When you look at your IG account there are two key numbers to bear in mind. The first is the funds in your account; the second is the profit and loss figure.

Your equity, the amount that belongs to you is your funds plus/ minus the figure in the P & L.

When you add money to your account because of a margin call this adds to the funds figure. If the value of the shares rises above your margin requirement this creates funds available for investment and boosts your P&L. If you invest this money in more shares your fund and P & L figures are not affected. All you have done is change cash for shares.

If things go well and your P&L figure equals your funds figure this means you have doubled your money (the cash you have actually invested) and that is the time to sell and start again.

When you start again, if you start with the same figure, you will be investing your profits.

When you start this process the five times gearing means that the value of your shares needs to rise by 20pc to double your investment. But the more you invest profits in new shares the lower this required gain becomes, 19pc, 18pc, 17pc and so on. In theory the required percentage gain could go to one per cent.

Table of Contents

The next thing that becomes important is how long it takes to double your money. This strategy can be pursued very aggressively. If you top up your margin on every margin call and reinvest all significant additions to the P&L this strategy could move very fast.

This is a pure guess but I am imagining that you might be able to double your starting capital three or four times a year. When your P&L draws close to equalling the funds figure you could set a limit order to be triggered when the equalling (and doubling of your capital) takes place.

If you really like the stock you could invest your profits in another SB fund for a long term hold or play the doubling game again with a larger starting amount each time..

