Friday, 5 March, was an extraordinary day in US stock markets. At one point the Nasdaq 100 was down over 200 points before ending the day up 204 points. Even after this recovery it is down 1,211 points from the all-time peak in three weeks, a decline of 8.7pc.

Individual shares have been hit harder, especially some of the momentum plays. Tesla is $597, after hitting an intraday low of $539, down 33.7pc from a recent peak of $900. On of my favourite shares, The Trade Desk, saw its price plummet in 10 days from $920 to a low of $561 on Friday before rebounding to end the day at $654. Has anything actually changed at the business to justify these wild moves – probably not.

The trigger for the mayhem has been a recent sharp rise in US 10 year bond yields. In August 2020 the 10 year bond yield hit a lowest level ever of 0.51pc. The latest figure is 1.54pc, with the rate almost doubling in the last month.

Investors are concerned that approaching $3bn of fiscal stimulus, courtesy of presidents Trump and Biden, is going to hit a US economy just as it begins a strong recovery from Covid-19. A booming economy is going to put pressure on the Federal Reserve to tighten policy to ward off inflation; at least that’s the worry that is pushing US bond yields higher and scaring investors in shares.

I don’t have a crystal ball to tell how this is all going to pan out. There are powerful long term forces driving the secular bull market such as the technology revolution, globalisation and the rising spending power of China’s middle class. Nevertheless rising long term interest rates are a negative so the current turbulence is understandable.

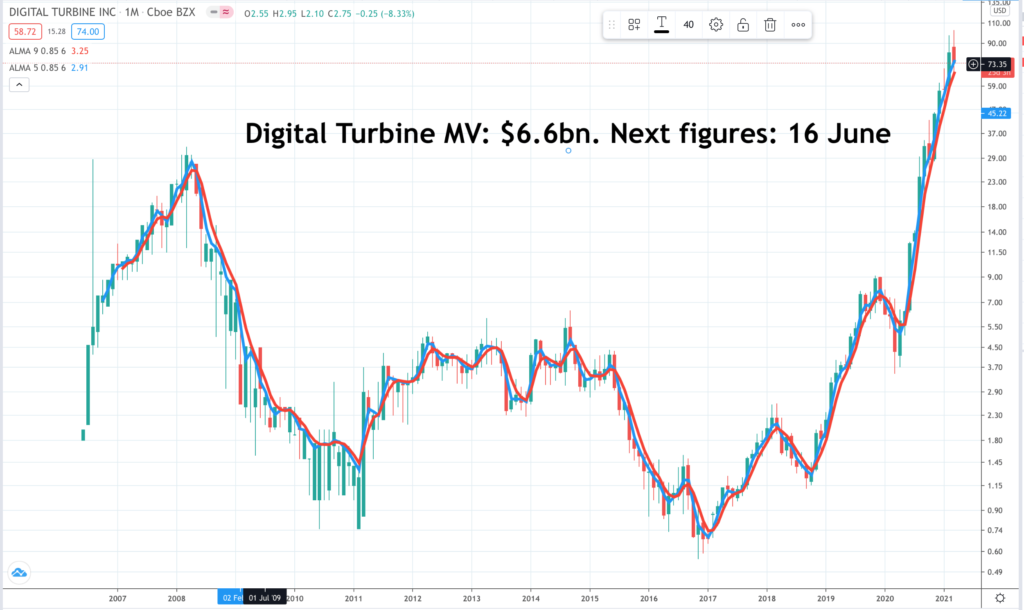

A problem for investors, who like to sleep at night is the volatility of shares in the most exciting companies. I think Digital Turbine (see story inside) is a phenomenally exciting company, growing at a blistering triple-digit rate supplying app-enabling software for Android mobile phones. But the shares are all over the place. In the last four days the shares have dropped from a peak $102.56 to a low of $66 before a partial rally to $74. The selling partly reflects profit-taking for a share that has risen 20-fold since April 2020.

Buffett has pointed out that volatility can be used by investors to buy shares cheaply. I am looking at a strategy, which I have provisionally called Quentinvest Programmatic Investing (QPI), to make that possible. The idea is that when you buy a share your initial investment is part of a programme so that your ultimate average cost of investment will prove profitable, ideally high profitable, if the company in which you invest is a fast-growing business.

It gets more complicated but I am excited about the potential. It capitalises on the fact that I am good at choosing exciting businesses in which to invest (at least that is what my track record suggests) but everything else, timing of buying, selling. short term market trends, is an unfathomable mystery to which nobody has the answers. This way I choose the shares and the programme delivers a profit, even if there are some bumpy periods on the way.

Alphabet/ GOOGL Buy @ $2007 – “Analyst reckons Alphabet worth $2,800 based on sum of the parts”.

Ashtead/ AHT. Buy @ 4018p – “We experienced, by some distance, our best ever month in November.”

Best of the Best/ BOTB Buy @ 2780p – “I am excited about the future.” William Hindmarch, CEO & founder, 24 February 2021 (that is a strong statement coming from him)

BiliBili/ BILI. Buy @ $98 – “This videolization trend is creating massive market opportunities in China.”

