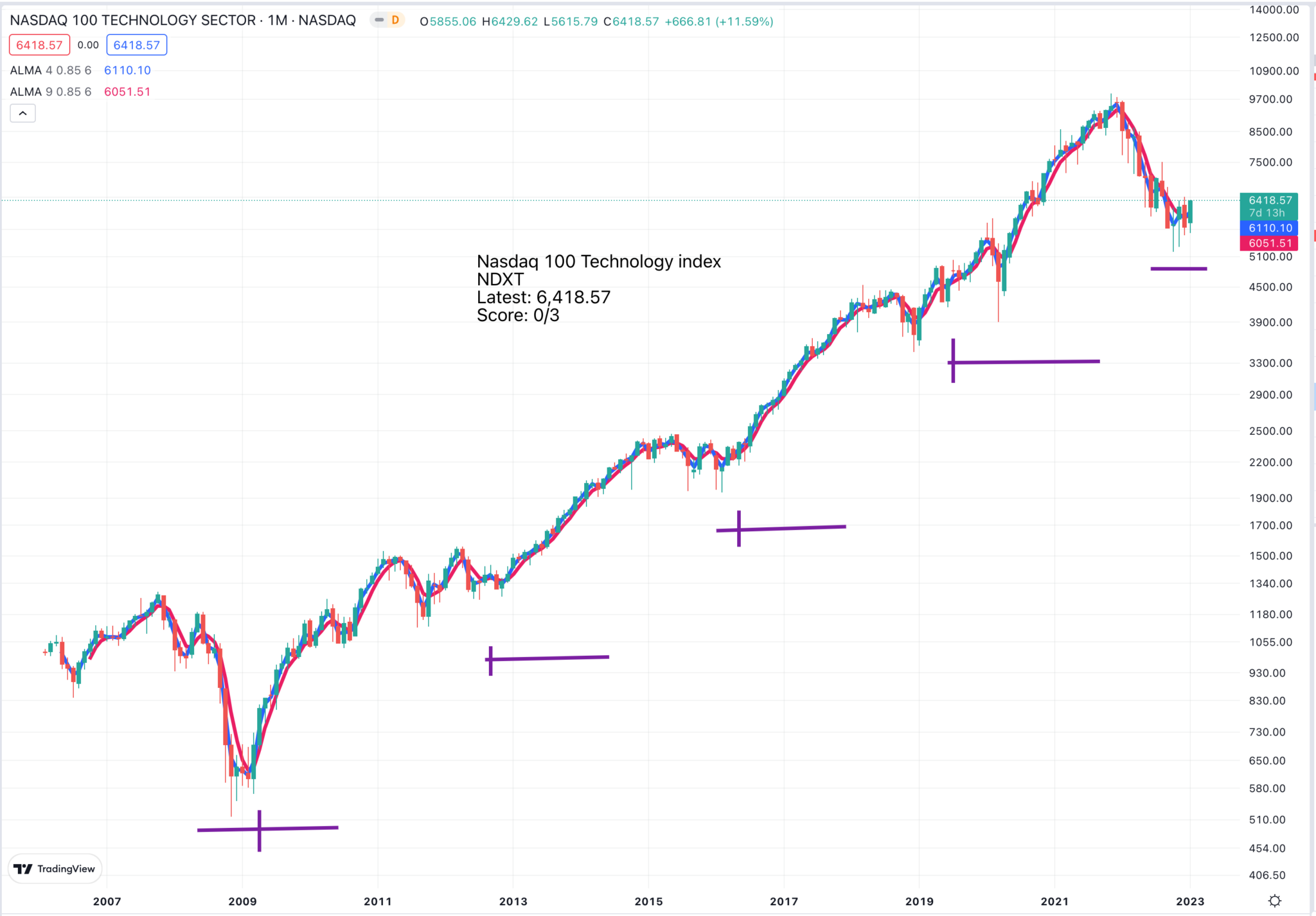

My indicators feel like a piece of software which is being continually updated. The purple lines above show when the Nasdaq Technology Sector index was in the buy zone with the vertical crosses showing actual Coppock buy signals. As you can see they are good and the buy zones work well too – at least historically.

If they work as well in real time and I am hopeful that they will that will be exciting. The NDXT seems to be building a small base pattern and the Coppock line, which has been falling since the end of the last purple line, so since September 2021, looks set to give a buy signal in February.

