The advantage of these epic scale charts, where each candlestick equals a year, is that buy signals are rare and usually important. Not only do we have a double whammy buy signal for Microsoft (golden cross plus Coppock turning higher) but the shares have reached a new all-time high. Not many shares have does this so far after the fierce correction in 2022 and this has been done even though interest rates have not fallen and may yet rise even a little further.

Microsoft stands at the heart of the generative AI/ exponentially accelerating technology revolution. It is one of the world’s biggest spenders on r&d, $7bn in the latest quarter or $28bn annualised; that is more than most companies have in turnover and that does not include initiatives like the company’s $10bn plus investment in OpenAI, the creator of ChatGBT.

Companies like Microsoft are investing colossal sums in their future and this is why they can grow so fast and keep their share prices climbing.

Like Apple everybody in the connected world is familiar with Microsoft and most probably using their services. This is an asset of incredible value as the world moves into the next stage of the technology revolution, the ‘world of wonders’ stage.

As an aside I am becoming ever more convinced that everybody should have a stake in what is happening by buying appropriate US shares and ETFs. Microsoft, for instance, after this new breakout is being added to my list of must-owns. In the early 19th century wealthy people with excess savings put money in the funds (gilt-edged bonds issued by the British government to fund the Napoleonic wars). The modern equivalent is to invest in the businesses engaged in driving forward the technology revolution. These are mostly found in America. They may be expensive but they are the Crown Jewels of global equity markets.

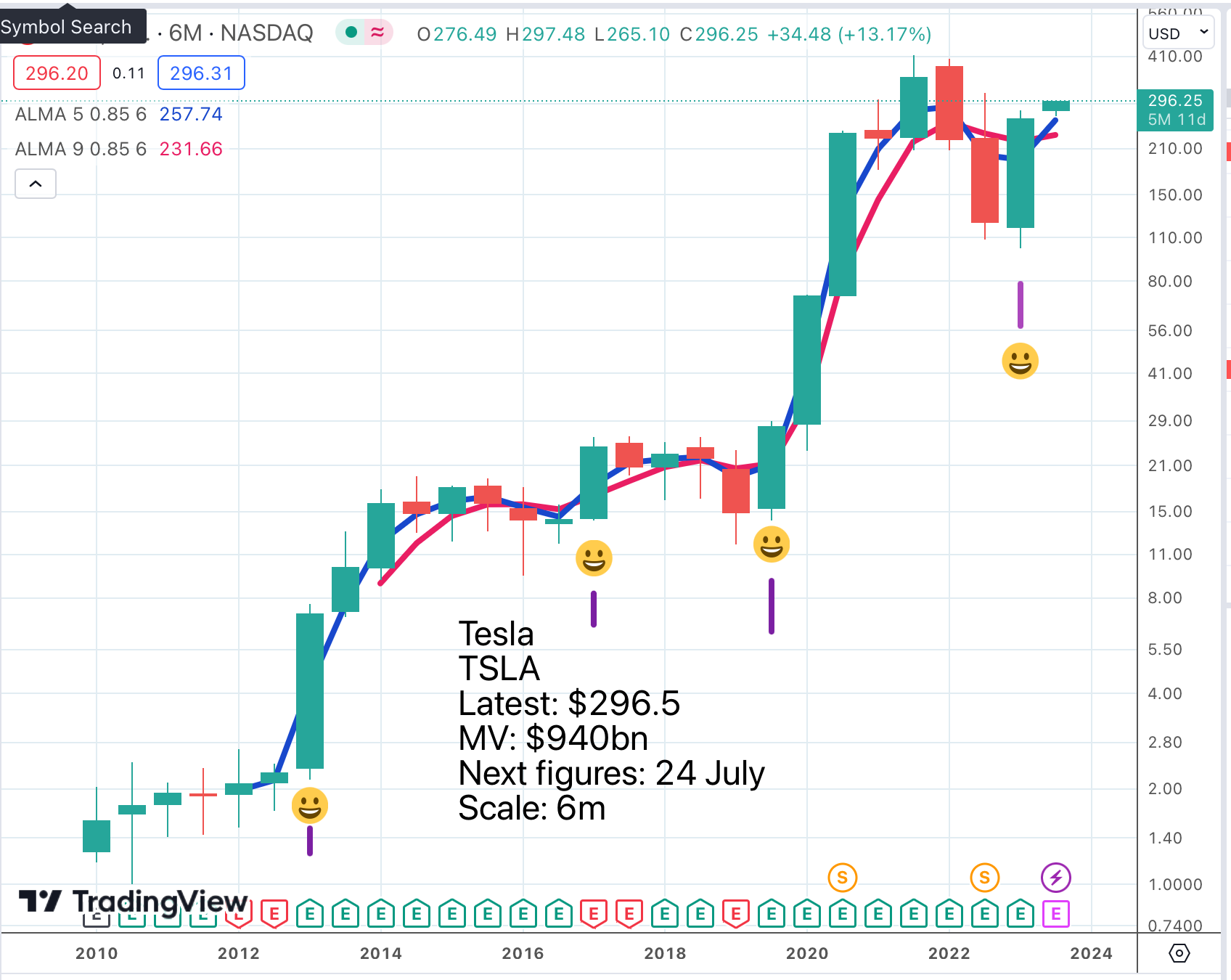

Another stock which I have decided to promote to must-own status is Tesla. There is a negative reaction to the latest quarterly results but that is a flicker on the big picture for this share, hardly a change of direction.

