Looks like a bull market; feels like a bear market; what is going on?

I have grown up with the idea that shares were either in a bull market, generally rising or in a bear market, generally falling. Since 2009 the pattern has changed somewhat with a long bull market, led by technology shares, interspersed with periods of profit-taking that have occasionally been so dramatic that they looked like what used to be called panics. These new style panics could be very severe but also have been short-lived, typically around three months from peak to trough.

Covid-19 and the associated lockdowns led to a change in the pattern. Lockdown forced activity on-line and had a devastating impact on all activities which involved people gathering in groups or even coming close to each other. A big chunk of the stock market went into meltdown with businesses fighting for survival and clinging on with government support.

Meanwhile technology shares were off to the races. They benefited from booming demand as digital transformation swept the planet. They also benefited from the build up of savings as people trapped at home spent less and saved more and looked for a home for their money that paid more than cash in the bank. Last but not least their shares flew higher as they became the only game in town.

After the party comes the hangover. Technology shares, we can now see, flew too high in this halcyon period and many are suffering as a result. I define a down trend as occurring when the monthly averages I use (five and nine months) are falling with the five below the nine. A number of exciting names are in downtrends by this metric.

There is as yet no sign of any noticeable deterioration in the fundamentals. I look, in all my publications, for stocks which are 3G (great chart, great growth, great story). At the moment the great chart bit is not always behaving but the great growth and the great story remain fully intact. Companies I like on fundamental grounds are mostly still growing strongly and addressing large markets pointing to sustainable growth well into the future.

The fundamentals appear to be so strong that even when waves of profit-taking are hitting the market many names are not in downtrends but are consolidating. This applies to some very important names. Apple is not only consolidating but the chart looks very like an upward sloping triangle. Any chartist will tell you that this is normally a bullish pattern waiting to be confirmed by an upside chart breakout.

Apple began consolidating in August 2020 and the shares have been trading broadly sideways for about nine months. It’s a grey area where to draw a line but I would feel excited on a close above $135, especially if the close had breakout characteristics – higher volume, a gap in trading or an exciting piece of ‘something new’ news.

Some sort of breakdown would be disappointing but unlikely to be disastrous. Apple is a business with outstanding fundamentals. I think it is reasonably priced on a PE in the middle to low 20s, especially given that the company’s gargantuan free cash flow enables it to buy back its own shares in industrial quantities. For Apple to really break down something visibly disastrous, a catastrophic black swan, would have to strike the global economy.

Bottom line, the odds strongly favour an upside breakout eventually. Other big names consolidating include Adobe, Amazon and Nvidia. Other giants like Alphabet and Microsoft are still firmly in uptrends and Facebook has broken out firmly higher and is worth recommending at $318, which is one reason why the indices, even heavily tech-weighed ones like the Nasdaq 100, are trading close to their all-time highs. This is why I say it looks like a bull market but for many holders of middle ranking technology shares that have been such favourites across my publications it may feel more like a bear market because they are the ones bearing the brunt of the profit-taking.

In total from the QV tables I found 43 shares building consolidations and that understates the total because I favour consolidations where the performance seems clearly to favour a break to the upside as opposed to shares that are correcting after a big rise. As and when these shares start to break higher this would be an exciting moment for investors and for share markets overall.

The world’s emergence from lockdown is proving very patchy. Some countries like Brazil and India are still going from bad to worse, China and much of the Far East seems to be well out of the woods, Europe is patchy but probably past the worst, while other places like the UK and North America can clearly see light at the end of the tunnel, while still worrying about the threat of new variants leading to setbacks.

As we come out of lockdown this is going to be beneficial for the businesses that suffered most from lockdown. They may even do especially well because (a) in order to survive they have had to become more efficient and more in tune with the digital era and (b) because of reduced capacity in their sector as many businesses haven’t survived after what has been an incredibly tough period.

In periods like this it is classic survival of the fittest so when demand returns the survivors can surprise by doing very well indeed. This has given rise for me to a whole new concept of what I call resurrection stocks. This is companies (and their shares) which have had a near-death experience, somehow battled through and then gone on to enjoy years, even decades, of outstanding success and prosperity thereafter.

