Successful investing needs faith; winners from the Covid-19 second wave

The number of exciting, explosively growing companies in the world is incredible. I have been investing and writing about investing for a long time and I have never seen anything remotely like the present period.

As I noted in the last issue you can build a portfolio of 100 shares in today’s stock markets and every single one will be a star performer. Indeed, I strongly recommend subscribers to build exactly such a portfolio.

The trick to doing this incidentally is just to buy the good ones. If you read the newspapers, which I mostly don’t, especially the financial pages, they are always worried about values being too high, bubbles and short-term negative factors, which happen to be in the news at the time. It is only too easy to be drawn into their world of worry.

Don’t be. A shrewd observer of stock markets once pointed out that in a bull market shares climb a ‘wall of worry’. So if the press and many of the so-called experts are worried, paradoxically that is a good sign.

Much more alarming, as famously happened in 1929, investors became far too complacent. One expert talked then about the US having reached a plateau of permanent prosperity just before the crash began. Two points I would make about that crash are that first, the bulls were actually right, many exciting things were happening in the 1920s and 1930s like wireless, movies, household appliances, mass manufacturing, road building for the automotive age and much more. Unfortunately this exciting period was temporarily crushed because the authorities reacted to the crisis in the most disastrous way possible, which is my second point. They squeezed when they should have inflated and a stock market crash turned into the great depression and the long-running train crash that was the 1930s. Furthermore, as we know, when America sneezes, the whole world catches a cold.

So worry is good for stock markets, complacency and euphoria are bad. My impression is that it is very much a world of worry out there, not least because of the virus and the undoubted economic pain that many people and businesses are suffering because of lockdown.

Another thing to realise is that the connection between how a company is doing and how its shares behave can be surprisingly loose. There is, to put it mildly, not a one to one relationship between corporate and share price performance. On the contrary I think of many shares, especially those in companies where a great deal of the present value depends on hopes and expectations for future performance as rather like bitcoin.

Bitcoins are a virtual currency or cryptocurrency as they are popularly known. In 2013 there were moments when you could buy one bitcoin for around $1. The latest price is over $11,000 and has been higher. There is no particular fundamental about bitcoin to which you can point to explain such an incredible rise. The main thing that has happened is that bitcoins have captured the imagination of investors and huge global demand has met limited supply squeezing the price sharply higher. My take on bitcoin is that they are a perfect speculative instrument so I do believe they are worth buying and holding but there is no way of analysing the phenomenon to make predictions about the price.

Many people do make predictions but they are just guesses. Maybe they will go to $1m a coin one day and maybe they won’t. Who knows?

Now consider that shares have something in common with bitcoins. The main reason why they go up, just like bitcoin, is too many buyers chasing a limited supply, especially when you consider any individual share. Share values, especially shares in exciting, fast-growing businesses are mainly based on what is going to happen in the future, even the quite long-term future. As we know the future is unpredictable leaving such shares very much at the mercy of investor emotions. The main reason why they go down, again just like bitcoin, is because sentiment changes, eddies in the wind and a bout of profit-taking trigger a sell-off. The difference between shares and bitcoins is that shares do have fundamentals, which can be analysed. Over time companies can become dramatically bigger. Witness Amazon about which I wrote last month. This justifies a higher share price over time but along the way there will be violent movements, which have very little connection with how the business is doing.

This has led to my growing belief that for many investors the best strategy is (a) only buy shares in exciting, growing businesses (seems obvious but most people don’t do it) and (b) once you have bought, pay no attention to the vagaries of the short-term investors, algorithms and day traders making the price roller-coaster all over the place. Sit tight, do nothing and have faith in the company whose shares you have purchased.

Company owners do this and it works well for them. Bezos didn’t sell his shares when the first wave of profit was taking a hit. He didn’t even sell when the price fell through the floor in 2001-02. He had an advantage because he knew the business was going well but absent any announcement from the company to the contrary there was no reason to assume it wasn’t. There was no warning from the company on trading and the quarterly reports highlighted a business that was growing explosively. One problem was that back then, around the turn of the millennium, investors judged businesses by the profits they were making. They weren’t impressed by the growth, they saw the lack of profits and the absence of any clear pathway to short-term profitability. As we now know the lack of profitability was a sign of strength. Bezos could see both a massive opportunity and huge advantages in scaling before the competition could arrive. He had a far bigger objective than short-term profits. He wanted to win the battle for territory and it is his success in doing this and developing other exciting businesses like Amazon Prime (a subscription business) and Amazon Web Services, the world’s largest computing infrastructure business that has made Amazon the trillion dollar plus behemoth it is today.

I know it is not easy to have that kind of faith. Sometimes companies do crash and burn. There are no certainties in investing but I think if you build a 100 share portfolio of stocks with Amazon-like potential, if you invest equal amounts in each one and if you have faith and never sell you will eventually make a fortune.

The bizarre thing is that making money in the stock market is actually rather easy if you have faith. Traders don’t, which is why over 75pc of customers with spread betting, CFDs and share buying business, IG, lose money. When you trade stocks you are buying and selling shares which are shooting up and down based on the vagaries of the market. You are trying to anticipate how sentiment is going to change and that is difficult, not least because it is hard not to be infected by the madness of crowds. When you buy and hold, for years, you are investing in the performance of the company; that is why long-term investing is the only way to invest if you want to make money.

Warren Buffett is obviously a successful investor but his biggest trick is that he very rarely sells. In the early days Buffett was not that great a share picker. He bought loads of duds. It was his partner, Charlie Munger, who opened Buffett’s eyes to growth shares. Once he started investing in growing businesses, companies like American Express, Gillette, The Washington Post, Coca-Cola and other great growth stars of the 20th century; that’s when he began to pile up the billions. Growth plus patience proved to be an incredible winning formula for Buffett and Charlie Munger, who is also a billionaire; but most people still don’t get it.

Along with these mantras, growth, long-term investing and never-sell, another of my mantras, especially in the 21st century is technology. I joke that my three favourite sectors are technology, technology and technology but actually I am deadly serious.

I really do believe that for most people most of the shares in their portfolio should be technology shares. My main reason for this is my belief that humanity is at an early stage of the most important revolution of them all, the technology revolution.

Obviously it stands on the shoulders of early revolutions like the industrial revolution, the Enlightenment, the Renaissance and the switch by humanity from a hunter gather lifestyle to a settled existence based on agriculture, towns and cities. I think it is the big one and that in coming centuries human life is going to change out of all recognition. The wonders we have seen so far like wireless phones with the power of IBM computers are just the beginning.

A new element in this process is Covid-19, one of the most extraordinary Black Swan events to ever hit financial markets. It is becoming increasingly apparent (a) that there are no easy solutions, no magic bullets about to arrive and take us back to the pre-Covid era and (b) that lockdowns and social distancing have turbocharged the technology revolution.

The pre-eminent example, much recommended across all my publications, is Zoom Video Communications. What a business! The company has reported the two greatest quarters of growth in software history and the shares have exploded. At the beginning of the year the price was around $65. They are $559 as I write this and I think they are going higher. I even think Zoom is a candidate to become a trillion dollar business one day. I am sure that sounds wildly fanciful for a business that was valued at $18bn at the start of the year but then think about what they are doing. Zoom is the king of video conferencing, which CEO and founder, Eric Yuan, expects to move to the heart of modern communications. He is also offering what he calls UCaaS, Unified Communications as a Service. Lastly he believes that the way we work has changed for ever and that video communications are going to play a central role in this process. The company is the overwhelmingly leader in a sector, which is growing explosively and where the opportunity is enormous. I certainly think Zoom deserves to be one of the 100 shares in your 21st century portfolio. The shares are expensive, for sure but that is where the value guys get it so wrong because they have never been able to buy Zoom Video Communications or shares in countless other exciting companies like it. Let’s make it really simple. Zoom Video Communications is playing a key role in the biggest revolution in human history. What is that worth? I don’t know but surely a lot.

I often talk in my publications about 3G shares (great growth, great story, great chart). Latterly I have added an M for magic so I want shares, which are 3G+M.

Now I have some more letters. I want shares that are 3G+M+SN+FW. This stands for 3G+M plus something new plus a following wind. Find shares with those characteristics and Zoom is a perfect example and you should do well. Imagine a portfolio with 100 shares which are all 3G+M+SN+FW. What an opportunity you would have with a portfolio stuffed with such all-star performers.

At the heart of everything I do I am looking for high quality, sustainable growth. If a company is not growing in size why should the shares rise. I am not interested in shares in companies that aren’t growing. I don’t care how cheap they are, they are not for me.

In this issue many of the charts are of shares which are newcomers and most of them are UK or European names..

To balance that here is a list of US shares I think are timely to buy. The code comes after the forward slash.

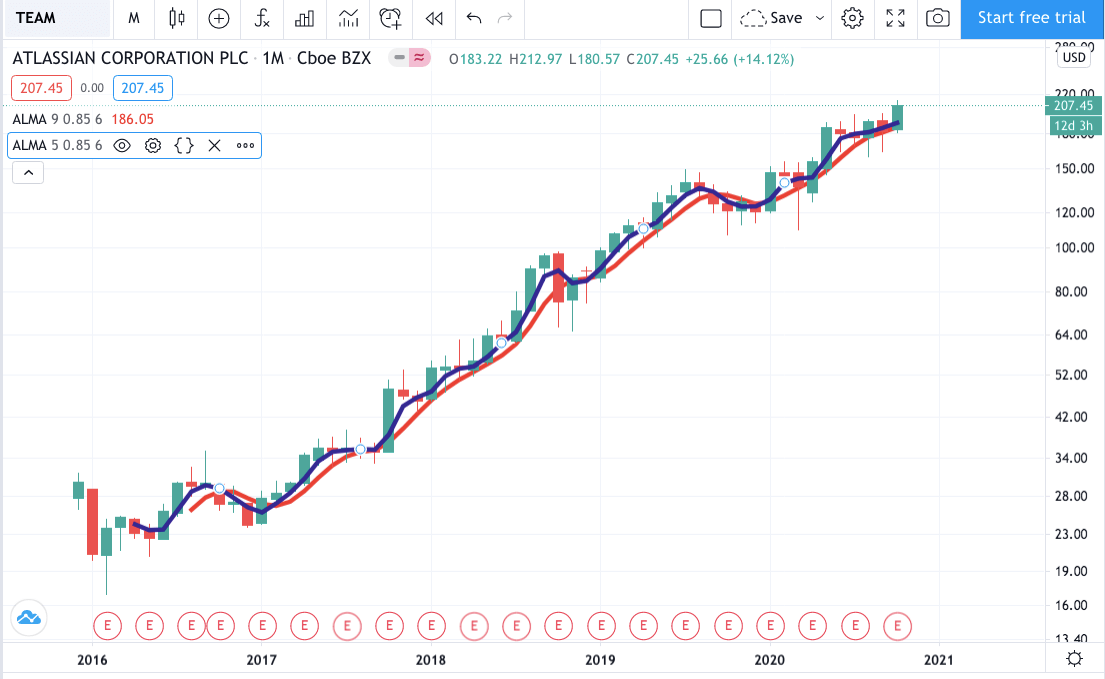

Appian/ APPN @ $82; Avalara/ AVLR @ $153; Atlassian/ TEAM @ $207; Beigene/ BGNE @ $301; Blackline/ BL @ $101; Five9/ FIVN @ $145; Globant/ GLOB @ $197; Humana/ HUM @ $433; McDonalds/ MCD @ $225; MongoDB/ MDB @ $265; Morningstar/ MORN @ $182; Monolithic Power System/ MPWR @ $311; Cloudflare/ NET @ $58; Nio/ NIO @ $28; ServiceNow/ NOW @ $522; Paycom Software/ PAYC @ $381; Paylocity/ PCTY @ $192; Pool Corporation/ POOL @ $354; Peloton Interactive/ PTON @ $131; SolarEdge Technologies/ SEDG @ $302; Thermo Fisher Scientific/ TMO @ $461; Tyler Technologies/ TYL @ $394; Veeva Systems/ VEEV @ $302 and Zoom Video Communications/ ZM @ $559.

