The unfolding technology revolution and the sheer energy of the American economy means there are plenty of 3G shares (great growth, great story, great chart). The further fact that we are , I believe, at an early stage of a new bull market, or a new leg of an ongoing US bull market, means that there are a growing number of shares giving buy signals using my preferred indicators.

I am sure with a little research I could give you 50 shares that meet my criteria for the Quentinvest method – great growth company, timely to buy, suitable for leverage or not depending how you feel about that approach to investing.

The question is do we want to buy all 50 shares or whatever number we come up with or do we want to prune the list and focus on the real cream of the crop. So what else should we be looking for, some magic for sure but most great growth companies have that which is why they are doing so well.

If we want something, that final use of the sorting hat that puts Harry Potter into Gryffindor and us into what legendary US investor, Peter Lynch, called 10-bagger territory we need something really special, what I call ‘something new’.

This is not rocket science and I am not unique in think such shares make great investments but, like so much else in the stock market that seems obvious, that doesn’t stop it from working. If you can find a share that ticks all the boxes as a great share AND has ‘something new’ there could be fireworks.

There is one last element in this package – a really strong chart. We want a share which is so exciting that any sellers are being overwhelmed by a tidal wave of buying and the crowd (the fan club if you like) of followers is growing rapidly.

Such shares are not so easy to find. Everybody wants them but at least we are ahead of the game if we are really looking and at Quentinvest that is exactly what we are doing.

Table of Contents

An excellent example is one of my latest alerts, Deckers Outdoor, with its HOKA running shoes business, where sales have grown from $3m to $1.4bn in a decade. Deckers Outdoor is still best known for its ubiquitous Ugg brand but I believe that DECK is turning into HOKA and that there is still huge potential growth in HOKA.

HOKA Still Small Relative to Juggernauts Like Nike and Reebok

It’s hard to overstate the multigenerational appeal of the shoes. Hoka is still small, relative to juggernauts like Nike or Reebok. Mr. Doolan says that the company has only 440 individual unique shoes for men and women in different colors and widths. (A Harvard project estimated that Nike has 10,000.) Somehow, though, the shoes have crossed into the mainstream.

Many people, including those who work in the sneaker industry, learned about Hokas from their parents. “The first pair that I saw were ones that my dad had bought,” Mr. Haines said. “He’s in his 60s, an older guy who needs the best comfort and cushioning.” Dr. Karen Onel, the chief of pediatric rheumatology at Hospital for Special Surgery in Manhattan, said that her life was “literally changed” when she bought a pair a few years ago after suffering ankle and foot pain. Her youngest daughter recoiled from the giant soles when her mother began wearing them.

“My daughter, a senior at Cornell, called me last week and said, ‘I’m going to buy Hokas,’” Dr. Onel said. “I was like, ‘Excuse me? You swore you would never wear them.’” Dr. Onel laughed at this turnaround but noted that since she had gotten her Hokas, they have popped up in more and more places. “I’m a pediatrician and now I see the fashionistas, the fancy women, in them,” she said. “They are taking over New York City.”

Dr. Onel also noted that Hokas have replaced Dansko clogs as the go-to footwear for hospital workers who are on their feet all day — and are, of course, in a position to recommend shoes to people who have foot trouble themselves.

The New York Times, 7 April 2023

Nike sales run around $50bn a year so Hoka’s $1.4bn is still small beer. And Deckers is dramatically stepping up its advertising for Hokas.

HOKA Steps up Its Marketing

MarketingDive, 15 June 2023

- Hoka is introducing its largest global integrated marketing campaign to date after recently surpassing $1 billion in sales, according to a news release.

- The Deckers Brands-owned sportswear shoe marketer centered the concept on murmuration, a flocking behavior seen in birds like starlings. A 60-second anthem spot uses striking visuals to reinforce the notion that distance runners and casual walkers feel like they are flying together in Hokas.

- “Murmuration” expands on a “Fly Human Fly” creative platform Hoka debuted last year and will appear across owned media, out-of-home, connected TV, digital and paid social on apps like TikTok, Meta and Snapchat.

The Global Opportunity Looks Huge.

We continue to remain focused on executing against our strategic priorities and driving progress towards our long-term vision, while actively managing the marketplace for our brands to build HOKA into a multibillion-dollar major player in the performance athletic space.

