It increasingly seems we may never exactly beat Covid but learn to live with it and contain it. Work from home may be with us for a while yet, long enough to become ingrained in the way we do things, which is probably good news for technology stocks and the ongoing technology revolution.

Covid has been a remarkable agent of change because it is driving technological advances in both the digital transformation of how we live and potentially dramatic advances in healthcare. The speed with which the science of mRNA has been transformed into effective vaccines has been amazing and the companies behind these developments insist there are more dramatic advances to come in other areas.

Digital transformation is also powering share prices higher and continually adding to the selection of great growth shares for investors to add to their portfolios. When I think of the choice of great growth stocks to buy when I first started invested compared with the choice available now it is like moving from 1950s rationing to a Whole Foods Supermarket. There is simply no comparison.

This is one of the reasons why I am such a strong advocate of large portfolios. Most of us do not have the expertise either to understand what cutting edge technology is all about or how to translate that understanding into effective stock selection. Large portfolios mean you don’t have to study for a PHD in each share you buy. You can pick stocks without straying out of your comfort zone.

Many of the most exciting 21st century businesses are developing software to be used by other developers. How on earth is the average layman expected to get their heads around exactly what they do? I don’t even try or only in a cursory way. I look for other signs of success such as a history of achievement, managements who can make a good fist of explaining what they do without losing their audience in incomprehensible technical details, a sense of purpose and optimism, ambition, recognition of their achievements by their industry peers and all the things that go to make a stock 3G+M (great growth, great chart, great story plus magic).

I look, in short, for the things I can recognise and leave the hard stuff to the management and their teams of researchers and developers. I don’t want to know if their technology is good (well, I do. but not directly). I want to know if they are good because then I can believe their assurances that the technology does what is claimed for it. It is a bit like knowing a lion is around by the footprint it leaves; you don’t need to actually see the beast.

I get excited when I find great growth shares which means I am in a continual state of excitement. In a world of transformation there are endless opportunities to use new technology to bring about new transformations. Every industry is in some process of disruption just like the way we live. Longer established companies are also moving rapidly to transform themselves. If not they will die or be swallowed up by more fleet-footed rivals. It is a world of Darwinian struggle out there with huge rewards for businesses that can adapt and change or better still are driving that change.

In Kensington, where I live, whole swathes of shopfronts are empty or boarded up and office towers have an abandoned look. This is not a sign of decline but of vibrant change. Demolition firms are having a field day and there is scaffolding every where.

In this world of winners and losers the key to success and substantial, even dramatic capital gains is not old notions of asset backing, dividend payments and other familiar measures of solidity and value but the search for winners in the battle for territory. My dream for my subscribers as well as myself is a portfolio consisting of equal investments in 200 or more carefully chosen winners. Shares in companies carving out new mini or not-so-mini empires in territories which thanks to technology are suddenly up for grabs. Build such a portfolio and an exciting and rewarding investment future is almost assured.

Quentinvest and all the publications that make up Quentinvest are increasingly geared to achieving just such a result.

Ambarella. AMBA. Buy @ $137 – “CV [computer vision] momentum continues to rapidly build.”

Basler AG. DWWS Buy @ €130 – “…changing from camera maker to a full range provider of accessories.”

DotDigital Group. DOTD Buy @ 278p. – “Global automation marketing spend to grow eightfold by 2027.”

Globant. GLOB. Buy @ $331 – “…in the middle of a once-in-a-generation accelerated change.”

Lightspeed. LSPD. Buy @ $120 – “Lightspeed is the technology that will ignite businesses everywhere.”

Next Fifteen Communications. NFC. Buy @ 1120p – New chair says “I am taking over the role at a hugely exciting time for the group.”

ServiceNow. NOW. Buy @ $678 – “The global economy is recovering at the fastest pace in 80 years.”

Wisetech Global WTC Buy @ A$49 – “Well positioned to transform the global $9 trillion logistics market.”

Ambarella AMBA. Buy @ $137. Times recommended: 5 First recommended: $105 Last recommended: $123.50

Ambarella smashes expectations as its new generation of CV SoCs builds momentum

Ambarella makes systems on chips (SoCs) to enable low power high quality computer vision (CV). It had a big run after the initial flotation powering chips for consumer companies like GoPro with their special sports cameras. When that growth slowed Ambarella’s growth slowed too and the shares fell back to earth. Since then CEO and founder, Fermi Wang and his team have been working hard to repurpose the business for new applications. These efforts are now starting to deliver exciting results.

“We’re pleased to report significant market share gains and financial momentum as our AIoT [artificial intelligence of things which is a combination of AI and IoT] transformation continues to play out. Q3 revenue was above the high-end of our guidance, up 13pc sequentially, and 58pc on a year-over-year basis. Our Q3 outlook is also well above the consensus estimate helped by CV product success in existing markets, as well as our penetration into entirely new markets.”

When Ambarella announced their Q2 2022 results on 31 August 2021 the shares exploded higher. In three days they have risen 37pc from $100 to $137. Investors are starting to perceive Ambarella in a dramatically different way and realising that it is an exciting business with huge potential. It is a bit like Nvidia which has been finding exciting new applications outside video gaming for its graphics semiconductors.

Ambarella is looking for new applications for its low power high quality chips to make visual applications possible and is both finding them and developing new SoCs with greater power and capabilities like 3D. These computer vision or CV chips are forecast to grow from 10pc of the business in 2021 to 25pc in 2022. The group also sees a growing business in automotive applications, in all sorts of IoT applications and in the whole newly emerging field of chips enabling the combination of artificial intelligence and Internet of Things.

