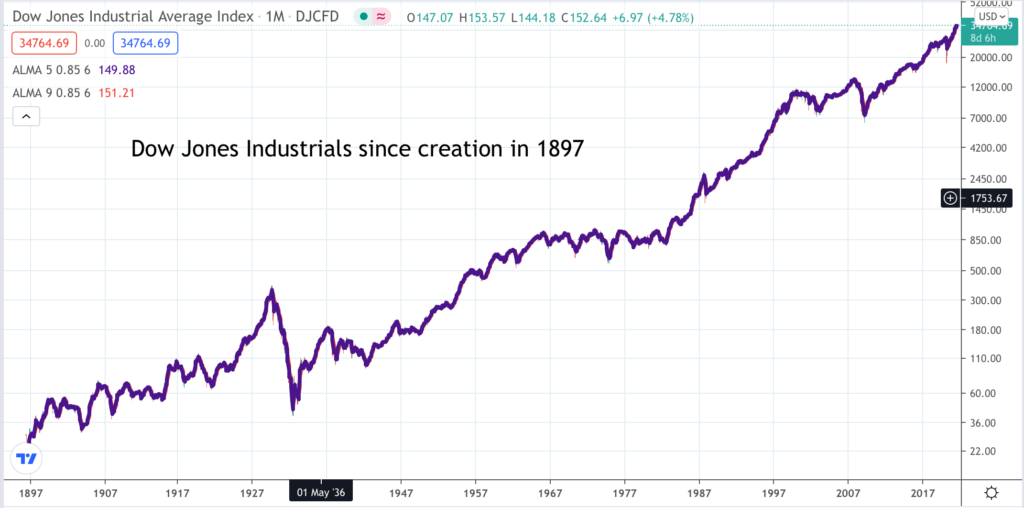

By way of variety I am showing a very long term chart. The Dow Jones since it was created at the end of the 19th century. The things which stand out for me are first the strength of the secular uptrend and second the two dramatic bear markets in 1929 and 2008. The biggest bear market for the Nasdaq indices, which did not exist in 1929, was the 2003 collapse as the late 1990s Internet bubble burst and America reeled from the attack on the World Trade Centre. Amazon shares fell by 95pc from peak to trough. Also less noticeable on this chart is the devastating UK bear market of 1974, when the FTSE All-Share index lost 75pc of its value.

The third thing which stands out is the prolonged consolidation running from 1965 to 1983, which coincidentally left the index trying to break through 1,000 for many years. The breakout, when it came, ushered in a spectacular bull market for bonds as well as shares as long and short term interest rates entered a multiyear period of decline.

I don’t think the chart gives any clear clues as to what is going to happen next. Will it keep climbing? Will share prices collapse? Will there be another 15-plus years of consolidation? I have no idea because these things would be determined by black swans – entirely unforeseeable events. My assumption is that share prices will continue to climb and this forms the basis of my investment strategy.

What is clear though, contrary to many assumptions, including my own for a while, is that share prices, especially in the US, do not need falling interest rates to move higher. This bull market is driven by growth as companies use technology, endless innovation and easy access to global markets expanded by the demise of communism to scale from small to large to gigantic in a process delivering astonishing returns for shareholders. Since it plunged in 2003 the Amazon share price has climbed 636 times to make Jeff Bezos the richest man in the world and his former wife one of the richest women.

Nor is it just technology where this is happening. There are opportunities in other fields too. Shares in luxury goods manufacturer, LVMH, are up 16-fold since 2009. Shares in fast-growing casual dining business, Chipotle Mexican Grill are up nearly 50-fold over the same period. Shares in Mettler-Toledo, which makes things like pipettes for research labs are up 104-fold since 1997.

Another key driver has been share buybacks. As companies mature and growth slows, they used their quasi-monopoly profits and strong cash flows to buy back their own shares in industrial quantities. This is precisely the phenomenon which has helped Mettler-Toledo shares do so well and it is becoming an increasingly common practice among successful quoted US businesses. Apple spent $75bn on share buybacks in 2019, $50bn in 2020 despite Covid and has authorised $90bn for 2021, which is enough to buy most of the world’s quoted companies outright.

The Quentinvest for Shares table is becoming very long. The is not a bad thing because the process of regularly updating it gives me ideas for action and a feeling for what is happening in that part of the stock market in which I am interested, namely shares in high quality, fast-growing businesses. I have been described as an out-and-out growth share investor and that is exactly what I am. What I struggle to understand is why would anyone want to be anything else. What is the attraction of slow-growing or not-growing-at-all businesses? They certainly don’t attract me.