Bitcoin/ BTCUSD. Buy @ $54,000 – “It’s money 2.0, a huge, huge, huge deal.” – Chamath Palihapitiya, (Previous head of AOL instant messenger)

Digital Turbine/ APPS Buy @ $62 – “Our recurring revenues are now nearly 50pc compared to just over 10pc a year ago.”

Walt Disney Company (The)/ DIS. Buy @ $202 – “We’ve got an amazing, robust pipeline of original content in development.”

Shift4 Payments. FOUR. Buy @ $76 – “This continued growth in our merchant base makes us incredibly optimistic as we look forward into 2021.”

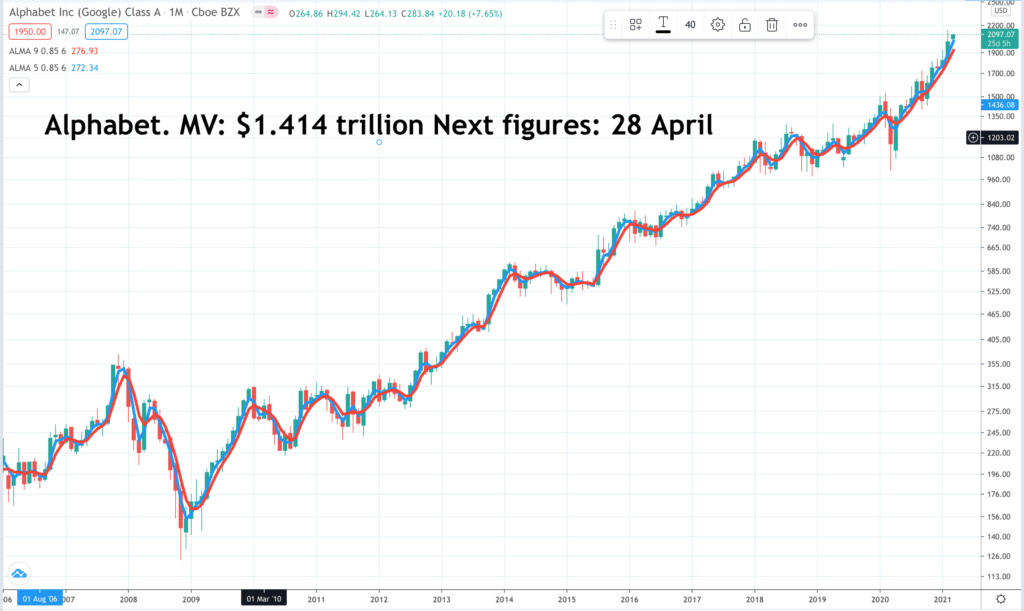

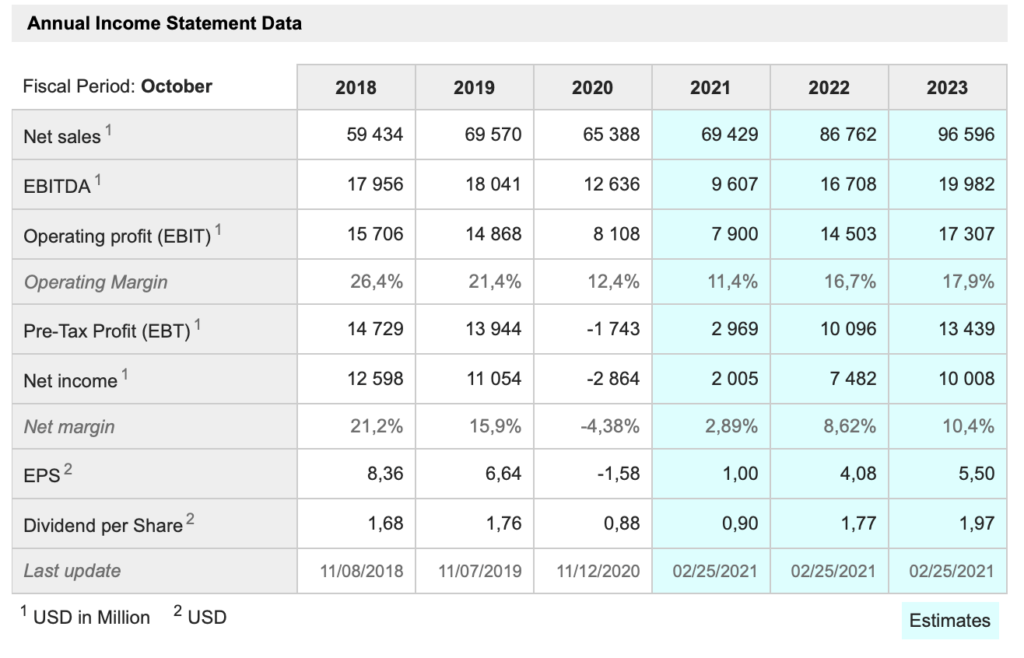

Alphabet/ GOOGL. Buy @ $2007. Times recommended: 16. First recommended: $985.19. Last recommended: $2083

