This is a chart of the world’s first share index, the Dow Jones Industrials with its 30-share components. On 7 December 1941 the Japanese launched their surprise attack on Pearl Harbour. It is not the lowest point on the chart which came in the depths of the Depression in 1932 but it is the second lowest point and the launchpad for a bull market in US shares which is still running today.

There is extraordinary disdain for America across much of Europe where it is perceived as a land of guns, Rednecks and Donald Trump but this chart tells a very different story, a story of achievement unmatched in human history. I love America and this is part of the reason why – the energy and opportunity in this country is almost beyond belief.

Europe is quaint and beautiful with amazing history and culture but increasingly we are riding on the coattails of the Americans, who are immigrants from across the world. You can see this from the names of the people who run America’s great corporations which are exotic in a way that would be unimaginable in Europe, let alone China, which, as far as I can tell, does not have immigrants.

We do but they are being crushed by the dead hand of the state. If only Britain could be a land of opportunity instead of a land of envy and bureaucracy. It is as though the fast-spreading 20mph speed limits are a metaphor for the whole country.

Poor Liz Truss, what she really showed us with her much derided and wildly exciting budget, was how completely this country has been brainwashed to believe that our citizens can no longer be trusted with their own money.

We need a new political party because the Conservatives are losing the plot. If only Rishi would try playing Bazball* like the English test team we might see some results and at least life would be exciting.

*Bazball cricket has become a buzzword in England’s cricketing landscape, capturing the essence of a new approach to the sport. Coined after the legendary New Zealand cricketer Brendon McCullum, known as “Baz” during his playing days, this term signifies an aggressive and fearless brand of cricket.

MINT, 21 June 2023

Look at this chart of the FTSE 100. The blistering uptrend ending in 2000 shows the impact of Maggie Thatcher, it would look even more amazing if it extended back to 1982 and the famous Douglas Howe budget which was so derided by the establishment that 365 economists, including a future governor of the Bank of England, signed a letter published in a full page ad in the national newspapers deriding the government’s economic policies.

The chart tell us vividly who was right and, sadly, how clear it is that the dead hands are back in charge. The progress since 2000, a time when the USA has been blazing ahead, is almost non-existent and this for the land where Adam Smith was born.

People don’t get it because they simply have no idea what is going on. I read in a newspaper that Poles now have higher per capita income than people in the UK. What is going on and why would a country doing this badly even think of making Keir Starmer prime minister. I suppose the thinking is that the only way to make money in the UK is to make laws to steal it from people who have more – higher corporation tax, wealth taxes, inflation pushing ever more people into higher tax thresholds, doubled council tax for those who have had the temerity to acquire a second home, inheritance taxes that now kick in even for London properties priced at the average for the capital, insane levels of stamp duty and on and on. Everywhere you look it is tax, tax, tax and is it working – no! no! no!

My subscribers used to ask me why I make so few recommendations of UK stocks. It wasn’t always like that; I used to but now I can find very few shares to recommend and the US is such a treasure house of opportunity that I have almost stopped looking.

So now for that rare bird, a recommendation for a UK share.

Ashtead is really an American business. There is a graphic below which shows you what Ashtead is all about.

Even after so much growth they still only have 13pc of the market so no reason to think they have run out of steam yet. They are also the second largest equipment retail company in Canada with 115 stores and the largest in the UK with 185.

They continue to operate with strong tailwinds.

What we call a ‘trifecta’ of market dynamics – supply constraints, inflation, and skilled trade scarcity – is increasing our competitive advantage rather than limiting us. These ongoing issues come with operational challenges but those are outweighed by the corresponding benefits to our business, and they favour the larger rental players such as Sunbelt. We are seeing an increased rental penetration and are taking considerable market share because we possess the scale, experience, equipment purchasing influence and financial strength needed to prosper in this market environment. Those companies benefitting from the continued structural change are the very few, larger, more experienced, more capable rental companies who can position themselves to be there for this increasing customer demand, thereby realising a larger share of what is without question a larger and growing market.

Ashtead, annual report, 2023

Great chart, great business, great opportunities – what more do you want?

United Rentals and Ashtead Share 30pc of US Market

A business whose shares move in tandem with Ashtead is United Rental, which also has a great chart.

I used to think that AHT was unequivocally a better buy than URI but now I am not so sure. They seem to track each other and URI is a great business by any standards and the US market leader in equipment rental with 17pc market share.

In effect URI and AHT are slowly but surely dividing the market up between themselves.

The company is storming ahead.

Total revenue rose by 28pc year-on-year to a second quarter record of almost $3.6bn. Within this, rental revenue grew 21pc as reported with broad-based demand across verticals, regions and customer segments while fleet productivity increased 2.1pc on a pro forma basis.

Adjusted EBITDA increased 29pc to a second quarter record $1.7bn driving solid margin expansion. Adjusted EPS grew by 26pc to a second quarter record $9.88. And clinically, our return on invested capital set another new high watermark at 13.4pc. In short, we are on-track for another record year driven by robust customer activity. And the increases to our full-year guidance reflects our continued confidence in customer demand.

