Testing times for growth share investors as valuations tighten and profit-takers strike

The stock market looks in good shape judged by the major indices but for aggressive growth share investors this impression is illusory. Mega caps like Apple and Alphabet are still holding up well though chinks in the armour are starting to appear. The rungs below of even faster growing growth stocks are being hit harder.

Take an example at random – Shopify. The shares peaked in November at $1762. On 7 December, the day after my bearish Quentinvest alert on US growth shares across the board, ‘Time to circle the wagons’, they traded as high as $1535. The latest price is $1144.48, a decline from the peak of 35pc in less than two months.

The future is always unpredictable but this decline does not appear to reflect a deterioration in trading. On 28 October the company reported a super strong quarter. “In the space of just 16 months, our merchants cumulative GMV [gross merchandise volume] has doubled, going from $200bn in June 2020 to crossing $400bn at the beginning of October.” There is an incredible amount of innovation going on at the business and prospects look as exciting as ever. “We are excited about all of our vectors of growth and the opportunities they offer to our merchants.“

So, if trading is strong, what is the problem. Maybe after years of strong growth and good news the shares just climbed too high and, in the jargon of the stock market, became massively overbought. At the $1764 peak Shopify shares were valued at a level fast approaching 50 times the sales expected for calendar 2021. No question this is an ambitious valuation even for a business as exciting as Shopify.

In a less gung-ho market a value of 20 times expected sales is still hardly conservative and that would put Shopify shares at $729. A valuation of 14 times sales such as prevailed in December 2018 would drop the price to $518 so it is easy to see why there is room for volatility.

A second problem is profit-taking. Shopify shares have risen from a low of $18.16 in January 2016. There are many investors going to be tempted to sell if they see a falling market whittling away their profits.

Third is the margin issue which is a problem for the whole US stock market. Present day share values are supported by nearly $1 trillion of margin debt. If that starts to unwind this could create sustained selling pressure.

Why are we suddenly seeing pressure now? A possible reason is widespread shortages driving rising inflation. Even if this proves temporary it makes it hard for the central bank to ease aggressively and may drive them towards tightening and higher interest rates. Higher rates put the pressure on growth shares as the present day value of future sales and profits is discounted at a higher rate. It also puts pressure on margin debt by raising the cost of borrowing.

You can always make a case for lower share prices but now they are actually happening so the charts look threatening too.

The businesses haven’t changed. They are still great businesses driving the technological changes that are creating a brave and exciting new world in the 21st century. Most likely these companies are going to be significantly, even dramatically larger, a decade from now. This is all about how we get from here to there. As a highly leveraged investor I have to raise liquidity. Other investors may do what Buffett does and sit it out. Even a substantial decline will give way to a new bull market. They always do. As always it is a judgement call and when the turn comes from bear to bull it can be very swift but meanwhile the line of least resistance for many shares appears to be down and you never know how far falling shares are going to fall.

One example from the battered market for Chinese shares quoted on Nasdaq is Futu. This is a very exciting, phenomenally fast growing platform for Chinese investors looking to buy and sell shares, often on margin. Even in a challenging market the group reported Q3 revenues rising 83pc. Still the shares have been slaughtered. In February 2021 they peaked at over $204. The latest price is $41.99. A fast-growing rival to Futu Holdings, Up Fintech Holding, has seen its shares fall from $38.50 in February 2021 to $4.33.

Falls like this help make it clear why it is so dangerous to chase rallies in a market where the overall trend is down.

