In an earlier alert I said if it looks like a top and breaks down like a top it is a top. Bitcoin after five months of battling to hold around $20,000, has broken down, completed not a top exactly, that happened earlier, but a breakdown from an important consolidation and I suspect is headed sharply lower. It could easily fall below $10,000.

For me cryptocurrencies are all about the charts. There were some massively profitable upside breakouts but they are now history. Since completing its double top in November 2021, first top in April 2021, amid huge bullishness on prospects, bitcoin has entered a fierce bear market.

The Coppock indicator began to fall in September 2021 and is minus 107.1, having recently become negative. At current prices it will reach a maximum low of minus 632.9 in February 2023 and turn higher in March 2023, exactly in line with my forecasts for equity markets.

I haven’t done the calculations for ether but I imagine the story would be similar. Again we have a completed top area, a consolidation and all the signs of a renewed breakdown. Rising interest rates are not a good environment for zero yielding speculative instruments like bitcoin and ether and as prices fall there will be fears of more problems ahead and bankruptcies affecting key players, some of whom are absorbing huge losses.

At the very least neither of these cryptos should be bought until my indicators change direction from down to up of which there is no sign. Things can change fast but presently all the changes are in a downward direction and there is now a serious new area of consolidation to force prices sharply lower.

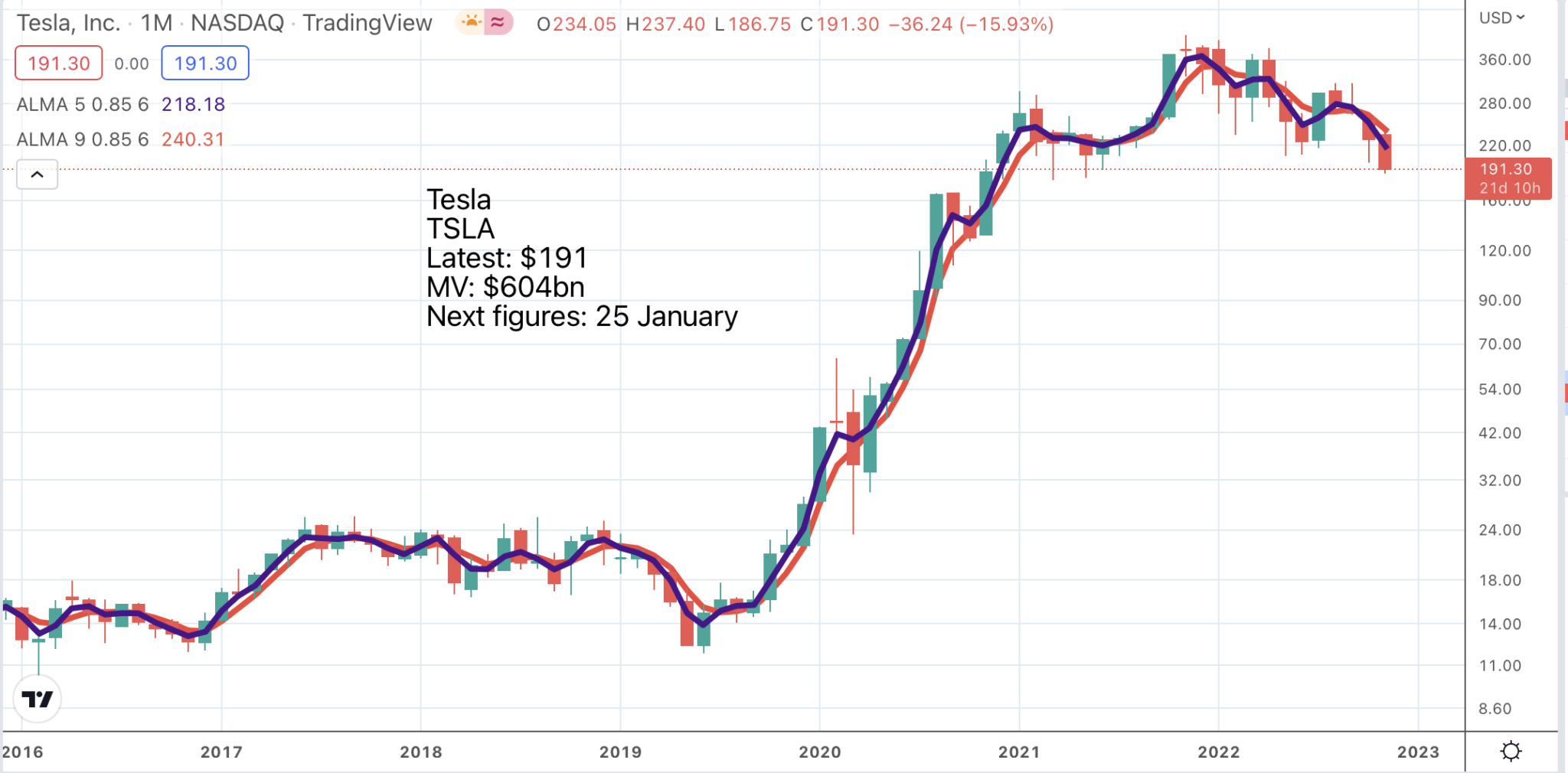

