Stocks are stuck in what we could call limbo land. There is an ongoing bear market as reflected in my indicators but a number of interesting shares have stopped falling. This may be temporary or may be part of a base building process. Eventually the shares will declare themselves by breaking higher or lower and that will give us a powerful clue to the future direction of markets, especially if my Coppock indicators start to turn higher.

There is also what we could describe as a battle between fundamentals and charts. The Tesla chart, see above, looks threatening with a massive potential head and shoulders top. The Coppock indicator is falling and presently looks unlikely to turn higher before next May.

But the company looks as exciting as ever with a string of important new models poised for launch next year including the cyber semi, the cyber truck, a new roadster. The Tesla Model Y, already in production, is expected to be the world’s best selling car in 2023, battery technology is improving by leaps and bounds with talk of the top of the range cyber truck having a range of 500 miles and Tesla has both production and strong sales in the huge Chinese market.

The company is run by an autistic genius/ madman who has already become the world’s richest man at 51 years old and probably feels he is just getting started. He has just bought Twitter and made himself CEO. He is planning to colonise Mars with a test launch planned for the Space X Starship in December 2022.

When I go to bed I often wake up with new ideas for books, alerts, new features for my properties, stuff like that; I can’t imagine what this guy has in his head when he wakes up or what he might be up to in 2033 when he will still only be 61.

All this colours my view when I look at the Tesla chart. The chart looks threatening but there is no sign that either Musk or Tesla are firing on any less than all cylinders. The new generation Tesla Roadster is expected to have a range of 1,000 kilometres and accelerate from 0 to 100kmh in 1.9 seconds. My BMW i3 does something similar in 7 point something seconds and that feels so fast that if I do it too often I start to feel slightly sick. I never actually do it. I might do 0 to 40mph which is plenty for me. These electric cars are very quick and my previous car was a five series BMW.

So what does the future hold for Tesla. On fundamentals I think we could be looking at the world’s first ten trillion dollar company. On the charts if they fall much lower than $220 they complete a head and shoulders top and could fall off a cliff. Thinking about this makes my brain overheat. I am just going to watch and see what happens and when I think I know I will let you guys know.

