Digital Turbine joins portfolio – nothing to do with turbines, everything to do with apps

Digital Turbine Buy @ $90 New entry

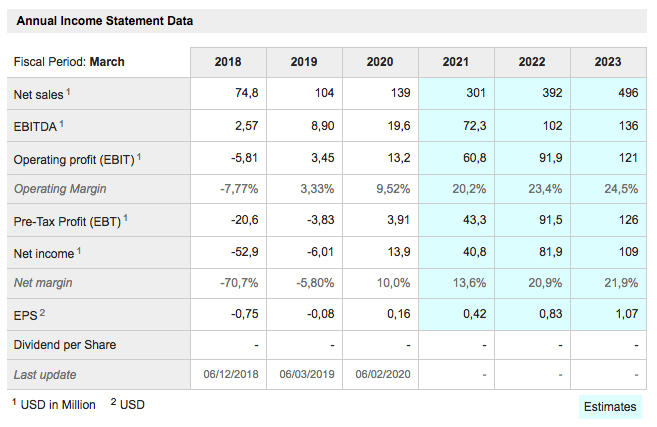

As we shall see below Digital Turbine is growing at an incredible rate. This is how they describe what they do. “Digital Turbine simplifies content discovery and delivers it directly to the device. Its on-device media platform powers frictionless application and content discovery, user acquisition and engagement, operational efficiency, and monetization opportunities. Through 31 March, 2020, Digital Turbine’s technology platform has been adopted by more than 40 mobile operators and OEMs [original equipment manufacturers] and has delivered more than 3bn application preloads for tens of thousands of advertising campaigns.”

I don’t use apps so I struggle to get my head around this but clearly what they do is very useful because their user base is huge and it is driving almost incredible growth. A simpler way of looking at their apps business is that their software is preloaded on Android phones sold by companies like AT&T, Verizon or Samsung. Developers such as game makers, digital music companies and restaurants pay Digital Turbine for slots on the phones so their apps are automatically available to the consumer upon activation. Digital Turbine gets paid about $3 per phone and remits $1.80 to the carrier.

CEO, Bill Stone, outlines the growth that took place in Q3, 2021, reported on 3 February.

“To close out our fiscal 2021 third quarter, we continue to build out on our breakout momentum from the first half of the fiscal year with record results across the board. We had $88.6m in revenue, which represented nearly 150pc annual growth on an as-reported basis and over 70pc on a pro forma basis. Higher gross margins and accelerating operating leverage enabled us to turn the strong revenue growth into more than four times the EBITDA [earnings before interest, tax, depreciation and amortisation] compared to the EBITDA generated a year ago. We delivered 278pc growth in earnings per share and more than 3x the free cash flow from a year ago as we continue to benefit from network effects of our platform and economies of scale.”

Not many people are yet aware of this staggering growth. Their latest analysts’ meeting was attended by just five analysts. This is important because of crowd theory. Shares go up as more people find out what is happening. There is huge scope for this to happen here.

The more I read about APPS (the stock market code for Digital Turbine) the more amazing it looks. Revenue is driven by the number of devices using their platform/ technology/ software. They “added approximately 65m devices in the quarter, which represents over 50pc growth year-over-year.”

But it also reflects revenue per device (RPD). “In the US strong media demand resulted in 25pc growth of RPDs and we saw nearly 70pc growth in international RPDs.”

More devices and higher spending per device means fireworks. “Combined with the strong device growth, our international supply revenues increased by nearly 200pc year-over-year and for the first time, we also had more international demand revenues in our App Media business come from outside the United States.”

Exciting things are also happening with their content business. “In our content business, revenues in the December quarter increased by over 100pc . This result was driven by our new content platform being fully deployed and improved advertising rates all driving better operating results. This $31.7m in content revenues was achieved from over 10m daily active users or DAUs. Our existing addressable market distribution footprint is many hundreds of millions of devices with our current software, which means the opportunity for growth is enormous.”

The outlook for the business looks at least as good as what is happening currently.

“Our pipeline remains robust and we’re excited about many opportunities in front of us to further increase our device footprint. And as you’ve heard me mention on prior calls, expanding devices beyond smartphones is an exciting opportunity for us and a natural extension of our offerings. We continue to make progress on our TV offerings as we discussed on our last earnings calls and look forward to those launches occurring later this year.