Another terrifying chart is Tesla. If this is a top and it looks very much as though it is, it is a big one, stretching back all the way to December 2020 and with the shape of a classic head and shoulders. As a business Tesla has been and to all appearances remains a huge success but that does not mean that the shares have not risen far too high. There is just so much excitement a man can take and Elon Musk seems to have got himself into a dreadful tangle with Twitter which must take his eye off the Tesla ball since by all accounts he is already working 23 hours a day.

Whatever is going on with the Tesla fundamentals the chart has gone from hanging by a thread to falling off a cliff. On my triple lock system with a maximum score of nine, Tesla scores zero and is not to be touched until those numbers change dramatically.

This leaves another key benchmark stock which I am watching like a hawk, Apple. The fundamentals look very solid but the chart is hovering on the brink. So far in this market when stocks are hovering on the brink they end up falling. If Apple falls, like Tesla, that is a large top area and we can anticipate sharply lower levels.

If this happens this will lead to widespread wealth destruction and carry some important indices lower which will be a setback for stock markets overall and may begin to lead policy makers to think they have done enough on the interest rate front. We shall see. Already I think there is a distinct possibility that the inflationary/ interest rate shock is going to be followed by a shock plunge into recession across the developed world.

We live in exciting times as the Chinese sometimes say, not always enthusiastically.

Strategy

There are weak charts all over the place presently. It is brutal what is happening in the hitherto more exciting parts of the US stock market. Since I wrote about Carvana and their balance sheet problems an already severely depressed share has lost a further third of its value.

We are starting to see widespread lay-offs in the technology sector which is an incredible reversal after years of staff shortages, endless recruitment and soaring salaries.

