Cryptos winning acceptance as an asset class with bitcoin as digital gold

Appian Corporation. APPN. Buy @ $195

Argo Blockchain. ARB. Buy @ 220p

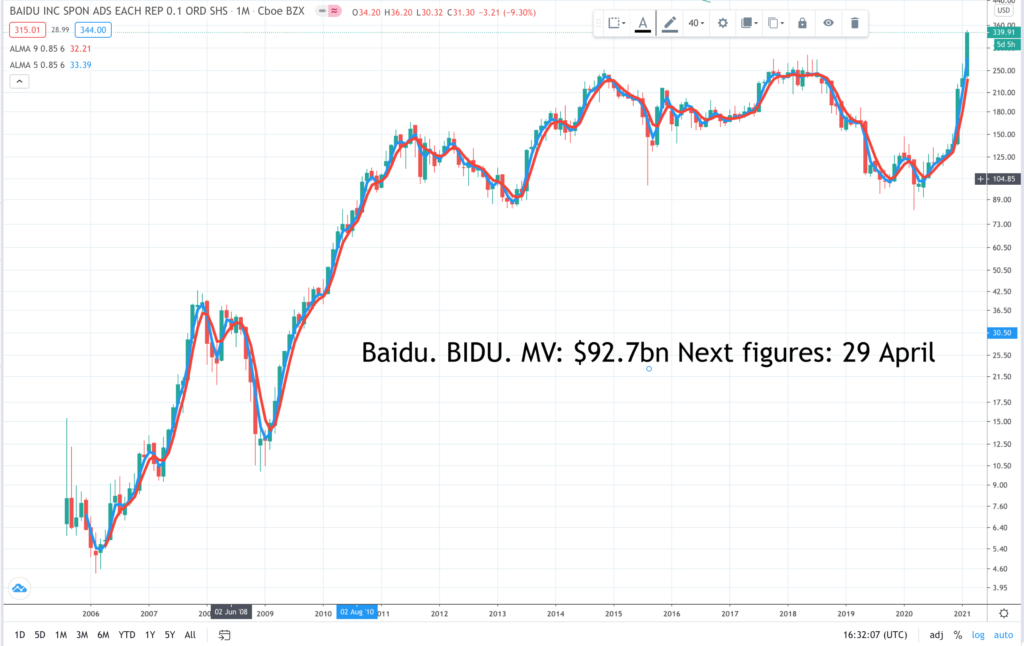

Baidu BIDU Buy @ $317

Bitcoin. BTCUSD. Buy @ $48,255

Carvana CVNA. Buy @ $286.5

Dynatrace. DT. Buy @ $50.29

Either ETHUSD. Buy @ $1,550

Genus GNS. Buy @ 5235p

Guardant Health. GH. Buy @ $164

JTC. JTC. Buy @ 642p

Litecoin. LTCUSD. Buy @ $179

Microstrategy. MSTR. Buy @ $865

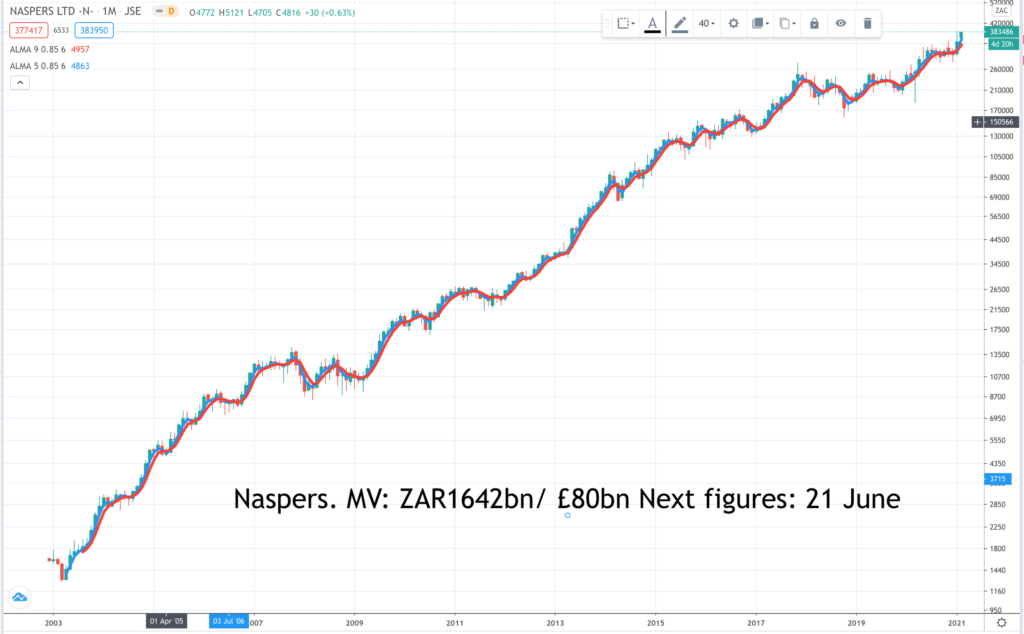

Naspers. NPN. Buy @ ZAR3,700/ £180

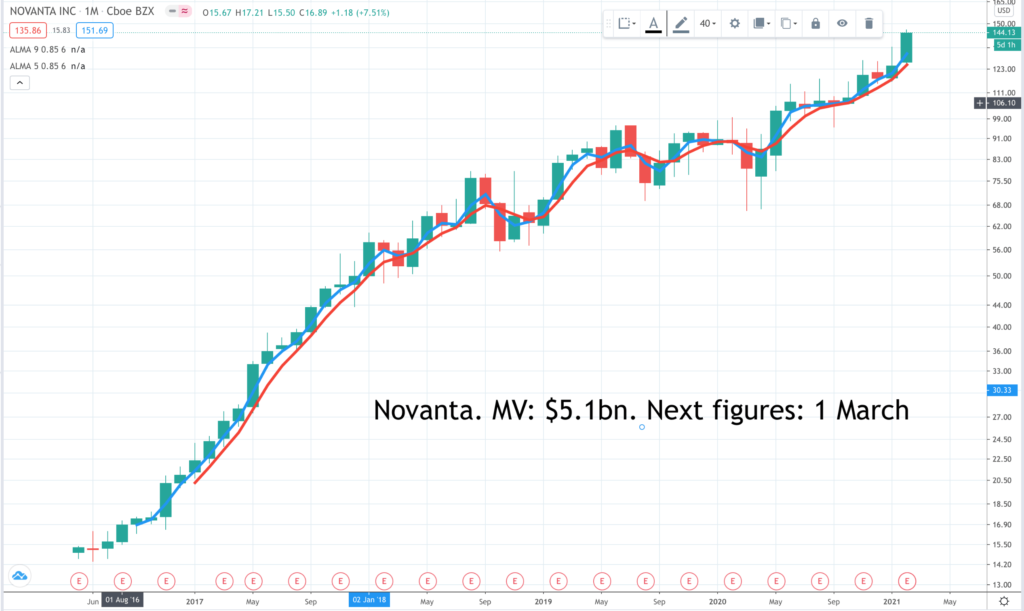

Novanta. NOVT. Buy @ $135.67

Pegasystems. PEGA. Buy @ $143.20

Pinterest. PINS. Buy @ $82.60

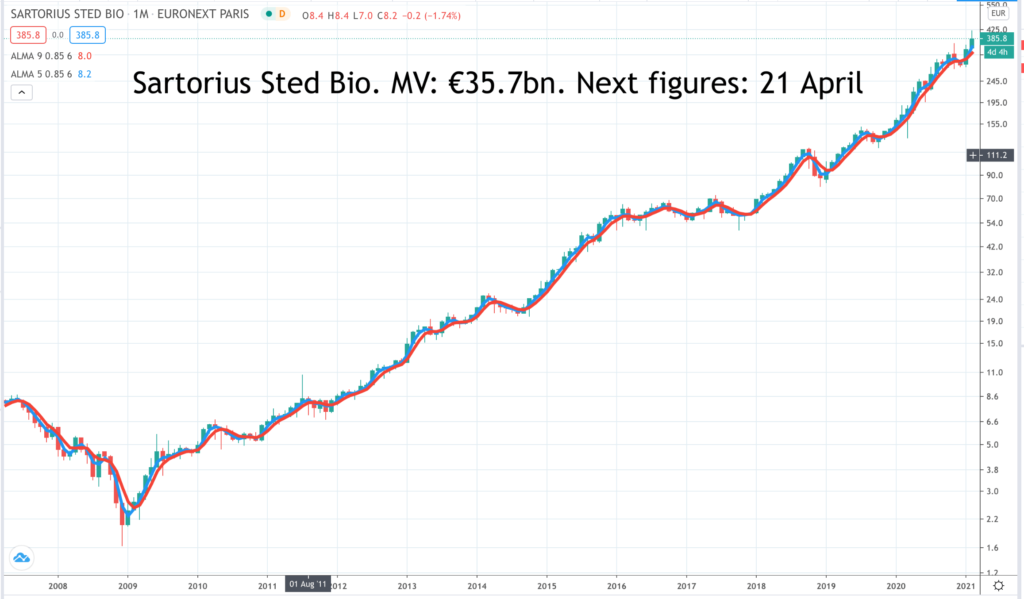

Sartorius. DIM. Buy @ €379

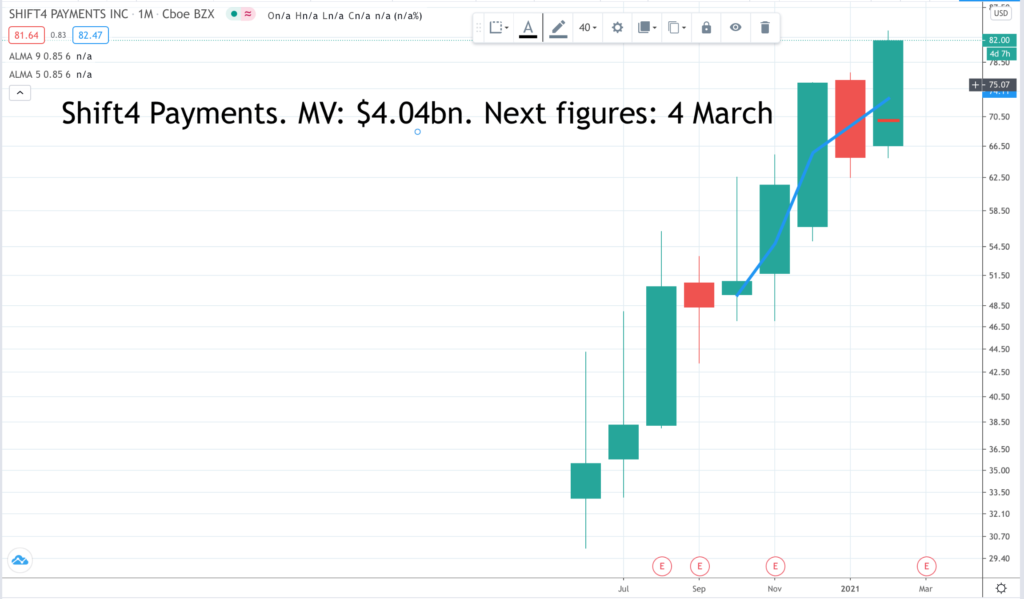

Shift4 Payments. FOUR. Buy @ $78.20

Silvergate Capital Corporation SI. Buy @ $154.40

Up Fintech Holdings TIGR. Buy @ $30.30

I have just been listening to a radio programme, where comedians where making fun of bitcoin for a studio audience. One claimed to have written a book about bitcoin and asked the audience to explain what bitcoins were. Nobody felt that they could. After noting that the price in the past had varied between incredible high and very low levels the speaker rhetorically asked the value of bitcoin and then immediately answered it as – ‘s*d all’, inspiring much hilarity from the audience.

This in itself makes an interesting point about human behaviour. We are all very ready to acknowledge that we don’t understand something but equally ready, despite this admission of ignorance, to jump to the conclusion that something new and unfamiliar is a load of rubbish. Maybe we all need to learn to pause for a moment and engage our brains. Just possibly the people buying and believing in cryptocurrencies are not idiots but are actually onto something important. Maybe not but let’s at least try to think about it and keep an open mind.