However now that the table has become so big I think there is scope for a more disciplined approach within the table. Accordingly I have decide to create a list – The List – of all the shares which I think are suitable for adding to your portfolio. Funds permitting I think it would be an excellent strategy to hold all of them and that is exactly what I am trying to do. I think if I could make a meaningful investment in every single share in The List I would have a world-beating portfolio with exciting prospects for sustained capital gains and rising income from dividends.

The problem is that it is a big list. There are 200 shares in my list. This is a good thing. It means I am making good selections when I add shares to the table but it also makes it expensive to buy all of them.

Buying them all is a good idea because it combines strong growth potential with most of the advantages of diversity. I don’t target diversity in terms of sectors but in terms of companies I do think for most people it is a good idea. Putting all your eggs in one or two baskets is stressful whereas if one or even several shares in a large portfolio take a hit it is far less of a problem which makes it more likely you will adhere to my buy and hold strategy.

It is also good fun to have a large portfolio because there is always something happening and you have so many management teams out there working their socks off to make you money.

I have not yet fully decided but my thinking is that I may only apply the ‘buying the green’ buy signals to The List. The other categories, Other Bets, Behaving Badly and Living Dead, will require stronger signals, initially to win them promotion back to the premier league, aka, The List and then to start being the subject of the less powerful buy signals.

I don’t think of being listed in either Other Bets or Behaving Badly as being more than temporary states. Most shares should recover eventually. Living Dead is disaster territory but only includes four shares.

This is an unusual issue in that I am not recommending any action so it is not an alert. I am just going to tell you all the shares in The List and in the other categories so you know what I think about them at this moment in time.

The shares in The List in alphabetical order are as follows:

Abbott Laboratories/ ABBT

Accenture/ ACN

Adobe/ ADBE

Advanced Micro Devices/ AMD

Align Technologies/ ALGN

Alphabet/ GOOGL

Amazon/ AMZN

Apple/ AAPL

Applied Materials/ AMAT

Argenx SE/ ARGX

Arista Networks/ ANET

Ashtead/ AHT

ASML/ ASML

Atlassian/ TEAM

Autodesk/ ADSK

Automatic Data Processing/ ADP

Avalara/ AVLR

Axon Enterprise/ AXON

Baillie Gifford European Growth/ BGEU

Berkshire Hathaway.B/ BRK.B

BiliBili/ BILI

Bill.com/ BILL

Bio-Techne/ TECH

Blackrock/ BLK

Broadcom/ AVGO

Burlington Stores/ BURL

Cable One/ CABO

Cadence Design Systems/ CDNS

Carvana/ CVNA

Carl Zeiss Meditec/ AFX

Charles River Laboratories/ CRL

Chegg/ CHGG

Chewy/ CHWY

Chipotle Mexican Grill/ CMG

Cloudflare/ NET

Cochlear/ COH

Co-Star Group/ CSGP

Croda International/ CRDA

Crocs/ CROX

Crowdstrike/ CRWD

Datadog/ DDOG

Dechra Pharmaceuticals

Dexcom/ DXCM

Diageo/ DGE

Diploma/ DPLM

Docusign/ DOCU

Domino’s Pizza Inc./ DPZ

Domo Inc./ DOMO

Dynatrace/ DT

Edwards Life Sciences

Enphase Energy/ ENPH

Epam Systems/ EPAM

Estee Lauder/ EL

Etsy/ ETSY

Everbridge/ EVBG

Experian/ EXPN

Facebook/ FB

Fair Isaac/ FICO

Ferrari/ RACE

Fiserv/ FISV

Fisher & Paykel/ FPH

Five9/ FIVN

Fortinet/ FTNT

FreshPet/ FRPT

Futu/ FUTU

Fiverr/ FVRR

Games Workshop/ GAW

Gear4Music/ G4M

Genscript Bio/ 1548

Genus/ GNS

Globant/ GLOB

Halma/ HLMA

HelloFresh/ HFG

Hermes/ RMS

Home Depot/ HD.

Horizon Therapeutics/ HZNP

Hubspot/ HUBS

IDEXX Labs/ IDXX

I-Mab/ IMAB

Impax Environmental Markets/ IEM

InMode/ INMD

Intuit/ INTU

Intuitive Surgical/ ISRG

iShares World Momentum/ IWMO

JD Sports/ JD.

