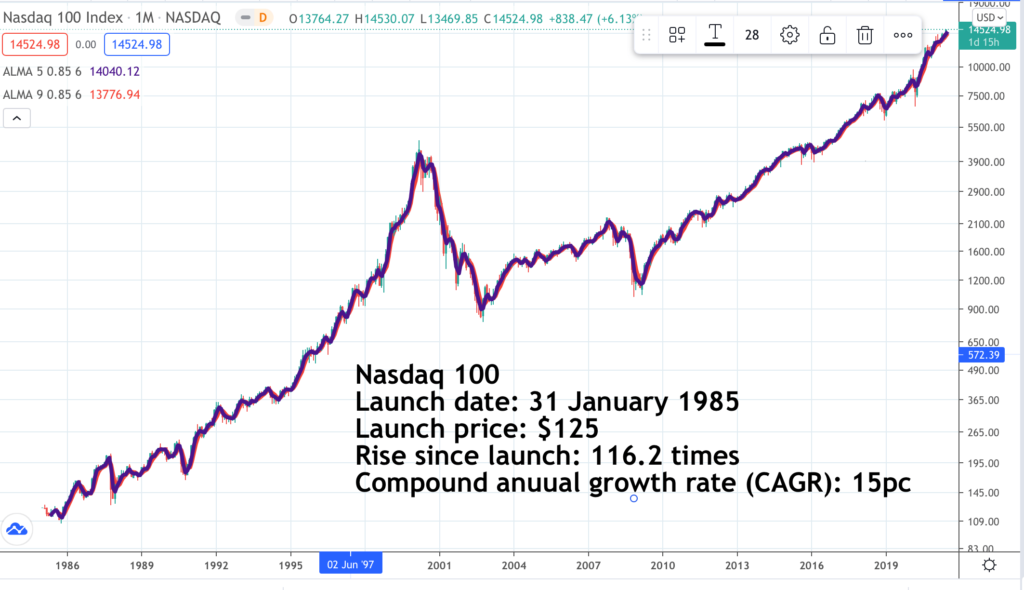

This chart illustrates why investing in US stocks is such a good strategy. The performance of the Nasdaq 100 since launch in January 1985 is one of the financial wonders of the world. Who would not want an investment that compounds (increases) in value by 15pc a year even before allowing for the effect of reinvested dividends. It is a sensational performance and a tribute to the vigour of the US economy. Europe is a lovely museum. America is the workshop that pays the bills and creates the future.

There is a new kid on the block in China and they are starting to make an impact, which is why there are a growing number of Chinese-based Hong Kong or Nasdaq quoted companies joining the QV portfolio. Other regions are also flickering into life and Europe may eventually throw of its chains (disband the euro and lessen its obsession with regulation). The UK post-Brexit will change, hopefully in a good way.

The world is heading into a boom which will likely give interest rates a tendency to move higher and lead to inflationary fears. My hunch is that inflation is not going to be a problem in a technologically advanced world and that interest rates will remain very low by historic standards but that is just my guess. I am certainly a bull of stocks given all the exciting things happening in the corporate world.

A strategy based on stock selection and follow-up buy signals

More experienced subscribers will know that Quentinvest for Shares is a work in progress. I liken my investment strategy to a piece of software which is constantly being improved and upgraded. In this issue I believe we are making a massive leap forward.

The core of the strategy is stock selection. I only choose one kind of share – 3G (great growth, great story, great chart). I measure these things pragmatically with my main criterion that the characteristic should be obvious. Great growth is straightforward although it may be based on one of many metrics and I may even (think C3:AI) accept slower growth if the story is really exciting. Great chart is also mostly obvious. A great chart is a rising chart. Within that I will accept massive volatility because that is what we are seeing in 21st century stock markets.

I could almost have a five minute rule. If it takes more than five minutes to determine that a stock is great growth and has a great chart they probably don’t fit the bill. The one that takes longer and is the fun bit is great story. For all the stocks in the QV portfolio I have studied them, some more than others but that is an ongoing process and found that they have great stories.

