The unusual position we have currently is that the S&P 500 index is noticeably stronger than the Nasdaq 100. The S&P has given a buy signal recently (see chart above), whereas the Nasdaq 100 is trying to give a signal but nothing confirmed as yet.

This makes sense. The Nasdaq 100 is heavily weighted for technology shares, which benefited from an accelerated move online during the lockdown period. This trend may weaken as conditions return to normal with widespread vaccinations. Many technology shares are also showing massive profits for holders making them subject to profit-taking.

Companies are still reporting dramatic growth and making positive statements on prospects so there is no sign that it is game over for technology shares, more like a pause for breath.

Shares in Europe and the UK have not benefited so strongly from the enthusiasm for technology shares, which are heavily concentrated in the US and China but they have suffered from lockdown. A successful roll out of vaccines should be beneficial for business in Europe and we can see this in the charts.

Another issue for shares in fast-growing companies is the rate at which future profits are discounted to generate a present day value. This is based on bond yields. Since August 2020 the yield on US Treasury 10 year bonds has more than trebled from around 0.5pc to 1.62pc currently, which is a negative for shares in companies where much of their value relates to sales and earnings expected well into the future.

As this chart shows European shares can perform. They had a dramatic period between late 1987 and 2000 as long term interest rates (bond yields) fell and we moved into what historians may perceive as the dawn of the Internet era. Unfortunately, Europe has not played a leading role in the technology revolution. Everyday life has changed dramatically but it is mostly American companies making those changes happen. The euro, in my view, has also been a disaster pushing much of Europe into a never-ending economic stagnation.

This is reflected in equally stagnant stock markets. The Euro STOXX 50 share index is still well below its 2,000 peak. This is in stark contrast to the performance of the S&P 500, let alone the Nasdaq 100.

The question is could this long stagnation be coming to an end. This is a big question and I certainly don’t pretend to have the answer except that anything is possible. Europe has great universities and plenty of able people. The UK leaving Europe may be a wake-up call for continental Europe as well as the UK.

There are some signs of life in stock markets. The German Dax index is hitting new all-time peaks and doing much better than stock markets of other European countries including the UK. This is not so surprising. The euro works for the Germans because it makes them more competitive, while making the rest of Europe less competitive.

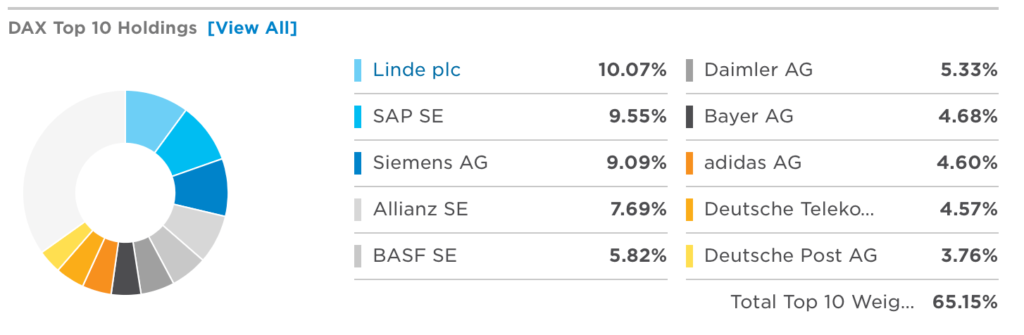

DAX. Global X DAX ETF. Buy @ $32.05 New entry

This fund is heavily weighted for big German exporters so should do well if we see a strong recovery in the global economy, which seems likely as lockdowns are lifted and pent-up demand is released.

