Stock market benchmarks weak but flickers of life amidst the gloom

Not a reassuring chart the US 10 year benchmark yield is through three per cent and looks to be on the verge of breaking higher, which could send shock waves through shares. The £/US$ chart is hitting new lows for sterling dropping below $1.15 to £1. I have just been through my benchmark charts and the picture is negative with only two Coppock indicators heading higher out of over 100 benchmarks.

The pound looks as though we could be heading for an old-fashioned sterling crisis. We have the bizarre possibility that we could end up with something close to £1=$1=1 euro.

Bitcoin also has a threatening chart. A decisive break below $20,000 would be scary.

What about my old trusty leveraged ETF, QQQ3 tracking the Nasdaq 100 times three turbocharged by daily rebalancing. This chart too seems to be rolling over and heading lower after a failed attempt at a rally. My brief flirtation with profits is now just a memory and I am waiting for the next buying opportunity

Some of the big stocks are looking alarming too. Below is a chart of Alphabet which has built a significant sideways consolidation. It tried to break higher and that failed. Now it is important that the $100 line should hold. Meanwhile the Coppock indicator, which began to fall in December 2021 is on the brink of turning negative.

Quite a few of the shares that were signalling rally attempts with possible 2B buy signals have failed to confirm those signals, which suggests an alarming lack of conviction in the buying. What I would really like to see to feel better about this stock market is a full 3B buy signal for the Nasdaq 100, which means a golden cross by the moving averages, a broken down trend line and a decisive change of direction by the Coppock indicator. Presently we don’t have any of those things and there is a possibility that after building a significant consolidation the index is going to break down again; that’s what can happen in bear markets. Based on the admittedly unrealistic assumption that the Nasdaq 100 stays where it is until January 2023 the Coppock indicator, currently minus 45.5 having just turned negative in August, would reach minus 190.1.

Another stock market that is starting to look alarmingly poised is the FTSE 100. Overseas earners should benefit from a weaker pound but won’t like rising interest rates and falling economic activity, which may be what lies ahead.

The latest pattern is beginning to look like a top area. We have a dead cross on the moving averages, a broken uptrend line and the Coppock indicator turned down in February 2022. UK stocks must be regarded as high risk.

The background is one of great uncertainty with the imminent appointment of a new leader for the Tory party, who will immediately become an unelected prime minister with none of the authority that Boris Johnson had and lost. We will then face the possibility of a general election to bring in a prime minister who does have a popular mandate although I suspect that is unlikely. My rule with new prime ministers is that you never know what they are going to be like until they start doing the job so here’s hoping Liz Truss will turn out to be a good one. I am feeling slightly hopeful at the moment after her comments that tax cuts, e.g., lower NI, should not be viewed solely through the lens of redistribution but also for their effect on growth. This sounds like a robust defence of Tory principles.

Meanwhile there is a feeling that the economy is running out of control with huge pressure on living standards as living costs rocket led by bills for energy and food that people find hardest to avoid. This will put pressure on discretionary spending as people are forced to make economies.

This is yet another alarming chart for a share which was a stalwart of the post-2009 bull market. Nvidia has had some bad news with the US government banning export of some chips to China. The company says this could result in $400m of lost sales and also create bad feeling between the US and China.

Apart from all the usual negatives, dead cross, broken uptrend and falling Coppock we have a breakdown from a tight pattern, which could take the price significantly lower.Nvidia is still a great business. It is because their AI chips are so powerful that the US authorities don’t want them to be sold to China but at the moment that is not the point.

Analysts fear there could be a structural risk to the whole semiconductor industry.

It is not all gloom. There are some charts looking more positive though all rallies can be treacherous in an ongoing bear market. The Tesla chart is either going to be amazing or disastrous. As subscribers know I favour amazing but for the moment we are waiting for a convincing buy signal.

Snowflake is another share I like. The company is targeting sales of $10bn by 2029 and privately is aiming to beat that number. Below I discuss in some depth what is happening at Snowflake because it makes the point that the ongoing technology revolution is a far bigger phenomenon than the current global energy crisis.

Starting in 2014, Snowflake’s cloud-native architecture removed the scale, performance, and economic bottlenecks that held back data analytics at scale for generations. The impact was immediate and led to a major expansion of workloads and use cases. Initially, organizations used Snowflake to drastically improve overnight analytical processes so that fresh up-to-date data about the business was reliably available first thing. Checking that box, customers moved on to using data for predictive insights and prescriptive solutions.