Berkshire Hathaway B. BRK.B. Buy @ $315.50

Ecolab. ECL Buy @ $226

Pepsico PEP Buy @ $175

Invesco QQQ Trust QQQ Buy @ $370

IShares Semiconductor. SOXX Buy @ $508

SPDR S&P 500 SPY Buy @ $457

Ashtead Technology. AT. Buy @ 194p

Simple strategies for successful investing

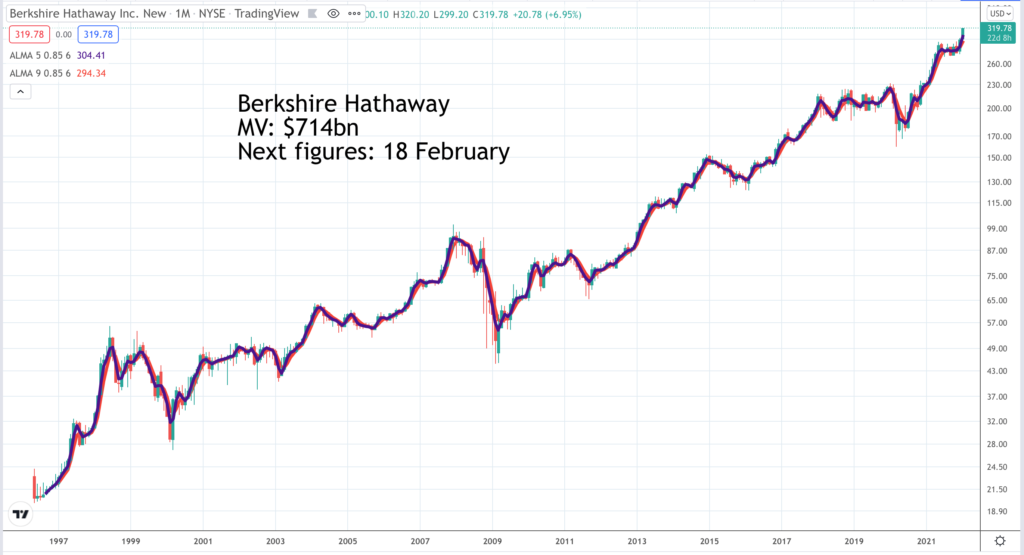

Berkshire Hathaway.B. BRK. Buy @ $315.50. Times recommended: 5 First recommended: $271 Last recommended: $285

Buffett’s optimism and value for money make Berkshire Hathaway a great investment

Featuring shares in Warren Buffett vehicle, Berkshire Hathaway, is a sign of a market where a flight to safety is taking place. Buffett’s business with its strong cash generation and famously wise and patient founder is a good place to be ing turbulent times. Also helping is that Apple, which has become the biggest group investment, is trading close to peak levels and showing a $100bn-plus profit for BRK.

Below is a snappy summary of the group made in December 2021.

“Berkshire is the ultimate conglomerate with 69 operating companies, a stock portfolio worth $333.75bn across 45 individual equities, and $149.2bn in cash. With $483.85bn between cash and equities on the books, BRK.B’s operating businesses are valued at $149.29bn or 23.61pc of the current market cap. In the TTM [trailing 12 months], BRK.B has generated $268.67bn in revenue and $87.4bn in net income from its operating businesses, which represent 23.61pc of the market cap. BRK.B looks like a complete value opportunity as its P/E is 7.61, P/S 2.42 and trades at a multiple of 1.31x its equity.”

You can make a very strong case that Berkshire Hathaway would be worth a great deal more if the company was broken up into investments and operating businesses. This becomes more intriguing when you consider that Warren Buffett is 91 and his long-time business associate, Charlie Munger, is 98. They seem to be immortal but one day they won’t be around and after that the business will be vulnerable to the sort of shareholder activism that pushed Apple into paying dividends and being more aggressive with share buybacks.

This was the writer’s conclusion.

“From a valuation standpoint, I think the market is deeply discounting BRK.B’s equity, and maybe investors should take a much closer look at its balance sheet and income statement. The fact that the operating companies make up 23.61pc of the current market cap and generate more revenue and net income than FB (now Meta Platforms) signals a buying opportunity, especially since FB has a larger market cap. This valuation is a steal when you throw in the $149bn in cash and $333bn in equities on the books.“

Berkshire Hathaway is to big and complicated a company to attempt a detailed analysis but the way I have always thought of it is a company which generates strong cash flow, mainly from its market leading insurance businesses, which it invests in long term bets on high quality strongly branded household name US companies like Apple. IT also keeps a huge cash warchest to create opportunities when share prices do fall.

