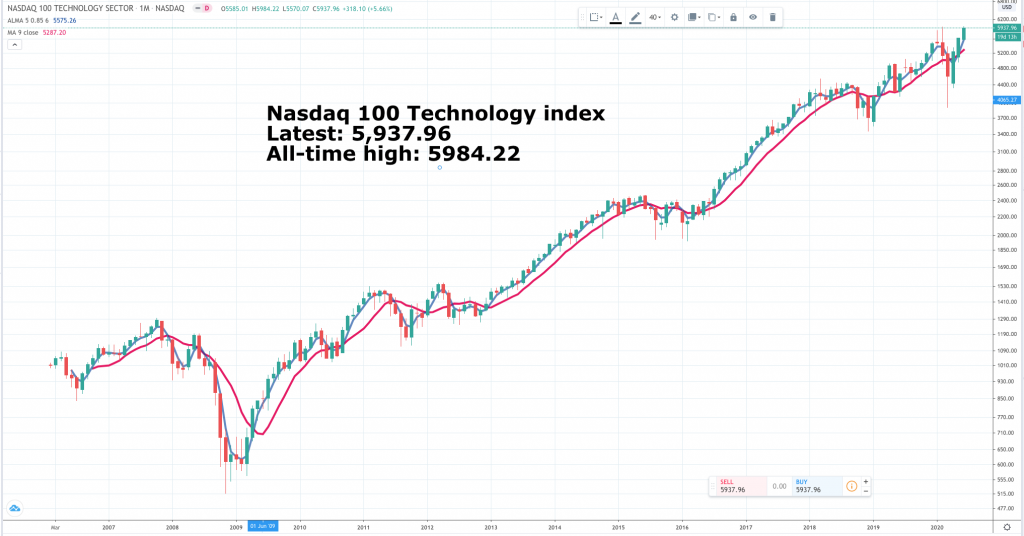

| Netease NTES Buy @ $430 MV: $55bn Employees: 21,000 Next figures due: 5 August

About: As a leading internet technology company based in China, NetEase, Inc. is dedicated to providing premium online services centred around innovative and diverse content, community, communication and commerce. NetEase develops and operates some of China’s most popular mobile and PC-client games. In more recent years, NetEase has expanded into international markets including Japan and North America (in a recent statement of intent CEO and founder, William Ding, paid $29m for one of Elon Musk’s houses in California). In addition to its self-developed game content, NetEase partners with other leading game developers, such as Blizzard Entertainment and Mojang AB (a Microsoft subsidiary), to operate globally renowned games in China. NetEase’s other innovative service offerings include the intelligent learning services of its majority-controlled subsidiary, Youdao (NYSE: DAO); music streaming through its leading NetEase Cloud Music business; and its private label e-commerce platform, Yanxuan.

News flash: NetEase has raised a total of $2.72bn by offering 171,480,000 new ordinary shares in the Hong Kong market, reported CNBC.The firm is looking to bolster its education and music streaming products and is following its rival Tencent Holdings in a bid to expand its global footprint by investing in gaming companies. NetEase said that 25 ordinary shares are worth one Nasdaq-listed American depositary share, meaning the HK$123 offer price is equal to $397 per ADS. As tensions between the U.S. and China increase, some Chinese companies are delaying their U.S. listings.