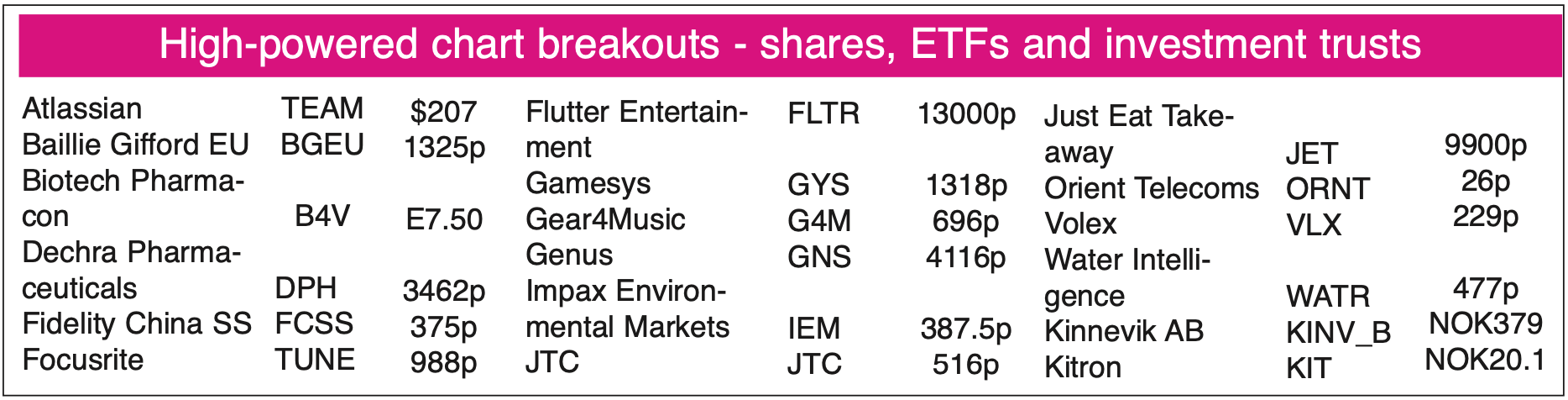

Baillie Gifford European Growth Trust. BGEU. 1305p. MV: £472m. Next figures: 28 November

Baillie Gifford invests in European shares and is beating its benchmark indices, notably in recent years. Over 10 years the nav is up 144.7pc v 108.1pc by the benchmark but over three years it is up 28.5pc v 9.2pc by the index and over one year the figures are 37.5pc v -0.3pc. Good stock selection is making an increasing difference. Number seven on the list is Spotify, which is quoted in the US but is actually a Swedish business. Their approach is similar to mine. If a business isn’t growing the value is unlikely to rise over time and the shares are not worth buying. A big factor in the outperformance is that in October 2019 Edinburgh Fund Managers were sacked and Baiilie Gifford appointed in their place. There was also a switch from targeting income and capital growth to targeting capital growth only.

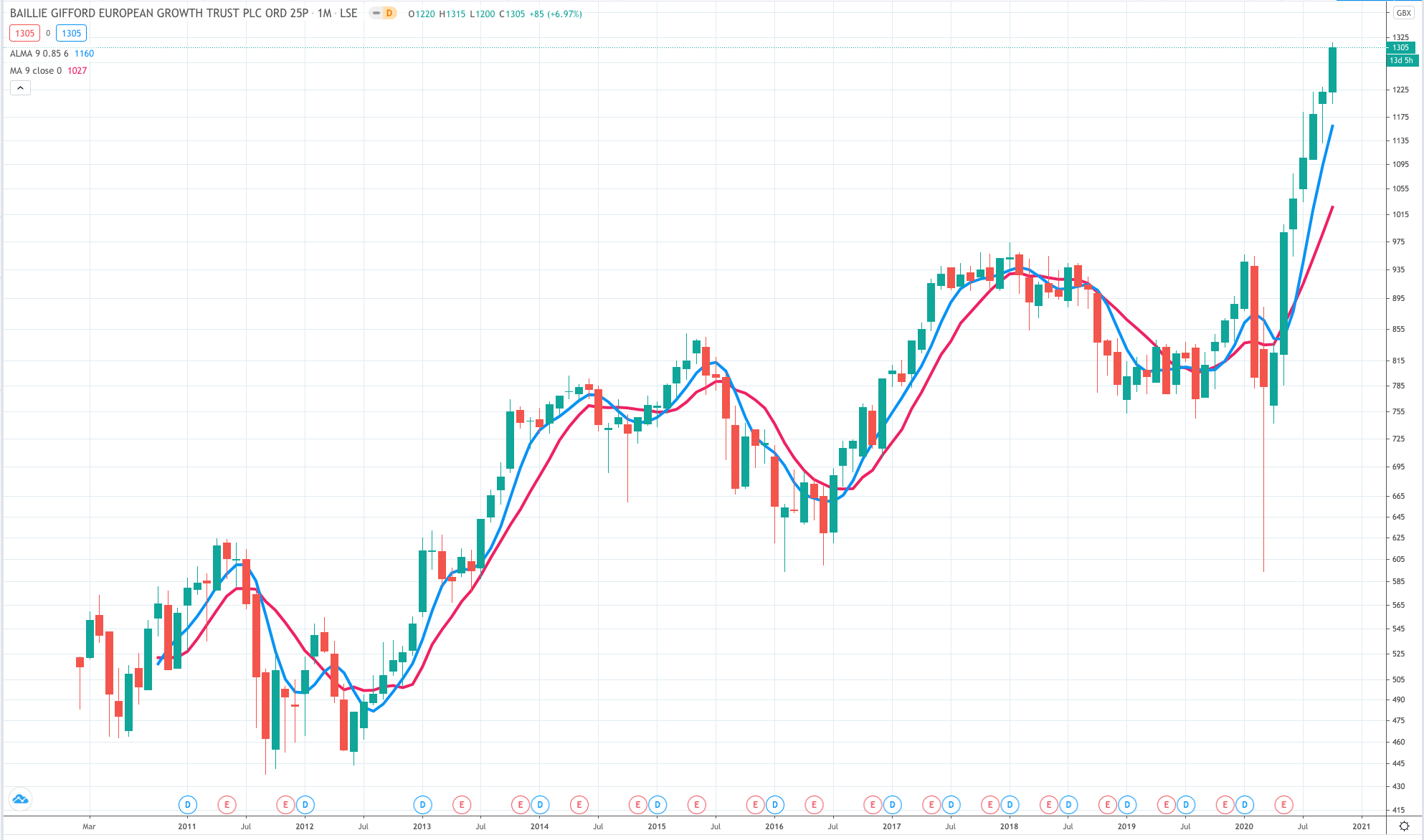

ArcticZymes Technologies B4V. E7.52. MV: E366m Next figures: 24 October

Originally listed as Biotech Pharmacon in 2005 Biotech Pharmacon recently rebranded itself as ArcticZymes Technologies ASA and is a global leader in development and commercialisation of enzymes. Latest figures revealed stunning growth with sales up 270pc to NOK33.4m (£2.75m) and gross profits up 244pc to NOK40.0m (£3.3m). The explosive growth is being driven by strong sales in the therapeutic segment and upside related to sales of enzymes for Covid-19 diagnostic tests. Sales growth also remained strong in the underlying non-Covid-19 related business. The group warns that sales growth will slow in the 2H for Covid-19 products but says it has secured a supply agreement with an Italian company fast-tracking the development of a Covid-19 vaccine.