An example they talk about is security cameras, which are currently monitored by human beings. They see a future where the cameras are monitored by machines which makes possible a whole range of sci-fi possibilities as well as eliminating the considerable potential for human error.

As they say. “CV momentum continues to rapidly build. Since introducing our CV SoC family to the market, we have had more than 240 unique customers purchase engineering parts, and or development systems, with almost 60 unique customers achieving production status in the first half of this year. Even at this early stage of our transformation, we are realising a revenue mix that is of a higher quality and with more diversity — diversification. A majority of our revenues are now driven by enterprise capex, public infrastructure spending, and consumer durable growth investment.”

This is a huge change from the old GoPro driven business and a hugely exciting ‘something new’ which investors are only now starting to catch up with. Returning again to the chart. It seems to me (this is more Great Charts than Great Stocks) that Ambarella shares are breaking higher from a seven year period of sideways trading, which could support a massive move.

Since the company is also reporting great figures ahead of expectations and telling us that the business is being transformed they look an exciting investment opportunity.

Basler International DWWS Buy @ €130. Times recommended: 2. First recommended; €129.5. Last recommended: €130

Growth accelerates at Basler AG as business transforms from camera maker to a full range supplier of vision equipment

Basler AG is a Germany-based manufacturer of industrial cameras for a wide range of applications. Its product portfolio comprises area scan cameras for traffic monitoring, factory automation or retail space; line scan cameras for quality assurance and sorting procedures, which review pictures line by line rather than as a whole; network cameras; three-dimensional (3D) cameras for applications in the area of logistics, as well as industrial image processing, imaging and inspection, and PowerPack Microscopy equipment. The company also provides related software and components, including lenses, lens adapters and cables, among others. The company operates through subsidiaries and representative offices in Europe, the United States and Asia.

In 2019 because of falling sales in Europe, sharply falling sales in America and a 30pc rise in sales in Asia the group made over 54pc of its sales in Asian markets. while overall sales rose by eight per cent to €162m euros. In 2020 most regions improved modestly while Germany fell back leaving Asia at over half sales at €94.8m, EMEA at €33m, North America at €26m and Germany at €16.5m, down from €20.2m.

This pattern has begun to change dramatically in 2021. Total sales for the six months to 30 June rose 30pc to €113.2m and incoming orders rose 65pc to €152.4m euros. The board commented cautiously.

“We are pleased to report very positive half-year results after a continuing positive course of business. We increased incoming orders, sales, and results with high growth rates. We take this momentum into the second half-year and prepare the way for a presumably strong financial year.”

Like many businesses Basler is being affected by reduced supply of semiconductors.

“Despite continuing Corona related restrictions, and an increasingly challenging situation with the supply markets for semiconductor and electronics, we were fully functional in the first half-year, and increased our production volume by 37pc compared to the previous year. However, the very strong demand combined with bottlenecks in material procurement led to an extension of our delivery times and a further increase in the order backlog, representing a major challenge in the second half of the year against the background of the further worsening situation in the procurement market.”

Asia again was a strong performer. “Particularly due to our strong position in Asia, we benefitted in the best possible way and significantly stronger than the industry from the current upswing, and thus further increased our market share.”

Basler is a new entrant to the QV for Shares portfolio but it is clear that exciting things are happening. “With great passion and powerful investments, we will continue to shape Basler’s future and transform the company from a camera maker to a full range supplier. In this context, in the past months, we authorized the recruiting of approximately 150 new employees and started the implementation of this recruiting program.”

Ironically part of the strong demand is coming from the semiconductor industry. “The strong demand for investment goods in the semiconductor, electronics, and logistics sectors continued in the second quarter. The demand from the general machinery and plant engineering as well as from the automotive industry showed the first signs of recovery.”

You can see why Basler is doing so well by the kind of products they are developing.

“Mid-January, Basler announced the expansion of the boost camera series by CoaXPress 2.0 (CXP 2.0) interface and launched six new high resolution models based on this technology. Thanks to their CXP 2.0 interface, Basler boost cameras are ideally suitable for applications with image transmission distances up to 40 meters requiring high data rates and resolutions. This can be for example applications in the semiconductor, photovoltaic, inspection of displays, print and packaging industries, and medical technology industries.”

The company is also broadening its range. “Within the change from a camera maker to a full range provider of accessories – cables, lenses, processing cards and lighting – the offering continues to expand.”

There are other interesting things going on that show just how high tech a business Basler is becoming. “Additionally, a new processing kit was presented at the embedded world 2021 DIGITAL rethinking embedded vision: The board developed by Basler is both – from the hardware and the software – optimized for a variety of vision applications. Due to its design developed for industrial use, the development kit can be used not only for prototyping but also in series production. Developers can thus use the embedded processing kit to create ready-to-use vision solutions very quickly. Furthermore, the new cooperation activities with Amazon Web Services were presented at the fair aiming at providing customers with embedded vision systems with cloud connection and AI algorithms.”

Given current trading the outlook is obviously good albeit affected by issues with procurement.

“The positive trend of demand for image processing components in applications for semiconductor and electronics as well as logistics typically weakens in the second half-year due to season reasons. However, due to the bottlenecks in the supply markets this weakening is expected be milder this year. Furthermore, the management assumes the demand for image processing components to recover further in other automation fields and the demand from the medical sector to increase continuously.”