The chart looks strong with a double whammy buy signal within a consolidation in the context of a strong secular uptrend. My feeling about Tesla is that it is collecting a mountain of data and developing sophisticated software and chips to address one of the greatest problems in AI, autonomous driving. This is going to make the company a technology powerhouse and that is going to create enormous future value.

Today is the day TSLA shows the world! Stock set to surge 15pc to 20pc on better-than-expected production, orders/backlog, and margins. Forward guidance likely to increase materially as well. Possibility of huge India announcements and share repurchase as well. Analysts will increase estimates and price targets as TSLA marches towards becoming the most valuable company in the world by market capitalization.

Paul, Yahoo Finance, 19 July 2023

Paul is a new chum, virtual chum, whose comments on Nvidia I recently included in an alert. He is very bold with his predictions but why not. He has drunk the Tesla Kool-Aid but so have I and I don’t see anything improbable about his suggestions.

What is interesting is the growing battle between Tesla and Nvidia to see which company can become more valuable and maybe, over time, become the world’s most valuable business.

Below is another comment on Tesla.

Moving on to TSLA’s valuation, I acknowledge that all valuation metrics for the stock look awfully inflated, due largely to the run up in its stock price that saw it more than double year-to-date, but let me cut to the chase – I think TSLA is actually incredibly undervalued. I will explain my stance on Tesla’s undervaluation in greater detail later in this piece, but I will explain here why I think TSLA’s ostensible overvaluation compared to its so-called sector peers is misleading.

First, if ever it was appropriate to analyze Tesla and its stock as part of the consumer discretionary sector, it is not appropriate now. Tesla is a technology company, and is best analyzed and compared as such, including analysis regarding its peers, sector, and valuation.

Second, Tesla’s current maturing business lines, namely EVs and energy generation and storage, are almost certain to outperform Wall Street’s expectations as they grow and contribute significantly more to revenues and profits. Observant investors’ eagerness to pile into TSLA before these predictably large revenues and profits lower valuation metrics to more digestible levels is quite reasonable, considering the market’s tendency to look at least 1-3 years ahead regarding a company’s prospects when valuing it. The market assigning a premium valuation to Tesla in the form of a forward P/E ratio of 77 at time of writing therefore makes sense to me.

Third, even the current premium assigned to TSLA is miniscule compared to the company’s likely future performance going into 2030, which I think the market isn’t pricing in yet. To better understand what investors and the market are missing, we have to take a closer look at Tesla’s many developing products, services, and operations to see how they will contribute to massive growth for the company and the stock.

The Long View Investor, 17 July

Cutting to the chase, look at this conclusion.

Tesla intends to offer an entirely new service centered on self-driving cars, a first in transportation, and intends to triple Apple’s revenues in just robotaxi profit, on top of its revenue from private car sales and the other business lines the company is planning to establish. If true, does this mean Tesla’s market cap is set to be more than three times Apple’s by 2030, i.e., over $9 trillion? That is what the math is implying so far.

The Long View Investor, 17 July

After that it gets really insane.

Lastly, according to Musk, as cited by Mesbahi, Tesla’s bot business could stand to count for the majority of Tesla’s valuation; if true, it would likely represent a majority of Tesla’s earnings too, i.e. more than the combined earnings total of Tesla’s businesses so far. Assuming a 55pc share of earnings coming from the Tesla Bot vs 45pc of earnings from the other businesses, Tesla Bot’s earnings should amount to $1.69 trillion in 2030. $1.69T plus $1.38T equals $3.07T in earnings.

Assuming Tesla’s outstanding shares will increase by an average of 11.6pc per year for the foreseeable future, based on Tesla increasing its outstanding shares by 2.5 times between early 2010 and early 2023, with the outstanding share number in early 2023 being 3.47bn, Tesla’s outstanding shares by early 2030 should amount to 7.5bn. Keep in mind that I will not be using the compound annual growth rate of Tesla’s outstanding shares, which would be a more conservative 7.3pc, and more favorable to Tesla’s EPS calculation.

In the end, then, $3.07T of earnings divided by 7.5bn shares equals earnings per share of $409 in 2030, far from this year’s forward EPS of $3.53, and representing a compound annual growth rate of 58pc. Assuming a 2030 P/E of 35, not unreasonable for a seasoned growth company, we get a stock price of ~$14,300 for TSLA in 2030.

The Long View Investor, 17 July

Strategy – Taking the Long View Indeed

What is interesting about these futuristic calculations is the insight they give into where technology might be going, which present day companies look best placed to take it there and the gigantic corporations that will be created if all or even any of this happens.

We are heading into a very brave new world and investors need to position themselves accordingly.

Meanwhile I found this bouncy comment on Microsoft.

One of the best stocks I’ve owned…..forever. Invest people. Stop waiting around for crumbs like pigeons. Solid company. I don’t think most people realize Microsoft has a monopoly on enterprise SaaS [Software as a Service], IaaS [Infrastructure as a Service], Cloud and email services. That’s recurring revenue from a ton of companies. Then there’s gaming. If you use email for work there’s only MSFT and Google these days and everything else that integrates with it. In the CRM [customer relationship management] space there’s Salesforce which is also a great company but MSFT is their biggest competitor. Let’s see what AWS [Amazon Web Services] does tomorrow- another great company.

NAV, Yahoo Finance, 27 April 2023

All this and he doesn’t even mention AI.

Share Recommendations

Microsoft. MSFT Buy @ $346.87

Tesla TSLA. Buy @ $262.90