Share charts still threatening with new breakdowns across the board

I have just been through my benchmark charts. I did this because I had a feeling that the US stock market was taking a turn for the worse and so it has proved. Out of my list of over 100 benchmark charts, over 30, around a third of the total are staging fresh breakdowns. Shares often rally when I write something bearish but not for long. My guess is that we are on the brink of a new downward leg by shares and investors need to be super cautious.

All the indicators I look at, index charts, Coppock, US 10 year Treasury bond yields. the £/$ exchange rate, cryptos and the balance of shares looking bullish (hardly any) against those looking bearish (almost all of them) tell me that this bear market is not yet finished. Rallies sputter out and die, even when supported by amazing fundamentals. Breakdowns triggered by disappointing fundamental news can be dramatic.

Everything that is happening is characteristic of a bear market in full spate. The Nasdaq 100 is presently 11,637 and is not on my list of stocks and indices breaking down. Nevertheless I am tempted to hazard a guess and it really is a guess for where this index may be headed. My provisional target is 7,500. If this were to happen this would imply a peak to trough move of around 55pc, which is not inconsistent with severe bear markets in the past.

I have been warning about the Alphabet chart for some time and today it looks more threatening than ever. Just based on the chart the price could fall into a range between $65 and $75.

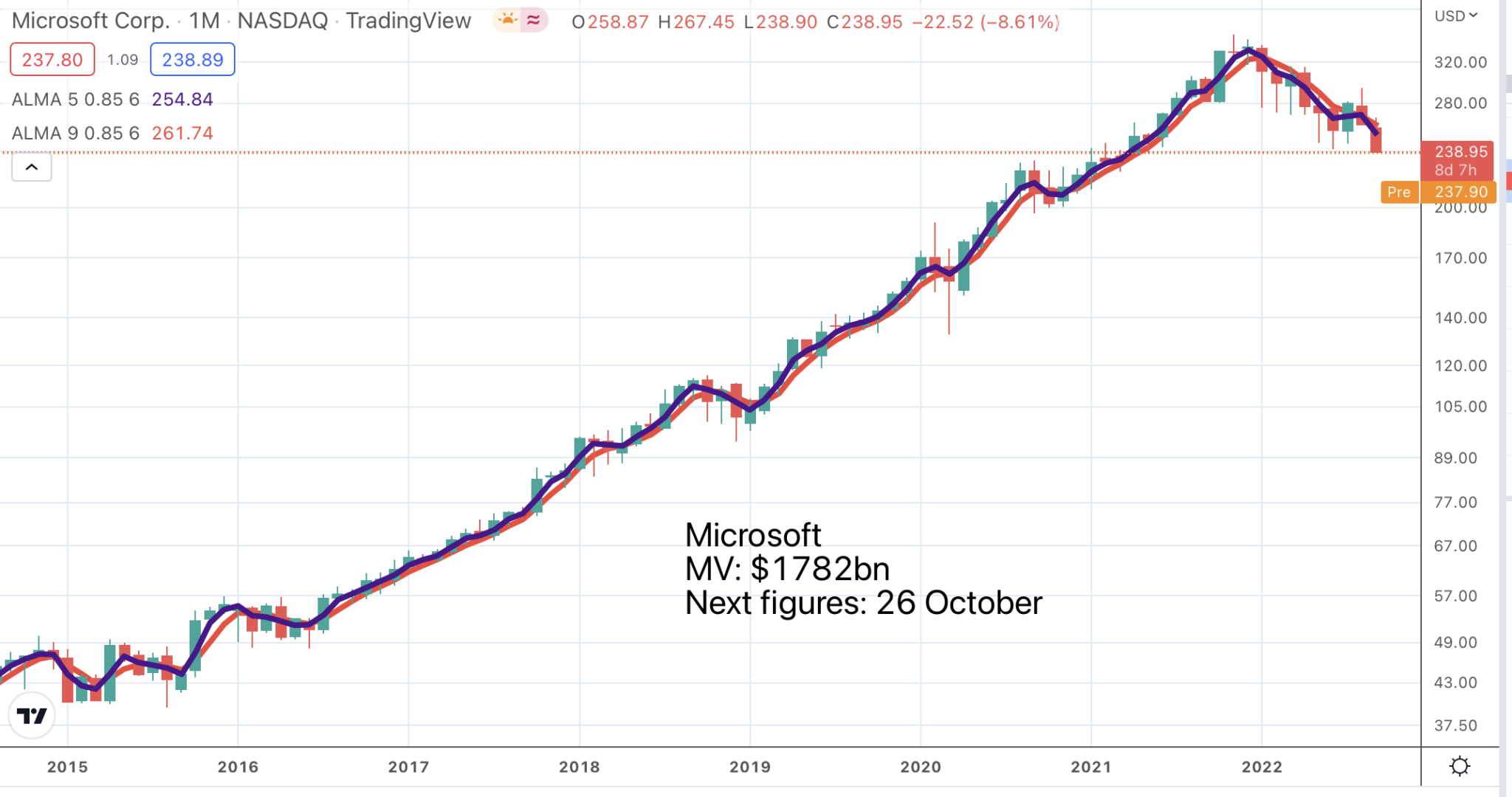

Another important chart that looks similar to Alphabet is Microsoft. As we know, for all these charts, the Coppock indicator is falling and is close to becoming negative. Charting is not rocket science. We have a downtrend as indicated by common sense and falling moving averages. We have a consolidation. We have a breakdown from the consolidation which enables us to predict that most likely these shares are going to fall further.

A chartist friend of mine likes an aeroplane analogy. Before it can crash the plane needs to fly. This plane has clearly been flying and now it is crashing.

There are other charts which are breaking down more violently.

Why are Okta shares so weak. Because they are suffering from a weakening economy.

We are starting to notice some tightening of IT budgets and lengthening sales cycles relative to last quarter. This leads us to believe that the weakening economy is having some impact on our business.

Q2 2023, 31 August 2022

What we can see here is that any bad news and the shares are hammered, whereas good news produces short-lived rallies. This is classic bear market behaviour.

