Companies enabling digital transformation make exciting investments

The big business news in recent days has been the imminent collapse of Arcadia, the hodge-podge of fashion retail brands, led by TopShop and assembled by Philip Green. The mainly bricks and mortar operation has been hit hard by widespread lockdowns but it was struggling even before Covid-19 arrived. In a world of widespread digital transformation Arcadia has failed to adapt and has been left exposed. It seems increasingly certain that Covid-19 has not so much changed the world as accelerated a process of change that was already taking place.

Among the world’s most exciting and fastest growing companies are the businesses, typically born in the 21st century and led by millennials or even younger, which are enabling this process. Five of the companies listed below are great examples – Atlassian, software for teams, Bill.com, back office automation, Crowdstrike, cloud security, MongoDB, document focused database software and Paycom Software, cloud-based software that enables employees to become part of the human resources process at businesses.

Alphabet, better known as Google, is a key player in making the Internet work for everybody, Cloudflare is an innovator in the critical infrastructure of the Internet and Axon Enterprise is something completely different. This is the business, which invented tasers and is trying to facilitate a world in which police can do their job without killing anybody. The growth being delivered by these companies and others like them is powering the whole stock market higher, especially in the US, where all the companies featured in this issue are located. It has also forced investors to learn new ways of valuing companies because many of these businesses are investing so massively in growth that they don’t make profits. Alphabet is almost the exception, which proves the rule here since its search technology was so instantly effective that it spread like wildfire across the globe enabling Google to quickly create a fast-growing but almost instantly profitable online advertising business. The subscription model adopted by many enterprise software businesses is great for driving growth but defers profits into the future. On top of that these companies invest massively in innovation and sales and marketing in a land and expand approach to getting & growing customers.

“Operating cash flow was $17bn with free cash flow of $11.6bn in the quarter and $34bn in the trailing 12-months.” Alphabet, 29 October 2020

“We’ve got big plans to deliver even more value to our customers in the cloud.” Atlassian, 29 October 2020

“Our vision is a world where bullets are obsolete.” Rick Smith, CEO and co-founder, Axon Enterprise, 9 September 2020

“I’m excited about the momentum we have in FY ’21 as our platform simplifies business for our customers and their network, making it easier for them to focus on what they do best.” Bill.com, 5 November 2020

“Turning to Cloudflare Workers, it’s incredibly exciting to see how the platform is taking off.” Matthew Prince, CEO and co-founder, Cloudflare, 5 November 2020

“Cybersecurity is mission-critical and more important now than ever as the threat environment escalates and the attack surface continues to grow.” Crowdstrike, 2 September 2020

“We have adjusted our approach to increase the velocity of acquiring new customers.” Dev Ittycheria, CEO, MongoDB, 2 September 2020

“We continue to get stronger and stronger in both the book sales as well as the starter sales.” Chad Ricchison, CEO & founder, Paycom Software, 4/11

Additions to live portfolio

Alphabet/ GOOGL @ $1748 (9)

Atlassian/ TEAM @ $220 (4)

Axon Enterprise/ AAXN @ $123.5

Bill.com/ BILL @ $116.5 (2)

Cloudflare/ NET @ $70.10

Crowdstrike/ CRWD @ $146.50 (2)

MongoDB/ MDV @ $272 (2)

Paycom Software/PAYC @ $405 (3)

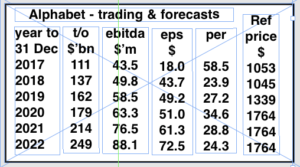

Alphabet Buy @ $1748

Alphabet GOOGL MV: $1208bn Next figures: 3 February

Alphabet continues to play a key role at the heart of Internet and digital ad spend plus much more

