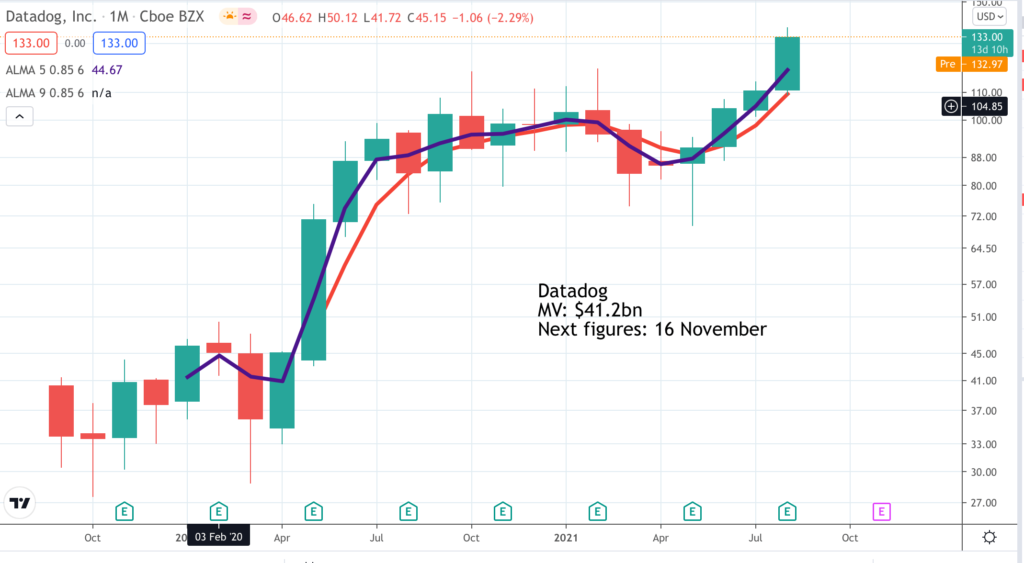

Datadog. DDOG. Buy @ $131.50. Times recommended: 9. First recommended: $55.5. Last recommended: $114.5

Two parts of the Datadog 3G investment case are easy to establish. First, the value of the business is rising rapidly. It was only founded in 2011 yet already the market value is over $40bn. We get blasé in this era of of Tesla, Amazon and Google but really that is a staggering achievement. Much of the increase in value has taken place while the company has been quoted. The shares floated with an IPO price of $27 and have risen roughly fivefold since then. This rise has taken almost exactly two years.

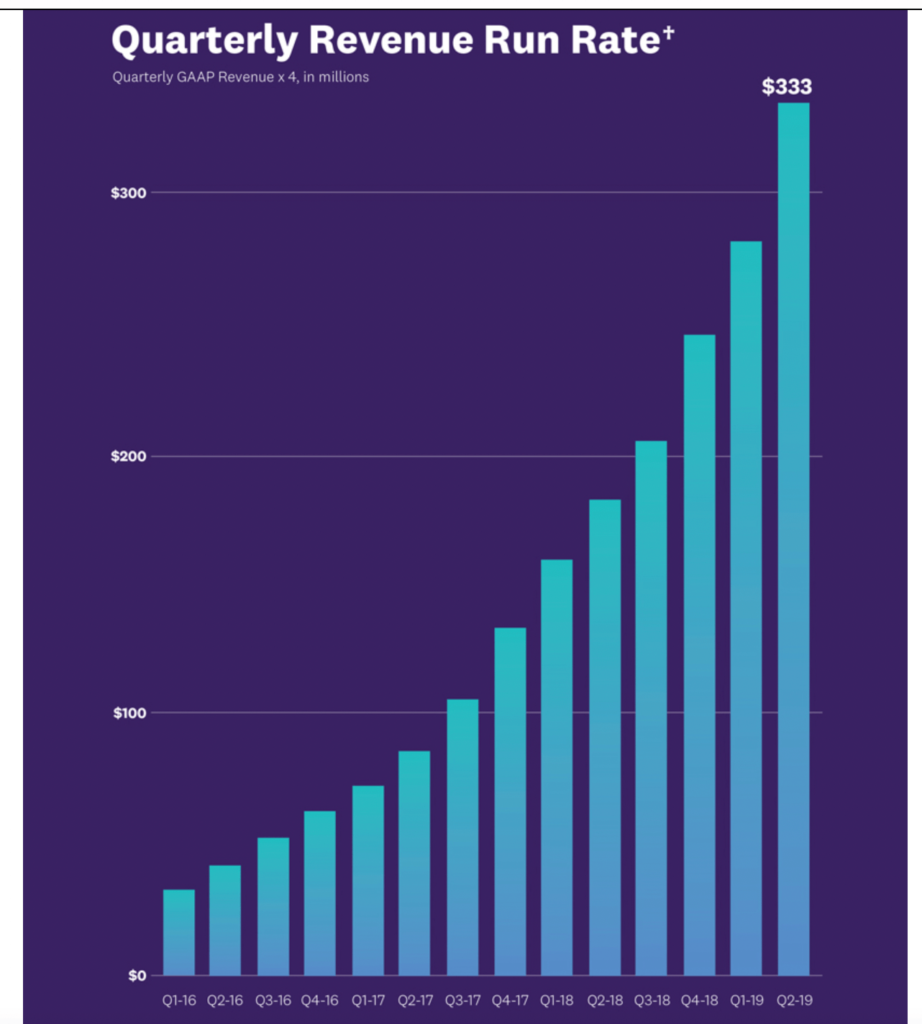

Second is the growth. Below is a chart of the quarterly run rate in millions of dollars up to the time of the September 2019 IPO. The latest figure, based on sales for Q2 2021, is $936m, well on the way to treble the 2019 number and the forecasts below show that strong growth is expected to continue.