Matthew Flannery, CEO, United Rentals, Q2 2023, 26 July 2023

It is a picture of outstanding performance across the board.

Key verticals saw broad-based growth, led by industrial manufacturing, metals and minerals, and power. Non-res construction was also up double-digits. Within this, our customers kicked-off new projects across the board, including numerous CV plants and semiconductor plants, solar power facilities, infrastructure projects and for the Buffalo Bill fans out there, a new stadium.

Geographically, we saw growth in all of our regions, on both the reported and pro forma basis. And our specialty business delivered another excellent quarter with rental revenue up 17pc year-on-year organically and double-digit gains across all major categories. Within specialty, we opened 19 new locations in the second quarter and are on-track for the 40 cold starts this year.

Turning to capital allocation. We returned over $350m to shareholders during the quarter through share buybacks, and dividends are on-track to return over $1.4bn of cash to shareholders this year. And our balance sheet remains in excellent shape.

Matthew Flannery, CEO, United Rentals, Q2 2023, 26 July 2023Strategy – Buy Either One or Both

I no longer have a strong view over which you buy although I have a soft spot for Ashtead which has been a successful recommendation for suc a long time and where I met the previous management team back in the days when I still made company visits.

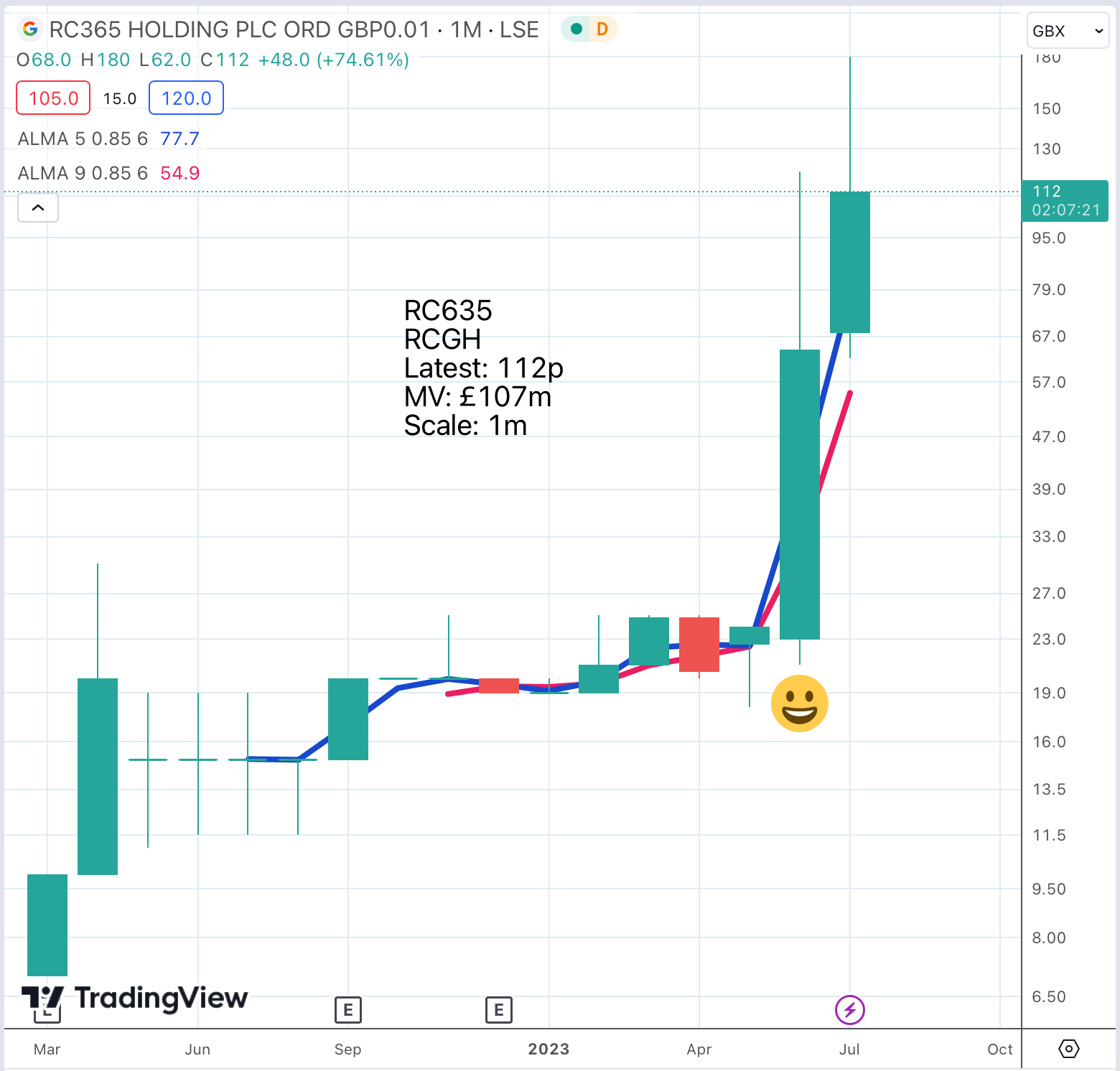

Now I want to look at a recently floated and small UK company whose shares are blazing ahead.

