OGIG – a perfect example of what makes ETFs such exciting investments

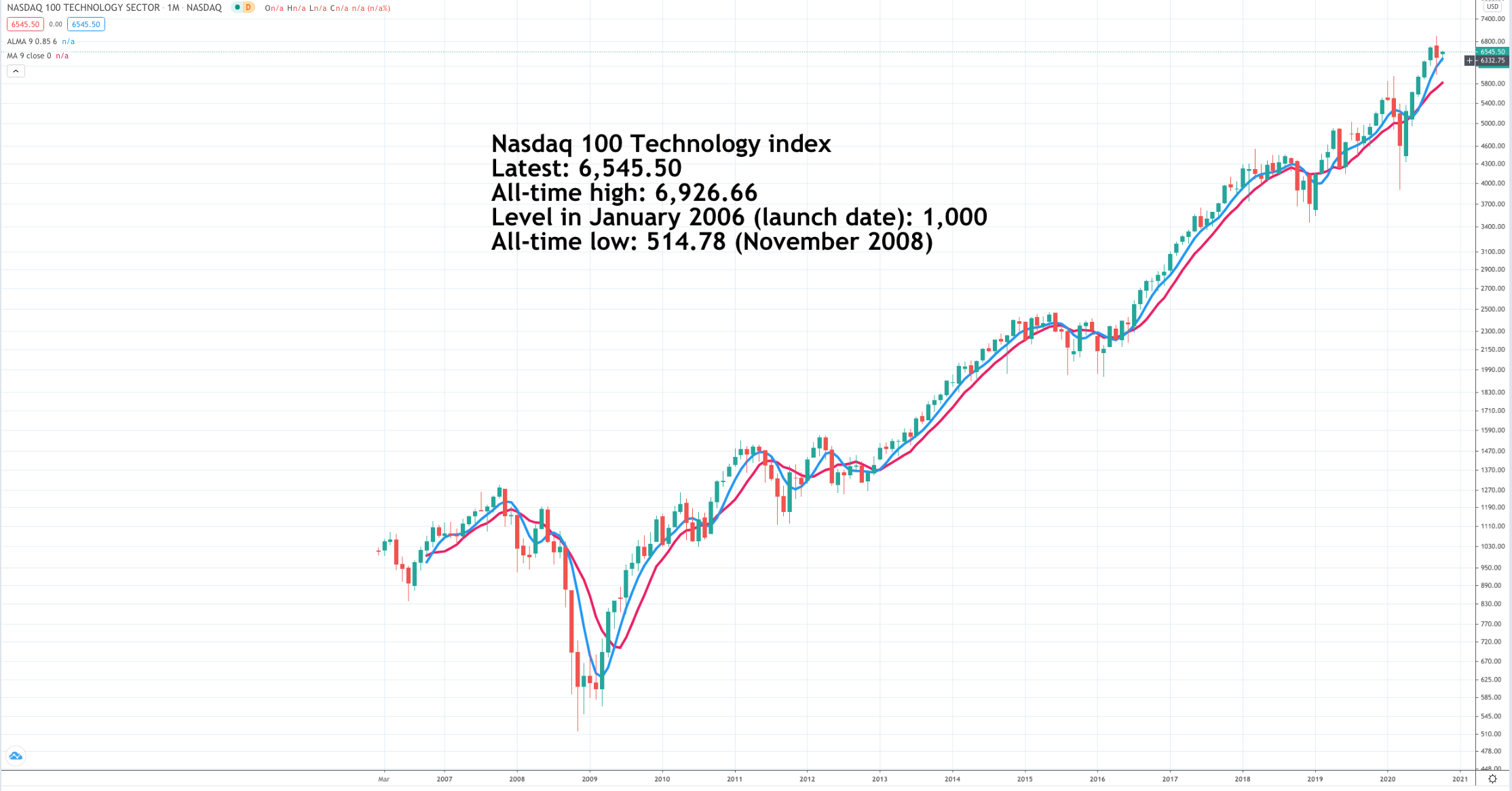

The Nasdaq Technology index is both a great performer and a great example of why investing in US technology shares is such a good idea. Since launch in 2006 it is up around 550pc and more than 10-fold from the low point of the 2008 bear market. The biggest difference between this index and the Nasdaq 100 is that it is equal weighted, whereas the Nasdaq 100 is dominated by a handful of huge cap high performers. I was surprised to find this has not made much difference to performance. They have both done well. Since January 2006 the Nasdaq 100 is up around 600pc. It looks better because it has been around longer and is up 100-fold since the mid 1980s.

