Bitcoin, Ether, Silvergate and more – investments making exciting moves

Bitcoin BTCUSD Buy @ $45,000 Times recommended: 10 First recommended: $3,540 Last recommended: $34,200

I normally stick with charts when writing about Bitcoin. All my buy alerts are based on charts but this time around there are some interesting developments on the fundamental front.

There seems to have been a tipping point in terms of institutional acceptance of bitcoin. Hedge funds are buying, banks and institutions are showing interest, companies like Square and PayPal are facilitating use of bitcoin and even investing in bitcoins. There are some serious chunks of money going into bitcoin. A quoted company called MicroStrategy has basically bet the business on bitcoin with an over $1bn investment and Tesla has invested $1.5bn.

People are pointing out that in the developed west we have a sophisticated financial infrastructure so maybe less need for something like bitcoin but in the rest of the world that could look very different. There may be another tipping point with government and central bank acceptance, which is yet to come. Currently, despite the growing interest, bitcoin and all the cryptocurrencies are climbing a wall of scepticism.

There is also the scarcity factor. There can only ever be 21m bitcoins and already 18.5m have been mined (an expensive and complex computing process by which new bitcoins are created). The supply is getting tighter, while demand keeps increasing. It does help explain why the price is rising.

Last but perhaps not least the chart looks very powerful. As always that does not come with any guarantees but I am starting to believe that one day the price could be in six figures. I know that is incredible but who ever thought, apart from a few crazies who are not looking so crazy now, that we would ever reach current levels. One virtual coin worth nearly $50,000. It’s either madness or part of something very big.

Ether Buy @ $1735 Times recommended: 6 First recommended: $1100 Last recommended: $1546 Lowest recommended: $240

Ether is similar but different to bitcoin but it is the second biggest cryptocurrency by market value. I think of it as effectively tailgating bitcoin and similarly effective as a speculative vehicle. Why is the price where it is? Like the old stockjobbers, my answer would be more buyers than sellers. I hold ether for the same reason I hold bitcoin in the hope that for some mysterious reason the price will keep performing the way it has in the past. I don’t bet the ranch on it but I hold enough to be very happy with the current price action.

Silvergate Capital Corporation SI Buy @ $143.50 MV: $2.5bn Next figures: 5 May Times recommended: 1 First recommended: $126.50

An investment in Silvergate is a bit like investing in bitcoin because the company, which is the holding company for a Californian bank, Silvergate Bank, decided, with incredible prescience, in 2013, to bet the business on becoming the bank for digital currencies. An infrastructure was put in place, the company was floated in 2019 and the shares are currently flying on the back of the booming cryptocurrency markets.

A key point to note about Silvergate is that they are all about institutional involvement in the cryptocurrency market, the people who do retail are their customers, which makes what is happening now even more exciting for them.

