Leveraged ETFs – an unusual but potentially highly profitable stock market niche

This is what a former editor of mine on the Investor’s Chronicle would have called a think piece. It is about general strategy so there are no specific recommendations. It was actually written back in January as a promotional piece but I think it would be helpful for subscribers. I am presently writing another piece on leveraged ETFs, again without specific recommendations, which may well be published later today.

Let’s start at the beginning. Back in the day investment portfolios were all managed. You bought units in a unit trust or shares in an investment trust. The former, especially, were heavily marketed but carried high charges. Savers also put large sums into other media like insurance funds and pension funds, which again were managed by investment managers who charged high fees for their input.

Somebody noticed that many of these funds were actually managed so that their portfolios closely resembled the make up of key share indices. These people became known as closet index trackers. It was also noticed that the more actively a fund was managed the more likely it was to underperform the indices.

This led to a clear conclusion. Investors were paying high fees to do worse than the indices. This whole process was known as active fund management.

It gradually dawned on people that maybe what the funds should be doing is simply trying to match the performance of the indices. This was also known as passive investment management and came with many advantages. First these funds did broadly match the performance of the indices. Secondly, since there were no expensive managers charges could be kept very low. The annual charges on the world’s best known ETF, SPY, which tracks the S&P 500 index, are 0.09pc. Active fund managers often charged so much that even if they did do well much of the gain accrued to the managers. Thirdly, shares in these funds could be bought and sold on stock exchanges like any other shares, hence the acronym, ETFs, (exchange traded funds).

Driven by these advantages the ETF industry has become huge. Since 2003 the amount ‘managed’ in ETFs has grown from $203bn to $7.7 trillion. There has also been an incredible proliferation of indices for ETFs to track leading to a corresponding proliferation of ETFs. In 2020 there were 7,602 ETFs traded globally.

At first I thought this made ETFs rather like other quoted shares and that investors should be looking to build large portfolios. You certainly can do this. For example, if you think that cyber security is going to continue to grow rapidly as seems highly likely in an ever more connected world, you could buy iSPY, an ETF which has roughly trebled since 2016. There is an ETF for almost everything.

However the more I look at ETFs the more I have pruned down the number in which I am interested and instead increased my focus not on which ETFs you buy but what you do with the ETFs that you do buy. There are five key ETFs that I like plus various permutations on those five.

The five are listed below:

IWMO (IShares Edge MSCI World Momentum) which tracks MSCI shares which are in uptrends

QQQ (Invesco QQQ Trust) which tracks the Nasdaq 100 index.

SOXX (iShares semiconductor) which tracks an index of US-listed shares in the semiconductor industry.

SPY (SPDR S&P 500 Trust) which tracks the S&P 500

XLK (SPDR Select Sector Technology) which tracks the S&P Technology Select Sector Index

The Nasdaq 100 index, which is tracked by QQQ, is rebalanced quarterly like all the other ETFs in this group except IWMO which is rebalanced semi-annually. This rebalancing takes account of the fact that the 100 biggest stocks in the index is changing all the time. This means the index is continually being rebalanced around the most successful stocks; that is why it performs so well over time.