Chi Kit Law Could Be a Man to Follow

This is certainly an interesting chart. The shares exploded in June 2023 and this may be connected with recent acquisitions made by the business.

The group has completed two major acquisitions in June 2022 by acquiring the entire issued share capital of RCPAY Limited (Hong Kong) and Regal Crown Technology (Singapore) Pte Limited and a further acquisition post period end in November 2022 of RCPAY Limited (UK). These acquisitions offer an abundance of growth opportunities for the Group by expanding the presence in Hong Kong, Singapore, UK and other ASEAN countries and offering local and cross border payment solutions to existing and potential clients located in those regions.

Results for 6m to 30 September 2022

It seems that RC365 Holdings is effectively a start-up and the excitement lies in the potential for the business and its software offerings.

The group is actively exploring a number of opportunities by forming different types of business relationships with corporates located in the United Kingdom, Singapore and Hong Kong.

The group expects to introduce different marketing campaigns designed to promote the Company’s Catch AR and Maid Maid Matching offerings in the coming 6 months, which the board expects to provide opportunities for the continued growth for the group’s target markets.

RC365 is exploring an opportunity to enter a co-operation agreement with a well-known Software and Application Development company in Hong Kong. The focus of such a co-operation agreement will be the development of an all-rounded Enterprise Resource Planning (ERP) software which can be sold to existing and potential clients. The ERP software is expected to encompass administrative, payroll, sale and purchase functions together with a payment function to enable subscriber to increase the effectiveness and efficiency of their operations. The group expects to introduce the above services to Singapore and Malaysia market in Q1 of 2023.

Results for 6m to 30 September 2022

I learned a little more by looking at the annual report.

A key focus for the group continues to be to develop innovative products and services to attract new customers. Loss before tax was HK$3,897k and cash at 31 March 2022 was HK$23.4m.

“Catch AR”, the group’s proprietary, internally developed mobile application for Android and iOS, which is aimed at providing clients in businesses, such as catering and entertainment, a platform to promote their services and branding through the group’s innovative AR (augmented reality) and VR (visual reality) system, is expected to officially launch in October 2022. The product soft launched in 2021 and the current users have expressed a strong intention that they will join the fee payment program as the trial period comes to an end. Once it has been fully developed, the group plans to expand Catch AR to clients in China and Singapore.

The “Maid-Maid Matching” platform that allow prospective maids searching for jobs to find an employer online without having to pay a high commission to a local employment service company is also set to officially launch in October 2022.

These exciting developments taking place next month puts RC365 ahead of the market and the company is well positioned to expand its products and services in other jurisdictions.

Annual report, 2022

The group is not lacking in ambition.

RC365’s strategy is to grow its share of its existing markets, develop new capabilities and expand into new geographies within the fast growing and attractive markets in which it operates. We will remain alert to opportunities and this annual report will explain the developments we have made over the course of the year and post year end. The board believes these advances have positioned the firm well for FY23 and continued future growth.

In order to successfully execute on its strategy, RC365 has strengthened the management team by appointing two experienced individuals from the Fintech Industry; Yee Leong Wong and Wai Siang Ang. RC365 will continue to build up and enhance the team to enable the group to meet its objectives.

Annual report, 2022

A key figure at the group is the CEO

Chi Kit Law, Executive Chairman and CEO (appointed 24 Mar 2021)

Mr. Law (Chinese name: 羅志杰), age 41, has almost 20 years’ of payment solution and banking leadership experience, having previously held roles as Head of Banking Systems at MoneySwap plc and Assistant Vice President of Group Technology and Operations at DBS Bank where he was awarded the Chairman’s Award for each year he was there. Mr. Law was also awarded the JP Morgan Services Star Award. Mr. Law has managed multinational banking projects when he was at Standard Chartered Bank, HSBC, JP Morgan Chase and DBS Bank. Mr. Law holds a Masters in Advanced Management from the University of Liege and a Bachelor of Information Technology (Honours) from West Coast Institute of Management & Technology, Perth, Western Australia.

Annual report

The company boasts an impressive board on non-executive directors with great experience suggestive of a business with large ambitions.

It is interesting to note that Chi Kit Law holds 69.75pc of the issued share capital (51pc according to another source). This will make the shares volatile but gives him a serious incentive.

There is not much information about this business but it has the look of a share that could be a red-hot performer. I would be inclined to buy a few, if you can in what may be a tight market, and await developments. We are almost day one in what could be an exciting story with plenty of news flow.

Share Recommendations

Ashtead AHT Buy @ 5762p

United Rentals. URI. Buy @ $464

RC365 Holdings. RCGH. Buy @ 120p