Last but not least it looks after shareholders more directly with a strong share buyback programme. On 8 November an article noted that BRK was on track for 2021 to top the group’s $24.9bn of share buybacks made in 2020. Another good feature of BRK is Buffett’s staunch belief in the power of US capitalism. In an interview with CNBC Buffett said “We’ve been a net buyer of stocks– or I’ve been, actually been a personal net buyer of stocks ever since I was 11, every year.’ He also said in March 2020 when everybody was running ing scared about Coronavirus: –“I do think that not only our businesses but American business generally will be doing fabulously better 30 years from now or 20 years from now. And the– long-term is very– in my view is very easy to predict in the general way. But an important way. I don’t think there’s any way to predict what the stock market will do ten minutes from now, ten days from now or ten months from now. So I work on what I think I– I’m able to do. And as desirable as it might be to know what was gonna happen ten minutes from now that’s just– not something I’ll ever be able to master. So fortunately I can come to a pretty firm conclusion that 20 or 30 years from now American business and probably all over the world will be far better than it is now.”

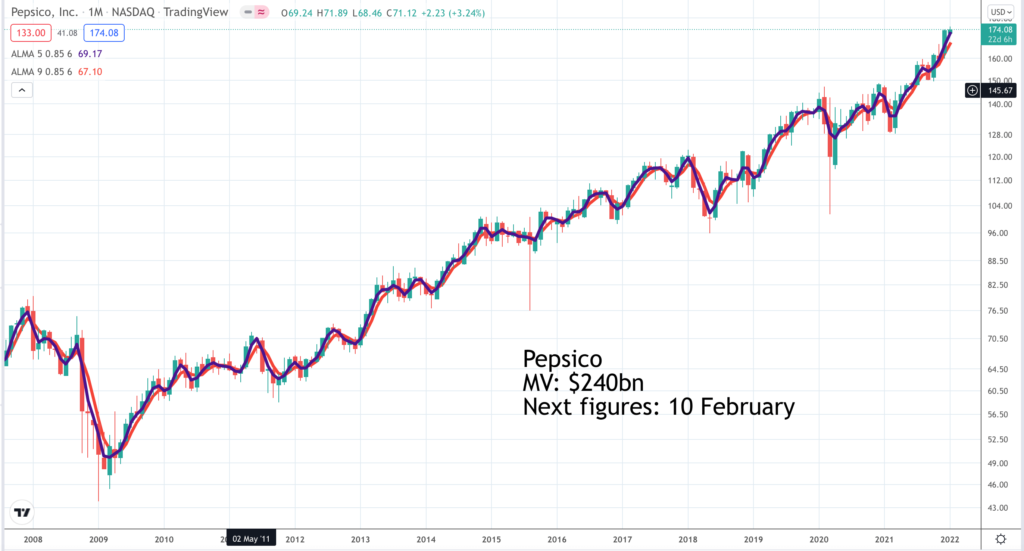

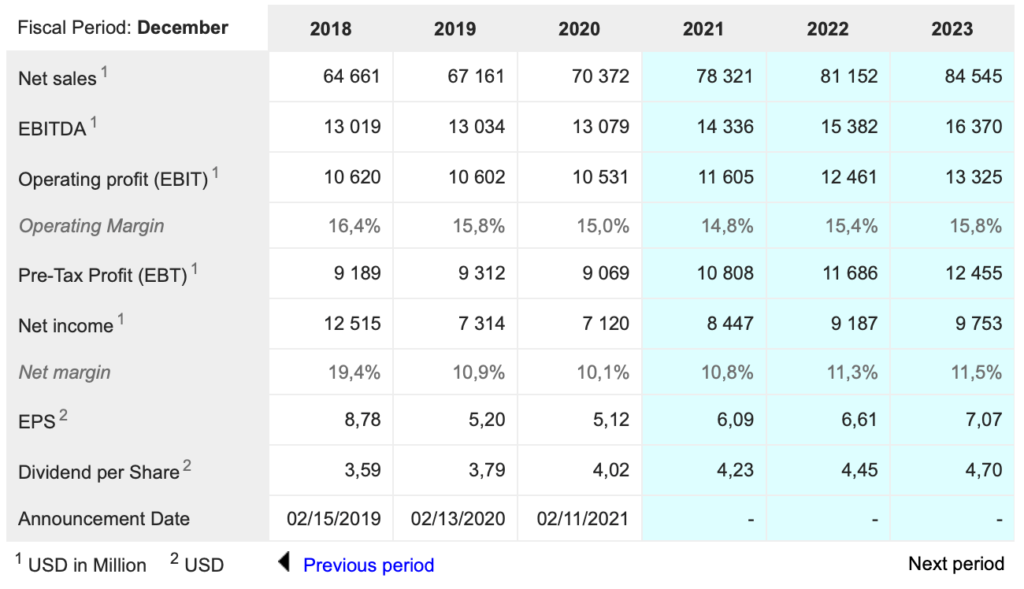

Pepsico PEP Buy @ $175. Times recommended: 4. First recommended: $156.49. Last recommended: $161.50

Pepsico’s plans to become faster, stronger and better

Pepsico is one of these all-encompassing US global branded companies that Buffett might consider a good investment though he already has a big position in rival, Coca-Cola. PepsiCo is all about snacks and beverages and owns a host of brands with which I am familiar but would never dream of eating or drinking. I am the kind of guy that if I feel like freshly squeezed orange juice I buy the oranges and do the squeezing myself. Nor would I be interested in any other kind of orange and certainly nothing carbonated. Ditto fo snacks though I occasionally eat crisps because one of my daughters really likes them. I still have my vices like wine, whisky and chocolate so hardly a puritan.