I don’t think I am ever going to understand exactly what Datadog does let alone whether their products are better mousetraps than everybody else’s. What I can see though is that they feed off digital transformation. Datadog’s products help you monitor and manage your technology infrastructure and your cyber security arrangements. It thus plays a critical role for companies that are using ever more sophisticated technology to run their businesses.

Here is their description of what they do, which they offered in their first set of quarterly results post IPO for Q3 2019.

“From a product perspective, Datadog was founded in 2010 as a real-time data integration platform that turns the chaos on diversified sources into digestible and actionable insights. Our vision was a single platform that will provide Dev and ops users with a common view across sources, teams and technologies. In 2012, we launched our initial use case, infrastructure monitoring. Starting with infrastructure give us broad deployment across Dev environment and ubiquity across Dev and ops users. In other words, we were deployed everywhere and used by everyone.

Since initial launch, we have continued to innovate across more environments, including containers [a technical term in IT] and serverless as well as on-premise hybrid private and multi-cloud environments. Because problems rarely stop at the boundary between infrastructure and applications, we saw a need for full stack observability, and we launched Datadog Application Performance Management or APM in 2017. We quickly added Datadog Log Management in 2018, thus completing what we like to call the 3 pillars of observability. Earlier this year, we also launched Datadog Synthetics to extend into user experience monitoring, by letting our customers simulate user journeys on their web applications and API [application programming interface] endpoints.”

As you can see you really need to be one of them to understand what they do. What is impressive is their ability to grow at such a rapid rate year after year even as they are starting each year with a much bigger base of sales. How on earth do they do it?

Part of the reason is the huge tailwind from the technology revolution which is driving a dramatic digital transformation of life and business on planet earth. Datadog gives the various departments within a business, especially developers and operational managers (dev and ops) the opportunity to know what is going on, communicate better and work together more effectively. In the past they have almost been adversaries.

Datadog is a classic example of the land and expand business model. In this model you land new customers and as they become more familiar with your products they acquire more of them and expand their spending with you. On top of this your r&d department is working ceaselessly to improve all the products and add new ones so that your existing customer base can spend even more each year.

Software companies talk about the companies they recruit as customers each year as that year’s cohort. `in the Datadog prospectus there is a chart showing how each cohort spends more year after year. It makes the whole business a bit like a snowball rolling down a hill. It gets bigger and bigger and if it can maintain a rapid growth rate the snowball can become enormous in a surprisingly short space of time.

Some idea of the effort Datadog puts into r&d is that in Q3 2019 the group spent 30pc of revenue on r&d. No wonder their product pipeline is so strong.

The other way Datadog grows so fast is the power of the land and expand business model. First they add new customers.

“In the third quarter [of 2019], we saw strong new logo additions as well as expansion from existing customers. As of the end of the third quarter, we had approximately 9,500 customers, up from 7,100 a year ago. We ended with 727 customers with an ARR [annual recurring revebue] of $100,000 or more, up 93pc from a year ago. That’s an increase of more than 130 in the quarter alone. Given that more than 70pc of our ARR is generated from customers over $100,000, we expect this cohort of customers to be a large driver of our future growth.”

Now we can look into the future and see what is happening in Q2 2021.

“We ended the quarter with 1,610 customers with an ARR of $100,000 or more, up from 1,015 in the year-ago quarter. Those customers generate about 80pc of our ARR. We have about 16,400 customers, which is up from about 12,100 last year. We also continued to be capital efficient with free cash flow of $42m.”

In less than two years the total number of customers has more than doubled as has the number of customers spending more than $100,000 a year. The free cash flow number is important because it means the group can grow without needing constant injections of cash from shareholders.

Next comes the exciting bit. Thanks to the expand element in land and expand significant annual growth in revenues each year is effectively built in. In Q3 2019 the group reported on the success of its expand strategy.

“As in past quarters, our dollar-based net retention rate was over 130pc as customers increase their usage and adopted our newer products. And we also continued to be capital-efficient as our cash provided by operating activities in Q3 was $3.8m and year-to-date, $6.8m.”

A next expansion rate (NER) of over 130pc means that the customer base you started the year with ended the year spending over 30pc more with you so your growth rate is over 30pc even before you add new customers. The position in Q2 2021 was much the same.