In the light of what is happening management projections for sales of €250m in 2023 could easily prove conservative, especially since by then the semiconductor industry will surely have ramped up production to make things easier on the supply side. Basler looks to me like a quality business reinventing itself for an increasingly exciting future.”

Dotdigital. Group. DOTD. Buy @ 278p. Times recommended: 2. First recommended: 280p. Last recommended: 291p

Powerful following wind for email automation specialist, DotDigital, as automation marketing spend forecast to rise eightfold by 2027

“dotdigital Group plc is a leading provider of email marketing and omnichannel SaaS technology to empower digital marketing professionals. Our marketing automation platform is used by over 70,000 marketers in 156 countries worldwide, empowering global marketers to achieve outstanding results with superior tools and services.”

Dotdigital helps companies and organisations with their email campaigns. This may sound a bit old school but according to Dotdigital email marketing is still amazingly effective.

“According to a recent survey of Fortune 1000 marketers by Chief Marketer, a leading content portal for marketers, email is now second only to social media as the most likely source of B2C [business to consumer] conversion post-Covid, having taken significant share from in-person sales and live events. Respondents also reported a dramatic increase in the effectiveness of email as a source of B2C engagement. This is consistent with what we have been seeing, with healthy levels of new business acquisition from May onwards and more frequent and extensive use of email by existing customers.”

DotDigital automates the whole processing from collecting the data to using it to connect with potential customers to recruiting new ones and encouraging existing customers to promote engagement and then provides live reports on how campaigns are progressing. Somewhere in their documentation I also saw the claim that every £1 spent on emails in a campaign generates an average £42 return, which, if anywhere near the mark, makes an amazing case for sending emails and explains why I receive so many.

Their growth strategies including developing strong partnerships such as those they have with Magento (part of Adobe), Microsoft Dynamics 365, Salesforce.com, Shopify and Big Ecommerce. They use these partnerships to develop mutual revenue generating opportunities and strengthen their transformation into a data-based omnichannel marketing aid for their customers. In their latest interim report they noted:- “Our Shopify connector revenue grew by 115pc and our MS Dynamics connector revenue grew by 25pc compared to the same period in the previous year.”

Another key strategy is geographical expansion. “All regions grew during the period, with the success of our international expansion strategy evident in that revenue from outside the UK was 31pc of group revenue for the year, up from 29pc in FY19. We expect this trend to continue as we deploy more investment in international regions.”

An attraction of the business model is that these are not one-off campaigns but continuing relationships so that over 90pc of group revenue is highly valued-recurring revenue.

The annual report is full of examples of the benefits to customers of teaming up with Dotdigital. One example is an Australian fomented beverages company called Remedy. “By using dotdigital, the company has not only enhanced its customer experience but also built a stronger approach towards brand recognition, as well as customer retention. In the past 12 months, Remedy has also seen 15pc of its revenue come from emails.”

As with so many companies the next frontier for Dotdigital is to incorporate AI [artificial intelligence] into its offerings. It is easy to see how this could be a game changer and the company is starting with a strong base.

A remarkable statistic from their interim figures is the forecast made by a research organisation called Forresters that global automation marketing spend will grow from $3.1bn in 2020 to $25.1bn in 2027. This would provide a formidable following wind for the group to continue its strong growth. Over the last 10 years revenues have grown by 21pc a year, ebitda by 24pc a year and earnings per share by 44pc a year.

By any standards this is a spectacular performance. Dotdigital is 3G with plenty of magic and looking well placed for an exciting future.