Clearly most people feel differently because Pepsico grew sales by eight per cent in its latest quarter to $20.2bn and earnings per share by 12pc. I guess they succeed because many people are hooked on their products and get a healthier alternative from innovations by Pepsico itself like zero sugar Pepsi. For many people in developing countries American brands are aspirational products and in Europe alcoholic drinks are becoming less of a way of life bringing non-alcoholic drinks more into focus.

Pepsico is also a very well run business. They have launched a programme called ‘Faster, Stronger and Better’ which has been running since 2019 and is looking to drive improvements in all aspects of the business – healthier and more sustainable products, faster innovation and implementation of changes and better all around. It seems to be working because sales are growing strongly, especially internationally, earnings per share are climbing faster than sales and there is strong momentum in the business.

“On a two-year basis, our organic revenue growth accelerated to 13.3pc, the fastest pace we have delivered since we began implementing our Faster, Stronger, and Better strategic framework in 2019.”

Pepsico is very much a defensive investment. People are not going to stop eating and drinking and nothing they make is that expensive so hardly affects most household budgets. Convenience is a big part of what they are about so work from home probably plays to their strengths as people stock up with soft drinks and snacks to get them through the working day.

The global opportunity is very large.

“We remain optimistic about the long-term potential of our international business and have a very clear playbook on how to develop and build strong market positions within our snacks business by replicating the models we already have in many key markets such as the U.S., Mexico, and Russia.”

Being large and acquisitive gives the company many opportunities to cut costs.

“Since 2019, the business has shifted its focus towards costs with the introduction of the productivity plan. As of Q2 of this year, the company announced an expansion and extension of this program until the end of 2026. It promises a deeper focus on new technology, automation, re-engineering and simplifying the manufacturing and supply chain footprint. As a result, the firm targets $1bn in annual productivity savings by 2026. The plan will result in pre-tax charges of approximately $3.15bn, of which about $2.4bn will be in cash. So far, by the 12th of June, the firm has incurred pre-tax charges of $874m.“

Ecolab ECL. Buy @ $226. Times recommended:4 First recommended: $145 Last recommended: $224.50

