This has got the makings of a spectacular chart. We have a broken trend line and a golden cross by the moving averages. The Coppock indicator is down from a peak plus 594 to minus 121 and is showing signs of turning higher. We also have an eight month pattern with the price meeting resistance around $70. If we see a strong breakthrough to say $80 that would be a powerful buy signal and they already have a 2B buy signal as mentioned in earlier alerts. Chinese shares have been volatile recently but the bull case remains intact both on the charts and with the fundamentals.

One of the great things about Chinese shares quoted on Nasdaq and in Hong Kong is that you don’t have to learn Chinese to find out what is going on because they report in English although perhaps not exactly English as we know it.

Helped by continuing growth in revenues and a much slower increase in costs latest reported profits exploded. Sales rose 39pc to $4.7bn, while operating profits soared by 335pc to $1.3bn. The company had this to say:

“We saw a recovery in consumer sentiment in the second quarter especially during the 618 shopping festival, a reflection of the resilience of overall consumption,” said Mr. Lei Chen, Chairman and Chief Executive Officer of Pinduoduo. “We remain committed to building a platform that serves as a force for good.”

“The postponement of certain projects and lower business-related expenses during the first half of the quarter affected overall expenses in short term,” said Ms. Jun Liu, VP of Finance of Pinduoduo. “Looking ahead, we stay dedicated to investing in areas such as agriculture and R&D to better serve our consumers.”

Q2 2022, 29 August 2022

Pinduoduo is leading a revolution in the way Chinese farmers engage with consumers.

Pinduoduo’s digital platform has helped millions of consumers discover new agricultural specialties. Millions of farmers now have the opportunity to boost their incomes through direct access to a wider consumer market. The increased transparency and communication channel have led to more productive planning and coordination in food production and distribution.

Investor relations website

These are serious numbers. Founded in 2015, Pinduoduo has grown to become a major digital platform with more than 880m users. More than 16m farmers have connected to the digital economy through the platform. And look at that launch date. Pinduoduo has only been in existence for seven years!

Pinduoduo is like a Tesla of farming.

The company has been organizing annual Smart Agriculture Competitions since 2020 that challenge data scientists and agricultural researchers to develop practical precision farming technology as part of efforts to promote sustainable, innovation-led growth in agriculture.

Website

I eat tomatoes every day. The tomato market is huge, growing fast, especially in Asia Pacific and is worth maybe $200bn. Pinduoduo is helping research into making cheaper, more nutritious tomatoes.

Pinduoduo, China’s largest agricultural platform, has teamed up with Wageningen University & Research (WUR) of the Netherlands to study ways to improve the quality of greenhouse-grown tomatoes.

WUR is widely regarded as one of the world’s top agricultural research institutions. The study will experiment with varying levels of nutrient concentration and lighting in high-tech greenhouses to improve the quality of fruit without compromising on the output.

The WUR study is the latest agricultural research collaboration by Pinduoduo, which has worked with leading global research institutes to advance food and agricultural science. Pinduoduo has made it a strategic priority to promote agricultural modernisation using technology.

26 April 2022

Pinduoduo is perfect for the new wave investor. You can make money and save the world at the same time.

Investors love it when companies beat expectations.

Prior to the start of trading, Pinduoduo said that it earned the equivalent of 93 cents a share, on revenue of $4.7B, for the quarter that ended June 30. Pinduoduo’s results blew past Wall Street’s expectations for a profit of 41 cents a share, on $3.44B in revenue.

Seeking Alpha, 29 August 2022

Strategy

Pinduoduo is one of my favourite US-quoted Chinese shares. What they have achieved in seven years is staggering and the company feels like a real player in e-commerce and technology growing fast by providing great services to customers and producers. What they are doing in agriculture looks trail-blazing. The world needs companies like Pinduoduo.

If you look carefully at the chart pattern you can see a head and shoulders (technically a reversed head and shoulders) with a neckline around $70. A powerful breakout through that line should see the shares heading all the way up to the old peak around $200.

There are many ways to play this stock. You could wait for that breakout. You could buy now. You could accumulate the shares starting now. You could wait for the Coppock indicator to turn higher before buying or some mixture of all those strategies.

The great thing is that both technically and fundamentally Pinduoduo is performing well and given what they have achieved in seven years it is easy to predict an exciting future. A customer base of 880m consumers is awesome and will surely offer huge opportunities going forward.