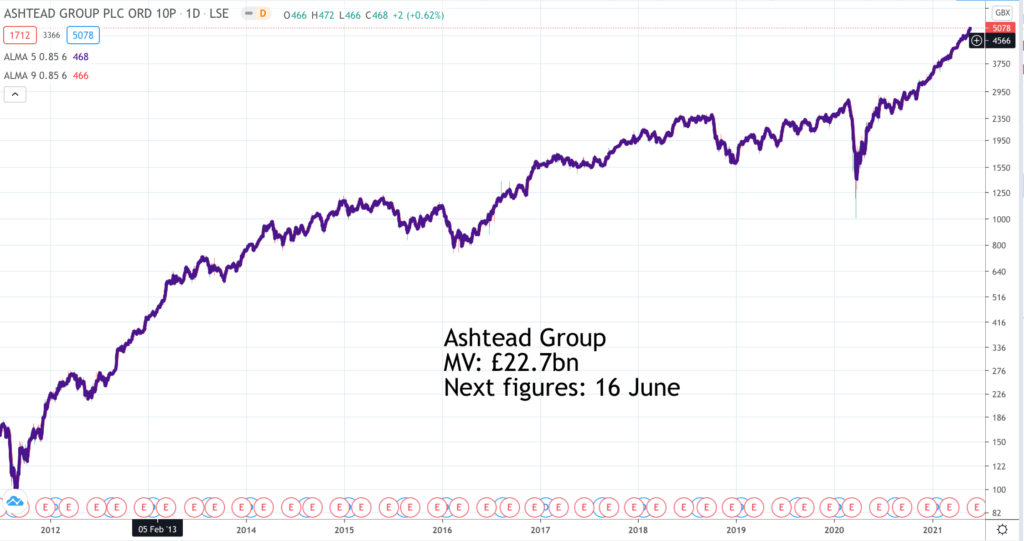

It is astonishing how many examples of this there are. My favourite is Ashtead, an equipment rental business that almost went under in 2003, survived and has grown like topsy ever since. The shares are up 2,539 times since 2003!

Sometimes it is not the business but the shares that have a near-death experience. A classic example is Amazon. The shares peaked in December 1999, at the height of the late 1990s Internet bubble frenzy, at $116. In the subsequent orgy of profit-taking, the shares then fell to $5.50 in October 2001. People often talk scathingly about over-excited investors who drive share prices to unreasonable peaks. But I think, far sillier are the people whose selling drives prices to such ridiculous lows.

Amazon founder, Jeff Bezos, was continually reminding investors of how well his business was doing but to no avail. Many investors simply stopped listening. This is what CEO and founder, Jeff Bezos, said in the 2001 annual report. “Ouch. It’s been a brutal year for many in the capital markets and certainly for Amazon.com shareholders. As of this writing, our shares are down more than 80pc from when I wrote you last year. Nevertheless, by almost any measure, Amazon.com the company is in a stronger position now than at any time in its past.”

Anyone listening to him, rather than watching the share price and reading the no doubt doom laden newspapers, might have done something seemingly really silly and bought the shares. If they did – Wow! Since then the shares are up approximately 582 times! There was another telling quote in that 2001 annual report. “And, most importantly, our heads-down focus on the customer was reflected in a score of 84 on the American Customer Satisfaction Index. We are told this is the highest score ever recorded for a service company in any industry.“

Bezos even had something to say about the contrast between how the company was doing and what was happening to the shares. “So, if the company is better positioned today than it was a year ago, why is the stock price so much lower than it was a year ago? As the famed investor Benjamin Graham said – ‘In the short term, the stock market is a voting machine; in the long term, it’s a weighing machine.’ Clearly there was a lot of voting going on in the boom year of ’99—and much less weighing. We’re a company that wants to be weighed, and over time, we will be—over the long term, all companies are. In the meantime, we have our heads down working to build a heavier and heavier company.”

The quote does seem to accept that investors were carried away in 1999 and valued the shares too high but there is also a strong clue to the opportunities for shareholders that lay ahead. I’m sure he wasn’t selling. And even those investors who did get carried away in 1999 still did much better than anyone who sold during the free fall period in 2001. Amazon shares are up 27-fold since the 1999 peak and, since they are currently building a lengthy consolidation, there may well be much more to come.

Amazon, like Apple, Alphabet (Google and YouTube), Facebook, Microsoft, Adobe, Nvidia, Netflix and others, is such a massive part of modern life that their opportunities to use ever-advancing technology and increasing global prosperity to keep growing look as good as ever. They are so big that future growth will surely be slower but against that almost all the names on this list are pouring cash into share buybacks, which are hugely beneficial over time to all their existing shareholders. They are pretty close to being can’t-lose investments, which may explain why Warren Buffett’s Berkshire Hathaway, itself a big exponent of share buybacks, holds a huge chunk of Apple and a big chunk of Amazon. He loves mighty American brands and that is what all these companies are.

I am beginning to think that investment volatility is a phenomenon that has yet to be fully explained. It is becoming incredible. Just look at the cryptos. China is becoming hostile to bitcoin mining, which, especially as practised in China, is not good for global warming because of the amount of coal-based energy used. This has sent the cryptos into free fall. Bitcoin is down from $65,000 to a recent low of $29,400. Ether has dropped from $4,360 to $2,409 in 11 days! Litecoin has more than halved in a fortnight including one day when the price more than halved in a day!

It absolutely bears out the idea that in the world of investment much of the times the lunatics are in charge of the asylum. I know, maybe the mad guys were the buyers. We shall see. On the face of it a clamp down on bitcoin mining in China would seem to be a bullish development, reducing the supply but this is a strange world of investor psychology where it is impossible to rationalise what is happening – a world of voting rather than weighing as Benjamin Graham might have said if he hadn’t been even more rude about what was happening.

Against this background the volatility in individual shares is both less extreme and very understandable. Many of the most exciting shares these days are hell bent on growth and first mover advantage. They don’t pay dividends, they don’t have earnings, they may even, in the early days have negative free cash flow and need constant injections of fresh equity capital to pursue their opportunities. In effect, they are bets on a glittering but sometimes fairly distant future.

This makes them a bit like bitcoin – very exciting when investors buy the concept but prone to severe sell-offs when those same investors get cold feet. The long term seems to favour those investors who hold their nerve (think Amazon and bitcoin) but meanwhile the ride can be terrifyingly bumpy.

