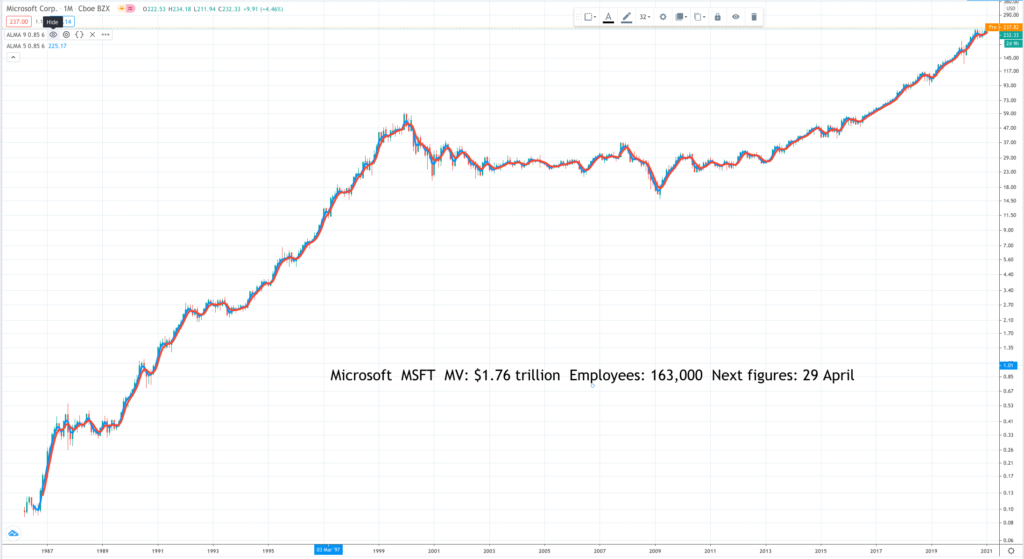

Microsoft has a great chart and an amazing long-term performance record. Since the company had its IPO in March 1986 the shares have risen 2,577 times and still look full of running as you will see from the story below. Like the other extraordinary businesses in this group Microsoft and its awesomely talented employees stand at the heart of a technology revolution, which is changing life for humanity at an accelerating rate. However big these companies already are there is every indication that over the next decade they are going to become a great deal bigger.

Alphabet GOOGL Buy @ $1838 MV: $1.24 trillion Employees: 132,131 Next figures: 2 February Times recommended: 13 First recommended: $985.19 Last recommended: $1,588

Alphabet (GOOGL) is best known for its search business. Estimates suggest that Google Search has a 90pc share of search worldwide and it keeps working better. I use it all the time and I am astounded at how well it works and how useful it is, similar to Hal in the sci-fi film, 2001, A Space Odyssey, which seemed way in the future, when that film was released in 1968, a date I found courtesy of Google Search.

The ubiquity of search and the targeted ads linked to the platform are a major reason why GOOGL sits on a staggering $132bn in cash, which is expected to reach $177bn by 2022. Search is still a growing business but GOOGL has other faster growing businesses, including YouTube and Google Cloud, which are both large and fast-growing businesses in their own right.

In Q3 2020 Google Search grew revenues from $24.7bn to $26.3bn, YouTube revenues grew from $3.8bn to $5.0bn and Google Cloud from $2.4bn to $3.4bn. This is enabling profits and earnings per share to grow strongly as illustrated in the table above. The company doesn’t pay dividends . If it ever does go down that road this will likely have a positive effect on the share price as it has for Apple but meanwhile shareholders are content to back the growth prospects and are benefiting from an increasingly aggressive programme of share buybacks.

In Q3 2020 the number of shares used to calculate eps was 679m v 693m a year earlier. Fewer shares in issue means higher eps for any given level of profits so has the effect of driving the share price higher.

Other bets include Waymo driving automation and DeepMind, which is intended to use computing power to speed up drug development.

YouTube revenues are mainly ad driven but in Q3 the company noted “YouTube subscriptions also continued to grow. YouTube now has over 30m music and premium paid subscribers and over 35m, including those on free trials. YouTube TV now has more than 3m paid subscribers.

Starting in Q4 2020, to be reported shortly, Google Cloud revenues will be broken out as a separate reporting segment, which is likely to focus attention on the strong growth of this division. Altogether the shares remain a high-potential investment despite the large market value.