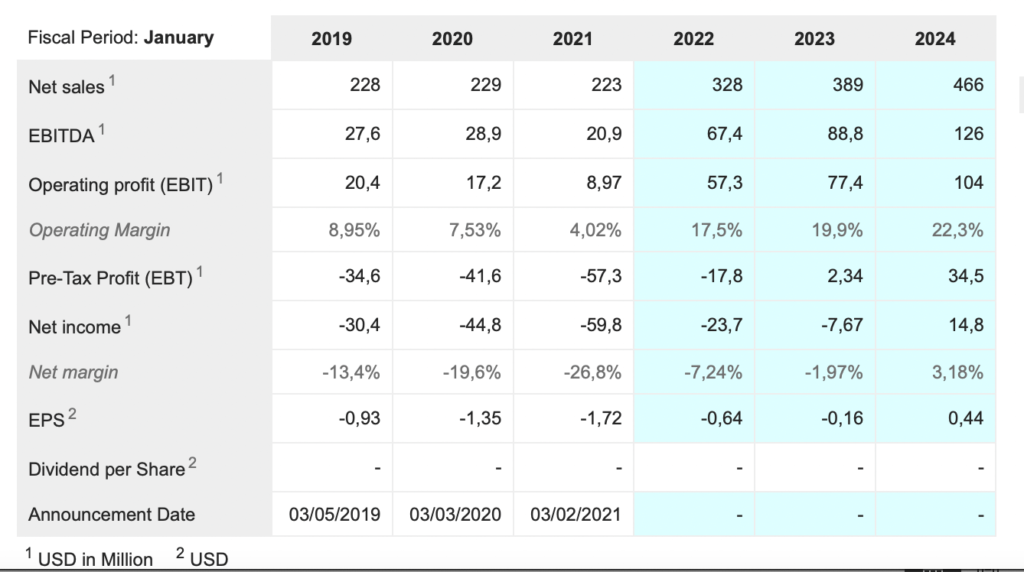

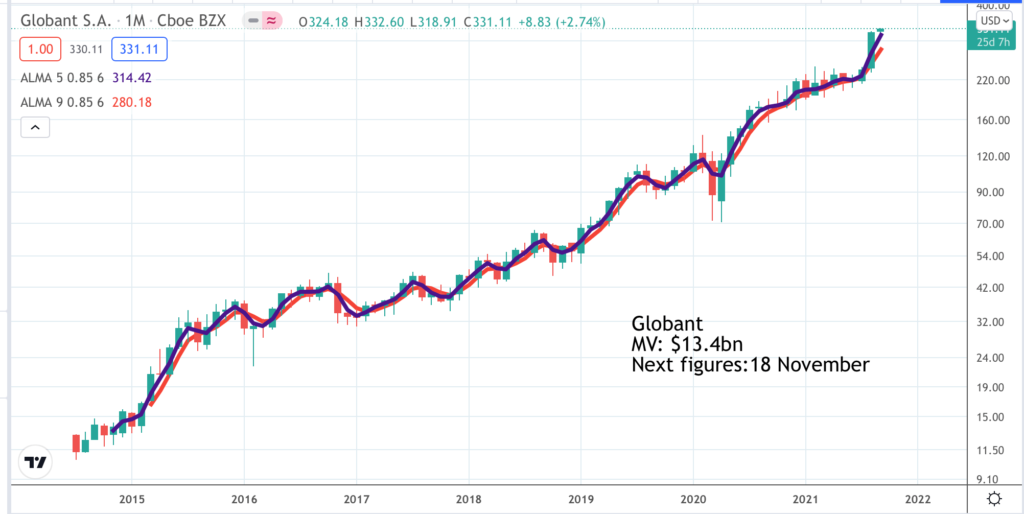

Globant. GLOB. Buy @ $331. Times recommended: 8 First recommended: £155 Last recommended: $321

Globant thrives in an era of rapid and exponential change which they describe as a ‘transcendental time for technology’

Globant is a software management consultancy superbly placed to prosper in a world undergoing accelerating change. “We are in the middle of a once-in-a-generation accelerated change, with the COVID-19 pandemic having impacted our global society in nearly every aspect of our personal and professional lives.”

“In the face of unpredictability and global uncertainty, we were able to continue on our growth path. Revenue increased 23.5pc year-over-year, reaching $814.1m. Also, I am proud to say that Globant is now a team of 16,251 Globers collaborating across 16 countries, serving almost 800 blue chip clients worldwide.”

My take on Globant is that it is a South American version of Epam Systems. Epam serves customers mainly in North America but keeps costs down by having its highly qualified labour force mainly based in central Europe where the founders come from. Globant serves its 800 plus blue chip clients located mainly in the US and UK but with staff mainly based in south and Central America. The founders hail from Argentina.

What do they do. “We create a way forward for our clients to become what we call Augmented Organizations: embracing agility, technology and collaborative culture to rise above the daily challenges to thrive. We work alongside them to bring together strategy, sustainable business models, digital trends, AI and inclusive culture to unleash their potential.”

There 2020 annual report says it all.

“We are witnessing a transcendental time for technology. There have been more business disruptors in the past 5 years than in the collective 50 previous. Organizations have had a major opportunity to take on new areas of the market that were unthinkable before. The rate of technological change is rapid and exponential, principally after a turbulent 2020 that outstripped the ability of many brands, businesses, and organizations to adapt and utilize new technologies to keep up with the user’s needs. Customer engagement is already the number two strategic business objective for organisations worldwide, and the need to evolve rapidly has never been more critical. Technologies that support this new future-centric approach are meant to reinvent key aspects of the organisation.”

Globant is thriving in this environment.

“In the second quarter we recorded a robust 67.1pc year over year revenue growth, with strong margins, leading to both top and bottom line beats. In addition, we accelerated our hiring in Q2, with IT professionals up 58.6pc year over year and 12.7pc quarter over quarter. Our revenues, adj. EPS and IT headcount, all recorded the strongest year over year growth since we are a public company. We also materially raised our full-year guidance. As we exit the Covid-19 pandemic, we are witnessing a demand environment stronger than before the pandemic. Moreover, our robust pipeline makes us believe we can deliver strong and elevated levels of growth for the foreseeable future,” explained Juan Urthiague, Globant’s CFO.”

The share price performance since the 2014 IPO has been stunning (shares up around 30-fold) and the price exploded higher after the latest quarterly figures with a beat and raise (better than expected quarterly figures and raised guidance for the rest the year).

The company has been investing some of its net cash reserves in bitcoin but not so far on a scale that would remotely affect the valuation of the business. Globant is classic 3G with loads of magic riding a global wave of technological innovation.