So much is this the case for 21st century investors that I have developed my strategies of staggered investing: £-cost averaging, programmatic investing and buying the green. Instead of piling in on day one, although that can work very well if you can hold your nerve, an alternative is to buy small but often. This should almost make sure that you achieve the Buffett mantra of buying great shares at a reasonable price and it is also very helpful in letting you sleep at night.

The idea is to turn volatility into a positive rather than a negative, enabling investors to build positions in shares at what subsequently prove to be attractive prices.

It would be great to buy at the bottom and sell at the top but history suggests very few people can do this. It is just so hard, without the benefit of hindsight, to know when it is the top or the bottom and then, by the time you think you do know, shares are ready to turn around. What seems to me very instructive is that the greatest investor of the modern era, Warren Buffett, does not make any attempt to time his investments beyond his famous mantra – “be greedy when others are fearful and fearful when others are greedy.” Even that sounds good but actually is hard to practise. I prefer my staggered approach. It works and you don’t have to be a genius to do it or own a string of insurance businesses filling your pockets with cash all the time as Berkshire Hathaway does.

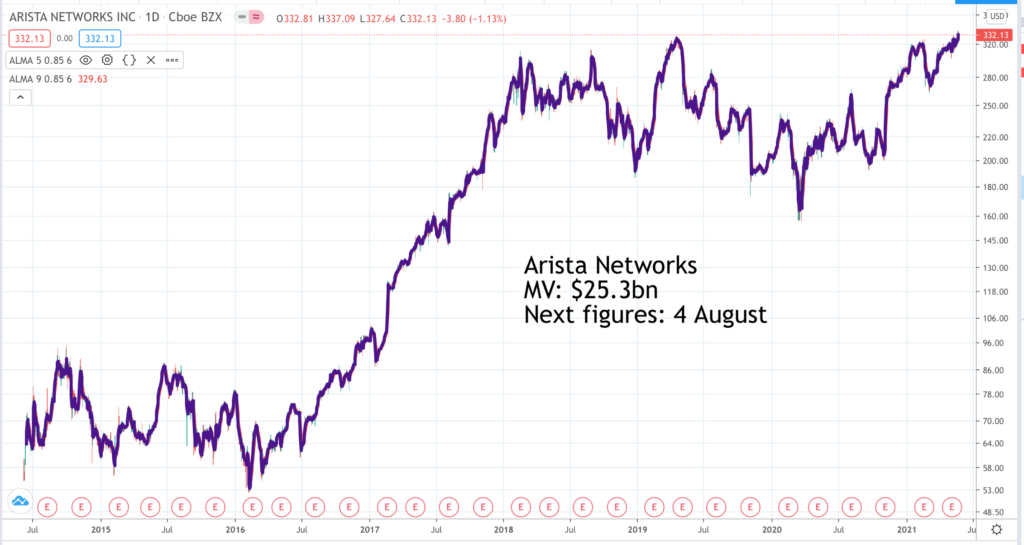

Arista Networks. ANET. Buy @ $334

Ashtead. AHT. Buy @ 5064p

Epam Systems. Buy @ $477

Fortinet. Buy @ $211.50

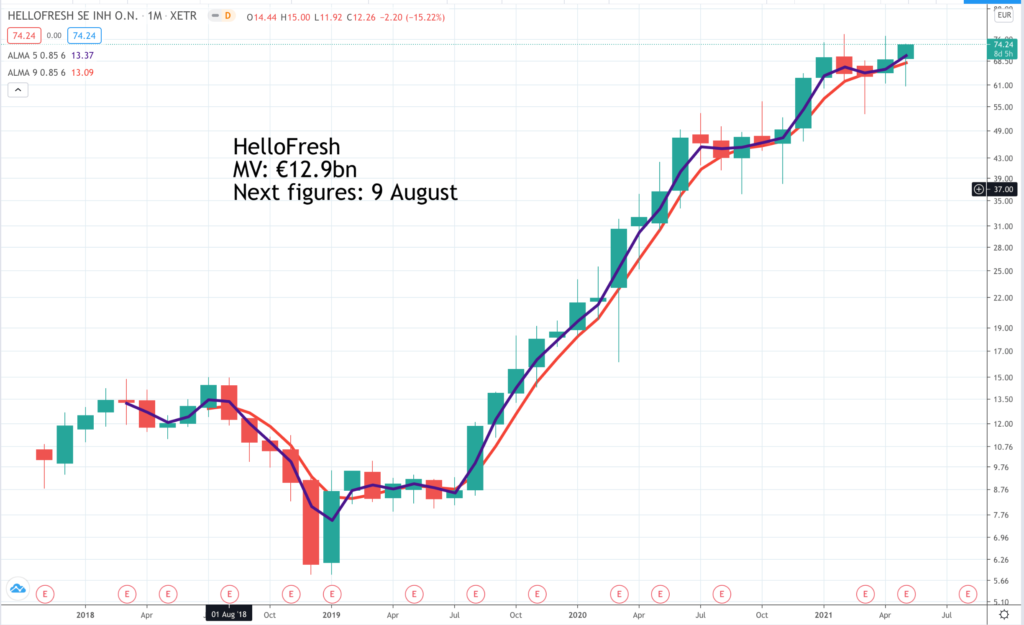

HelloFresh Group. HFG. Buy @ €73

Hermes International. RMS. Buy @ €1085

I-Mab Biopharma. Buy @ $68

Intuit. INTU. Buy @ $438

Kering. KER. Buy @€718

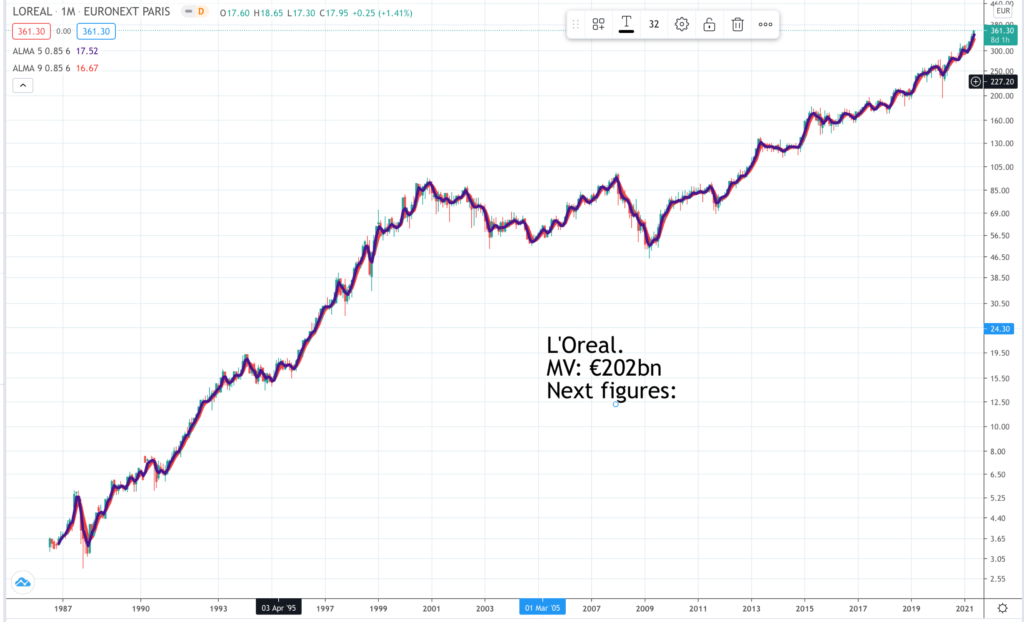

L’Oreal. OR. Buy @ €62

Meidong Auto. 1268. Buy @ HK$39.45

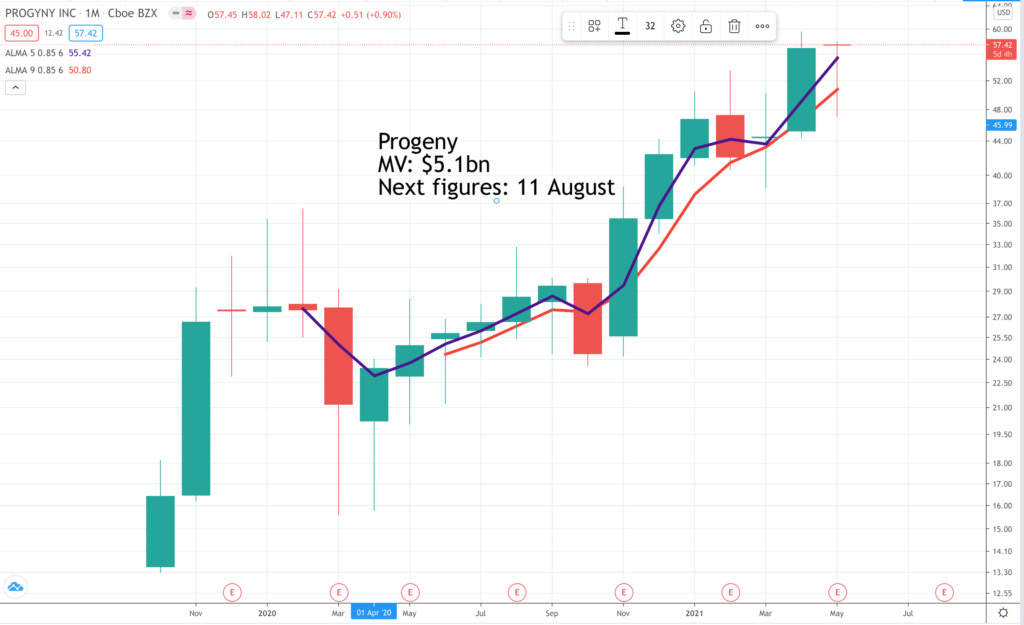

Progeny. PGNY. Buy @ $57.60

Prologis. PLD Buy @ $117.50

Roblox. RBLX. Buy @ $82.50

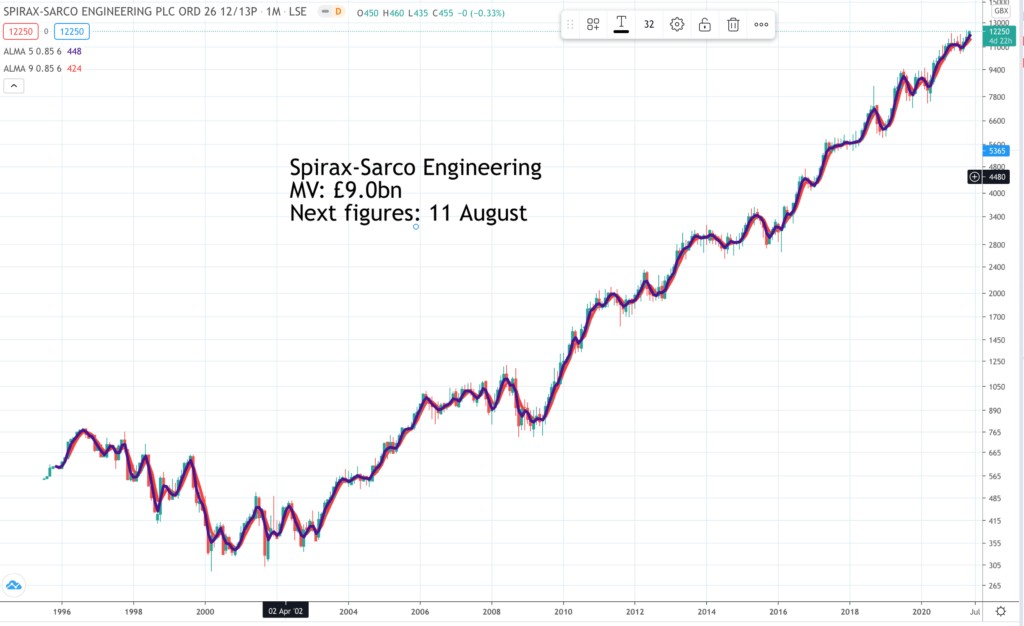

Spirax-Sarco-Sarco. Buy @ 12250p

Upstart Holdings. UPST. Buy @ $141.50

Watches of Switzerland Group. WOSG. Buy @ 782p

West Pharmaceutical Services. Buy @ $ 334

Arista Networks. Buy @ $334