Ecolab leads in the creation of a more hygienic world

“The strong third quarter results were better than expected, driven by continued accelerating pricing, new business gains and new product sales, as we also successfully managed to significantly reduce the unfavorable impacts from Hurricane Ida on both our customers and supply chain. We enjoyed strong double-digit sales growth and expanded operating margins in our Institutional & Specialty and Other segments, which leveraged continued recovery in the U.S., recent business wins and improving trends in Europe. Industrial segment sales also showed strong growth and sequential acceleration, though its operating income was negatively impacted by higher delivered product costs and incremental costs to ensure exceptional customer service in a challenging environment. The Healthcare & Life Sciences segment’s underlying growth remained good but reported results declined versus a very strong gain last year.”

As can be seen from the latest statement EcoLab is in great shape. Sales in the latest quarter rose 10pc driving a 20pc increase in adjusted diluted earnings per share and a 31pc increase in free cash flow. As suggested by the chart Ecolab is a wonderful high quality long-term growth business.

“Ecolab is a renowned leader in providing water, hygiene, and infection prevention solutions to a vast array of industries. With almost 100 years of experience, Ecolab has amassed a substantial global presence with over three million commercial locations worldwide. Purolite, a recent acquisition, brings a portfolio of products across the life sciences and industrial industry with a potential market of nearly $5bn. Ecolab has introduced new sustainable products with improved pricing, providing an excellent opportunity for ESG investors looking for long sustainable growth.”

Ecolab, a nearly century-old company, is a longstanding bastion of the environmental and sustainable services industry that continues to dominate the market. Through constant innovation, Ecolab provides data-driven insights on operational processes by ensuring safety and promoting a cleaner and more sustainable environment for its valued pool of customers. By being a market leader, they have amassed a substantial global presence with over three million commercial locations worldwide, a remarkably diversified customer base.

Prospects also look very good.

“With the top line and pricing accelerating, we expect to enter 2022 in a great position. We will continue to drive strong top and bottom-line growth through product and service innovation, digital solutions, new markets and appropriate pricing as we leverage an expected continuing though uneven global recovery, generally improving COVID-19 impacts and offset further significant cost inflation. Our value proposition and unique capabilities to help protect people and planet health while driving enhanced business health are more important than ever. We therefore remain confident in our long-term outlook and ability to leverage our robust growth opportunities through our investments to yield superior results for our customers and shareholders.”

Invesco QQQ (tracks Nasdaq 100) Buy @ $370. Times recommended: 33. First recommended: $139.28. Last recommended: $389 Highest recommended: $404

SPDR S&P 500. SPY. Buy @ $457 Times recommended: 16 (rises to 25 including recommendations for the similar IUSA which also tracks the S&P 500). First recommended: $283.34 Last recommended: $481.04

iShares Semiconductor. SOXX. Buy @ $506.50. Times recommended: 15 (rises to 23 including recommendations for other unleveraged ETFs tracking the Philadelphia semiconductor index) First recommended: $200 Last recommended: $525