It is also set to rise strongly throughout 2023 suggesting that a positive period for US technology shares lies ahead. NDXT is an equal weighted index of US technology shares so Apple is no bigger in the index than any other share. If NDXT, looks good then many technology shares should also look promising.

S&P 500 forms reversed head and shoulders

I have drawn in a blue line to show the neckline of what looks like a reversed head and shoulders pattern for the S&P 500 index, which would be broken by a close above 4,200. The strongest US index is the Dow Jones, followed by the S&P 500, the Nasdaq Composite and bringing up the rear the tech heavy Nasdaq 100.

This is almost the reverse of what was happening during the bull phase and gives us a pointer to what the bear market was all about. A burst of inflation led to the famous Fed pivot from falling to rising interest rates. The shares most affected by higher rates were the high growth, high momentum technology shares that soared in the bull phase. They have been hammered especially as the emphasis of valuation has switched back from revenue growth at all costs to profits and free cash flow.

Any new bull market is unlikely to revert to the high multiples of revenue awarded to fast growing high tech companies before 2022 but some compromise looks likely. The fact is that in the battle for territory it can make sense for companies to invest heavily in sales and marketing and research and development to drive headlong growth even at the expense of losses. As has been seen so often there is an element of winner takes all about the Internet. It pays to be big and to do that you need to be quick.

Snowflake builds a base

Snowflake is a case in point. The shares have had a savage bear market with the price down from a peak $428 to a bear market low of $110. They have been trading broadly sideways for nine months and it is now possible to calculate Coppock which is around minus 100 so the shares are in the buy zone.

Snowflake has a wonderful business with seemingly limitless growth potential.

Snowflake’s founders started from scratch and built a solution that would harness the immense power available in the public cloud. They created the Data Cloud — a global network where thousands of organizations mobilize data with near-unlimited scale, concurrency, and performance. Inside the Data Cloud, organizations unite their siloed data, easily discover and securely share governed data, and execute diverse analytic workloads. Wherever data or users live, Snowflake delivers a single and seamless experience across multiple public clouds. Snowflake’s platform is the engine that powers and provides access to the Data Cloud, creating a solution for applications, collaboration, cybersecurity, data engineering, data lake, data science, data warehousing, and unistore. Snowflake’s vision is a world with unlimited access to governed data, so every organization can tackle the challenges and opportunities of today and reveal the possibilities of tomorrow.

Website

Growth remains strong.

Data is becoming deeply ingrained in how global enterprises think, act, decide, and strategize. Relying on anecdotal observations will increasingly take a backseat to data-driven operations. The company is reporting $523m in product revenue, growing 67pc year on year. Our remaining performance obligations, or RPO, grew 66pc year on year to $3bn.

On a non-GAAP basis, product gross margin came in at 75pc, operating margin at 8pc, and adjusted free cash flow margin at 12pc. Snowflake’s Data Cloud strongly resonates in large enterprises and institutions. The idea of getting your data siloed again in the public cloud stack holds limited appeal. Data Cloud maximizes the power and promise of data science and artificial intelligence, a high priority in the modern enterprise.

In the quarter, we added 28 Global 2000 customers. Product revenue from the Global 2000 outpaced the company as a whole, growing 14pc quarter over quarter. Global 2000 customers now represent over 40pc of revenue. Our mission is the Data Cloud, a single data universe across geographies, data sources, compute clouds, and cloud regions; a single point of inquiry, analytics, and intelligence; maximum enablement of data sciences, analytics, and intelligence.

Q3 2023, 30 November 2022

The group has huge ambitions.

Our strategy is a global data sharing network, coupled with unlimited workload enablement. Work needs to find its way to the data instead of the historical habit of moving data to the work.

The opportunity ahead is massive and will take years to unfold.

Q3 2023, 30 November 2022

Snowflake is currently a 0/10 but if and when it becomes a 10/10 I think it will be a 10+. This is a phenomenally exciting business.

Even with a slowdown in hiring the group expects to add over 1,000 net new employees (latest number 5,547).

No surprise that the shares fell so heavily in 2022 because the business is massively loss making. In the latest quarter the group made a gross profit of $366m ($557m revenue less $191m cost of revenue) but spent $284m on sales and marketing and $211m on research and development ending up with an operating loss of $206m.