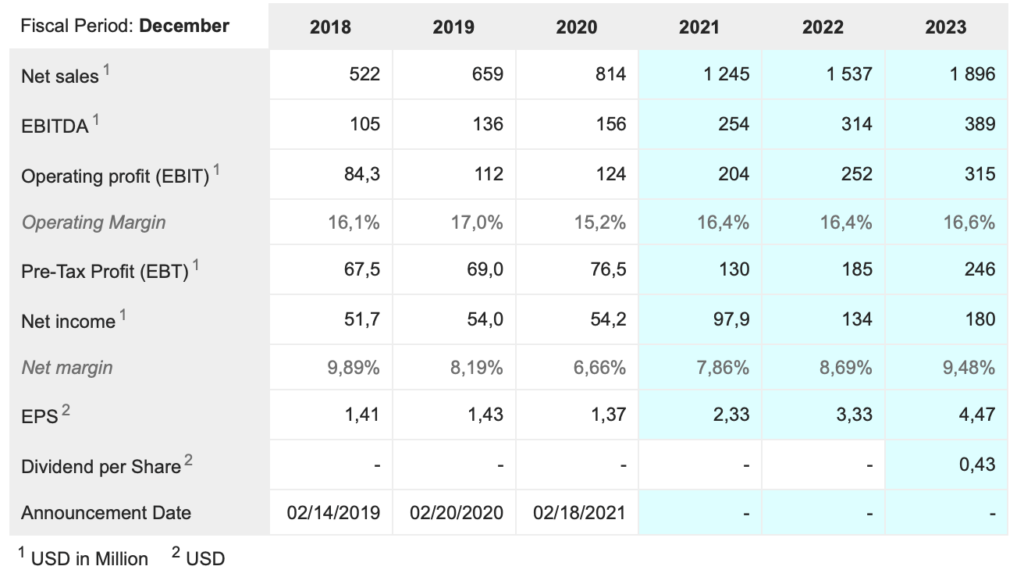

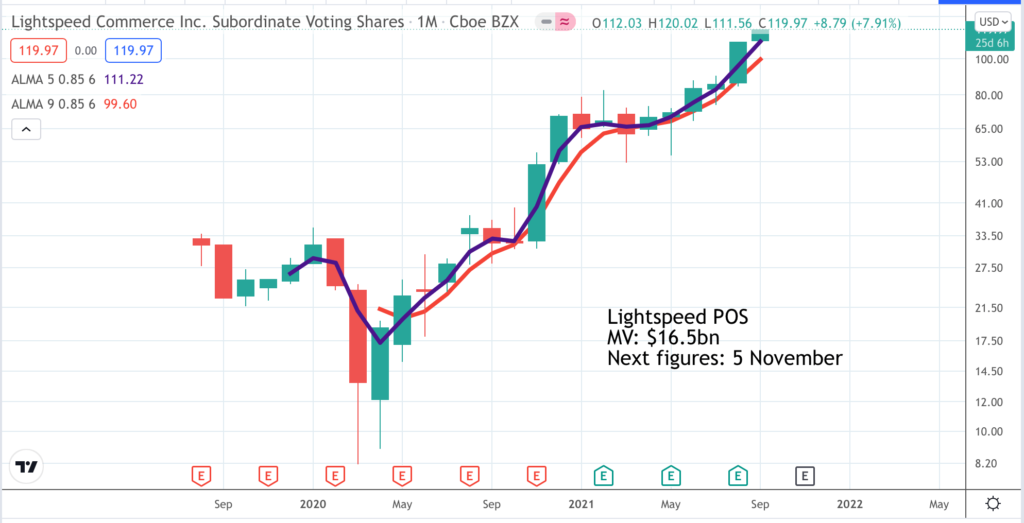

Lightspeed Commerce PoS. LSPD. Buy @ $120. Times recommended: 4 First recommended: $84 Last recommended: $113

CEO, Dax Dasilva, says – “The potential for Lightspeed as a true one-stop commerce platform has never been greater.”

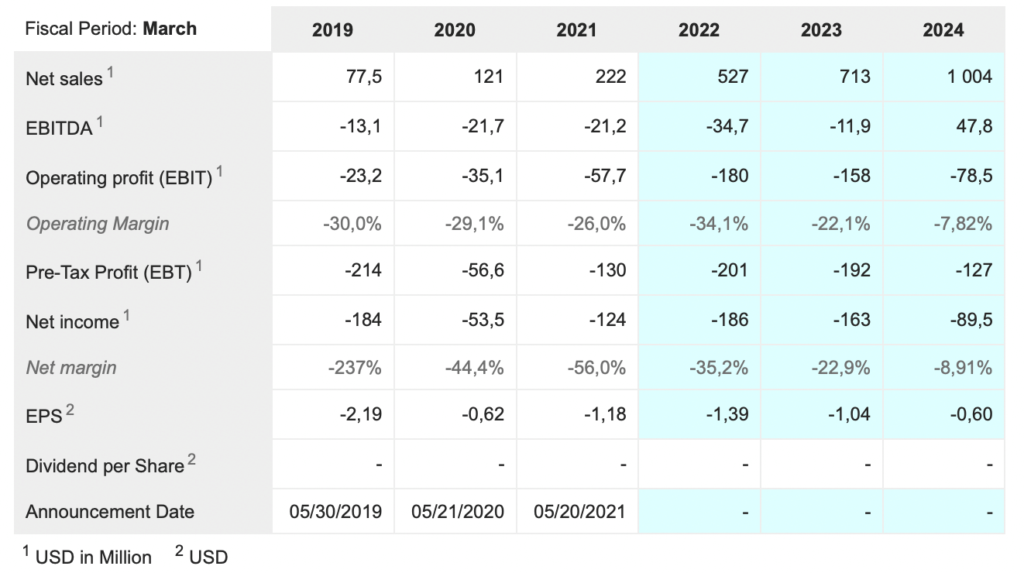

The first thing that strikes you about recently floated Lightspeed is the growth. A business with sales of $77.5m for the 12 months to 31 March 2019 is projected to have sales of over $1bn for fiscal 2024. Lightspeed provides a complete suite of software to help SMBs (small and medium sized businesses) to manage their operations from suppliers to customers.