The bottom line is that the QV portfolio, which now contains some 250 stocks (I haven’t actually counted them) is a very special list. It is a list of many of the most exciting quoted stocks in the world. Many of them are businesses which are creating the modern world. There is an excellent case for holding almost all of them. Some have obviously ceased to be 3G (again this will usually be obvious) and should not be bought.

Once selected there is the question of what to do with them. I have broadly three strategies. One is simple buy and hold. I find the stock, alert it in QV and we all buy a stake big enough to be meaningful but leaving us with the firepower to keep building the portfolio. The aim is to build a significant portfolio of say 100 stocks.

Note that I do not target diversity in my investment strategy. If your portfolio is 100pc invested in North American technology stocks that is fine with me. What I do like is not to put all my eggs in one basket (one stock) because that is too stressful and most people, unless they founded the business, cannot cope. I certainly can’t and nearly always come to grief when I try to do this. There is no need anyhow because there is a huge choice of exciting 3G stocks out there.

The second strategy is all about turning stock market volatility to your advantage and reducing stress levels to the lowest possible level consistent with making decent returns. This involves buying all the stocks in your portfolio in small incremental parcels. It is £-cost averaging applied to every stock you buy. My particular variant on this approach, discussed further below, is to buy incremental parcels on new buy signals. I like to do this because it focuses your portfolio on winners and neglects losers. This gives you an extra bias to success and is ideal for cautious, patient investors or for people investing money they cannot afford to lose. The gains may be less but they will be more certain (and should still be very substantial over times).

The third strategy which is closer to what I do personally is to buy a meaningful chunk initially and then add smaller parcels on subsequent buy signals. I use leverage to do this so my ride in the stock market is exciting but also at times scary. It works for me but then I am good at handling stress and love the excitement. I also keep on finding stocks that I just have to own so I am like a greedy kid in a sweet shop with a non-stop sugar rush.

This is why I always advise my subscribers to do what I say, not what I do, at least with the bulk of their funds. I am trying hard to be more sensible with my own investments but it is like asking a Formula 1 racing driver to take his foot off the accelerator. I find it very hard to do.

Nearly 200 buy signals.

There are nearly 200 buy signals in the latest issue of Quentinvest, which I am sure many of you will think is ridiculous so I am trying to explain the thinking behind my selections. I am trying to make QV for Shares (and QV for ETFs) a complete investment system. The idea is to (a) choose great stocks) and (b) add to holdings on ALL subsequent buy signals.

I have various kinds of buy signals, all chart based. The first is based on chart breakouts. The publication, Chart Breakout, still available in hard copy format as well as on line, is now known as Great Charts by Quentinvest. However it is still the same publication. I focus on shares making what I consider to be chart breakouts. GC is published once a month and is intended to be a fertile source of buying ideas for subscribers.

The second type of buy signal is what I call programmatic. I look at moving averages and trend lines to find stocks that have been in a decline but now seem to be heading higher again. It is not rocket science but you have to do your home work and many of my subscribers obviously have other things to do like their job.

The third type of buy signal and my newest invention is what I call buying the green. I use candle stick charts and the way they work is that if the price ends higher over the period of the candle (daily, weekly, monthly whatever) the candle will be (in my case because you can choose) green. If the price ends lower the candle will be red.

This is the ultimate in simplicity because there will be an unequivocal signal every month. Buy or don’t buy. You can have a further refinement whereby you only buy when a green follows a red. So you don’t buy all the greens but only a green preceded by a red indicating a recovery from a decline in the stock.

My reading of the whole stock market, especially in North America, is that after a period of turbulence, with heavy profit-taking in many exciting stocks, that prices are again heading higher. The effect of applying all my types of buy signals to the QV for Shares portfolio is that we have nearly 200 buy signals. These are listed below in alphabetical order.

Most people will be like me. They do not have an inexhaustible stock of funds available for investment. After many ups and downs I am still building my 100-share portfolio so I use this list more to add new names to my portfolio. But I also use it to take holdings to the next level. I am trying really hard to be more sensible in my approach to doing this.

What I always want to remind you is that although the list is long and all I do is name the stock and the price these are not weak recommendations. They are all based on a very exclusive club which is the QV portfolio. If you are not 3G you have no chance of being in this list. It is like inviting guests to a tennis weekend and you only get invited if you are already playing Wimbledon.