Arista Networks is one of the primary suppliers of data centre equipment, an area set to thrive as large cloud players upgrade in order to accommodate growing internet usage. Arista is not the largest supplier of high speed data centre switches, industry leader Cisco is but Arista has been taking market share for several years as a result, observers say, of superior technology. 2020 was a difficult period for Arista. “… in the past four quarters, we have experienced a triad storm of cloud titan volatility, COVID pandemic and deferred revenue related comp. Despite this tough reset year, we believe Arista will emerge stronger, not only returning to double-digit growth in 2021 but also aiming for consistent growth in the years beyond.” As a long-term investment Arista is a great business with a superlative management team, a great market position, great technology and playing a key role in the technology revolution. The world is going to need sensational infrastructure in the future, which companies like Arista will help to provide. The chart can be read as a giant consolidation from which the shares are just now breaking higher.

Ashtead Buy @ 5064p

I first met the management of Ashtead back in the last century and even then they made great efforts to explain themselves to investors. I suspect they felt that the better they were at informing investors about their strategy and performance the better they would actually do. I believe that Ashtead is the best equipment rental business there has ever been, which is why it makes such a great investment. They have operations in the UK but the real driver of the stunning rise in the shares has been their success in North America and especially the USA. There are now two big equipment rental businesses in the US, of which Ashtead is one and I believe the better managed and the faster growing though rival, United Rentals is by no means a slouch. These two are mopping up rivals and gaining market share in a market experiencing a secular shift from owning to renting, which companies have realised is a better use of their capital and makes for greater flexibility. In effect, Ashtead is benefiting from customers on a massive scale outsourcing their equipment requirements. It has now even reached the point where tradesmen rent rather than own their tools. Ashtead is big buts looks set to become a great deal bigger.

Epam Systems. Buy @ $477