There is a particular emphasis on hospitality businesses. Recent customer wins include a ski resort in Colorado, the hospitality operations of SpaceX, Elon Musk’s space exploration business and Kei Restaurant, a 3 Michelin stars Japanese restaurant in Paris.

Canada-based Lightspeed reminds me of Square and Shopify so I was interested to find this quote about the business. “An example of legacy POS [point of sale] systems being replaced are Aloha and Micros, which are both platforms that ruled the restaurant industry for over 30 years as sort of a duopoly before being bought by larger players. Both platforms, however, were were slow to upgrade their technology and are now in the process of being disrupted by emerging POS players such as Square and Lightspeed, that offer far more features for restaurant owners.”

Because of its focus on omnichannel and hospitality there is an element of Lightspeed which is geared to the recovery of bricks and mortar retailing and the hospitality industries worldwide.

“Lightspeed considers the Australian market as the bellwether market for the recovery. Australia had GTV (Gross Transaction Value) growth of over 75pc year over year in the latest quarter reported. ARPU (Average Revenue Per Unit) per location was up to $215, representing an increase of approximately 50pc from a year ago. So, signs of a recovery happening will be reflected in both increased transaction growth and ARPU. The other areas of strength for Lightspeed are in the U.S and UK, which also just happen to be areas that are in late stages of reopening both their economies. In Lightspeed’s latest earnings call in May, CEO Dax Dasilva also mentioned that even in regions where lockdowns are still present like Central Europe, the company is already seeing signs that preparations are underway for an eventual reopening.”

However the company has demonstrated its ability to grow at a phenomenal rate through Covid-19 as it adds more customers who need to adopt a fully digital approach to doing business.

The addressable market is huge. “According to, AMI Partners, there are approximately 226m small and medium size businesses (SMBs) around the world, which has generated an estimated $59 trillion of revenue in 2018. This includes 47m retailers and restaurants, which are in Lightspeed’s target market.”

The group is also a consolidator.” Lightspeed can be viewed as a consolidator in an industry that has lots of smaller players in many different markets worldwide. Lightspeed often uses their acquisitions to expand geographically and/or add new capabilities. Lightspeed added three important acquisitions during FY2021 (VendLimited, Upserve and ShopKeep).”

Lightspeed’s M&A strategy also helps increase the company’s scale, lower customer acquisition costs and helps with brand recognition. These M&A benefits are often immediate too.

Before the ShopKeep and Upserve acquisitions, the economics of both companies were inferior to Lightspeed’s economics. Since both of those acquisitions were completed, Lightspeed has already achieved the payment economic goals for ShopKeep and Upserve much earlier than anticipated, which is one of the reasons Lightspeed had such strong results in Q4 FY2021.

In Q1 FY2022, Lightspeed has made two more acquisitions purchasing e-commerce platform Ecwid for $500m , and NuOrder, a B2B ordering platform servicing wholesales, brands and retailers, for $425m. The NuOrder acquisition should help Lightspeed grow its emerging Supplier Network.

Another area where the group is growing fast is payments. In May, the earnings report showed that the company had their best quarter ever for customers contracting for Lightspeed Payments. Overall Payments revenue was also up by well over 300pc from a year ago. Last but not least, Lightspeed still has upside in operating economies as the company transitions some of ShopKeep and Upserve customers to full Lightspeed Payments.

The group is also providing capital to its customers. It has introduced a service that allowed U.S.-based retailers to access cash loans of up to $50,000 per retail location to help finance growth initiatives such as buying inventory, investing in marketing, or managing cash flows.

One of Lightspeed’s strategies is to constantly add new features in the form of modules to make the higher pricing tiers more attractive to small and medium businesses. The more store owners upgrade their packages, the more it raises Lightspeed’s subscription revenue.

Lightspeed is another newcomer to the QV for Shares portfolio and I still need to improve my understanding of their operations but it looks very exciting. A combination of acquisition and organic growth can deliver spectacular results. The company has come a long way in a very short time. The addressable market is gigantic. The balance sheet is strong with over $800m in cash. Last but not least latest revenue growth was 220pc.

One analyst had this to say about Lightspeed.

“Lightspeed is a buy for aggressive investors that are able to understand and withstand the risk of investing in a highly valued stock. Lightspeed’s stock could potentially be very volatile and is susceptible to a large drop in price, if the recovery fails to take hold but has a ton of potential upside in both the short and long term.”

That’s good enough for me.

Next Fifteen Communications. NFC. Buy @ 1120p. New entry

Next Fifteen sees huge growth opportunity as it transforms its model to become a growth consultant for its customers.

This is how Next Fifteen describe themselves.

“At its core, Next 15 is a group of businesses designed to help companies grow. We do that in four different ways. First, we use data to generate the insights that help businesses understand the opportunities and challenges they face and arm them with the knowledge they need to make the best decisions. Second, we help our customers optimise their brand reputation and build the mission-critical digital assets businesses need to engage with their audiences. Third, we use creativity, data, and analytics to create the connections with customers to drive sales and other forms of customer interaction. Last, we help customers redesign their business model or create new ventures to maximise the value of their organisation. So, you shouldn’t think of us as marketing consultants, you should think of us as growth consultants. And not surprisingly, we think that’s a big growth opportunity.”

You would have thought that 2020 (to 31 January 2021) would be a challenging year for them but they still managed to grow sales by seven per cent to £266.9m and earnings per share by 17pc to 40.7p.