Google changed its name to Alphabet to reflect the fact that it has become more of a conglomerate. Revenue comes principally from advertising driven by Search and YouTube, which make the company the world’s largest advertising medium. Other businesses include cloud services and Android. The group’s huge cash generation means it is able to invest heavily in so-called other bets like Waymo, the autonomous driving business. Alphabet/ Google is a gigantic business with a $1.2bn market value. I am not going to try to tell you all about it in a one page article but its key role in enabling digital advertising generates fabulous cash flow which it invests at scale in massive innovation. This has two key implications. Nobody is going to catch it in search and the related ad spend that can generate. Video is also increasingly at the heart of the Internet experience which means YouTube is ideally placed to continue to grow what is already a huge business. Also interesting is the way YouTube is diversifying its revenue streams by adding subscription revenue to its business model and we know what that has done for Amazon with its Amazon Prime business and Netflix. The company is also making a declaration of intent by telling investors that from Q4 it will be split ting out its cloud business as a separate segment.This will focus attention on the business both internally and externally and in a world of digital transformation the opportunity for the larger cloud services operations is very large. Last but maybe not least in the Other Bets segment is the progress being made by Waymo, the autonomous driving operation, which, inter alia, has entered a partnership with Daimler Trucks, which could be a game changer for both businesses. Not least of the attractions of investing in Alphabet is the sheer share price performance. Since the 2004 IPO, the shares have risen around 35 times. The company is much bigger now so will not replicate the initial triple digit growth but all the signs are that strong growth will continue.

“Google Workspace continues to grow. For example, Google Meet saw a peak in Q3 of 235m daily meeting participants and more than 7.5bn daily video call minutes. Finally, in our Other Bets, Waymo announced that its fully autonomous ride-hailing service in suburban Phoenix will open to the public making it the only company to offer a fully autonomous service for riders. Waymo also entered into a strategic global partnership with Daimler Trucks to enable fully autonomous trucking. Starting with the results for the fourth quarter of 2020, we’ll break out Google Cloud as a separate reporting segment. Given the progress we are making and the opportunity for Google Cloud in this growing global market, we continue to invest aggressively to build our go-to-market capabilities, execute against our product roadmap and extend the global footprint of our infrastructure.” 29 October 2020

“People come to YouTube for entertainment, information and opportunities to learn something new. As a sign of the times, views of guided meditation videos are up 40pc since mid-March, while DIY face mask tutorials have been viewed over 1bn times. YouTube subscriptions also continued to grow. YouTube now has over 30m music and premium paid subscribers and over 35m, including those on free trials. YouTube TV now has more than 3m paid subscribers. Three trends are driving the continued momentum of our Cloud business. First, as the shift to digital accelerates, Google Cloud continues to provide a foundation for data processing and analytics, one of the fastest growing segments of the market. BigQuery which provides real-time and predictive analytics is winning retailers like Best Buy, helping them create better experiences for shoppers. Second, customers are increasingly moving to the cloud to drive efficiencies and lower IT costs. Our strength in multi-cloud is an advantage here. This is helping us win large data centre and IT transformation deals like Nokia, which recently announced its migrating and modernising approximately 30 data centres across 12 countries onto Google cloud. And third, the future of work is creating a more collaborative world. Customers are looking to support hybrid work environments and we are seeing significant growth in demand.” 29 October 2020

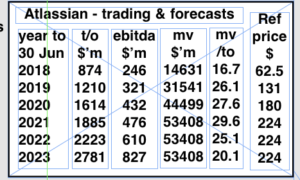

Atlassian/ TEAM Buy @ $220

Atlassian Corporation/ TEAM MV: $56bn Next figures: 21 January 2021

Atlassian makes a big bet on the cloud and warns of short-term pain for massive long-term gain

Atlassian was founded in 2002 by Mike Cannon-Brookes and Scott Farquhar, who remain joint CEOs. Atlassian released its flagship product, Jira, a project and issue tracker in 2002. In 2004 it released Confluence, a team collaboration platform that lets users work together on projects, co-create content and share documents and other media assets. Since then the products have been improved and extended by massive r&d spending. Atlassian, is an Australian based but global in scope, enterprise software business, which helps teams within organisations work together more effectively. The group began as an on premise software company but is increasingly moving to delivering its software from the cloud on a subscription model bringing benefits both to customers and the business. The latest quarterly report for Q1 2021 to the year ending 30 June 2021 is very much focused on the advantages of this transition and the size of the opportunity facing the business. “Atlassian has always looked for big markets with big potential for sustained long-term growth. Today, we play in three interconnected markets: agile software development, ITSM [IT service management] , and work management for all. Together, these markets exceed $125bn in available revenue, with over one billion users. Our cloud platform integrates with the myriad 1st and 3rd-party apps used by teams to manage their work in our core markets. Together, these products provide a tailwind for teams like legal, finance, marketing, and HR [human resources] as they work with technical teams and each other to solve complex problems. Through our cloud products, customers enjoy a steady drumbeat of product releases and improvements across the end-markets we serve.”