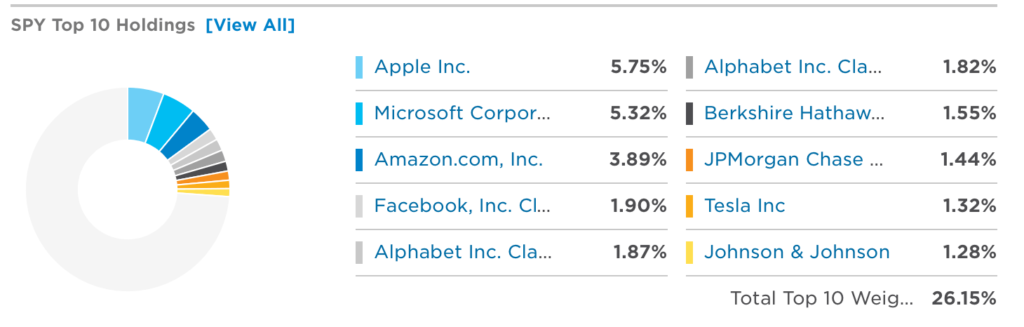

SPY. SPDR S&P 500 ETF. Buy @ $394.5 Times recommended: 4. First recommended: $283.34. Last recommended: $367

We have a programmatic buy signal for this S&P 500 tracker. If I include the IUSA ETF, which also tracks the S&P 500, there have been 12 alerts altogether. These are massive ETFs. SPY has $333bn of assets under management. The expense ratio is an almost invisible 0.09pc. This is the ETF, which Warren Buffett recommends as a core holding, even the only holding, for investors who are wary of picking individual shares to buy.

It’s a great stock for programmatic investing or any kind of £-cost averaging programme because it reflects the power and growth of the US economy so it is always going to head higher over time.

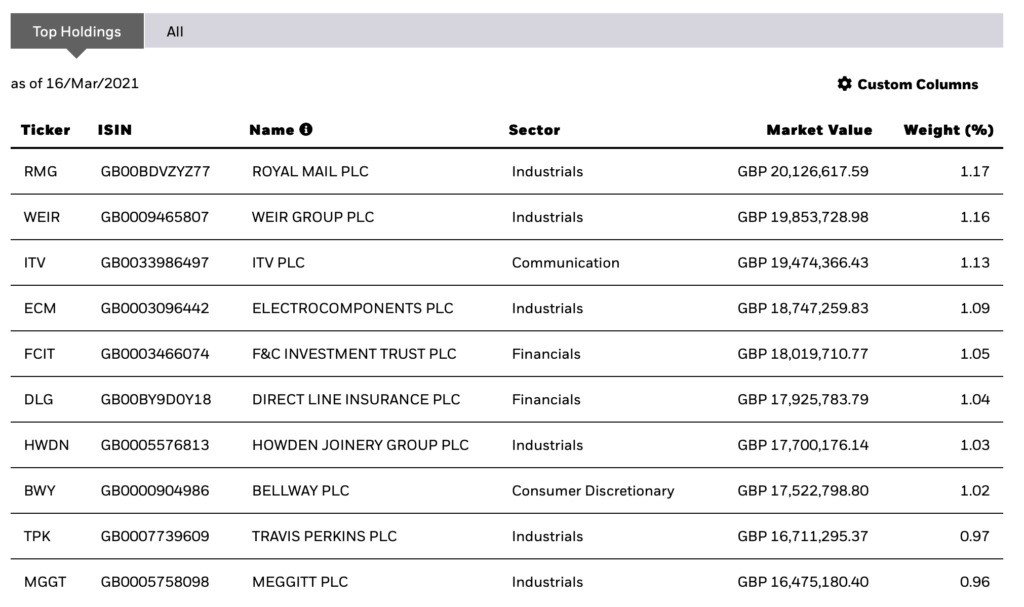

2MCL. Wisdomtree FTSE 250 2x Daily Leveraged. Buy @ 24567p Times recommended: 5. First recommended: 20818p. Last recommended: 19730p. Lowest recommended: 14000p

MIDD iShares FTSE 250. Buy @ 2048.5p. Times recommended: 4. First recommended: 1959p. Last recommended: 1849p. Lowest recommended: 1549.8p

The chart above for the two times leveraged version of the FTSE 250 ETF is giving a programmatic buy signal. The chart is short term because of a glitch preventing me from going back further. Leveraged ETFs always come with a health warning because of their volatility but if you stick with them they usually do well and obviously outperform the unleveraged versions both up and down.