Epam Systems is an IT consultancy business with over 41,000 employees, many of whom are based in Central Europe. The bulk of the team is in three locations, Belarus, Ukraine and Russia. They offer their services globally with just 2,236 of over 32,000 delivery professionals located in the US. The advantage off this low cost base comes about because 60pc of 2020 sales were in North America and 33pc in Europe. It is easy to imagine that for a highly qualified graduate in Central Europe a job with Epam is like winning the lottery. Effectively Epam is an outsourcer. Companies have their core business but they call in Epam and its highly trained professionals to help them change the way the do things and in particularly make sure they are using the latest technology. Epam can help with this because of its work across so many fields and enterprises including its biggest single division which is serving global titans. Using Epam’s services helps ensure that all its customers have best-of-breed solutions. The company is emerging from lockdown in great shape. The group recently reported strong results for Q1 2021 and raised its outlook for the year. “So looking ahead to 2021, we see a market that continues to be very active and one that demonstrate strong demand for our services.”

Fortinet. Buy @ $210

In many respects the world of cyber security is a complete mystery to me. Fortinet says – “We continue to see momentum and adoption of our SD-WAN, SASE and zero trust network access solution among the world’s largest service providers.” Sounds good but don’t ask me what it is or what it does except that zero trust is self explanatory and very much a buzz word in the industry presently. What I can see is that cyber security is becoming ever more important in a digitally transformed and connected world. Cyber criminals, often state backed, seemed to be continually on the prowl. It is almost like there is a war raging out there, which is driving continually improving technology and increased spending. Fortinet is one of the bigger players benefiting from what it calls a move “toward a holistic platform approach, delivering integrated and automate security cover on-premise network, endpoint and cloud secure edge. The Fortinet Security Fabric is a cyber-security platform, organically built on a broad and a huge set of networking and security technology designed to seamlessly operate together.” Its working because in the latest quarter – “Billings increased 27pc to $851m, driven by solid execution across a broad and integrated product and services. Secure SD-WAN contributed 14pc to first quarter billing. Total revenue grew 23pc to $710m with product revenue growth of 25pc, the highest quarterly product revenue growth in the last five years.”