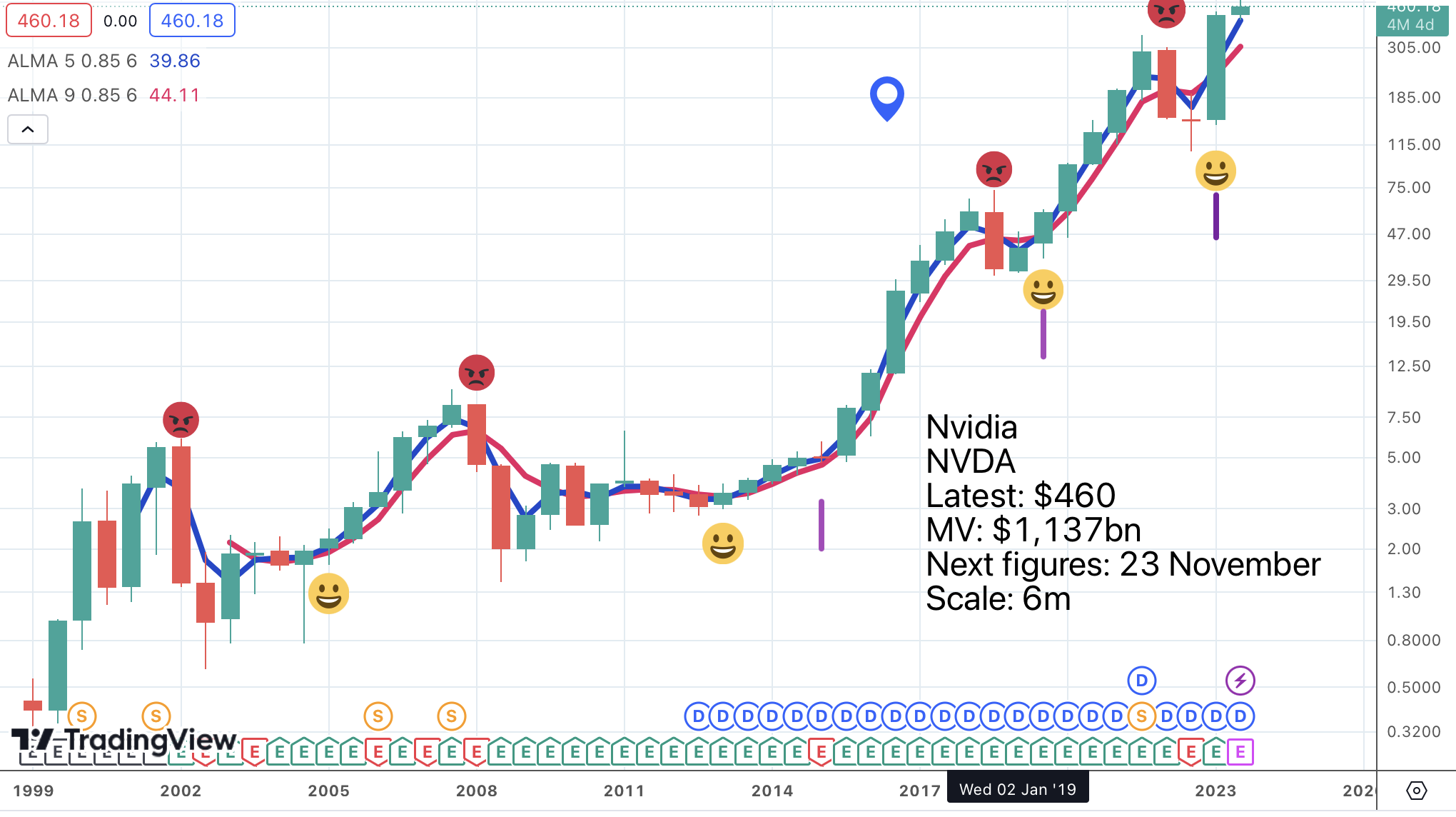

What is Going on with Nvidia?

As you can see the chart remains strong but the reaction to an incredible set of Q2 results was puzzling to say the least. The shares briefly touched $520 before plummeting to nearly $450.

There can be little doubt that Nvidia is among the most exciting businesses on the planet. There have been suggestions that even with this incredible growth the company could sell twice as many H100s etc., as it is selling. This puts into perspective suggestions that sales could rise from $27bn for the year to 31 January 2023 to $54bn plus to January 2024 and circa $100bn to January 2025 with rising profitability.

We could be looking for earnings per share heading for $20 for a company targeting a data centre market worth $1 trillion quite apart from its other markets in gaming, visualisation and automotive.

The data centre explosion is incredible.

Let me first start with data centre.

Record revenue of 10.32bn was up 141pc sequentially and up 171pc year on year. Data centre compute revenue nearly tripled year on year driven primarily by accelerating demand for cloud from cloud service providers and large consumer internet companies for our HGX platform, the engine of generative and large language models. Major companies including AWS, Google Cloud, Meta, Microsoft Azure, and Oracle Cloud, as well as a growing number of GPU cloud providers are deploying in-volume HGX systems based on our Hopper and Ampere architecture tensor core GPUs. Networking revenue almost doubled year on year driven by our end-to-end InfiniBand networking platform, the gold standard for AI.

There is tremendous demand for Nvidia accelerated computing and AI platforms. Our supply partners have been exceptional in ramping capacity to support our needs. Our data centre supply chain, including HGX, with 35,000 parts and highly complex networking, has been built up over the past decade. We have also developed and qualified additional capacity and suppliers for key steps in the manufacturing process such as co-op packaging.

We expect supply to increase each quarter through next year.

Colette Kress, CFO, Nvidia. Q2 2024, 23 August 2023

Just listen to Jensen Huang, admittedly never a shrinking violet when it comes to Nvidia’s prospects but then look at what he has already achieved.

A new computing era has begun. The industry is simultaneously going through two platform transitions: accelerated computing and generative AI. Data centres are making a platform shift from general-purpose to accelerated computing. The trillion dollars of global data centres will transition to accelerated computing to achieve an order of magnitude better performance, energy efficiency, and cost. Accelerated computing enabled generative AI, which is now driving a platform shift in software and enabling new, never-before-possible applications.

Together, accelerated computing and generative AI are driving a broad-based computer industry platform shift. Our demand is tremendous. We are significantly expanding our production capacity. Supply will substantially increase for the rest of this year and next year. Nvidia has been preparing for this for over two decades and has created a new computing platform that the world’s industry — world’s industries can build upon.

What makes them so special are, one, architecture. Nvidia accelerates everything from data processing, training inference for every AI model, real-time speech-to-computer vision, and giant recommenders to vector databases. The performance and versatility of our architecture translates to the lowest data centre TCO [total cost of ownership], and best energy efficiency. Two, install base.