It is a truism of investing that markets climb a wall of worry. This means that paradoxically widespread scepticism about an investment can be bullish. In the early days everybody thought Tesla was a train crash waiting to happen and the shares were massively shorted [sold by speculators looking to profit from a falling price]. Tesla is now one of the world’s most valuable businesses.

This same widespread scepticism is now directed at cryptocurrencies. The Governor of the Bank of England, Andrew Bailey, said in January that he doesn’t believe cryptocurrencies will last. No surprise that before becoming Governor he was chief executive of the Financial Conduct Authority (FCA) which, in a breathtakingly patronising move, recently banned spread betting firm, IG and other such investing platforms, from allowing retail investors to buy bitcoin.

Many of the great and the good are not just sceptical but actively hostile to cryptocurrencies. Bill Gates dismissed them recently as ‘useful for criminal elements’ and Warren Buffett described bitcoins as “rat poison squared”.

There is one thing though with which the sceptics cannot argue and that is the price. In 2013 a computer developer, who knew about a new virtual currency that had been created by a mysterious figure or group known as Satoshi Nakamoto, in 2008, swapped 10,000 of them for a pizza delivery. ‘Big mistake’ as Pretty Woman’s Julia Roberts said so satisfyingly to the snobbish shop assistant, who had refused to serve her, thereby missing out on some serious spending.