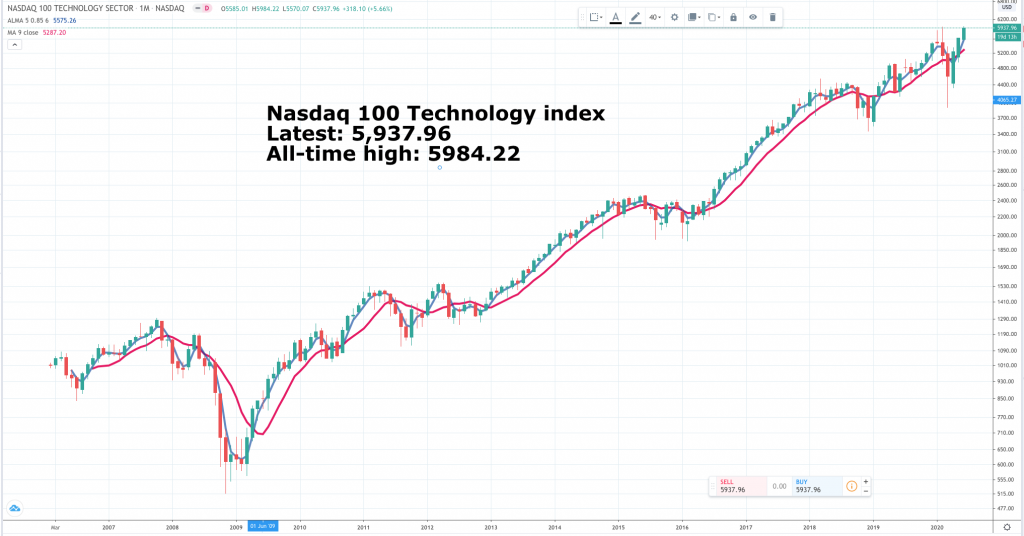

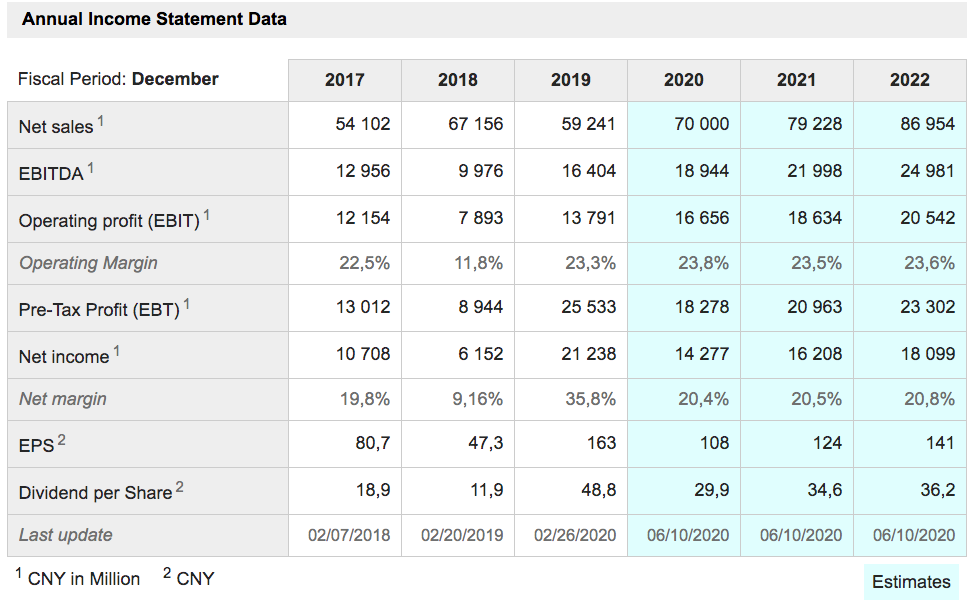

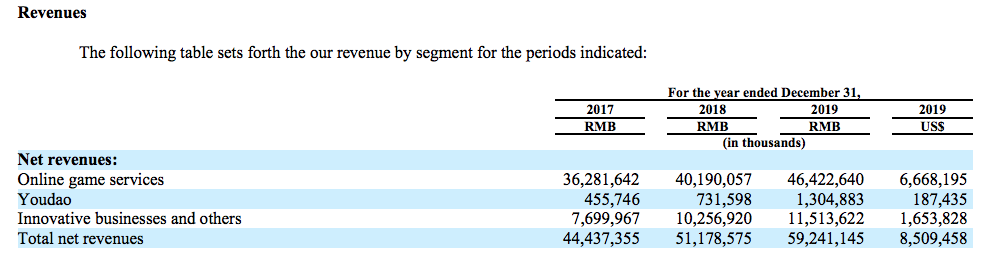

Quotes: “Our company had a good first quarter, with total net revenues growing 18pc and net income from continuing operations attributable to the company’s shareholders increasing by approximately 30pc, both on a year-over-year basis. “Our online game services net revenues reached RMB13.5bn during the quarter with both our flagship titles and many of our newer titles performing well. The strength of our games business is supported by our growing portfolio of games with impressive longevity across an increasingly broad variety of genres. Encouraged by our success in overseas markets such as Japan, we are more confident and committed than ever to extending our reach internationally. Our other core businesses are growing healthily. Both Youdao and NetEase Cloud Music are on track to reach their development goals for 2020. Moving forward, we remain committed to our mission to deliver innovative products and high-quality services that surprise and impress our users, and the larger community worldwide. The quarter-over-quarter and year-over-year increases in online game services gross profit were primarily due to increased net revenues from self-developed games including Fantasy Westward Journey 3D, Fantasy Westward Journey mobile game, Fantasy Westward Journey Online and New Westward Journey Online II, as well as certain licensed games. The quarter-over-quarter and year-over-year increases in Youdao gross profit were primarily attributable to the significant increase in net revenues, improved economies of scale and faculty compensation structure optimisation for its learning services and products. The quarter-over-quarter decrease in innovative businesses and others gross profit was primarily due to seasonality of NetEase’s advertising services. The year-over-year increase was primarily due to increased net revenues from NetEase Cloud Music.” William Ding, CEO, 19 May.

Comment: Netease is primarily a video gaming company with a large proportion of its gaming revenue coming from mobile games. It also has a range of Internet related businesses including online learning, e-commerce, e-mail and other premium services. The games division is supported by in-house research and development capabilities, growing use of machine learning and artificial intelligence and a focus on augmented and virtual reality. A major aspiration is to grow the business outside China, initially in other areas of the FarEast like Japan and in South East Asia but the group has also signalled its global ambitions by setting up a research studio in Canada. Last year the group did deals with Marvel and Pokemon to develop games. Most recently it has done a deal with Warner to develop a Lord of the Rings game. It has just raised $2.7bn with a Hong Kong secondary offering to fund its international expansion plans. Last year an executive said the company hoped to generate 30pc of revenue from overseas earnings in three years. |