There are two UK-quoted investment trusts that specialise in technology. They have been incredible performers over the years, were hammered in the 2022 shakeout and are looking promising now as tech comes roaring back.

Also exciting and important is that the stock market, which for me almost invariably means the US stock market, has new leadership driven by the inflection point in Artificial Intelligence (AI), which promises to launch a new leg of growth in the accelerating technology revolution.

These are fantastic times to be an investor and I urge my subscribers not to miss out. There could be huge moves ahead for favoured stocks.

Table of Contents

The first investment trust I am going to look at is Polar Capital Technology Trust (PCT).

The chart looks great with a double buy signal (Coppock plus golden cross on the moving averages) of a type which has initiated big moves in the past. Just look at them, hitting the bullseye time and time again.

My rule is never worry about where the share has come from, think about where it might be going.

Their description of what they do immediately makes it likely that the shares are going to be great performers.

Disruption and innovation in how we live and the way we work is being driven by technology and technological developments.

Technology’s impact is being felt across every industry with new opportunities coming from the move to smartphone technology, the cloud and, increasingly, artificial intelligence.

The Polar Capital Technology Trust provides investors with access to the huge potential of companies within the global technology sector and is managed by a team of dedicated specialists with the ability to spot developing technology trends early on and invest in those companies they feel are best placed to exploit them.