Since then the price has risen from effectively zero to a recent peak above $57,000 making those 10,000 coins worth $570m. There is a theory called the rubbish theory of value, where scarce items start valueless and become incredibly valuable. Bitcoin may end up as one of the most staggering examples ever of this process in action.

I understand why people find it hard to ascribe a value to bitcoin which, as far as I can tell is essentially a piece of open source software. However it is a very clever piece of software because it has set strict limits on the supply . There can never be more than 21m bitcoins of which some 18.5m have already been created and of which many were lost before people realised their value.

Rumours also suggest that Nakamoto may have squirrelled away 1m coins.

It is not only difficult to make them involving using massive amounts of computing power [and a significant share of the world’s total electricity generation] but it is becoming progressively more difficult [and expensive].

“The bitcoin mining process rewards miners with a chunk of bitcoin upon successful verification of a block. This process adapts over time. When bitcoin first launched, the reward was 50 bitcoin. In 2012, it halved to 25 bitcoin. In 2016, it halved again to 12.5 bitcoin. On 11 May, 2020, the reward halved again to 6.25 bitcoin. This effectively lowers Bitcoin’s inflation rate by half every four years. The reward will continue to halve every four years until the final bitcoin has been mined. In actuality, the final bitcoin is unlikely to be mined until around the year 2140. However, it’s possible the bitcoin network protocol will be changed between now and then.”