Three broad brush ETFs that are always right to buy for long-term investors

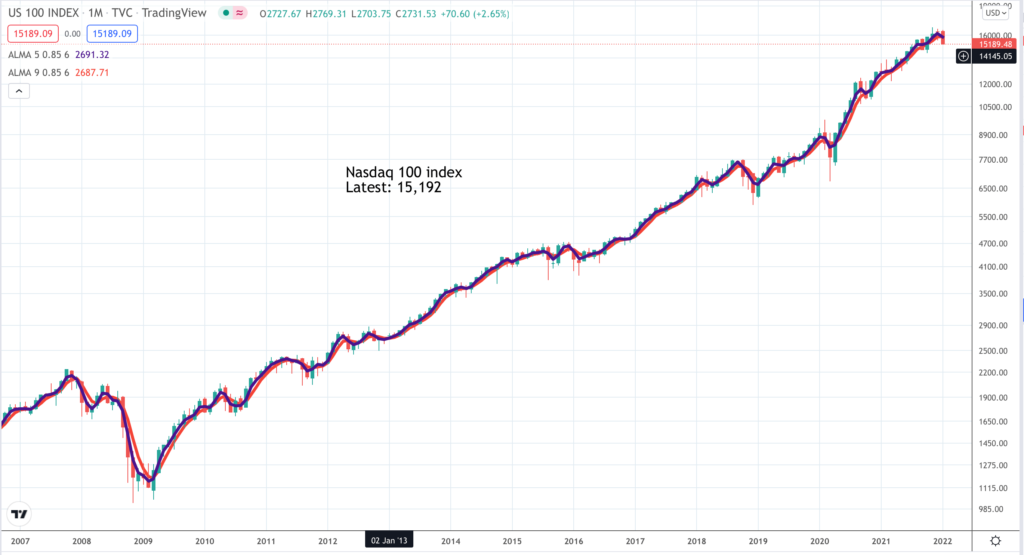

I’m feeling cautious at the moment as can be seen from the opening editorial and recent QV alerts. There are too many. charts in established downtrends for me to make aggressive recommendations for individual shares. So I am going back to some old favourites which are, or at least historically have been, always right to buy for long-term investors. QQQ tracks the Nasdaq 100, SOXX tracks semiconductor shares, which stand at the heart of the unfolding technology revolution and SPY tracks the S$P 500, corporate America.. If these ETFs don’t perform long-term a faltering stock market will be the least of our problems.

Over the years my emphasis has always been on stock picking. I have been described as an out and out growth share investor and that is a fair description. In the long run this can bring incredible success but in times like the present when profit-takers are out in force and margin debt may be starting to unwind growth shares are vulnerable..

It is also the case that never in history have there been so many quoted companies delivering such fast growth as there are are now. It is a function of an accelerating technology revolution and the way that ecommerce and the replacement of communism as a live ideology by capitalism has enlarged world markets and made them easily accessible.

It is an extraordinary time to be an investor but that does not mean that periods of falling share prices have been abolished. The global economy in recent times has been characterised by quantitative easing and interest rates so low that in some countries bond yields became negative. This is extraordinarily favourable for shares generally and growth share particularly.

Growth shares benefit because much of their value comes in the future when investors expect the business to be bigger and more profitable. They arrive at a present value, consciously or unconsciously, by discounting this future value back to the present day. Ultra low interest rates mean the rate at which this future value is discounted back to the present day is correspondingly very low.

If rates rise present day values are liable to fall proportionately. This may be a key factor behind the recent fall in values for high growth shares. There may also be unknown factors at work. Demand for digital transformation and the shift to ecommerce has accelerated dramatically during the period of Covid lockdowns. As and when these end this growth could slow.

As always the future is a mystery about which we learn more as it becomes the present and then the past. Meanwhile one thing has been very reliable in the past and that is a programme of £-cost averaging in the three ETFs listed above. Like any shares they go up and down but in the end they always go up. This is almost inevitable because they are periodically rebalanced around the biggest companies which means they track and reflect success.

If Apple went bust (hopefully extraordinarily unlikely) because of some nightmare development at the company – massive fraud, a CEO who turned out to be a serial killer or something way out of left field like that, the indices would take a hit but Apple would be replaced and in time it would be onwards and upwards again. These indices are about as bullet proof as any equity-related investment can be.

So once selected it is all about strategy. One of the simplest strategies is to buy a few shares, even one share, in each of these ETFs every month, every quarter or whatever. Just because the strategy is simple does not mean it is not a good one.

Because these ETFs are so reliably likely to head higher over time and will never go bust unless the planet is hit by a meteor five miles across or bigger or Covid suddenly becomes more infectious and starts to kill everybody it is even reasonable to adopt strategies based on leverage. I am starting to write about these in Quentinvest and there will be more about these strategies in future.

Leverage can make any investment exciting. Since March 2009 the worst performing of these three ETFs, SPY, has risen approximately sevenfold. One way to get some leverage is to buy ETFs with leverage built-in such as SPXL, which is similar to SPY but moves three times as much, in both directions as SPY. This makes it very volatile but over time it does much better. Since March 2009 SPXL is up an incredible 116 times.