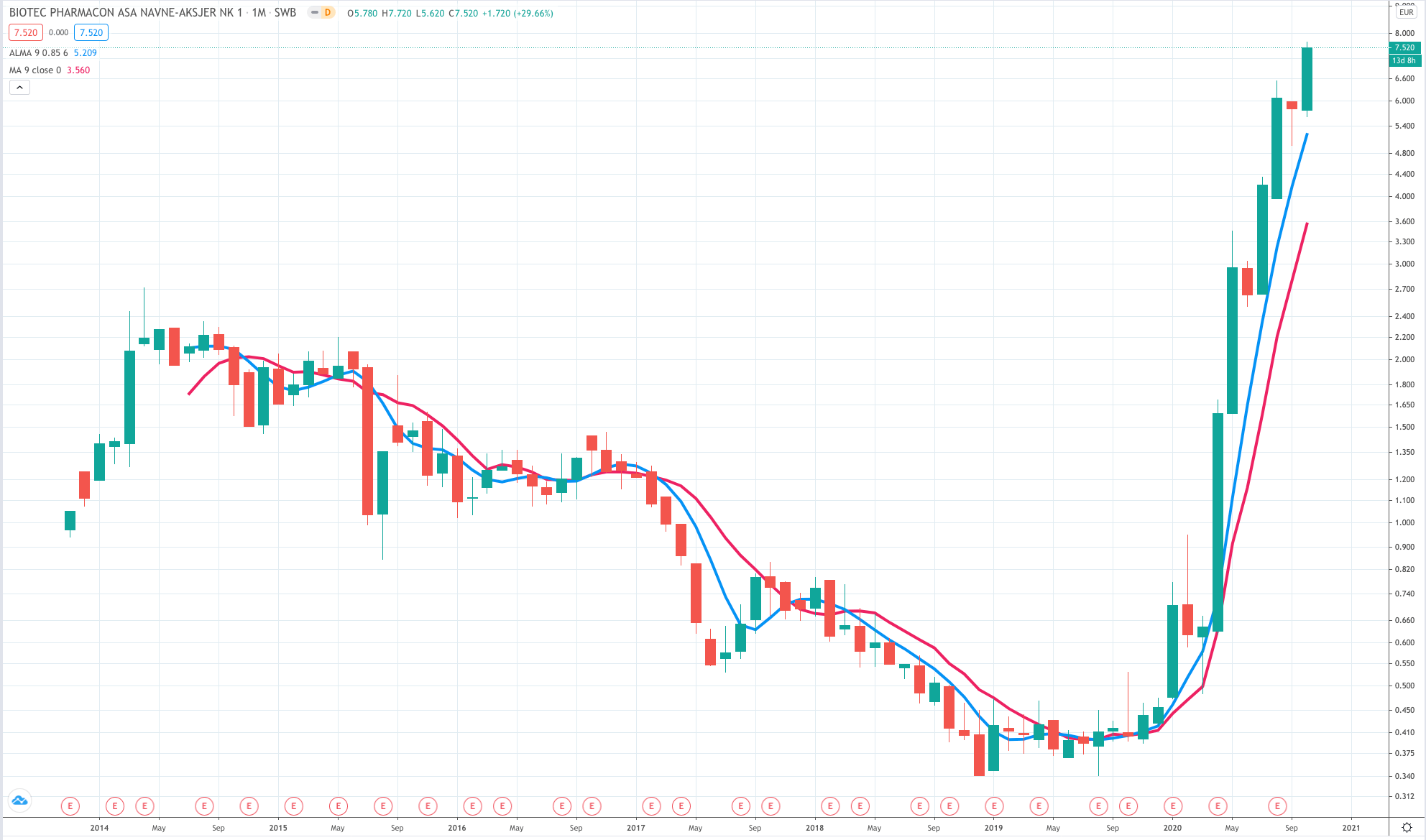

Dechra Pharmaceuticals DPH. 3478p. MV: £3.76bn. Next figures: 24 February

Dechra Pharmaceuticals is a veterinary pharmaceuticals business. The group started as a wholesaler of veterinary products and floated on the UK stock market at 120p in September 2000. Since then it has been steadily extending its business into proprietary pharmaceutical products for animals, who not only suffer from many of the ailments human animals suffer from but are increasingly given the expensive treatments humans receive. The group has also been highly acquisitive over the years and has increasingly spread its wings globally. In 2005 Dechra US was established. One source of growth has been winning approval to sell a drug, Vetoryl, for the treatment of Canine Cushing’s Disease, which lowers blood cortisol levels. In 2013 the services business was sold to focus on pharmaceuticals. In 2015 the group entered the vaccines market. The acquisitions have kept coming driving strong growth.

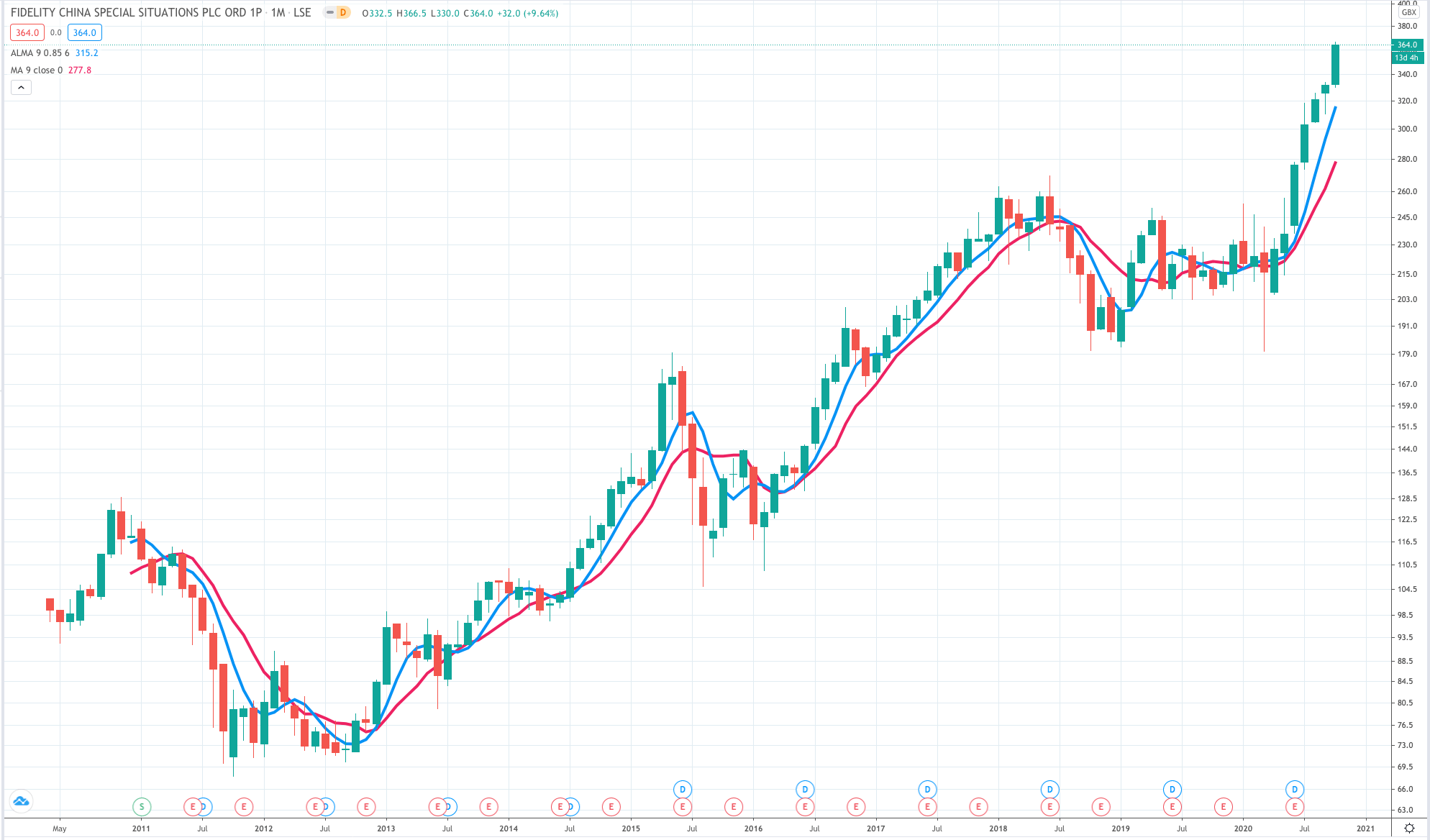

Fidelity China Special Situations FCSS. 364p. MV: £1.88bn.

The manager believes there are strong investment opportunities in Chinese stock markets. Over the 12 months to 31st August 2020, the Trust’s NAV registered 50.3pc in returns, outperforming its reference index which delivered 24.9pc over the same period. Adding to performance was the Trust’s high-conviction holding in China Meidong Auto Holdings. Its focus on lower-tier cities, a strong portfolio of luxury brands, strong revenues from after sales services and an improvement in new car sales margins contributed to its healthy sales and profits. China Pacific Insurance held back returns amid weaker activity following the COVID-19 outbreak.

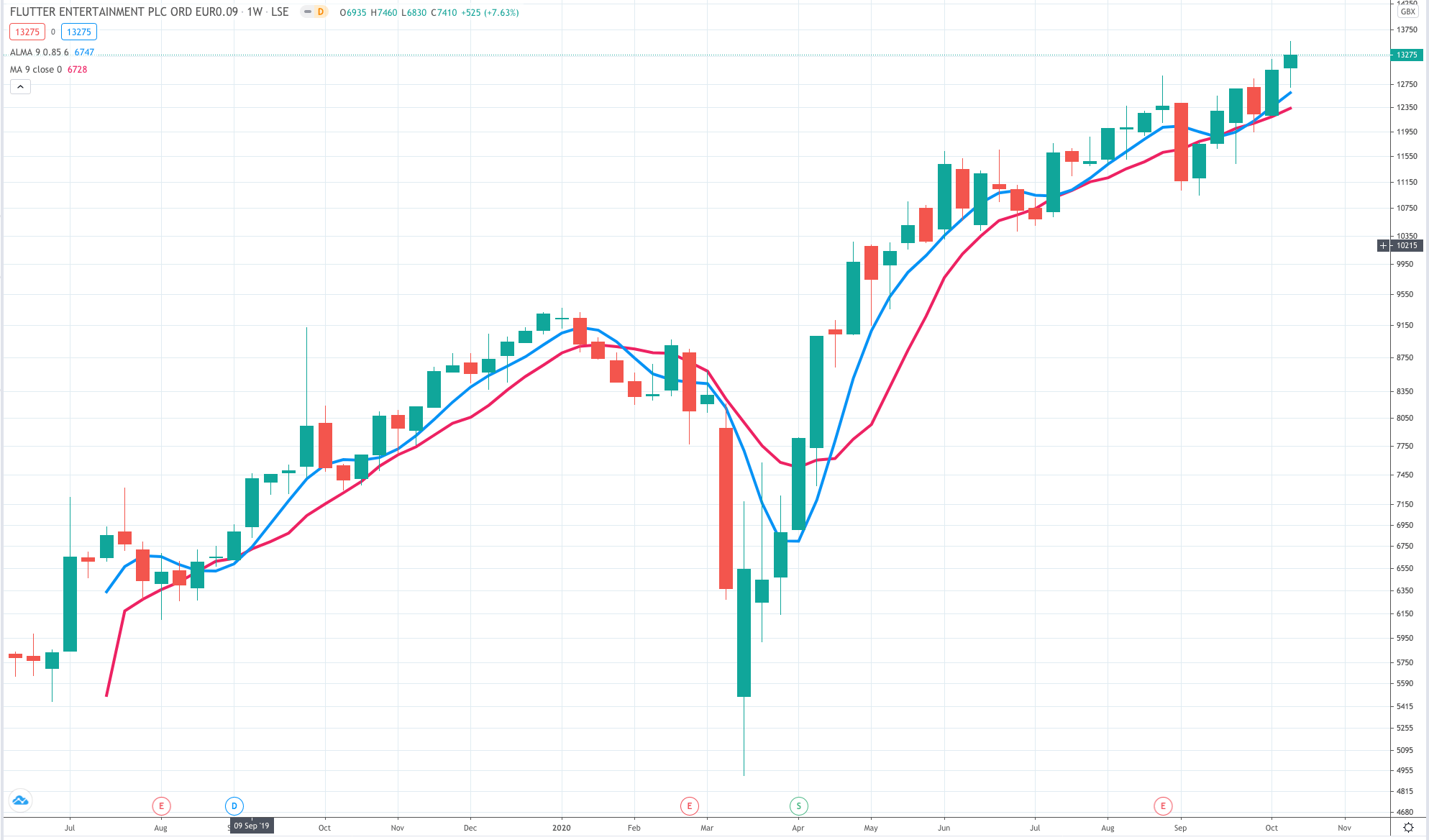

Flutter Entertainment. FLTR. 13000p. MV: £20.5bn. Next figures: 21 March

Back in the day Flutter Entertainment used to be a highly successful chain of betting shops, based in Ireland but growing strongly by expanding into the UK. Since then a series of mergers have transformed the group which went from being PaddyPower to PaddyPowerBetfair to becoming Flutter Entertainment. The group also owns Adjarabet and recently bought The Star Group bringing in PokerStars, the world’s largest poker site and the home of live and online poker. The group is betting the ranch on the move of the betting market online. “Our vision is to be a global leader in online sports betting and gaming.” The global betting and gaming market is estimated to be worth around £345bn and currently just 12pc of that is online. Latest results showed sales growing by 49pc to £1.5bn and earnings up 29pc for the six months to 30 June 2020.

