Valuation bubble pricked by rising interest rates and exploding commodities

I have two publications, Great Stocks and Great Charts, which used to be printed but are now online. As the names suggest one focuses on fundamentals, the other on charts.The problem at the moment is that nobody is interested in fundamentals. It is all about the charts which look terrible. I look at growth stocks and virtually all of those are in decline. This is taking place in such an across the board fashion that it suggests a generalised rerating downwards for shares in fast-growing companies. This happens sometimes and it is not a great time to be buying shares, not my kind of shares anyhow. Oil and commodity shares are doing well and may yet do much better but I don’t follow them.

A derating of shares is not so unreasonable. The spectacular share price boom we enjoyed between 2009 and November 2021 was part strong growth in sales and profits and part rerating. This combination is very powerful in driving shares higher and logic says that at some point values will get too high. It seems that happened in the latter part of last year and now prices for growth shares, almost across the board are trending lower.

Once this starts to happen fundamentals for particular companies cease to be useful for determining where share prices are going to go and the emphasis switches almost entirely to charts which as noted do not look good.

Our present stance at Quentinvest is that this is a market from which to stand aside. There is a positive aspect to this because shares in many companies are rapidly becoming cheaper and at some point this process is likely to overshoot on the downside. Once this happens and we get chart buy signals joining up with strong fundamentals, the full 3G effect, shares should be able to make good progress.

In a nutshell this is a market where it makes sense to watch and wait. We are seeing periodic strong rallies but that is a characteristic of bear markets as short sellers rush to cover their positions. It is possible to lose a lot of money chasing rallies and I am very hopeful that at Quentinvest we will be able to tell you when this market turns higher for real.

There are a number of indicators we use to do this. One is the balance of shares and ETFs in uptrends v shares in downtrends. We are also looking at not just national indices but sector indices to further improve are understanding of what is happening in the market.

Last but not least are the Coppock indicators I look at which have an extraordinary record of success in spotting market bottoms or soon after. At the moment almost all the Coppock indicators we are plotting are falling, which is anther reason why investors should not be making new commitments.

I don’t think the bear trend is all about Putin and Ukraine. Even before he attacked that country commodity and energy prices were rising, inflation and interest rates were moving higher and there are widespread shortages. These are all negatives for non-commodity related shares. Putin’s behaviour is clearly alarming since he seems to be painting himself into a corner. Even if he wins in Ukraine he is doing this at the cost of a massive hit to the Russian economy. And he may not win. Who ever thought the Americans would be unable to win in places like Vietnam and Afghanistan but it is hard to persuade attacking soldiers to die whereas soldiers defending their homeland fight like tigers. Even football teams are more likely to win playing at home.

One of Warren Buffett’s key strategies is to buy shares in great companies, when temporary bad news poleaxes the shares. IT consultancy, Epam Systems is a wonderful business that has grown dramatically by using a high quality workforce mainly based in central and Eastern Europe to provide services to enterprises and organisations based in North America and other western countries. This strategy has put it in the front line of the war with 14,000 employees, around a quarter of the total, based in Ukraine.

As a result the company has had to withdraw its guidance on sales and profits and the shares plunged by 45 per cent in one day. I am not recommending the shares here because who knows how bad the situation might become but at some point it seems likely that there is going to be an opportunity to buy the shares at a good price.

This is part of a noticeable pattern in today’s stock markets. Good news sends shares higher but often the rallies are short lived or at least some of the gains are subsequently lost. By contrast, bad news has a devastating impact and the shares may continue to fall.

The current carnage may also have something to do with Covid-19 which kept people at home unable to spend money leading to a build up of savings at the very moment when a home based economy saw an explosion in e-commerce and digital transformation. This perfect storm driving share prices of technology companies higher is no longer working and we are seeing a violent correction.

In some four months Shopify, a poster child for a geek-led, explosively fast-growing technology business has seen its shares lose 68.6pc of its value. Not a lot has changed on the fundamentals though investors are worried about the cost to the company of building out a fulfilment network. The problem is the valuation which is still $74bn versus expected sales for 2022 of around $6bn. Growth investors are running shy but there is nothing here yet for value investors.

The stocks that are holding up by far the best are the megacaps like Apple, Microsoft, Alphabet and Amazon although even their charts are in downtrends so buying does not look advisable. Both Alphabet and Amazon have announced 20:1 share price splits which should give a big boost to the shares one day by making them more accessible to retail investors.