Website

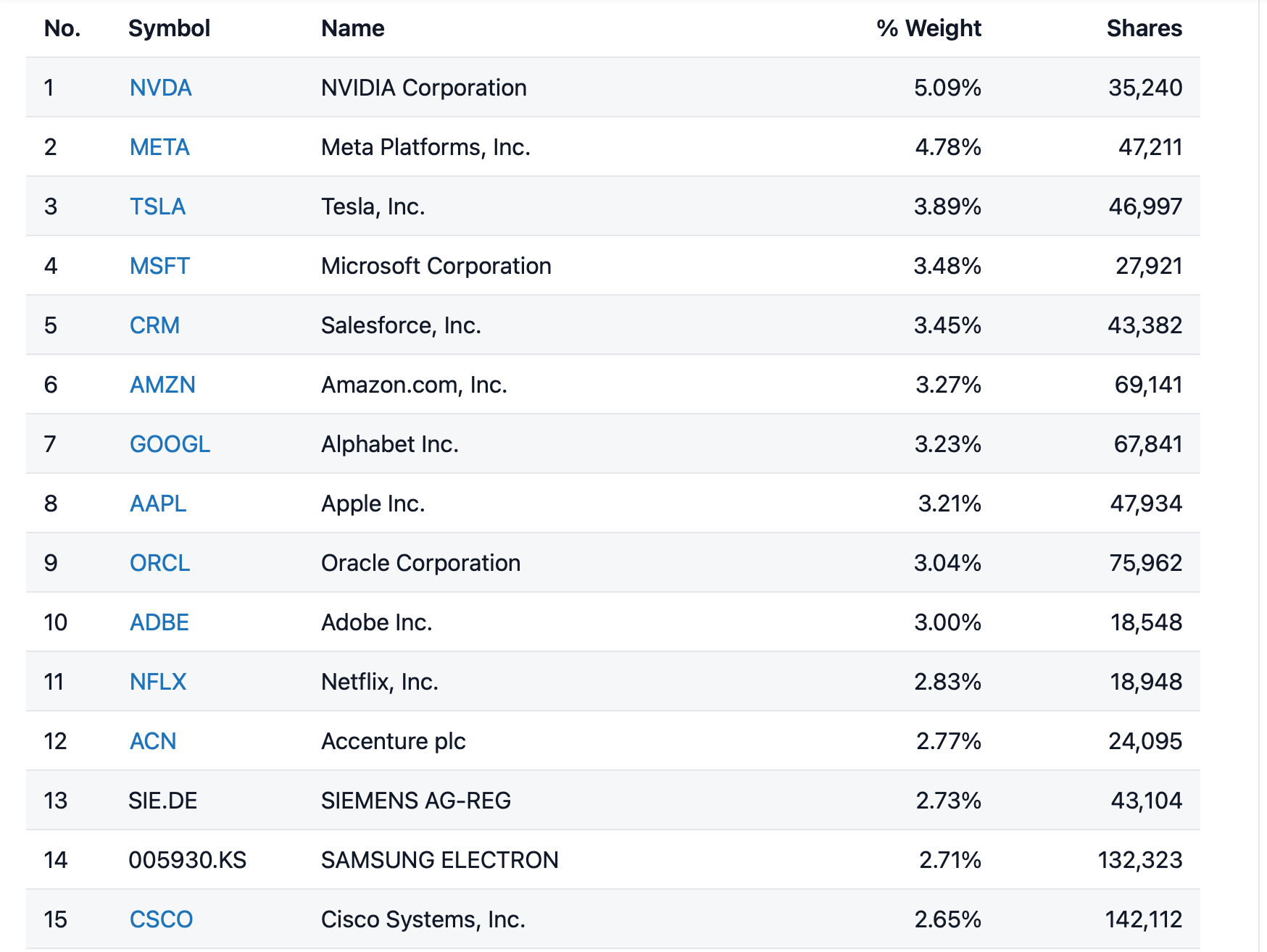

PCT’s largest holdings emphasise the US, semiconductors and software

It is a fantastic portfolio, with holdings in many of the biggest guns in technology. Eight of the shares are American, TSMC is a Taiwanese company building a huge operation in the USA and Samsung practically is South Korea. All these shares have good individual charts. PCT presently has nearly 50pc of the portfolio in semiconductors and software.

Here is what the managers say about AI.

We remain excited by the longer-term disruptive potential of AI and believe we are at a true inflection point for broader AI adoption. The Trust has broad exposure to this trend with more than half the Trust exposed to ‘AI beneficiaries’ (where AI is part of our investment rationale) and the vast majority of the Trust comprised of ‘AI users’, using a broader definition.

Newer & Views, 5 May 2023

My second investment trust selection is Allianz Technology Trust (ATT), which has another great chart.

The chart looks similar to that of PCT with the same series of double whammy buy signals.

What tells a story is the geographical sector breakdown. It looks as though they have nothing in the UK. What has happened to this country? We used to be amazing. Now we are nowhere and subscribers complain because I feature so few UK stocks.

The general approach is similar to that of PCT and indeed of Quentinvest. I notice that Hubspot is in their top 10. This is a good one and likely to feature as a future alert and Salesforce.com is using AI to have a powerful new lease of life.

I also like Apple partly for its chart but also because I am impressed by the Apple Vision Pro. It may be clunky but so were the first brick-sized mobile phones and look at them now. What impresses me is the capabilities of this incredible piece of kit.

Apple Unleashes the Power of Spatial Computing

Imagine if this device had been launched 20 years ago at this $3,500 price. It couldn’t have been because it depends on many other technology improvements to make it possible. But if something like it had been available demand would have been off the scale so don’t underestimate the potential importance of this new launch to Apple.

The shares are hitting resistance around $180 but I read this as a strong chart with the same double whammy buy signal I have been talking about for the two investment trusts.

Two ETFs for the AI Boom

This is another cool chart. AIQ is perfect for what is happening now as indicated by the list of largest holdings below.

The odd one out here seemed to be Siemens AG, a German electrical engineering company but the shares have been rocketing over the last year. The business sounds sexy.

Siemens is a technology group that is active in nearly all countries of the world, focusing on the areas of automation and digitalization in the process and manufacturing industries, intelligent infrastructure for buildings and distributed energy systems, smart mobility solutions for rail transport, and medical technology and digital healthcare services.

Annual report 2022

The latest results for Q2 2023 were excellent.

“Siemens continues its outstanding performance, delivering several records, including impressive margin increases and all-time highs in profit for Digital Industries and Smart Infrastructure, as well as another record in order backlog,” said Roland Busch, President and Chief Executive Officer of Siemens AG. “Our very strong results show that we have the right strategy, the right technology, and the right team to support our customers in becoming more competitive, resilient and sustainable.”

“We have delivered what we promised: We converted our fantastic revenue growth into high profit and ultimately into strong free cash flow. That is execution at its best, giving us the confidence to raise our guidance,” said Ralf P. Thomas, Chief Financial Officer of Siemens AG.

Q2 2023, 17 May 2023

So clearly this company deserves its place in the AIQ portfolio and if AI delivers anywhere near up to expectations this ETF should do extremely well.

My other AI ETF which I like is Global X Robotics & Artificial Intelligence (BOTZ).

The scale on charts does funny things. If you look at this chart the shares look extended and on a short term view no doubt they are but imagine if the shares are heading for $200 long term. The chart would then look very different. You can see how it might look below.

What I have done is flattened the chart so that $200 appears on the vertical scale on the right. Now you can see that all the trading between summer 2016 and summer 2023 could be part of a giant base pattern. You can play this game with any chart but that is why breakouts look so vivid on charts when shares do rise manyfold.

