Yesterday saw a huge rally when the inflation numbers came in better than expected. It doesn’t move the needle on my indicators. Could it be the bottom? Of course; one day there will be a rally and that will be the bottom. How can we tell? The way I do is by watching my indicators. These tell me to expect a turning point in March 2023 but that is not written in stone (see Strategy comments below). It is still my best expectation.

Bear in mind that in US markets especially there is a huge amount of short selling. This means that rallies can be explosive as shorts rush to cover their positions. As noted my indicators all point to the need for continuing caution.

There is a share which is presently looking interesting and that is Nasdaq Inc. The chart is shown above. The shares have been incredible long term performers and are doing well in the short term as well with both moving averages rising.

There is a massive something new happening at Nasdaq Inc., which makes the shares contenders to rise strongly as and when conditions improve. In 2017 Adena Friedman became the new CEO. I saw an interview with her and was very impressed. She has set out to reinvent the business.

I’ll begin today with a summary of the new corporate structure for Nasdaq that we announced during the quarter. The new structure organizes our business units into the following three divisions that align us more closely to the foundational shifts that are driving our strategic evolution.

Market Platforms led by Tal Cohen will include our North American and European market services as well as our market infrastructure technology business. The division will also include our digital assets and carbon markets businesses.

Capital Access platforms led by Nelson Griggs will combine our corporate platforms and investment intelligence businesses. And Anti-Financial Crime led by Jamie King, will include Verafin, our fraud detection and anti-money laundering solution, as well as our market and trade surveillance business.

Q3 2022, 19 October 2022

On 8 November the group held an analysts’ day. This was a very American affair with the main speaker, Adena Friedman, starting to speak at 8.05, two 10 minute breaks and all over by 12am, leaving guests able to return to work and put in a pretty full day.

What is the point of the new structure?

We believe the new structure will elevate our strategy and amplify our growth opportunities by allowing us to provide even more holistic solutions to our clients’ most complex challenges.

We view this as the next chapter in the strategic pivot that we launched five years ago, which solidified our focus on liquidity, transparency and integrity as the foundation of our strategic growth pillars.

Q3 2022, 19 October 2022

One analyst had this to say about what is happening at Nasdaq Inc.

The company just reported earnings, which came in higher than expected. The business transition away from a traditional transaction-focused company towards an asset-light technology company is going great, and I have little doubt that Nasdaq will continue to outperform both the Nasdaq Index and its industry peers.