I am also alerting MIDD, the unleveraged FTSE 250 tracker, which should also do well if the buy signal works properly and better still, if Brexit and the emergence from lockdown finally spark a moribund UK economy into life.

Come on Boris, let’s see what a capitalist economy can do if you take off the brakes and give Adam Smith a chance. We did it in the Victorian age. We could do it again if the government would show real belief in the entrepreneurial energies waiting to be unleashed.

The top 10 holdings don’t exactly make the pulse race but they would benefit from a strong recovery in the UK economy and to my amazement I see that shares in Royal Mail have more than quadrupled since March 2020 – all those commerce-driven parcel deliveries seem to have woken up the slumbering giant.

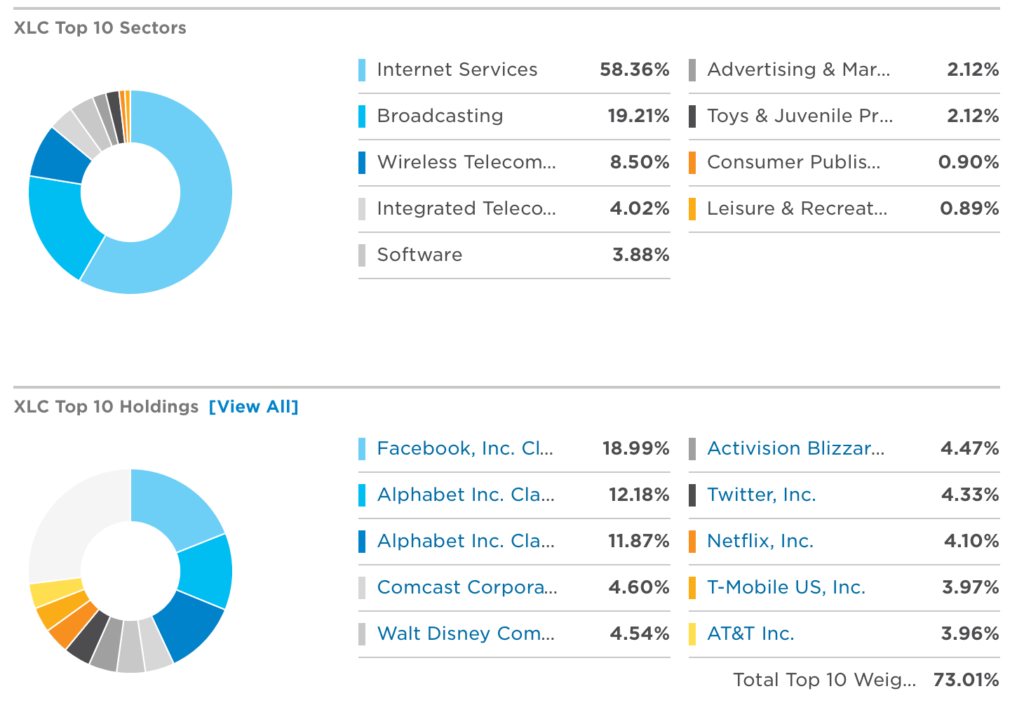

XLC. SPDR Communication Services Buy @ $76. New entry

The top 10 holdings include some of the usual suspects but there is a bias to social media, online entertainment and telecommunications, which are all sectors placed to grow strongly for the foreseeable future. This ETF has an explosive chart and recently gave a programatic buy signal.