Alphabet’s technology sits at the heart of the digital world driving ever-advancing sales and profits

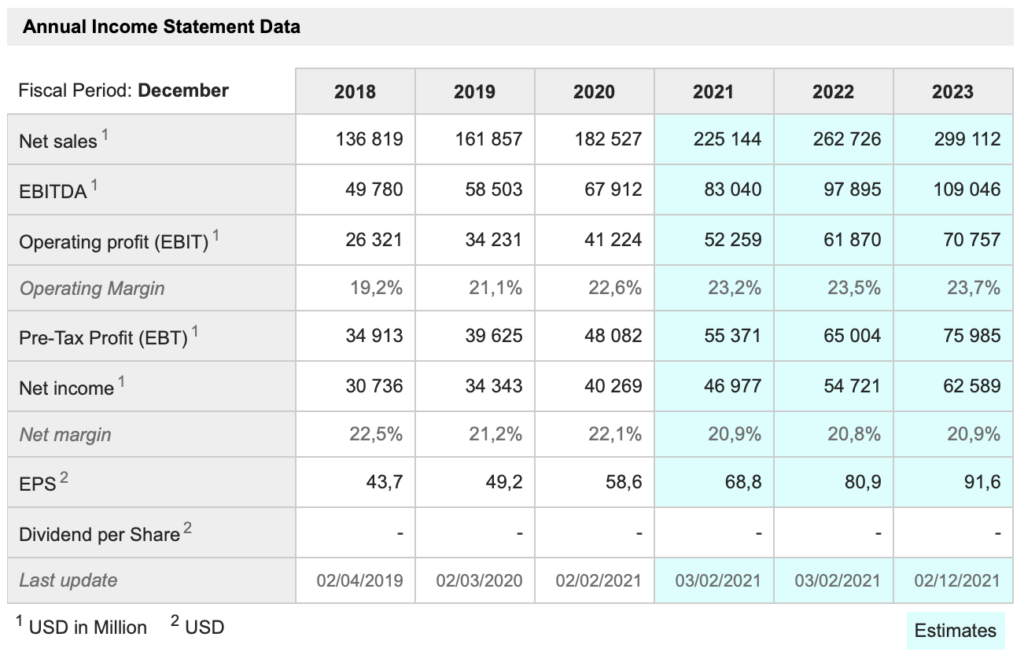

It is extraordinary that a business as large as Alphabet can be forecast by analysts to more than doubles sales and profits over a five year period. And Google’s free cash flow is another wonder of the investment world, expected to reach $70bn a year by 2023, by when net cash could have reached $229bn.

One observer argues that Alphabet suffers from a holding company discount and that based on the individual parts the business should be worth more like $2,800 a share, which is well ahead of the current price.

The main source of revenue is advertising related to platforms such as search and You Tube, which are unbelievable businesses by any standards and responsible for most of the numbers below.

There are some other jewels in the Alphabet crown such as Google Cloud, a platform providing cloud services, which grew 46pc last year and where the company has promised to break down the contribution in future results. The is likely to be a factor explaining the current strength of the share price.

Alphabet then has its ‘Other bets’ businesses such as Waymo, the self-driving cars operation, which is presently loss making but could become hugely valuable in the future as the world shifts to a transport as a service model instead of owning cars. Hugely valuable in Google terms wold be $100s of billions.

Then there is the other stuff like Deep Mind (neural networks and artificial intelligence), Wing (drones) and even something called X, which is working on all sorts of futuristic stuff. The company has such deep pockets there is nothing it cannot do.

A potential future trigger to realise some of the underlying value in Alphabet would be an IPO for any of the ‘Other Bets’ businesses. Even if that doesn’t happen for a while the sheer growth of the core businesses should keep Alphabet’s shares marching higher.

Best of The Best. Buy @ 2780p. Times recommended: 7. First recommended: 1480p. Last recommended: 2660p

Booming BOTB ends takeover talks: CEO and founder, William Hindmarch, says “excited about the future”

We never learned much about it but BOTB has spent around a year in talks with numerous interest parties about a possible sale of the business. CEO, William Hindmarch, has finally accepted what was obvious to observers. His business is doing so well and has so much headroom for further growth, why on earth would he want to sell out now; so the talks have been terminated.

BOTB began offering cars at airports to be won in a game of skill, spot the ball, lottery process. It never did that well because there weren’t many customers, ticket prices were high and so were costs. All that has now gone and BOTB has become an entirely online business delivering what Hindmarch describes as a “step change” in growth and performance.

No kidding! In the last 12 months or so the business has taken off in spectacular fashion. Latest interim results for the six months to 31 October, showed sales almost trebling to £22.08m, which is considerably more than the £17.8m reported for the whole of the previous year and earnings per share almost quintupling to 59.8p.

The company is using this staggering performance to invest in growth by improving the prizes, each car in the dream car competition now comes with £50,000 in cash and to reduce ticket costs. It would be no surprise if allied to ever improving marketing and higher budgets there was a very healthy increase in customers. We have to guess because BOTB is not the most transparent of businesses.