There are four bits to Next Fifteen.

A customer insight business that uses data to help clients see the opportunities that face them and predict their customer behaviour. Business transformation capability that is designed to help our customers solve any problem that is holding back their ability to become better understood by their audiences. A customer engagement digital asset design and building business that is creating the ecommerce platforms, apps, and websites that are the window through which the vast majority of most of the world’s commerce is now transacted. A customer delivery business. This is last link in the chain and is increasingly a digital link. Businesses want to anticipate what their customers want, when they will want it and so on. It is perhaps not surprising that this is a high growth area for the group.

This new emphasis on four segments: customer insight, customer engagement, customer delivery and business transformation will not only focus internal investment but future acquisition strategy.

The company grows organically, by acquisition and geographically. It also has some important customers.

“We work with many of the world’s most important companies. This includes Google, Facebook, Amazon, Microsoft, Procter & Gamble, American Express, Salesforce, Pepsi, Genentech and the World Health Organization. The significance of the role we play for them is reflected in the fact that many of these relationships are over a decade long.”

The group has recently acquired a new chair, Penny Ladkin-Brand, who says: “I am taking over the role at a hugely exciting time for the group. The ambitions and plans the executive team has for the group should see it continue to expand in interesting an innovative ways.”

There is more to learn about Next Fifteen which is new to the portfolio but there is enough here to make clear that this is an exciting business which is transforming itself to provide even better service to its impressive and growing client list.

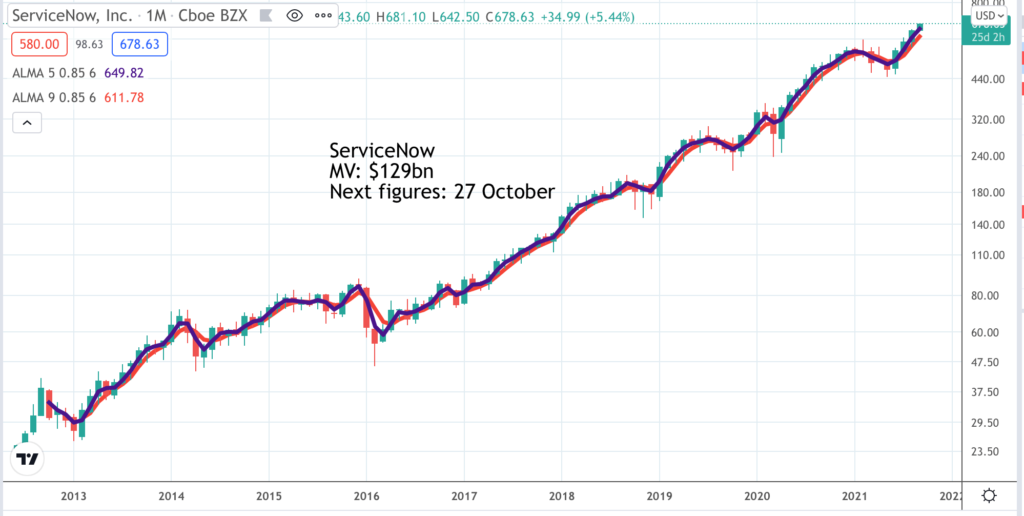

ServiceNow. NOW. Buy @ $678. Times recommended: 13 First recommended: $243 Last recommended: $651

ServiceNow aims to be the defining enterprise software company of the 21st century

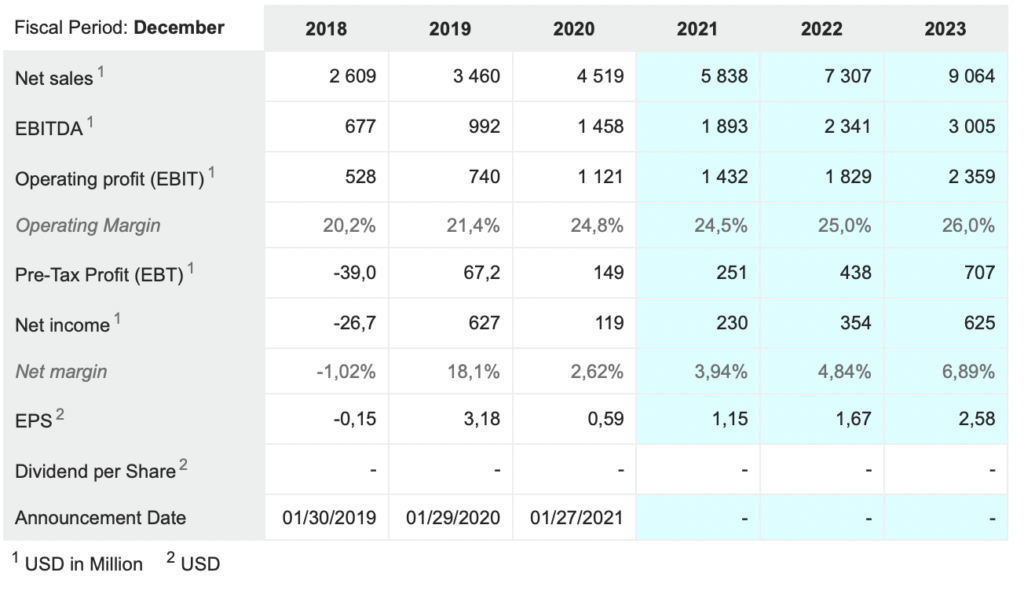

For such a large company ServiceNow delivered stunning Q2 results.