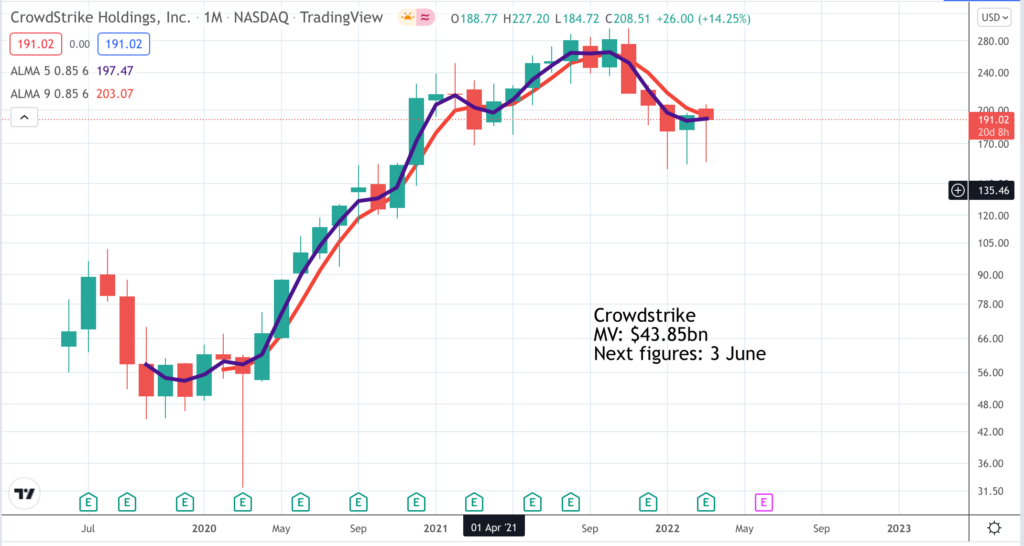

Crowdstrike CRWD. Buy @ $191. Times recommended: 19 First recommended: $92 Last recommended: $276.50 Lowest recommended: $51 Highest recommended: $286

Talking about prospects Crowdstrike CFO asks analysts if they can hear the excitement in management’s voices

Before I start writing about Crowdstrike I want to set the scene. The ideal time to buy a share is when the national index, the sector index and the individual stock in question all have strong charts pointing higher. At the moment none of these conditions is fulfilled though the Crowdstrike chart may be on the turn. I am writing about it purely because it is a superb business and the shares surely will be a strong buy at some point. I am also influenced by the fact that the mad Russian has a history of using cyber war as a tactic and Crowdstrike is brilliant at identifying and negating such attacks.

The latest results from the business were incredible.

“First, CrowdStrike delivered an exceptional fourth quarter that far exceeded our expectations. This quarter’s results are headlined by an acceleration in net new ARR [annual recurring revenue] growth for the second consecutive quarter to reach $217m. Record 19pc non-GAAP operating margin and record free cash flow of $127m or approximately $197m when excluding the IP transfer tax payment related to the acquisition of Humio. Second, our success outside of traditional endpoint security is now punctuated by both scale and hypergrowth as we surpassed the $150m ARR milestone, while growing in excess of 100pc year over year for our IT hygiene, vulnerability management, identity protection and log management modules collectively. Third, we exited the year with tremendous momentum for ARR derived from Falcon deployments in the public cloud, where ARR eclipsed the $100m milestone and grew 20pc quarter on quarter as we lead the effort to transform security for the public cloud. And fourth, as you can see from our outstanding results, our growth engine is executing on all cylinders, which includes our thriving partner ecosystem.“

Just fantastic results! If this was a private company I am sure you would want a piece of the action at almost any price.

The company also has a strong partnership with AWS, Amazon Web Services, the cloud services business that has become such a behemoth for Amazon.

“One partner, I’d like to highlight is AWS. In fiscal 2022, ending ARR transacted through the AWS marketplace grew more than 100pc year over year. Furthermore, CrowdStrike ended the year as one of the top ISV [independent software vendor] partners by transaction volume on the AWS Marketplace, with partner source deals growing strongly throughout the year. We believe this speaks to the success of our partnership with the world’s largest public cloud provider and highlights the value we can provide to both partners and customers alike.”

In discussing the results CEO and co-founder, George Kurtz, noted:-

“Growth was also fuelled by rapid customer expansion among companies of all sizes from large enterprises to small businesses.”

I was also intrigued to notice that another of my favourite companies became a customer during the last quarter.