And so that’s really our focus right now is, globally, I think awareness for the HOKA brand is around 24pc, certainly lower in EMEA [Europe, Middle East and Africa] and China, as you can imagine. And so we need to build that demand. We need to build a representation of the brand in front of the consumer and the experience. And we’re really excited about those opportunities, and we see all these markets, including some distributor markets in the Asia Pacific region, as very exceptional growth opportunities for this brand. But as I said at the beginning, we’re going to manage it the right way for the health of the brand, health of the profitability, full price sell-through and consumer experience. So we’re at this for a long time.

Dave Powers, CEO, Deckers Outdoor, Q4 2023, 25 May 2023

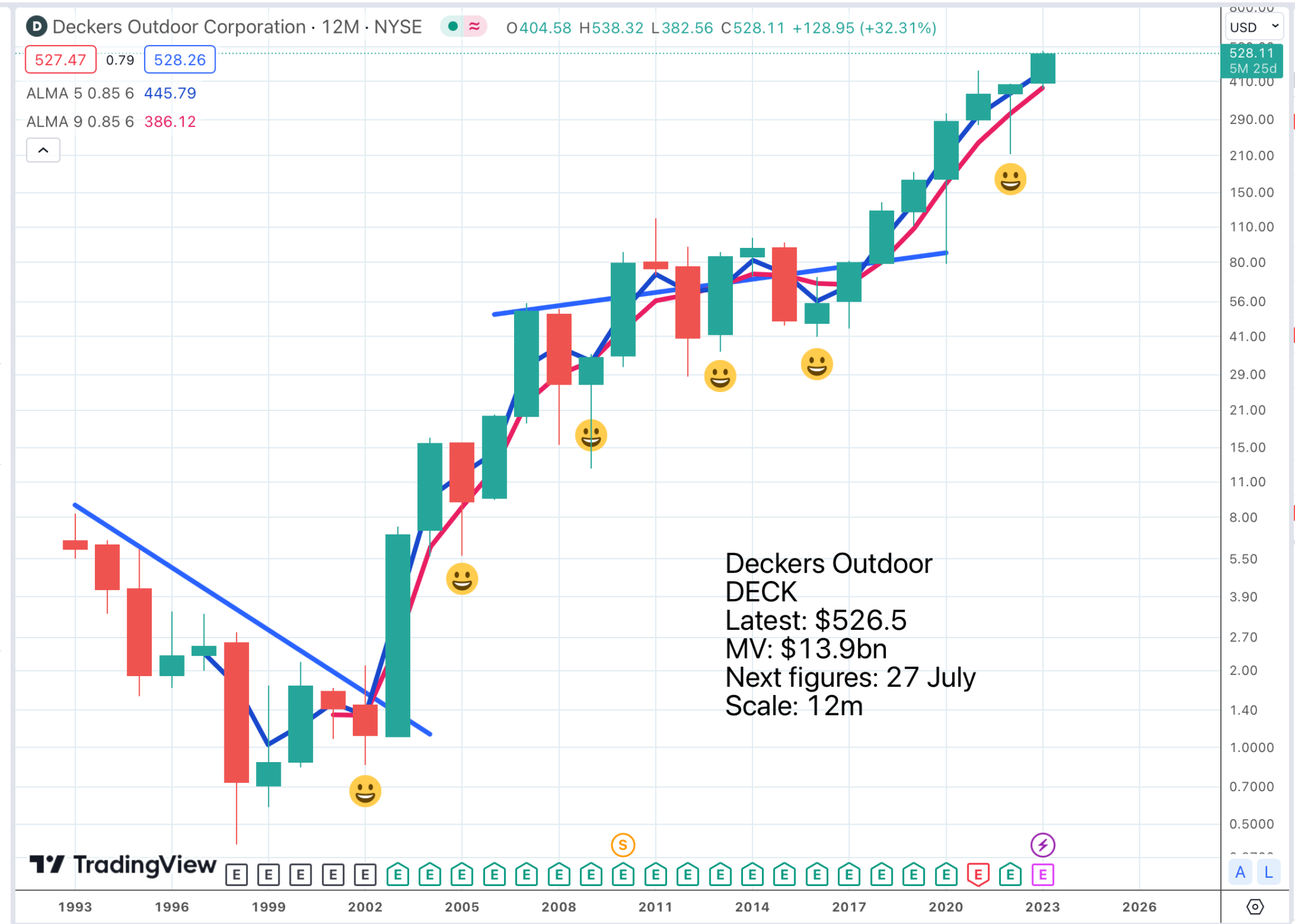

So now we have established that Deckers Outdoor has a massive ‘something new’, not as new as it was but still with a long runway of growth ahead. Next question is how the chart ties in with these fundamentals. There is no chart message as such except for a recent double whammy buy signal based on a shorter term chart.