This process of changing the bitcoin protocol is complex and mysterious. However one thing seems clear. Given the influence of powerful interested parties it is unlikely ever to be done in a way, which will lead to lower values.

Even more curious it appears there is life for bitcoin miners even after the last bitcoin is mined. “Even when the last bitcoin has been produced, miners will likely continue to actively and competitively participate and validate new transactions. The reason is that every bitcoin transaction has a transaction fee attached to it. These fees, while today representing a few hundred dollars per block, could potentially rise to many thousands of dollars per block, especially as the number of transactions on the blockchain grows and as the price of a bitcoin rises. Ultimately, it will function like a closed economy, where transaction fees are assessed much like taxes.”

The thing I have always liked about bitcoin, apart from a mysterious charismatic quality that it has, is the combination of fixed supply with potentially limitless demand. It may be impossible to say what they are worth or indeed if they are worth anything but as speculative instruments they are close to perfect. This lack of measurable value is paradoxically part of the value because there is no incontrovertible way to demonstrate that any price is too high. It is always just the price, which balances supply and demand at a moment in time.

If bitcoin can go from zero to $57,000 for one virtual coin, why should $100,000 or even $1m be impossible. My simple reason for having an investment in bitcoin and ether is just this possibility that the price could soar to unimaginable heights, even more unimaginable heights than it has already reached. It is similar to the reasoning I use when investing in shares. I like companies that just might take over the world. I don’t pretend to understand the workings of cryptos any better than you but if they can go this far, something big must be happening, which could maybe take them much further.

I also ask myself what makes a banknote, a piece of paper with $100 written on it, worth $100. It is just fancy paper or plastic so the intrinsic value is minimal. It is worth $100 only because other people act as though it is and because if I use my printer to make copies I risk a long jail sentence. It sounds surprisingly like bitcoin to me but with one crucial difference. There are some $37 trillion of dollars in circulation in the world. Money in all forms, including cryptos, has reached 1.4 quadrillion dollars in value.

On top of that the world’s supply of dollars increased by $3.8 trillion in 2020 alone. For comparison, the supply of new bitcoins in 2020 was worth maybe $5bn (900 coins mined daily times an average price of $14,500) and will reduce in future years. Looking at those numbers it is easy to see why the value of bitcoin is high and rising, while the real purchasing power of dollars will continue to fall.

It has also been suggested that many developing nations without the financial infrastructure of the developed world may turn to cryptocurrencies as a base on which to build that infrastructure. Jack Dorsey the billionaire boss and founder of Twitter and Square says bitcoin is “probably the best” native currency of the internet due to bitcoin being “consensus-driven” and “built by everyone.” Square facilitates payments with and purchases of bitcoin and recently invested $50m in bitcoin.

Imagine the impact if any nation, developed or undeveloped, starting buying bitcoin as a reserve currency.

The idea here may be a bit like the old gold standard for countries and individuals. You hold bitcoin in your account as a reserve asset and that provides the collateral for you to make payments electronically with bitcoin as the backing. It is called digital gold for a reason. Until President Nixon broke the link in 1971 people only believed in paper money because it was backed by gold. After 1971 it was backed by governments, which has worked better for some countries than others and initially led to a sharp weakening [great inflation] in the value of paper money in many developed countries.

Elon Musk’s Tesla invested $1.5bn in bitcoin recently on the rather unenthusiastic grounds that bitcoin was less rubbish than fiat money like dollars, when returns were low and even sometimes negative. He then added something on the lines of ‘current prices are rather high’, which may have contributed to tumbling prices as I write.

I don’t want to sound blasphemous but I see parallels between the rise of bitcoin and the emergence of the Christian religion. It all starts with a mysterious figure, details about whom are increasingly loss in the mists of time. A few fanatical supporters keep the flame burning and spread the word in the face of a hostile establishment. The number of followers grows exponentially towards levels that threaten the existing geopolitical structure. Eventually the authorities decide that if you can’t beat them you must join them [the emperor Constantine in AD325 at the first council of Nicaea adopted Christianity even though the evidence is equivocal about whether he was a believer himself]. Acceptance spreads rapidly and Christianity becomes the official religion of the Roman Empire and the western world.

Bitcoin is not a religion, at least I don’t think it is but the march to acceptance does throw up some uncanny parallels – mysterious founding figure, fanatical supporters, establishment hostility, growing acceptance. Some people might even describe the rise in price as a miracle akin to walking on water.

It is also a classic of crowd theory. As the crowd of supporters grows the price rises and the bitcoin crowd is already global but still a fraction of the numbers it could reach. It is the belief that bitcoin could become as ubiquitous as gold in portfolios that is behind the theory that the price could rise to $500,000 a coin. All the gold ever mined is worth some $10 trillion. Divide that by the maximum number of bitcoins (21m) and you reach something like $0.5m a coin.

If more people want to hold bitcoin than hold gold, which I see as a plausible scenario, then the value of bitcoin goes even higher and seven figure numbers start to come into play, which would be quite something for an asset that most people still don’t understand and think may be worthless.

