Table of Contents

AI is the most powerful technology force the world has ever known. The NVIDIA AI platform offers skills like computer vision, conversational AI, recommender systems, AI avatars, robotics, and accelerated genomic sequencing to the world’s enterprises.

Nvidia website

Everybody is becoming very excited about ChatGPT which, as I understand it may be the first example of AGI or General Artificial Intelligence. It is said to be amazing and has becoming the fastest-growing app in history, reaching 100m users in just two months and valuing OpenAI, the business that founded it at $30bn.

There are three stages in AI, weak or narrow AI, generative or general AI known as AGI and super AI, known as ASI, where the machines become more intelligent than humans. It is this last level which some say may never be reached and others say could be scary because the machines may decide that they do not need us as happened in the future in the Terminator films.

ChatGPT was created by a company called OpenAI in which Microsoft recently invested $10bn, or so it is believed following earlier investments of $2bn to $3bn. Most recently there was a conversation between Satya Nadella and Sam Altman, CEOs of Microsoft and OpenAI respectively, which took a very positive view on AI.

“We believe that the creation of beneficial AGI will be the most important technological development in human history, with the potential to shape the trajectory of humanity. We have a hard technical path in front of us, requiring a unified software engineering and AI research effort of massive computational scale, but technical success alone is not enough. To accomplish our mission of ensuring that AGI (whether built by us or not) benefits all of humanity, we’ll need to ensure that AGI is deployed safely and securely; that society is well-prepared for its implications; and that its economic upside is widely shared. If we achieve this mission, we will have actualized Microsoft and OpenAI’s shared value of empowering everyone.”

Satya Nadella, CEO of Microsoft talking to Sam Altman, CEO of OpenAI, March 2023

My theory is that AI/ AGI could become a dramatic focus of investor interest with a scramble to invest in companies that are benefiting from this gigantic potential. This is a massive ‘something new’ that could drive extraordinary stock market gains. I started my search by looking at an ETF, Vance Semiconductor (SMH).