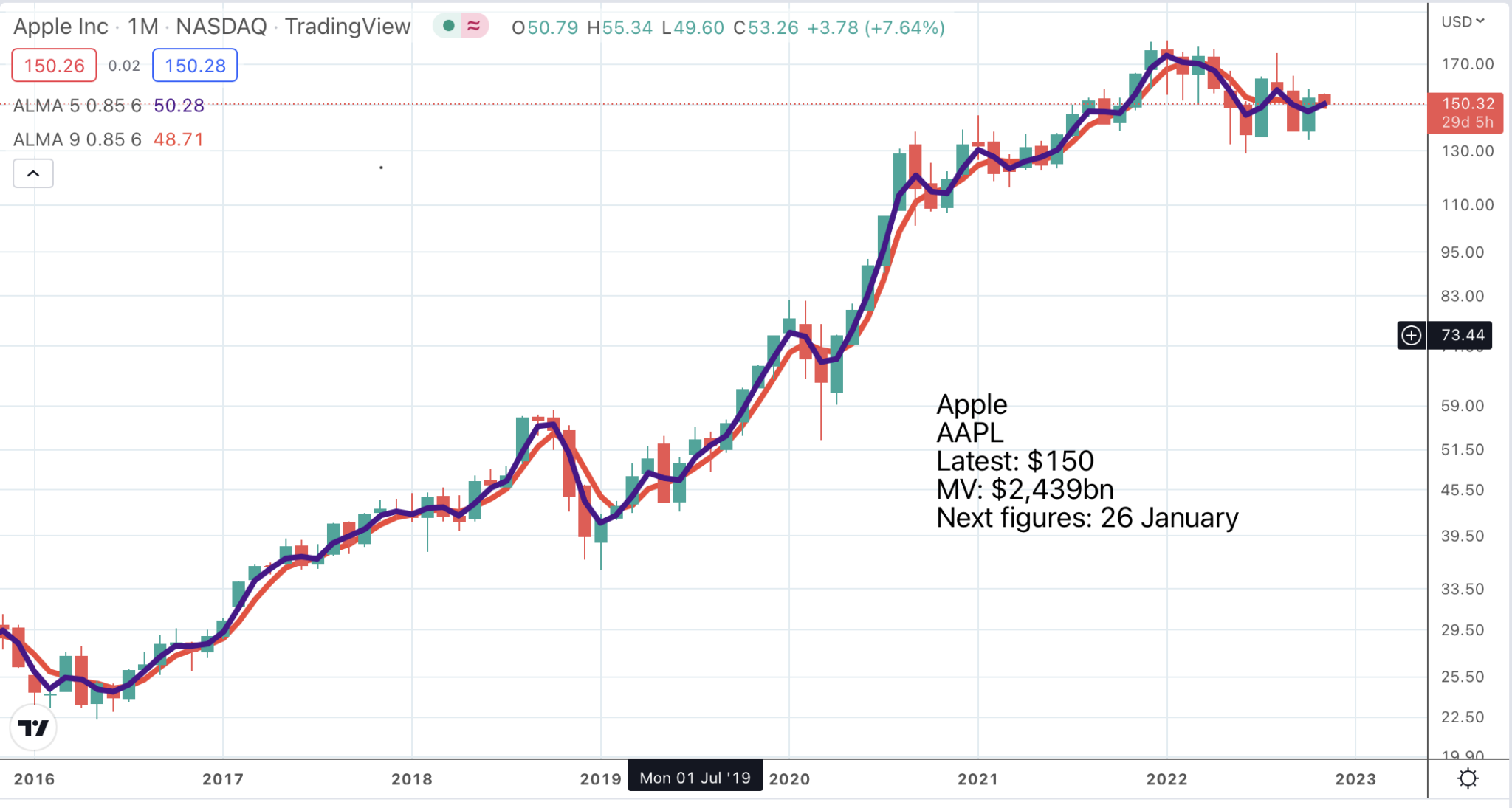

Another share tying my head in knots is Apple. The shares look like a top and the Coppock indicator has been falling since January 2021 but against that the fundamentals look incredible. Where would we be without Apple? Where would I be without Apple? Everywhere I look there are Apple devices in this house – lap tops, iPads, iPhones and there are many families that are even more Apple-centric than mine and Apple is increasingly using this huge diaspora of devices to sell us services and wearables like watches, iPods and the like.

The latest report showed the usual strong progress by this phenomenal company.

For the September quarter, we reported record revenue of $90.1bn, which was better than we anticipated despite stronger-than-expected foreign currency headwinds. We set an all-time revenue record for Mac and September quarter records for iPhone and wearables, home, and accessories.

Services notched a September quarter record as well with revenue of $19.2bn and more than 900m paid subscriptions (that is on the way to being twice as many subscribers as Netflix, Disney and Amazon Prime put together). We reached another record on our installed base of active devices, thanks to a quarterly record of upgraders and double-digit growth in switchers on iPhone. Across nearly every geographic segment, we reached a new revenue record for the quarter. And we continue to perform incredibly well in emerging markets with very strong double-digit growth in India, Southeast Asia, and Latin America.

Q4 2022, 27 October 2022

Apple is amazing because once you get into it you cannot imagine coming out of it. Will I ever buy a non Apple computer or phone – never and nor will anyone in my family which is already me, my wife, my three children, their partners, my three grandchildren and the extended families of my children’s partners. Everybody we know, practically, buys Apple which gives them a decent sized business just from us and then repeat that hundreds of millions of times.

I guess Tesla may be the same. Once you buy one you are hooked into those endless new models, software upgrades, the charging network and the excitement of wondering what Musk will do next.

I have been a Mercedes/ BMW guy for as long as I can remember though for a while when my children where growing up I had a Range Rover as well which my diminutive wife adored. That may be why I opted for the electric BMW which is a super cool car but next time around it could be Tesla and it is obvious that sales are booming. Everywhere I look in London and Saffron Walden I see Teslas with 2019, 2020, 2021, 2022 plates and this guy hasn’t even started on pickups, semis, vans, coaches (which he will need to transport his nine and counting children) and buses.

I guess Apple and Tesla may be the two most important shares in the world just now which is why I spend so much time thinking about them. Could Tesla become the Apple of electric cars? Definitely not impossible. Could Apple use its devices business to build the world’s greatest services business. Definitely not impossible. How much would those businesses be worth? A lot!

This gives us a bit of leeway in reading the charts. Apple shares have been consolidating since August 2020. Tesla shares have been consolidating since January 2021 so if they finally break higher they could have a long way to climb. But if they break down ………watch out!

Apple is a big business.

In fiscal 2022, Apple achieved revenue of $394bn, representing 8pc annual growth. We set records for iPhone, Mac, wearables, home and accessories and services while growing double-digits in emerging markets and setting records in the vast majority of markets we track.