Amazon AMZN Buy @ $3,285 MV: $1.64 trillion Employees: 798,000 Next figures: 2 February Times recommended: 26 First recommended: $984 Last recommended: $3,167

The first thing to note is that despite its size Amazon is still a strongly growing business. Between calendar 2017 and 2022 sales are forecast by analysts to grow from $178bn to $530bn, ebitda from $20bn to $88.5bn and earnings per share from $6.15 to $65.6; that still leaves the P/E ratio around 50 but something high is surely justified given the growth.

Amazon has always been impressive for its ability to fund its growth, even while reporting losses, without tapping shareholders for fresh funds. As it grows this is translating into an ability to generate strong free cash flow, which is expected to grow from $8.4bn for 2017 to $64.9bn for 2022. The company has always been focused on cash flow. The first item on the Q3 2020 results was to note that operating cash flow had risen 56pc from $35.3bn to $55.3bn.

One analyst believes that with the return on cash likely to remain low because of near negative interest rates this will force to company to look for ways of returning cash to shareholders. This could be in the form of share buybacks, like Alphabet above or via dividends or a mix of both like Apple. He is forecasting that over the next decade Amazon is going to become a dividend star and is worth buying now for this dividend potential.

It remains attractive for the growth potential. Each of its three businesses, Amazon Marketplace (the retail business, increasingly driven by sales for third parties) , Amazon Prime (the subscription business offering free, fast delivery and video streaming) and Amazon Web Services (the highly profitable cloud infrastructure business) is in great shape and still delivering strong growth in an increasingly online, digitally transformed and ecommerce driven world.

I am an Amazon Prime subscriber and this has two effects. It predisposes me to buy from Amazon because it is so convenient and I know my purchase will arrive rapidly, often the next day. I also watch films on Amazon Prime. Sometimes they are free, sometimes I pay to rent them. I never bother to buy but I can see how this is wonderfully easy money for Amazon like the books I buy to read on my Kindle.

Reading Amazon’s results statements is exhausting because there are so many things going on. The business is incredible innovative making it likely that in 10 years time it will be much larger than it is now and also much changed. There may even be a fourth or a fifth exciting new business to add to the three it has already.

Apple AAPL Buy @ $143 MV: $2.39 trillion Employees: 147,000 Next figures: 27 January (today) and 20 April Times recommended: 20 First recommended: $39.46 Last recommended: $140

Apple is reporting its results today, after Wall Street closes, which means after 9pm UK time. The shares may be volatile after the results, up or down but for long-term investors, the important thing is that they are good and consistent with an exciting long-term outlook. My impression is that the world is developing in a way, which is favourable to the development of Apple’s business and that yet another decade of strong growth lies ahead of the business.

The case for the shares is that the iPhone is going to benefit from a 5G super cycle, that the devices business (watches, airpods etc.) is going to continue to grow strongly and that the services business, iTunes, Apps etc.) is also going to grow strongly generating valuable recurring revenue.

The company is starting from a position of great strength with 1bn installed iPhones and 585m subscribers to its services business, expected to reach 600m by the 2020 year end, up 115m in the last 12 months.

The other wonder of Apple is its high powered cash generation, which is enabling the business to return a tidal wave of cash to shareholders. It is important to realise here that Apple is primarily a design and marketing operation; most of the devices are made by contract manufacturers so leaving Apple with the lion’s share of the profits, deservedly so given that Apple is the worlds most valuable brand but also keeping capital expenditure low.

Over the next several years Apple is expected to generate $80bn plus a year in free cash flow taking its cash balances back towards $200bn plus by 2022 even after returning half a trillion dollars to shareholders in dividends and share buybacks.

Apple is often and deservedly described as an incredible business and brilliantly led by Tim Cook, who was the chief operating officer under Steve Jobs, working miracles in managing the logistics of such a massive business.

And, like Google, there are wild cards. The rumour machine is in overdrive about Apple’s plans to develop autonomous cars which are increasingly devices with wheels and stuffed with sensors and microchips. Apple also has a big presence in China with its increasingly affluent and growing middle class.

In the Q3 report Tim Cook said “Without giving away too much, I can tell you that this year has a few more exciting things in store.” I am sure he will be able to say something similar every quarter for the foreseeable future and that is great news for Apple shareholders.