“Our team delivered an outstanding quarter, significantly exceeding the high end of our guidance across all metrics. Subscription revenues were up 31pc.Subscription billings were up 30pc. Operating margin was 25pc. And the number of deals greater than $1m was 51, up 28pc year over year. Free cash flow for the first half of the year was up 34pc year over year. An incredible performance by our team, an exceptional first half and we have unstoppable momentum. And we reflected this in our strong full-year guidance raise across the board. Gina will review the details with you in a few moments. The global economy is recovering at the fastest pace in 80 years.”

Here is what one analysts says about ServiceNow.

“ServiceNow has one of the best cloud platforms for workflow automation. ServiceNow continues to expand the product offerings with AI, new no-code/low code, and observability capabilities. We expect the company to grow 23pc CAGR until 2026 to reach $15+ billion in revenue, as the company outlined at its Analyst day in May 2021. Revenue growth is driven by landing new customers with larger initial deals, growing existing deployments wall-to-wall, cross-selling new products, upselling premium SKUs, and expanding internationally. We expect ServiceNow’s share price to hit $681 by the end of 2022, $800+ by 2023, $1000+ by C2024, $1200+ by 2025, and $1300+ by 2026.

Those share price forecasts could easily be overtaken by events since they are already $678. Investors are increasingly realising that ServiceNow is a wonderful business and one of the great growth stars of corporate America.

The company addresses ITSM [IT service management], ITOM [IT operations management] and custom application workflow markets. These markets combined have a TAM [total addressable market] of about $165bn. ServiceNow’s competitive moat stems from its large installed base of large customers, breadth of product portfolio, and formidable go-to-market capabilities.

It has very big ambitions. “Our aspiration is to be the defining enterprise software company of the 21st century.” This may explain why it was able to attract Bill McDermott, formerly the highly successful CEO of German software giant, SAP, to join what was then a much smaller company.

Bill McDermott is an inspirational guy, who also says that “ServiceNow is “the control tower of digital transformation where he expects $8 trillion to be spent over the next three years.” He adds that the company’s pipeline has never been stronger. He says the team at ServiceNow is fired up to be the fastest growing SaaS company at scale in the world. This is heady stuff but ServiceNow really does look to be a company on fire and perfectly placed for the digital transformation sweeping the corporate world.

A measure of his impact is that since he became CEO the share price has more than quadrupled. Bottom line, ServiceNow is an incredible company and one of the most exciting investments on the US stock market.

Wisetech Global. WTC. Buy @ A$49. Times recommended: 6 First recommended: A$15.19 Last recommended: A$48.50

Logistics software supplier, Wisetech Global, on track to become the operating system for global logistics

Wisetech Global is an Australian company which has developed a software platform, Cargowise, which is widely used by the global logistics industry. The company’s strategy is to focus on the top 25 global freight forwarders and the top 200 global logistics providers. It claims that – “More than 18,000 logistics organisations use our software solutions, including 24 of the top 25 global freight forwarders and 41 of the top 50 global third party logistics providers.”

The growth has been impressive. Since 2016 the annual compound growth rate of revenue has been 37pc. The increasing scale allied to an intensified focus on operating costs is also leading to a step change in profitability. As a result full year revenues to 30 June 2022 are expected to grow between 18 and 25pc to a maximum $635m but full year 2022 ebitda is expected to grow between 26pc and 38pc to a maximum $285m.

The company, which was cofounded in 1994 by current CEO, Richard White, has a huge ambition. It wants to become the operating system for global logistics. In the light of what has been achieved so far this is not a ridiculous ambition.

The key focus of the business is on relentless innovation. Over half the group’s employees are focused on product development with 1,100 product upgrades and enhancements in 2020. In beta with selected clients is Cargowise Neo, which is intended to be a single platform for the entire international ecommerce fulfilment supply chain.

It is certainly needed because the complexities underlying international trade are mind-boggling. As they say seamless import and export require vast amounts of documentation involving multiple parties and message types. Wisetech’s answer is that they are building the world’s integrated customs platform designed to cover 90pc of manufactured trade flows.

In order to fast track its progress to where it is now the group has been highly acquisitive. In total the group has made some 38 acquisitions with 18 of those in 2018 alone as the group accelerated its global expansion. CEO, Richard White, says that most likely the pace of acquisitions will slow as the group focuses on the development and rollout of its Cargowise software platform and the launch of Cargowise Neo.

As I study Wisetech and take on board the scale of their ambitions, the pace at which they are moving, their huge investment in innovation, their footprint among the world’s leading logistics businesses, with FedEx signed up since June 2021 and what they have achieved so far, I suspect I have underestimated this business. I am beginning to feel it could become a giant.

Between 2009 and 2019 the group signed up one or two logistics giants a year to its platform with Cargowise being launched in 2014. In some years it didn’t sign up any of the giants. In 2020 it signed up six of the world’s top 25 global freight forwarders. This is beginning to look like a business that is (a) taking off and (b) becoming a no-brainer for serious players in the global freight forwarding market looking for comprehensive logistics software to automate their operations.

This may well be connected with the impact of Covid-19 and the digital transformation sweeping the world. Companies have struggled on with increasingly ineffective legacy systems for years. This is no longer an option and Wisetech Global offers a solution with its constantly improving Cargowise Platform.

The shares skyrocketed after the latest results announcement that came in at the top of guidance. This look very much like the start of something big.