Kering/ KER

Lam Research Corp./ LRCX

Lightspeed POS/ LSPD

Liontrust Asset Management/ LIO

Logitech/ LOGI

L’Oreal/ OR

Lululemon Athletica/ LULU

LVMH/ LVMH

Marketaxess/ MKTX

Masimo Corp. MASI

Mastercard/ MA

Match Group/ MTCH

Maxcyte/ MXCT

Mcdonalds/ MCD

Meidong Auto/ 1268

MercadoLibre/ MELI

Mettler-Toledo-Toledo/ MTD

Meituan/ 3690

Microsoft/ MSFT

Middleby Holdings/ MIDD

Moderna/ MRNA

MongoDB/ MDB

Monolithic Power Systems/ MPWR

Morningstar/ MORN

MSCI Inc./ MSCI

Nasdaq Inc./ NDAQ

Natera/ NTRA

Netease/ NTES

Netflix/ NFLX

Nike/ NKE

Nio/ NIO

Novanta/ NVTA

Nvidia/ NVDA

O’Shares Global Internet Giants/ OGIG

Okta/ OKTA

O’Reilly Automotive/ ORLY

Palo Alto/ PANW

Paycom Software/ PAYC

Paylocity/ PCTY

PayPal/ PYPL

Pegasystems/ PEGA

Peloton/ PTON

Pinterest/ PINS

Polar Capital Technology/ PCT

Pool Corporation/ POOL

Procore/ PCOR

Invesco QQQ/ QQQ

Rapid7/ RPD

Repligen/ RGEN

RH/ RH

Rightmove/ RMV

Ringcentral/ RNG

Roblox/ RBLX

Roku/ ROKU

Rotork/ ROR

S4 Capital/ SFOR

S&P Global Inc./ SPGI

Salesforce.com/ CRM

Sartorius Stedim Biotech/ DIM

Sea Limited/ SE

ServiceNow/ NOW

Shift4 Payments/ FOUR

Smartsheet/ SMAR

Snap Inc./ SNAP

S&P 500 ETF/ SPY

SolarEdge Technologies/ SEDG

Spiral-Sarco/ SPX

Springworks Therapeutics/ SWTX

Square Inc./ SQ

Stamps.com/ STMP

Starbucks/ SBUX

Stryker/ SYK

Synopsys/ SNPS

Taiwan Semiconductor Manufacturing/ TSM

Team17/ TM17

Teledoc Health/ TDOC

Teleflex Inc./ TFX

Tencent/ 700

Tesla/ TSLA

Tractor Supply/ TSCO

The Joint Corp/ JYNT

The Trade Desk/ TTD

Twilio/ TWLO

Tyler Technologies/ TYL

UnitedHealth Group/ UNH

UP Fintech/ TIGR

Upstart/ UPST

Veeva Systems/ VEEV

Verisk Analytics/ VRSK

Victoria Carpets/ VCP

Visa/ V

Volex/ VLX

Waste Connections/ WCN

Waste Management/ WM

Watches of Switzerland Group/ WOSG

Water Intelligence/ WATR

West Pharmaceutical Services/ WST

Wingstop/ WING

Wisetech Global/ WTC

Wisdomtree Nasdaq 100 3x Daily Leveraged/ QQQ3

Wix Communications/ WIX

Workday/ WDAY

Wuxi Bio/ 2269

Xero/ XRO

Xilinx/ XLNX

YouGov/ YOU

Zai Laboratories/ ZAI

Zalando/ ZAL

Zebra Technologies/ ZBRA

Zendesk/ ZEN

Zoetis/ ZTS

Zoom Info Technologies/ ZI

Zoom Video Communications/ ZM

ZScaler/ ZS

The next group is what I call Other Bets. Shares in companies that just look a bit more speculative and uncertain than the shares in The List (there are 50 shares in Other Bets).