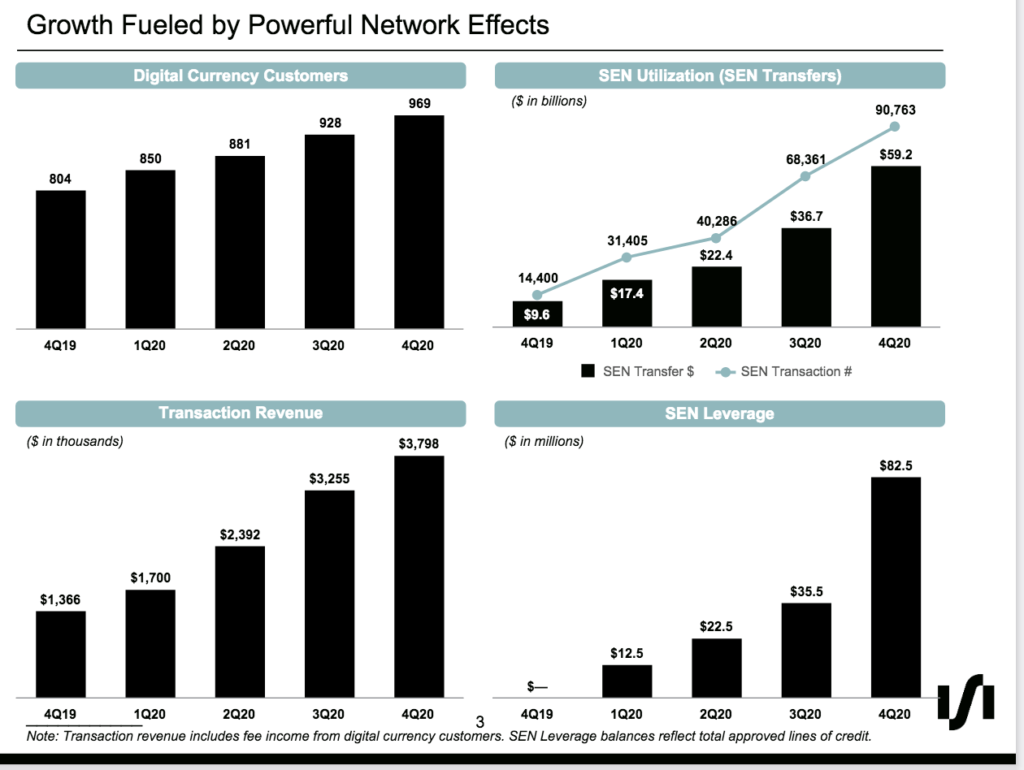

Their main business is SEN about which they had this to say with their recently reported Q4 2020 results.

“In the fourth quarter, digital currency activity on the Silvergate Exchange Network, or the SEN, continued to escalate rapidly with a record of 90,000 transactions and over $59bn in SEN volumes. Transaction dollar volumes of this magnitude represent 62pc growth on a sequential basis, and demonstrate how the combination of network effects and our scalable platform have led to the rapid adoption of the SEN by the digital currency community. As of year end, we had a total of 969 customers, up over 20pc year-over-year, and our pipeline of potential new digital currency customers remains robust with more than 200 prospects at year end.”

A newer business is helping their customers to use their cryptocurrency holdings as collateral.

“I’m also excited to provide an update on SEN Leverage, which allows Silvergate customers to obtain U.S.dollar-denominated loans collateralised by their investment in Bitcoin. We were prudent in the rollout of the product, and tested it over the past year through our pilot program. At the end of the third quarter we exited the pilot program, making SEN Leverage a more integral part of our growth and monetization of the platform. As of year end, we had approved lines of credit totaling $82.5m versus $35.5m at the end of the third quarter. We are in the early stages of scaling SEN Leverage, and are confident that we have a significant runway for platform revenue growth in the coming years.”

A graphic from the latest results gives the flavour of how Silvergate is growing.

I recently listened to an hour long interview with the CEO, Alan Lane. As a lifelong atheist I was shaken to learn that he reads the bible every day but nobody is perfect. He is definitely clever, on top of his business and excited about the outlook. Another key figure, who plays a key role at analysts’ meetings, is the chief strategy officer, Ben Reynolds, who joined the group in January 2016.

The business is on fire and prospects look great.

“Deposits from digital currency customers for the quarter grew by $2.9bn to $5bn as of 31 December, 2020. Digital currencies, and bitcoin in particular, saw significant price appreciation in the second half of 2020, spurring increased investment by a number of hedge funds and adoption by corporate treasuries and digital-first retail platforms. As more institutional participants adopt digital currencies, there is increased reliance on the SEN global payments platform to move U.S. dollars in real time, 24 hours a day, 7 days a week. As we look to 2021 and beyond, I’m extremely excited about the opportunities and multiple areas of growth ahead. We consistently listen to our customers and look for innovative ways to solve problems. In fact, most of our product launches have been born out of those conversations.”