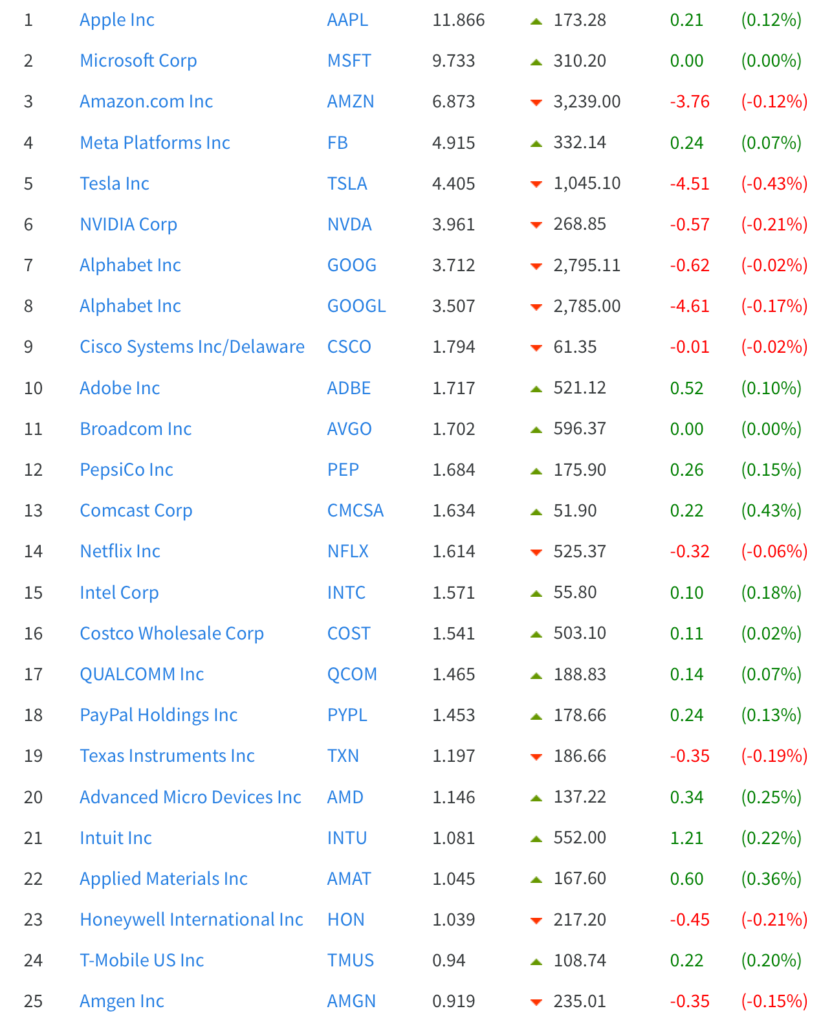

Since launch in 1986 the Nasdaq 100 has risen 144-fold to the recent peak of 16,764 but this incredible performance is partly because the fund is kind of managed because of the regular rebalancing. It drops out underperformers and adds stronger performers all the time plus it gives greater weight to the best performers. Below are the current 25 largest stocks in the index.

This list is unrecognisable from the constituents that dominated the list in 1986. Many of the companies did not even exist back then. In effect the Nasdaq 100 is a managed fund but is managed purely for success with no discretion on the part of the managers. It is like a giant momentum fund. If it was stuck with the original 100 constituents from 1986 it would not have done nearly so well. Presently Apple and Microsoft alone make up over 21pc of the index.

This is why the regular rebalancing is so important and why QQQ and other index-tracking ETFs do so well. They are not nearly as passive as people often imagine. In effect, they are managed momentum funds. Since 2009, trough to peak, QQQ has risen over 16-fold.

Another attraction of ETFs is that because of their success orientation in effect they practice the never sell strategy which I preach on Quentinvest. QQQ is like Quentinvest in action. So much so that I think subscribers should consider these ETFs very strongly when putting together their investment strategies. This also explains why I am becoming increasingly interested in what strategy investors adopt as much as which shares and ETFs they buy.

There are many different strategies you could adopt.

For example you could just buy the above ETFs, which have all been incredible performers over the years.

A variation on this strategy would be to use a £-cost averaging approach, investing roughly equal amounts in each one on a monthly basis. The advantage of doing this is that it turns stock market volatility into an asset. When prices are low your money buys more shares.

A third strategy would be to sex this up dramatically by buying the above shares in a CFD or Spread Betting account. I looked at this in detail in a recent QV Alert, Spread Betting for Beginners. I suggest you go back and read this article if you are interested in a leveraged strategy.

A key new feature of my leveraged strategies to lower the risk over time is that all investments should be funded for cash. What this means is that if you want to invest say $1500 you need to put $300 into the account. IG allows beginners to leverage their investments fivefold so $300 buys $1500 worth of shares. I discussed this new strategy recently in a Quentinvest Alert, Investing by the Rule of 10 or Operation CFD.