Investors find this alarming especially when interest rates are rising and share prices generally are falling but it makes eminent sense for Snowflake which is all about the battle for territory, the battle to have the best technology and root it in a huge global footprint with the world’s largest companies as customers.

Strategy

Snowflake has been a tricky share for me. It looks so perfect from a fundamental point of view with the dominant technology platform generating transaction/ usage based revenue in a vast and fast-growing market that it is easy to believe that it is one of the world’s most exciting companies.

I have been lured in time and again and lost money every time. The shares floated in a frenzy of excitement and it has been mostly downhill since then but the business looks as brilliant as ever. I think they are going to have their day in the sun and will eventually reach new all-time peaks.

This is a share to hold when it is supported by a rising Coppock, something that has never happened so far in its life as a quoted company.

Meanwhile the rest of the stock market, especially the sexy, technology bit in which I am most interested. seems to be convalescing after a serious bout of illness, hereby-jeebies, whatever you care to call it.

Coppocks to pivot – from falling to rising

My analysis suggests that we are approaching the moment when the stock market transitions from falling Coppocks to rising Coppocks. Many shares and indices are already in the buy zone. Soon we should have buy signals and Coppcks heading higher. Past experience suggests that this is a favourable time to be invested and a moment of great opportunities.

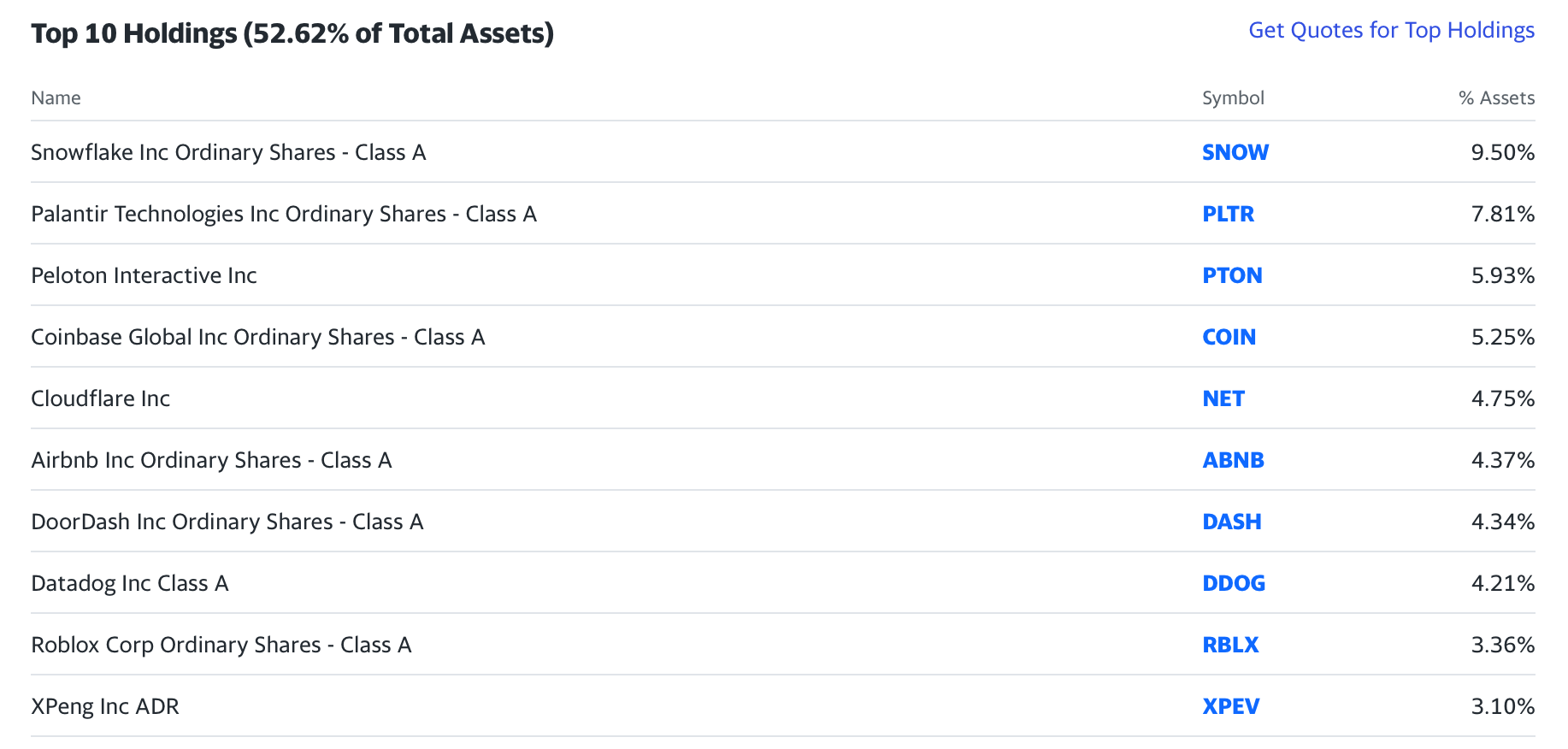

Below is a chart of IPO, an ETF, specialising in recent IPOs, with a large holding in Snowflake.

IPO’s 10 largest holdings are all shares which have had a brutal bear market. One of them is Peloton, which to my great surprise has an interesting chart. A base pattern seems to be building and there is even a Coppock buy signal. This still only scores it 2/10, one for fundamentals, see below, because my other two indicators (golden cross on the moving averages and broken trend line) have yet to signal.

New CEO says Peloton turning the corner

It turns out that some interesting things are happening at Peloton including a massive ‘something new’. The something new is that the CEO and founder left in February and has been replaced by Barry McCarthy, a former CFO (chief financial officer) at Netflix and Spotify. He has options which can be excercised when the share price tops $38.77. Peloton values his package at $168m. It needed to be big to tempt him out of retirement.

