Something new and the bitcoin proxies – Silvergate and Argo Blockchain

This is the chart, which is spooking US equity markets. The yield on US 10 year Treasury bonds, which fell last August to an all-time low level of 0.52pc has since roughly trebled on fears that a post Covid-19 economic recovery will revive inflation and lead to even higher rates.

I think it is an overrated fear but who really knows. My feeling is that the sheer scale, openness and technology-fuelled power of the 21st century global economy is so potent that inflationary pressures will be absorbed and the economy will continue to grow with low inflation. There is no sign that the exciting shares making up the QV for Shares portfolio will not continue to thrive in this environment and that is what is really driving this bull market.

There will always be ups and downs along the way; that is the nature of stock markets and the downs always have a reason, one which seems overwhelmingly important at the time but as time passes ceases to be a major influence.

It may help to introduce subscribers, who didn’t study economics at university, to a phenomenon known as the yield curve. It plots interest rates at intervals from short term to long term and its shape tells a story about economic prospects. In August 2020, when long bond yields fell to 0.52pc, this compared with a Fed Funds rate (the rate at which the US central bank, the Federal Reserve or Fed, lends to other banks) of 0.25pc.

This meant that the yield curve was very shallow, almost flat. A flat yield curve indicates that future economic activity is expected to be flat or declining. Last August, Covid cases were reviving with a vengeance and expectations for future economic activity were very cautious.

Now we have the vaccine and many observers believe that a dramatic pick-up in economic activity is just a matter of time. The Fed is still keeping short term rates low because these are set by the Fed but long term rates are set by the market and, in reflection of these changing expectations, long rates are rising sharply leading to a steeper yield curve.

A steeper yield curve is a normal state of affairs and not an inevitable sign of rising inflation ahead. However it does raise the so-called opportunity cost of holding shares because now investors are giving up a higher return on bonds by holding shares instead. So some nervousness in markets is entirely understandable.

There is another shape for the yield curve, where it slopes downwards because short rates are higher than long rates. This usually happens at the tail end of a boom, when the bank is acting to restrain over exuberance in the economy. This is far from being the situation presently.

Silvergate is a perfect bitcoin proxy

Silvergate Capital Corporation. SI Buy @ $141.5 MV: $2.68bn. Next figures: 5 May Times recommended: 4. First recommended: $126.50. Last recommended: $140. Highest recommended: $143.50

Silvergate Capital Corporation is the holding company for a Californian bank. In 2013, the CEO, Alan Lane, had come across bitcoin for the first time and thought (a) it had an important future and (b) it desperately needed better infrastructure and banking support, which it was not remotely receiving from the banking system, where people had either never encountered bitcoin or, like Andrew Bailey, the current governor of the Bank of England, regarded cryptocurrencies with great suspicion.

Lane positioned Silvergate to fill the gap, which led to SEN, the Silvergate Exchange Network, which is used by institutional players in the digital currency market to transact between themselves. The importance of SEN is that it is instantaneous, vital when the bitcoin price can move thousands of dollars in minutes, it is open 24 hours a day, 365n days a year like the crypto markets and all the participants have been carefully vetted before being allowed to participate in the SEN.

Part of Silvergate’s core skill is its regulatory and compliance expertise, which it has been honing for eight years giving it a huge head start in the market. There is also a crucial network effect as it would be expensive and pointless for key players to try to set up or move to an alternative network, when an excellent one already exists in SEN.

Due diligence is important because as people like Bill Gates have pointed out there are some very dodgy and poorly financed players in the market. Institutions using SEN can only transact with each other, which gives them great comfort and creates a powerful network effect as all the big players are now part of SEN and the number of institutional participants will soon exceed 1,000.

Silvergate is working to use its key position in the digital currency market and its knowledge of the participants and their requirement to provide additional fee-earning services like custody services for which it can charge fees. In the latest Q4 2020 quarter fee income grew to $3.8m from $1.4m for Q4 2019. This could become a major source of recurring revenue in the future with so many services needed to make the crypto markets function more effectively.

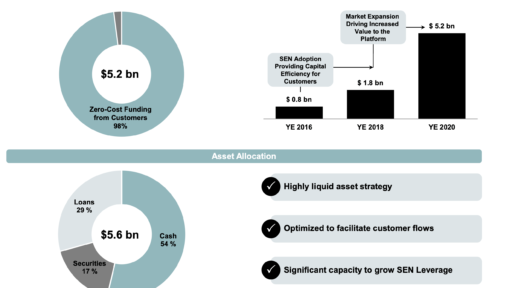

Part of Silvergate’s advantage is that it is a bank and it makes money like a bank by taking in deposits and lending the money. The key advantage of SEN is that the vast bulk of the deposits, 98pc recently, are non-interest bearing so Silvergate’s cost of funds is effectively zero.