One of the key features of Atlassian and a reason why the shift to a cloud model is so beneficial for the business is that it drives growth more by intense r&d delivering an irresistibly cost effective model for its customers rather than spending massively on sales and marketing, albeit that figure has been moving higher as the group presses harder on its land and expand (win customers who spend more) business model. In Q1 Atlassian spent $223m on r&d versus $70.2m on sales and marketing. For most software businesses these numbers would reversed.

“At this time of great change, we stand on the cusp of an exciting new era as a cloud-first business – an evolution several years in the making. Throughout our cloud journey, we’ve remained focused on our long-term ambitions while scoring the shorter-term wins that propel us towards our goals. Q1 was no exception. We achieved FedRAMP status for Trello Enterprise and released Table View for Trello, strengthened our Slack partnership, and built on our machine learning “Smarts” capabilities across our cloud platform. In Q1, we also added more than 8,600 net new customers and posted $460m in revenue, up 26pc year-over-year. Creating products that unleash our customers’ potential has always been what drives us, but never more so than right now. And we’re leveraging our cloud platform to pursue that mission.” 29 October 2020

“We’ve put in the hard yakka (“hard work” for you non-Aussies) over the past several years, to build a scalable cloud-native platform because cloud is where our customers want to be. In fact, over 95pc of new customers choose our cloud products because of the instant scalability, streamlined administration, enterprise-grade security, and deep integrations. Today, roughly 85pc of all customers enjoy these cloud benefits. Yet, approximately 75pc of all paying users still use at least one on-premises deployment, creating a massive opportunity to bring them more value in the cloud. Getting started with Atlassian cloud products takes just a few minutes. Plus, nearly all our cloud products are available free to small teams, giving them powerful tools they might not otherwise have access to. And because adding more users, trying a new product, and adding an app from the Atlassian Marketplace is as simple as clicking a button, customers grow with us 20pc faster in the cloud compared with server*. The cloud allows us to see how users engage with our products. We capture real-time analytics that help us understand usage patterns and make improvements that delight customers. We also use this data set to power “Smarts,” our machine learning engine that delivers millions of time-saving notifications, relevant content suggestions, and reminders every day.” 29 October 2020

“Eliminating the need to buy hardware and reducing the administration load saves customers money and frees IT teams up to work on strategic projects. Online realty broker Redfin, for example, saved over $60,000 in just a few months after migrating to our cloud. As Evan Lerer, director of engineering at Redfin explains: “Atlassian’s cloud saves our team time, which saves us money”.

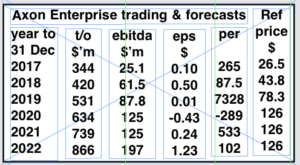

Axon Enterprise/ AAXN Buy @ $123.50

Axon Enterprise. AAXN. MV: $8bn Next figures: 2 March 2021

Wherever you look Axon Enterprise is making progress and opening up new opportunities.

Axon Enterprise develops technology and weapons products for military, law enforcement and civilians. It’s first product and the previous company name was Taser, a line of electroshock weapons. It has since diversified into body cameras and a cloud-based digital evidence platform. The company has taken a long time to achieve commercial success but is benefiting from improving technology and changing attitudes to incidents involving police. Axon’s mission to make bullets obsolete resonates in a world where ‘black lives matter’.

“Recent milestones in our international expansion include the Toronto Police Service’s deployment of Axon body cameras, the London Metropolitan Police’s upgrade to Axon Body 3 cameras, government approval to sell TASER 7 in the UK, and the first major agency in Ukraine purchasing TASER devices. International revenue of $23m in the quarter represented 15pc year-over-year growth and reflected typical third quarter seasonality. Year-to-date international revenue is up 43pc.”