We don’t know how many customers they have, the average spend per customer or loads of stuff that would help us understand better how the business is doing except that it is obvious that it is doing very, very well.

One clue they did give was that despite paying a special dividend in February costing £3.7m they still have over £10m in cash. This means they are generating free cash flow each month somewhere between £1m and £1.5m.

In the latest trading update, released on 24 February, Hindmarch reiterated “the guidance that it remains on track to outperform its previous management expectations driven by the traction of the pure online model and increased confidence in marketing investment”.

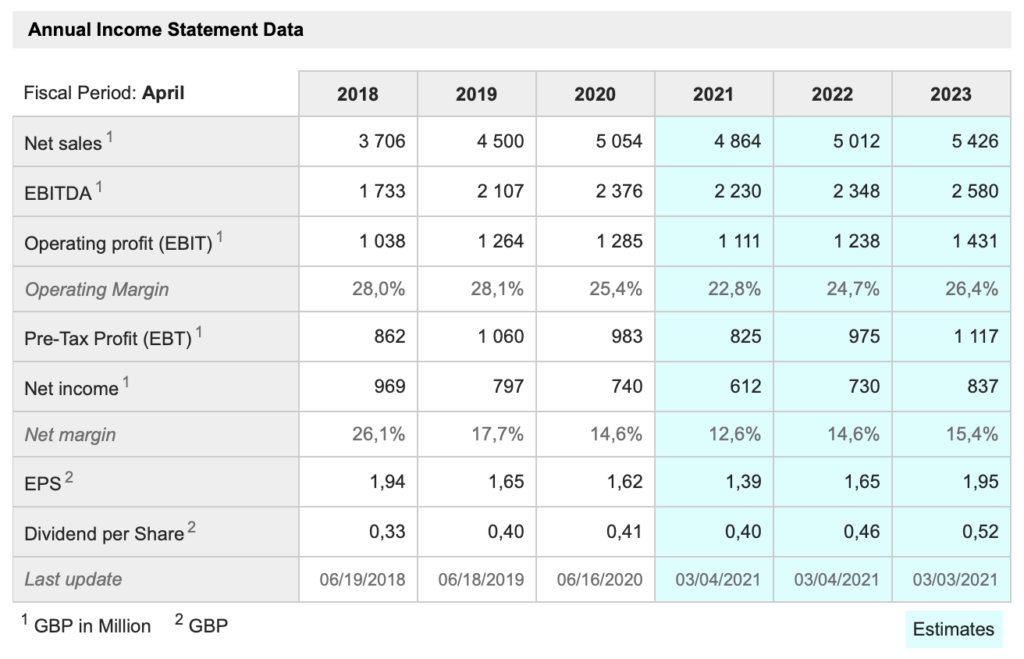

I have been crunching some numbers to gain an idea of what the year to 30 April 2021 might deliver in terms of sales, profits, free cash flow, earnings and dividends. If I am anywhere near right (think free cash flow and profits in a not too different ball park) these shares are very cheap and the price will explode when they report their full year figures in June.

The only caution is that the simultaneous improvement in prizes and reduction in ticket prices might squeeze margins in the short run. I don’t think it will and expect fiscal 2021 to be an amazing bumper year for BOTB.

The shares are famously hard to buy but not impossible. There seems to be a little supply to keep things ticking over. Management own over half the shares and reward themselves and all their shareholders by paying out a big chunk of earnings every year in special dividends. They have already paid a 40p special dividend with the interims and I expect more generosity with the finals.

If you want a number I think the shares are worth minimum £50.

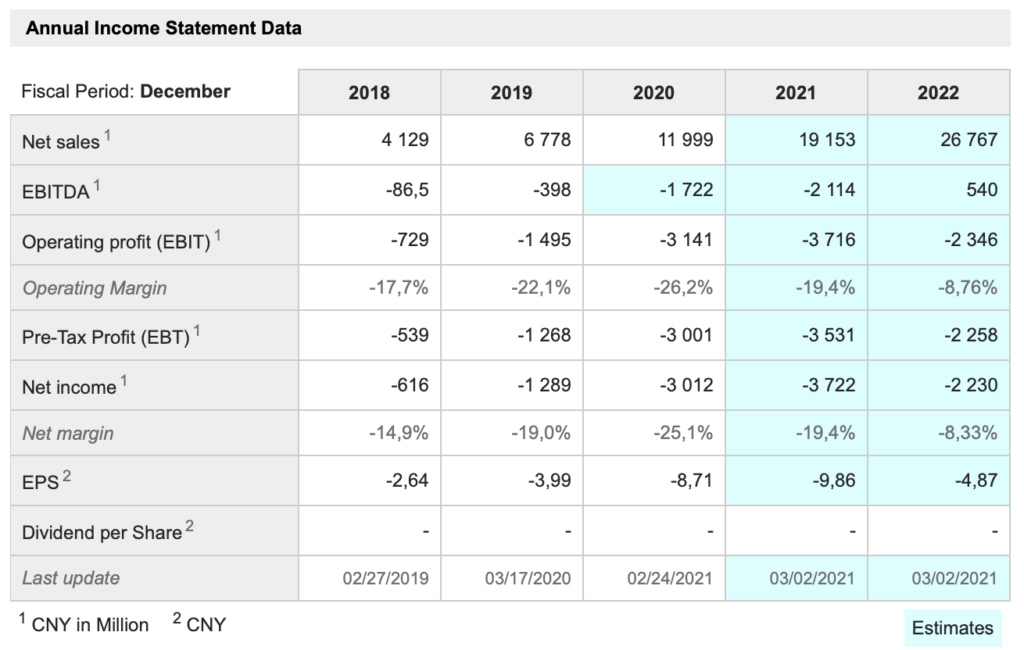

BiliBili. Buy @ $98. Times recommended: 6. First recommended: $62.50. Last recommended: $127