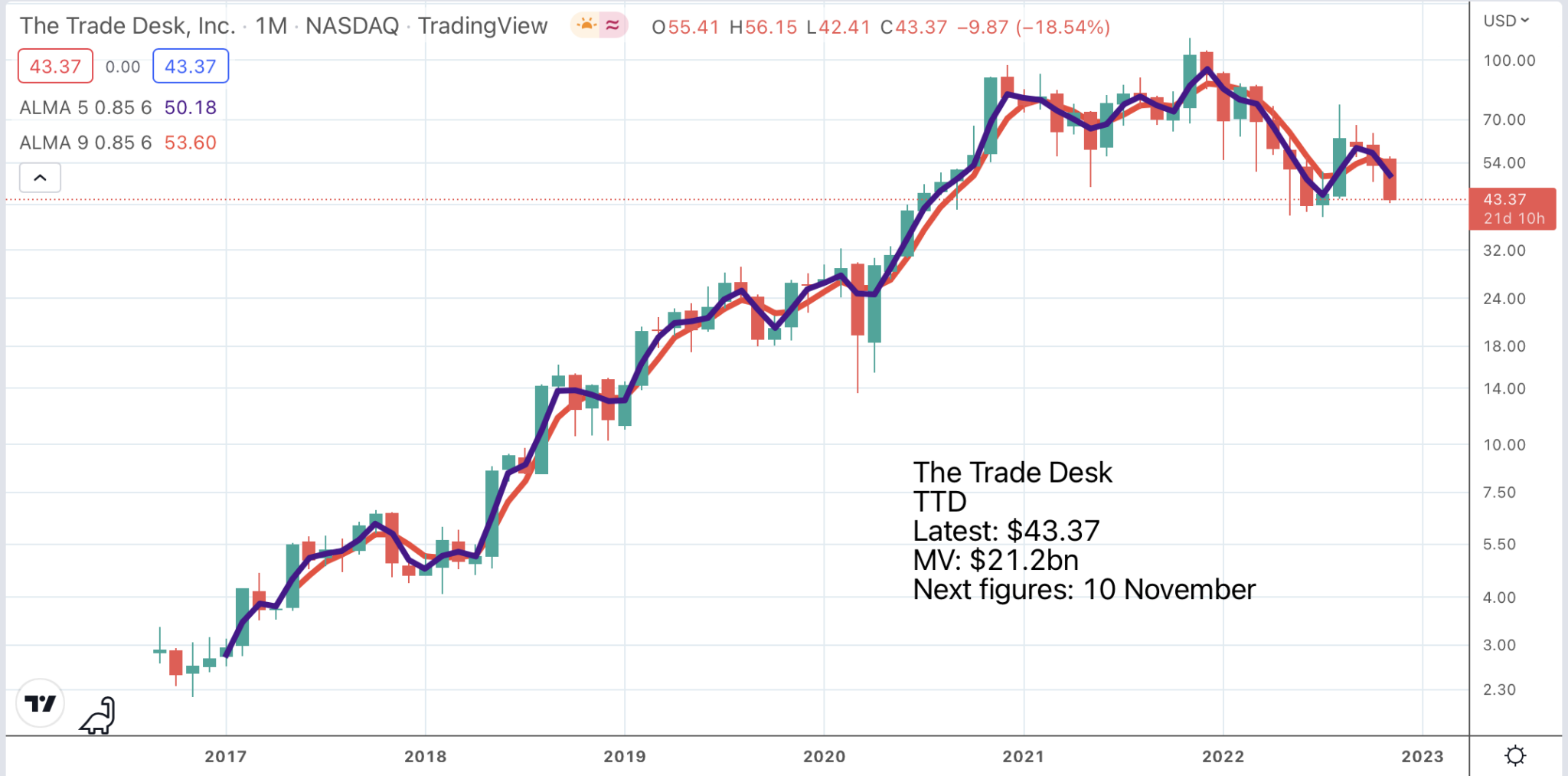

Another stock with fabulous fundamentals and a classic charismatic, desk pounding founder CEO, The Trade Desk, is famous for its success in programmatic advertising and as a platform for ads to be placed in the streaming world of connected TV. The world is changing just as CEO, Jeff Green predicted but will that be enough to save a rolling over share price.

If we think of the world economy as like a giant lemon we can think of globally tightening money as being like a giant fist squeezing until the pips squeak. The pips are the stock market and especially the more highly rated zero or low yielding bits of it which were catnip for buyers in the boom and became wildly overpriced as a result.

A huge price reset is taking place which is why so many shares are falling so heavily as they struggle to find a level appropriate to the new circumstances.

Eventually it will be job done on the inflation front and that mighty fist will start to loosen its grip. If my charts are right this may start to happen some time next Spring.