Atlassian TEAM $207 MV: $51bn Next figures: 29 October

Atlassian is based in Australia but quoted in the US, were it does much of its business. The group is an enterprise software business, part of an exciting and fast growing group of businesses that are helping drive the digital transformation of the world. The company is due to report results imminently and investors are looking for good news. The shares fell in late July when the company reported its Q4 2020 results for the year to 30 June. Sales grew 33pc to $1.6bn for the year with the company serving more than 174,000 customers of whom more than 150,000 are using the group’s cloud products. The company provides software to help teams work more effectively and is growing from the technology world into less high tech areas. Relentless innovation drives growth.

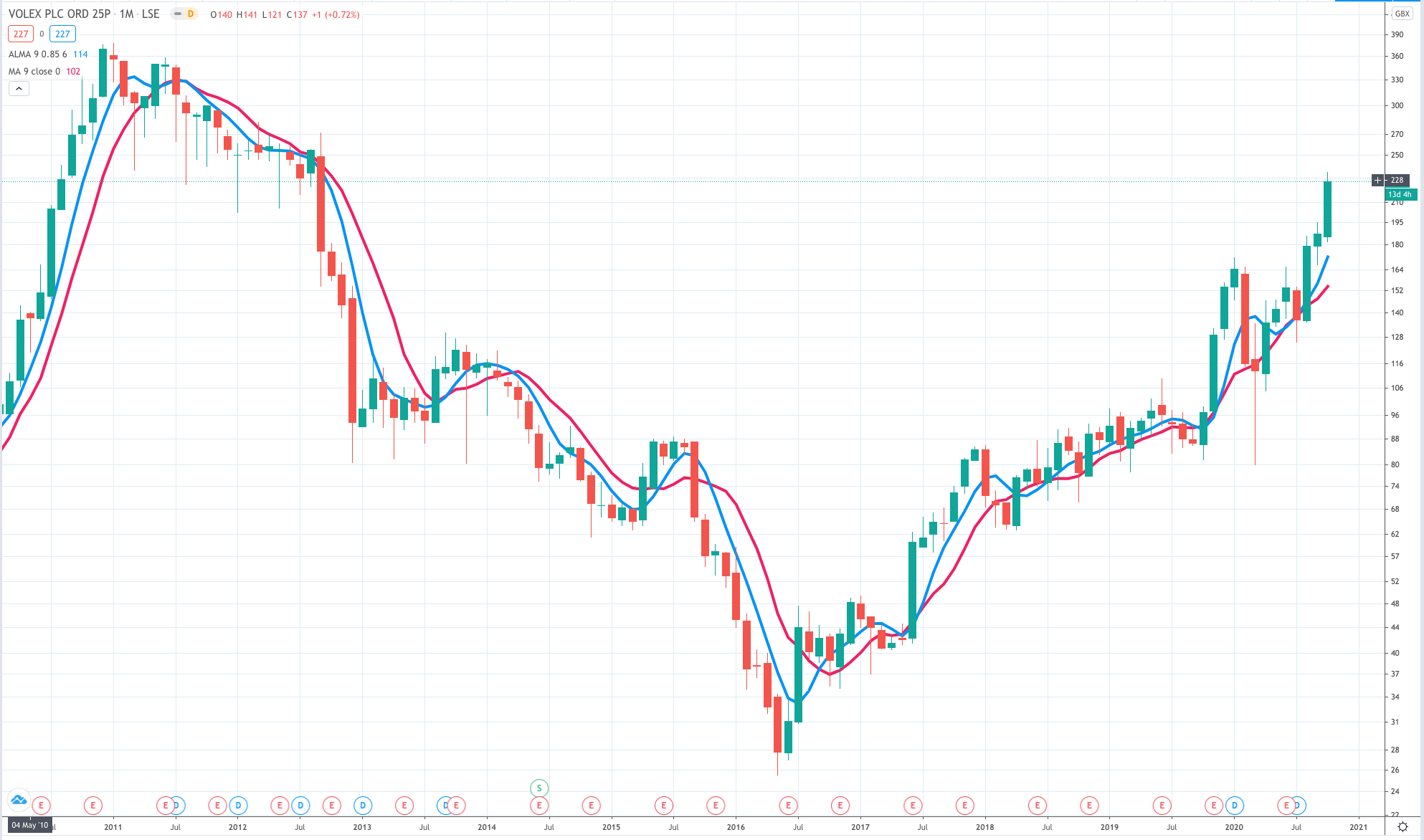

Volex VLX 229p MV: £345m Next figures: 14 November

Volex is a leading integrated manufacturing specialist for performance-critical applications and supplies of power products. They serve a diverse range of markets and customers, with particular expertise in cable assemblies, high-level assemblies, data centre products, electric vehicles and consumer electronics. Helped by acquisitions the group operates from 14 manufacturing locations and employs over 6,000 staff across 20 countries. The group says its products and services are integral to the increasingly sophisticated digital world in which we live. Helped by their global footprint they can balance production demands in Asia, offering a tariff-free capability from sites in Vietnam and Indonesia with product engineering managed from their Asian head office in Singapore with procurement centralised in China. Latest profits were up from £21.6m to $31.6m.

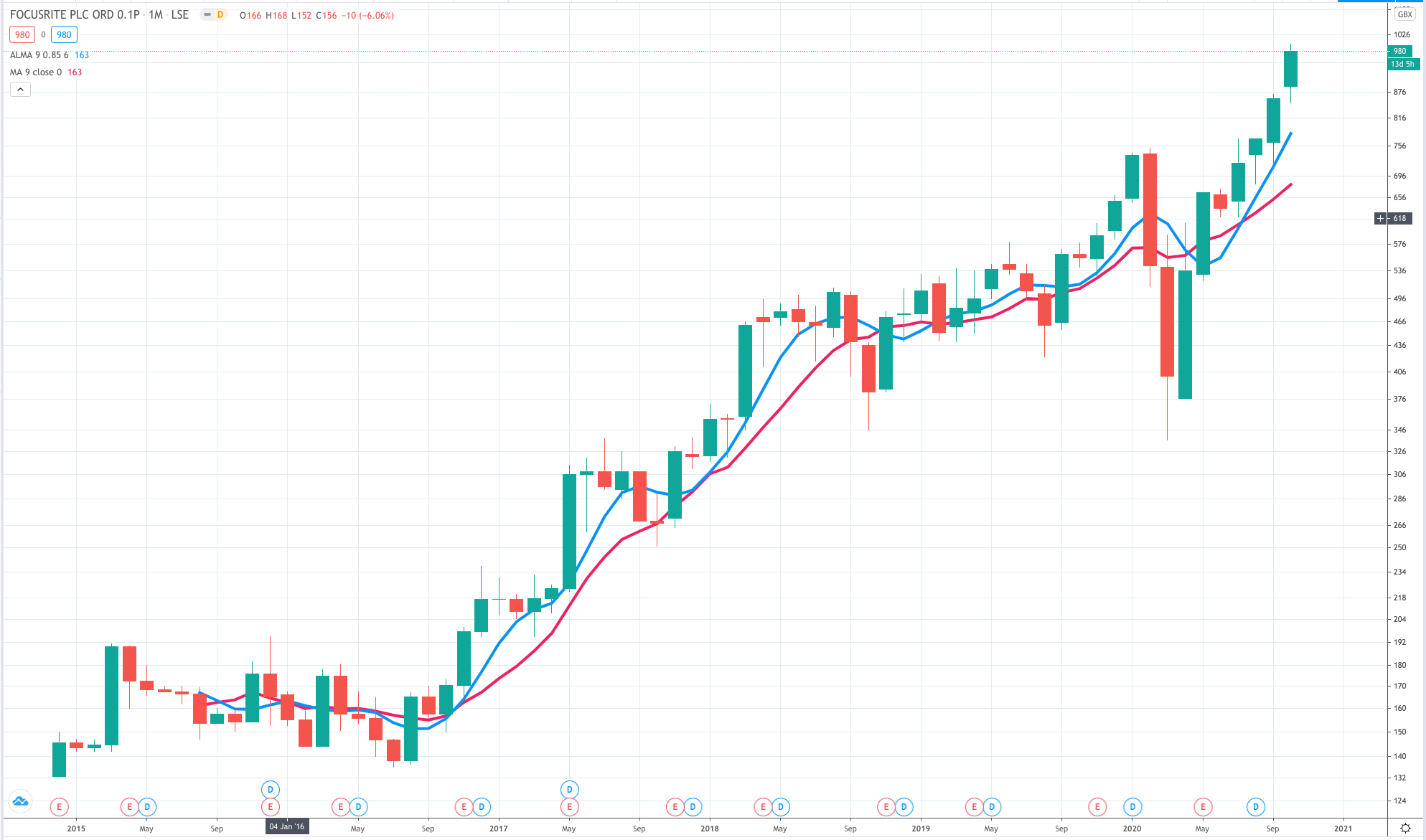

Focusrite TUNE. 980p. MV: £558m. Next figures: 19 November

Focusrite is a global music and audio products business, which makes proprietary hardware and software products for audio professionals and amateur musicians. The group has a global customer base with a distribution network covering 160 territories. Full year results due in November are likely to be good after the group reported strong growth for the first six months to end February. Sales rose 23.5pc to £49.9m despite an estimated £2m impact from the coronavirus. The group is growing by acquisition and has strong sales in North America. “Since the half year, consumer demand for Focusrite and ADAM Audio products has been high especially via ecommerce and we have seen record levels of product registrations at Focusrite indicating positive sell-through to end-users”.