This means it can make money by lending to very safe borrowers like other banks. Its returns may not be that high but they are still highly profitable given its zero cost of funds and the rate at which its deposits are growing. Transactions on SEN grew 530pc between Q4 2019 and Q4 2020 and non-interest bearing deposits rose from $2.1bn for Q3 2020 to $5.0bn for Q4 2020 and were $1.25bn a year earlier.

An exciting something new is happening at Silvergate because it has begun lending to its SEN customer base using cryptocurrencies as collateral. This lending, which Silvergate calls SEN Leverage has climbed from $12.5m in Q1 2020 to $82.5m for Q4 and looks as though it could be a massive growth story going forward.

As the bank pointed out the total value of all cryptos reached $1 trillion recently. The potential for lending against that vast sum leading to greater capital efficiency for participants in SEN and much improved profitability for Silvergate looks very considerable. As CEO, Alan Lane noted.

“Looking ahead to 2021, I am extremely excited about the multiple paths to continued growth and opportunities to monetize the SEN platform, such as digital asset lending and custodial services. In particular, SEN Leverage, a lending offering that was piloted through the majority of the past year, is now a core Silvergate product that enables customers to obtain US dollar loans collateralized by bitcoin. We anticipate increased demand for this offering over the next year.”

What is clear is that Silvergate’s performance is closely tied to price levels and activity in the cryptocurrency markets. In the last six months the bitcoin price has more than quadrupled. Over the same period Silvergate shares have risen 10-fold.

This makest Silvergate is a good alternative to hold bitcoin and the shares can be bought and sold on IG or other platforms, with or without leverage, like any other share.

Alan Lane is not only an inspiring leader but he has an eye for talent. A key hire was Ben Reynolds, now chief strategy officer and a key participant at earnings calls, who joined the company in 2016. He and Lane make a formidable team and are a key factor in the rapid progress being made by the business.

Argo Blockchain bets big on bitcoin mining

Argo Blockchain. ARB Buy @ 285p MV: £985m. Next figures: 29 April Times recommended: 1. First recommended: 220p

It could be argued that Argo is an even better bitcoin proxy than Silvergate. In the last six months the Argo share price has risen a staggering 59-fold. It looks like a classic example of the rubbish theory of value. Six months ago nobody had any interest in Argo; that has changed dramatically as investors have realised how closely Argo’s fortunes are tied to the bitcoin price and how active the company is being in capitalising on its opportunity.

The shares are not cheap. Analysts are forecasting sales reaching £25.3m for calendar 2021, which compares with £18.9m for 2020 and zero for 2019. The story at Argo is its ambitious plan to go crypto mining in Texas.