The bitcoin market is dominated by so-called bitcoin ‘whales’. Reports suggest that some 2,500 individuals own 40pc of all the bitcoins out there. Participation by retail investors has been small and seemingly is being increasingly discouraged by the authorities, in the UK at least. IG has said that from 22 February the margin on cryptocurrencies will go to 100pc and from 24 March they will not allow retail investors to hold cryptocurrencies at all and will forcibly sell their holdings.

I asked IG for an explanation of this outrageous behaviour. It is apparently the fault of the regulator. Once retail investors were forbidden to trade bitcoin, from 6 January 2021, they all turned overnight into long-term investors because if they sold they could not buy back again. This deprived IG of its normal trading revenue and left them dependent on funding charges, which they promptly raised to a punitive 25pc a year. Even then the money tied up is not generating adequate returns so they are basically closing their whole retail crypto operation down, killing what had been a highly successful business.

I am accordingly making arrangements to liquidate my crypto holdings on IG, which have become quite significant simply because the price has risen so much, and replace them with holdings on Coinbase, which I anticipate will have to be fully funded.

Incidentally, none of the comments above should be taken to mean that I have the faintest idea where bitcoin’s price will go next. Earlier in January the price fell $12,000 in three days, losing a quarter of its value. Bitcoin is the ultimate buy and pray investment and extreme volatility is part of the game.

Alternative ways to invest in bitcoin

There are not yet any funds to invest in bitcoin, which would probably be the ideal way for retail investors to participate. There is something called Grayscale Bitcoin Trust but it is not an ETF and requires a minimum investment of $50,000. The chart is pretty much identical to the bitcoin chart.

More subtle things that investors can do to gain cryptocurrency exposure involve shares in companies, which are themselves increasingly involved in the cryptocurrency market. I have already mentioned Square, a fast-growing fintech company, which has a CashApp, where account holders can buy cryptocurrencies and which has invested $50m in bitcoin. PayPal entered the market in October 2020 announcing that it’s customers could buy, sell and hold cryptos .

Some time in 2021 they will also be able to use cryptos for purchases. “PayPal announced that it will enable cryptocurrency as a funding source for purchases in 2021, allowing users to use their cryptocurrency holdings to make purchases at its network of more than 26m merchants. Once launched in 2021, when a consumer selects cryptocurrency as the funding source, the cryptocurrency will be instantly converted to fiat currency (dollars, euros, pounds etc,) and the transaction will be settled with the PayPal merchants in fiat currency.”

Microstrategy is a US-quoted software company, which has effectively bet the business on bitcoin. On 21 December the group announced that it held 70,470 bitcoins bought for $1.125bn or $15,964 a coin. At current prices those bitcoin would be worth nearly $4bn. The company is valued at over $8.5bn so it seems to make more sense to buy cryptocurrencies directly although it would be normal for the shares to trade at a considerable premium to the value of the bitcoin stake.

Coinbase, the leading US bitcoin exchange for buying and selling bitcoin, where I have just opened an account, has announced plans to go public via a direct listing, a technique pioneered by companies like Spotify, which also has a large customer base. In July 2020 Coinbase revealed that it had 35m users, up from 5m a year earlier, so the shares are likely to meet an enthusiastic reception.

Another company whose fortunes are closely linked to cryptos is Silvergate Capital Trust, the holding company for a bank, Silvergate Bank, based in California, which operates SEN, the Silvergate Exchange Network, where exchanges and other institutions can buy and sell cryptocurrencies. Not only is this business growing rapidly but Silvergate has also begun lending, using cryptocurrencies as collateral and given that the market value of all bitcoins reached $1 trillion recently it sees a huge opportunity for this business to grow.

Another share linked to cryptos, which has captured the imagination of UK investors and been a huge success for one of my subscribers, who first alerted me to the stock, is Argo Blockchain. The shares floated in 2019 and were around 4p as recently as last October. Since then they have been as high as 340p. The founders and the CEO are Canadians. They listed in London because they noticed a gap in the market for a UK-quoted cryptocurrency miner and make considerable efforts to attract attention to their business. Initially they had to cope with a sharply falling bitcoin price and the shares struggled.

Argo holds bitcoin, mines bitcoin and recently announced plans to acquire 320 acres of land in West Texas, US, where it intends to build a new 200-megawatt cryptocurrency mining facility. This will add to the six mining operations it already operates in North America. It seems like a good bet that the shares will continue to track the bitcoin price, up and down. The current valuation is around $1bn, which is option money on US stock markets.

I have listened to an interview with Argo CEO, Peter Wall. He sounded like a sensible man and a passionate believer in the long-term future of bitcoin. He emphasised that they use mostly sustainable energy for mining, hence the Texas location to use wind and solar energy to power the mining process. He also noted that the group sees its future as an innovator across the whole blockchain space, which seems like a good idea even if I don’t have much idea what he is talking about. The shares look like a credible speculation in a world where cryptocurrencies are experiencing strong demand.