HelloFresh Group. Buy @ €73

HelloFresh supplies meal kits and describes itself as the world leader in its field. Latest figures paint a picture of almost astounding growth. “While the company reached an all-time-high of 5m active customers, the number of orders more than doubled year-on-year, to 19.49m (up 114pc from the third quarter in 2019).HelloFresh’s revenue growth in the third quarter amounted to 120.2pc y-o-y (127.7pc y-o-y in constant currency), accelerating the group’s revenue to EUR 970.2m (Q3 2019: EUR 440.6m). This development was driven by the continued strong engagement by active customers as well as an increase of new customers in both operating segments. As a result of low marketing costs and a sequential improvement of the contribution margin despite summer seasonality, the adjusted EBITDA margin for the HelloFresh Group increased year-on-year by 8.3 pp to 11.8pc, reaching a total adjusted EBITDA of EUR 114.7m.” Post lockdown growth will slow but the shares are reasonable valued, the business is increasingly global and the total addressable market is huge.

Hermes International. Buy @ €1085

There is something magical about Hermes, the French luxury goods company, which is why a few years ago LVMH made an abortive attempt to gain control. Hermes is a jewel and this is reflected in the quality of the products, in the stunning prices they are able to charge and the performance of the business. If you want to buy something wonderful as a gift or for yourself and money is not an issue, Hermes is an obvious port of call. This drives ever climbing sales at impressively high profit margins. Last year was a tough one but even then sales only fell modestly and operating profit margins were 31pc. Net after tax profitss are not far off being a quarter of sales. The shares are not cheap at around 59 times expected earnings for 2021 but they are like the products, a luxury item and priced accordingly. My guess is that as we come out of lockdown we are going to see an explosion of wealth creation and a surge in travel. These are huge following winds for Hermes as is the rise of an increasingly affluent middle class in Asia. Hermes is a perfect lock away investment.

I-Mab Biopharma Buy @ $68

I-Mab Biopharma is a recently floated Chinese biopharma, led by Joan Shen, who joined the group in 2017 and was appointed CEO in 2019. The company’s stated ambition is to create a global vertically integrated biopharmaceutical business. This is in line with the aspirations of the Chinese authorities, who are keen to see the emergence of a strong biopharma industry in China to focus on developing products targeting the special needs of the local population rather than being dependent on imported products from developed western countries. Shen has worked at western pharmaceuticals like Pfizer and the company has r&d operations in both the US and China. It has a strong pipeline of candidates at various stages in trials and like other Chinese led biopharmas is using its local presence to form partnerships with non-Chinese biopharmas to bring novel therapies to the Chinese population. As well as these in-licensing deals I-Mab has other types of partnerships. “In the past two years, we have out-licensed three assets and initiated four co-development programs with our partners ABL Bio, Everest Medicines and WuXi Biologics. The revenue from out-licensing and co-development deals is expected to continue to grow as our pipeline progresses.” It seems likely that some important Chinese biopharmas are going to emerge over time. I-Mab could be one of them.

Intuit Buy @ $438

Intuit is the leading player in supplying accounting software to small and medium sized businesses in the US. Its chief rival in global markets is an Australian company called Xero, which pioneered the practice of linking accounting packages to a business’s bank accounts. Intuit has largely completed the transition from selling software packages to providing accounting as a service paid for by regular subscriptions, a transition which many of the longer-established software businesses have had to make. The company is using its strong base in accounting to add other services such as the recently acquired Credit Karma, which helps make credit available for its SME customers and has strong links with Upstart (featured below). “We closed the acquisition of Credit Karma on 3 December and welcomed 1,300 Credit Karma employees to the Intuit family. We bring together a large customer base of 110m Credit Karma members and 57m Intuit customers to help them unlock smart money decisions. Credit Karma’s data platform creates powerful network effects through personalised financial offers, benefiting members and partners, while adding a new monetisation engine to Intuit.” As well as the powerful network effects from this acquisition Intuit notes – “We’re making great progress serving fast-growing underpenetrated Latinx, self-employed and investor segments.” Intuit is also making what it calls five big bets to drive future growth so plenty going on.

Kering Buy @ €718

The first quarter of 2021 saw a sharp revenue rebound at luxury goods group, Kering. Sales were up 25.8pc on the previous quarter and even up 5.5pc on a pre-pandemic Q1 2019. Star turns in the performance were Asia-Pacific, up 83pc, North America, up 46pc and e-commerce. “Sharp growth in online sales continued across regions, up 108pc in the quarter, driving the penetration of e-commerce to 14pc of retail sales.” The big beast in the Kering empire is Gucci, yet another business which LVMH tried to buy back in the day before losing out to Kering and its equally acquisitive boss, Francois Pinault. Across the board in the group Gucci grew sales 24.6pc to €2.2bn, Yves St Laurent, 23.4pc to €516.6m, Bottega Veneta, 24.6pc to €328.2m and other houses, 33.1pc to €714.3m. Strong performers among the other houses were Alexander McQueen and Balenciaga. As you can see Kering has many wonderful brands in its empire. In 2020, Kering had over 38,000 employees and revenue of €13.1bn. Gucci was transformed in 2015, when Alessandro Michele was appointed design director. Since then Kering shares have roughy quintupled. It’s all happening for the world’s great luxury goods businesses. The brands they own are catnip for the world’s rich, for well-off Chinese and for travellers. The did astonishingly well during lockdown. They will do even better as we come out of it.

