MongoDB develops database software which it sells on subscription. The shares jumped by a third after the latest figures which confirmed that a company which has been growing fast for years continues to grow rapidly and sees a huge opportunity ahead.

The Q3 2022 figures were amazing.

We generated revenue of 334m, a 47pc year-over-year increase and above the high end of our guidance. Atlas revenue grew 61pc year over year, representing 63pc of revenue.

Q3 2022, 7 December 2022

Below are some quotes to give you the flavour of what MongoDB is all about.

Let me remind you of the key pillars of our developer data platform. First, MongoDB enables our customers to unleash developer productivity.

The more productive developers are, the faster their organizations can innovate. The document model, which underpins MongoDB, has proven to be the best way for developers to work with data because it aligns well with how developers think and code. Second, MongoDB supports the performance and scale requirements of the most demanding modern applications. MongoDB is built from the ground up as a distributed platform and allows organizations to easily and cost-effectively scale their applications to address the most exacting performance requirements.

Third, MongoDB allows enterprises to remove enormous complexity and costs out of their technology stack. MongoDB is a general-purpose platform capable of serving a broad array of use cases, including transactional, time series, mobile, search, and application-driven analytics. MongoDB continues to be the most popular modern data platform with developers. In the last 12 months alone, our open-source community server has been downloaded more than 150 million times from our website, which is more than in our entire company history through the beginning of 2020.

Q3 2022, 7 December 2022

This is driving tremendous growth.

And in Q3 alone, we had over 300,000 signups for Atlas feature, which is up 15x over the last five years. We also see growing evidence for how our value proposition resonates with IT decision-makers who are known for their focus on ROI [return on investment], especially in an economic environment such as the one we’re in today. Customers who are moving to the cloud at scale, such as companies in the financial services industry, are increasingly choosing MongoDB as their underlying data platform to modernize their application portfolio. IT decision-makers value not being locked into any one environment, and by building apps on MongoDB, customers preserve their ability to run these apps on-premise, on any cloud, and to easily switch between cloud providers.”

Q3 2022, 7 December 2022

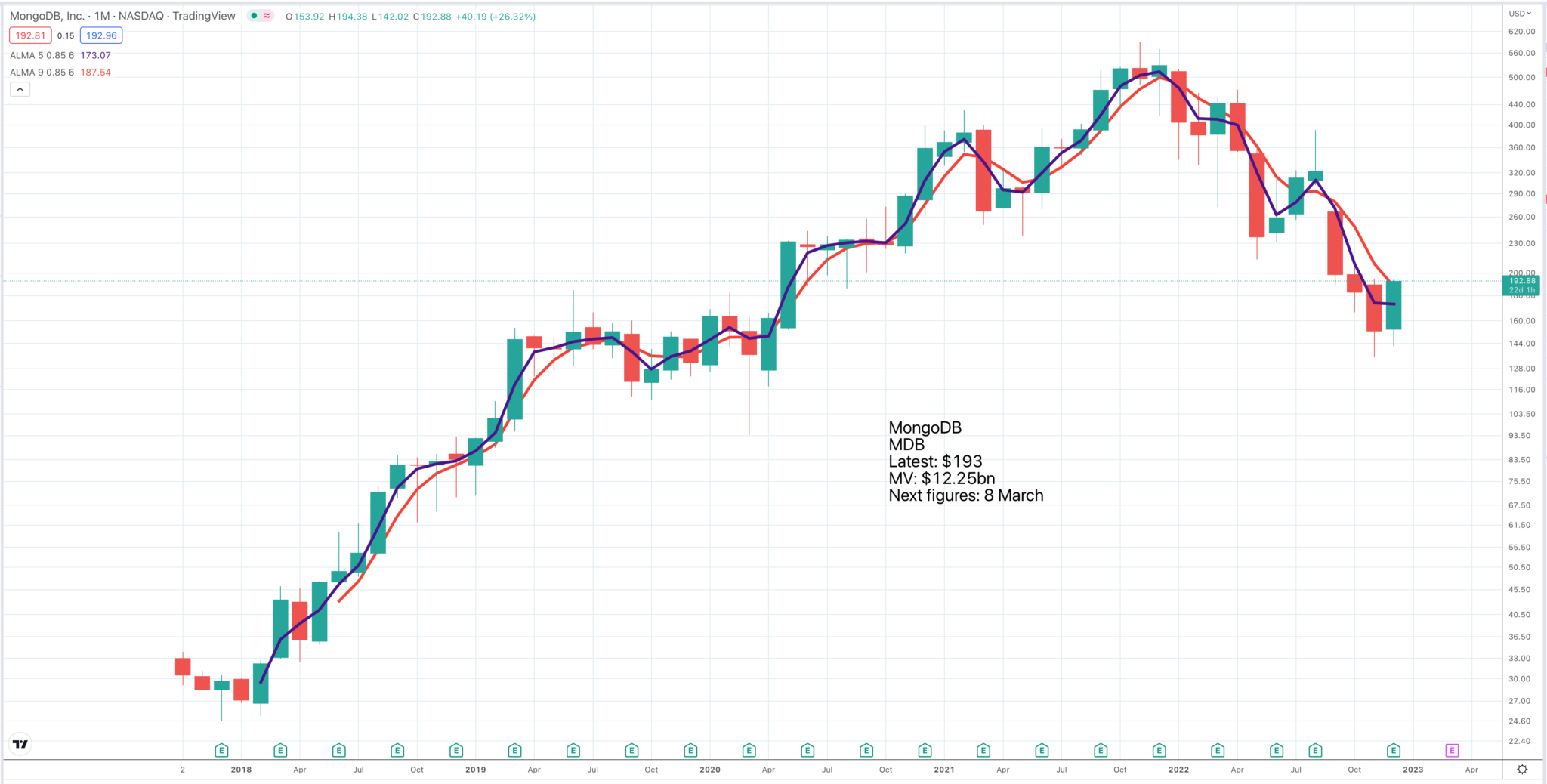

So why are the shares down so much? Well, that is what happens in bear markets. The company fundamentals remain outstanding but a sharp rise in long term interest rates has driven down share valuations, especially for high growth companies like MongoDB where much of the value lies in the future. In 2021 MongoDB was valued at some 40 times sales. By the year to January 2025 that could be approaching five times which is a very reasonable figure for such an exciting business.

The table above which includes analysts’ forecasts vividly illustrates how fast MongoDB is growing and the expected move into profitability. An operating margin of 5.5pc is low for this type of enterprise software business which could easily reach 20pc or more as the business matures.

If you are wondering why the business is not profitable now, this is all to do with what I call the battle for territory. When a new technology business is growing fast it makes sense to spend a high proportion of turnover on research and development and sales and marketing to ensure that the technology is ahead of the competition and recruit as many customers as possible.

This makes double sense because new customers typically increase their spend over time, often dramatically.

MongoDB had revenues of $321m for Q3 2022. Out of this it spent $177m on sales and marketing and $106m on research and development. This means it is spending 88pc of revenue on growth which helps explain why it continues to grow fast. If it ever decided to rest on its laurels profitability would explode.

Strategy

The Nasdaq 100 is jumping around all over the place but my prediction stays the same, the Coppock indicator will give a valid buy signal in March 2023. Given this outlook it is tempting to have a nibble at MongoDB with a view to adding to the holding when the shares give a valid buy signal.

There is a case for arguing that the combination of a negative Coppock indicator with outstanding fundamentals is bullish; that it it is just a matter of time before the shares move into a durable uptrend.

That said it has to be admitted that for most shares and indices the Coppock indicators are still trending lower.