BiliBili wows China’s Generation Z, moves further into content, eyes older generations

BiliBili shares hit serious turbulence in nervous markets and in one day traded between $128 and $110 before closing at $118. This is all to do with general market funk because BiliBili, a platform for video content for China’s teenagers and Gen Z, is growing at a breathtaking rate. The company reported its Q4 2020 numbers on 25 February showing a business that on some metrics is almost doubling in size annually. The shares hit $147.50 after the results but have since been dragged lower as waves of profit-taking cut down all the tall poppies.

BiliBili operates a classic freemium model so revenue growth depends partly on a bigger pool of users and partly on the company’s ability to convert free to paying customers. In Q4 monthly average users (MAUs) rose 55pc to 202m and mobile MAUs rose 61pc to 187m showing that this is very much a mobile phone business. Highly engaged users spend an average 75 minutes on the platform every day.

Monetisation of the user base was even more impressive with MPUs (monthly paying users) rising 103pc to 18m. The paying ratio was up in a year from 6.8pc to 8.9pc, which helped drive 91pc growth in quarterly sales to RMB3.8bn. In the context of China’s massive domestic market this is still a relatively modest number, equivalent to US$589m though a stunning number for a business that was only founded in 2010.

Q4 growth of 98pc compares with 77pc growth in the full year numbers showing that growth is accelerating. The successful performance comes from an ever better content library and raising brand awareness. BiliBili closed 2020 with its second New Year’s Gala night, which tripled the popularity index delivered by its first gala night, achieving 120m playbacks within 24 hours. The group believes it can continue with this strong momentum in 2021, which is good news for shareholders.

The market opportunity being addressed by BiliBili is massive. “The video-based market is expected to reach RMB1.8 trillion in revenues, generated by nearly 1.2 billion video users by 2025, according to iResearch. As a full spectrum video community platform, and the go-to platform for the Gen Z+ demographic, we are at the forefront of this exciting videolization opportunity.”

BiliBili has ambitions beyond China. “We are excited to be a pioneer in promoting Chinese anime worldwide. Some of our international endeavors include our cooperation with Sony’s Funimation and Netflix to stream Bilibili-produced Chinese anime series around the world.”

The group is also emerging as a player in the video games market. Sales of video games grew 30pc in Q4 and there is a pipeline of 14 new titles including high-potential names such as “NetEase’s Harry Potter and Diablo Immortal, as well as Tencent’s League of Legends mobile game.”

In many areas it is clear that BiliBili’s growth story is just starting. The market inspired weakness offers a wonderful opportunity to start building a position in the shares or adding more. There is clear potential, especially as BiliBili extends its reached to older generations and expands its library of content, for the company to become an Internet giant.

Bitcoin. Buy @ $54,000. Times recommended: 12. First recommended: $3,540. Last recommended: $46,083

If bitcoin really is digital gold as many supporters claim then it is not ridiculous to forecast the price reaching $0.5m plus one day

When I ranked my best recommendations since 2015 the other day, for promotional purposes, the runaway winner was bitcoin. The gain since I first featured bitcoin in Quentinvest in 2017 is 1,335pc. Since I first featured bitcoin in any of my publications the gain is 4,729pc.

Part of the reason for this is the I have never been a bitcoin sceptic in the sense that I have always been open to the idea that blockchain technology generally and bitcoin specifically could develop into something important. It is part of my rubbish theory of value that things that seem useless and insignificant can transform into something very important.

Maybe not; it could be the South Sea Bubble or Tulip Mania but who can ever tell. Back in the 1990s, many of the great and the good thought the Internet was just a passing mania. We don’t hear that any more.

There is also an elitist tendency to be snobbish about anything that becomes too popular. If Joe Public likes it then it must be rubbish. This too is nonsense. I am sure it shows my age but as far as I am concerned Elvis is right up there with Mozart and Beethoven so I am much more sympathetic to popular enthusiasms.

Bitcoin is my ultimate buy and pray investment. You buy some, any quantity you like if you are using Coinbase, Revolut or Square’s Cash App to buy (it doesn’t have to be a whole coin) and then hope that amid all the volatility they will climb to the stars.

Bitcoin is increasingly proving its worth as a store of value, which is why increasing numbers of serious institutions are taking a second look and even buying bitcoins.

