Here is the kryptonite killing US shares. The most explosive rise in long bond yields in history from 0.333pc to 4.955pc. The only time when yields were higher, rising to a staggering 15.7pc was during the inflation era which ran from the mid-1960s to around the turn of the millennium although inflation fell fairly steadily through the 1980s and 1990s courtesy of the economic policies followed by Thatcher and Reagan and the shift to independent central banks.

This is going way back for most people but when the Second World War ended the big worry was that like in the depressed 1930s demand would be deficient. This led to an enthusiastic adoption of Keynesian policies by which the government was to step in and keep demand high leading to full employment in sharp contrast to the unemployment queues of the 1930s.

It worked well initially but allowing politicians to pour fuel on the flames of the economy every time an election was looming was a recipe for disaster and sure enough in the 1960s inflation began to take off. Eventually the beast was slain or was it? Years of easy money, low interest rates and quantitative easing have reawoken the beast half a century later.

Initially it was asset prices that benefited and share and property prices marched higher but as the authorities and the bond markets have reacted we have seen a crunch for shares and to some extent for property. The authorities on both sides of the Atlantic want inflation to settle down below two per cent. Bond markets seem to have decided that this is going to require long bond yields of at least five per cent, maybe higher.

As a result shares, especially growth shares are reeling. We have had a rally in 2023 after a dismal 2022 but it never really felt like a bull market and now that rally seems to have run out of steam. Shares like Microsoft and ServiceNow are still reporting great results but there is no sign that this will do much more than trigger share price rallies and consolidations.

Artificial intelligence is causing great excitement which looks very much justified but progress may prove to be more of a slow burn than investors currently imagine. Even Nvidia, which has been leading the charge and reporting incredible results has a wobbly looking chart with a dead cross on the monthly moving averages.

My benchmark charts are almost all heading lower now with holdouts being such shares as the obesity drug pair, Eli Lilley and Novo Nordisk.