The real point about this chart is that it is very strong and that is what you like to see when a share is having a major ‘day in the sun’ moment. My guess is that five years from now, 10 years from now, these shares are going to be massively higher; that’s what a powerful ‘something new’ can do.

Strategy – Invest in ‘Something New’

That is the strategy, buy some shares in Deckers Outdoor, run an accumulator by adding to your holding every month, leverage your holding for some dramatic action.

Dave Powers, the CEO, was appointed in June 2016 and just look at what the shares have done since then. This guy is a star and most of the growth in HOKA has come since he took charge. Since he arrived the shares have risen almost 10-fold, which makes him another exciting ‘something new’. He has an amazing CV including spells at Nike and Timberland.

Does Deckers Outdoor have 10-bagger potential? I have no idea but it is in the hunt.

Share Recommendations

Deckers Outdoor. DECK. Buy @ $534

Bond Yield Cloud on the Bulls’ Horizon

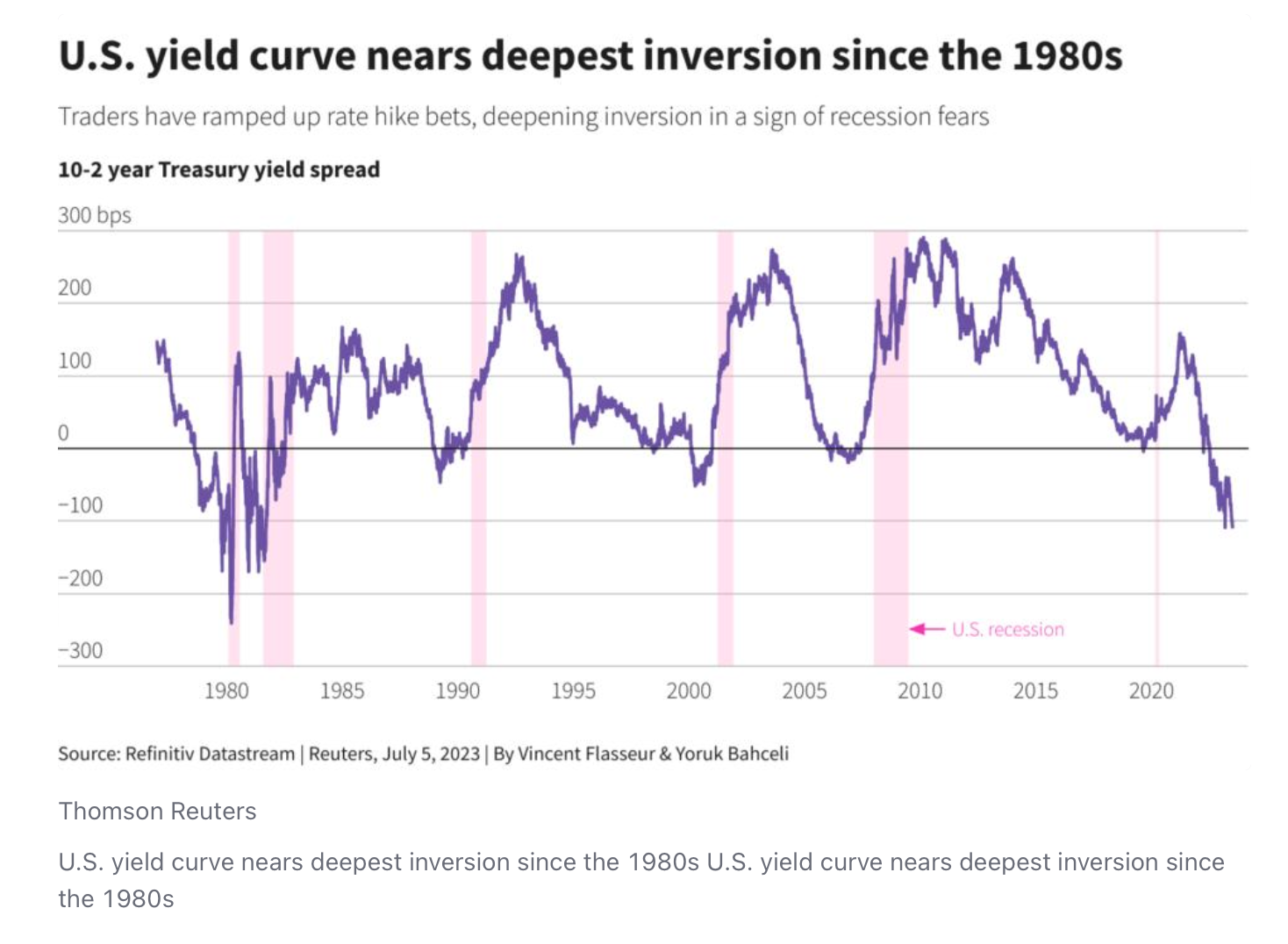

Not everything in the garden is rosy. US bond yields look as though they may be shaping up to head higher. This would not be a positive development for the stock market and investors need to bear that in mind. As you can see on the chart the last two occasions when the moving averages crossed in an upwards direction saw bond yields moving sharply higher. There is a clear risk that is about to happen again.