The reason why this is more conservative than my usual approach is that any paper profits on the account are not used to support new investments. This means that over time your leverage should become less. Sorry if this starts to get a bit complicated. If you actually do it you will soon get the hang of it.

The effects of leverage can be amazing. Suppose you had opened a spread betting account in 2009 and put in $300 to buy $1500 worth of QQQ shares. These shares have appreciated roughly 15-fold since then at latest prices so that $1500 would be worth $22,500. This is a gross figure. You would have been paying interest to IG on the full value of your portfolio on a daily basis but their rate of interest is very reasonable, much like the rate you might pay for a mortgage. So you would have seen very good net appreciation.

I have done the sums and suspect you might have borrowings around $4000 currently so your original $300 (the amount you actually invested) would have appreciated to $18,500 ($22,500 – $4000). Broad brush we are looking at something around 60 times appreciation.

However there is another strategy for the ETFs mentioned above using leveraged ETFs that I believe would have worked even better. The involves buying ETFs with built-in leverage.

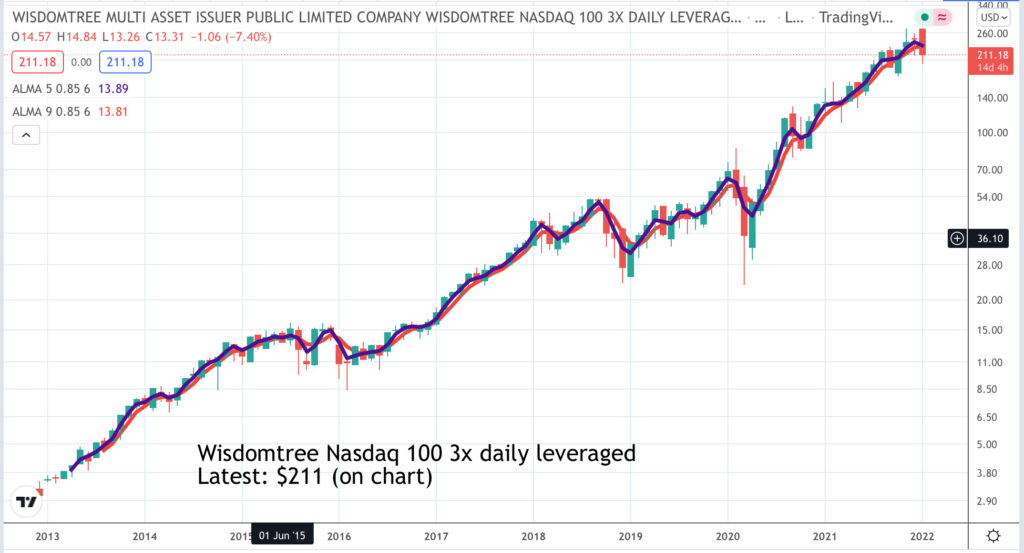

In order to make the comparisons clearer I am going to look at QQQ3 which is a 3x leveraged version of QQQ. As we have noted since the 2009 low point QQQ is up 16-fold to the recent peak. If you had bought QQQ with five times leverage it would be up roughly 60-fold. There are no figures for QQQ3 since 2009 because the ETF was only created in December 2012 but even since then it is up an incredible 90-fold trough to peak.

Leveraged ETFs cannot be bought in leveraged accounts because that would be piling leverage on leverage and IG doesn’t want its customers to do that so you have to buy them in a share account which means there is no interest and no possibility of being sold out whatever happens in the stock market. So you get better performance, no interest charges and no possibility of being sold out. What you do get and you need to be aware of this is incredible volatility. When shares generally are falling fast you probably don’t want to look at how your leveraged ETFs are doing because it may trigger a heart attack. But if you hang on in there they will always recover and if you are following a $ or £ cost averaging programme this volatility will give you the opportunity to buy some very cheap shares.