Charles River Laboratories is an example of a share in a steep downtrend which is suffering a renewed breakdown from a tight consolidation.This is more classic bear market behaviour. There are plenty of charts which look like this, especially in the previously high-flying technology sector. This is why NDXT, the Nasdaq Technology sector index, looks weaker than the Nasdaq 100 and is down 1.54pc as I write v minus 0.74pc for the Nasdaq 100 and 0.61pc for the S&P 500. The Nasdaq Technology index, 5,950 presently, could easily dip below 5,000 before this bear market is over.

Why is all this happening. One explanation is that a monster we thought was slain, inflation, is back bigger and badder than ever. It is like the Lord of the Rings, were they thought Sauron was defeated for ever but the Rings of Power and especially the one Ring to rule them all were still out there and the menace of Sauron loomed large again over Middle Earth.

It was difficult to defeat Sauron and it is going to be difficult to defeat inflation, especially in a world of shortages which seem to be both endemic and rather mysterious. Why is everything in short supply suddenly? I don’t really get it but everything from used cars to York Stone flags and much, much else is soaring in price which is driving prices higher across the board.

It can’t all be the fault of the ghastly Putin but while inflation rages it is hard for shares to rise and anything that relies on politicians for a solution always fills most sensible people with dread. Maybe Liz Truss will work miracles but maybe she won’t. Maybe the central bankers know what they are doing and maybe they don’t. This is why I like Adam Smith and his invisible hand. The less we rely on the great and the good the less scope there is for giant cock-ups and the law of unintended consequences to make fools of us all.

If I was in charge I would let capitalism rip and I am sure the result would be much better than what is happening now. If we need a safety net let’s have a safety net but please don’t put politicians at the wheel of the whole economy; that is a recipe for disaster. I would privatise everything in sight; set a flat rate tax of say 18pc across the board; abolish inheritance tax; scrap VAT and stamp duty and watch the economy blast into orbit. Even when countries impose duties on British goods I would not tax any imports, I would tear up all subsidies including this insane cap on energy costs. If a foreign company wants to buy the NHS and start charging so be it. I don’t even care if they are Chinese or Russian. Annual budgets with a raft of ridiculous tinkering would be a thing of the past. Just renew the right to tax; that’s all you need. The Chancellor of the Exchequer would be a junior clerk as would most members of the cabinet if they even kept their non-existent jobs and meaningless job titles. And all that would just be getting started on the process of freeing up the lumbering dinosaur which the British economy has become. My administration would be all about oiling the wheels, not throwing in endless quantities of well-meaning but useless grit. We have had Brexit; now let’s use it. And if you think I am radical you need to meet my cousin.