The stock market is wobbling, especially high momentum growth stocks

It is a testing time for growth share investors. They have had a great run since March 2020. Investors are sitting on big profits. US Treasury bond yields have trebled from the August 2020 low point of around 0.5pc. Margin debt has risen since last March from $500bn to a record $800bn. It is not too surprising that we have seen profit taking and once the selling starts it tends to feed on itself for a while as falling share prices trigger margin calls.

Technically, falling share prices manifest in broken uptrends and falling moving averages and there are quite a few of those around. My rule is that once a share starts falling it is best to not buy until there are clear signs – a broken downtrend and a turn for the better by the relevant moving averages – that the shares are starting to climb again. Once shares start to fall there is no telling how far they may tumble.

Last Spring shares in one of my favourite businesses, Carvana, a company led by a team of all-star graduates, which is disrupting the US used car industry, plummeted in just two months from a peak $116 to $21. Investors were worried that because of Covid-19 the company would be left with a large stock of valueless automobiles as the global economy tanked and consumers stopped making large purchases. The fears were vastly overdone and in the next six months the shares rose more than 10-fold to eventually treble the former peak.

I know it is hard not to panic when a share you hold seems to be in free fall but the founding managers of the business typically don’t and it usually works for them so most investors should do the same. The problem is that we only know what a share is going to do with hindsight. The really smart thing to do with Carvana would be to sell at the top, buy back a much bigger holding at the bottom and order the champagne. Unfortunately, I don’t know how to do that and I have never met anyone who does.

Curiously, I am reading a book called Notes on Deep Time about geology, which sheds some light on the difficulties facing share investors. Back in the 1960s many scientists were convinced that they would soon know how to predict earthquakes. Now there is not a scientist in the world, who believes there is any possibility of that happening in the foreseeable future. The moment when accumulated stresses in rocks and fault lines deep below the earth’s surface reach the point where an earthquake is triggered is a total mystery and likely to remain that way.

Ditto with the ups and downs in share prices. This is why so many wise investors, led by the great Warren Buffett, long ago concluded that there was no point in trying. As Buffett once said, investing in the stock market is like going into partnership with a manic depressive. Instead, sensible investors have devised strategies built around being in a share for the very long term. Over long periods share prices are determined by corporate fundamentals. In the short term, over days, weeks, even months, much of the movement relates to investor psychology and nobody has yet come up with a way to do more than guess at how that is going to behave.

With many shares Buffett even gives himself the advice I give my subscribers. He says he will never sell.

Once you decide to be a long-term investor many things fall into place. First, it is clear that what you buy is far more important than when you buy. Warren Buffett has another great quote for this. He says it is better to buy shares in a great business at a reasonable price than to buy shares in a reasonable business at a great price. All your focus should be on the quality of the business – growth potential, management, industry dynamics and the like. Get that right and you will do well; maybe extremely well.

It may sound as though that means spending long days and nights with wet towels wrapped around your head studying reams of statistics but it is nothing like that. Great businesses are usually obvious. If you have to keep asking yourself if it is great it almost certainly isn’t. This is also precisely the job we try to do for you at Quentinvest. All my effort goes into finding great stocks and most of the ones I find are great; that doesn’t mean their shares will rise all the time but they will most of the time and over long enough periods, the investor version of the geologist’s deep time, they will be profitable.

Long term investors can also try to turn volatility to their advantage. One way to do this is by a strategy known as pound cost averaging. You could invest a certain amount every month in a fund like SPY, which tracks the S&P 500 index or QQQ, which tracks the Nasdaq 100 index. By doing this you will buy more shares when prices are low giving a strong bias to a low average cost. This makes eventual profits almost certain, especially if, as is also likely, the index makes upwards progress over time.

A variant on this strategy is to buy not every month but every time your chosen indicator gives a buy signal. For example, you could decide to buy every time selected weekly moving averages give a golden cross buy signal. A golden cross happens when the shorter moving average rises up through a longer period moving average. This will ensure that all your purchases are made into rising prices after a fall which is often a good time to buy.

I have recently been considering another approach which I call ‘Buying the Green’. The charts I regularly look at are candle stick charts. I choose the period for each candle, which can be daily, weekly, monthly or any other period you choose. The colour of the candle is determined by whether the price ends the period up – green, or down – red. In this strategy you buy at the end of every period if the candle is green. If it is red you wait. You could either buy on every single green, a very aggressive approach or less aggressively you could buy only on the first green after a red.

In the old days the dealing costs of such a strategy would have made it impractical but things have changed. There are trading platforms now that offer commission free trading and also allow you to buy fractions of a share with high priced shares like Tesla and Amazon. This means you could economically buy very small parcels, say $50 a time on every green or invest more if that seems too small. Over time you should still build a decent holding and you would be certain to make a profit eventually unless the business went bust.

Well-chosen shares go up over time, which would make this strategy very rewarding. Alternatively, you could focus on ETFs. ETFs are regularly rebalanced around the most valuable companies in an index and because they are portfolios of shares they never go bust.

I use IG for my investing. In a share account, so with no scary leverage, if you trade more than three times a month, which is highly likely with my buy the green strategy, you pay zero commission on US shares and £3 each time on UK shares. IG doesn’t offer fractional investing so this would be an expensive strategy with Amazon on a share price around $3,000 but most shares have far lower values.