This is what has driven Snowflake’s massive platform expansion in terms of workload types, user types, and data types. Snowflake’s data sharing solves the challenge of data access and enrichment. In Q2, the number of Snowflake data sharing relationships measured with what we call stable edges grew 112pc year on year. 21pc of our growing customer base has at least one stable edge, up from 15pc a year ago.

Among customers over $1m in product revenue, 65pc have at least one stable edge.

Q2 2023, 24 August 2022

Before I try to explain what a ‘stable edge’ is I just want to highlight the insane growth of data in a technology-driven world.

Two years ago [2018 in this quote], the market research company IDC estimated the amount of data collected by mankind to date at 18 zettabytes (ZB). One zettabyte is equivalent to just over 1 trillion gigabytes. Today, in 2020, this number is likely to have more than doubled. Looking five more years into the future, experts forecast the expected amount of data to be as much as 175 zettabytes. If all this data were to be burned onto DVDs, the pile would circle the earth 222 times. But this is only the beginning. All new technologies, including in particular the Internet of Things, deliver a large amount of data every second. With digitisation and more and more everyday applications, we are facing exponential data growth.

A beginner’s guide to cloud/ edge computing, 24 March 2021

More on edge computing

Edge computing is a form of computing that is done on site or near a particular data source, minimizing the need for data to be processed in a remote data center. Compared to traditional forms of compute, edge computing offers businesses and other organizations a faster, more efficient way to process data using enterprise-grade applications. In the past, edge points generated massive amounts of data that often went unused. Now that IT architecture can be decentralized with mobile computing and the Internet of Things, companies can gain near real-time insights with less latency and lower cloud server bandwidth demands—all while adding an additional layer of security

Considering that IoT and edge computing are still in their relative infancy, their maximum potential is far from full realisation. At the same time, they are already accelerating digital transformation across many verticals, as well as changing day-to-day lives around the world.

At a base level, edge computing streamlines how much data businesses and organizations can process at any given time, and as a result, they are learning more and uncovering insights at an incredible rate. With more detailed data from a variety of multi-access edge computing locations, businesses are better equipped to predict, manage, prepare, and adapt for future demands using historical and near-real-time data and scalable and flexible processing without the costs and constraints of older IT options.

The acceleration of data and convenience of edge computing is also the driving force behind many new and exciting technologies, from the faster and more powerful mobile devices, online collaboration, and faster and more exciting gaming, content creation, and transportation. The ongoing development of self-driving cars, in particular, is a prime example of edge computing in action, with driverless cars reacting and adapting in real time instead of waiting for commands from a data centre hundreds of miles away.

Hewlett Packard Enterprise

There is a powerful ‘something new’ business developing at Snowflake.

Our next frontier of innovation is aimed at reinventing cloud application development. Our ambition is far reaching. Our aim is to transform how cloud applications are built, deployed, sold, and transacted.

To help achieve this, we launched our Powered by Snowflake program. Today, we have 590 Powered by Snowflake registrants, representing 35pc quarter-over-quarter growth. We announced a number of significant product innovations at our Summit users’ conference in June, which saw an approximate fivefold increase in attendance from 2019.

Q2 2023, 24 August 2022

It was amazing listening to Snowflake CFO, Mike Scarpelli, talking at an investor conference on 31 August 2022. He said the average Snowflake Global 2,000 customer spent $1.2m a year on Snowflake products, a sum that could be recouped by laying of just five people. He said one of their biggest opportunities was simply to get these customers to spend more, $10m a year instead of $1.2m. At the same time the company is recruiting more customers.

In the quarter, we added 12 new Global 2000 customers. Our average trailing 12-month product revenue from these customers grew 14pc quarter over quarter to $1.2m. We believe these accounts will grow to become our largest customers. A Global 2000 technology company is now a top 10 product revenue customer less than two years after signing their initial deal.

Q2 2023, 24 August 202

Snowflake is a vivid example of what is happening in this market, where there are still many companies with glittering fundamentals. The chart shows a 2b buy signal. We can finally calculate a number for Coppock (we need 24 months of price data) which is minus 66, setting the scene for a powerful buy signal.