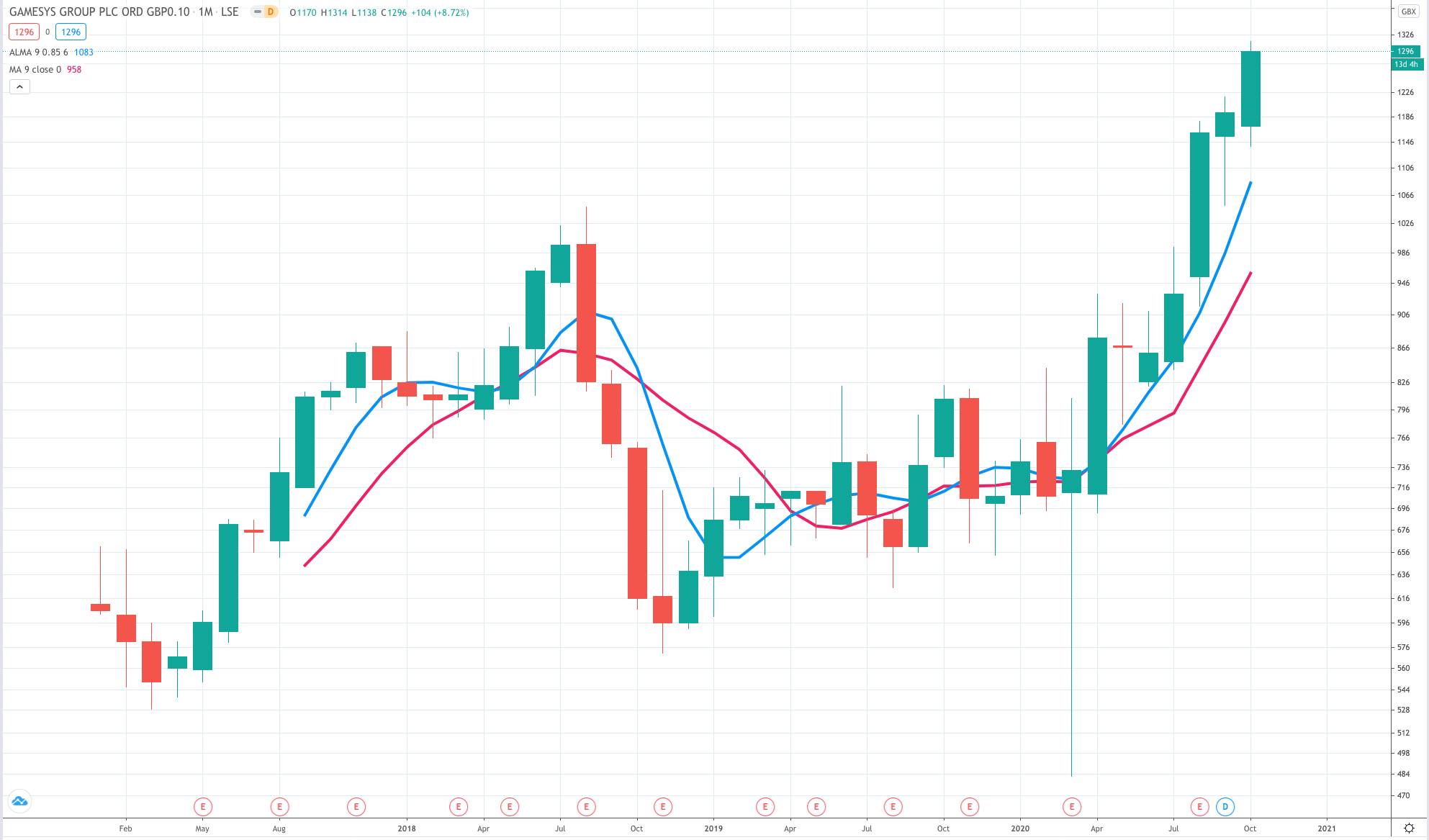

Gamesys Group. GYS. 1296p. MV: £1.41bn Next figures: 17 March

Gamesys is a leading operator of online casino and bingo-led brands. The group partnered with Richard Branson in 2013 to become the UK’s leading casino brand. Virgin Casino was launched in 2014 in New Jersey, USA and most recently, in late 2019, the group launched Riches Casino, which “leverages the powerful brand equity of the nation’s most loved slats game”. Other brands relate to bingo and there is even Monopoly Casino which launched in the UK in 2015 and expanded into Spain in June 2020. Latest results for 1H 2020 show that strong growth in 2019 accelerated in 2020. Overall revenues grew 27pc with the UK up 17pc and Asia rising 92pc. Th group has also seen strong growth in new and active customers leaving them well placed for the second half.

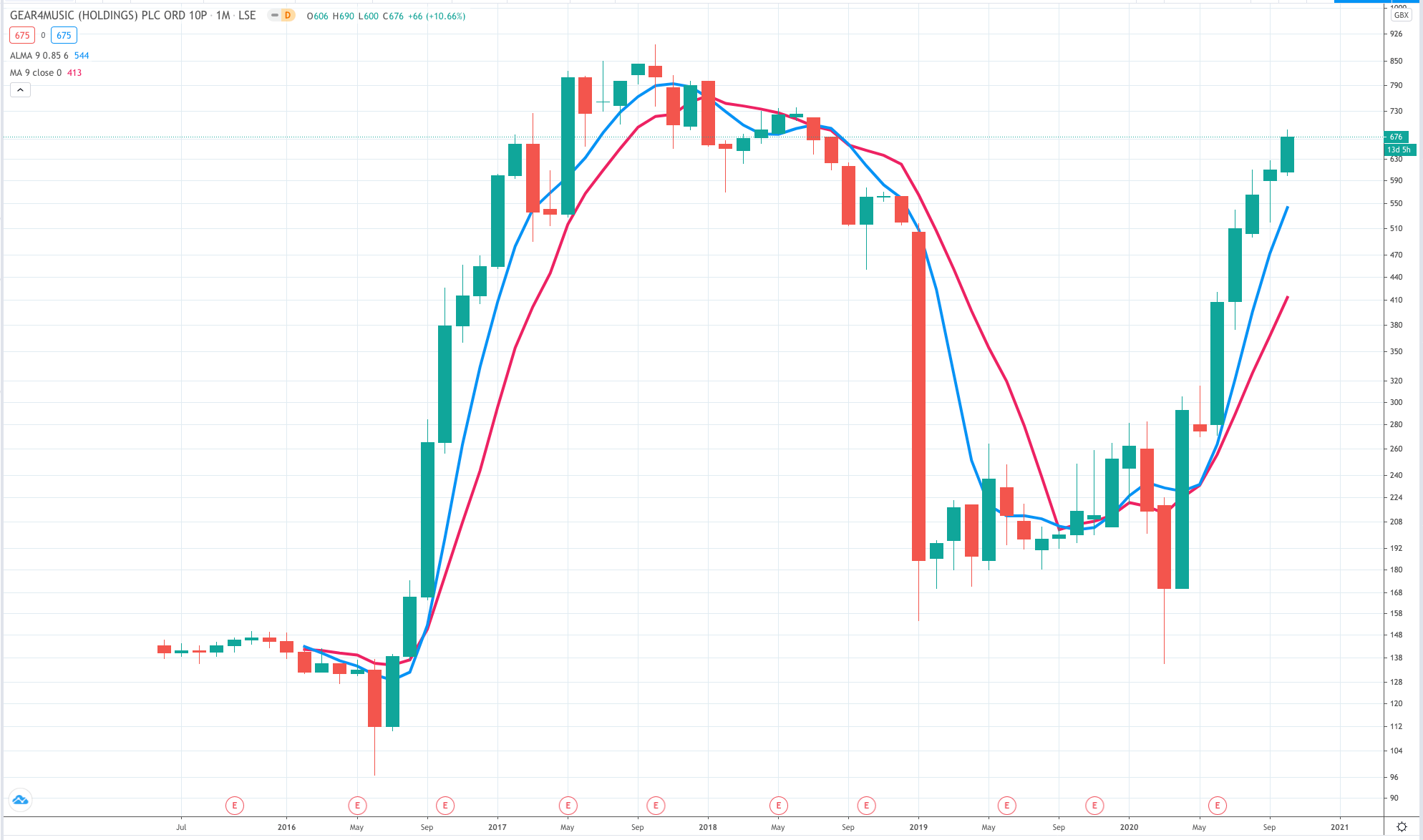

Gear4Music G4M. 676p. MV: 141m. Next figures: 12 November

Gear4Music is the largest UK based retailer of musical instruments and music equipment which it sells online. As is clear from the chart the group has received a huge boost from global lockdown giving people more time to look for musical equipment online, more time to play once they have bought it and they are forced to buy on line. The group is due to issue a trading update on 22 October and report its interim results on 17 November. For fiscal 2020 the group reported sales 2.0pc higher at £120.3m but margins improved 310 basis points to 25.9pc and ebitda was up 239pc to £7.8m. Web site visitors increased five per cent to 28.4m. The historic growth record is strong with sales up from £24m in 2015 to £120m for 2020. Since then the group has issued an agm statement saying that the strong performance has at least been maintained. The results represent a strong rebound from a difficult year in 2019.

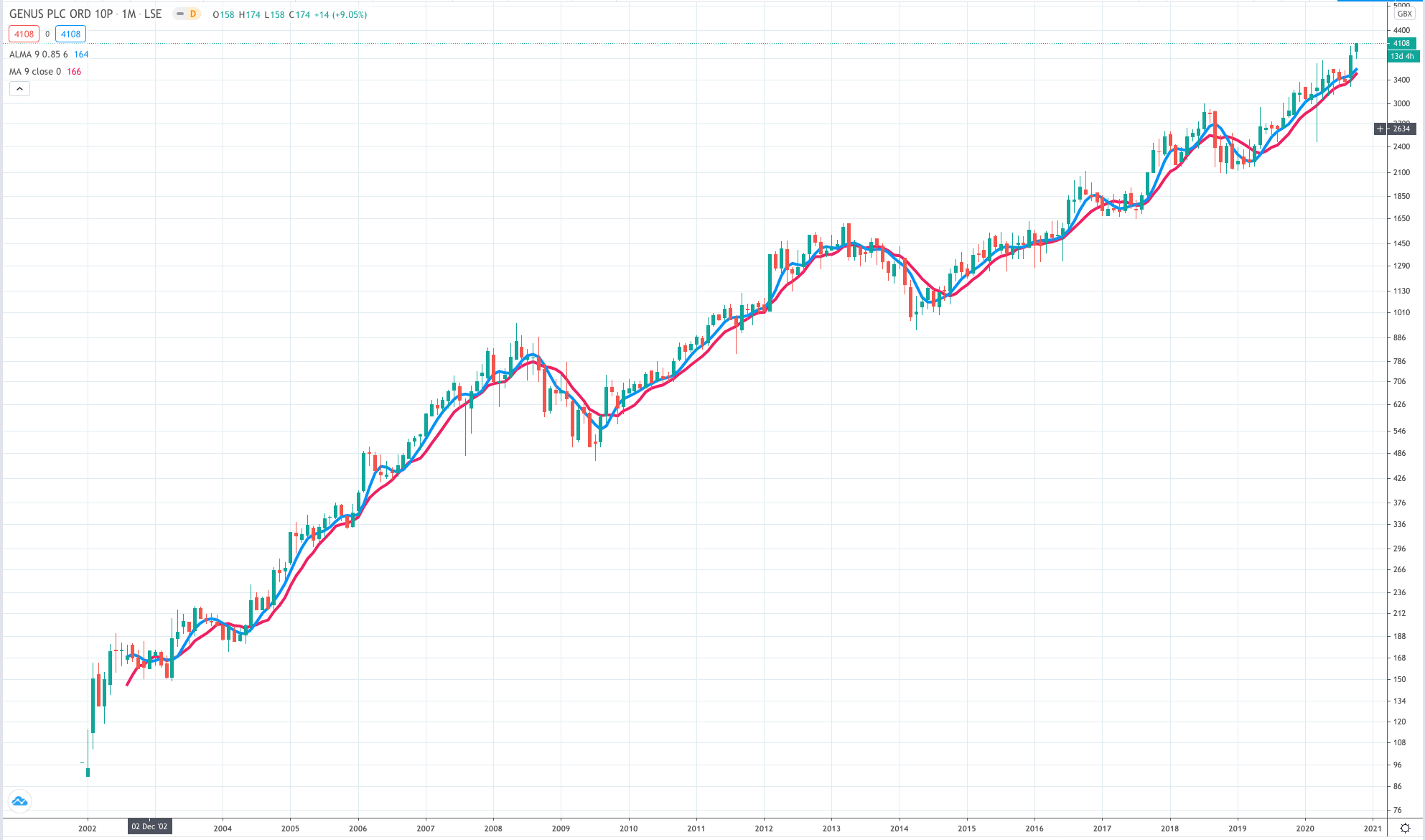

Genus. GNS. 4108p. MV: £2.67bn. Next figures: 27 February

Genus posted a big uplift in profits before tax with cash flows more than tripling thanks to strong sales in China.For the year ending on 30 June, the cattle and swine genetics specialist a 13pc jump in sales to reach £551.4m and a 22pc rise in profits to £71.0m on adjusted basis, for a 23pc improvement in earnings per share to 85.4p. Free cash flow meanwhile was 352pc higher to £35.2m. The company’s boss, Stephen Wilson, highlighted the strong demand seen in China for its swine products, as large customers looked to restock their herds in the wake of the 2019 African Swine Fever epidemic. The group’s porcine genetics business, known as PIC, saw sales rise by 17pc, with volumes up by 13pc or 6pc excluding China, and operating profits growing by 25pc. ABS, which is Genus’s dairy and beef cattle arm, meanwhile saw volume growth of 8% with total revenues 9pc higher. The firm more than doubled the size of its PIC supply chain in China to capitalise on the country’s drive to restock.