My subscribers will know this but I just want to make totally clear that a high price does not mean a share is expensive in terms of company valuation. High prices usually come about because a share, like Amazon, has been rising for a very long time without any share splits. The key to how a company is valued is its market capitalisation divided by earnings and the market cap is itself determined by the number of shares in issue multiplied by the share price.

If you held Amazon and they had a 100:1 share split you would own 100 time as many shares but the price would drop to around $30. Would this mean the shares had suddenly become screamingly cheap and should be bought immediately for a quick return to $3,000? Not at all; the truth is nothing would have changed but the nominal price of the shares. The valuation of the business would be identical (100 x $30 or 1 x $3,000) multiplied by the number of shares in issue.

Growth is king

There has been much talk of Tesla shares being in a bubble. They have certainly risen very strongly including climbing more than tenfold between March 2020 and March 2021. They became very overbought at $900 a share but you could probably have said that in April, when the shares were around $150, making them more than double their March 2020 low point and five times their level in June 2019. The truth is that shares in successful businesses spend much of their time looking heavily overbought. How many times did Microsoft become overbought between 1986 and today as the shares rose from nine cents to a recent peak of $244?

I can see why common sense would suggest that it is absurd for Tesla shares to rise from $30 to $900 in less than two years but maybe this is like the stresses in geological fault lines that build and build until suddenly, seemingly out of nowhere, there is an earthquake or a volcanic eruption. Over a longer time scale Tesla, the business, has performed incredibly, justifying a massive rise in the shares. In 2011 Tesla had sales around $200m, itself an impressive performance for a business only founded in 2003 but that was just the beginning. In 2020 the group had sales of over $31bn and some people think that even that may still be early days in a long-running growth story.

Cathy Wood, the founder of ARK Investment, is a huge Tesla fan and holds big chunks of Tesla stock in the funds she controls. She recently set out some statistics for Tesla’s potential sales by 2025. Her forecasts range between $234bn and $367bn by that date. No surprise she thinks the Tesla share price still has a long way to climb. Her median forecast for the shares is $3,000. Many people either don’t agree with her or challenge her calculations but given what Tesla has already achieved you certainly cannot dismiss her projections out of hand.

My guess is that like shares in many exciting fast growing businesses, the fall in Tesla’s shares from a peak over $900 to around $600 is a stock market phenomenon (more sellers than buyers) and doesn’t tell us anything about the performance of the business. More than ever these days in a world where many industries are being disrupted by new companies wielding powerful new technologies it is incredibly hard to value businesses. If Tesla shares fell to $100 the business would still be valued at $100bn. This compares with non-GAAP income (excluding stuff like share options and other supposedly one-off events) of $2.5bn for 2020 implying a historic PE ratio of 40, which back in the day would have been considered a punchy valuation.

On the other hand if Cathy Wood is right and not only are sales going to reach a staggering $367bn by 2025 but the bulk of that is going to come from recurring autonomous ride hail revenues then even a $600bn valuation would be much too low. No wonder investors are punch drunk trying to make sense of all this. Similar reasoning applies to many exciting 21st century businesses, which makes for massive volatility but also great excitement. Who would not want to invest in a company like Tesla capable of lifting sales maybe more than 1,800 times in 15 years. Nevertheless in the short term at least the chart is trending lower and the shares should be treated with caution until we have a fresh buy signal.

Transition from Covid winners to Covid losers

There is an element of transition taking place in the stock market. Investors have spent a year investing in businesses that either survived or even benefited from Covid-19, especially shares involved in taking our lives online, helping us work from home and run digitally transformed businesses. Meanwhile another raft of companies, event promoters, hospitality businesses, cruise ships, airlines and others saw their businesses devastated by Covid. Now the pendulum may swing back as hard hit operators recover.

Longer term though the most exciting companies are likely to be technology-focused as the world innovates towards a constantly changing future. The star performers pre-Covid are likely to remain the stars of the post-Covid era, not least because many changed patterns of behaviour including much more working from home are likely to persist.