“And lastly, we are thrilled to announce that Cloudflare, a trusted CrowdStrike technology partner, on a mission to build a better Internet, became a new customer in the quarter, adopting both Falcon Complete and Horizon.”

Crowdstrike is not lacking in confidence.

“In total, for fiscal year 2022, we gained significant leverage from our partner ecosystem. During the year, partner stores ending ARR grew 83pc year over year with our MSSP [managed security services providers] business growing more than 200pc. Our architecture is fundamentally different from any other vendor we see in the market. While our technology advantages are vast, it all starts with how we design the platform from the beginning with smart filtering capabilities on the agent, which gives us the ability to dynamically adjust our aperture to stream rich telemetry to the cloud in real time.”

Don’t ask me what that last bit means but it sounds good.

Everywhere you look Crowdstrike has powerful engines driving growth.

“You have heard me say that CrowdStrike is more than just an endpoint provider. The success of our platform strategy is reflected in the hypergrowth we are deriving from many of our modules, as well as our strong module adoption metrics, which have consistently increased quarter after quarter. In Q4, subscription customers with four or more, five or more and six or more modules increased to 69pc, 57pc and 34pc, respectively. As both new and existing customers increasingly trust Falcon to solve security challenges outside of core endpoint, we have multiple product areas contributing significantly to ARR growth.”

It must be so exciting being the CEO of Crowdstrike or indeed working for the company in any capacity. Everywhere you look they are doing incredibly well. Although I wish they didn’t use so many acronyms. You need a translator.

“Our success to date in these adjacent areas speaks to the extensibility of our platform outside of core next-gen AV [antivirus] and EDR [endpoint detection and response], the data we collect and our ability to make meaningful inroads in accessing new TAMs [total addressable markets]. Changing from a module perspective to a deployment environment view, our public cloud business surpassed the $100m milestone in Q4 to reach $106m in ending ARR. This milestone encompasses our modules deployed in the public cloud, including our cloud runtime protection and CSPM [cloud security posture management] modules. We have seen tremendous momentum in this business as we exit the year.“

Crowdstrike talks a lot about endpoint detection which is no doubt clear to them but less so to others. This is one definition I found.

“Endpoint detection and response (EDR), also known as endpoint threat detection and response (ETDR), is an integrated endpoint security solution that combines real-time continuous monitoring and collection of endpoint data with rules-based automated response and analysis capabilities. The term was suggested by Anton Chuvakin at Gartner to describe emerging security systems that detect and investigate suspicious activities on hosts and endpoints, employing a high degree of automation to enable security teams to quickly identify and respond to threats.”

The truth is that Crowdstrike uses very advanced technology to do what they do and I don’t have a clue how they do it. What I can see is that whatever they do they do it very well and people who do understand these things are impressed.

Crowdstrike’s problem, like other great companies in this market, is that it is a sensational company with a valuation to match. One analyst had this to say.

