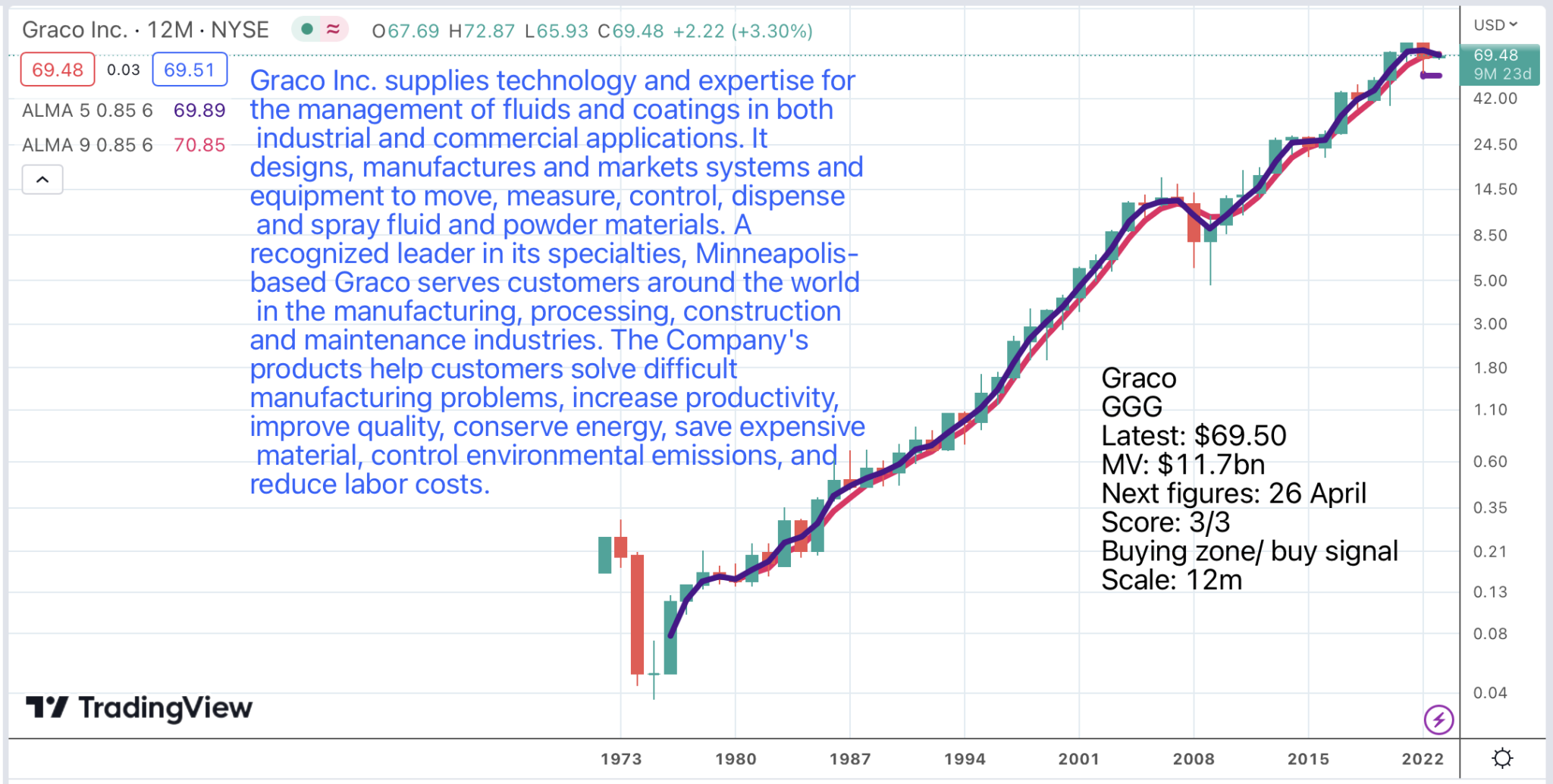

How similar these charts look and how impressive. Since the beginning of each chart the respective gains are Parker Hannifin, 100 times, Lincoln Electric, over a shorter timescale, 27.3 times, Eaton Corp, 117 times and Graco, 435 times.