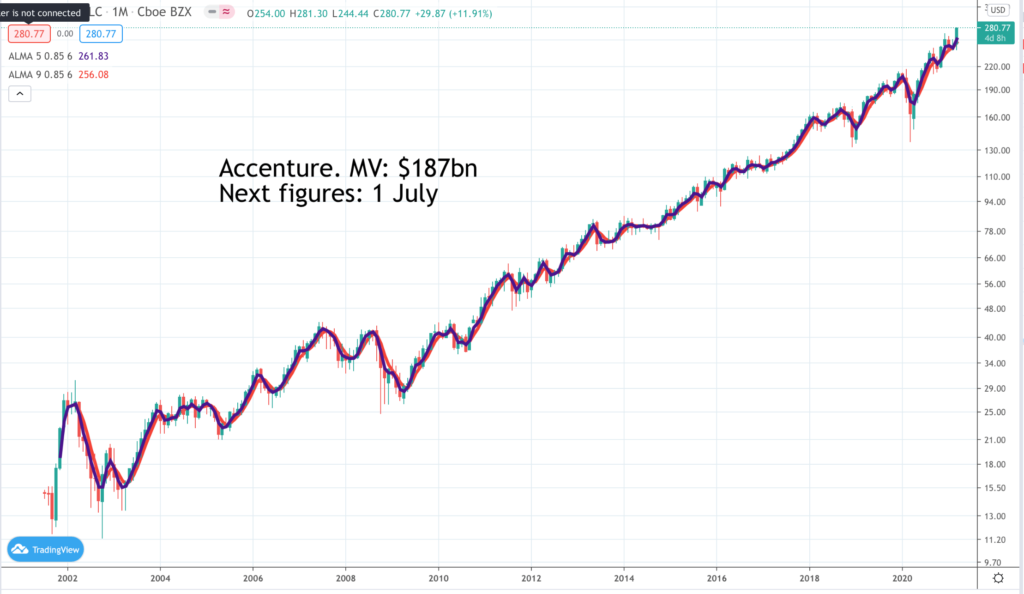

Accenture ACN Buy @ $278

Aptitude Software Group. APTD. Buy @ 698p

Applied Materials. AMAT. Buy @ $125

ASML ASML. Buy @ $605

Boston Beer. SAM. Buy @ $1163

Casey’s General Stores. CASY. Buy @ $216.50

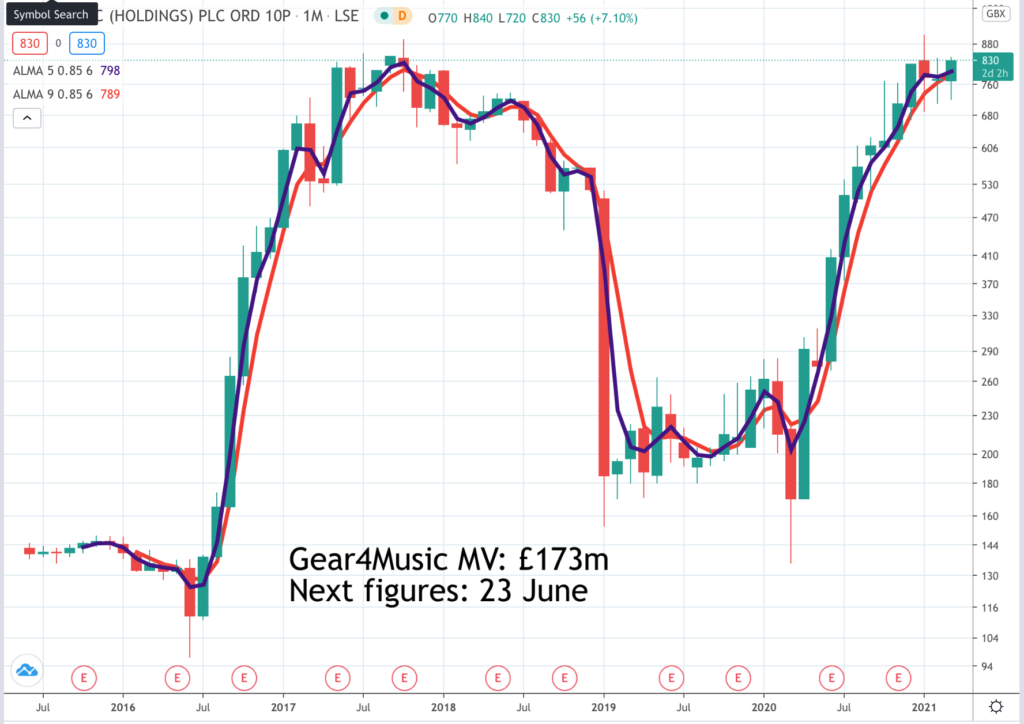

Gear4Music. G4M. Buy @ 830p

L’Oreal. OR Buy @ €325

Micro Focus International. MCRO. Buy @ 517p

Nasdaq Inc. NDAQ. Buy @ $149

O’Reilly Automotive. ORLY. Buy @ $506

Pliant Therapeutics. PLRX. Buy @ $38.75

RH. RH. Buy @ $576

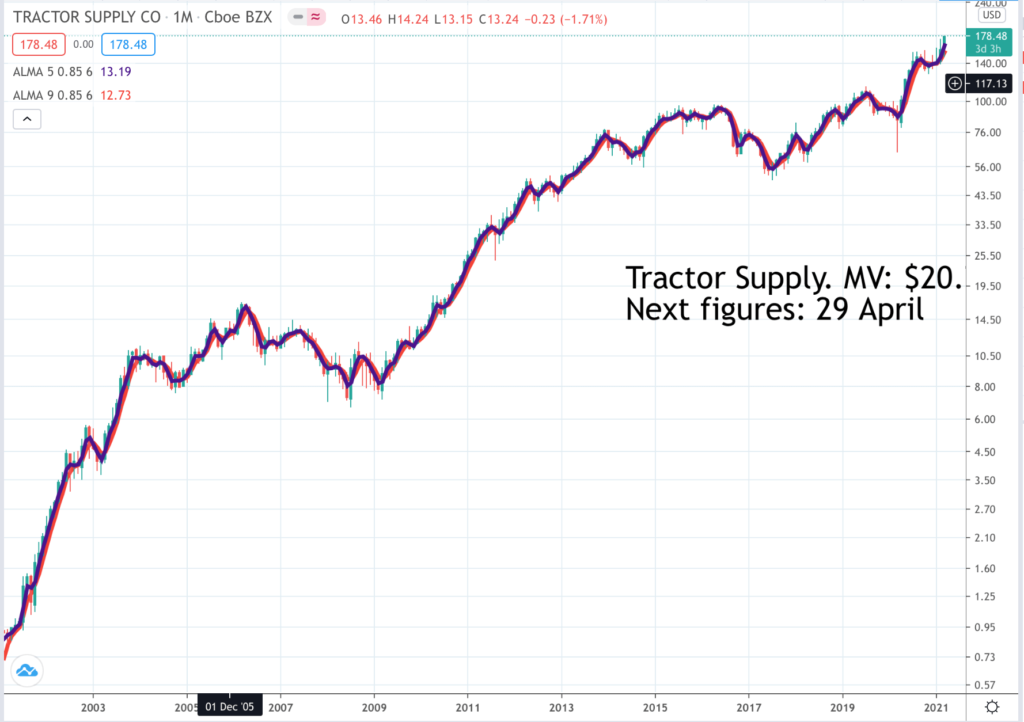

Tractor Supply. TSCO. Buy @ $175

TripAdvisor. TRIP. Buy @ $52.50

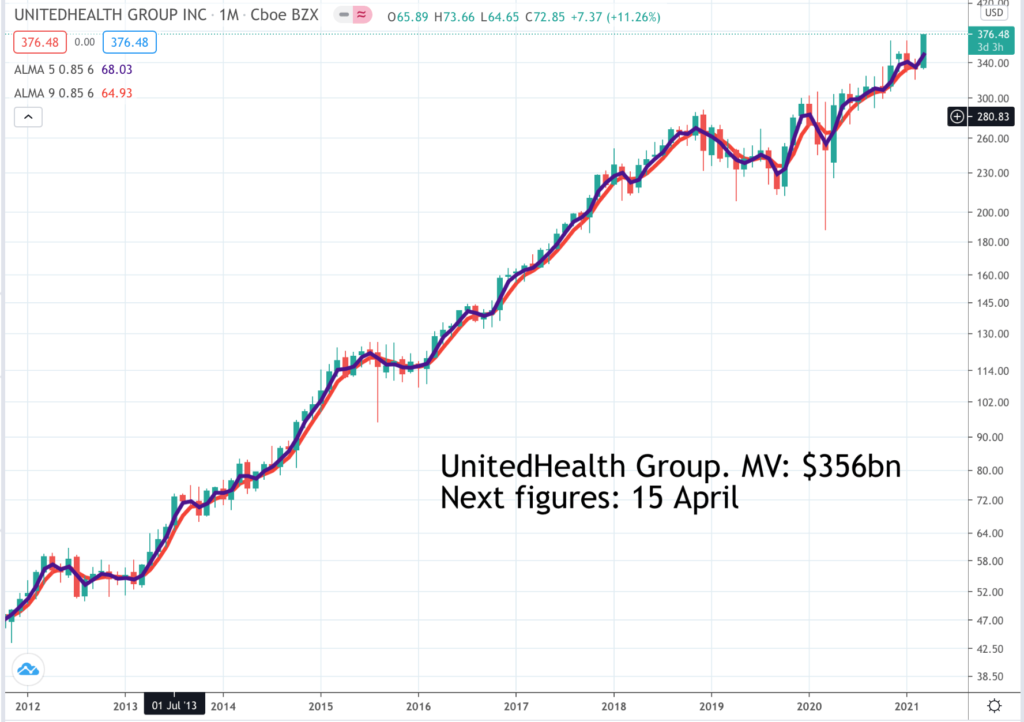

UnitedHealth Group. UNH Buy @ $375

Upstart Holdings. UPST. Buy @ $137

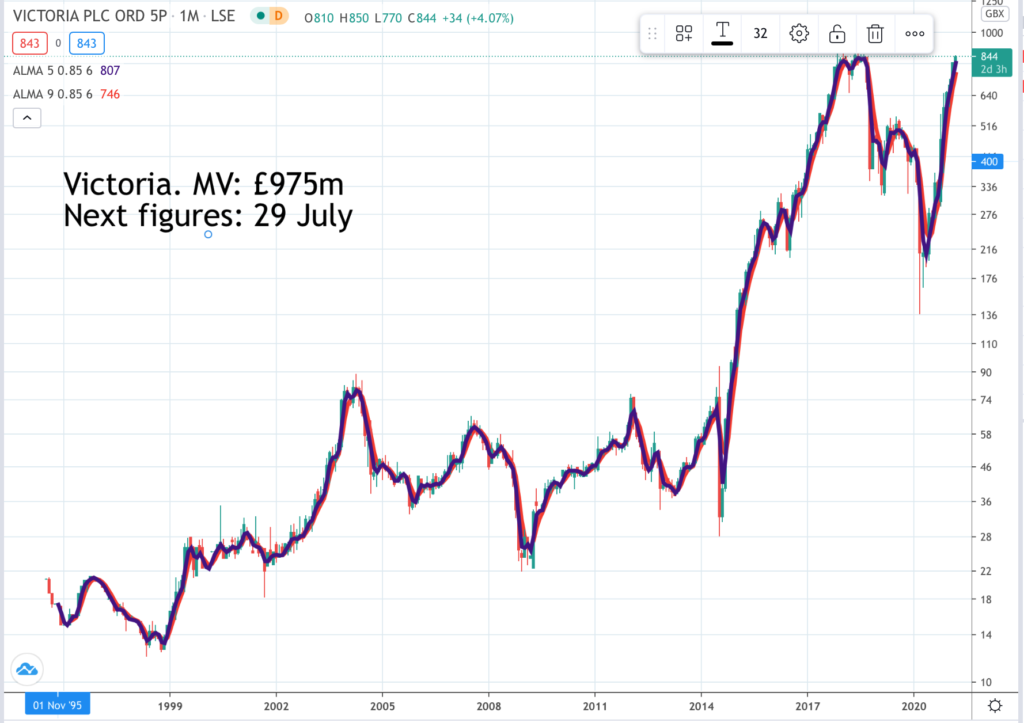

Victoria. VCP. Buy @ 822p

Accenture is a giant management consultant operating in 150 countries and with 537,000 employees at the last count. The CEO since 2019, Julie Sweet, has been described as the world’s most powerful businesswoman and she presides over a highly successful business, which has kept growing even through the Covid-19 inspired lockdowns. She says “COVID has hit a giant fast-forward button to the future, and we believe the demand to innovate at unprecedented speed and scale with rapid adoption of cloud, AI and other disruptive technologies is accelerating.“

Accenture has numerous advantages as business. Companies and organisations benefit greatly from the outsider view of their operations that companies like Accenture can provide. The company is a magnet for the world’s top graduates because of the launch pad working there can provide for a successful career. Last but not least it plays a key role not just in helping businesses with digital transformation but also in playing their part in making the world a better place. Already 185 partners at Accenture specialise in all things ecological.