There is a mystery here because you would expect that with three times leverage it would be up 21 times not 116 times. The only reason for the difference I can come up with is that SPY tracks the S&P 500 which is rebalanced quarterly but SPXL stands for Direxion Daily S&P 500 Trust and is rebalanced daily. Over time it seems this can make a big difference to performance.

There is a third strategy which would be to buy SPY in a CFD or spread betting account on maximum five times leverage. You would imagine that with five times leverage it would be even more volatile that the ETF with built in three times leverage, SPXL but now I don’t think so. QQQ in a CFD account, without the effect of the daily rebalancing, most probably will deliver five times the leverage of SPY so the seven fold rise since March 2009 would become 35 times and it should be less volatile.

As noted I will be studying these strategies in more depth in future issues because of my growing belief that the strategies you adopt can have a big impact on your success as an investor.

Last but not least my impression is that it does not matter very much when you buy these ETFs. You could wait for the next buy signal and only buy on buy signals after that but I suspect that buying every month or quarter, with or without a buy signal will do just as well or maybe even better over time.

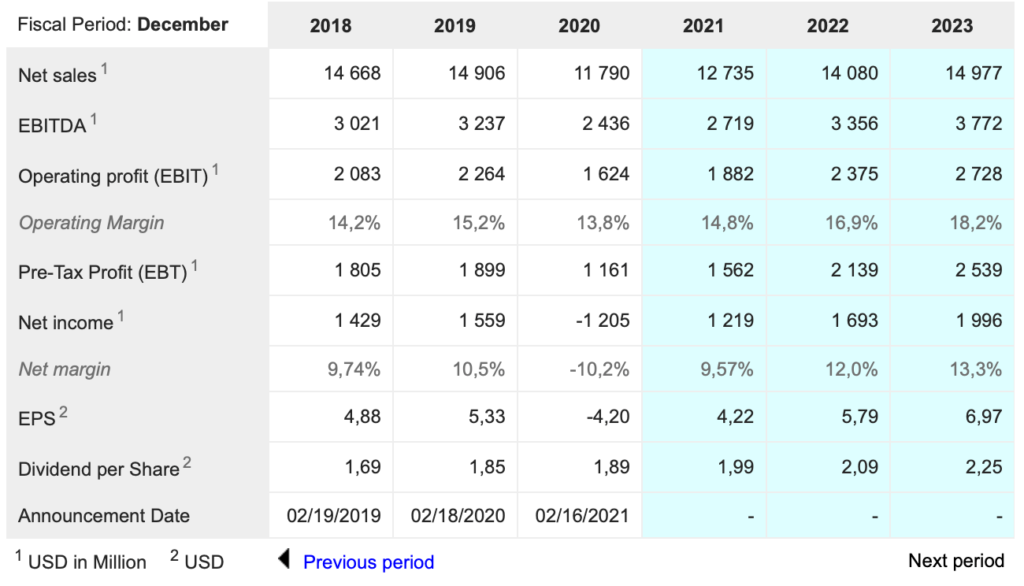

Ashtead Technology. AT. Buy @ 194p New entry (not to be confused with Ashtead Group)

Ashtead Technology goes public after 35 years – expect acquisitions

Ashtead Technology is an equipment rental business that did belong to Ashtead Group for a while which explains the name. There is no connection between them now. In 2016 Buckthorn Partners and Arab Petroleum Partners (APP) bought the business and they retain a controlling stake after the recent floatation on AIM. The business has a solid record of growth with an interruption in 2020 when Covid struck.

Latest figures show a strong recovery. “Despite the impact of the COVID-19 pandemic on trading in 2021, the Group’s business has recovered well and revenue, Adjusted EBITDA and Adjusted EBITA for the 12 months to 31 December 2021 is expected to be not less than £52m, £21.5m and £12.8m, respectively. This represents growth of approximately 23pc, 26pc and 104pc respectively compared to the prior year.”