Fiverr International FVRR Buy @ $284.5 MV: $10.0bn Next figures: 18 February Times recommended: 6 First recommended: $65 Last recommended: $233

Latest results painted a picture of a business storming ahead. “We are excited to deliver another quarter of record-setting growth as revenue, active buyers, and spend per buyer all further accelerated from the prior quarter. Revenue grew 88pc year-over-year, active buyers grew 37pc year-over-year to over 3.1m, and spend per buyer increased 20pc year-over-year to $195. Our success underscores the tremendous growth potential of our business. This is supported by a large and mainly untapped addressable global market, our strong business model that’s highly efficient and scalable, as well as industry tailwinds towards remote work and digital transformation. The velocity of our growth matters, but it’s the quality of our buyers and the efficiency of how we attract those buyers that give us confidence in driving long-term sustainable growth in the business.”

Covid has player a role. There is a reason why the shares took off last March and have risen 14 times since then. Widespread lockdowns have played to the company’s strength. I know from my own business how much we are using freelancers from all over the world to help us with projects. It is amazing the high quality of resources that are available.

If everybody is reacting the same way this creates a powerful following wind for the Fiverr platform, which is all about connecting freelancers with work. But that does not mean this is a transitory boom and that as vaccinations are rolled out we will go back to the old ways of doing things.

On the contrary, Fiverr’s management think that this is just the beginning of a global transformation in the way people work and companies organize their workforces.

“Over the last few months, we have continued to make exciting progress towards our key strategic initiatives: that is going upmarket, international expansion, and expanding Promoted Gigs. Fiverr Business was officially launched in September, after running a beta with select partners. We introduced a brand-new onboarding flow and started to make top-of-the-funnel marketing investments in both awareness and acquisition. One of the major value propositions for Fiverr Business is to allow us to land more buyers with our initial touchpoints within larger organizations, and we are encouraged by the fact that nearly 50pc of new registrations so far have invited other members to join their Fiverr Business account.”

They think and I agree that Fiverr Business could be massive. “The pandemic has forced companies everywhere to rethink best practices for hiring, and this means focusing on a full-time team supporting their core competencies while integrating freelance talent as a way to easily scale. Fiverr Business was designed to integrate into a companies’ workflow and become a part of the digital onboarding experience for employees — they get access to email, Slack, and Dropbox, as well as their Fiverr Business team account wherein all of their projects can be managed. It is reliable, budget friendly, and simple, but most of all, it gets the job done faster than any other method.”

The company is also racing ahead to expand internationally.

“In Q3, we continued to execute on international expansion. Our sixth non-English website was introduced in Portuguese allowing us to expand our country presence into Portugal and Brazil. We also integrated with a local payment solution provider in Brazil to streamline the local payment experience. On the marketing front, we continued to ramp up our performance marketing infrastructure across international regions, expanded our Affiliate program in Germany and France, and added localized Affiliate dashboards in five languages. What we see is that Affiliate programs work extremely well in the international markets in a similar way to the U.S. markets in terms of efficiency and scalability.”

Before that in July the group launched in Italy and the Netherlands. This follows the success the company saw with its expansion efforts in Germany, France and Spain.

This is a company on a massive roll.

“Over the past ten years, we have built the world’s largest marketplace for freelancers with a proprietary digital service catalogue, a sophisticated matching, quality and liquidity engine powered by a decade of transaction data, a highly efficient and scalable marketing infrastructure, a global brand and a global community with millions of buyers and sellers. These allowed us to execute and grow with tremendous momentum in 2020, and expand our leadership position during a time when businesses and freelancers needed us the most in terms of digital transformation and income opportunities.

We are excited to be in a position to finish out the year strong, and even more excited about what lies ahead in 2021. We are currently developing our 2021 roadmap and as we deepen our efforts in bold strategic areas and plan towards many others, we expect to continue our momentum into next year and set ourselves up for a great 2021 and beyond.”