Seeking Alpha, 20 October 2022

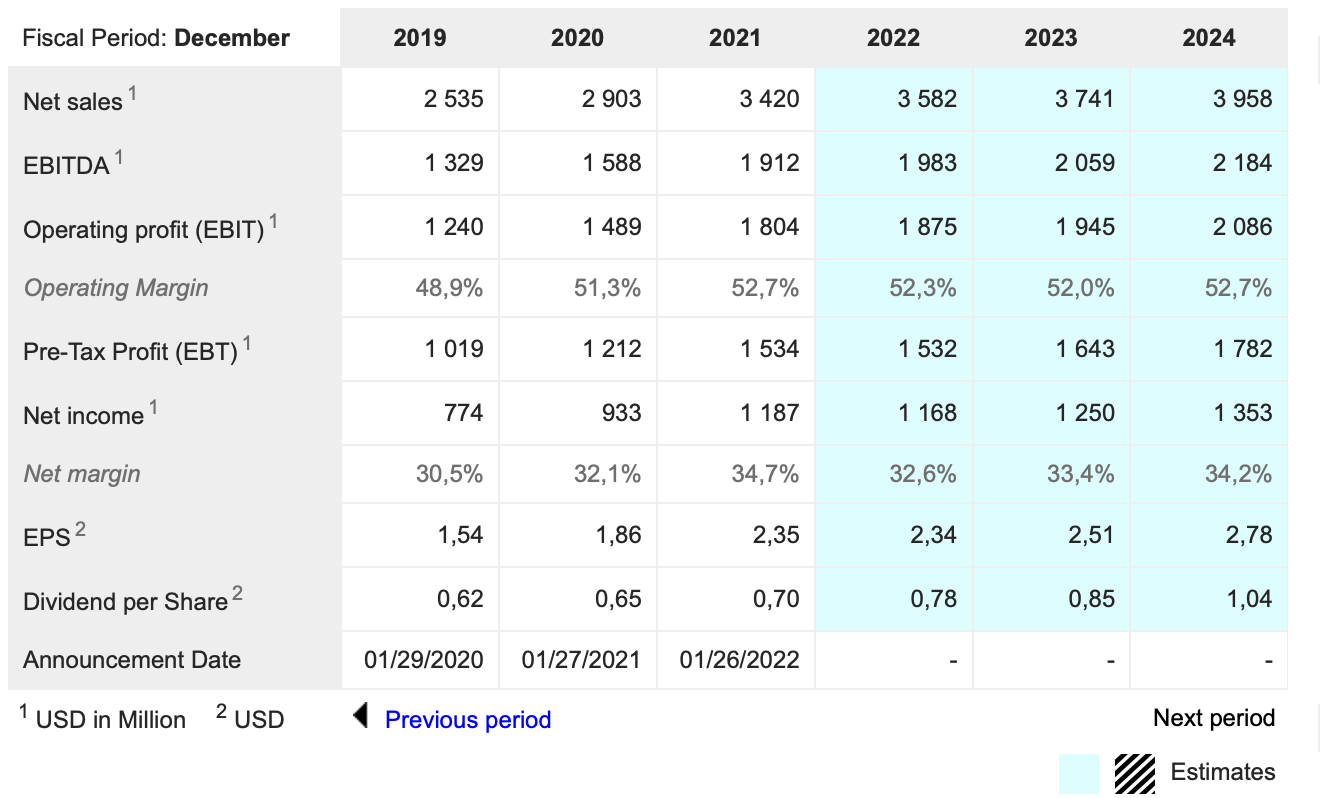

As can be seen from the table above Nasdaq Inc. is a highly profitable business with net profit margins of around 33pc which means roughly a third of revenue falls through to net profit. You can see this another way if you compare employee numbers to revenue. Nasdaq has 6,300 employees and expected 2022 revenue of $3,582m, which means each employee generates $569,000 of revenue. Employees would be the main cost item in a business like Nasdaq so even if they earn very well you can see why profitability is so high.

Apple generates an even higher £2.4m per employee but has much higher costs because the company needs to make, distribute and market its products so it ends up with a lower but still impressive profit margin around 24pc.

Given those high profit margins the key to success for Nasdaq is to drive strong growth in revenues. This can happen proactively with the company developing exciting new product areas like digital assets, carbon markets, fraud detection and anti money-laundering. It can also happen passively when financial markets are buoyant and activity levels are rising with more trades, more IPOs, more requirements for financial data and the like.

In this sense you could say that Nasdaq Inc is like a royalty on activity in financial markets and this is confirmed by looking at the chart, with the shares strong when markets are rising. Historically at least since 2010 the rise in Nasdaq shares has been broadly in line with the rise in the Nasdaq 100 index.

Presently the shares are outperforming the Nasdaq 100 and this may be in anticipation of the strategic pivot taking place under Ms Friedman to make the business more technology focussed to drive faster growth.

Strategy

If we look at rallies and reactions in the US market we can see that there is a pattern for sharp moves in any direction to quickly be at least partially reversed. This is what you would expect in a market like the US so dominated by day traders and algorithms. Time and again when shares spike sharply higher or lower there is an almost equally sharp reaction. In March 2022 OGIG shares sparked sharply down to a low of $31.25 and then rallied to a peak $39.87 in April before the decline resumed. We have just had another sharp downward spike followed by a sharp rally. On neither occasion did we see a convincing turnaround by the moving averages with both rising together and there is much to do before that happens now.

I have just done all the Coppock calculations for OGIG. Subscribers will remember that this is an ETF with many shares that are in the QV benchmarks list. Based on these calculations if the current price for OGIG is maintained the Coppock indicator will hit its maximum low point in November 2022 at minus 530.4, and start rising in December 2022. The conclusion is that we could be close to a new bull market in OGIG shares which would be an exciting development for the Quentinvest list of shares.

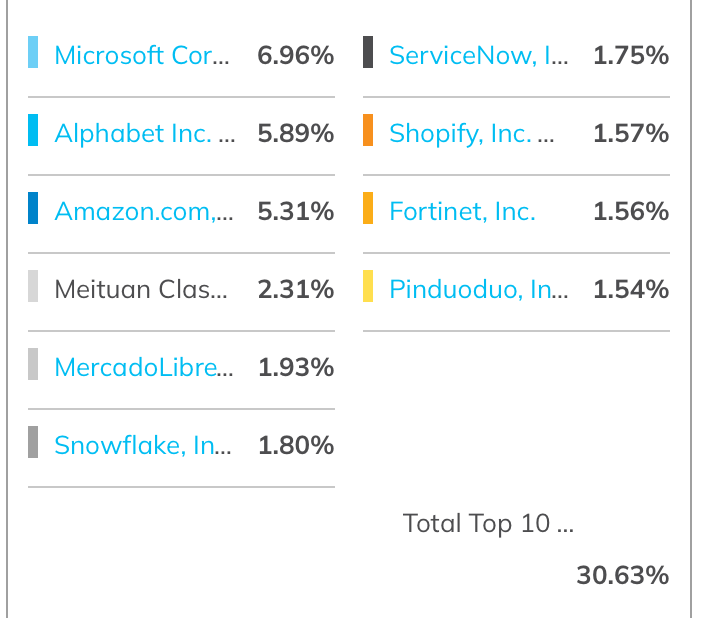

The top 10 OGIG holdings are listed below. They are all in the QV benchmarks list as are many other holdings in the portfolio. In effect OGIG seems to have followed a Never Sell strategy which has led to a dramatic decline in the share price but leaves them now poised for a recovery.

Given what we can see may be happening on the Coppock front this would make a golden cross on the moving averages and a trend line break exciting developments and have me hunting for buy signals on the QV benchmark list.

Once we do start seeing strong buy signals it will be time to talk more about my ideas for how subscribers can best profit from those signals. It is not so surprising that OGIG is showing signs of turning higher before the broader indices because the portfolio is around 80pc technology and that is the sector which has borne the brunt of the selling. Peak to trough OGIG shares are down 66.6pc which compares with the Nasdaq 100, down 38pc and the S&P 500, down 27.5pc.

New bull market starting in December 2022; how about that for unexpected!