L’Oreal. Buy @ €362

L’Oreal is yet another incredibly successful French luxury goods company, albeit not quite in the same elevated price ranges as Hermes and Kering. ““In spite of the health crisis and the ongoing associated measures in some countries, particularly in Western Europe, the beauty market continues to recover. Against this backdrop, L’Oréal has started the year with very strong growth at +10.2pc like-for-like in the first quarter, significantly outperforming the market. The group is therefore continuing its acceleration, initiated in the third quarter of 2020, and is increasing by +5.0pc like-for-like compared to the first quarter of 2019.” This is an amazing performance given the effect of lockdown on travel and shutting down so many beauty parlours and hairdressers. Even with this happening the L’Oreal professional products group is showing double digit growth. “All geographic zones are growing, with the exception of Western Europe still impacted by the measures associated with the health crisis. North America is performing well both online and offline. All zones in the New Markets are growing above 10pc, especially the Asia Pacific Zone which is returning to the extremely dynamic pre-pandemic growth rates, driven most notably by a fast-growing mainland China.” This strong performance has been achieved even though the largest division, consumer products, is down 6.2pc because of Covid-19. No wonder the group is confident on the outlook.

Meidong Auto. Buy @HK$39.45

You won’t be surprised to hear that Meidon Auto is yet another luxury goods business. It operates a chain of motor dealerships in China. “It mainly focuses on mid brands and mainstream luxury brands, including Porsche, BMW, Lexus, Audi, BMW Mini, Toyota and Hyundai. Embracing its strategy of “Single-city-single-store”, it operates 63 stores in Beijing, Guangdong, Hunan, Hubei, Fujian, Jiangxi, Anhui, Hebei, Gansu and Shandong provinces in China (as of 31 December 2020).” The company has delivered outstanding results for shareholders from what is a relatively old-school business model. “Since listed in 2013, MeDong Auto was able to deliver a revenue and net profit CAGR of 32.0pc in which, 50.8pc of its profit was redistributed as dividend, in an effort to share our business success with our shareholders.” The difference is that what seems old school to us would have been much more novel in China with no long history of buying luxury car imports. The tailwind driving this growth was highlighted in a report by Goldman Sachs. “Across Asia, rising incomes are creating an enormous new class of consumers. Much of that growth is coming from China, whose working population is larger than those of the US and Europe combined. As more Chinese consumers gain purchasing power, their needs and preferences will have a powerful effect on the global economy.” They went on to say. “Today’s China consumer market is dominated by a relatively narrow middle class. Less than 2pc of workers earn enough even to pay income tax. So what the world has seen so far is only a preview of the opportunities to come.”

Progeny. Buy @ $57.60

Progeny is quite an unusual company. It offers fertility packages to US companies to make them more appealing to female employees. My wife and I know all about this because we waited years before the children started to arrive and had various treatments. There is strong demand because the company had a barnstorming first quarter. “Reports Record First Quarter Revenue of $122.1m, Reflecting 51pc Growth; Issues Revenue Guidance of $126.0 to $131.0m for the Second Quarter of 2021, Reflecting Growth of 95pc to 103pc. Continues to Demonstrate Leverage in Operating Model Through Increased Profitability.(Americans love capital letters)”. The group’s mission statement says – “We envision a world where anyone who wants to have a child can do so.” The tailwind driving this growth is strong demand. “The incidence of infertility is high and continues to grow. Couples are beginning families later than ever, beyond the ideal age for fertility in women. More single women and members of the LGBTQ+ community are embarking on the journey to parenthood. However, lack of adequate financial resources can delay, or even end their journey to fertility treatment before it begins.” The group says one in eight couples need fertility treatment, which is not cheap. This is a huge market and one that matters tremendously to the couples affected.

Prologis. Buy @ $117.60

Prologis is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of 31 March, 2021, the company owned or had investments in properties and development projects expected to total approximately 990m square feet in 19 countries. Prologis leases modern logistics facilities to a diverse base of approximately 5,500 customers principally across two major categories: business-to-business and retail/online fulfillment. The group is big with $154bn of assets under management and net income of $3.2bn. The company reports strong tailwinds. “There is great momentum moving through the supply chain that is signaled by retail sales, import volumes and rising inventory levels. This will continue as inventory to sales ratios have just begun to rise as companies race to keep pace with demand. Logistics asset values are up a record 7.5pc over the last two quarters. Applying the valuation uplift to our $148bn owned and managed portfolio, we estimate that the value of our real estate rose by more than $10bn over the past two quarters. Our efforts over the past 10 years to reposition the portfolio and balance sheet have set us up to outperform in 2021 and beyond. And you’re probably tired of us saying this, but it continues to be true, we believe the best years for the company are still ahead of us.” Looking good, as they say.