One step at a time

When shares are in strong uptrends, so just the kind of shares I look for to put in the Quentinvest portfolio, they often rise in a pattern that looks like a series of steps. Below I show the chart for Shopify, which perfectly illustrates this phenomenon. My old mentor, Nicholas Darvas (I never met him but I loved his approach to investing) used to talk about boxes. For him each step was a box (a tight trading range). When the shares broke up through the top of the box he bought more shares. Like me he traded on margin so the rise through the top of the box created the financial fire power to fund the additional purchases.

In his system a break down through the bottom of the box was a sell signal. I am influenced by that but not as strongly as he was. If I like the fundamentals I will tolerate quite a lot of share price weakness though I don’t like to see a full blown downtrend. Shopify and its gifted management team are a combination in which I have huge belief so it would take a lot to make me turn negative.

Shopify Buy @ $1450 Times recommended: 20 First recommended: $118.84 Last recommended: $1235

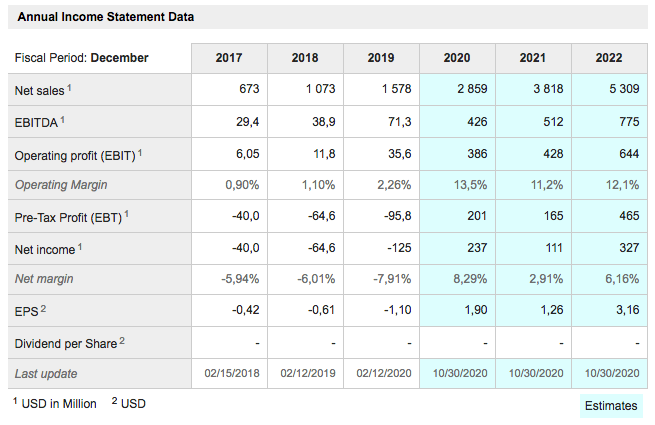

The shares are racing higher on a breakout from the latest step/ box. They are doing this ahead of the figures for Q4 and full year 2020, which are clearly expected to be good. Below is a table illustrating consensus forecasts for the next several years.

A broker recently released a report saying that helped by generally elevated e-commerce activity they expected the Q4 figures to be good although it should also be noted that their target for the shares is $1290. The group also said it would be rolling out its Shop Pay feature across Facebook and Instagram for merchants using those platforms. Shop Pay is an accelerated checkout that lets customers save their email address, credit card, and shipping and billing information so that they can complete their transaction faster the next time they are directed to the Shopify checkout.

Day traders become particularly active ahead of figures, especially for hot stocks like Shopify and this can introduce volatility. My approach is to pay no attention so I will happily recommend shares I like before figures, after figures, whenever. What attracts me to Shopify is the long-term story, which is electrifying. I expect the company to reach a valuation of a trillion dollars plus one day.

One last point on the chart front. Shares in really strong uptrends tend to have classically strong charts; the kind of charts where you look at it and kick yourself for not buying the shares at much lower prices. Shopify has just such a chart.

Nvidia NVDA Buy @ $588 MV: $353bn Next figures: 24 February Times recommended: 18 First recommended: $164.7 Last recommended; $543 Lowest recommended: $147.21

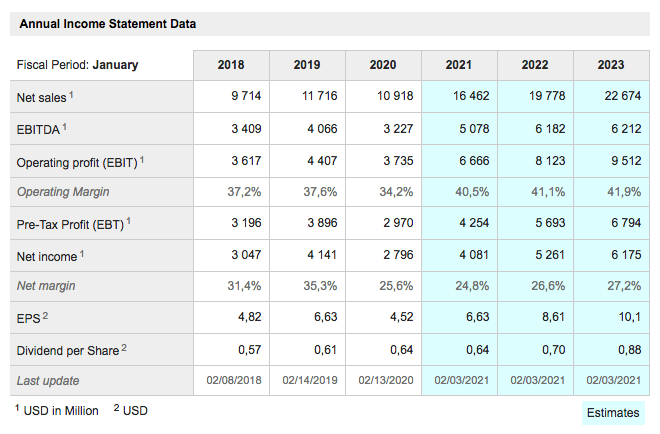

Nvidia is classic 3G – great chart, great growth (see table below) and a great story. Semiconductors play a key role at the heart of the technology revolution. Nvidia is a great semiconductor company.