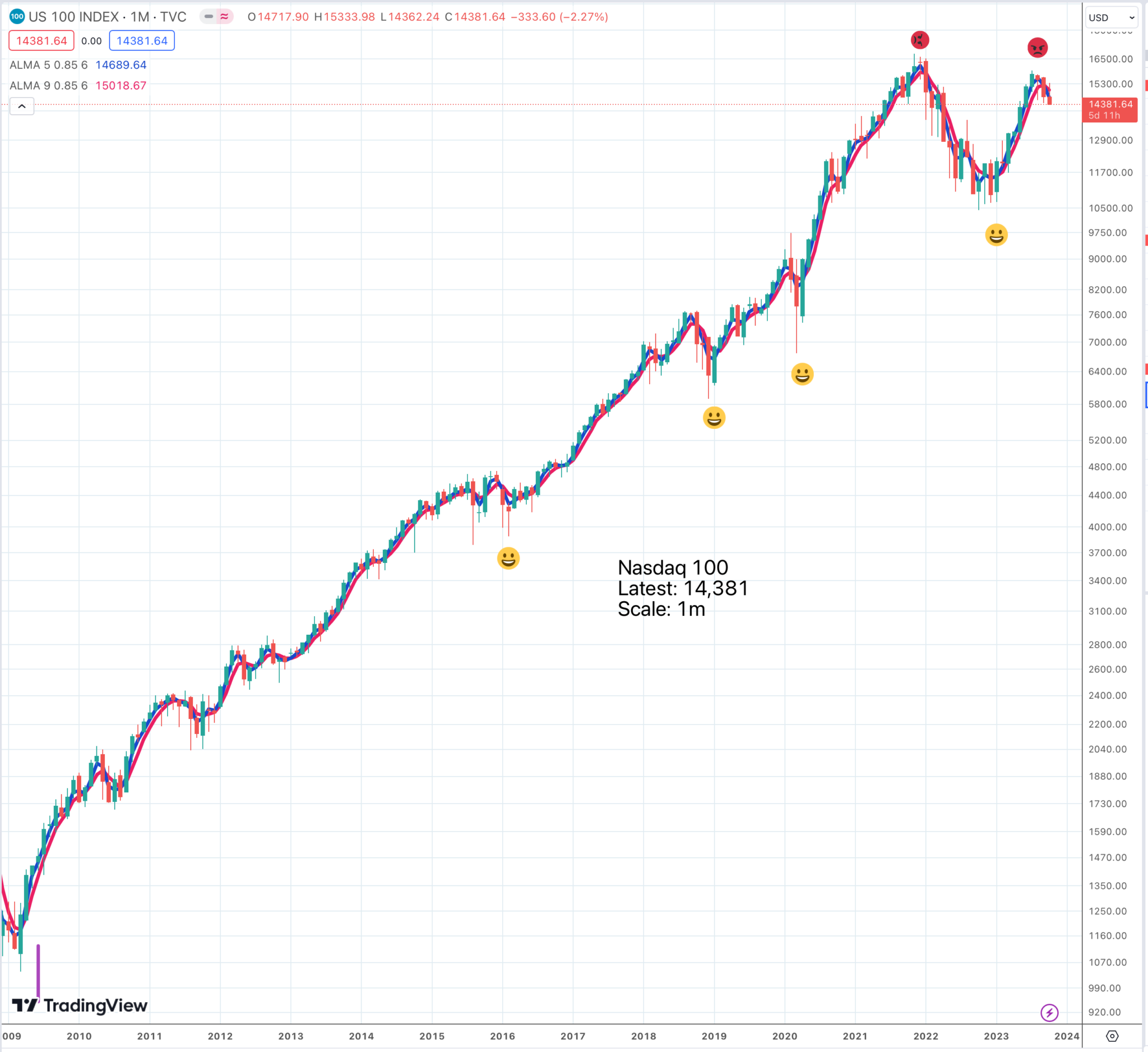

Above is a chart of the Nasdaq 100, which is heavily dominated by the performance of the mega caps. My old chartist friend, the late Eustace Storey, would probably look at this chart and call it a double top. If that is what it is there could be trouble ahead. What kind of trouble I don’t exactly know but we now have two wars raging in the world and the Israelis, understandably, are not looking to make friends in the Middle East so a wider war looks very possible.

And these are proxy wars. Democracies are fighting for the little guys and the tyrannies are biased against them. Incidentally it is striking how keen protesters are to speak up for Palestine but not a cheep about the Jews including women, children and babies who have been killed in the most despicable way. If Hamas behaved like an army and not a horde of hate-filled thugs they might be treated as such by other observers than the BBC. Anti-semitism just won’t go away and seems to appeal to extremists on both left and right of the political parties.

It is going to be an interesting test for Kier Starmer given the strong pro-Palestinian bias in parts of the Labour Party. As I grow older I find politics increasingly bizarre. Voters may be unhappy after the long years under the Tories but Starmer has not given the slightest indication that he has any solutions beyond tired old mantras that have been around the block so many times. All Labour seem to offer is new faces. How sad that such an empty reason can decide an election, especially when Rishi Sunak is act rally a newer face and as far as I can tell a more impressive individual than Starmer whose only claim to fame is that he is not Jeremy Corbyn and even that was hardly apparent when Corbyn was the leader.

Most Politicians Make Things Worse – Discuss

My advice to the politicians is leave us alone, stop meddling and give power back to individuals, especially over their own money. They know much better what to do with it than you do and there is nothing more exciting than a country and an economy that favours opportunity over everything else.

Liu Truss was right in a way. If you wait for the perfect opportunity to make a bonfire of all those wretched taxes that clog up the wheels of commerce you may never do it. My government would commit to remove at least one major tax burden every year and the job of government would be to fund its obligations with the money it had, not just raise taxes every time it needed more cash.