Up until the end of May bond yields were falling and this triggered a rally in stock markets. The bg rise before that was a major factor in the stock market correction in 2022 so if yields do head higher again there is a risk that we will see another setback in stock markets.

This would be a case of macro economic factors asserting themselves and distracting investors from often bullish developments at individual shares. It does not mean the shares and the companies are not in impressive shape but it would most likely take some toll.

There seems to be a soft area within which bond yields can move up and down without having a big stock market impact but if 10 year yields break through four per cent and keep climbing that would be noticed.

Concerns about the lagging economic impacts of the Fed’s aggressive path of rate hikes has kept the yield curve inverted for more than a year. Yet the recent push that has deepened the inversion may be a result of leveraged positions by hedge funds and other institutional investors as issuance by the Treasury Department surged since the passage in early June of a Congressional plan to raise the debt ceiling, analysts say.

Deeper inversions do not necessarily mean deeper or longer recessions, Jacobsen said. The curve plotting yields of three-month bills against those of 10-year notes, which had already inverted in intraday trading in July, turned negative in late October, closing inverted for the first time since early 2020. WHAT DOES AN INVERTED CURVE MEAN?

The inversions suggest that while investors expect higher short-term rates, they may be growing nervous about the Fed’s ability to control inflation without significantly hurting growth. The Fed has raised rates by 500 basis points since it started the cycle in March 2022 .

The 2/10 year yield curve has inverted six to 24 months before each recession since 1955, a 2018 report by researchers at the San Francisco Fed showed. It offered a false signal just once in that time. That research focused on the part of the curve between one- and 10-year yields.

Anu Gaggar, global investment strategist for Commonwealth Financial Network, found the 2/10 spread has inverted 28 times since 1900. In 22 of these instances, a recession followed, she said in June.

For the last six recessions, a recession on average began six to 36 months after the curve inverted, she said.

Before this year, the last time the 2/10 part of the curve inverted was in 2019. The following year, the United States entered a recession caused by the pandemic.

WHAT DOES THIS MEAN FOR THE REAL WORLD? When short-term rates increase, U.S. banks raise benchmark rates for a wide range of consumer and commercial loans, including small business loans and credit cards, making borrowing more costly for consumers. Mortgage rates also rise. When the yield curve steepens, banks can borrow at lower rates and lend at higher rates. When the curve is flatter their margins are squeezed, which may deter lending.

Reuters, 6 July 2023

Deep Yield Inversion Believed to be Recession Signal

The normal pattern is that the yield curve slopes upwards so that as savers lend for longer periods they expect a higher return. If the curve becomes inverted (slopes downwards) so that loans for shorter periods earn higher returns this normally signals an expectation that something (a recession) is going to happen to bring long rates, and probably all rates, down.

We have such an inversion now but also a tendency for rising short rates to force longer rates higher, which in turn, raises the rates at which future profits are discounted back to the present so it creates a tendency for share prices to fall, especially shares in fast growing businesses where much of their value lies in the future.

The bigger picture is that these things happen, especially when the monetary authorities are trying to get inflation down to below a target level and shares in great growth companies are typically not that much affected and soon recover as conditions eventually improve.

Bitcoin and Ether Look Bullish

Intriguingly, even confusingly, at the same time as bond yields threaten to head higher, the bitcoin chart looks bullish, with the blue line (shorter term moving average) heading firmly higher and crossing the red line (longer term moving average). Coppock has also given a buy signal.

The chart for ether also looks promising. I always tend to assume that higher interest rates are a negative for cryptocurrencies which don’t pay dividends and have no yield but these charts suggest that it is not that simple.

There is no doubt that on a strict reading of the charts many shares, the cryptos and bond yields look to be heading higher. Make of that what you will. Certainly there is no cooling of excitement around technology and the AI boom and, as an example from outside the technology sphere, both chart and story for Deckers Outdoors (see above) look amazing.

Cryptocurrency Recommendations

Bitcoin. Buy @ $31,256

Ether Buy @ $1944