Police forces around the world are realising that they need to avoid killing people in confrontations with criminals and Axon can help them. They also need a clear, unambiguous record of what is happening as they go about their law enforcement duties because of the growing risk of legal action and intense community pressure if they seem to have stepped out of line in any way. Most people realise that the police in every country have a difficult job to do but now they are doing it under intense public scrutiny. This is especially so after incidents like the George Floyd killing, which has fuelled huge mistrust of the police and led to police officers being charged with serious offences. The obvious answer to these issues with police and many others such as 999/911 response times and helping police with real-time information as they deal with incidents is to take advantage of the dramatic advances in technology taking place across multiple fields of activity. Axon Enterprise seems to be rapidly cornering the market in bringing policing into the 21st century and the business is showing signs of having reached an important tipping point. The question being asked across many jurisdictions is not should we use their technology but increasingly how can we justify not using it. CEO, Rick Smith, says the success with federal government is a game changer and I think he is right.

“As 2020 enters the final stretch, Axon is on track to exit the year strongly. We are pleased to report a surge in momentum in our business in the third quarter. We drove bookings growth of 62pc sequentially and 56pc year over year, aided by robust North American demand for body cameras and cloud software, and a rebound in TASER demand driven by the US federal and corrections markets. High-margin annual recurring revenue topped $200m, doubling in two years’ time. And we are on track to exceed our original 2020 financial targets — which is a testament to the mental toughness and dedication of our teams and the market’s reception to our products that solve real problems.” Rick Smith, CEO, 9 Nov. 2020

“The following two areas of strength are the direct result of accelerated investments in the US federal law enforcement channel and the development of real-time command-and-control software for public safety. As a result of targeted investments in building direct relationships with federal customers, we achieved a record $38m in bookings from federal customers in the third quarter, up 400pc year over year. We established our first two programs of record with the federal government, including a $13m U.S. Customs and Border Protection order for body cameras and digital evidence management. We signed our first indefinite delivery, indefinite quantity (IDIQ) contract with a federal agency. We signed our first Officer Safety Plan contract with a federal agency. Officer Safety Plan is our integrated subscription bundle that includes TASER 7, Axon Body 3, and a host of cloud software features to empower an agency. This early achievement gives us confidence that the integrated subscription bundle that has proven popular with municipal law enforcement may also be valuable to the federal adjacency. We sold body cameras and digital evidence management for the first time to the Department of Defense. Selling to the DoD further expands Axon’s federal total addressable market. We signed our largest TASER contract in company history, valued at $15.5m, with the Department of Homeland Security.” 9/11/20

“Axon Respond is designed to empower everyone involved in incident response: dispatchers, call takers, command staff, patrol officers, firefighters and medical personnel. The Respond platform includes several distinct products that work together, including dispatch software, body cameras, alerts, and cloud-enabled geo-tagging and mapping.” RS, CEO, 9 November 2020

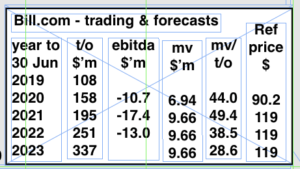

Bill.com/ BILL Buy @ $116.5

Bill.com Holdings. MV: $9.4bn Next figures: 4 February 2021

Back office automation provider, Bill.com grew sales 53pc to $44m in Q1 but sees $30bn opportunity