Abbvie/ ABBV

Activision Blizzard/ ATVI

Afterpay/ APT

Ambarella/ AMBA

Avast/ AVST

Bandwidth/ BAND

Beigene/ BGNE

Beyond Meat/ BYND

Blackline/ BL

Bruno Cucinelli/ BC

Burford Holdings/ BUR

Canada Goose/ GOOS

Corporate Travel Management/ CTD

Cyber-Ark Software/ CYBR

Delivery Hero/ DHER

Digital Turbine/ APPS

Disney (Walt)/ DIS

Dropbox/ DBX

Ecolab/ ECL

Ether/ Ether

Fevertree/ FEVR

Figs/ FIGS

Gamestop/ GME

Godaddy/ GDDY

GrowGeneration/ GRWG

Imogen/ INGN

Intertek/ ITRK

ITM Power/ ITM

James Cropper/ CRPR

Keywords Studios/ KWS

Li Auto/ LI

London Stock Exchange Group/ LSEG

Lyft/ LYFT

Magellan Financial Group/ MFG

Microstrategy/ MSTR

Monday.com/ MNDY

On The BeachGroup/ OTB

Par Technology/ PAR

Plus500/ PLUS

Restore/ RST

Sanne Group/ SNN

Shake Shack/ SHAK

Silvergate Capital/ SI

Splunk/ SPLK

Spotify/ SPOT

Superdry/ SDRT

Unilever/ ULVR

Weight Watchers/ WW

You Group/ YU.

Zillow/ Z

The third group is shares in the portfolio which are behaving badly, which is usually but not always a mixture of a declining chart pattern and some weakness in the fundamentals. This can change quickly so even with these shares it can be unwise to be too negative. However if you do need to sell something these would be the ones to go (there are 51 shares in the Behaving Badly list).

Abcam/ ABC

AB Dynamics/ ABDP

Accesso/ ACSO

ADC Therapeutics/ ADCT

Agora/ API

Airbnb/ ABNB

Alibaba/ BABA

Allogene Therapeutics/ ALLO

Alteryx/ AYX

Anaplan/ PLAN

Appian Corporation/ APPN

AptarGroup/ ATR

Aptitude Software/ APTD

Argo Blockchain/ ARB

ASOS/ ASC

Baidu/ BIDU

BioXcel Therapeutics/ BTAI

Bitcoin/ Bitcoin

BOTB/ BOTB

Blue Prism/ PRSM

Boohoo/ BOO

Booking Holdings/ BKNG

Boston Beer/ SAM

Bumble/ BMBL

C3.AI

Casey’s General Stores/ CASY

Coupa Software/ COUP

Craneware/ CRW

Fastly/ FSLY

FD Technologies/ FDP

Frontier Developments/ FDEV

Get Swift/ GSW

Guardant Health/ GH

Hargreaves Lansdown/ HL.

Hilton Food Group/ HFG

Inspire Therapeutics/ INSP

IQE/ IQE

Irobot/ IRBT

JTC/ JTC

Just Eat Takeaway/ JET

LendingTree/ TREE

Litecoin/ Litecoin

MCRO/ Micro Focus International

Naspers/ NPN

Pinduoduo/ PDD

Pliant Therapeutics/ PLRX

Renishaw/ RSW

TripAdvisor/TRIP

Turning Point Therapeutics/ TPTX

Vuzix/ VUZI

Wandisco/ WAND

Living dead shares speaks for itself. These shares should have been sold but if they haven’t they have effectively sold themselves. Fortunately there are only four.

GSX Techudu/ GSX

Nikola/ NKLA

NMC Health/ NMC

Wirecard/ WDI

I am going to stick with this format for this issue but in future I may just have three lists – The List of core portfolio holdings, Behaving Badly for shares that could be sold if needs must and Living Dead for shares that should have been sold long ago, when they started to implode. The idea is that I will not make too many changes to these lists unless I scrap the whole idea and just revert to having one list for buying the green, programmatic or whatever. Most likely the changes I will make are moving shares from Other Bets and Behaving Badly to The List because in many cases it is fairly marginal as to which list they were put in.

The attraction is that a 200 share portfolio for a private investor in these days of zero commission and fractional investing is surprisingly practical. My constraint is that I like each individual holding to be meaningful so building a 200 share portfolio is quite a serious venture but if you just want to build the portfolio it need not cost that much at all. In effect what I am proposing is that subscribers behave with their portfolios like small institutions or family trusts.

The aim is to build a substantial but highly liquid asset over time which delivers impressive total returns in the form of dividends, share buybacks and capital appreciation. Share buybacks don’t put money directly in your pocket but otherwise are very similar to dividends. They just provide the return as capital appreciation which has the advantage of deferring any tax liability.

As Warren Buffett notes if you hold shares showing substantial profits as long as you don’t sell it is as though HMRC is making you an interest free loan to make further gains.

The table is still going to be based on the Never Sell strategy. It would be far too complicated to try to incorporate sell signals and on past form might very well not improve the overall performance. The key to success as always is good share selection. Timing is much less important.