Also interesting is the question of how to value bitcoin. They are becoming scarcer all the time because of the relentless increase in computing power and energy needed to make (mine) each bitcoin so that is forcing the value higher on a cost of production basis but for efficient miners is still well below its current price.

The asset which bitcoin most resembles is clearly gold. Gold is scarce, attracts demand way beyond its appeal as jewellery and is increasingly expensive to mine. But it is not as scarce as bitcoin. So, if bitcoin is digital gold, you could argue that at a minimum all the world’s bitcoin should be as valuable as all the world’s gold, which throws up a valuation for bitcoin of around $0.5m a coin.

Emperor’s clothes (or lack of them) perhaps but maybe it is true. Digital transformation is affecting every aspect of human life. Why should gold not experience a digital transformation (metaphorically speaking) into a virtual construct which has already been described as the world’s hardest currency.

“While cryptocurrencies are the most well-known use of blockchain technology, their potential extends far beyond digital currencies. For example, blockchains could be used to secure every aspect of the supply chain, store property records, create a reliable digital identity system, and even store and count votes in an election. As investors continue to pour money into this technology it’s only a matter of time before it fundamentally reshapes our world.”

“Until 2017, institutional investors avoided investing or even talking about cryptocurrencies. This changed in December 2017 when CBOE Global Markets introduced its Bitcoin futures trading platform.”

“The Bitcoin mining difficulty was at its lowest at the time of launch and has gradually increased over the years. Between January 2017 and January 2018, the average Bitcoin mining difficulty increased by six times.“

“As of 2017, most of the Bitcoins (96pc to be exact) were owned by only 4pc of all BTC addresses.”

Digital Turbine. Buy @ $68. Times recommended: 2. First recommended: $90. Last recommended: $92

Digital Turbine the mobile platform making life easier for service providers, device manufacturers, content providers, advertisers and customers

Turn on your android mobile phone and the apps you see on your screen will most likely be there courtesy of Digital Turbine’s Ignite Dynamic Install software. The apps should be ones you want to see if Ignite is doing its job properly but they are also good news for all the parties involved from service providers and device manufacturers to content providers and advertisers because it enables them all to generate revenue or reach potential customers. It’s a win-win all around and especially for Digital Turbine, stock market code APPS, which is growing dramatically as use of its platform explodes.

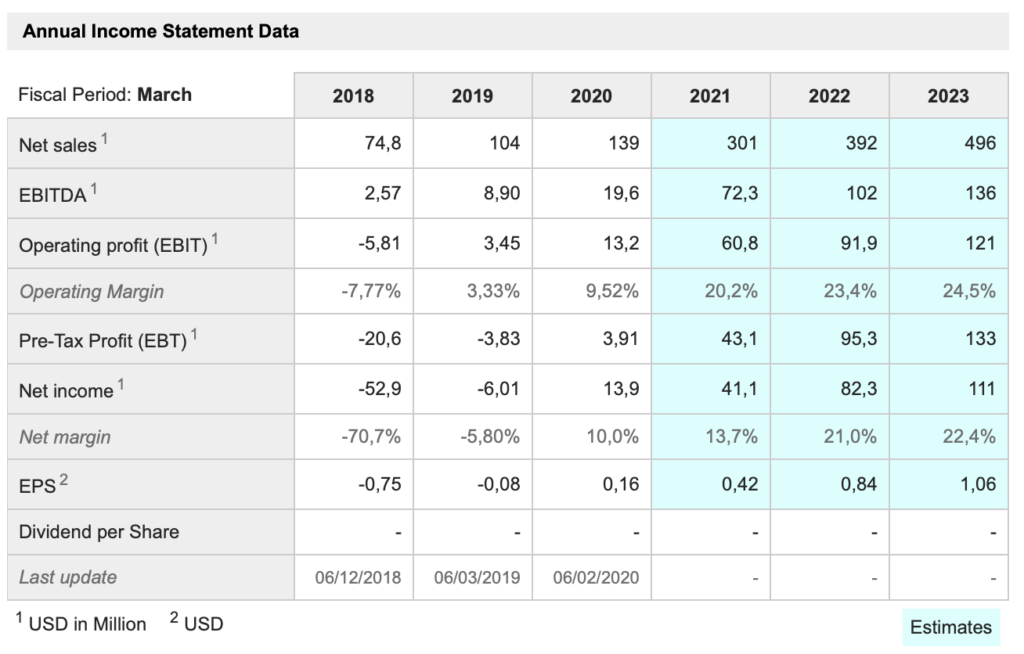

On 3 February APPS reported its Q3 2021 figures (the group has a 31 March year end) showing that sales grew nearly 150pc on an as-reported basis and 70pc pro-forma. The actual figure was higher than the pro-forma because the latter was boosted by the acquisition of Mobile Posse, which APPS acquired in February 2020.

Higher gross margins and accelerating operating leverage enabled APPS to turn strong revenue growth into EBITDA up more than fourfold, 278pc growth in earnings per share and more than trebled free cash flow as the business continued to benefit from network effects and economies of scale.

