This breakout rally looks like it will last for years.

Specifically, we’re observing strong parallels between the AI stock breakout of 2023 and the internet stock breakout of 1991. We believe those parallels will persist for the foreseeable future.

Therefore, we think we are due for a tech stock boom throughout the 2020s that will look a lot like the dot-com boom of the 1990s – which, as history proves, was the biggest tech bull market of all time.

Investors made fortunes in the dot-com boom by investing in internet stocks.

And they’ll make fortunes in this stock market boom by investing in AI stocks.

InvestorPlace, 17 July 2023

Table of Contents

This chart of the Nasdaq Technology index (unweighted, all-tech) is a beautiful one. We have a powerful double whammy buy signal which has just been triggered. We can also look at the latest rise, in 2023, and compare it with what happened between 2008 and 2021. The rally we have seen to date is peanuts by those standards.

NDXT is a relatively new index. We can go back further with the Nasdaq 100 index (heavy on techs, weighted for mega caps, excludes financials) and see what happened to that in the 1980s and 1990s and it is explosive.

The 1990s saw the famous Internet bubble. At the time everybody thought it was madness and for many stocks it was but any thought that it was the last great bull market was dispelled by the spectacular advance in the second decade of the 21st century.

I strongly suspect this technology-inspired bull market is nowhere near over yet with echoes of the Internet boom in the excitement surrounding generative AI.

The share which best captures this long-running, multi-staged boom is Microsoft.

Just look at what happened between 1986 and 2000. The shares rose something like 700 times. They then went to sleep for 15 years until Prince Charming in the form of Satya Nadella (described as the most transformative CEO in corporate history) took charge in 2014 and a spectacular new bull run got underway.

Now here is an extraordinary thought. Suppose the latest pattern [2021 into 2023] is a mid-term consolidation. Between 2014 and fast-approaching 2024 the shares have risen some 10-fold. If that was to happen again the market value could reach some $25 trillion.

Unimaginable! At the time of the 1986 flotation Microsoft was valued at around $500m or $0.5bn. At the peak in 2000 it was worth $550bn, an increase of 1100 times; that’s a bull market! It shows what can happen when a company is delivering sustained explosive growth and investors go wild with excitement. Never underestimate the potential of a bull market in full flight.

Strategy – Get Ready for the Greatest Bull Market in History

It may not happen; that is always a possibility but what if it does. Think of the tech boom as a three stage rocket of which we have completed two stages. Stage one ran from the mid-1980s to 2000. Stage two ran from 2008 to 2021. Stage three has just begun, should run until at least 2030 and could be the most explosive of them all as an exponential technology boom changes everything.

We don’t have a crystal ball so who knows which shares to buy to take advantage of the coming bull market but we can start making educated guesses. My approach is to go for shares with the strongest charts, the most explosive growth, the most exciting stories, that special magic and an amazing ‘something new’. I know when I have found them because the experience is a bit like falling in love.

We can also use ETFs like QQQ and QQQ3 to cover the bases. As one of my subscribers wisely pointed out. You don’t have to bet the ranch on Nvidia when it is one of the largest holdings in QQQ/ QQQ3; that is a fair point and illustrates the huge potential of these two ETFs.

Let us look at them through the lens of my three stage rocket theory, as far as that is possible.

This is the QQQ chart. It starts from when the first leg of the technology bull market rocket ended in 1999/ 2000. Then came the decade of bear markets between 2000 and 2009, ending in March of that year when the second stage rocket began to fire. QQQ subsequently rose from 25 to 404, not bad going by any standards.

Waiting for the Third Leg to Blast Off

We are now waiting for the third stage rocket to blast off into orbit. This will be the era when exponentially advancing technology turns our lives upside down and it will most likely have a similarly dramatic effect on the stock market.