If you took any of these stocks and did an in-depth study you would be impressed. They all have exciting stories – every single one of them. If you had the money to buy them all I would certainly say – go for it. All these stocks will be added to the table at the recommended price so I need them to go well to keep my performance figures high. I am confident that they will.

Remember, if you do study them before buying that I choose stocks for excitement, not for value. A focus on value leads inexorably to a portfolio full of shares in worthy but unexciting businesses and I am not interested in those for Quentinvest.

Some people describe me as an out-and-out growth stock investor and that is exactly what I am.

The list

Abbott Laboratories. ABT. Buy @ $115.50

Adobe. ADBE. Buy @ $588

American Micro Devices AMD Buy @ $87

Afterpay. APT. Buy @ A$120.47

Alibaba. BABA. Buy @ $227

Align Technology ALGN. Buy @ $621

Alphabet. GOOGL. Buy @ $2448

Alteryx. AYX. Buy @ $89

Amazon. AMZN. Buy @ $3443

Ambarella. AMBA. Buy @ $106

Anaplan. PLAN. Buy @ $55

Appian Corporation APPN. Buy @ $144.50

Apple AAPL Buy @ $134.50

Argenx SE ARGX. Buy @ Euro315

Ashtead. AHT. Buy @ 5386p

Arista Networks. ANET. Buy @ $362

ASML. ASML. Buy @ $704

Avalara. AVLR. Buy @ $165.

Avast. AVST. Buy @ 502p.