Sweet adds “In Q2, our engines of growth across Accenture have roared to life to meet these needs of our clients, and we see strong momentum going into Q3.“

Aptitude Software Group APTD. Buy @ 698p

One of the most important ‘something new’ changes that can happen at a company is a new CEO. In January 2020 Jeremy Suddards took over as CEO at Aptitude Software. His arrival coincided with and forms part of what looks like a total makeover of the business. A slower growing subsidiary was sold in 2019 for £61m and the group is increasingly being focused around subscription businesses, which generate recurring revenue. In 2020, even though business overall suffered Covid-19 effects ARR (annual recurring revenue) grew by 11pc to $31.2m making up 53pc of total revenues. “A key strategic highlight in the year has been the launch of Aptitude Accounting Hub (‘AAH’) and Aptitude Insurance Calculation Engine (‘AICE’) as SaaS offerings and the subsequent entry into multi-year SaaS agreements with two North American insurers for this new service. The launch expands the Group’s existing SaaS capabilities and allows the business to deploy all its key products using this service, capitalising on the accelerated move to the cloud that the industry has experienced in 2020.” The group’s research operation, the Aptitude Innovation Centre, is based in Poland helping keep costs low.

Applied Materials. AMAT. Buy @ $125

Applied Materials is a supplier to the booming semiconductor industry and business is very good. “I’m very pleased to report another quarter of record performance for Applied Materials. Since the beginning of our fiscal year, we’ve seen a continued acceleration of demand in our semiconductor business as major macro and industry trends fuel increasing consumption of silicon across a wide range of markets and applications. 