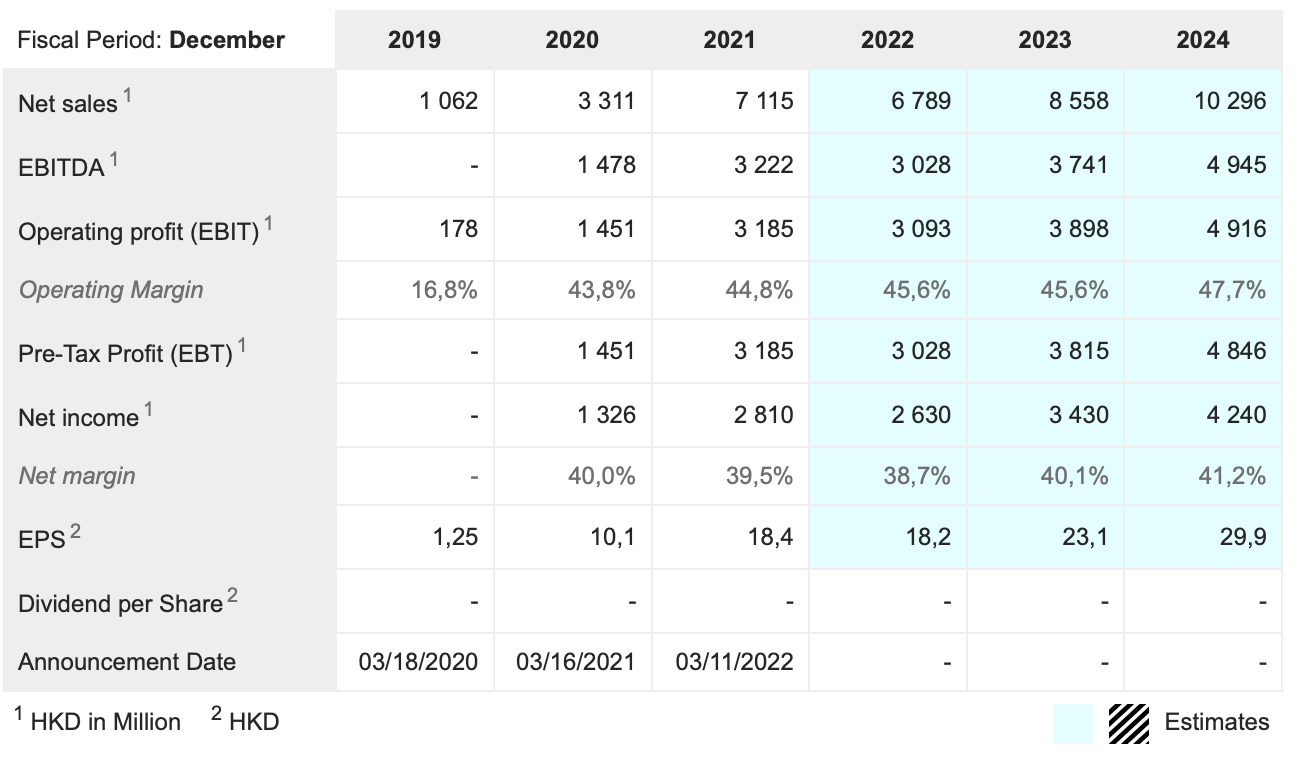

Futu Holdings is another share which I think could feature strongly in the next bull market. The company is based in Hong Kong and operates as a stockbroker and wealth manager. It has been growing at an incredible rate as illustrated by the table below. It’s a Chinese share listed in Hong Kong and on Nasdaq and the shares have been affected by the tension between the US and China. It also had an unbelievable run between March 2020 and February 2021 rising from below $10 to over $180. The Coppock indicator is minus 121 having been plus 1,844 at the peak. Futu has a high exposure to US stocks and also US-quoted Chinese names so it is encouraging to see how well the business is weathering the bear market. Client numbers are still increasing at a healthy rate. Singapore is a newer area of activity for the business and client assets there grew 377pc.

Futu is all about applying technology to financial services.

We believe that our superior user experience remains our biggest competitive advantage. In the first half of this year, we continued our relentless pursuit of product experience by releasing 99 versions of our mobile app and desktop clients and adding 3,989 new features, up 21pc and 52pc year over year. Going forward, we intend to launch more customized features for clients of different regions.

Q2 2022, 30 August 2022

My feeling is that it is safe to dip a toe in the water with these stocks and other stocks with super-exciting fundamentals like Pinduoduo and Palo Alto Networks, which I recently wrote about as long as you are prepared for the possibility of further overall share price weakness and can add to holdings on new buy signals. I just cannot believe that these spectacular fundamentals won’t be rewarded by the stock market eventually.