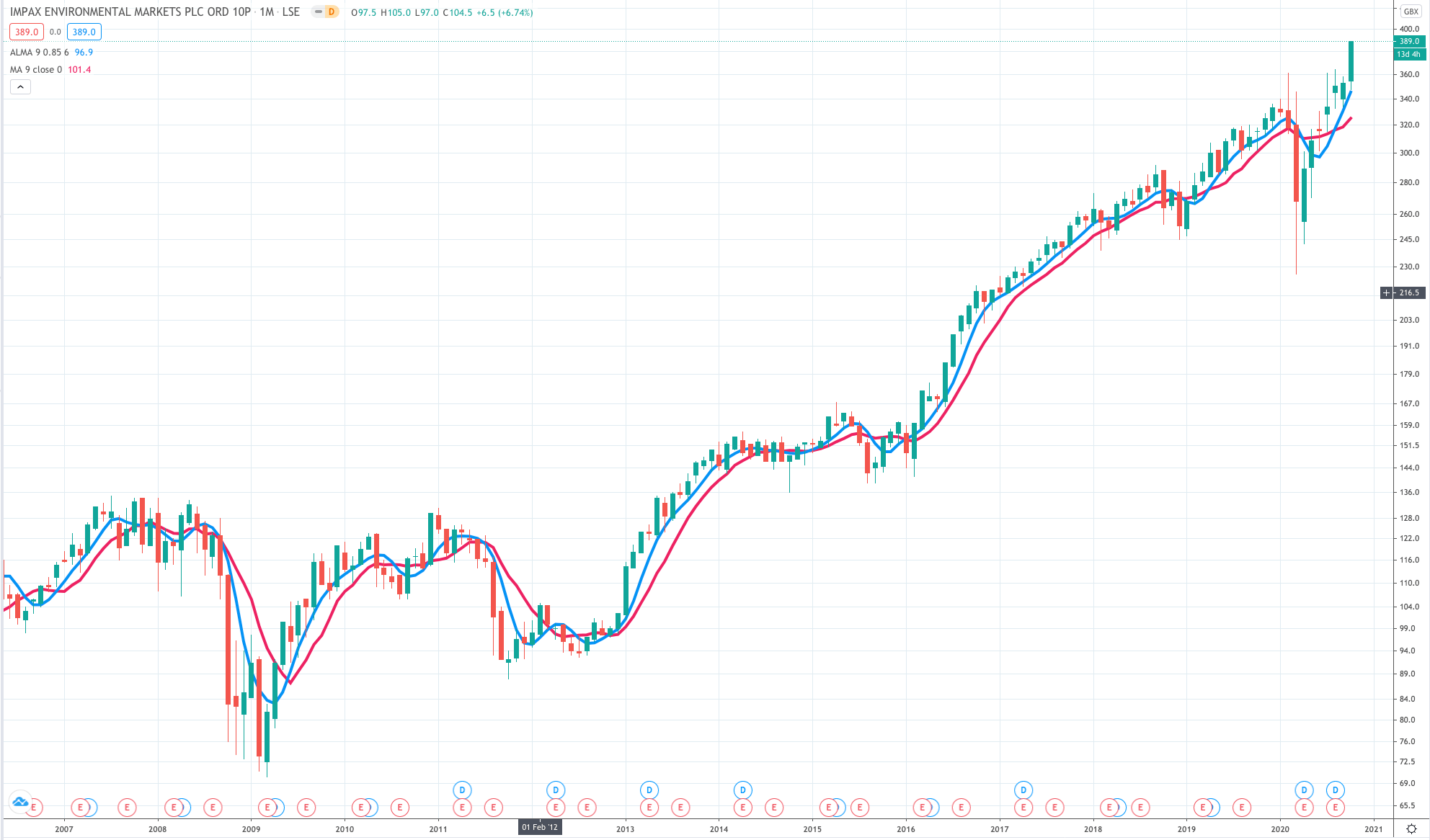

Impax Environmental Markets. IEM. 389p. MV: £984m. Next figures: 20 April

Launched in 2002, Impax Environmental Markets is today the UK’s largest environmental investment trust. The company’s objective is to deliver long term capital growth by investing in companies offering solutions to environmental challenges, particularly clean energy and energy efficiency, water treatment and pollution control, waste technology and natural resource management and sustainable food. The group has delivered consistent growth in net asset value – 46.3pc in 2016, 15.2pc in 2017, 7.1pc in 2018, 8.3pc in 2019 and 14.5pc in 2020. The company’s year ends in September. The company is optimistic on prospects. “The contours of the post– COVID landscape are yet to come into focus, but there are clear signs that, unlike in the wake of the global financial crisis, concerns about environmental issues have been elevated by what we have all experienced. The manager’s report highlights a number of relevant opportunities for existing and future investments. The pandemic has revealed the fragility of human society in the face of a natural phenomenon and has triggered the kind of collective response that will be needed to address climate change.”

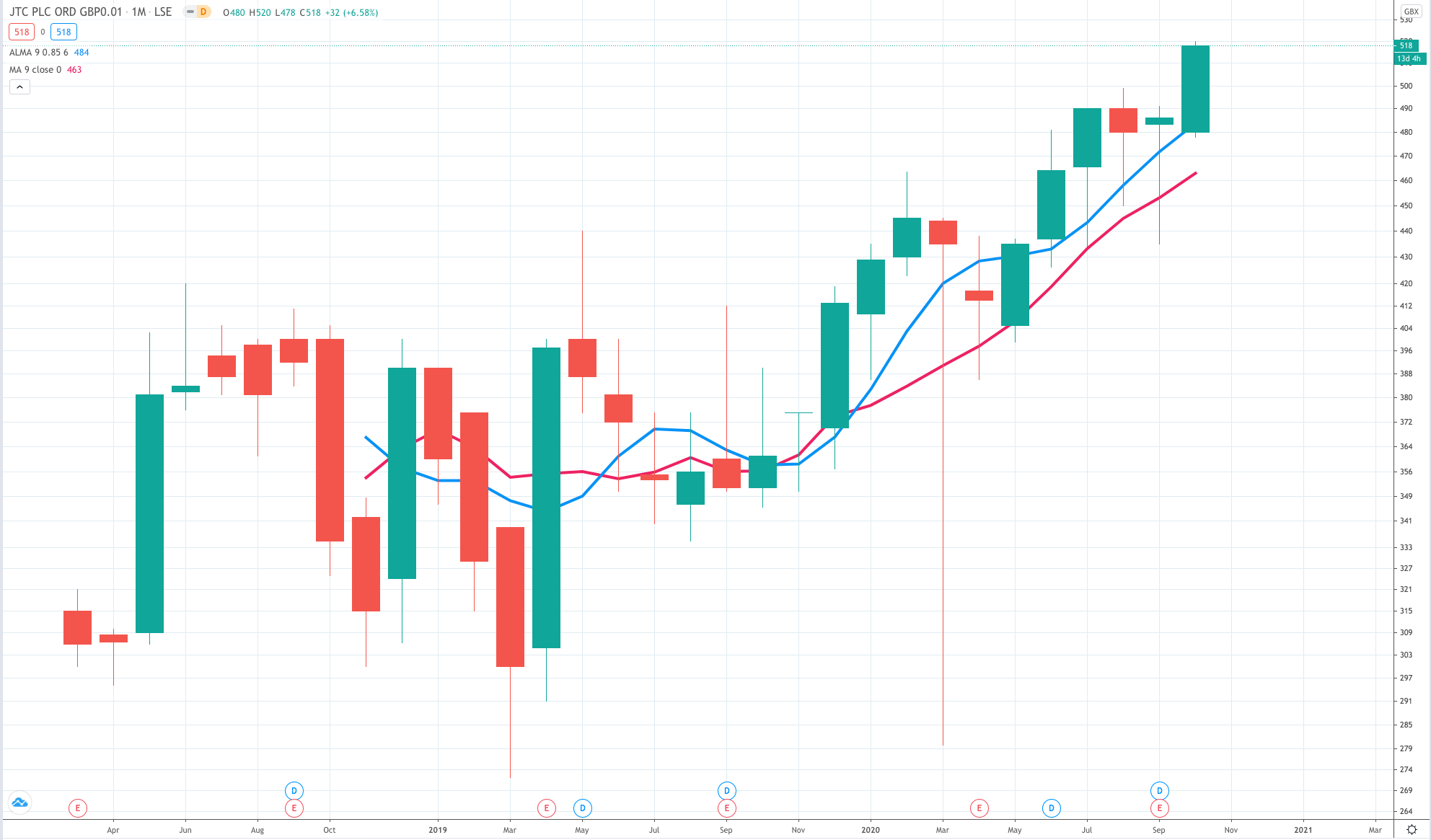

JTC. JTC. 518p. MV: £623m. Next figures: 7 April

JTC was established in 1968 to oversee the development of Singapore’s first industrial estate. The portfolio has expanded as the group develops new infrastructure for Singapore’s industries. Its biggest project is the Jurong Innovation District, 600 hectares, which are being developed to become a one-stop advanced manufacturing campus, which is expect to create up to 26,000 digital economy jobs. The development is expected to open in phases from 2023. In February 2020, JTC announced that it will be revamping the 500-hectare Sungei Kadut industrial estate, one of the oldest industrial estates in Singapore, to support the transformation of traditional manufacturing industries as well as new growth sectors in agri-tech and environmental technology. Housing businesses in the timber, furniture, construction and waste management industries, the estate will be developed progressively over the next 20 to 30 years