The deal, announced 10 February 2021, to build the facility in Texas is an ambitious bet on future bitcoin prices and their ability to mine bitcoin efficiently. The deal is being funded by the issue of $17.5m of Argo shares (priced at 104p) and partly by a $100m loan facility, which is a punchy number for a company that has such a short trading history. The shares are likely to be volatile but there can be no question about the drive and ambition of the management team and there is likely to be plenty of future news flow to keep investors interested.

The three cryptocurrencies that I favour for investment are bitcoin, ether and litecoin, especially the first two, mainly because they seem to have the highest profile. Given that the fundamentals are such a mystery I have tended to focus on chart signals to time purchases.

Bitcoin has a strong long-term chart. It peaked a little below $20,000 in 2017 and then suffered a prolonged liquidation to a low of $3,180 a year later. The price then backed and filled below $12,000 for two and a half years before breaking decisively higher last November since when a powerful new uptrend has developed.

This is curiously reminiscent of the performance of the Nasdaq 100 index, which had a huge run up in the 1990s (the dawn of the Internet era) to a peak of 4,792 in December 2000. It then fell in a prolonged liquidation to a low of 808 in September 2002. Over the next decade it built a massive consolidation. It broke higher in early 2012 and has risen some fivefold since then. This time around it doesn’t look like a bubble because so many Internet-based businesses have exciting fundamentals and are delivering spectacular growth.

Amazingly, the fall from peak to trough for bitcoin and for the Nasdaq was almost identical at around 83pc. None of this tells me what is going to happen to the bitcoin price but it feels as though we are in a sustainable uptrend and if the price does go into the stratosphere, people will look at that chart and say the message was there that something extraordinary was going to happen.

Like the Nasdaq, the earlier run in bitcoin was based more on hope than reality. The second run or third, if you include the first charge from zero to $1,000 plus, feels as though it is more solidly based with serious investors building stakes in the coins and growing signs that the investment establishment is starting too see a role for cryptos as an important asset class, especially bitcoin.

The other moral of the tale is that it would be unwise to bet your shirt on bitcoin, at least if you want to sleep at night but that there is a respectable case for making cryptocurrencies a small part of a portfolio. As Peter Wall says the clear trend looks to be up and that alone makes a case for investors to have some kind of participation. If, as time passes, many people come to agree with him that would bring huge buying power to a market with very limited supply.

This in turn makes the case for other cryptos because if bitcoin goes into orbit investors are going to look for cheaper options and that will drag the others higher too.

I would like to finish with a great quote.

“Gold is valuable because no matter how high the price only a small amount can be mined every year. Bitcoin takes this scarcity to the next level! No matter what price bitcoin is selling for, only a predetermined number will ever exist. This makes bitcoin the hardest currency in the world.”

Baidu started as a search business and was often described as the Chinese Google but this business has struggled in recent years. However the shares have more than doubled in just three months. In December the group increased its share repurchase programme to $4.5bn. In January it announced plans to establish an intelligent electric vehicle company in partnership with auto manufacturer, Geely. On 17 February the group announced Q4 2020 results. “Our focus on innovation through technology is paying off with Baidu Core non-marketing revenue growing 52pc year over year in the fourth quarter. As we enter 2021, Baidu is well positioned as a leading AI company with a strong internet foundation to seize the huge market opportunities in cloud services, autonomous driving, smart transportation, and other AI opportunities.” The shift away from search-related revenue is going well.

One of the striking features about bitcoin is how as soon as awareness began to grow in 2013 the price rocketed from zero to over $1,000; that alone suggests that there is something special about bitcoin. Since then the pattern has been one of huge rise, big fall, consolidation and we are now experiencing the third period of dramatically rising prices. It is anyone’s guess how far this might go but on the chart the breakout still looks early days. The percentage gain in the first surge was effectively infinite; in the second phase it was 19,500 pc; in the third phase so far the percentage rise is 1,721pc. All that tells us is that the percentage gains are likely to be less each time but it again suggests that this leg of the journey may have further to go. One off the most bullish factors is the widespread incredulity about what is happening. There are many people yet to be converted.

The chart for ether is not as impressive as the one for bitcoin but it is still a strong chart. A reaction/ period of consolidation could come at any time but the odds are good that it would be an interruption in a continuing uptrend. The bitcoin price climbed to $57,000 at one point this week, giving it a total value of over $1 trillion, while ethereum, the second-largest cryptocurrency, broke $2,000 per ether token for the first time—giving it a total value of $226bn. Musk warned on the bitcoin and ethereum price during a discussion on Twitter about the nature of money. Replying to gold investor and bitcoin skeptic Peter Schiff, Musk said: “Money is just data that allows us to avoid the inconvenience of barter. That data, like all data, is subject to latency and error. The system will evolve to that which minimizes both. That said, bitcoin and ethereum do seem high.”