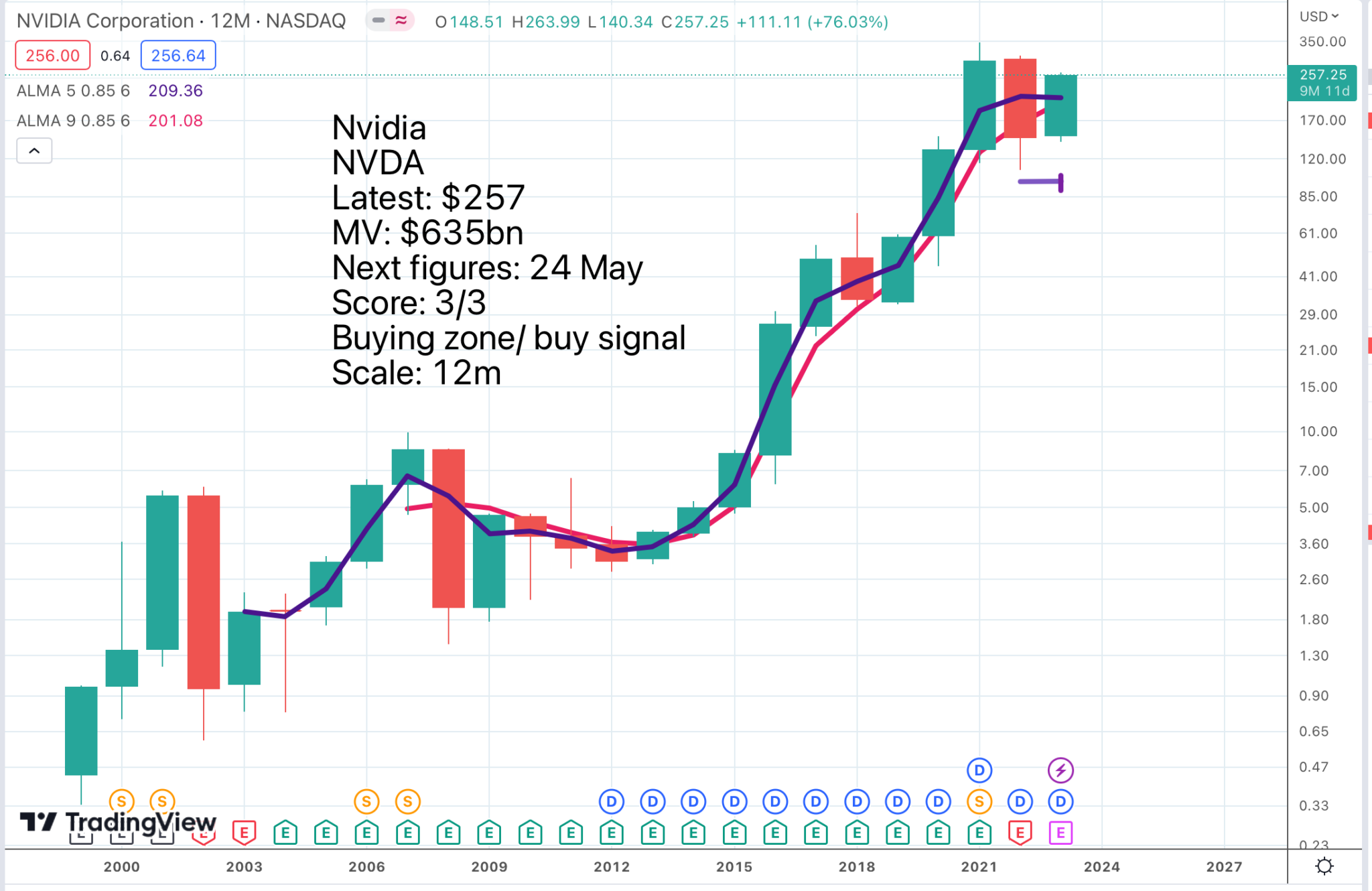

The chart looks positive with a Coppock buy signal and a consolidation after a period of strong gains. I have also been looking at the constituents of this fund and other shares that are key to what is happening with AI. I put together a list of around 20 shares with exciting fundamentals and positive charts – classic 3G, in short. A company which is clearly seeking to put itself at the heart of AI is Nvidia. I said some while back that I expected the market value of Nvidia to overtake that of Tesla and this has already happened with Nvidia valued at $635bn v $570bn for Tesla.

The pattern on the Nvidia chart is known as a step pattern and is one of the most bullish patterns. The odds are good that the shares will eventually break higher from the current consolidation.

What is AI?

In its most fundamental form, AI is the capability of a computer program or a machine to think and learn and take actions without being explicitly encoded with commands. AI can be thought of as the development of computer systems that can perform tasks autonomously, ingesting and analyzing enormous volumes of data, then recognizing patterns in that data. The large and growing AI field of study is always oriented around developing systems that perform tasks that would otherwise require human intelligence to complete—only at speeds beyond any individual’s or group’s capabilities. For this reason, AI is broadly seen as both disruptive and highly transformational.

A key benefit of AI systems is the ability to actually learn from experiences or learn patterns from data, adjusting on its own when new inputs and data are fed into these systems. This self-learning allows AI systems to accomplish a stunning variety of tasks, including image recognition; natural language speech recognition; language translation; crop yield predictions; medical diagnostics; navigation; loan risk analysis; error-prone boring human tasks; and hundreds of other use cases.

Though the theory and early practice of AI go back three-quarters of a century, it wasn’t until the 21st century that practical AI business applications blossomed. This was the result of a combination of huge advances in computing power and the enormous amounts of data available. AI systems combine vast quantities of data with ultra-fast iterative processing hardware and highly intelligent algorithms that allow the computer to ‘learn’ from data patterns or data features.

The ideal hardware for the heavy work of AI systems are graphical processing units, or GPUs. These specialized, superfast processors make parallel processing very fast and powerful. And massive amounts of data—essentially the fuel for AI engines— comes from a wide variety of sources, such as the Internet of Things (IoT); social media; historical databases; operational data sources; various public and governmental sources; the global science and academic communities; even genomic sources. Combining GPUs with enormous data stores and almost infinite storage capabilities, AI is positioned to make an enormous impact on the business world.