2020 was an excellent year for Applied as we outperformed our markets while growing our earnings nearly twice as fast as revenue. We carry this strong momentum into 2021.” The company recently announced a further $7.5bn share buyback programme. Days earlier the group “unveiled a major innovation in process control that uses Big Data and AI technology to help semiconductor manufacturers accelerate node development, speed time to revenue and earn more profits over the life of a node” confirming the accelerating progress of innovation within the business. “Semiconductor technology is becoming increasingly complex and expensive, and reducing the time needed to develop and ramp advanced nodes can be worth billions of dollars to chipmakers around the world.”

ASML. ASML. Buy @ $605

Netherlands-based, ASML’s technology stands at the heart of the silicon revolution. Corporate metrics are impressive. In 2020 sales reached €14bn with gross margins of 48.6pc and €2.2bn spent on research and development. The group says flatly – “We will continue to deliver shareholder value and strong growth into the next decade.” the group is in great shape. “Following a strong 2020, we currently expect another year of good growth in revenue and profitability in 2021.” Demand is growing ever stronger as witnessed by EV companies like NIO having production issues because of a shortage of chips. “While we are still very early on in the year, we think that with these demand drivers on full throttle for advanced as well as mature nodes, we expect Logic revenue to be up at least 10pc from an already very high number of EUR7.4bn in 2020. In Memory, customers have indicated that inventory levels continue to come down and expect a further tightening of supply throughout the year. As is the case with Logic, the digital transformation is also fueling memory demand across a broadening application space. The long-term demand drivers only increase our confidence in our future growth outlook toward 2025.”