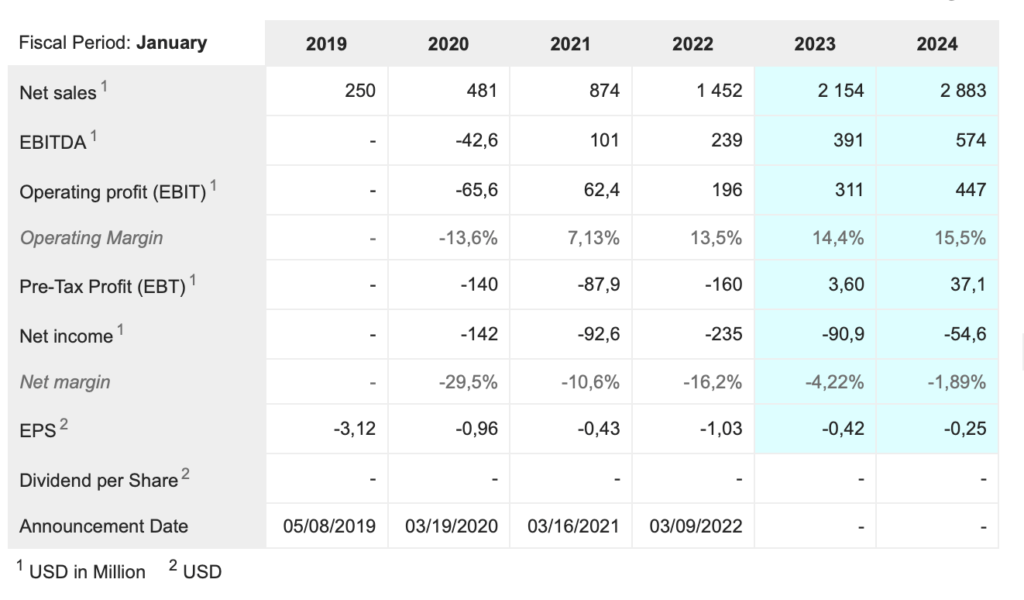

“CrowdStrike is a rare gem in the SaaS [software as a service] space. The company is a technology leader in a fast-growing market and will likely continue to take share from industry incumbents. There’s nothing to dislike about the business and the industry, but there’s everything to be concerned about the company’s valuation given current market conditions. For calendar 2022, management is guiding $2.15 billion in revenue (+48pc YoY / above +38pc consensus) and non-GAAP EPS of $1.03 to $1.13. This comes down to a forward EV/sales of 20x (vs. 3-yr high/low of 75x/13x) and a forward P/E of 176x.”

It is a high valuation but it looks fair to me. Anything much lower and the shares start to look cheap. This is one of the most exciting businesses in the world. What is that worth? Surely – a lot!

The big picture is that Crowdstrike could become an industry giant given the strength of the tailwinds driving growth in cyber security.

“There are powerful tailwinds driving our markets, and we do not currently see any indication that these trends will abate anytime soon. The adversaries are certainly not slowing down, actually quite the opposite. As we’ve published in our most recent global threat report, 2021 provided no rest for the weary with an 82pc increase in ransomware-related data leaks. As the nation’s state events of the past few weeks have demonstrated, cyberspace is centre stage joining land, air, sea, and space as the fifth dimension of warfare. There are no borders in cyberspace and the cyber blast radius has no bounds, putting every organisation and government at risk as attacks can extend far beyond their intended targets as we saw with NotPetya.“

NotPetya and Petya are forms of ransomeware that were used in a series of malware attacks in Ukraine in 2017 and in other countries later.

Just as an aside I am starting to think of Putin as Sauron in the Lord of the Rings books as what Reagan called the evil empire starts to rise again in the East. Maybe Crowdstrike has a bit of Gandalf. Let’s hope so. We need some wizards to help us in this battle.

How many companies can talk about an outlook like this.

“Additionally, the attack surface is expanding rapidly and the digital supply chain is ever growing as organisations embrace digital transformation and move more workloads to the cloud. We believe our TAM continues to expand, and all of these factors will lead to sustained market growth for the foreseeable future. We also continue to see a very favorable competitive environment and multi-year runway to displacing legacy endpoint vendors, which is bolstering our growth as companies look to transform their security stack.”

The company has so many opportunities.

“In addition to our growing leadership in the EPP [endpoint protection market] market, we now have multiple vectors driving our growth and scale that are outside what some might consider our core. We have been very deliberate and purposeful in choosing to enter markets. Enterprise risk is coalescing around three critical areas: endpoints or workloads, identity and data, all three areas we have been investing, innovating and see as core to CrowdStrike’s mission. These areas represent the biggest risk for organisations, and customers are increasingly looking to the Falcon platform to solve their most pressing security needs, as legacy products in these markets are brittle, complicated and struggle to deliver value to the customer.”

This is what the finance director had to say.

“In Q4, we ended with a magic number of 1.3 as we continue to ramp investments to capture more of the market opportunity at hand and expand globally. Our continued exceptional unit economics speaks to the efficiency of our go-to-market engine and our ability to rapidly onboard and support customers of all sizes. We also believe that a magic number of 1.3 continues to indicate that we should increase investments even more, given the massive market opportunity.”

So what is the magic number? Keeping it simple it is your return on sales and marketing spend. The average of 0.7 for SaaS businesses is considered healthy. You spend $100 for $70 in additional sales. It is when the figure starts to exceed one that it becomes magic so 1.3 is a sensational figure indicating that not only does Crowdstrike have a huge TAM but it is making spectacular progress in capturing a good share of it. The term was first invented when somebody came across a company generating $2 of sales for every $1 of marketing spend and exclaimed ‘It’s magic’.

This was the last thing the CFO said at the analysts’ meeting.

“And then we’ve got this tremendous amount of new logos to be able to go after, whether it’s an enterprise, mid-market or SMB. And that’s the beauty of where we are. And that’s why we’re — you’re hearing the excitement in our voices.”

What else do we need to make us buy these shares and if and when the chart turns bullish – pile in. This company is amazing and it’s on fire.

Note: normal service for Great Stocks will be resumed when market conditions improve.