassian Marketplace. Hundreds of profitable startups have built and scaled SaaS offerings in partnership with Atlassian. Over 600 apps were added to the Marketplace in FY21 and over 60pc of Atlassian customers use an app built by developers from the Marketplace. Atlassian recently announced that Forge, its next-generation cloud app development platform, is generally available. Customers and developers can rely on Forge’s infrastructure, storage, and function-as-a-service to build cloud apps to extend, customize, and integrate with Atlassian cloud products. Forge reduces the cost and complexity for developers to build cloud apps. Over 500 apps have already emerged from Forge’s early access program.”

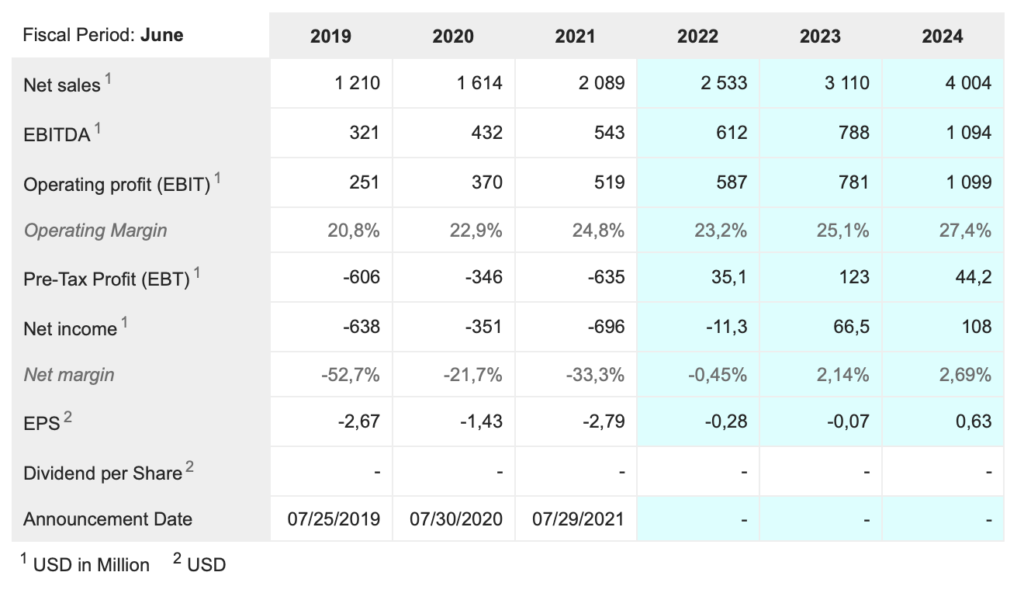

Valuation is often a sticking point for some investors with a company like Atlassian. The shares are valued at around 10 times expected sales for 2024 which on my Datadog rule of thumb assuming margins will be 20pc of sales implies a PE ratio, one day, around 50. The real issue about shares in companies like Atlassian is that they always look expensive. In 2019, when the shares were around half what they are now sales were running at around $1bn so the valuation was around 20 times sales, which is similar to where they are now.

What is also noticeable is that even if you buy on what many investors will regard as very demanding valuations you can still make money. The key to share price progress is not the valuation at which you bought but the performance of the business. If this stays good the shares will perform.

The chart may also put some investors off because it has already been so strong. The shares are up 20 times from their level in 2016, which explains why Cannon-Brooks and Farquar are two of the richest men in Australia busy building portfolios of uber-expensive Sidney sea front properties. But if you bought Microsoft shares when they were up 20 times from their lowest post-IPO level you would now be looking at 150-fold appreciation on your investment.

I call stocks like Atlassian climbing aboard stocks. It doesn’t matter when you join the party you should always do well because these guys are on a course to build enormous businesses. I know the world already feels very high tech but the truth is we ain’t seeing nothing yet and as this astonishing science fiction world takes shape it is companies like Atlassian that are going to play a key role in making it happen.

Here is another fun fact about Atlassian. In the year to 30 June 2021 the company spent $763m on r&d. This amounts to 47.2pc, nearly half turnover. Throw in the $300m spent on sales and marketing and the company spent $1.063bn on discretionary items. Of course, the company needs to spend this money to drive growth but if it stopped spending it, even for one year, the free cash flow the business would generate would be staggering, well over $1bn.

The truly amazing thing about Atlassian and other similar companies is that they can find productive ways to spend such staggering amounts on r&d and sales and marketing. When I first started looking at companies there was no way this would have been possible. Even large companies regarded money spent on r&d as money down the drain. The way to be successful was though to be to keep costs as tight as possible, maximise profits and pile up cash on the balance sheet.

Perhaps what is even more amazing about Atlassian and other businesses in the technology era is that to some extent they have found the way to do both. They can invest two thirds of turnover in driving growth but still generate cash. The 2020 accounts showed Atlassian holding free cash and short term investments of over $2.6bn. This is extraordinary because as they note themselves the shift from perpetual licenses to a software as a service business model means payments are deferred into the future which puts pressure on cash flow.

They also note that growth in the increasingly important cloud business is expected to accelerate in 2022.

Atlassian reflects my belief that to succeed as a long term investor it is all about what you buy not when you buy. It also pays to have plenty of eggs in your basket so the ones that don’t work out do not have an over-large impact on overall performance.

Something I didn’t realise at first is that much of the way that Atlassian has developed reflects when they started in 2002. At the time the Nasdaq was still on its ways to falling 95pc from its early 2000 peak and Amazon was tracking down from a peak $112 to a low point of $5.30. It was impossible for an Aussie tech start up like Atlassian to raise money so the pair survived on their credit cards for five years as they developed their first product, Jira, to help teams of engineers work together.

Then when they launched they couldn’t afford a sales team so they had to use channels and a freemium model to get the product out there. The key was that as developers themselves Cannon-Brookes and Farquhar knew that if they could get the product into the hands of developers they would like it and so it proved.

This had an amazing result because three years after launch the business was profitable without having received any venture capital funding. The company used this financial success to start buying other complementary products enabling it to grow even faster.

In 2010 the company did raise $60m of venture capital funding to help with driving growth and making more acquisitions. At the time the group had around 20,000 customers which compares with over 200,000 when they reported Q4 2021. Over the years they have been consistently acquisitive to make their portfolio more comprehensive which allied to their massive r&d spending has created a product suite which customers really love.

This incidentally also explains why Cannon-Brookes and Farquhar are so rich because they still own 47pc of the company.