Let’s have a look at SPY where you can make comparisons going back to 2009. A good leveraged ETF tracking the S&P 500 is SPXL which has built-in leverage of 3 times the movements of the S&P 500 index. in 2009 SPXL bottomed at $1.16. Its recent peak was $147.98, a gain of 127.5 times. By comparison unleveraged SPY is up seven fold since 2009 and the performance if the same shares had been bought in a leveraged account would be somewhere between 25 and 30-fold appreciation.

So we can see that buying SPXL can be a sensational investment. One downside in this comparison is that if you buy ETFs or any shares in a spread betting account any gains are tax free. This can be a significant advantage if larger sums of money are involved.

One strategy would be to buy leveraged ETFs in a share account and when they are riding higher sell a few and take out some cash which will be tax free up to the tax free allowance which was £12,300 last year. If really big money is involved then the tax free spread betting strategy may become a better option although the returns on ETFs with built in leverage can be so sensational that even after tax they may work.

This is where SOXL and TECL come into focus. SOXL is a three times leveraged version of SOXX, tracking semiconductor shares. Since 2009 SOXX, the unleveraged version, is up around 20 times. SOXL is up around 225 times! Let me repeat that. Trough to recent peak, since 2009, SOXL, the three times leveraged ETF tracking semiconductor shares is up 225 times Wow! Wow! Wow! This is a staggering performance. How can anyone say that leveraged ETFs don’t make great long-term investments.

This comes with huge volatility. In two months in March 2020 SOXL fell from a peak $21.60 to a low $3.40 but that works both ways. Since the low point in March 2020, so in less than two years, SOXL has risen nearly 22 times.

TECL is a three times leveraged ETF which tracks technology shares. The constituents are rebalanced every day so you cannot look them up. This is what one service says about TECL.

“The underlying index (tracked in unlevered form by SSgA’s XLK) consists of all tech companies in the S&P 500. This broad definition of the tech sector means TECL contains names traditionally thought of in technology in addition to those in diversified telecommunications services, communications equipment, semiconductors, and office electronics. However, the portfolio is concentrated in just a few names.”

This service also says.

“It is important to clearly understand the risks in using such leverage. In addition, this product should only be utilized by those who actively manage their investments.“

It seems to me that is too cautious a view. TECL is incredibly volatile but in a market in a secular uptrend that volatility works hugely to the advantage of long-term investors. Since 2009 the unleveraged version, XLK, is up around 13 times. Over the same period TECL is up 353 times!!! For God’s sake – that is incredible – 353 times!

So I think you can understand why a key element for Quentinvest is building strategies around these ETFs with which I have already done very well. QQQ3 has been recommended 27 times since October 2017 with gains ranging up to over 600 per cent. On SOXL the gains range up to 720pc. TECL is a more recent discovery so the gains there only range up to 224pc, which is still a very healthy gain.

When I look at the incredible returns on ETFs with built in leverage the gains almost seem too good to be true. One worry is that markets are becoming so concentrated in a few names. If you take XLK, Apple and Microsoft make up 44pc of the fund. This reflects the fact that Apple and Microsoft together are valued at over $5 trillion or twice the value of all the stocks in the FTSE 100.

On the other hand the scale of these companies is also incredible. In the year to 30 September 2021 Apple returned $100bn to investors in the form of share buybacks and dividends. I don’t suppose the comparable figure for the whole of the FTSE 100 would match that amount. Analysts see this strong buyback programme continuing for the next 15 years which provides a powerful underpinning for a continuing strong share price performance.

Warren Buffett is a large shareholder in Apple and he has pointed out that for many people now life without a smart phone is unthinkable. On that basis, prices around $1,000 or less for a phone look very reasonable. As he said, only half joking, he spends around $1m a year on his private jet. If he used his phone as much as most people he would sacrifice the plane first even if they cost the same.

Also the effect of rebalancing means that as newer companies like Tesla and Nvidia come into prominence they help to drive the indices and the funds higher so even this massive concentration may not be too much of a problem. What it really points to is the overwhelming role played by US companies in the technology revolution.

So don’t be afraid to build investment strategies around these ETFs. They should do very well.