Scarier than ever – the shark is still circling and we definitely need a bigger boat

How many charts look like this now. The answer is lots. The chart picture is fiercely negative reflecting a world wrestling to get inflation under control with the front line tool rising interest rates, which are like kryptonite for the stock market, spreading weakness all around.

I have now made a number of predictions to give us a road map for how this devastating bear market may continue to unfold – five per cent yields for bonds in the US (currently around 3.7pc), 7,500 for the Nasdaq 100 (currently around 11,298), sub-5,000 for the Nasdaq Technology sector (currently 5797), sharply lower levels for crypto currencies and for a whole raft of key US technology shares.

An interesting one is the £/$ exchange rate, which continues to fall. Nobody in government or at the Bank of England seems to be making the slightest effort to stop it falling which makes me wonder if they want it to fall. A weak pound is inflationary but who is going to notice when inflation is already out of control. It is also reflationary by boosting exports, reducing imports and strengthening demand for domestic goods and services.

Liz Truss has been gung-ho about her desire to stimulate demand so maybe a weaker pound is all part of her crafty plan. What we have seen in the last few months is a major devaluation so most likely not an accident.

As investors we have to weather the storm and keep our powder dry. Yet again I have closed my tiny positions and its back to QQQ3 which is plummeting. It looks likely that I will get my chance to buy at $50 and who knows, maybe even lower. I guess the pound is oversold but this looks like a big breakdown. Could we see £1 to $1? We certainly could according to this chart and in a dollarised global economy that could end up bringing in a lot of demand for sterling assets. London property is going to look like an amazing deal, when the dust settles. This is my theory by the way. In the short run inflation hurts property prices by raising interest rates but longer term all that inflation feeds straight into rents and prices because London is amazing and nothing will change that, so is Britain. I love living here and as the world heats up many other people will feel the same. The UK, literally as well as figuratively, is a cool place to live.

Below are some more shares with scary charts to give the flavour of what is happening.

Semiconductor shares are volatile and sensitive to the technology cycle. SOXL is three times leveraged to the Philadelphia Semiconductor index so exaggerates the moves. Shares like Nvidia, Advanced Micro Devices and Taiwan Semiconductor Manufacturing are all breaking down. It would be a surprise if they don’t go significantly lower.

In this stock market strong fundamentals are almost a negative. It is all about interest rates, inflation and the macro economy so we have shares in great businesses like ServiceNow breaking down from significant areas of consolidation. For years these shares have been flying and now they are crashing. Not to be touched until things change; that’s for sure or as sure as anything can be in anything as unpredictable as stock markets. The Coppock indicator has just become negative but do I feel like buying these shares – no.

What a bull market Shopify had and what a bear market it is having now. The shares are down from $174 to $28 and have just broken down again. Shopify is paying the price for being too gung-ho during lockdown.

During the pandemic, we made a bet that retail spend would disproportionately favor e-commerce at a much higher pace than it has. Our belief was that the channel mix, the share of dollars that travel through e-commerce rather than physical retail, would permanently leap ahead. As we built for the digital leap, we stepped up our efforts and we expanded the company accordingly. We couldn’t know for sure at the time, but we did know that if the prediction came true, we would have to rapidly scale the company to meet that future.

Fast forward to now, as things have turned out differently. While the normalized rate of spend online, which is where most of our merchants orders occur, has reset certainly higher than where it was in 2019, the rate is lower than we had planned for. In short, we overshot our prediction. Recalibrating our investments and spending, we are making sure we do not sacrifice the components we feel are critical for Shopify remains in an enviable position in a massive growing market as enabler of multichannel commerce.

Q2 2022, 27 July 2022

I think we got used to the idea that Shopify could walk on water. It is a shock to find that they can’t.

C3.AI is an example of a share in a company that pressed all the right buttons in terms of story but never matched it with growth in the numbers. The shares are down nearly 93pc from the peak. They haven’t even been trading long enough to calculate a Coppock but when we do it is not going to be positive. The stock market is clearly questioning whether there is any value in this business with profits not even remotely on the horizon.