I think many people, not just among the middle classes but anyone with a shred of ambition, would vote for a commitment like that and it would introduce some serious excitement into the political process. Imagine on a six year view – no inheritance tax, no stamp duty, no VAT, no higher rate tax bands, no capital gains tax, no income tax! The economy would go ballistic and the Labour Party in its present form would cease to exist. It worked well for the Victorians who ruled the world and virtually created the modern middle class.

Just look how much of modern London was built by them. And it would make the UK a magnet for ambitious people and capital from all over the world; that would be a reason for Brexit! Instead we have the poor old FTSE 100 which has gone nowhere for 25 years. Shame on you guys. It must be possible to do better.

Any CEO who turned in a performance like this would have been replaced years ago and somebody with real talent would have been found to inaugurate a root and branch overhaul of an enterprise that was so completely failing to deliver results.

And imagine what AI could do to empower individuals in this low tax world and how exciting it would be to go to work knowing that you could keep everything you earned and acquire and dispose of assets with no tax on the gains. Accountancy would virtually disappear as a profession but that would be no bad thing.

The Government would be broke but does even that matter. They would have to start learning to live within their means and presenting their much slimmed accounts in a way that people could understand (X raised in taxes, Y spent on consumption and Z invested in a better future).

This whole fuss over HS2 is a case in point. It shouldn’t bee anything to do with the government. IF is mainly about winning votes and not about a decent on capital don’t do it and especially don’t use fraud to pretend it is a good idea.

People imagine we need a fortune for the NHS and to distribute to the ‘poor’. I don’t believe we do. Sell the NHS and let somebody else have a go. They could hardly do worse and there is no reason why an insured system has to be unaffordable. I don’t see anyone in the world eager to copy the NHS which is a byword for inefficiency. And what happens if we don’t pay the so-called poor. Let’s find out.

There are people who need help but not half the population. Try getting a job guys and girls. It worked for me. In London I see job offers and help wanted ads everywhere I look.

The only place that was run on these lines (virtually no taxes) was Hong Kong, until the dead hand of mainland China arrive and what a success story HK was – no unemployment pay, no unemployment, incredible growth and a magnet for highly qualified immigrants!

Maybe we are learning why democracy has not become the go-to political system around the world because it is a form for slow decay and the UK may have reached a critical stage where if the decay is not arrested it will start to accelerate.

Strategy – Head for the Hills with a Rifle and Plenty of Baked Beans.

If global warming doesn’t get you the politicians will. I hope I am not being too pessimistic but sometimes I think it has been all downhill for the UK since Thatcher. The saving grace has been technology and the introduction of a gigantic Chinese labour force into the global economy. Maybe these effects are starting to wear off and the contradictions that are emerging in democratic capitalism are finding expression in rising inflationary pressures, which is why bond markets are unable to settle.

Just as a completely irrelevant aside Linda Kronstadt, born in 1946, is an almost exact contemporary of mine yet it is only now that I realise what a staggering singer this woman was. I have been checking her out and as I expected there is a huge Mexican influence. Her grandfather was a Mexican band leader and her father loved Mexican songs as do I. Her album, Canciones de mi Padre, sold 3m copies and became the best selling non-English language album in American history. In total she sold 50m albums; that compares with over 162m by Elvis but then he was something else again. The message is that she is incredible. One of the great voices in pop history.

This chart of a leveraged technology focused ETF, looks bearish. There is no clue as to how far it might fall although it is by its nature very volatile. I think what we may be seeing is the need for more consolidation before a new bull market can get under way. We had a huge bull run from 2009 to 2021, a rise over some 12 years of 455 times!!! It would not be too surprising if we got carried away, especially with interest rates falling close to or even below zero across the developed world at the end of the period.

In retrospect we can see that it was a perfect storm of bullishness, especially with more. brokers selling shares on credit. It may take a while to consolidate those gains and at the moment shares seem to be consolidating downwards.