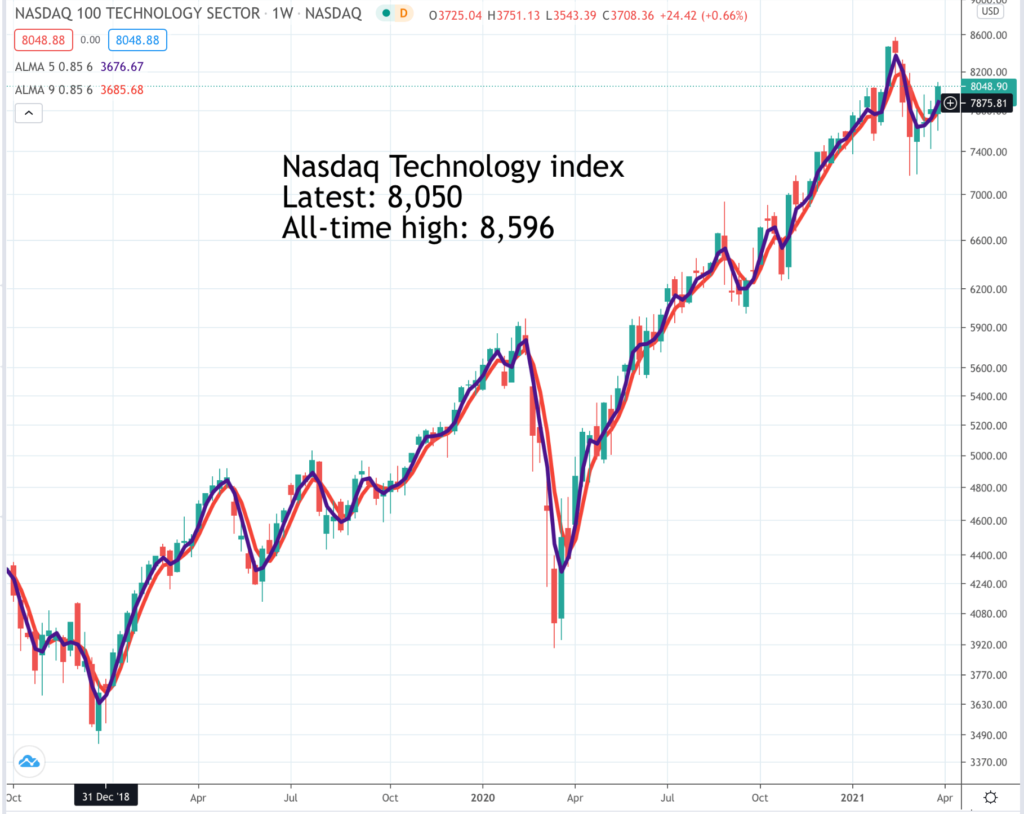

The Nasdaq Technology index is giving a programmatic buy signal. I believe this makes it timely to take an aggressive approach to buying US technology-focused ETFs. Accordingly I am recommending some of the leveraged ETFs below. Not everybody wants leverage. I love it but I am a gambler. I am also recommending, where appropriate the unleveraged versions, which will always head in the same direction but obviously not so far, either up or down.

QQQ3 Tracks the Nasdaq 100 x 3 Buy @ $138.50 Times recommended: 15. First recommended: $31.50. Last recommended: $139.10 Lowest recommended: $30.50

QQQ Tracks the Nasdaq 100 Buy @ $323. Times recommended: 20 First recommended: $139.28. Last recommended: $322

2MCL Tracks the FTSE 250 x 2 Buy @ 24,564p Times recommended: 6 First recommended; 20,818p Last recommended: 24657p. Lowest recommended: 14,000p

MIDD Tracks the FTSE 250 Buy @ 2054p. Times recommended: 5. First recommended: 1,959p. Last recommended: 2,048.50p Lowest recommended: 1,549.80p

SPXL. Tracks the S&P 500 x 3. Buy @ $87. Times recommended: 8 (includes eight recommendations for the Wisdomtree version – code 3USL, at prices between $432 and $877; SPXL is a new entry)

SPY Tracks the S&P 500 Buy @ $399.50. Times recommended: 5 (11 including IUSA, which does the same thing) First recommended: $283.34 Last recommended: $394.50

FAS. Direction Daily Financial Bull 3x Buy @ $93. Times recommended: 4 First recommended: $104.5 Last recommended: $50. Lowest recommended: $31.22

SOXL Tracks the PHLX Semiconductor index x 3 Buy @ $ 41.25 Times recommended: 8. First recommended: $14.12. Last recommended: $24.27. Lowest recommended: $6.8 (all prices adjusted for a 15:1 share split)

SOXX Tracks the PHLX Semiconductor index Buy @ $435. Times recommended: 11 First recommended: $200; Last recommended: $370

TECL Direction Technology Bull 3x Buy @ $43.21 Times recommended: 3 First recommended: $22.2 Last recommended: $30.0 (all prices adjusted for 10:1 share split)

At this point I was going to dazzle you all by showing you the results for all my alerts for leveraged ETFs since QV for ETFs was launched in the summer of 2017. I can’t do that yet because I have new computers and new software. They work differently to the old versions and I haven’t mastered all the tricks yet. I can give one example though. The average gain on the 15 recommendations for QQQ3 starting in October 2017 is 202.05pc. Anyone who says leveraged ETFs are not suitable for long-term investors has surely not considered the statistical evidence, which strongly suggests that they work very well.

The volatility is ferocious but that can also work to your advantage if you use my programmatic strategy to buy on buy alerts which will sometimes be triggered at low levels. All the ETFs above, which include a cross section of my favourite leveraged ETFs, are currently giving programmatic buy signals and are timely to buy now.

Individual buy signals don’t come with a guarantee of instant success although the odds are generally favourable. What I am very confident of is that investors, who stick with the strategy, will do well.