A market value of $72bn may seem like a lot but in the grand scheme of things may turn out to be a modest figure in relation to where this business could be going.

In relation to buying anything I would just caution that the chart for the US Treasury 10 year government bond yield still looks alarmingly poised.

The Pinduoduo chart vividly exemplifies Buffett’s point about investors being manic depressives. In the last 19 months the price has ranged between $223 and $23 and is currently around $67. The story hasn’t changed. It certainly hasn’t got worse. The performance has been affected by the macro environment but the business remains excitingly high growth.

As well as growing strongly Pinduoduo is sitting on a lot of cash. Their web site has crashed so I wasn’t able to check but I think we are talking about something like $17bn, which gives them great flexibility going forward. This is definitely an exciting business in which to invest either now, after buy signals or if we get some dramatic down days as a result of rising US bond yields.

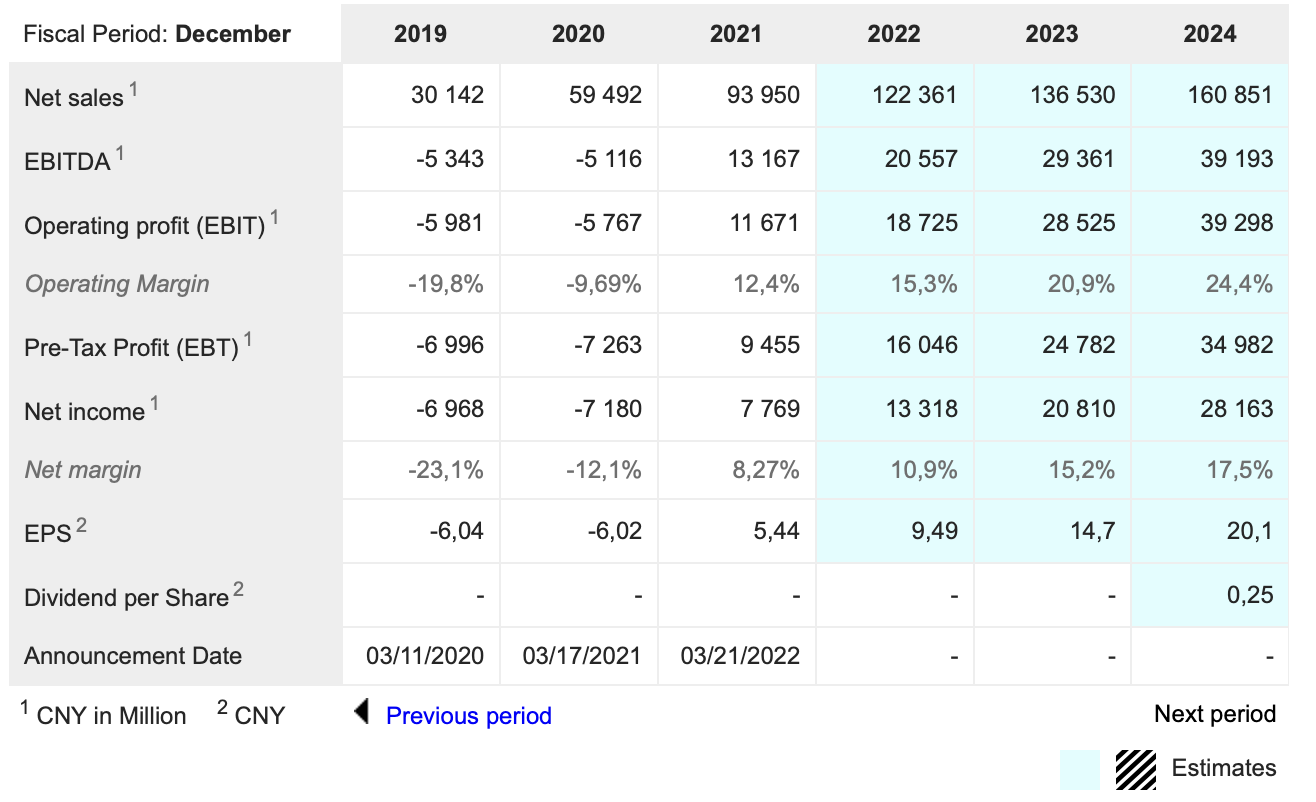

The estimates in the table below are not written in stone. They are just best guesses by the analysts but give the flavour of where the business is going.