The core business was going gangbusters anyhow thanks to more content providers and devices manufacturers like Samsung, coming on board for the dynamic installs. But the icing on the cake was the Mobile Posse acquisition for a mixture of cash upfront and performance related deferred payments. Mobile Posse is on course to deliver something like $100m in the year to 31 March versus the $55m it generated the previous year and way ahead of what was expected at the time of the deal. It turns out February 2020 was a great moment to buy a business, which benefited from Covid-19 lockdowns.

Mobile Posse is all about content and advertising revenue, much of which is recurring and on excellent margins. This is a new business area for APPs and one with huge potential. As a result they are making more acquisitions. On 26 February they announced the purchase of AdColony, a deal which could cost $400m depending on the earn out proportion and brings in a business with a reach of more than 1.5bn monthly global users. On 2 March the group said it was buying Triapodi for $22m plus an additional $6m to incentivise top management. Triapodi’s Appreciate DSP runs 60m daily auctions to transparently drive higher mobile advertiser conversion and return on investment.

There are no trading numbers yet to evaluate these deals but APPS has said it expects the AdColony acquisition to have a significantly positive impact on results in the first full year of ownership, the year starting 1 April. It has also said that the integration of Triapodi is expected to accelerate SingleTap scaling and add additional revenue synergies with AdColony’s platform.

SingleTap is an exciting new division within APPS, which lets users download and use an app with a single tap, enormously increasing the number of downloads.APPS CEO, Bill Stone, is very bullish of prospects for SingleTap. Not only has he commented on turnover going from seven figures to seven figures quarterly to seven figures monthly but he also said in response to an analyst’s question that he expected SingleTap to grow fast enough to add zeros to the run rate.

It’s no surprise that in talking about the 100pc increase in content revenue in Q3 and the size of the market being addressed that Bill Stone concluded – “Thus, the opportunity for growth is enormous.”

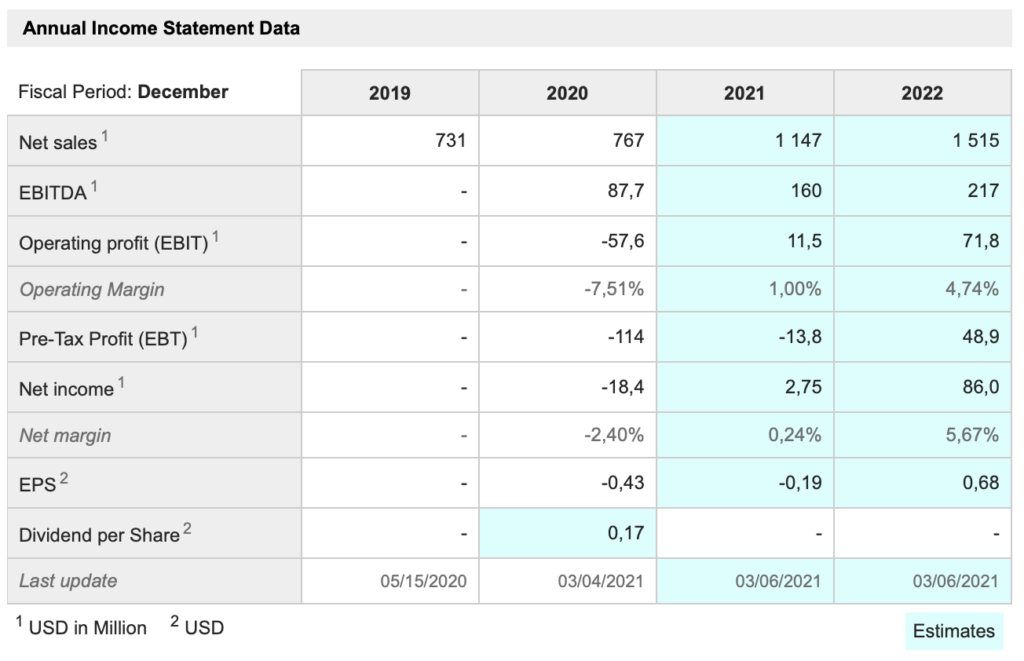

Walt Disney Company, The. Buy @ $202. Times recommended: 6. First recommended: $140. Last recommended: $196. Lowest recommended: $109

Disney’s streaming business off to a spectacular start; rest of Disney posted for post-Covid recovery

As revealed at a recent investor day, Disney’s streaming business has grown far more rapidly than expected, helped by widespread lockdowns forcing people to turn to at-home entertainment.

“Disney’s streaming services are currently four years ahead of expectations. This led to the company’s revised estimate for total subscribers being between 300-350m across all three platforms in FY24, up from the previous 108-162m subscriber forecast. This growth is mainly driven by Disney+ and its original content. Disney+ is the hub of the Disney empire, which has delivered some of the highest grossing movies of all time.”

The analyst who wrote this then listed Disney’s top 20 highest grossing movies, led by The Avengers Endgame, grossing $2.8bn and ending with Iron Man 3, grossing $1.2bn. Disney is brilliant at creating, acquiring and monetising great content and there is no reason to suppose it is going to be any less effective going forward.