Bill.com is a provider of cloud-based software that automates back-office financial operations for small and midsize businesses. The group partners with the largest US financial institutions, over 70pc of the top 100 US accounting firms and leading accounting software packages. During 2019 the group introduced many innovations and announced key partnerships with Mastercard and American Express. It also opened its second office in Houston, Texas. . When I look at Bill.com’s latest presentation for Q1 2020 they show how the typical SMB operates, a chaos of bits of paper, need for payments to be approved and often manual systems for reconciliation of everything that is happening so that business owners now what is going on. Bill.com claims to replace this shambles with clear automated processes that free businesses to focus on making the business successful rather than being bogged down in administration. In what they call their end-to-end solution, invoices arrive in an online inbox, they can be viewed and approved from any device, an e-payments system makes it simple to settle invoices by simply clicking pay and the payment is then automatically synced with the business’s accounting system. Customers obviously love it because the group has a net expansion rate (revenue generated during the year by businesses who were customers at the start of the year) of 121pc. In other words the business grows by 21pc during the year even before adding new customers and in the latest quarter the number of customers grew by 27pc to over 100,000. Part of the way in which businesses like Bill.com generate such strong NERs is by constant innovation so that they can see what their customers need and keep innovating to meet those needs.

Another strength of Bill.com is its huge, 2.5m strong, network of suppliers on the system, which means that SMB customers can often deal with suppliers, knowing that all their details are already on the system. Marketing for Bill.com is highly effective because of its ecosystem of related service providers like accountants. Customers love the financial savings they can make with Bill.com when clerical staff cost between $37,000 and $65,000. Last but not least is the size of the opportunity, which the group quantifies as a $9bn local opportunity rising to $30bn for the global opportunity.

“We kicked off our new fiscal year with strong Q1 financial results, which exceeded our expectations across the board as we continue to see significant demand for the Bill.com platform. In Q1, we saw our SMB [small and medium-sized business] customers getting back to business, illustrated by several of our key metrics showing improvement. We are excited about the increasing adoption of our platform throughout our diversified go-to-market ecosystem. Core revenue, which we define as subscription plus transaction revenue, grew by 53pc year-over-year to $43.8m. We also delivered a strong non-GAAP gross margin of 77pc in the quarter. At the end of the first quarter, we achieved a company milestone by surpassing the 100,000-customer mark, with overall customer growth of 27pc year-over-year.” Rene Lacerte, CEO & founder, Q1 results, 6 November 2020.

“Our customers trust the Bill.com platform to manage their workflows and process their payments, which totalled billions of dollars monthly. As a reminder, our platform extends well beyond our customers to over 2.5m network members that pay and get paid through Bill.com. We believe that we are operating one of the largest B2B [business to business] networks in the United States. Later, I’ll be talking more about how we are focused on growing and monetizing this network asset. During the quarter, we processed $28.8bn in total payment volume, or TPV, an increase of 31pc over Q1 of the prior year. This demonstrates the strong customer demand for our platform and the new payment capabilities we’ve added over the last 18 months. We recently surveyed over 900 Bill.com customers using a third-party firm. Survey respondents represented a broad spectrum of company sizes, industries and product usage. The results really showcased Bill.com’s strong value proposition with 97pc of respondents noting that Bill.com allows them to operate their businesses remotely. The vast majority said that Bill.com enables them to digitise financial operations and described Bill.com as essential to their operations. It’s this value proposition that leads to our platform becoming mission-critical for customers and our strong customer and revenue retention metrics.” 6 November 2020

“Our customers trust the Bill.com platform to manage their workflows and process their payments, which total billions of dollars monthly. As a reminder, our platform extends well beyond our customers to over 2.5m network members that pay and get paid through Bill.com. We believe that we are operating one of the largest B2B networks in the United States. During the quarter, we processed $28.8bn in total payment volume, or TPV, an increase of 31pc over Q1 of the prior year.”

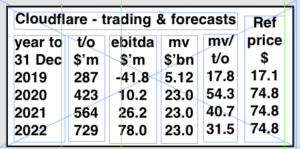

Cloudflare/ NET Buy @ $70.10

Cloudflare NET MV: $23bn Next figures: 18 February 2021

Fuelled by Covid-19, Cloudflare, sees accelerating growth and ‘incredibly exciting’ prospects

Cloudflare is a US web-infrastructure and website security company providing content-delivery-network services, DDoS [distributed denial of service] mitigation, Internet security and distributed domain-name server services. Founded in 2009, Cloudflare’s services sit between a website’s visitor and the Cloudflare user’s hosting provider, acting as a reverse proxy for websites. The number of large customers has risen over sevenfold since 2016.