Among the many and growing technologies propelling AI to broad usage are application programming interfaces, or APIs. These are essentially highly portable bundles of code that allow developers and data scientists to integrate AI functionality to current products and services, expanding the value of existing investments. For example, APIs can add Q&A capabilities that describe data or call out interesting insights and patterns.

It isn’t an overstatement to say that artificial intelligence, or AI, offers the capability to transform the productivity potential of the entire global economy. A study by PwC found that AI’s contribution to the global economy will total nearly $17 trillion within ten years.

Nvidia web site

I could go on but I think you get the idea. As with another of my favoured AI investments, Cadence Design Systems (CDNS), Nvidia looks an obvious choice to benefit since without Nvidia and its amazing chips it is hard to see the AI revolution happening. My hunch is that Nvidia is going to become a giant company, up there with Apple and Microsoft.

I don’t do what the analysts do and try to look in detail at what Nvidia is doing and what their immediate prospects are partly because I am not equipped to do so but also because I don’t think it is that critical to the decision on whether to buy the shares. What is clear is that the guys at Nvidia are excited.

In no computing era did one computing platform, ChatGPT, reached 150m people in 60, 90 days. I mean, this is quite an extraordinary thing. And people are using it to create all kinds of things. And so I think that what you’re seeing now is just a torrent of new companies and new applications that are emerging.

There’s no question this is, in every way, a new computing era. And so I think this — the TAM [$300bn hardware TAM and $300bn software TAM] that we explained and expressed, it really is even more realisable today and sooner than before.

Nvidia, Q4 2023, 23 February 2023

Microsoft is another key player in AI

Another company which is at the heart of the AI revolution is Microsoft, which has a big stake in OpenAI, which created ChatGPT. Microsoft is now using GPTChat technology to bring AGI to Microsoft Office and the implications could be huge.

Make no mistake, this is a significant milestone for generational AI and, more importantly, for the world of work.

Bringing the powers behind ChatGPT to the humble Word, Excel and PowerPoint programmes, quite possibly the most used work programmes in most offices, plonks it directly in the daily lives of millions of workers.

I know people have been using ChatGPT to help them do their jobs – to write computer code, speeches, website copy. Students are using it to help them with their homework.

But most of us have been having fun, getting it to write poems, songs, jokes. I asked an audience at a live event recently who had tried ChatGPT. Most hands shot up. But most went back down immediately when I asked who was using it professionally.

Putting Copilot into Office365 is a real game-changer. Imagine instead of summarising that long dull report for your client meeting, you just get a chatbot to do it for you in a few seconds. But why stop there – do you even need to be at the meeting at all? Just get Copilot to recap it for you and send you the notes of it afterwards.

Watching a demo of it creating a stylish PowerPoint presentation in moments was really quite heartwarming for anyone familiar with the phrase “death by PowerPoint”.

Microsoft would argue that this frees up your time to do other jobs. But what if Copilot has one day beaten you to those things as well?

BBC News, technology editor, Zoe Kleinman, 17 March 2023

Microsoft is also excited about the implications for its Azure Cloud service.

Microsoft CEO, Satya Nadella, said Tuesday that search powered by artificial intelligence is the biggest thing to happen to his company in the nine years he’s been at the helm.

CNBC, 7 February 2023

He pursued the same theme at the company’s most recent earnings meeting with analysts.

And the next major wave of computing is being born as we turn the world’s most advanced AI models into a new computing platform.

Moving to the cloud is the best way for any customer in today’s economy to mitigate demand uncertainty and energy costs while gaining efficiencies of cloud-native development. Enterprises have moved millions of cases to Azure and run twice as many calls on our cloud today than they did two years ago. And yet, we’re still in the early innings when it comes to long-term cloud opportunity. As an example, insurer AIA was able to save more than 20pc by migrating to Azure and reduced IT provisioning time from multiple months to just an hour.

We also continue to lead with hybrid computing with Azure Arc. We now have more than 12,000 Arc customers, double the number a year ago, including companies like Citrix, Northern Trust, and PayPal. Now on to data. Customers continue to choose and implement the Microsoft Intelligent Data Platform over the competition because of its comprehensiveness, integration, and lower cost.