Litecoin is similar in nature to bitcoin but with a much lower price – bitcoin lite indeed. It was a spin off from bitcoin in 2011 and has a maximum potential supply of 84m. The price action has been similar to that of bitcoin – surge, reaction, consolidation, repeated and then a new breakout. The difference is that so far litecoin has failed to reach a new all-time high. Litecoin has been described as the silver to bitcoin’s gold but there is no ready explanation of why the price is so much lower. Bitcoin has clearly won some sort of popularity contest. As in other areas of technology there may be a first mover advantage for bitcoin and an element of winner takes all. Nevertheless it seems plausible that a rising bitcoin will drag other cryptos higher in its wake.

Appian delivers an enterprise platform for digital transformation that enables organisations to revolutionise their customer experience, optimise their business operations, and master global risk and compliance. Powered by industry leading business process management (BPM) and case management capabilities, Appian’s low-code approach can radically accelerate the time it takes to build and deploy powerful, modern applications, on-premises or in the cloud. Low-code is a visual approach to software development. One suggestion is that “by 2024, low-code application development will be responsible for more than 65pc of application development activity.” For Q4 2020 Appian reported cloud subscription revenue up 40pc out of total revenue growth of 17pc. Thanks to the disruptions of 2020 “our slow revolution was pre-empted by a fast revolution. The events of last year will shape the low-code market profoundly. Appian now has an opportunity to be a leader in the leading market.”

Carvana is a US business, led by a string of graduates from Stanford and Harvard, which is disrupting the American used car industry. Think Netflix for used cars and you get the idea. They use technology to take the stress out of buying and selling used cars, put cars through a factory to fix faults before you take delivery, give you an unconditional week to return the car if it doesn’t meet you requirements and effectively makes the whole process, including securing finance, a fun experience. One recent bull of the shares said “As a leading ecommerce platform for buying and selling used cars, Carvana is at the forefront of the digital disruption in this $840bn category. We expect expanding vehicle selection, increasing coverage, faster delivery and rising brand awareness to drive a robust 32pc revenue CAGR [compound annual growth rate] and nine per cent market share over the next 10 years.”

Recently floated Dynatrace’s technology sits at the heart of the digital transformation process. “We designed our software intelligence platform to allow our customers to modernize and automate IT operations, develop and release high quality software faster, and improve user experiences for better business outcomes. As a result, as of 31 March, 2019, our products are trusted by more than 2,300 customers in over 70 countries in diverse industries such as banking, insurance, retail, manufacturing, travel and software.” Dynatrace is a typical enterprise software business growing subscriptions rapidly by spending massively on r&d and sales and marketing. Latest results beat expectations with sales up 28pc and one observer described the company as becoming “the killer app for digital transformation”.

Genus haas featured eight times in my publications in the pre Quentinvest era, starting at 1723p in July 2016. This recommendation will take it into the QV portfolio because now that QL (Great Stocks by Quentinvest) and CB (Great Charts by Quentinvest) are included in the Quentinvest subscription all recommended stocks in both publications go into the QV portfolio and into the master table. Genus has been a stunning performer but also one I have struggled to fully understand. The core business is helping farmers improve the quality of their livestock like a high tech stud farm for cattle and pigs. It’s big business. Sales of £388m in 2018 grew to £551m last year with profits of £71m. If you think of the company as the world leader in using science to improve animal genetics and deliver “desirable characteristics including feed efficiency, disease resistance, growth rate, protein and fat content, and fertility” you can see why they do so well.

Guardant Health is a leading precision oncology company focused on helping conquer cancer through proprietary blood tests, vast data sets, and advanced analytics. Liquid biopsy is at the core of their mission to conquer cancer with data. They believe the key to conquering cancer is unprecedented access to its molecular information throughout all stages of the disease and are developing a solution through tests that require only a blood sample. Today, Guardant’s blood tests are enabling timely therapy selection for patients with cancer while they also advance programs for recurrence detection and early cancer detection. In addition, they are working together with pharmaceutical companies to discover and understand new treatment approaches that lead to better outcomes for patients. It sounds exciting and is already delivering strong growth. Sales are projected to grow from $49.8m for 2017 to $508m for 2022.

JTC consists of two very roughly equal divisions, ICS, institutional client services and PCS, private client services. It has been growing year on year for 32 years, grew sales overall by 28pc in 2019 and has a strategy of combining organic growth with a regular stream of bolt on acquisitions. In 2020 the group acquired the private clients business from Sanne, a similar type of business, which is in the QV portfolio but has been disappointing. On current form JTC looks like a better bet in what should be a very promising business area as rock bottom interest rates drive institutions and private clients across all geographies to more active investment strategies. JTC has 900 employees, was founded in Jersey in 1987 and operates a network of 23 offices in 19 jurisdictions. Interim results showed solid growth and after some Covid-inspired softness an accelerating acquisition pipeline.

Back in the day a South African conglomerate called Naspers bought a 31pc stake in a fledgling Chinese technology company called Tencent for $32m. Since then Hong Kong-quoted Tencent has grown to become one of the world’s largest technology businesses with a market value of HK$7049bn (US$909bn/ £650bn). Tencent rapidly became the tail that wagged the Naspers dog with the latter, even though it has many other assets, moving to a discount to the value of its Tencent stake. In an effort to close the gap Naspers spun off its international investments including Tencent into a Netherlands quoted company called Press. Since then Prosus has moved to a discount to Tencent and Naspers to Prosus such that recently Naspers was valued at half its stake in Tencent. This gap may now be starting to close.