Cloudflare is serious technology so I am never going to pretend I understand what they do. I just think they do it very well. This is what one commentator said about Cloudflare’s 2019 IPO [initial public offer].

“Website infrastructure and security company Cloudflare (NET) is expected to IPO on Friday,13 September 2019. At a price range of $10-$12 per share, the company plans to sell up to $483m of shares with an expected market cap of $3.2bn. At the midpoint of the IPO price range, NET currently earns an unattractive rating. Cloudflare offers a variety of cloud-based services that used to be performed by many different on-premise solutions – such as firewalls, routing, virtual private networks (VPNs), traffic optimisation, and load balancing – for businesses and websites. The company’s services have become integral to the operations of millions of websites around the world – but it has struggled to turn that global reach into positive cash flow.”

It shows how hard it is to value these enterprise software stocks. Cloudflare was ‘unattractive’ at $10-$12 yet 15 months later the price is over $70. Cloudflare operates a freemium model. The free tier protects websites and reduces loading times. Paying customers get more advanced and faster offerings and more customisation. Free customers are in the millions. Paying customers are a small fraction but growing rapidly. Total paying customers have more than doubled from end 2016 to 75,000 as at June 2019. Customers paying over $100,000 annually have more than quadrupled from 95 to 408. The latest figures (see above) are over 101,000 paying customers with 736 large (>$100,000) within that and every sign (see below) that interest is growing alongside the growth in Cloudflare’s stable of products. There is no point in trying to value Cloudflare. It is all about explosive growth and huge opportunity. You believe or you don’t.

“We had an exceptional quarter. In Q3, we crossed a number of significant milestones. First, we blew through $100m in quarterly revenue, achieving $114m, up 54pc year-over-year. We crossed 100,000 paying customers ending the quarter with just shy of 101,000. For large customers in the quarter, we added nearly 100, 99 precisely and now have 736 spending more than $100,000 per year with us. These large customers accounted for 47pc of our total revenue in Q3, and we anticipate they will make up more than half of our revenue going forward.”

Q3 results, Matthew Prince, CEO and co-founder, 5 November 2020

“In late-March, traffic across our network spiked as the world shifted to working from home. In two weeks, we saw more than 50pc growth in traffic, more than we had forecast for 12 months. We’ve been able to continue to build out our network to meet the unprecedented demand for our services, while staying within our CapEx budget. Even though we charge almost exclusively on a fixed subscription basis, we were able to meet our gross margin target, hitting 77pc v Q3, without hitting our customers with burgeoning bills. And we’ve exceeded our ambitious revenue goals actually accelerating growth, while continue to sign up larger and larger enterprise customers. We’ve also been able to hire great people. In Q3, we had over 60,000 applications and extended offers to only 0.4pc. In the last four months, we’ve been on a tear releasing a ton of incredible new products. We announced more than one product per day around Cloudflare workers, our serverless computing platform during the week of 26 July. And more recently, we fleshed out our vision for Cloudflare teams with a new architecture called Cloudflare One over the week of October 11, which we dubbed the zero trust week. These weeks leverage one of our superpowers, engineering and marketing, and may result in significant spikes in organic inbound interest from potential customers. In fact, during zero trust week, organic inbound leads more than doubled of their already elevated level.” Matthew Prince, 5 November 2020

“One goal we had for 2020 was to win our first $10m customer on an annual run-rate basis. We achieved that this quarter. That customer, a Fortune 500 software company, started with us in 2016, because one of their engineering leaders had used the free version of our service on his personal site. Today, this customer has integrated our network and customised our products deep into their staff. It’s been a terrific partnership, and we expect we will continue to grow alongside them.”

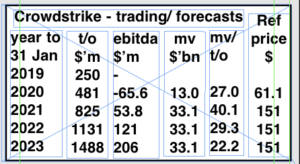

Crowdstrike/ CRWD Buy @ $146.50

Crowdstrike MV: $33bn Next figures: 4 December

Crowdstrike’s cloud-based cyber security software in high demand as whole world goes digital

Crowdstrike is a US cybersecurity business founded in 2011 by George Kurtz and Dmitri Alperovitch. In 2013 the company launched its first product, Crowdstrike Falcon, to provide threat intelligence and identify nations conducting espionage and IP theft. The group has uncovered cyber attacks by the Chinese, Russians, North Koreans and others. In 2020 the group acquired Preempt Security, a zero trust and conditional access provider for $96m.

