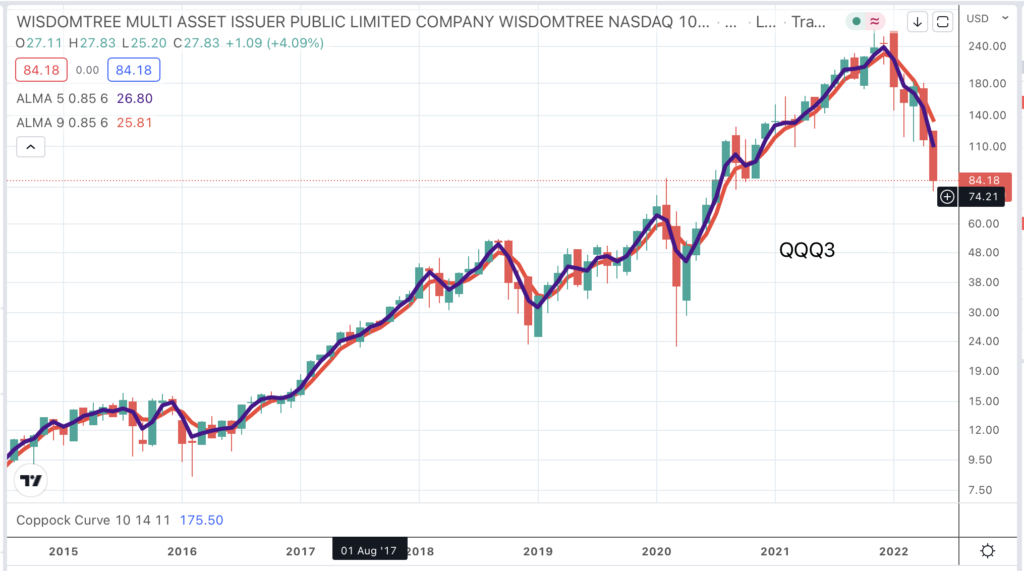

QQQ3 Buy @ $82.96

‘UK retail investors can’t access ETFs based in the US. That’s because American ETFs don’t conform to a set of EU Undertakings for the Collective Investment of Transferable Securities (UCITS) regulations. UCITS requires fund providers (including ETFs) to provide a Key Information Document (KID).’

I have just discovered what a recent email from a subscriber was all about. Thanks to the madness of an overweening nanny state you can no longer buy most US ETFs if you are a UK retail investor. Americans, even the reddest of red necks from Alabama, can handle the risk of buying shares in volatile ETFs (they go up and down, duh) but apparently not us brainless chumps in the UK. It’s pathetic to put it mildly and makes me wonder why we had Brexit if we are still in thrall to these appalling regulatory bodies in Brussels.

When I told the guy at IG what I thought of these people he reminded me that we were being recorded. I asked him to send the recording to Brussels with my compliments.

Fortunately, at the end of the day, one leveraged technology ETF is much like another in performance terms and QQQ3 is traded in London so not subject to the new restrictions so I have just bought a few more of them. What exactly UCITS brings to the party I cannot imagine. Why is it safe to buy QQQ3 but not SOXL, SPXL and TECL. I don’t suppose these idiots in Brussels have the faintest idea.

It shouldn’t change anything about the strategy if we base it entirely on QQQ3. Just be patient. Accept heavy losses if they happened and since the shares are so volatile either £-cost average at regular intervals, only if the shares fall really sharply and/ or wait for buy signals. It’s common sense. If you end up with a low average price you will make money in the end.