Leveraged investments can be very exciting and safer than you think

The chart above is of an ETF, actually a leveraged ETF but more about that below. What are they? ETF stands for exchange traded fund. They came into being when people in the investment industry realised that many managed funds charged high fees but effectively tracked indices. Worse still, because of frequent position adjustments and other discretionary changes to the portfolio, they often underperformed those indices. Retail investors were effectively paying high fees for a worse performance than simply tracking the index.

Because of this index tracker funds were born. They had low fees and used computer software and algorithms to track the indices, whose performance they effectively replicated. Trade these funds on the stock market like shares in single businesses and there you have ETFs. They are an excellent way to invest in the stock market. One ETF, with the code SPY, which tracks the S&P 500 index, is strongly recommended by super-investor, Warren Buffett, as a core investment for retail investors.

On my paid-for alerting service, QV for ETFs, I have alerted two ETFs, that track the S&P 500. They do an identical job. One is SPY, mentioned above; the other has the code IUSA. Between them these two ETFs have been alerted 11 times on QV for ETFs. The S&P 500 is trading close to all-time peak levels so no surprise that all 11 alerts are in profit. Since I first alerted IUSA, the gain is 45.9pc. The average gain on all 11 alerts is 25.15pc, which reflects the fact that many of the alerts have been in the recent past so have not yet had time to perform.

There is a leveraged version of these ETFs with the code 3USL. What this ETF does is much the same as the unleveraged versions but multiplied by three, up and down. This makes it very volatile and very exciting. 3USL, full name Wisdomtree S& P 500 3x Leveraged, has been alerted eight times in QV for ETFs. The average gain is 124.8pc.

One reason why the gain is so big is that on QV for ETFs I turn the volatility of these leveraged ETFs to an advantage by alerting them to buy after big falls. The alert I made for 3USL in April 2020 is up 209.5pc. Whenever there is a big sell-off in shares I start looking for buying opportunities on these leveraged ETFs.

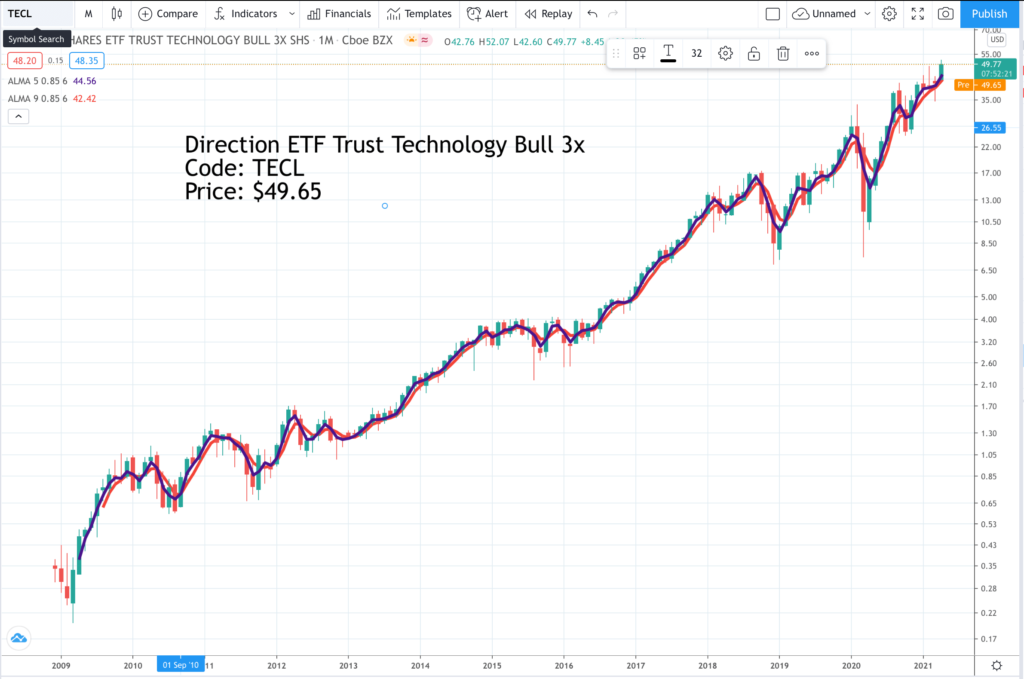

Contrary to popular wisdom leveraged ETFs make great investments. The chart above shows the performance of TECL, which tracks the S&P 500 Technology sector index but multiplies the performance three times. Although this index is routinely described as only suitable for short-term traders it has appreciated since launch in 2009 by a staggering 143 times. I only recently began recommending this ETF in QV for ETFs but already my four alerts are up 70.5pc and that is just since June 2020.

The message is that leveraged ETFs can make very rewarding investments. They will be volatile, incredibly so on occasion but that too can be turned to your advantage as a long-term investor.