And now it has Disney+, the most powerful vehicle yet for generating high-value recurring income from all that great content. In just a year streaming has become Disney’s main business, rapidly making up for the devastating effect that lockdown had on film production, theme parks, cruise lines, merchandising and much of the rest of the Disney empire, which should now be poised for a strong recovery.

Bottom line is that Disney is surely the world’s greatest entertainment business and that is a good place to be.

Shift4 Payments Buy @ $76. New entry

Shift4 Payments eyes strong recovery in 2021 after weathering Covid-19 unexpectedly well

Not the least extraordinary thing about recently floated payments processing business, Shift4 Payments, is that CEO, Jared Isaacman, founded the company 22 years ago, when he was only 16. The company has a large and diversified client base but also substantial exposure to the hospitality and travel industries, which makes it remarkable that the business came through 2020, as tough a year as you could ever imagine for those sectors, able to say:-

“Every KPI [key performance indicator] was up year on year including the number of merchants using our services, the end-to-end payment volume they processed and the revenue it produced for the company. This represents 21 consecutive years that we have grown our top line.”

The company is optimistic going forward.

“Vaccinations, consumer confidence and pent-up demand have contributed to end-to-end payment volume growth in January and especially February, where we would have expected to see more seasonality and impacts from inclement weather. Organic growth initiatives have retained momentum, with new merchants continuing to adopt our end-to-end services each month, including many customers that are migrating from a legacy gateway-only product to the full stack offering. Our technology teams continue to innovate and enhance the products and services we offer, which has always provided our distribution channels with clear competitive advantages. We have made considerable progress with our inorganic initiatives, including highlighting our eCommerce platform, Shift4Shop, as well as announcing the acquisition of VenueNext, which we expect will accelerate our pursuit of payment opportunities in sports stadiums, theme parks and other venues. We are also pursuing several other strategic opportunities that we think will be quite transformative to our story.”

The shares initially reacted badly to the 2020 figures, with slow growth never welcome from a normally high growth business but given the circumstances investors quickly realised that Shift4 had actually performed strongly and looked well placed to resume fast growth as lockdowns eased.

There is also excitement about Shift4’s acquisition of 3D Cart, now renamed Shift4Shop, which takes the group into the e-commerce market. As CEO, Jared Isaacman, says this opens up an exponential new opportunity for the company.

Ahstead. AHT. Buy @ 4100p. Times recommended: 12. First recommended: 1803p. Last recommended: 4006p

Ashtead ideally placed to benefit as infrastructure spending rises on back of huge US stimulus programme

Ashtead Group is one of the UK stock market’s greatest comeback stories. Early in the millennium the group was struggling with huge debts and falling revenues. It weathered the storm and then delivered sustained growth as great management came together with a structural shift in the US market from owning to renting. In 2003 the shares dropped to a low of 2p. They are up 2,050 times since then and they are still full of running.

The group took a hit from Covid-19. This was inevitable. Not only was construction activity affected, especially early in the lockdown period but the group also supplies massive amounts of kit for events like rock festivals, which shut down completely. In the circumstances the latest results for the nine months to 31 January 2021, showing rental revenue down just two per cent to £3.93bn was an amazing performance.

There is also a silver lining to a period of depressed demand. Part of Ashtead’s appeal to its huge customer base is that the kit is always up to date so the group spends vast sums on equipment. In the last 12 months this spending has slowed as the group focused replacement spending on the most highly utilised items of equipment but demand held up surprisingly well. As a result cash has been pouring into the business. In the nine months the group generated record free cash flow of £1.06bn versus £363m a year earlier. Net debt to ebidta leverage fell from 1.9 to 1.6 giving the group powerful fire power to grow strongly going forward.

The result is that the group can now step on the gas.

“We expect capital expenditure for the full year to be at the upper end of our previous guidance (c. £700m). Looking forward to 2021/22, we expect to return to growth and anticipate gross capital expenditure of £1.3 – 1.5bn, which should enable mid-single digit revenue growth in the US.”

Another good sign of a business doing well is that the results beat expectations, which helps explain the recent positive share price performance.

The business is in great shape.

“The quarter represents another market share-gaining, industry-leading performance with encouraging sequential momentum in our general tool segment and ongoing growth within our specialty business, making more clear the structural change opportunities that will fuel our growth into the future.”

Part of the growth comes from adding new rental locations, both organically and by acquisition.

“Our organic expansion continued with 17 greenfields added in the period, returning to a good cadence, which we will continue. With another quarter under our belt and momentum continuing and despite the challenging market conditions, we now expect full year results ahead of our previous expectations.”

The strength and flexibility of the Ashtead business model is what makes the shares such a great investment. Whatever happens these guys take advantage to keep winning market share from less finely tuned competitors in what is still a fragmented market.

“Never has the flexibility of our model been more clearly demonstrated than in this year of adversity. Our ability to flex capital expenditure down at short notice and generate significant free cash flow against an adverse market backdrop has enabled us to reduce leverage from 1.9x a year ago to 1.6x at the end of January, despite lower EBITDA. This is the strength of the model. As we’ve said on many occasions, this strong balance sheet and flexibility gives us a competitive advantage and positions us well for the future.”