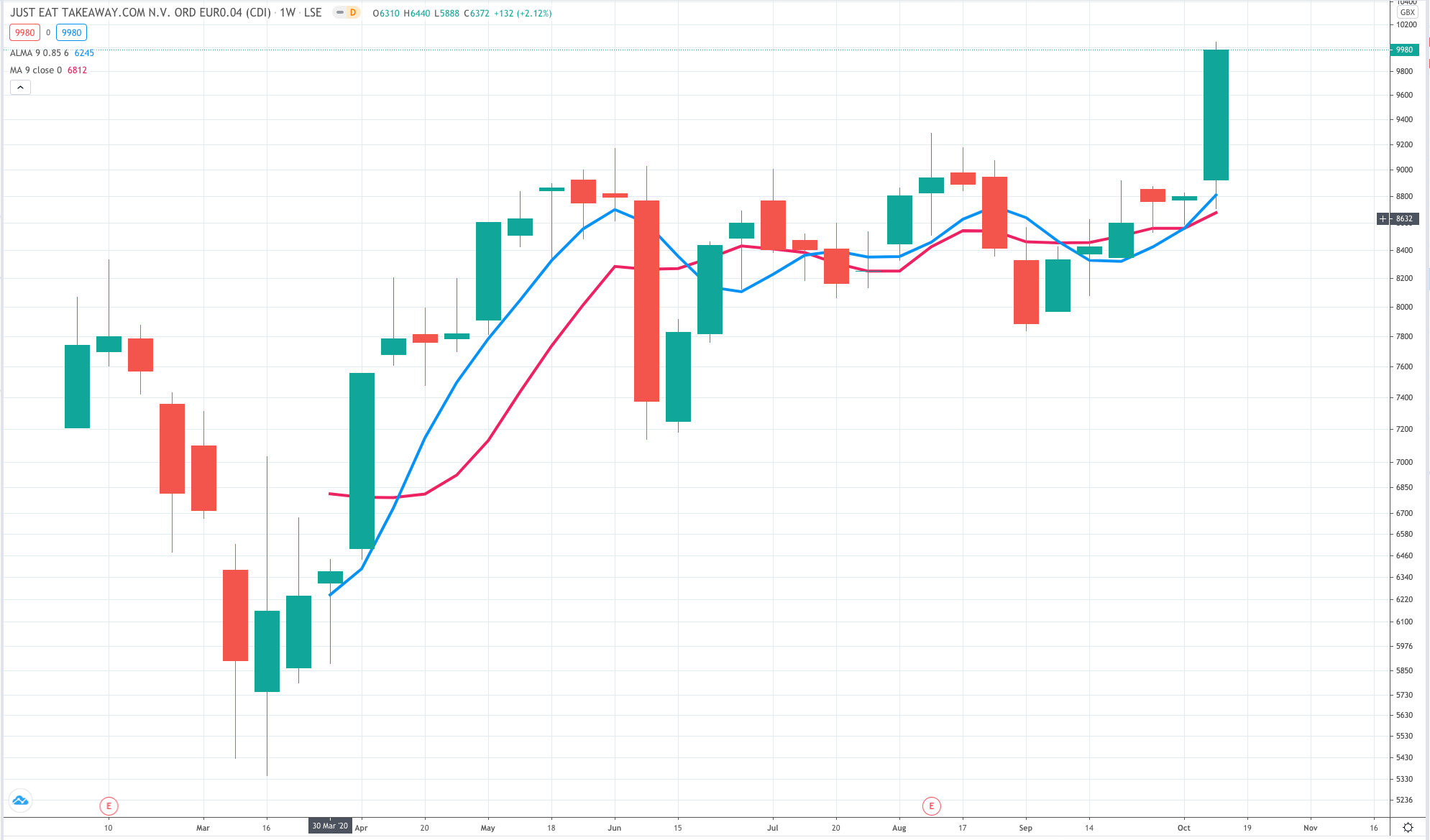

Just Eat Takeaway. JET. 9900p. MV: £14.8bn. Next figures: 10 March

Just Eat Takeaway is the food delivery behemoth which is currently in the throes of acquiring GrubHub, a North American food delivery business. Order growth accelerated compared with the prior quarter, leading to a widening gap to competition in key countries, including the UK and Canada. Australia was the fastest-growing country, delivering market share gains with triple-digit order growth in the quarter. “Just Eat Takeaway.com has started an aggressive investment programme in the legacy Just Eat countries to strengthen its competitive positions, significantly increasing spending on marketing and sales. This programme has delivered accelerated growth while maintaining strong adjusted EBITDA.The company continued to enhance its restaurant selection, driven by several new partnerships, including the roll-out of approximately 800 McDonald’s restaurants and 300 Greggs locations in the UK. On 7 October 2020, the acquisition of Grubhub was approved by at the egm. Completion of the transaction is anticipated to occur in the first half of 2021.”

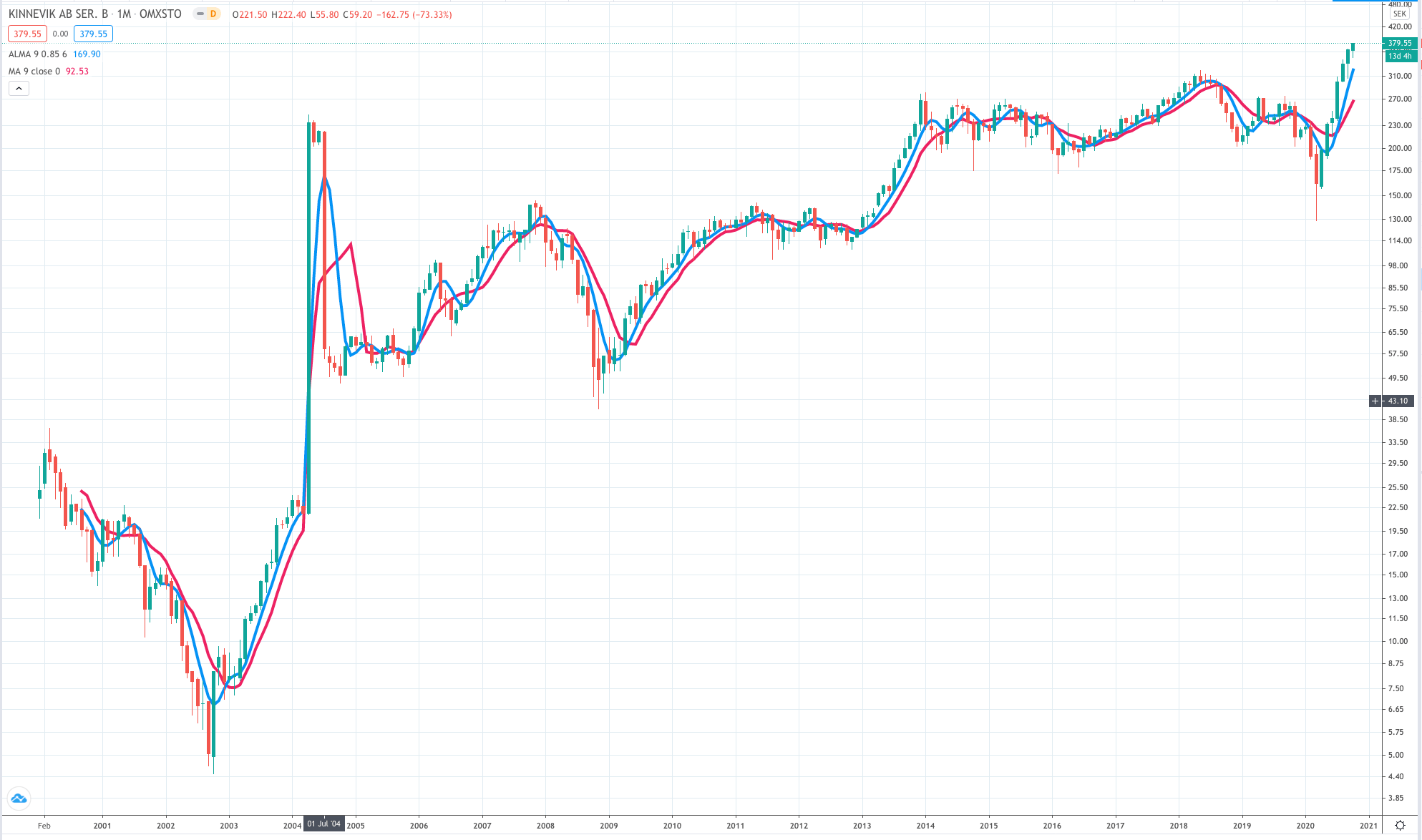

Kinnevik AB KINV_B. SEK379. MV: SEK103bn (£900m)

“In partnership with talented founders and management teams we build challenger businesses that use disruptive technology to address material, everyday consumer needs. As active owners we believe in delivering both shareholder and social value by building long-term sustainable businesses that contribute positively to society. We invest in Europe with a focus on the Nordics, the US and selectively other markets.” The group has delivered a five year annualised total shareholder return of 25pc. Its biggest investments are Zalango and Livongo, which are flying.