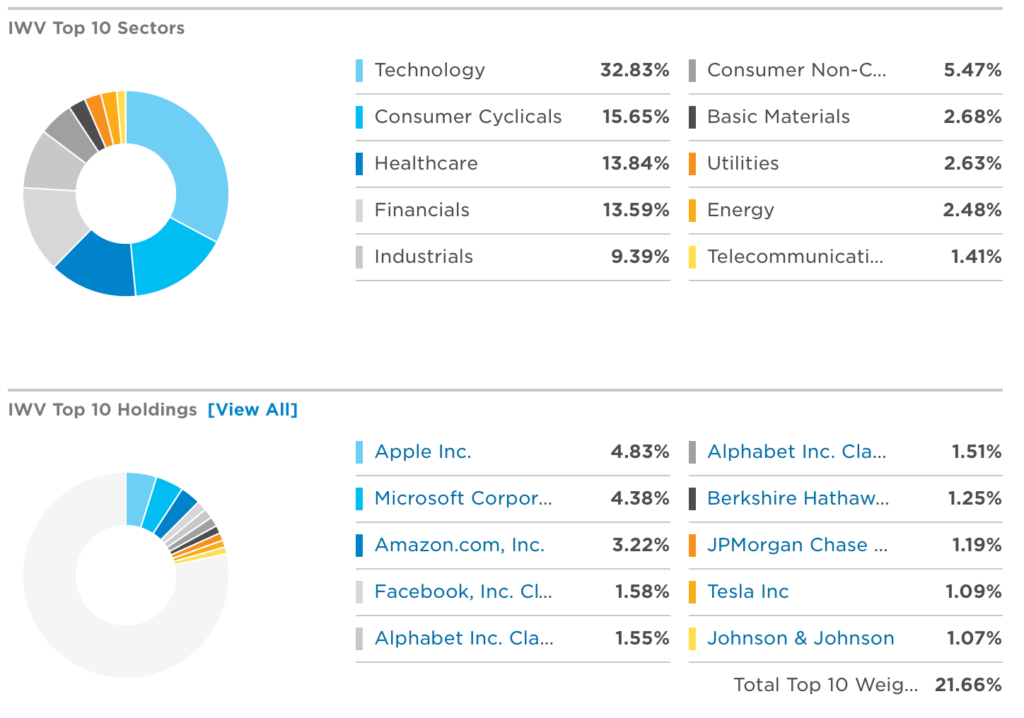

IWV. iShares Russell 3000 ETF. Buy @ $237.50. Times recommended: 5. First recommended: $150.14. Last recommended: $212

As you can see from the chart above the Russell 3000 is not a bad index to track. It is up over sixfold since 2009 and has almost doubled since March 2020. The Russell 3000 is effectively the largest 3,000 US quoted shares. The idea is to include all the companies suitable for institutional investment.

There are many familiar names in the top 10 holdings but the weightings are lower than is often the case with other funds. Instead of the big techs being 50pc or 60pc of the fund they are 22pc giving the fund much broader exposure to the performance of the whole US and global economies. You may lose something in long-term performance v indices like the Nasdaq 100 but the trend is still impressive and the greater diversity means greater safety. This fund is ideal for investors who like to sleep at night although, as with all equity related investments, there will be volatility.

I have a theory about how post-2009 stock markets behave. Instead of long-drawn out bear markets we get vicious volatility. It’s testing at the time and often seems to strike out of nowhere but ultimately it is healthy. There are so many day and momentum traders out there, often operating on margin, that huge bull positions can build. Periodically the short term traders need to be shaken out and that seems to be happening right now.

In my recent piece – Grounds for Caution – which was published to both QV for Shares and QV for ETFs, I noted (a) that long bond yields were rising sharply and (b) that margin balances had roughly doubled in the last year. It is not too surprising that we are seeing some shaking of the tree, with loose holders being frightened into liquidating their positions.

Once the short-term money has been shaken out the secular uptrend can resume. This analysis particularly applies to the tech and momentum heavy Nasdaq 100 index. The pattern since 2009 is that periods of weakness have lasted a maximum three months before the uptrend resumes.

The programmatic approach should help me spot any turning points soon after they have been signalled both for the overall market and for individual shares.