Not only that but the climb has been relentless. It takes a major general stockmarket setback like those which happened in 1973-74, 2007-08 and the latest one in 2022 to stop these shares climbing. They are not like hot tech stocks which rise 50 times in two years and then get hammered. These guys just plug ever onwards and upwards, perfect for long-term growth share investors.

There are other similarities between them. They are all in aspects of the same business – engineering, electrical, health and safety, environmental, welding and related activities. They also tend to be serial acquirers, providing an exit strategy for owners of smaller businesses which are not suitable for their own IPOs.

They resemble a UK company I greatly admire called Halma, which has been a staggering performer over almost any timescale you care to look at. They have something else in common. They are all holdings in the Global X Infrastructure Development ETF/ PAVE which I recommended recently.

They have not just done well in the past. They are doing well now. One reason why is highlighted by a quote from the just reported Ashtead Group, a similar business to recently featured United Rentals but UK quoted, which observed:

Our business is performing well with clear momentum in strong end markets, which are enhanced by the increasing number of mega projects and recent US legislative acts.

Ashtead Q3 2023, 7 March 2023

There is an accelerating boom in large infrastructure projects in the US, which is a favourable background for all these companies. Everything you can think of is happening. Manufacturing is returning to North America. A tired infrastructure, neglected for many years, is finally being refreshed and in an energy and resource uncertain world domestic resources are being developed ever more aggressively. On top of all this is the shift to renewables as we try to do all the above while saving the planet and using less people to do it as people become an increasingly scarce resource.

Parker Hannifin echoes Ashtead’s comments about the strong end market.

The most significant CapEx spending in decades will bring growth to Parker with all the technologies we have supporting the secular trends today and for many years to come.

Q2 2023. 2 February 2023

The group is super positive on prospects.

So we have a very promising future. We have a highly engaged team that’s living up to its purpose. We’ll continue to accelerate our performance with Win Strategy 3.0. We are seeing the benefit of our strategic portfolio transformation, and we will continue to be great generators and deployers of cash.

Q2 2023. 2 February 2023

Re the transformation this was something the company said a year ago.

“The completed acquisitions of CLARCOR, LORD Corporation and Exotic Metals Forming along with the pending acquisition of Meggitt plc continue to transform Parker,” said Tom Williams, Chairman and CEO. “This has resulted in our portfolio becoming more balanced toward higher growth, longer cycle, higher margin businesses. These portfolio changes, combined with continued implementation of the Win Strategy 3.0 across our operations and the engagement of our team members, have contributed to an acceleration of Parker’s financial performance. We continue to see opportunities to take our performance to even higher levels, leading us to commit to new five-year financial targets.”

8 March 2022

I keep finding more of these incredible engineering companies. Illinois Tool Works is another. Since 1972 the shares are up 223 times.

What does put all this into perspective is that since 1972 the Nasdaq Composite index is up 126 times so Parker Hannifin and Eaton Corporation have underperformed the index. I think that is excusable because the period covers the accelerating technology revolution which has given birth to some staggering performers like Microsoft, Amazon, Netflix and many others. Since 1986 Microsoft shares are up 2,540 times making it the second most valuable quoted company in the world after Apple. The 10 largest companies in the Nasdaq Composite index are all pure technology businesses.

The apparent underperformance by Parker Hannifin and Eaton Corporation is misleading because these companies pay dividends. On a total return basis (share price appreciation plus reinvested dividends) over the period they will have outperformed the Nasdaq Composite.

Strategy

It s obvious that all these shares are worth buying and add a core of strength and reliability to a portfolio. They are especially appealing at the moment because there is still so much uncertainty in technology. They also all seem to be raising their game making them even more appealing as investments in the future.

As recently alerted there is an ETF, PAVE, which is doing well, has a strong chart and includes all the names above. Part of the appeal of buying the shares directly is that when they report you can find out how they are doing and see what plans they have for a more exciting future.

There is also this gathering explosion in infrastructure spending in the US which may be part of a global phenomenon and which creates a positive background for these businesses. They also have exposure to military spending and a lot of expensive kit is being tested to destruction in Ukraine at the moment.

Share recommendations

Parker Hannifin. PH Buy @ $360.50

Lincoln Electric. LECO. Buy @ $170

Eaton Corp. ETN. Buy @ $175.50

Graco. GGG. Buy @ $69.50

Illinois Tool Works. ITW. Buy @ $236