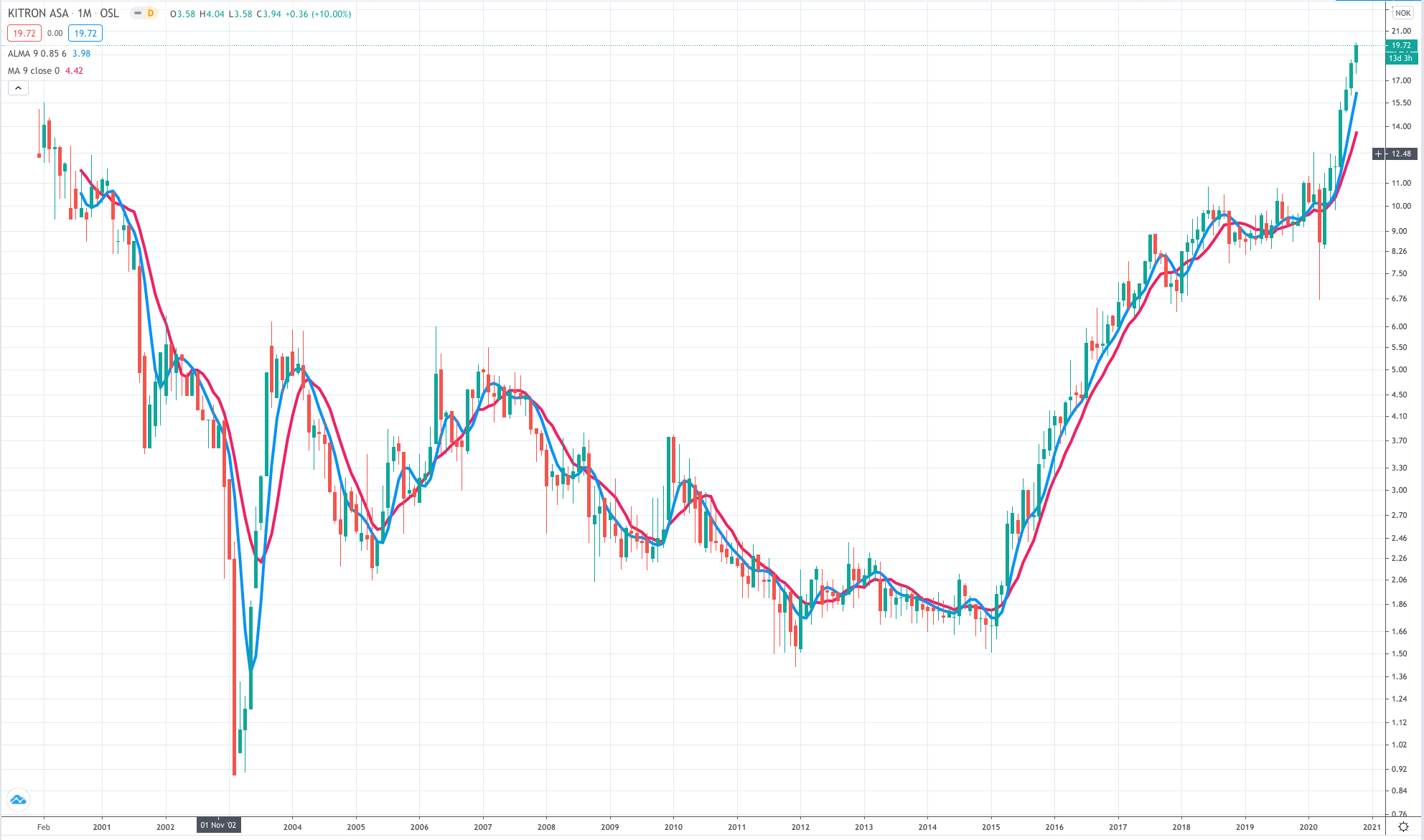

Kitron ASA. NOK19.72. (163p). MV: NOK3.53bn (£291m). Next figures: 21 October

Kitron is an Oslo-quoted contract manufacturer of electronics covering the entire value chain involving the manufacturing and assembly of electronics and industrial products containing electronics. In 2019 the group established a new site, Kitron Technologies in the USA. Also in 2019 the group inaugurated a new factory in Poland to build on the strong growth of its Lithuanian operation. In July Kitron reported sales up 21pc, very strong growth in profits and orders up 45pc

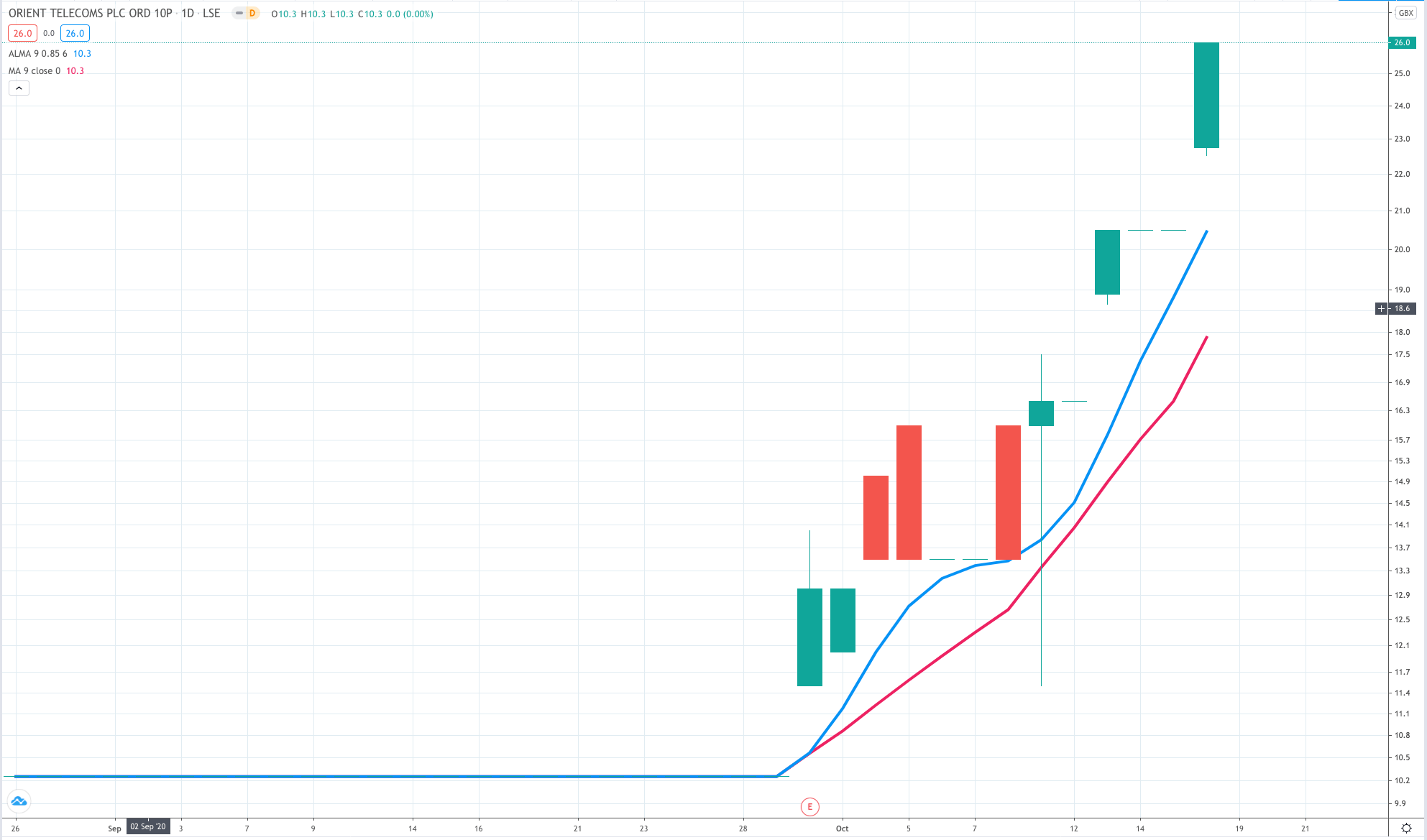

Orient Telecoms ORNT 26p MV: £2.6m

Orient Telecoms has an explosive chart but it is very hard to find out what is going on. The company is quoted in London but operates in Malaysia where it describes its mission as keeping everybody connected. The CEO left late last year and a new chairman was recently appointed. The only financial data I could find was that sales for the latest reporting period trebled to £600,000. Many of the group’s employees have been designated as key workers so able to keep working through the pandemic. Something interest is happening but so far I know nothing beyond what is noted here. It’s kind of like a mystery bet that might pay off big.

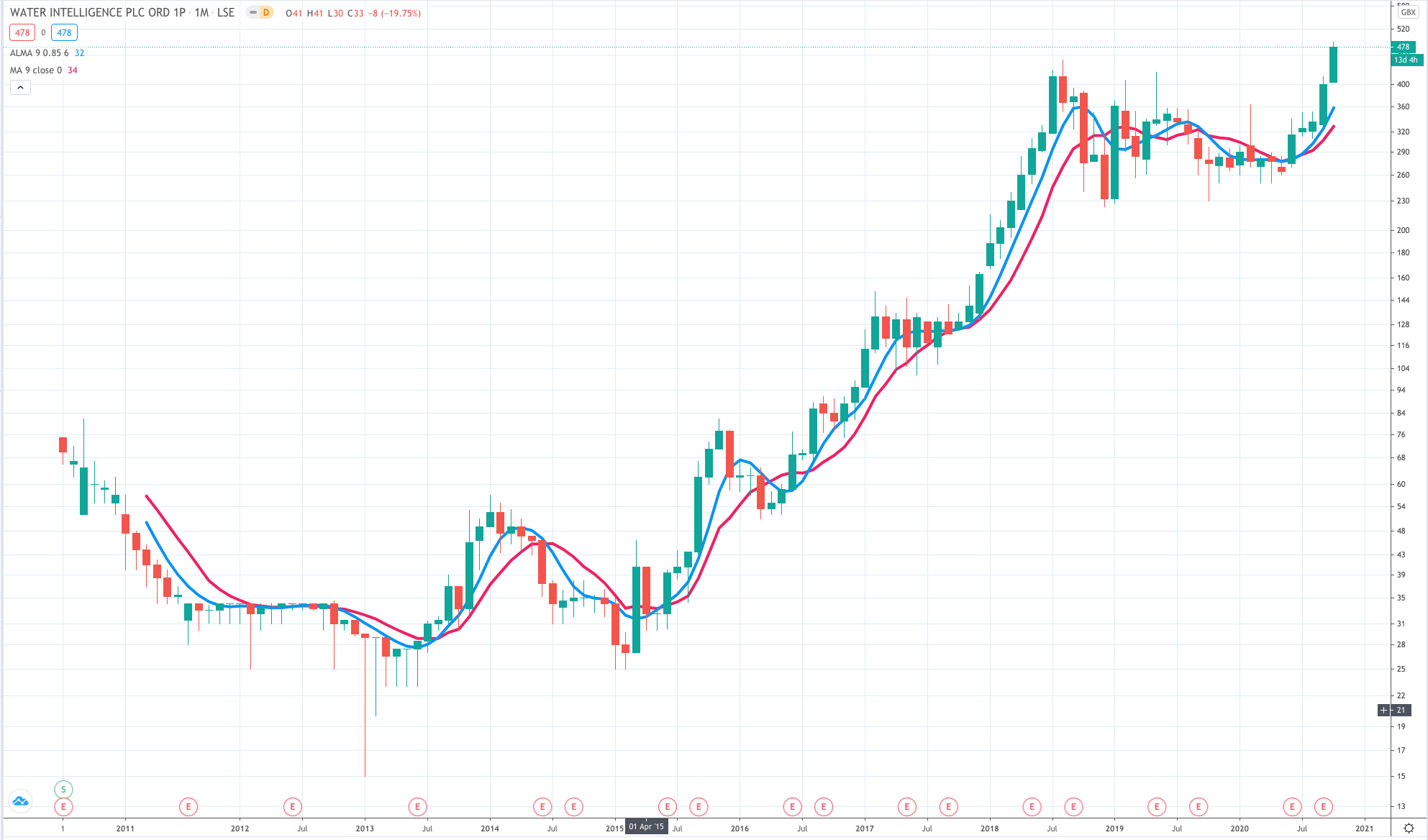

Water Intelligence WATR 478p MV: £70.2m Next figures: 17 June

Water Intelligence has the vision to be a world-class water infrastructure services company. Over the last five years they have delivered compound annual growth of 35pc in sales and 33pc in profits. Supporting their performance is global demand for preventing water loss through infrastructure products and services for which demand is increasing despite the crisis. Te company operates in the US with its flagship American Leak Detection business and in the UK as Water Intelligence International. The US business focuses on residential and commercial leak detection in the US, Canada and Australia. Despite Covid-19 the group remains ambitious with its growth plans.