Nvidia has hundreds of millions of CUDA-compatible GPUs worldwide. Developers need a large install base to reach end users and grow their business. Nvidia is the developer’s preferred platform. More developers create more applications that make Nvidia more valuable for customers. Three, reach.

Nvidia’s in cloud’s enterprise data centres, industrial edge, PCs, workstations, instruments, and robotics. Each has fundamentally unique computing models and ecosystems. System suppliers like OEMs [original equipment manufacturers]– computer OEMs can confidently invest in Nvidia because we offer significant market demand and reach. Scale and velocity. Nvidia has achieved significant scale and is 100pc invested in accelerated computing and generative AI.

Our ecosystem partners can trust that we have the expertise, focus, and scale to deliver a strong roadmap and reach to help them grow. We are accelerating because of the additive results of these capabilities. We’re upgrading and adding new products about every six months versus every two years to address the expanding universe of generative AI. While we increase the output of H100 for training and inference of large language models, we’re ramping up our new L40S universal GPU for scale — for cloud scale-out and enterprise servers. Spectrum X, which consists of our Ethernet switch, BlueField-3, supernet, and software helps customers who want the best possible AI performance on Ethernet infrastructures. Customers are already working on next-generation, accelerated computing and generative AI with our Grace Hopper.

We’re extending NVIDIA AI to the world’s enterprises that demand generative AI but with the model privacy, security, and sovereignty. Together with the world’s leading enterprise IT companies, Accenture, Adobe, Getty, Hugging Face, Snowflake, ServiceNow, VMware, and WPP; and our enterprise system partners, Dell, HPE, and Lenovo, we are bringing generative AI to the world’s enterprise. We’re building NVIDIA Omniverse to digitalize and enable the world’s multi-trillion-dollar heavy industries to use generative AI to automate how they build and operate physical assets and achieve greater productivity. Generative AI starts in the cloud, but the most significant opportunities are in the world’s largest industries where companies can realize trillions of dollars of productivity gains. It is an exciting time for Nvidia, our customers, partners, and the entire ecosystem to drive this generational shift in computing. We look forward to updating you on our progress next quarter.

Jensen Huang, CEO and co-founder, Nvidia, Q2 2024, 23 August 2023

If this isn’t wow what is! Against that the shares had roughly quintupled in around a year at the recent peak of $520 so the great fundamentals have hardly gone unnoticed. But it does make it tempting to use something like my Kamikaze for income strategy to load up into a falling price.

Option Traders Distort Reaction to Nvidia’s Incredible Results

This is especially so given that much of the weakness is technical.

Option traders and funds employing systematic strategies are firmly in control of the U.S. stock market, mitigating the impact of so-called fundamental news such as Nvidia’s latest blockbuster earnings report, according to a Goldman strategist.

To recap: after a huge rally Wednesday, Nvidia Corp. (NVDA) reported its earnings post-market and its stock price staged a sharp reversal on Thursday, dragging the rest of the market down with it, particularly the “Magnificent Seven” megacap technology stocks that have been integral to the 2023 rebound rally. The stock had closed above $500 a share on Wednesday but closed at around $470 on Thursday.

The company reported profits that were $2bn above the Wall Street consensus, and forecast revenue for the third-quarter that was more than $3bn above expectations.

This kind of volatility has left many professionals scratching their heads.

“I was pinged more times during [Thursday’s] market trading than any other trading day in my 20-year career on Wall Street,” said Scott Rubner, a managing director and a derivatives strategist at Goldman Sachs.

But according to Rubner, there’s a simple explanation: systematic funds and option traders are pushing the market around as liquidity has dried up during the typically slow month of August, which is also typically a weak month for U.S. equity returns, Dow Jones data show.

Meanwhile, option market makers have helped to amplify intraday swings instead of acting as a stabilizing force due to their growing exposure to customers buying contracts on the verge of expiration.

As a result, traders are operating in a “no rules” market, he said.

More recently, markets have been struggling to absorb a flood of selling from a class of systematic trend-following funds known as commodity trading advisers, or CTAs, he explained in the note.

MarketWatch, 25 Augusr 2023

Despite the huge rise in Nvidia shares since the beginning of the year the spectacular growth means the shares are actually becoming cheaper.