Axon Enterprise. AXON. Buy @ $172

Bandwidth. BAND. Buy @ $141

Beyond Meat BYND. Buy @ $155.5

BiliBili. BILI. Buy @ $126.50

Bill.com BILL. Buy @ $186.50

Blackline. BL. Buy @ $112.50

Bio-Techne Corp. TECH. $445

Booz Allen Hamilton. BAH. Buy @ $85.50

Bumble. BMBL. Buy @ $57

C3.AI. AI. Buy @ $66.40

Cable One. CABO. Buy @ $1897

Cadence Design Systems CDNS. Buy @ $137

Canada Goose. GOOS. Buy @ $42.3

Carvana. CVNA. Buy @ $305

Carl Zeiss Meditec. AFX. Buy @ Euro166

Charles River Laboratories. CRL. Buy @ $366

Chegg. CHGG Buy @ $84.50

Chewy. CHWY. Buy @ $83

Chipotle Mexican Grill CMG. Buy @ $1506

Cloudflare. NET. Buy @ $106

Cochlear. COH. Buy @ A$251

Corporate Travel Management. CTD. Buy @ A$20.84

Coupa Software. COUP. Buy @ $262

Croda International. CRDA. Buy @ 7308p

Crowdstrike Holdings. CRWD Buy @ $253

Datadog DDOG. Buy @ $106

Dexcom DXCM. Buy @ $427

Diageo. DGE. Buy @ 3505p

Digital Turbine. APPS. Buy @ $80

Docusign. DOCU. Buy @ $284

Domino’s Pizza Inc. DPZ. Buy @ $463

Domo Inc. DOMO. Buy @ $82.50

Dropbox. DBX. Buy @ $30.15

Dynatrace. DT. Buy @ $59.50

Edwards Lifesciences. EW. Buy @ $102.50

Enphase Energy. ENPH. Buy @ $188

Epam Systems. EPAM. Buy @ $521

Estee Lauder. EL. Buy @ $314

Etsy. ETSY. Buy @ $198

Everbridge. EVBG. Buy @ $139.50

Experian EXPN. Buy @ 2815p

Facebook. FB. Buy @ $355.50

Fastly. FSLY. Buy @ $61

Fevertree. Drinks FEVR. Buy @ 2642p

Fisher & Paykel Healthcare. FPH. Buy @ A$29.50

Five9. FIVN. Buy @ $184.50

Fortinet. FTNT. Buy @ $247

Futu Holdings. FUTU. Buy @ $178

Fiverr International FVRR. Buy @ $250

Gear4Music. G4M Buy @ 1020p

Genscript Bio. 1548. Buy @ HK$35.65

Getswift Technologies. GSW. Buy @ A$1.22

Globant. GLOB. Buy @ $288

Godaddy. GDDY. Buy @ $87.50

Halma. HLMA. Buy @ 2731p

HelloFresh. HFG. Buy @ Euro82

Hermes. International RMS. Buy @ Euro1227

Horizon Therapeutics. HZNP. Buy @ $95.50

Hubspot. HUBS. Buy @ $594

IDEXX Laboratories. IDXX. Buy @ $631

Impax Environmental Markets. IEM. Buy @ $477

In-Mode. INMD. Buy @ $96.46

Inogen. INGN. Buy @ $66

Inspire Medical Systems. Buy @ $196

Intertek. ITRK. Buy @ $5570p

Intuit. INTU. Buy @ $486

Intuitive Surgical Corp. ISRG. Buy @ $912

ITM Power ITM. Buy @ 489p

IShares World Momentum IWMO. Buy @ $63.14

Just Eat Takeaway. JET. Buy @ 6794p

Kering KER. Buy @ Euro755

Keyence Corp. 6861. Buy @ Yen56210

Learning Technologies Group LTG. Buy @ 192p

Lemonade. LMND. Buy @ $110.50

Lendingtree. TREE. Buy @ $220

Li Auto. LI. Buy @ $33.50

Lightspeed POS. LSPD Buy @ $106

Liontrust Asset Management. LIO. Buy @ 1848p

London Stock Exchange Group. LSEG. Buy @ 81.96

L’Oreal. OR. Buy @ Euro385.50

Lululemon Athletica. LULU. Buy @ $363

LVMH. LVMH. Buy @ Euro676

Lyft. LYFT. Buy @ $58.50

Masimo Corp. MASI. Buy @ $248

Mastercard. MA. Buy @ $367

Match Group. MTCH. Buy @ $161.50

Meituan. 3690. Buy @ HK$323.8

MercadoLibre. MELI. Buy @ $1570

Mettler-Toledo. MTD. Buy @ $1381

Microfocus International. MCRO. Buy @ 543p

Microsoft. MSFT. Buy @ $268.50

Middleby Corp. MIDD. Buy @ $171.50

Monday.com. MNDY. Buy @ $232

MongoDB. MDB. Buy @ $389

Monolithic Power Systems. MPWR. Buy @ $374

Morningstar. MORN. Buy @ $250

MSCI. MSCI. Buy @ $534

Nasdaq Inc. NDAQ. Buy @ $177

Natera. NTRA. Buy @ $116.50

Nio. NIO. Buy @ $53.44

Nikola Corp. NKLA. Buy @ $18.50

Nvidia. NVDA. Buy @$795

O’Shares Global Internet Giants. OGIG. Buy @ $57.50

Okta. OKTA. Buy @ $247

O’Reilly Automotive. ORLY. Buy @ $561

Palo Alto International. PANW. Buy @ $378

Par Technologies. PAR. Buy @ $70.40

Paycom Software. PAYC. Buy @ $373

Paypal Holdings. PYPL. Buy @ $293

Pegasystems. PEGA. Buy @ $140.50

Peloton Interactive. PTON. Buy @ $126.50

Pinterest. PINS. Buy @ $78.50

Polar Capital Technology Trust. PCT. Buy @ 2382p

Procore Technology PCOR. Buy @ $93

Pool Corporation. POOL. Buy @ $456

Prologis. PLD Buy @ $121.50

Invesco QQQ Trust. QQQ Buy @ $353

Rapid7. RPD. Buy @ $96.50

Repligen. RGEN. Buy @ $201

Rightmove. RMV. Buy @ 661p

Ringcentral. RNG. Buy @ $306

Roku. ROKU. Buy @ $440

S4 Capital SFOR. Buy @ 621p

S&P Global Inc. SPGI. Buy @ $410

Salesforce.com CRM. Buy @ $244

Sea Limited SE. Buy @ $281

Servicenow. NOW. Buy @ $552