Roblox Buy @ $82.5

Roblox is such a new age kind of company that I am struggling to get my head around it. I am at least half a century out of their typical customer age range and it shows. One thing is clear though, Roblox is an incredibly exciting business and this is close to the first opportunity for retail investors to buy into their story as I have just done. Roblox is a company that benefits from lockdown but is on such a tear that it can’t just be lockdown. “Revenue increased 140pc over Q1 2020 to $387.0m. Net loss for Q1 2020 was $134.2m. Net cash provided by operating activities increased nearly four times over Q1 2020 to $164.5m (including one-time direct listing expenses of $51.9m). Exclusive of one-time expenses related to our direct listing, net cash provided by operating activities would have been $216.4m. Bookings increased 161pc over Q1 2020 to $652.3m. Free cash flow increased 4.1x over Q1 2020 to $142.1m. Average daily active users (DAUs) were 42.1m, an increase of 79pc year over year driven by: 87pc growth in DAUs outside of the US/Canada with 111pc growth in DAUs over the age of 13. Hours engaged were 9.7bn, an increase of 98pc year over year primarily driven by: 104pc growth in engagement in markets outside of the US/Canada; 128pc growth from users over the age of 13. Founder and CEO, Dave Baszucki, describes Roblox as a co-experience platform linking developers and consumers and says it is going to be bigger than gaming. That’s big.

Spirax-Sarco Engineering. Buy @ 12250p

“An investment in Spirax-Sarco Engineering is an investment in a world-leading engineering group with a long history of stable, sustainable growth and excellent profitability.” No argument with that statement. This is a business that has not only grown its share price 41.5 times in the new millennium but has been delivering rising profits and increased dividends for 50 years. Keep taking the pills, as the old joke runs. It turns out I like this company so much the latest annual report pops up twice in my down loads. “Spirax-Sarco is a multi-national industrial engineering group with expertise in the control and management of steam, electric thermal solutions, peristaltic pumping and associated fluid.” The moat surrounding the business, a key requirement of Warren Buffett for long term success and above average margins, is spectacular. They have the best products, the strongest customer relationships, the best teams, the most extensive distribution network, unrivalled maintenance and support systems and they have scale. As a customer you would be mad to go anywhere else. This delivers relentless growth in good times and great resilience in times of hardship. As a lock away investment for your grandchildren they SPX is as good as it gets.

Upstart Holdings. Buy @ $141.50

Upstart is a newly floated company, founded in 2012 by former Google software engineers, which is using artificial intelligence to improve the process of borrowing money. It partners with banks and institutions who provide the loans for the borrowers using its platform. The artificial intelligence bit comes in as they (a) use data to evaluate more accurately the likelihood that a loan will be repaid and the interest that should be charged and (b) the software learns from the data to steadily improve the experience. The model is highly scaleable and in the recent past has been delivering explosive growth. “Our Q1 2021 revenues were up 90pc. Our profits were up by a factor of seven over the first quarter of 2020. Despite softer loan demand from consumers due to government stimulus programs, almost 170,000 loans were transacted by our bank partners in Q1, more than double the volume from just two quarters ago.” The company is forecasting full year 2021 sales of $600m, up from $233m the year before. This growth is currently based mainly on personal loans but, helped by an acquisition, Upstart is planning to enter the auto loans market, where they say there are massive levels of mispricing of loans. This looks like a huge opportunity so I am a little puzzled that analysts are forecast growth slowing dramatically after 2021 with forecasts of $788m for 2022 and $1bn for 2023. I listened to a video with co-founder and CEO, Dave Girouard, and my guess is he will expect to beat those numbers by a mile. The shares are super volatile and go down every time I buy them but they look super exciting.

Watches of Switzerland Group. Buy @ 782p

No surprise we are looking at yet another luxury goods investment here and one which is new to Quentinvest. Business is good as suggested by this quote. “When the coronavirus pandemic hit Europe in the spring, forcing watch factories and retailers to shutter their premises for a couple of months, there were genuine fears that the watch industry was on the brink of crisis. But nine months on, it appears those fears were misplaced. Sure, initially exports and sales fell off a cliff. But taking the UK as an example, following the reopening of watch showrooms in mid-June, sales of luxury watches have gone turbo-nuclear. According to market intelligence company GFK, sales of watches priced more than £1,000 in this country were up by 10.3pc year-on-year in September. China meanwhile, which was already an industry crutch, has imported 11.3pc more watches this year.” Watches Of Switzerland Group, which operates more than 130 showrooms in the UK and US said last October that it was trading ahead of forecasts with revenues up over 20pc on 2019. The world’s most valuable watch brand is Rolex, worth €25bn plus, plus, plus but privately owned and very secretive. WOSG is the nearest thing to an investment in Rolex.

West Pharmaceutical Services. Buy @ $334

West Pharmaceutical Services is all about injectables. The business was doing well anyhow but has received a major boost from Covid-19. This is what they say. “We have accelerated the timeline for capacity builds within our existing footprint by working closely with our incumbent suppliers and staging installations around the 24/7 plant schedules. Our first phase, which began at the start of the pandemic is about 75pc installed and operational, with expected completion in the second half of the year. Our second phase, will see equipment arriving in the back end of the year to be operational in 2022. And we are evaluating additional investments for a third expansion phase in response given the increasing possibility that COVID-19 boosters and annual vaccinations will be required over the next few years.” The recent Covid impact was significant. “We recorded net sales of $670.7m representing organic sales growth of 31.1pc. COVID-related net revenues are estimated to have been approximately $102.9m in the quarter.” Helped by margin expansion the net effect was a 102pc increase in earnings per share. The current situation is obviously somewhat special but nevertheless CEO, Eric Green, says- “We’re working from a position of strength, and we believe we have a long horizon of continued organic sales growth and margin expansion.”