The age of AI is upon us and Microsoft is powering it. We have the most powerful AI supercomputing infrastructure in the cloud. It’s being used by customers and partners like OpenAI to train state-of-the-art models and services, including ChatGPT. Just last week, we made our Azure OpenAI service broadly available, and already over 200 customers from KPMG to Al Jazeera are using it.

Q2 2023, 24 January 2023

There is tons more stuff like this but again I think you get the message, AI is happening and Microsoft is at the heart of it.

Meta Platforms announces ‘year of efficiency’

Another company I suspect is going to benefit from AI is Meta Platforms, formerly known as Facebook. At the moment Meta is laying off employees like there was no tomorrow, at least 21,000 redundancies have been announced taking the number of employees from 87,000 at the peak to around 65,000. This is chiefly intended to improve profitability at its core social media, ad funded businesses while it keeps spending on its loss making but futuristic Reality Labs business focused on the metaverse.

I want to discuss my management theme for 2023, which is the “year of efficiency”. We closed last year with some difficult layoffs and restructuring some teams. When we did this, I said clearly that this was the beginning of our focus on efficiency and not the end. Since then, we’ve taken some additional steps like working with our infrastructure team on how to deliver our roadmap while spending less on capex. Next, we’re working on flattening our org structure and removing some layers of middle management to make decisions faster, as well as deploying AI tools to help our engineers be more productive. As part of this, we’re going to be more proactive about cutting projects that aren’t performing or may no longer be as crucial, but my main focus is on increasing the efficiency of how we execute our top priorities.

The two major technological waves driving our roadmap are AI today and over the longer term the metaverse.

First, let’s talk about our AI discovery engine. Facebook and Instagram are shifting from being organized solely around people and accounts you follow to increasingly showing more relevant content recommended by our AI systems. This covers every content format — which is something that makes our services unique — but we’re especially focused on short-form video since Reels is growing so quickly. I’m really proud of our progress here. Reels plays across Facebook and Instagram have more than doubled over the last year, while the social component of people resharing Reels has grown even faster and has more than doubled on both apps in just the last 6 months.

We continue to be excited about the monetization opportunity with business messaging too. Facebook and Instagram are the first two pillars of our business, and in the next few years we hope to bring messaging online as the next pillar. One way of doing this is click-to-message ads, which is now at a $10bn run rate.

AI is the foundation of our discovery engine and our ads business – and we also think it’s going to enable many new products and additional transformations within our apps. Generative AI is an extremely exciting new area with so many different applications, and one of my goals for Meta is to build on our research to become a leader in generative AI in addition to our leading work in recommendation AI.

We just launched avatars on WhatsApp last quarter and more than 100m people have already created avatars in the app. Of those, about one in five are using their avatar as their WhatsApp profile photo. I thought that was an interesting example of how the Family of Apps and metaverse visions come together. Because even though most of our Reality Labs investment is going towards future computing platforms — glasses, headsets, and the software to run them — as the technology develops, most people are going to experience the metaverse for the first time on phones and start building up their digital identities across our apps.

Q4 2022, 1 February 2023

My feeling is that we should give Mark Zuckerberg the benefit of the doubt that he knows what he is doing and that Meta Platforms shares are a buy.

Arista Networks does 26pc of business with MetaPlatforms and Microsoft

Arista Networks has just reported a year of sensational growth.

You might recall, in November 2021 Analyst Day, we had given you a guidance of 30pc growth and instead have achieved well beyond that at 48pc growth for the year, driving to an annual revenue of $4.38bn with a non-GAAP earnings per share of $4.58, translating to an EPS growth of 58pc for 2022. Indeed, a memorable year.

Shifting to the segment sector revenue for 2022, cloud titans contributed significantly at approximately 46pc, resulting in a triple-digit growth annually. Enterprise and financials together was strong at approximately 32pc, while the providers were at approximately 22pc. Both Meta and Microsoft are now far greater than 10pc customers at 25.5pc and 16pc contribution respectively. Clearly, we continue to enjoy a strong and strategic partnership with M&M.