Shares in Nvidia NVDA have surged this year, buoying the entire stock market and lifting the S&P 500 and Nasdaq indexes as the chip maker became a key way to play the frenzy over artificial intelligence. Despite the gains, the latest earnings for the company mean that its valuation based on a critical metric has actually become more reasonable.

The forward price/earnings ratio, which measures a stock’s current price relative to earnings in the future, often in the next year, is a widely used way of tracking what a company may be worth and what people will pay for its stock. It shows Nvidia shares are now cheaper than they have been since Jan. 5, though the stock is up 250pc since then.

This is the math. Nvidia’s latest results, and particularly its outlook, were so good that analysts have significantly ramped up their forecasts for the company’s future earnings, which makes its forward P/E suddenly look much more attractive. As of July 31, the consensus call among analysts surveyed by FactSet was for earnings of $7.95 a share in fiscal 2024 and $11.53 in fiscal 2025.

By Friday morning, those EPS estimates had risen to $10.60 and $16.51 for 2024 and 2025, respectively. In turn, Nvidia’s forward P/E — the price relative to earnings expected over the next 12 months — has moved lower because the denominator in that ratio is much higher.

As a result, the stock looks cheaper. Much cheaper. Nvidia was trading at a forward P/E of 33.8 on Friday, down from above 43 before its earnings and at the lowest level since Jan. 5.

Similar conclusions can be drawn from Nvidia’s trailing P/E ratio — the price relative to earnings for the past 12 months. That is a metric that bearish traders may take more seriously because it doesn’t consider what could be hyped-up consensus estimates of future earnings.

Nvidia was trading at a trailing P/E of 113.8 on Friday, down from almost 245 on Wednesday, before the earnings. It was the lowest level since March 28, when the stock closed at $269.84. The shares opened above $502 on Thursday after its earnings, representing a rally of 86pc.

Valuation tools like forward or trailing P/E ratios aren’t the be-all and end-all of what stocks are worth, but they are a good starting point. And for investors trying to cut through the fog of post-earnings analysis, they offer a reminder that those who thought the stock was valued fairly in January may think the same thing now.

Barrons, 28 August 2023

Strategy – Time to Find a Cash Rich Friend

I am a gambler, always putting cash to work. Sometimes I win, sometimes I lose. Meanwhile the huge rise in interest rates is putting huge pressure on the cost of my interest only mortgages which have left me in the front line of the Bank of England’s drive to force down inflation. Three-quarters of the population are unaffected by this or, if they have cash in the bank, they may even benefit from it. I am being crucified.

Memo to the Governor of the Bank of England. Pleas stop picking on me. It is not my fault that inflation took off.

So I have come up with a plan. The best way to make my Kamikaze for Income strategy work is to have huge liquidity on the sidelines. My thinking is that a 20:1 ratio should deliver high returns with a low risk of loss.

Let’s imagine you put £5,000 in your spread betting account to buy £25,000 worth of stock. On the sidelines you have funds of £100,000 plus (20 times £5,000). Every time the stock falls enough to trigger a £500 plus margin call you top it up, which lowers the price at which you start to make profits. Every time you make £500-plus of profits you buy additional shares which increases your shareholding and lowers the percentage gain need to trigger the moment when your P&L account equals your Funds account (the moment when your cash invested has doubled in value).

You share the profits 50:50 with your cash-rich pal and start again every time you cash in and keep doing this ad infinitum. If this happens say four times a year you and your partner should soon be very happy bunnies.

Warning

This strategy is untested and I am not a great mathematician so it is still in beta. If you are nervous you can make the first investment very small, say £1,000 backed by £100,000 pounds which should be totally bullet proof. I am in favour of being a little more aggressive just now because Nvidia looks so exciting and such good value. The company is the king of AI and Generative AI. If the expected revolution happens it will surely play a starring role. The biggest risk is that AI is a damp squib but that seems most unlikely not just because so many experts are excited but because common sense suggests that it is indeed a hugely important development.

Share Recommendations

Nvidia NVDA. Buy @ $460

P.S. I am fed-up because the bizarre stock market reaction to Nvidia’s incredible results meant that I was sold out of three quarters of my holding (by two dollars in five minutes before the stock recovered) and need to rebuild.