Boston Beer SAM. Buy @ $1163

Boston Beer is an astonishingly innovative company, which seems almost more like a technology business with its constant stream of new product launches. “”The company achieve double-digit volume growth for the 11th consecutive quarter. We achieved depletions growth (a proxy for turnover growth) of 26pc in the fourth quarter and 37pc for the full year. We see significant distribution and volume growth opportunities in 2021 for our Truly, Twisted Tea, and Dogfish Head brands, which remain our top priorities for 2021. Early in 2021, we launched Truly Iced Tea Hard Seltzer, which combines refreshing hard seltzer with the real brewed tea and fruit flavor. [Hard seltzer, spiked seltzer or hard sparkling alcohol water is a type of highball drink containing carbonated water, alcohol, and often fruit flavouring. In the US the alcohol is usually made by fermenting cane sugar; sometimes malted barley is used.] “We are excited about the response to the introduction in early 2021 of several new beers, Samuel Adams Wicked Hazy, Samuel Adams Wicked Easy and Samuel Adams Just the Haze, our first non-alcoholic beer.” The Truly brand overall generated triple-digit volume growth in 2020. “We expect the Truly brand to continue to lead the growth of the business as it has come to stand for a great-tasting, refreshing, pure-play hard seltzer brand.”

Casey’s General Stores. CASY. Buy @ $216.50

Casey’s operates 2,000 general stores many of which also offer self-serve petrol mostly in rural locations in the USA. The business model is that local populations come to the stores for the gasoline they need and buy high margin items from the convenience stores. Another thing that has been a major winner for Casey’s in recent years has been a growing range of prepared foods like made-from-scratch pizzas, donuts and sandwiches, which come with even higher margins than the grocery items. The group owns the freeholds to most of its locations and uses its strong balance sheet to make acquisitions like the 49 stores being acquired in Oklahoma for $39m. It is also trading well enough despite the impact of Covid-19 and the fact that Casey’s is hardly an e-commerce business. Q3 earnings per share rose 14pc. Other group initiatives include expansion of its private label programme and an expanded share buyback programme. Another initiative that is off to a great start is the rewards programme. “We surpassed 2.3m Casey’s Rewards members, and are seeing nearly 20pc of all transactions include Rewards participation – just six months since launch. The Rewards platform has become a powerful tool to enhance the shopping experience as well as message to our guests.”

Gear4Music G4M. Buy @ 830p

Gear4Music claims to be the largest UK-based retailer of musical equipment. It operates entirely online. The shares suffered a sharp sell-off in 2019 as European expansion squeezed margins, while the shares were vulnerable because of the previous rise putting them on a demanding valuation. However in general the group has continued to trade well and as an entirely online operation experienced a double whammy benefit during lockdown as buyers turned to e-commerce and people stuck at home bought musical equipment for something to do. Since then there has been a series of positive trading updates from the group. Most recently in February 2021 the company announced – “Group trading performance in the 2021 calendar year to date continues to be strong. Both our UK and European Operations have performed well post Brexit, helping to drive revenue growth and support margins that have exceeded our previous expectations. The Board now expects EBITDA for the 12 months ending 31 March 2021 (“FY21”) will be not less than £18.2m, up from the guidance provided on 14 January 2021 of not less than £16.5m.”

L’Oreal. OR. Buy @ €325

L’Oreal is the leading business in global skincare and beauty products with sales of over $33bn in 2020 making it 50pc larger than the next largest player, Unilever. The group is benefiting from key trends in the beauty market led by the growing numbers of the global population in the middle and upper tiers of affluence eager to spend on sophisticated beauty products. There is a strong link between sales of beauty products and travel so no surprise that most charts fell off a cliff in 2020 albeit with a strong recovery in the second half of the year. In the same way as Netflix has adapted to make programming with strong local appeal, L’Oreal is increasingly skilled at developing products to suit all skin colours, hair types and ethnic groups, which is helping drive sales across the planet. The group is also rapidly adapting to an online world. E-commerce sales rose 62pc in 2020 to make up 26.6pc of total sales. After a bumper 2019 total sales fell modestly in 2020 but the group is clearly poised for a dramatic rebound during 2021 or whenever lockdowns lift and normal life resumes. L’Oreal is one of the world’s relentless corporate growth machines and there is no sign of that pattern changing.

Microfocus. MCRO. Buy @ 517p

Micro Focus International had a period of high drama in mid-2018 as detailed in the quotes. “On 19 March 2018, Micro Focus shares fell 55pc to 849p after the company warned of a sharp fall in revenue; its chief executive, Chris Hsu, resigned. On 2 July 2018, it was announced that Micro Focus would sell its SUSE business segment to EQT Partners for $2.535bn.” Prior to 2018 Micro Focus had enjoyed periods when it was a very exciting business indeed. Post 2018 it went into the doldrums but there are signs that a revival may be under way not least in what looks like a dramatic turnaround on the chart. The financial projections don’t look too exciting with operating profits projected as falling steadily between 2017 and 2023. Management know they have a job to do. “Last year, the board set out the strategic initiatives required to turn around our business. We are one year into this plan; this year we have built a foundation on which to build despite the operational headwinds of COVID-19.” On 22 March it was announced that Micro Focus had partnered with an exciting US technology company called Snowflake to deliver data-centric security solution around the world so things are happening.