Q4 2022, 27 October 2022

What is also amazing is that out of that $394bn of revenue the company generated free cash flow of $111bn. This enabled the company to return $29bn in cash to shareholders in the September quarter. Annualised this means the company is returning 4.8pc of its current market value to shareholders every year.

I guess the big difference between Apple and Tesla is that the latter is much earlier in its growth curve. Apple’s most important product, the iPhone, has already achieved world domination and is ubiquitous in the wealthier parts of the world. Tesla is nowhere near that point but that could be where it is heading. There are many powerful incumbents in the automotive world but if Tesla is what the Americans call a category killer there may not be so many a few years from now. What, after all, do we need all these car companies for when half of them look identical to the others. Think Mercedes,Volvo, Porsche, BMW, Audi, even Bentley and Rolls-Royce SUVs. Can you tell them apart without the badges?

A giant Tesla with 25 gigafactories worldwide and the world’s best battery technology may force huge change on the existing lineup of car manufacturers. My suspicion is that BMW stopped making the BMW i3, which is a fabulous little car, described by Top Gear in June 2022, as the best small premium electric car out there, because even selling it at £35,000 to £40,000 they could not make any money from it.

Meanwhile Tesla is talking about launching a Tesla Model 2 priced at $25,000. What a category killer that would be. One reason not to do it, not yet anyhow, is because they can sell every Model 3 and Model Y they can make and there are orders for 1m of the cyber truck pickup, priced up to $70,000 so why cannibalise sales for a lower value car.

Lessons learned from Spotify

Now for a complete change of subject. I like to listen to music while I work. I used to buy songs on Apple Music and had maybe 100 or 150 songs in my list, which I would shuffle and play at weekends. Then I switched to Spotify which is rapidly becoming a life changing experience. In the last six months my Liked List of songs has grown to 2,124, which I estimate is around two weeks of daylight hour playing time. I have literally got my own QL radio station which only plays songs I love, which is not the Beatles. I have about 3 Beatles songs on my list whereas a session musician you have probably never heard of called Warren Storm (not Warren Hastings which I keep calling him), who had his roots in something called swamp pop, has 15 songs on my list. Swamp pop, which was born in the Cajun-dominated bayous of southern Louisiana has a cult following in the UK. Well, I am part of that cult. This music sends shivers down my spine.

The reason why I have so many songs on Spotify is partly because of the clever algorithms Spotify uses to find songs I like but also because I have become adept at finding songs using, Spotify, Wikipedia, YouTube and tweaking the algorithms to home in on songs that might work for me. One of my favourite singers is Tantowi Yahya. His latest job is Indonesian ambassador to New Zealand but this guy can sing country music like no tomorrow. He is amazing. I found him when I stumbled on his version of a song I liked. Then I checked him out on wikipedia. Then I listed all his songs on Spotify and then I played those songs, realised that I loved his voice and started adding songs to my liked list. I now have 17 of his songs in my liked list.

You may totally disagree with my musical choices. Like my cousin I think The Beatles ruined popular music which was much more magical before they came along but I am sure that is very much a minority view. Elvis v The Beatles is no contest for me. It has to be Elvis every time and not bland super bore, Paul McCartney, who I am sure, if he ever dies, will practically get a state funeral, whereas poor Elvis shuffled off almost unnoticed. At least there was something raw and rock and roll about John Lennon.

So what has all this got to do with Quentinvest. Subscribers may recall me saying that a new bull market is led by new shares and new themes. I expect a new bull market to start next Spring so I want to be ready to start identifying the new names that will emerge as leaders. I have been wondering if the techniques I use to find new songs I like on Spotify, can be adapted to help me find new 3G shares that I like for Quentinvest.

I am getting quite excited about this. If I can start finding the new super stocks as early as possible there could be some fabulous money spinning opportunities. So, this is what I am thinking about and what I have noticed is that the bigger my Spotify footprint becomes the faster I find new songs that I like. My latest discovery is Quebec, the home of Celine Dion. I like her but she is just the tip of the iceberg of some fabulous stuff with a lovely country feel. Country music is, of course, the world’s greatest musical genre but I am sure you knew that; it is like a self-evident truth.

Strategy

Limboland is where we are when we have had a severe bear market and are not sure whether there is more to come or whether we are approaching a turning point. There is no point in trying to be dogmatic. We must observe with an objective mind and let the market tell us where it is going to go next. I believe it will.

My best guess is that we have not yet hit bottom but I am ready to be proved wrong. Either way I expect my Coppock indicators for key indicators to turn higher next March and that will be a massive buy signal for the stock market.