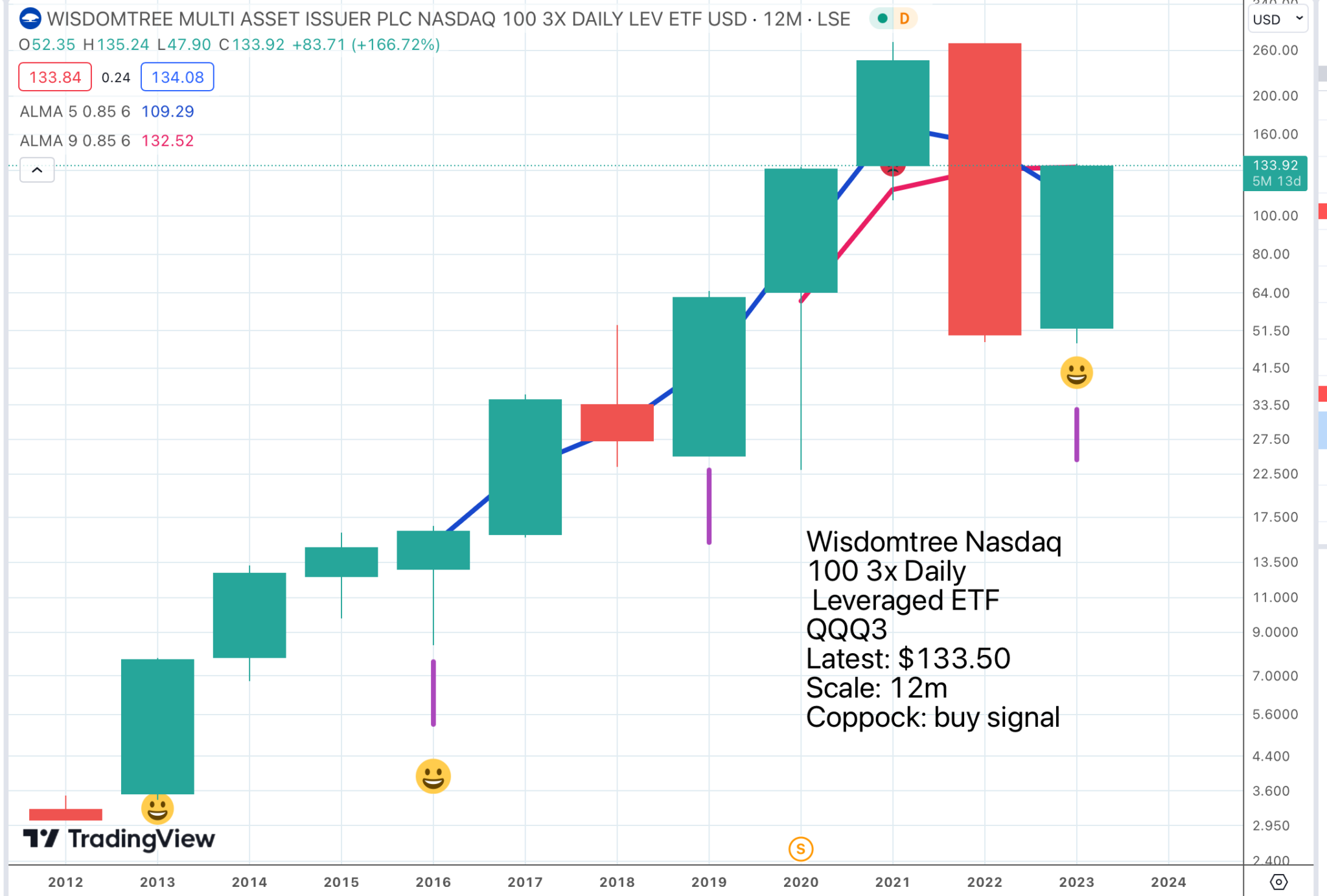

This chart of QQQ3 only captures part of stage two of the technology rocket and yet even that has been enough for the shares to rise 44-fold to today’s price. If stage three is going to be the biggest and most dramatic stage of all you can see why an investment in QQQ3 merits consideration.

Imagine if QQQ3 had existed in January 1986 how much it would have climbed from the initial offer to the present day let alone the 2021 peak. This is the sort of performance that may lie ahead and in a share account you cannot be forced to sell. You can either weather the volatility or use it to buy more shares.

Share Recommendations

Microsoft MSFT Buy @ $345

Invesco QQQ. QQQ Buy @ $381

Wisdomtree Nasdaq 100 3x Daily Leveraged. QQQ3 Buy @ $134.95

Avoiding CGT on QQQ3

I rang IG to complain about having to pay tax on my gains on leveraged ETFs and the guy I spoke to pointed out that QQQ3 can be bought in an ISA or a SIPP. I don’t use these things myself because of my passion for leverage but I can see how they would be very helpful in shielding your QQQ3 gains from the tax man.