Our partnership with Microsoft and Meta grew even stronger last year. Both of these titans are in the midst of deploying our next-gen 100, 200 and 400-gig products at several [key tails] (ph) of their networks. The cloud is reshaping the Internet with their massive footprint, global backbone and edge partnerships.

While we will continue to add 100 and 400-gig products to our portfolio, we also launched our first 1 rack unit 25-terabit product, with 800-gig ports that can be broken out as 2 x 400-gig. These products have good use cases and high-speed applications, such as artificial intelligence.

At Meta, we have our co-developed platforms, such as the Tomahawk 3 7368 and 7388, which helped them improve throughput and datacenter power efficiencies. [FPaaS](ph) and EOS are deployed with very high reliability in the cluster fabrics using these products. Our deployments in their backbone and in generative AI and recommendation engines with the 7800 series are now smoothly deployed in production.

AI is a good example where we are continuing to grow into next-generation architectures with our cloud customers. The use cases we are involved in are generally core to their business and not an optional spend. Our cloud journey has come a long way over the last decade. This is still a very exciting market segment given the pace of innovation and our partnerships here.

Q4 2022, 13 February 2023

It won’t be lost on other customers that if Meta Platforms and Microsoft are happy to place so much business with ANET they must be impressive at what they do.

In the non-cloud category, we have registered solid number of million-dollar customers as a direct result of our momentum in the enterprise and campus throughout the year. We have now surpassed 9,000 cumulative customers.

Q4 2022, 13 February 2023

Arista Networks is a very exciting company with an inspired leader in Jayshree Ullal

As we enter 2023, Arista is well positioned as a game changer in data-driven client to cloud networking. A key part of this transformation is to make our cloud first principle and bring that to every aspect of the data network. Software functions such as routing for WAN, Zero Trust security and observability are moving into the Arista U.S. stack. We are building upon our cloud network heritage to bring proactive platforms, predictive operations and a complete prescriptive experience, unifying datasets from multiple sources. Our NetDL architecture and AVA, or autonomous virtual assist, using AI and ML and natural language processing techniques is a very compelling combination. Together, this architecture can gather, store and process multiple modalities of network data. And this way, network operators can reconcile all their different silos.

Q4 2022, 13 February 2023

And this supremely innovative business is not resting on its laurels.

2023 is the start of Arista’s 2.0 journey. Arista 2.0 is our migration from best-of-breed products to best-of-breed platforms as we address our expanded TAM of $50bn ahead. We are uniquely qualified to bring modern software principles to build that world-class data center and data-driven networking. It is based on that foundational focus on quality, availability, AI-driven deployments with top notch support. And as we undertake this 2.0 journey, we are excited to work with a collaborative ecosystem of our partners, and customers worldwide to realize this vision.

Q4 2022, 13 February 2023

Financial strategy

There are two conflicting trends in the stock market right now. There is the unfolding banking crisis with its scary echoes of 2008-09 and there is yet another Great Leap Forward in technology with the success of ChatGPT using artificial generative intelligence. Banking crises are always scary because a loss of confidence can spread so rapidly through the system. There is also this feeling that the wise men us lesser folk rely on to keep the wheels on don’t know any more about what they are doing than we do and are making it up as they go along. Our hope must be that capitalism is a self-regenerating system and will bring us out of our difficulties whatever the bureaucrats do. This time around the banking system is generally in good financial health and much of the corporate system is in amazing financial health which should help.

As noted I am becoming very excited by the potential for AGI. The world is accumulating vast amounts of data and computing power is exploding even though Moore’s law is no longer working. It seems certain that great wonders are coming and quickly and are going to have a huge impact on the stock market. I think the sector could become red hot in the next bull market and many shares are already behaving in a positive way.

Share recommendations

Nvidia NVDA Buy @ $256.50

Vance Semiconductor ETF. SMH. Buy @ $250.50

Microsoft MSFT. Buy @ $272

Meta Platforms. META. Buy @ $197

Arista Networks. ANET. Buy @ $162.50