ShakeShack. SHAK. Buy @ $105

Shift4Payments FOUR Buy @ $95.50

Shopify. SHOP. Buy @ $1492

Shotspotter. SSTI. Buy @ $48.50

Snap Inc. SNAP. Buy @ $66

SPDY S&P 500 ETF. SPY. Buy @ $427

SolarEdge Technologies SEDG. Buy @ $284.50

Spiral-Sarco Engineering. SPX. Buy @ 13810p

Splunk. SPLK. Buy @ $144

Spotify Technologies. SPOT. Buy @ $271.50

Springworks Therapeutics. SWTX. Buy @ $83

Square. SQ. Buy @ $247

Stryker.Corp SYK. Buy @ $260

Superdry. SDRY. Buy @ 427p

Synopsys. SNPS. Buy @ $276.5

Teledoc Health. TDOC Buy @ $169

Teleflex Corp TFX. Buy @ $407

Tesla. TSLA. Buy @ $677

The Joint Corp. JYNT. Buy @ $82.50

The Trade Desk. TTD. Buy @ $79

Turning Point Therapeutics. TPTX. Buy @ $76

Twilio. TWLO. Buy @ $398

Unilever. ULVR. Buy @ 4283p

UP Fintech Holding. TIGR. Buy @ $28

Veeva Systems. VEEV Buy @ $320

Verisk Analytics. VRSK. Buy @ $175

Victoria Carpets. VCP. Buy @ 1055p

Visa V Buy @ $235

Volex. VLX. Buy @ 387p

Vuzi. VUZI. Buy @ $18.60

Watches of Switzerland Group WOSG Buy @ 820p

Water Intelligence. WATR. Buy @ 840p

Wingstop WING. Buy @ $157

Wisdomtree Nasdaq 100 3x daily leveraged. QQQ3. Buy @ $177.14

Wix.com WIX Buy @ $297

Workday. WDAY Buy @ $242

Wuxi Bio. 2269 Buy @ HK$144

Xero XRO Buy @ A$138.09

Xilinx XLNX Buy @ $138

Yougov. YOU Buy @ 1185p

Yu Group YU. Buy @ 241p

Zalando ZAL Buy @ EUR102.50

Zebra Technologies ZBRA Buy @ $530

Zendesk. ZEN Buy @ $147.50

Zillow Z Buy @123

Zoom Info Technologies ZI. Buy @ $53.80

Zoom Video Communications. ZM Buy @ $387

Zscaler. ZS. Buy @ $219

When my daughter saw that in this issue of Quentinvest there were going to be nearly 200 alerts she groaned theatrically and I expect some of you may feel the same. However there is method in my madness. These are real buy alerts. It is just that there so many of them and because they are chart-based there is no commentary. My reasoning is that we need research and explanation when a stock goes into the QV for Shares portfolio but when it is a follow-up buy recommendation the name, code and price is all we need.

It could be nice to talk about latest developments and any ‘something news’ that might be going on to drive particular shares higher but this is not practical with so many stocks. I have a choice between alerting a handful of stocks giving buy signals and providing more commentary or alerting ALL the stocks giving buy signals and skipping the commentary which is not strictly necessary. Since the point of the alert is the buy signal the latter approach makes sense.

An interesting question is to think about the stocks which are not giving buy signals. As well as buying the green you could use the chart to signal selling the red. Since all the ‘buying the green’ stocks from the portfolio are listed above this means that all the stocks not listed are currently reds as in the latest candle stick on the chart is red. I don’t treat these as sell signals partly because in most cases these are very minor sell signals.

The overwhelming momentum in these stocks is upwards making even minor buy signals interesting. Sell signals are against the trend so likely to be reversed. Some sell signals are more important but even then most often the passage of time sees the uptrend resuming. So back to the core philosophy which means no sell signals. Quentinvesr is a one-way strategy – buy, hold, buy more.

In this approach a consistent failure to buy becomes a kind of sell signal because such stocks rapidly become less important to the portfolio. Also what may happen when a stock is very weak is that there will be a string of red candlesticks so when the green buy signal eventually comes it can be at very low levels so even underperforming stocks can eventually become profitable.

It is a matter of taste whether you buy stocks once or keep adding to your holdings as I do but if you do the latter these regular buy signals can be very useful. My idea, at the moment, is to do this mass alerting process each month. In stronger markets there will be many alerts as currently. In weak markets there will be fewer.

We should then have a complete investing system, which I believe will deliver excellent results.