There is not a lot of belief on Wall Street that he can make much difference but he has been busy as can be seen from the quote below.

For the last nine months my goal has been to turn around Peloton and position it for sustained growth and scale. I thought it would take a year. We are beating that timeline.

Our results show we’re making significant progress. Take by way of example, FCF which was negative $747m in 3Q22, improved to negative $412m in 4Q22, improved again to negative $246m in 1Q23, and is forecast to reach near breakeven for the second half of FY23. Or take gross margin, which improved Q/Q from negative 4.4pc in 4Q22 to positive 35.2pc in 1Q23 (adjusted gross margin was 38.3pc excluding the $26.5m Tread+ recall-related revenue charge and $2.5m of recall-related expense adjustments), or adjusted EBITDA which improved Q/Q from negative $289m to negative $33m in 1Q23. Or take liquidity. We ended the quarter with $938m of unrestricted cash in the bank and an unused revolving credit line of $500m. (Note: free cash flow, adjusted gross margin, and adjusted EBITDA are non-GAAP financial measures. For a reconciliation of each non-GAAP financial measure to the most directly comparable GAAP financial measure and rationale for why we rely on each of these measures, please see the reconciliation tables located below).

On October 6th, we implemented a reduction in force of approximately 500 positions from our global team. As with prior actions, this decision was incredibly difficult but necessary to ensure the further health of our business by aligning costs with projected revenues in pursuit of our FCF [free cash flow] objective for the fiscal year.

Aside from the ongoing effort to optimize our Peloton retail store footprint, our restructuring effort is complete. Together, we have dramatically reshaped Peloton’s cost structure. It’s been a heavy lift for everyone associated with Peloton – a very heavy lift – and I want to sincerely thank all the current and former Peloton team members who have made and are making this turnaround possible. Because of their hard work, from this point forward, we are, once again, focused on growth.

Q1 2023, 3 November 2022

Management are going to put the most positive spin possible on what is happening but the CEO has a huge incentive, great experience, no baggage from the past and seems to be achieving results by taking firm action. The chart bears out the message that better times lie ahead for Peloton.