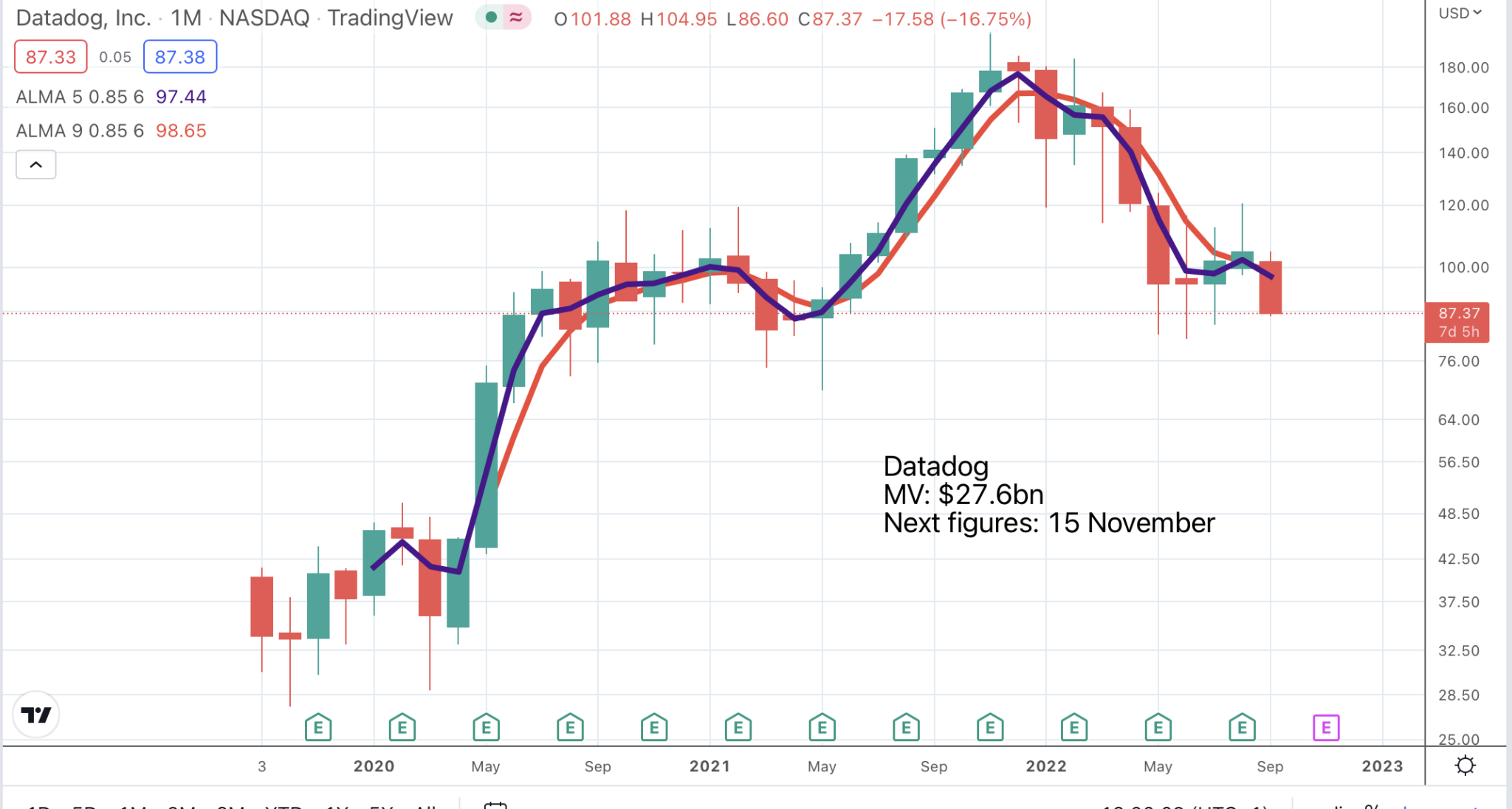

You can pick shares almost at random in this market and the price action looks threatening. The latest results from Datadog were brilliant.

In Q2, revenue was $406m, an increase of 74pc year over year and above the high end of our guidance range.

We had about 21,200 customers, up from about 16,400 in the year-ago quarter. We ended the quarter with about 2,420 customers with ARR of $100,000 or more, up from 1,570 in the year-ago quarter. These customers generated about 85pc of our ARR. We generated free cash flow of $60m and a free cash flow margin of 15pc.

And our dollar-based net retention rate continues to be over 130pc as customers increased their usage and adopted more products. Now moving on to this quarter’s business drivers. In Q2, while we overall saw strong customer growth dynamics, we have seen some variability in growth among our customers. We saw our larger spending customers continue to grow but at a rate that was lower than historical levels.

Q2 2022, 4 August 2022

I suppose there was a chink in the armour in that last sentence that larger spending customers continue to grow but at a rate that was lower than historical levels. The chart pattern is not exactly a breakdown but the line of least resistance is certainly lower and looking at what is happening elsewhere I would not be a buyer of these shares at the moment.

And so it goes on. We are in a raging bear market, which is especially punishing technology shares.

Strategy

What is the best strategy? Every time I buy anything it ends in tears so I am losing enthusiasm even for the little nibbles I have been doing. Bear markets end in capitulation but I don’t think we have seen that yet. In 2008 I quoted from King Lear who was trying to persuade himself that things could not get worse and then was told that his beloved youngest daughter was dead. His grief stretched even Shakespeare’s ability to make a point – ‘never, never, never, never, never’ say things cannot get worse because they always can cried out the shattered old man. Well late stage bear markets can be a bit like that so keep your powder dry.