Even so, whatever either of these indices does, I think OGIG will do better. I first alerted OGIG on 1 June 2020 at $34. They are currently $45.88, a rise of 34.9pc. Over the same period the Nasdaq 100 Technology index is up 17.3pc and the Nasdaq 100 is up 21.0pc. If you think technology shares are going to keep performing strongly, as I do, then OGIG is a must-own investment.

OGIG is an unusual ETF in that it is actively managed according to a set of investment rules devised by the managers. Most ETFs are passive funds, which track an index. Technically OGIG is what is known as a rules-based ETF. It’s full name is the O’shares Global Internet Giants ETF. It was founded by a guy called Kevin O’Leary who looks and sounds as Irish as his name. One of his reasons for setting up the fund was dissatisfaction with some of the technology-based indices, which do not include stocks like Amazon but instead treat them as consumer stocks.

I have had a look at the OGIG portfolio. It is fantastic. His approach is very similar to mine. The portfolio is stuffed with exciting stocks, which you may never have heard of unless you follow my share-based publications. In that case you will know almost all of them and understand immediately why I like this ETF so much.

The basic rules are that it is all about global technology and high quality growth (just like my publications). He defines technology more broadly so it does include businesses like Amazon. Growth he judges primarily by revenue growth since so many of the world’s fastest growing companies are targeting sales rather than profits in the early years of what I call the battle for territory. Quality he judges by cash burn. Again Amazon is a good example. It is not yet highly profitable but it generates a phenomenal amount of cash. This is a good strategy in part because it keeps your tax bills low much to the fury of governments all around the world.

Below is a screenshot from the QV for ETFs table relating to OGIG. It started as a new entry (NE) when I first became aware of its existence. It then quickly featured as an alert and is now being alerted for the fifth time. This ties in with my £/$-cost averaging approach to making money from ETFs. When you find a good one you should buy again and again including after periods of weakness. Ideally, as here, the recommendations come at steadily higher prices but I do try to take advantage of overall market setbacks to add to positions; that is how £/$-cost averaging works. The price on the far right is the all-time high. All prices are in US$ and the change is in per cent.

ETFs have the huge advantage for regular investment programmes that they don’t go bust and they are regularly rebalanced around the best performers.

The second table below gives you a flavour of the OGIG portfolio with the top 15 holdings. All of the top 11 are in the QV for Shares portfolio.

OGIG is a perfect buy and hold investment, perfect for regular investment programmes and seriously exciting. Buy some shares and you instantly have an adrenaline-fulled portfolio of the world’s fastest growth technology-focused businesses. This is a forward looking portfolio. Its present day value comes from the long-term growth potential of the constituent businesses. In this sense it is not for the faint-hearted. There will be periods of considerable volatility.

My view is that the best way to deal with risk is to accept it. I am totally happy to invest in risky shares as long as they have what OGIG is looking for, high quality as businesses and great growth potential. To use a motoring analogy the shares in this portfolio and the shares I like are the Formula 1 performers on the equity circuit, the ones that are likely to win because they are going the fastest. This is investing with the pedal pressed to the floor.

Because of this underlying emphasis on quality, real quality, reflecting the ambition, talent and dedication of some of the world’s most impressive management teams, I think that ultimately these seemingly risky investments are actually the safest way to preserve and grow your capital over time.

So my answer to the question – is OGIG a suitable investment for widows and orphans is yes, especially if they follow a regular investing programme.

P.S. I am sending this alert via Mailchimp and posting it on the new web site to make sure everybody receives it.