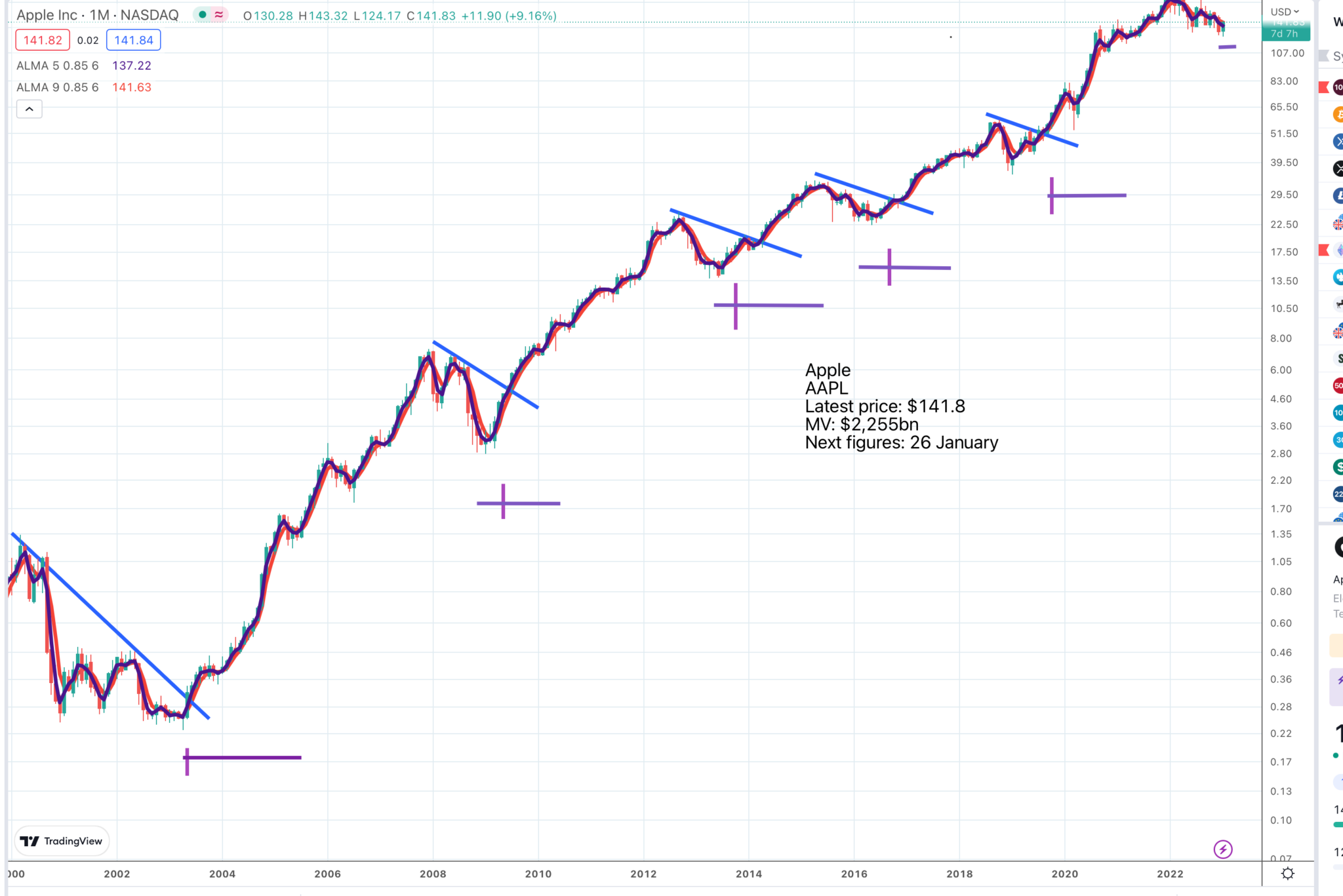

Apple analysis shifts from patterns to Coppock

Another share I have been looking at in the light of my growing focus on Coppock is Apple. In pattern terms the shares seem to be flirting with disaster but using Coppock a different picture emerges. The Apple Coppock has been falling since February 2021 and recently turned negative, which, in my new way of thinking, especially for a business like Apple in no danger of going bust, is that the shares have entered the buy zone with a Coppock buy signal the next likely item on the agenda.

Apple is clearly a wonderful business using its massive footprint in devices so many of us love and depend on to build a fast-growing services business (the App Store, Apple music, Apple TV, Apple Pay and so on). Tesla is trying to be the Apple of cars, Apple already is the Apple of phones and much else besides. Warren Buffett’s theory is that smart phones play such a large role in our lives that we will always be ready to pay a premium for a best-in-class device that works so well with so many of the other devices we have.

The new charting

I am coming to think of Coppock for me at least as the new charting. Instead of being an out and out trend and momentum chaser I have a system that helps me buy low, stay in for much if not most of the ride upwards, sell somewhere near the top and stay out for the fall. That seems like a pretty good system to me and it has another advantage that it is operating behind the scenes as it were so helps me to go against the crowd.