Let us have a look at Tesla without flattening the chart.

Tesla’s Third Consolidation

As Elon Musk says sometimes, Tesla is not about making cars which anyone can do but about building incredible, giant, state of the art factories.

What stands out very clearly is two areas of consolidation when the shares are all over the place and two periods when the price was rising dramatically. What we have now may well turn out to be another period of consolidation with a different shape again. The breakouts look clear and vivid in retrospect but did not look so clear at the time. We need to use our imagination.

BOTZ is both very concentrated and rather unusual in its largest holdings.

Dynatrace Creating a World Where Software Works Perfectly

I had a look at Dynatrace to see what they did and was suitably impressed.

Dynatrace offers a unified observability and security platform with analytics and automation at its core, purpose-built for dynamic, hybrid, multicloud environments. Our comprehensive solutions help global organizations simplify cloud complexity, innovate faster, and do more with less in the modern cloud.

Our mission is to deliver answers and intelligent automation from data at an enormous scale. Our purpose is to enable flawless and secure digital interactions. Our vision is a world where software works perfectly.

Digital transformation is ubiquitous, with software defining how we bank, manufacture, deliver healthcare, educate, receive government services, transact business, and communicate with our colleagues, friends, and families. This transformation is happening in particular in dynamic hybrid, multicloud environments, which bring a scale and frequency of change that is exponentially greater than that of the old data centre world.

Traditional approaches for developing, operating, monitoring, and securing software were not designed to keep pace with these modern cloud environments. What was once a well understood layering of applications running on operating systems on physical servers connected to physical networks has rapidly become virtualized into software at all levels. Applications are no longer monolithic and have become fragmented into thousands, potentially millions, of microservices, written in multiple software languages. These applications run in environments that may extend across Infrastructure as a Service (“IaaS”), Platform as a Service (“PaaS”), and Functions as a Service (“FaaS”), offered through hyperscaler vendor solutions such as Amazon Web Services (“AWS”), Microsoft Azure (“Azure”), and Google Cloud Platform (“GCP”), and more traditional data center solutions such as mainframe environments. To monitor and secure their IT environments, organizations increasingly need to move from manual processes, static dashboards, and remediating after the fact to solutions that deliver vastly improved insights, analytics, answers, and automation.

As enterprises and public sector institutions embrace modern cloud environments as the underlying foundation of their digital transformations, we believe that the scale, growing complexity, and dynamic nature of these environments are rapidly making solutions such as the Dynatrace® platform mandatory instead of optional for many organizations. Our Dynatrace® platform combines the only fully unified end-to-end solution for comprehensive observability and continuous runtime application security together with advanced artificial intelligence (“AI”) for IT operations (“AIOps”) to provide answers and intelligent automation from data at enormous scale. This approach enables IT, development, security, and business operations teams to modernize and automate operations, deliver software faster and more securely, and provide better digital experiences.

Annual report 2023, 25 May 2023

And they are trading strongly.

Dynatrace delivered an exceptional finish to FY 2023 with fourth-quarter results that exceeded expectations across the board. For the full year, adjusted ARR growth, constant-currency subscription revenue growth, and free cash flow margin were all 29pc.

Q4 2023, 17 May 2023

The chart looks good with the double whammy (Coppock + moving averages) buy signal that we are seeing almost across the technology sector. It’s not just an inflection point for AI but for tech stocks generally and is compatible with the idea that a long-running new bull market is taking shape.

Strategy – Make Sure to Buy Only Exciting Shares and ETFs

My approach may seem a bit like a butterfly going from flower to flower as I look at ETFs and shares but there is a common theme. Everything I look at is recommended, is 3G and has a great story. If you are building a portfolio these are all ideas that should work for you.

You can mix and match. Go in hard on shares that really catch your imagination, go in for leveraged ETFs for the excitement they provide and also build portfolios of ETFs and shares.

Share Recommendations

Apple AAPL Buy @ $178

Tesla. TSLA. Buy @ $224.5 (not a full on chart buy yet but looking promising)

Dynatrace DT. Buy @ $50

ETF and Investment Trust Recommendations

Polar Capital Technology Trust. PCT. Buy @ 2235p

Allianz Technology Trust. ATT. Buy @ 263p

Global X Artificial Intelligence & Technology ETF. AIQ. Buy @ $26.50

Global X Robotics & Artificial Intelligence ETF. BOTZ. Buy @ $28.14