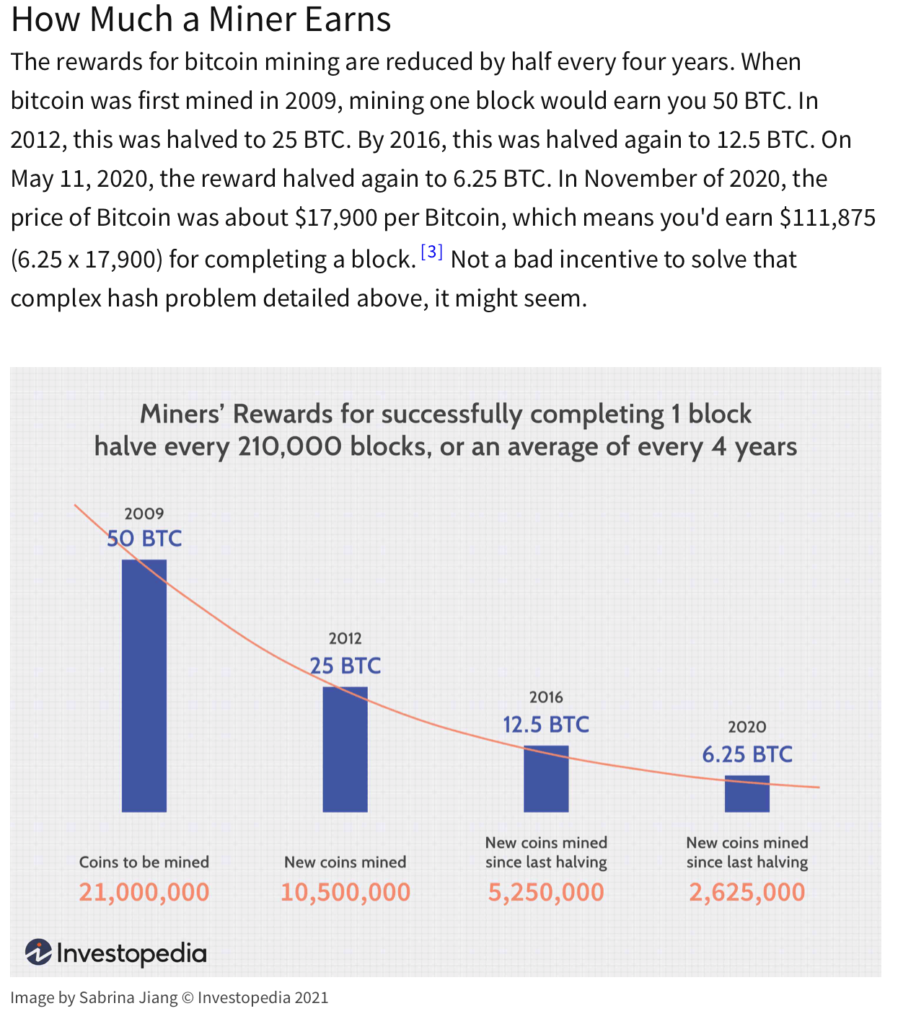

There is much more to what bitcoin mining is all about. It is so complicated it is almost funny. Mining bitcoin seems a bit like player poker professionally with the help of banks of supercomputers. This is the game that Argo is proposing to play on a really serious scale.

The company made the following announcement today.

“Based on daily foreign exchange rates and cryptocurrency prices during the month, mining revenue in February amounted to £4.34m (January 2021: £2.48m). Argo generated this income at an average monthly mining margin of approximately 81pc for the month of February (January 2021: 71pc). At the end of February, the company held 599 BTC. As announced on 26 February, the company has installed an additional 4,500 Bitmain Antminer S19 and S19 pro miners that it agreed to lease from Celsius Network in November 2020 and which are now fully operational. This instalment takes the company’s total mining capacity to 1075 Petahash (SHA-256) in addition to 280 Megasols of equihash mining capacity. One petahash is a quadrillion hashes per second (A “hash” is a fixed-length alphanumeric code that is used to represent words, messages and data of any length. Crypto projects use a variety of different hashing algorithms to create different types of hash code – think of them like random word generators where each algorithm is a different system for generating random words). The company is also pleased to announce that beginning from the 1st of March, Argo will pay the salary of its CEO, Peter Wall, in Bitcoin. In addition, any other Argo team members may choose to be paid in Bitcoin for part or all of their salaries. For those that opt in, Argo will automatically convert salaries from fiat to Bitcoin at the daily market rate using the Toronto-based Satstreet exchange using their “Bitcoin Savings” service. Peter Wall, Chief Executive of Argo said: “I’m delighted that Argo has followed up with another record month in both mining revenue and profits. A mining margin of 81pc is absolutely amazing, and we continue to add to our BTC HODL. I’m also pleased to be the first publicly traded company that we know of to have their CEO paid in Bitcoin.”

The company is moving fast to make an impact in the bitcoin market. On 10 February it announced a letter of intent to acquire 320 acres in Texas for bitcoin mining. The plan is to acquire the land with access to up to 800-megawatts of electrical power, where Argo intends to build a new 200mw mining facility in the next 12 months. “When completed, this facility will provide Argo with electricity at some of the lowest rates in the world with the majority from renewable sources.” Peter Wall, Chief Executive of Argo Blockchain, said: “We are incredibly excited about this proposed acquisition. It gives Argo tremendous control over its mining operations, as well as significant capacity for expansion. In addition, we have been able to secure access to some of the cheapest renewable energy worldwide in a location where innovation in new technologies is encouraged and incentivised.”

I am not going to try to quantify this but it looks like a massive bet on bitcoin, which could pay off dramatically, especially if the theory put forward by the bitcoin supporting Winklevoss twins is right and one day the market value of bitcoin will match that of gold and each bitcoin will be worth $0.5m or more.

Accordingly, I think Argo deserves a place in a portfolio as a highly leveraged bitcoin proxy. Is it speculative? Of course – but that is part of the fun.

You can buy bitcoin and other cryptocurrencies on Coinbase in any amount you like from very small to very large. But I I think investing in shares like Silvergate and Argo is a good alternative to invest in bitcoin direct, offering a similar risk/ reward profile. I also think Silvergate may be right that the higher the bitcoin price rises the less speculative it becomes. Cryptos are knocking on the door of the financial establishment and the widespread scepticism is bullish, nor bearish. It’s still scary but so much investment is speculation. It is not a game for faint hearts but it can be very rewarding for those who hold their nerve.

Both companies also offer something new as investments. Argo is making a huge bet on bitcoin with its $100m plus investment in Texas, an extraordinary initiative for such a small company. Silvergate has what looks like a massive opportunity with its move into making loans using bitcoin as collateral. I can see that business growing with incredible speed.