While the strong growth is exciting, I believe it will be even better as we drive more revenue synergies on our content products. We continue to capture the recent momentum in our SingleTap business and other emerging products such as notifications ramp even faster. Our recurring revenues are now nearly 50pc compared to just over 10pc a year ago.”

This is what one analyst said about the company recently. “Digital Turbine is a really special kind of company. It combines great revenue growth figures with huge opportunities, increasing recurring revenues, a unique position and clever execution that enable it to continue increasing rates, great operational leverage, and large operational cash generation, to name a few highlights.”

He sums up their opportunity as follows. “The Ignite footprint on the number of devices, RPD (revenue per device), content media; new products; international expansion and new devices (TVs).”

Ignite is their Application Media platform on which app producers vie for a prominent place on the first few screens of your Android mobile phone. Driven by the additionof 65m phones revenues grew 58pc to $56.9m.

Revenue per device grows because space on phones is limited while the apps universe is expanding.

Content media was boosted early last year by the acquisition of a company called Mobile Posse. Mobile Posse’s Firstly Mobile platform turns telecom companies into mobile media organizations by aggregating customizable news, entertainment, sport and weather content from multiple sources and delivering it directly to smartphone users via a single pre-loaded app.

The segment achieved $31.7m in revenues (+108pc, pro forma) from 10m DAUs (daily active users) with most of the growth coming from T-Mobile, but these include just 100K DAUs from their device footprint (and thus a result of cross-selling). Given the nearly 600M devices which they can monetize they haven’t even begun to scratch the surface here, the opportunity in front of them is enormous.

As you will realise from the chart of Digital Turbine I am never frightened by the fact that a share has already risen dramatically. On a long view that just confirms the exciting potential but it can sometimes mean the shares are going to take a breather before the next leg higher.

When I find an obviously super-exciting share I prefer to take a position and then consider the next move. If I become even more convinced that the stock has the potential to be a big winner I will buy some more. I do this all the time, ideally building from strength by buying less shares than my original purchase at higher prices.

It’s a trick I learned long ago from a man called Nicholas Darvas, who wrote a book called “How I made $2m in the stock market”, when $2m was a serious amount of money. He would buy a pilot position in a stock to get a feel for the shares and the business. If it all felt right then he would pile in. He was not an analyst; he was a ballet dancer. He also preferred to buy stocks with great momentum; what I call 3G.

He made a fortune from a company called Lorillard, which introduced America to filter tip cigarettes. As you can see his glory days were some time ago but I learned an important lesson from him. Shares in great businesses go up and up and up, typically way higher than anyone thought was possible at the beginning of their rise.

When buying shares I am also mindful of Warren Buffett’s advice to build a meaningful position in stocks you like. My rule is that you need to own enough that it hurts if they fall but not so much that it becomes overly stressful. I sometimes break this rule, when I really, really believe but in general I am trying to learn another lesson, not to be too greedy because that way you make more in the end.

My ideal position is a big holding, where most of it is profit; that too can eventually become stressful but that relates to another of my rules about giving miracles a chance to happen. If you take profits just because they are profits you lose the opportunity to make a life-changing investment.

My main requirements when buying a stock are that it is 3G (that is a deal breaker, no 3G, no way do I buy); that it has quality (often intangible but I usually know it when I see it) and that it has big ambitions and big potential. If all those conditions are met then it is just a question of whether I have the funds to make a purchase.

Digital Turbine meets all my requirements. The growth is explosive but it still looks as though they are just getting started and as they grow their financial strength and footprint the opportunity to introduce new products and make value-adding acquisitions becomes bigger all the time.

The classic growth stock enters a virtuous circle, where the bigger they grow the stronger they become, which helps them grow even bigger. In technology this is sometimes described as the network effect. The shares oscillate around this process, sometimes becoming over-extended so they take a breather or even correct but setbacks are short-lived and then they head higher again, often propelled by positive news flow.

I tend to use lots of quotes when I first write about a business as part of a getting to know you process. As I learn more I can express myself more freely and with greater confidence.