Just the description of the business makes you want to buy the shares.

“NVIDIA is the pioneer of GPU-accelerated computing. We specialize in products and platforms for the large, growing markets of gaming, professional visualization, data centre, and automotive. Our creations are loved by the most demanding computer users in the world – gamers, designers, and scientists. And our work is at the centre of the most consequential mega-trends in technology.”

Nvidia doesn’t make stuff or not much. Like Apple it majors in research and development to create great products and sales and marketing to sell them. If I look at their latest results they had gross profits of $2.96bn v $1.92bn a year earlier so a big jump. They spent $1.05bn on r&d and $515m on sales and administration.

Money spent on r&d and sales and marketing is effectively money invested in future growth. It is a key reason why so many technology companies are able to grow so fast. They have huge opportunities in a world undergoing digital transformation and are able to invest in growth at a rate which most non-technology companies could not imagine.

This money has to be spent wisely. I am not the best judge of the details of this but everything about Nvidia suggests to a layman that they are doing exciting, leading edge things and playing a crucial role in taking global technology to the next level and beyond.

This is what they said in their Q3 2021 results aboyt their new gaming chip.

“Driving strong growth was our new NVIDIA Ampere architecture-based GeForce RTX 30 series of gaming GPUs. The GeForce RTX 3070, 3080 and 3090 GPUs [graphics processing units] offer up to two times the performance and two times the power efficiency over the previous Turing-based generation. Our second generation NVIDIA RTX combines ray tracing and AI to deliver the greatest ever generational leap in performance. First announced on September 1st and ranging in price from $499 to $1,499, these GPUs have generated amazing reviews and overwhelming demand. PC World called them staggeringly powerful, while Newegg cited more traffic than Black Friday. Many of our retail and e-tail partners sold out instantly, the RTX 30 series drove our biggest ever launch.”

Then they talk about another breakthrough.

“In technology and media and entertainment, we gained wins for design, rendering and broadcast applications. During the quarter, we announced the Omniverse, the world’s first 3D collaboration and simulation platforms has entered open beta. Omniverse enables the tens of millions of designers, architects and creators to collaborate real time, on-premises or remotely. Fusing the virtual and physical worlds, Omniverse brings together NVIDIA breakthroughs in graphics, simulation and AI. It will help enterprises address evolving requirements as workforces become increasingly distributed. Initial market response from this transformative platform has been phenomenal. Over 400 individual creators and developers in diverse industries have been evaluating Omniverse, and early adopters including Ericsson, BMW, Foster and Partners, and Lucasfilm.”

Then they talk about the data centre.

“Now moving to data centre. Revenue was a record $1.9bn, up 162pc year-over-year and up 8pc sequentially, driving growth with a strong ramp of our A100-based platforms, continued growth with Mellanox and record T4 shipments for inference.”

Eventually it becomes a bit like Amazon’s reports. There is so much happening your head starts to spin. Nvidia is a fantastic business, one which the world really needs. The shares have been moving broadly sideways for nearly six months. I don’t know if the imminent figures will be the trigger to send them higher but I think the next big advance is just a matter of time.