Novanta is a leading global supplier of core technology solutions that give medical and advanced industrial original equipment manufacturers (“OEMs”) a competitive advantage. Q3 2020 results were affected by Covid and sales fell but even so many exciting things are happening. “Our microelectronics business was up over 50pc year-over-year driven by EUV, 5G and cloud infrastructure equipment. We also continue to experience double-digit year-over-year growth with our smoke evacuation medical consumables, our medical bar code solutions for ICU patient monitoring and diagnostic test equipment, and in China, we saw year-over-year growth accelerate to 46pc.” It is clear that as Covid-19 loosens its grip medical procedures will recover and this will drive a sharp rebound at Novanta. As they say “We continue to believe that our long-term secular growth drivers are even more relevant post pandemic, with particular focus on industrial and surgical robotics, minimally invasive surgery, precision medicine and Industry 4.0.”

Pegasystems is the leader in software for customer engagement and operational excellence. Its addressable market covers customer relationship management, business process automation, customer engagement, low code, and more providing many options to drive solid double figure growth. The adoption of low-code, marketing, and sales automation offerings will expand the near-term opportunity. The shift to recurring subscription revenue continues to mask the underlying growth. 2021 represents a pivot year with the growth and profitability picture to improve significantly towards the end of the year. In Q3, 66pc of new commitments were Pega Cloud. This represents 16pc growth compared to H1’20. This drove a 27pc growth in subscription revenue. Analysts forecast sales growing from $1bn for 2020 to $1.8bn for 2023.

Pinterest is on a dramatic growth charge with sales forecast by analysts to grow from $756m to $4492m between 2018 and 2023 while ebidta will rise from a negative figure to a projected $1476m. One analyst says “Pinterest represents a mesh of Facebook, Google, and Amazon all in one and that combining search, social, and commerce together creates what could be one of the greatest value propositions in all of advertising”. This analyst is convinced that Pinterest is still in the early innings of its growth. The company recently reported its Q4 2020 results saying “In Q4, monthly active users grew 37pc year over year to 459m. Revenue in the quarter grew 76pc to $706mn, and we were profitable for 2020.” Ceo, Ben Silbermann, says – “Historically, we’ve empowered Pinners to bring their favourite content from the web onto Pinterest. Today, we continue to invest in emerging formats like video, which represents dynamic new ways to deliver inspiration, like how-to tutorials and incredible storytelling from brands. We’re also now expanding our focus to bring the most inspirational people onto Pinterest, creators.” No wonder he’s says they are “excited about progress, but more excited about the opportunities ahead.”

Sartorius is a leading international partner for the biopharma sector. Their solutions are supporting customers to develop and produce drugs safely, timely and economically. The group has been annually growing by double digits on average and has been regularly expanding its portfolio by acquisitions of complementary technologies. Vaccine related services have boosted growth. “Sartorius grew in all its geographies [in 2020], with this growth driven primarily by strong organic development and further by several acquisitions as well as additional pandemic-related demand. Sales revenue surged by around 30pc to €2,336m and thus far exceeded our original forecast of 10pc to 13pc issued at the beginning of the year. Underlying EBITDA, our most important earnings indicator, also rose close to 40pc to €692m….To support this growth, we have started to accelerate and extend the expansion of our production capacities very significantly in all geographies, the Americas, Europe, and Asia.”

Shift4Payments is a recently floated business built to tackle the complex problems of multiple software solutions, omnichannel payment acceptance, enterprise-grade reporting and analytics, and solve a number of other pain points through a single vendor solution. Merchants can subscribe to Shift4 via their gateway-only channel or, as is increasingly becoming the case, through their full end-to-end payment solution. Many customers are in the hospitality industry making it extraordinary that the business has weathered lockdowns so strongly. In the last reported Q3 2020 the group grew end-to-end volume by just over 20pc and in October growth reached 28pc. Gateway-only customers rely on Shift4 for software integration and payment security and third parties for things like merchant acquiring, payment devices themselves, reporting. The end-to-end solution collapses all of these functions with Shift4 as a single vendor solution. The group also recently acquired 3dcart taking it into the $2 trillion e-commerce market.

UP Fintech Holding Limited, known as “Tiger Brokers” in Asia, is a leading online brokerage firm focusing on global investors. The company has entered a phase of explosive growth. “In the third quarter, total revenue was $38m, an increase of 148pc from the same period last year and a record high for our firm. Operating income and net income also demonstrated healthy growth. In the third quarter, we added 46,800 funded accounts, seven times the quarterly growth rate in the same period last year and total funded accounts reached 214,700, an increase of 110pc on the same period last year. I am also happy to report that on 28 October, 2020, we reached a major milestone as total client accounts reached 1m. This is especially notable given our five-year operating history. Overseas clients now account for over 20pc of our newly funded accounts and we are confident this number can increase to more than 50pc in the next 12 months to 24 months.”