Crowdstrike is one of a growing number of exciting investments/ companies where I can get the broad gist of what they do – protecting their customers from cyber attacks but the detail of how and what they do is a mystery. Stockbrokers and investment banks employ clever people who do understand what they do and can carry out complicated analyses using carefully studied valuation techniques. Good for them. My approach is different. I use my 3G rule (great growth, great chart, great story) to set a bar, which Crowdstrike beats with ease. I look for other attributes such as something new of which there is always plenty with these new age technology companies, which live and breath innovation. I look for a strong following wind and you can see from the quotes (above and front page) how strong that is in the field of cyber security. Last but not least I look for the magic, an impression of the company and the management that makes me feel they have something special. Crowdstrike has these qualities in abundance. There is little doubt that it is an incredible company, led and staffed by visionary, highly motivated people addressing an enormous business opportunity. Cyber security is clearly taking shape as an enormous global industry playing an increasingly vital role in our lives. Warren Buffett says better to buy a great business at a reasonable price than a reasonable business at a great price; that is how I feel about Crowdstrike. The shares are expensive but what a business, what an opportunity.

“CrowdStrike was founded in 2011 to reinvent security for the cloud era. Realizing that the nature of cybersecurity problems had changed but the solutions had not, we built our CrowdStrike Falcon platform to detect threats and stop breaches. With our Falcon platform, we created the first multi-tenant, cloud native, intelligent security solution capable of protecting workloads across on-premise, virtualised, and cloud-based environments running on a variety of endpoints such as laptops, desktops, servers, virtual machines, and Internet of Things, or IoT, devices. Today, we offer 11 cloud modules on our Falcon platform via a SaaS subscription-based model that spans multiple large security markets, including endpoint security, security and IT operations (including vulnerability management), and threat intelligence.”

“A few of our accomplishments in the second quarter, include setting a record for net new ARR [annual recurring revenue] with over $100m added in the quarter and ending the quarter with a record pipeline, sustaining our strong subscription revenue growth rate of 89pc, adding record net new subscription customers of 969, closing the second-largest deal in the company history, which was sourced, trialled, and closed remotely, and for the second consecutive quarter, we generated non-GAAP operating income. With strength in multiple areas of the business, we added $104m in net new ARR in the second quarter, which was up 77pc year over year and ahead of our pre-COVID expectations. Additionally, year over year, we delivered 89pc subscription revenue growth, and 84pc total revenue growth. We once again saw a strong partner engagement and deal flow throughout the quarter among both large and SMB customers that span multiple industries. Our gross retention rate remained consistently high and our dollar-based net retention rate once again exceeded 120pc. We also continue to see rapid module adoption by new and existing customers, which is a key tenet of our growth strategy. This quarter, the percentage of all subscription customers with four more modules increased to 57pc and those with five or more modules increased to 39pc. Strong secular trends and a favourable competitive environment are fuelling our growth. Organisations around the world are shedding outdated systems and accelerating their move to modern cloud-native technologies to meet the demands of today’s threat landscape and future-proof their security architecture.” George Kurtz, CEO and co-founder, 2 September 2020

“In the first half of 2020, we have seen a 154pc increase in intrusions, stopped 41,000 potential breaches, which is more than all of last year, and we have seen a sharp increase in e-crime with 27 different industry verticals falling victim to criminally motivated intrusions, which is more than double in the same period last year. We believe CrowdStrike is a winning combination to continue gaining new customers at a rapid pace, displacing both legacy and next-generation players.”