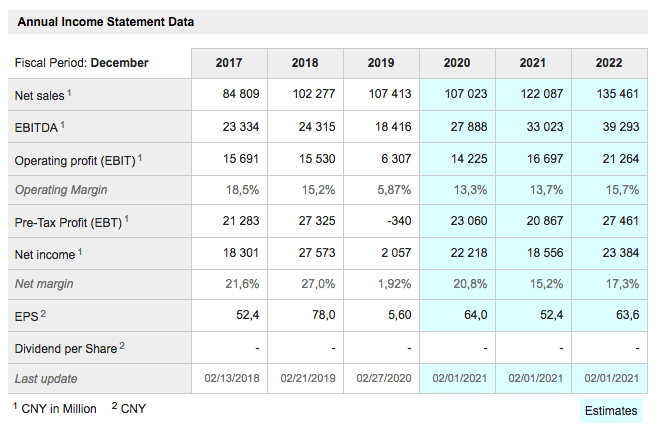

Baidu BIDU Buy @ $312 MV: $75.4bn Next figures: 17 February Times recommended: 6 First recommended: $259.37 Last recommended: $250 Lowest recommended: $125

Baidu started off as China’s answer to Google, selling ads linked to search results and online ads still make up the bulk of group revenue. The shares soared as Google stepped away from the Chinese market because of censorship concerns. They then weakened as growth slowed in a fiercely competitive Chinese market.

Analysts sometimes divide companies into cash cow businesses, growth stars, businesses which are growing fast and generating revenue and growth projects, which could be exciting but are absorbing large amounts of cash.

If we apply this analysis to Baidu we can call all the online ad-related businesses cash cows, the AI and cloud businesses are more like growth stars and the autonomous driving project, yet another echo of Alphabet/ Google is a project that could pay huge dividends but is eating cash.

The recent strong recovery in the share price is partly reflecting a recovery in ad spend after the Covid lockdown effects but is mainly about the newer businesses.

One analyst recently valued the autonomous car business at around $40bn, which is about half Baidu’s market value. CEO and founder, Robin Li, is super bullish about prospects for autonomous driving in China. The company recently confirmed plans to produce electric vehicles in a partnership with Zhejiang Geely Holding Group. Baidu will provide intelligent driving capabilities to power the passenger vehicles for the new venture, and Geely will provide vehicle design and manufacturing.

Baidu currently has a very similar value to Chinese electric car manufacturer, Nio, so it is easy to see how this partnership could have a dramatic impact on Baidu’s value once they start making and selling vehicles.

Baidu’s autonomous driving project is called Apollo after the moonshot. “With each new generation of Apollo vehicles, the cost will be halved, while performance will increase by tenfold, said Zhenyu Li, corporate vice president of Baidu and general manager of their Intelligent Driving Group. Li refers to the Apollo brain as an “experienced AI driver”. That’s the AI system’s ability to control the vehicle independent of a human driver. So far, the Apollo platform has logged over three million miles of road tests without any accidents and has carried over 100,000 passengers in 27 cities around the world. Apollo’s “experienced AI driver is well-trained.”

The latest advance in the Baidu share price came after reports that it was planning to raise funds from venture capitalists for a stand alone AI and semiconductors business. The idea is that the new business would be a Baidu subsidiary but the external funding and the likely need for more cash down the road points to an eventual IPO for the new business, probably at a fabulous valuation.

Baidu is developing AI for autonomous driving, for a voice activated assistant called Duer, which already processes over 5.8bn queries a month and for its upgraded Baidu Brain 6.0, the underlying AI infrastructure for its industrial applications and cloud platform. Baidu Brain is already one of the largest open AI platforms in the world, with 270 core AI capabilities for 2.3m developers. The company expects it to become a “key driver” in the “intelligent transformation of a wide range of industries.”

If the company ends up as three companies – (1) online search and entertainment, (2) autonomous vehicles and (3) artificial intelligence/ cloud/ semiconductors it is easy to see how the parts could end up being worth a great deal more than $80bn.

Cryptocurrency prices have been all over the place just while I have been writing this article. As Warren Buffett once commented, investing in the stock market is like going into partnership with a manic depressive. Short-term investing is a mad house. The only way to stay sane is to take a long term view, back your judgement and be patient.

On that basis I think bitcoin, ether and all the shares featured above have further to go, perhaps much further.