Nasdaq Inc. Buy @ $149

Nasdaq Inc. runs the eponymous electronic NASDAQ stock exchange so no surprise that with values rising strongly, important IPOs and other share offerings that the business has prospered in 2020. “For the fourth quarter, we achieved $788m in net revenues in the fourth quarter 2020, a 22pc increase compared to the prior-year period, while non-GAAP earnings per share of $1.60 rose 24pc compared to the fourth quarter of 2019.” The Market Services segment which directly reflects the impact of strong trading and turnover on the NASDAQ saw sales rise 21pc over the whole of 2020 v 14pc growth for total turnover. Market related revenues are more volatile. The group is increasingly focusing on ARR, annual recurring revenue and within that SaaS (software as a service) revenues, which reached $1.58bn for the full year, up 11pc. These recurring revenues provide a strong base for the company enabling it to explore other growth initiatives. The company finished the year in great shape. “Because of this strong performance for the year and in particular the very strong finish in the fourth quarter, we enter 2021 with incredible momentum.” The company is in course of acquiring Verafin “which will complement Nasdaq’s established reg tech leadership to create a global SaaS leader focused on the $13bn market for anti-financial crime technology solutions.”

O’Reilly Automotive ORLY. Buy @ $506

O’Reilly Automotive sells automotive aftermarket parts from 5,594 outlets in the US. This is what one analyst said about the latest results. “Amid new store opening and comparable-store sales for the fourth quarter growing by 11.2pc due to higher sales volumes, quarterly revenues grew by 14.1pc to $2.83bn. Annual sales grew by 14.85pc YoY to $11.60bn, which marks the company’s 28th year of consecutively higher revenues. This consistency is quite incredible if you think about it, displaying both management’s competency in growing the business as well the business model’s resiliency itself.” Higher margins meant net income grew by 25.8pc to $1.75bn. The majority of the company’s cash from operations is returned to shareholders solely through ORLY’s share buybacks. O’Reilly has repurchased around half of its own stock over the past decade including repurchasing nearly $1bn of stock during Q4 alone. It was the largest amount of stock repurchased within a quarter ever for the company. In support of prospects the group notes – “We offer a compelling value proposition to our customers, providing excellent customer service through a well-equipped, technically proficient team of professional parts people leveraging industry-leading parts availability.”

Pliant Therapeutics PLRX. Buy @ $38.75.

Fibrosis is caused when cells that normally repair tissue through scar formation become dysregulated, or out of control. This dysregulation causes the cells to create and deposit excessive collagen in the affected organs, a process known as fibrosis. Fibrosis replaces healthy tissue with scar tissue in vital organs, causing irreparable damage and eventual organ failure. Pliant Therapeutics is a biopharma focused on treating fibrosis. The problem with treating fibrosis is that systemic treatments help repair the damaged areas but simultaneously damage healthy tissue creating severe side effects. Pliant Therapeutics says that its treatment solves this problem by targeting the damage tissue while doing much less damage to healthy tissue offering hope for sufferers who currently have a poor prognosis. The company has two clinical stage assets in development for four different indications, strong finances and a partnership with Novartis. Much will depend on results from clinical trials taking place in 2021. The trials are all phase 2 or earlier so it is still early days but the company is targeting an important unmet needs with exciting new technology.

RH. RH. Buy @ $576

RH is an upmarket furniture business, led by a younger Ralph Lauren lookalike called Gary Friedman, which is on fire. He says – “We are building the most comprehensive and compelling collection of luxury home furnishings in the world. The desirability and exclusivity of our product amplified in our inspiring spaces has enabled us to gain significant market share with RH for demand up 36pc in the fourth quarter. Our demand has accelerated sharply with February up 73pc and the first two weeks of March up 96pc prior to the cycling — prior to cycling the closing of our galleries, restaurants and outlets a year ago. Adjusted gross margin increased 480 points in the quarter, 540 basis points for the year and 1,210 basis points on a three-year basis versus fiscal 2017 again demonstrating the desirability of our exclusive offering and the pricing power of our brand. The strategic separation we’ve created will continue to grow as we further elevate and expand the RH Brand with the introductions of RH Contemporary in 2021 plus RH Color, RH Couture and RH Bespoke over the next several years.” He adds – “RH has now eclipsed the operating margin of LVMH. And we have a clear line of sight to 25pc plus operating margin over the next several years. With less than $3bnn of net revenues, you can imagine the leverage we should experience as we scale. RH has also become one of the top performing consumer stocks of the past decade.”