Microsoft MSFT Buy @ $236 MV: $1.78 trillion Employees: 163,000 Next figures: 29 April Times recommended: 16 First recommended: $75.56 Last recommended: $214

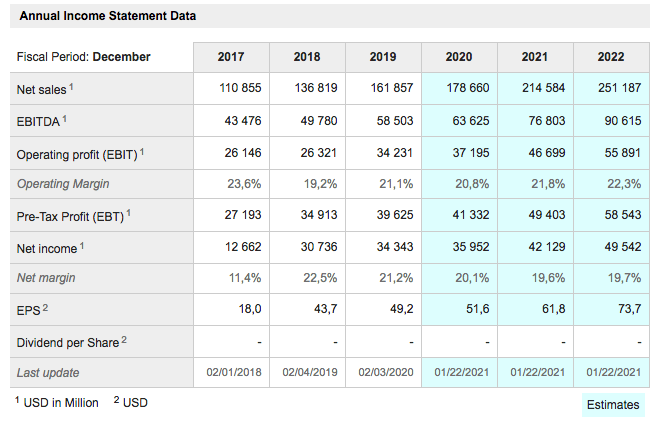

Microsoft has already reported its Q4 2020 results, which handsomely beat expectations and initially propelled the share price over $243 until a general market sell-off brought them rattling back. However, the figures were extremely impressive. Microsoft’s great achievement, under the leadership of 53 year-old, Satya Nadella, has been to reinvent the company around the cloud. The effect of this makeover has been stunning as illustrated by the latest results.

Microsoft has various business streams including the office products, the gaming division, LinkedIn, devices and other elements but the key to prospects is the outlook for the fast-growing cloud services business, which is addressing a rapidly growing segment of the economy.

Cloud spending globally is projected to increase at a CAGR [compound annual growth rate] of 17.5pc from 2020 through 2025, growing from $371.4bn today to $832.1bn in 2025.

Microsoft already has a sizeable cloud business. Revenue from Microsoft’s cloud offerings represents approximately 41pc of the company’s revenue stream. In Q1, revenue from those sources increased by 31pc to $15.2bn. And Nadella had this to say about the just reported Q2 results (Microsoft has a June year end).

“It was a record quarter driven by our commercial cloud, which surpassed $16bn in revenue, up 34pc year over year. What we are witnessing is the dawn of a second wave of digital transformation sweeping every company and every industry. Digital capability is key to both resilience and growth. It’s no longer enough to just adopt technology. Businesses need to build their own technology to compete and grow. Microsoft is powering the shift with the world’s largest and most comprehensive cloud platform.”

When you think of what Microsoft is doing it is amazing. “We’re building Azure as the world’s computer to support organisations’ growing cloud needs.” Ten years from now Microsoft is going to be dominated by its cloud services business as strong growth in this division makes everything else fade in significance, unless it does something unexpected, which is always possible..

If the company was to break itself up the sum of the parts, as with other behemoths in this group, would likely be more, maybe much more than the current valuation. Especially given how well some of the non-cloud businesses are doing. ” Microsoft 365 consumer subscriptions grew to 47.5m, up 28pc year over year. Dynamics revenue grew 21pc, driven by Dynamics 365 revenue growth of 39pc. The number of customers adopting multiple Dynamics 365 workloads accelerated again this quarter. LinkedIn revenue increased 23pc, significantly ahead of expectations. Growth in our marketing solutions business accelerated to 53pc, benefiting from a stronger advertising market.”

Q2 revenue was $43.1bn in total, up 17pc helped by a weakening dollar, while earnings per share rose 34pc to $2.03, extraordinary figures for such a large business.

The company has strong free cash flow, much of which it puts to work to fund huge share buybacks. In September 2019 the board authorised the third $40bn share buyback programme in the group’s history. By dramatically reducing the number of shares in issue these buyback programmes are a key factor pushing the shares higher.

The late financier, Jim Slater, favoured smaller company investments on the argument that ‘elephants can’t jump’. I think he might change his mind if he saw what is happening to day with companies like those discussed above. All these shares have been recommended many times in Quentinvest and many times more in my print publications before Quentinvest was launched as an online service in mid-2017 and they are still performing.

I don’t think any of these companies is anywhere near running out of runway to keep growing in a world experiencing a digital transformation. For billions of people a world without the Internet is unimagineable and yet this Internet revolution only got going in earnest a couple of decades ago. Its like 1820 in the Industrial Revolution or the 1400s in the Renaissance. It is likely there is a long way to go and many wonders still to happen in a world being reinvented by technology.

Alphabet, Amazon, Apple and Microsoft are key actors in these changes and still have a role to play in any aggressive growth portfolio.