It’s business is classic equipment rental from nine service hubs. “Ashtead Technology is a leading subsea equipment rental and solutions organisation supporting the installation, inspection, maintenance and repair (“IMR”) and decommissioning of infrastructure across the offshore energy industry. Headquartered in the UK, Ashtead Technology operates globally, servicing customers from its nine international customer service hubs. Ashtead Technology’s specialist equipment, technical solutions and support services enable its customers to understand the subsea environment and manage offshore energy infrastructure. Ashtead Technology’s service offering is applicable across the lifecycle of offshore wind farms and offshore oil and gas infrastructure. In the fast-growing offshore wind sector, Ashtead Technology’s specialist equipment and services are essential through the project development, construction and installation phase. Once wind farms are operational, Ashtead Technology supports customers with IMR. In the more mature oil and gas sector, Ashtead Technology’s focus is on IMR and decommissioning.”

Renewables is a key area of focus. “Revenue from offshore wind increased from 10pc of total group revenue for the year ended 31 December 2018 to 29pc for the year ended 31 December 2020. The group is targeting revenue from the offshore renewables market of at least 50pc in the medium term.“

The interesting question is why have they decided to float. It has enabled Buckthorn and APP to realise some of their investment but I think the real reason is to be able to pursue a more aggressive acquisition strategy in a highly fragmented market. Between 2017 and 2019, so after the arrival of Buckthorn and APP the group made five acquisitions. Covid then put a temporary block on progress. Now I suspect they will be raring to go and with quoted paper bigger deals will be possible.

Will they do deals? We shall see but If they do we could see the shares moving strongly higher.

Simple strategies for successful investing

I am becoming increasingly interested in the importance not just off stock selection but also of developing simple stock market strategies that really work. In some ways stock selection is almost the easiest part. In a world undergoing a dramatic, an arguably even accelerating, technology revolution, led by American companies, finding exciting stocks has never been simpler. There are loads of them.

The big question is how to use these stocks and related ETFs to reliably make money. This is not so easy because there are so many forces at work. Big investors use algorithms which take them in and out of shares. Smaller investors use margin trading and are drawn to momentum shares. Everybody is at the mercy of changes in interest rates and black swans like Covid and its variants. It is only too easy to be right about the stock but still fail to make money.

Volatility can be vicious. In November shares were racing higher. In December and now in January they are falling as fast as they rose and seemingly with little change in the underlying fundamentals.

At Quentinvest we have some ideas about how to help subscribers negotiate these turbulent waters, which we will be developing in future issues.

Personally, I am interested in creating strategies that enable me and like-minded subscribers to use leverage successfully. I am fed up with the roller coaster of making tons of money on the upswings and then seeing a chunk of my gains melt away on the downs – the endless stock market game of snakes and ladders about which I have written in the past.

There is no perfect solution but I think I can do better. Many subscribers are mistrustful of leverage and that is very understandable. It doesn’t matter. What works for a leveraged account should work just as well for a cash account.

Part of what I will be looking for in my stock market strategies is simplicity. It is very easy to over-complicate the investment process. Take one example. Warren Buffett is right lauded as a very savvy investor. He has become one of the world’s richest men and at 91 can be forgiven if he takes a day off from time to time.

His vehicle, recommended in this issue, is Berkshire Hathaway. Since March 2009 shares in Berkshire Hathaway are up roughly sevenfold. Over the same period QQQ, the ETF which tracks the Nasdaq 100 index and is also recommended in this issue, is up 16 times. It turns out that if Buffett had liquidated Berkshire Hathaway and reinvested the proceeds in QQQ he would have made an even bigger fortune, most likely enough to be the world’s richest man. This is something he could probably actually do because Berkshire Hathaway’s assets are very sellable and if he buys huge quantities of QQQ they just create more units.

I suspect he is aware of this because in the past he has suggested that retail investors should stop wracking their brains about what to do and just invest in an ETF like SPY which tracks the S&P 500. Simple strategies can work very well and that is exactly what we shall be looking for at Quentinvest.