“Our dollar-based net retention rates continued to be over 130pc as customers increased their usage and adopted our newer products. We are pleased that positive business trends from recent quarters continued in Q2. First, usage growth from existing customers remained very robust. Among other factors, we continued to see the impact of our strong new logo growth in the past several quarters as those new customers grow into their commitment.”

Add together the strong NER and the increase in customers and you can see why Datadog is still growing revenues by 67pc annually and also why it is pouring money into r&d and sales and marketing to make sure it emerges as a winner in the battle for territory. There will be time to report rising profits down the road once the territorial battles are won and the business matures.

This is what CFO, David Obstler, said about the Q3 2019 results.

“We have built the leading monitoring and analytics platform for the cloud age and are generating growth at scales that few companies can match. We are making continued investments for growth in the foreseeable future. We believe we are at the early stages of a multibillion-dollar market opportunity, and we feel very good about our ability to build a very large and successful company over time.”

There has been no change in this feeling in Q2 2021.

“Our strategic focus remains on investing to optimize for long-term growth. We are planning for continued aggressive investments in R&D and go-to-market through the remainder of 2021.”

The total addressable market is a bit meaningless in the case of Datadog since it seems to be everybody who uses technology which seems to be everybody.

A distinctive feature of the company is that the two founders, Olivier Pomel and Alexis Le-Quoc, are both French. This has encouraged the company to open an office in Paris and probably makes them an especially attractive employer for people of French descent.

My impression is that Datadog has a wonderful business which could be much bigger a decade from now. The quarterly revenue run rate is calculated by taking the latest quarter’s revenue and multiplying by four. It could well top $1bn the next time they report.

Warren Buffett says the best way to make money in the stock market is to buy a meaningful stake in a wonderful company at a reasonable price. Datadog looks like a wonderful business. Investors struggle to know what is a reasonable price for a business that is more than doubling in size every two years. On the chart it looks as though every price is a reasonable price in the end because the shares head strongly higher over time.

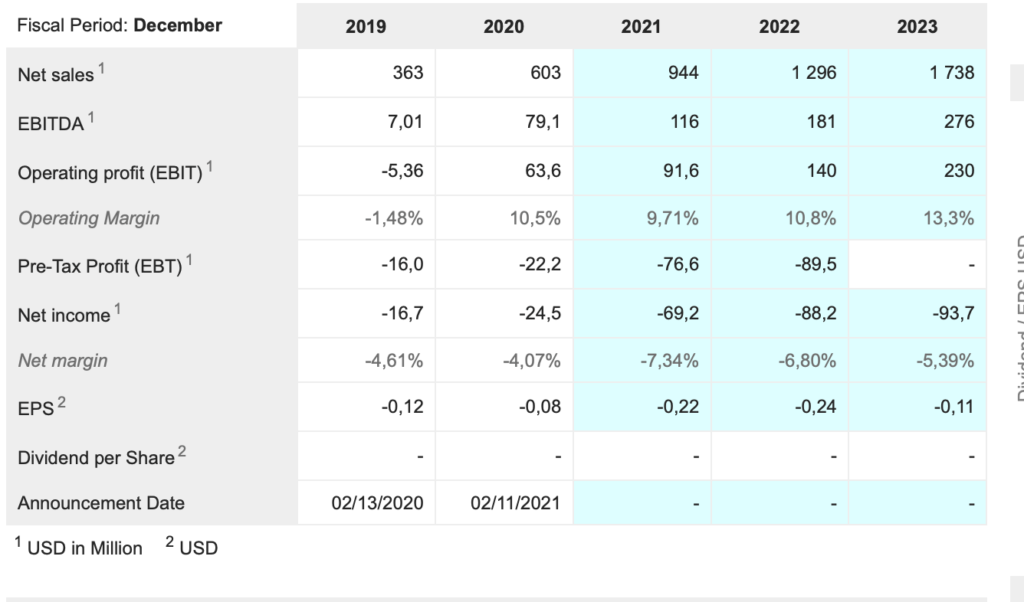

My rule of thumb is that businesses like Datadog, when they mature, are likely to generate net income margins of around 20pc of sales. Work this through and if we suppose the annual revenue run rate by Q4 2023 is going to be around $2bn that implies earning power of $400m. The company doesn’t actually make this profit because of continued aggressive spending on r&d and sales and marketing in the battle for territory although it will be generating a lot of cash.

Divide $400m into $40bn and you get a PE ratio of 100, which for such a fast growing business looks surprisingly reasonable. Especially based on the big picture that even with sales running at $2bn a year Datadog would have barely scratched the surface of its market opportunity.

Plus companies like Datadog get into incredibly powerful virtuous circles of growth. The bigger they get the more data they collect about what their customers need which makes them better able to address those needs thus recruiting more customers and selling more to each of those customers (land and expand). It also makes them ever more attractive to top talent as an employer so becoming even more powerful r&d machines and an ever bigger part of the technology ecosystem.

It is no wonder they feel they have such an amazing opportunity. It is hard for investors to get their heads around the idea that company which had sales of $363m in 2019 could have sales of 10 or 20 times that amount in the not too distant future. Technology has completely upended all our assumptions about how fast companies can grow and for how long they can sustain these exceptional growth rates. It really is a whole new ball game.