Tractor Supply TSCO. Buy @ $175

Tractor Supply operates in the same neck of the woods as Casy’s. It is the largest rural lifestyle supply business in the US with 1,932 stores and over 42,000 employees. Q4 results portray a business that is growing dramatically. “We delivered another strong quarter that exceeded our expectations. In the fourth quarter, we had strong net sales gains of 31.3pc, with comparable store sales up 27.3pc. We continue to gain market share and benefited from customers shopping with us with larger baskets.” The company is also fast maturing into a multi-channel business. “For the third quarter, e-commerce saw strong triple-digit growth and increased significantly as a percentage of our overall sales. The work we did this year to improve our omni-channel capabilities has certainly resonated with our customers, as we’ve seen several years of digital adoption accelerate in just a matter of months. For the year, about 75pc of our omni-channel sales were picked up at a Tractor Supply store, further reinforcing importance of our stores to our customers.” Another strong growth indicator is that the group added over 10,000 employees in 2020. The group has clearly benefited from the same Covid-19 effect seen in property markets as consumers shift to a more outdoors lifestyle.

TripAdvisor. TRIP. Buy @ $52.50

TripAdvisor has been hit like all travel related businesses by Covid-19 and widespread travel restrictions but prospects could be better than ever. First, is the prospect of a surge in travel as widespread vaccination programmes lead to restrictions being lifted. Secondly, the group has moved dramatically to cut costs. “We executed disciplined cost controls since the pandemic hit and for the full year 2020, we achieved more than $200m in workforce‐related and discretionary fixed cost savings versus 2019.” Thirdly, TripAdvisor is the world’s largest travel guidance business and it plans to use this position to launch a premium travel subscription business. “Hundreds of millions of consumers have chosen their preferred subscription services across categories like music, online shopping, and video content, and we believe Tripadvisor Plus can fill the notable void of an affordable, high value subscription offering in travel. Plus delivers travelers compelling value in an entirely new way. Today, Plus subscribers can access deals and perks across more than 100,000 hotels as well as exclusive savings on our hundreds of thousands of bookable experiences. Like these other consumer subscriptions, over time we envision adding many more services and benefits such as more VIP amenities, in‐destination travel benefits, airline related perks, people‐powered travel support, member‐only content, and exclusive availability to experiences and reservations at the world’s most iconic destinations and restaurants.”

UnitedHealth Group. UNH. Buy @ $375

In the UK we have the NHS and a largely insurance-financed private health sector. In the US it is all about insurance and this has led to the creation of some gigantic businesses of which UnitedHealth is the largest. British people tend to assume the NHS is great and the US system is horrendous. When I look at UnitedHealth I have a very different impression. Part of the problem is that many British people struggle with the idea that a company can be caring, efficient and profitable but UNH seems to be all those things. The company has 325,000 employees and covers 45m people worldwide. People talk about the group as the Amazon of healthcare. OptumCare, a part of the Optum subsidiary of UnitedHealth Group (UHG), provides data driven, integrated direct-to-patient care including physicians, home health, urgent care and surgical care. Some analysts believe this business could eventually generate over $150bn of revenue and could quickly become the largest system in the US. OptumCare entered 2021 with over 50,000 physicians and 1,400 clinics. “We continue to expect 10pc to 15pc growth in 2021, as care activity returns to normalised levels.” Bottom line UNH continues to grow strongly while using its scale and purchasing power to do a fantastic job for patients. I suspect it beats the NHS hands down.

Upstart Holdings. UPST. buy @ $137

Upstart is a company that is using technology to change and improve the way in which banks and other lenders make loans to consumers. The company was formed by two ex-Google employees and another talented individual in 2012 with the aim of revolutionising personal lending. Investors include such eminent figures as Eric Schmidt, formerly executive chairman of Google, Marc Benioff, founder of Salesforce.com and Mark Cuban, a billionaire investor. The company has managed to grow strongly despite Covid and electrified investors with its outlook statement looking for revenues to more than double to $500m in 2021. It also announced an acquisition taking it into the auto lending market which it believes is extremely inefficient and where consumers would benefit dramatically from Upstart’s AI-fuelled loan evaluation technology to enjoy lower borrowing costs. The company is also launching a Spanish language version of its loan software to help America’s huge Hispanic community. Most recently it has announced the launch of its lending platform to help banks, which are currently awash with deposits, to find high quality borrowers.

Victoria. VCP Buy @ 822p

The first thing that greets you on their investor relations website is the news that £1 invested in Victoria when Geoff Wilding joined the business would now be worth £50.72 if all dividends were reinvested. His shareholders will be delighted and the story is by no means finished. Wilding is a serial acquirer, which has been a key factor in driving the share price gains. Half year 20/21 results were not too exciting but things picked up after the year end with the news that Koch Equity Development, a subsidiary of the US$115bn revenue group, Koch Industries, committed to invest £175m in preferred equity to accelerate Victoria’s acquisition strategy. They also acquired a 10.7pc shareholding in Victoria. The results also gave a foretaste of what was possible “- Across all the businesses we took the decision to return to full operations as soon as we could lawfully do so – even in advance of flooring retailers being allowed to re-open. As a result, we hit the ground running, ramping up production to maximum capacity – ahead of our competitors – to meet the strong demand received when stores opened. Despite the lockdowns during April to June, during which Victoria’s monthly revenues declined by as much as 80pc, revenue for the six months was broadly in line with that of the comparable period last year after a remarkable 23pc year-on-year revenue increase post-lockdown. Earnings and operating margins also recovered strongly, with record earnings in Q2 almost fully making up for Q1 when our factories in the UK and Europe were obliged to close.”