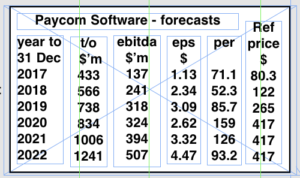

Paycom Software/ PAYC Buy @ $405

Paycom Software. PAYC MV: $24bn Next figures: 5 February 2021

Paycom Software seeing ‘very strong demand’ as it helps customers find and keep top talent

Founded in 1998 by Chad Richison, who is still the CEO, Oklahoma-based, Paycom Software, is regarded as one of the first fully online payroll providers. One measure of its growth is that it moved offices to a 90,000 square foot building in 2011. Since then a series of additions with the last completion in 2018 has taken the space to 500,000 square feet. The group joined the S&P 500 in 2019. Part of the way that Paycom Software works is to involve employees in keeping their data up to date. This saves money, ensures accuracy and by involving employees in the process improves engagement. DDX or direct data exchange shows how this works.

“When an employee makes a data change themselves, the company saves $4.51 and the savings are calculated in real time using the DDX. We are extremely ambitious with our product road map and we are continuing to invest in R&D. The pandemic’s impact on our pre-pandemic client revenue remains stable and it’s unclear if or when those same clients will add to their employee counts.”

Paycom Software generates revenue when corporate customers increase employment so the virus has had a negative impact on the business. This helps explain why investors reacted so positively when the group reported a 12.3pc increase in Q3 revenues and continued ‘very strong demand’ for the group’s services. Paycom Software has been a disruptor in the human resources industry because it uses technology to do everything. It describes its products as HR tech that helps you find, pay, develop and retain great employees. This is important because although thanks to the virus many countries are experiencing high levels of unemployment the employees that the fastest growing companies want to hire and keep remain a scarce resource. I often describe competition between companies as a battle for territory but you could equally describe it as a battle for talent. The companies able to attract top talent are the companies that go on to win the battle for territory. In these circumstances it is no surprise that a company like Paycom Software which helps this process in a way that involves employees using technology in just the way they want to do is experiencing such strong demand. HR executives are key people and they need the best tools.

“Our marketing plan in the third quarter delivered strong demo leads, leading to strong new client sales and we plan to continue to spend aggressively on advertising to fuel future revenue growth. The challenges created by the pandemic are exposing the shortcomings of disparate HCM systems, which are cobbled together from multiple vendors and the value proposition of Paycom’s single database solution is stronger than ever for companies of all sizes including companies well above our target range. We continue to be pulled well above our stated targeted range as larger companies look to leverage automated processes for their own employees. At the same time, our small business adds have continued to increase in 2020 as we continue to build out our inside sales force.” Chad Richison, CEO, 4 November 2020

“Manager on-the-Go continues to gain popularity and was recently named a top HR product at this year’s HR Technology Conference. We are receiving more leads and referrals as the industry shifts toward an employee usage strategy. Since the end of Q1 2020, usage of Manager on-the-Go has nearly doubled. 98pc of all Paycom clients have deployed Manager on-the-Go. Manager on-the-Go fundamentally changes manager workflows and accelerates the speed that data moves throughout the system, which further increases the ROI [return on investment] of our solution and sets us up for future usage patterns that pave the way for future product innovation and automation. DDX [direct data exchange] usage continues to trend upwards towards the 100pc mark, up from the low 90s. In July we changed our sales procedures to ensure that new clients commit to 100pc usage. We are now at our highest DDX usage rate since launching the industry’s only software of its kind last year. CEOs and HR [human resources] executives continue to see the savings from an employee’s direct relationship with the database.” Chad Richison, CEO & founder, 4 November 2020

“We had an excellent Q3 and continue to see very strong demand for our differentiated solutions. We are putting greater distance between our products’ value proposition and that of our competitors. We believe Paycom is the clear choice for those seeking a more efficient way to manage their Human Capital Management needs. With less than 5pc market share today, we believe we have a long runway and are in a very good position to generate strong growth for years to come.”

MongoDB MDB Latest: $272 MV: $15.9bn Next figures: 8 December

MongoDB is an innovative supplier of database software, which has encountered strong demand from developers. Latest sales grew 39pc to $138.3m. Within that is the cloud based Atlas supplying data base software on subscription, which grew sales 66pc to account for 44pc of total revenue. The company continues to innovate rapidly not only to the software offering but also the go-to-market operations helping drive continued strong sales growth.