Quantum Leap, now Great Stocks for Quentinvest, has been in continuous publication since 1984. It is a big step stopping the print version but frankly something that was long overdue. The vast majority of people now have access to the Internet and publishing online has many advantages and is also better for the planet, which I think everybody realises has to be a consideration in everything we do.

As an online publication it can be published the minute it is ready with no cumbersome printing and posting process to delay its arrival in subscribers ‘metaphorical’ hands. There is more flexibility in the writing and it becomes more like a piece of software which can be progressively improved and better integrated into what I think of as the whole Quentinvest growth shares ecosystem.

Read the leaflet included with this publication and visit the web site to see how easy it is to switch to becoming an online subscriber.

Global stock markets freaked out on Friday because of the emergence of a new variant of Covid-19 in South Africa leading to new travel restrictions. Medical opinion in the UK seems to be that this is not a game changer but more part of an ongoing process with which we will just have to learn to deal.

Vaccine-related shares shot higher perhaps because the latest developments make the point that as a planet we are all in this together. If the developed world wants to be free of the virus it is in their interests for the under-developed world to be vaccinated as well.

As always when markets fall sharply the question you have to ask yourself is whether the businesses in which you hold shares have suddenly become worse businesses. If, as is almost invariably the case, the answer to that question is no then masterly inactivity is usually the best response.

As noted in previous issues no reaction since the latest stage of the bull market began in 2009 has lasted more than three months, at least in the US stock markets which I follow particularly closely. There is also still no reason to suppose that US shares won’t generally make the best investments. Although as changing technology increasingly spreads everywhere we are surely going to see more exciting companies being created on a global basis.

The first recommendation in this issue, About You, is a German online fashion business, which is enjoying great success and is, at heart, a technology company. So much is this the case that as well as providing an online shop window for many of the world’s brands they also license it out to others to help with their e-commerce operations.

I keep repeating that if property is about location, location, location, 21st century investing and portfolio building is about technology, technology, technology. Most of the great investments of the new millennium have been fundamentally technology shares although not all. There are businesses like Starbucks, Chipotle Mexican Grill and Hermes which have done very well but where technology is not the first attribute that springs to mind in describing these companies.

One of the most striking though not often mentioned characteristics of companies in the Internet era is how they have managed to make research and development so productive. Many of the companies I look at are dramatically increasing their research spending every year and as a result bringing out a stream of innovations which they can sell to a growing customer base.

This is a huge change. 20th century companies mostly thought r&d spending was a waste of money and left it to governments and the military, for whom the Internet was originally created. Now the driving force is very much civilians and spending has become amazingly productive. In the blink of an eye we move from the desktop era to the era of smart phones and mobile computing. At the same time new iterations of the network driven by advances like 5G lead to hugely increased speeds while dramatic advances in compute power make possible sci-fi developments like cloud computing, artificial intelligence, machine learning, autonomous driving, the metaverse and who knows what else.

I use Google Search a lot and I can remember what it was like compared to how it works now. The change is incredible from simple word associations that often came up with laughably wrong results to now where you can spell and even phrase the question badly and still get the right answer. It really is like you were talking to the computer which is exactly what many people do.

Meanwhile things like facial recognition mean my phone recognises me for better security and I don’t even notice that I can just look at my phone and start using it whereas somebody else couldn’t. And now there is the possibility that within my lifetime many of us will be spending a good part of our time experiencing life in a virtual world. The mind totally boggles.

It’s exciting for investors too. The company you buy shares in may be unrecognisably different (and bigger) 10 years after you first invested. You only need a few of those, even one or two, to make a dramatic difference to your wealth over time and with so many qualified candidates you could need up with many big winners.

I don’t believe there has ever been a better time to receive a service wholly dedicated to helping you build a portfolio of great 21st century growth shares. I also have high hopes for my latest Rule of 10/ Operation CFD strategy. It is off to a somewhat bumpy start, having run full tilt into the latest Covid-inspired sell-off but I have great hopes that with it I have found a way of combining the incredible gains that can be delivered over time by leveraging your portfolio with a portfolio that becomes more resilient and less risky over time.

Is this the Holy Grail of aggressive growth share investing? I don’t know but I have high hopes and am going to give it a thorough test myself. Subscribe to Quentinvest and you too can join me on this exciting journey.

About You. YOU Buy @ €23.20 – “SCAYLE … has the potential to become the engine of the future e-commerce marketplace.“

Advanced Micro Devices. AMD. Buy @ $157.5 – “Our product portfolio and road maps have never been stronger.“

Apple AAPL. Buy @ $165 – “We are optimistic about the future, especially as we see strong demand for our new products.”

Croda International. CRDA. Buy @ 9895p – “I am excited by Croda’s increasing opportunities in emerging technology platforms and faster growth markets.”

Intuit. INTU. Buy @ $652. – “Our AI driven expert platform strategy is accelerating innovation.”

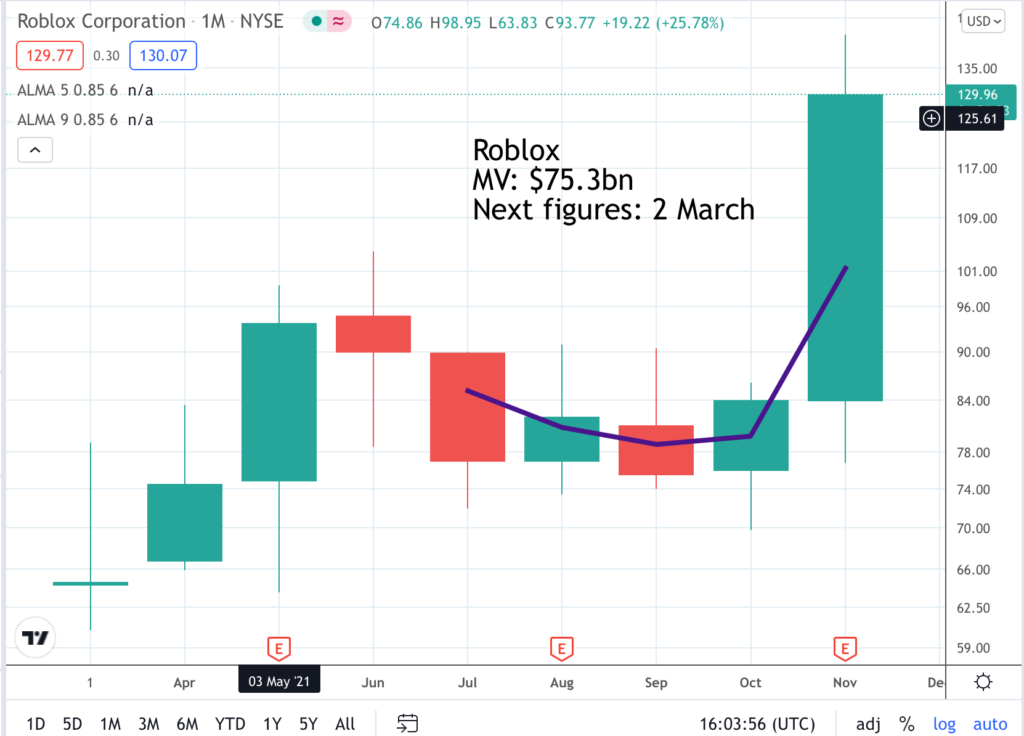

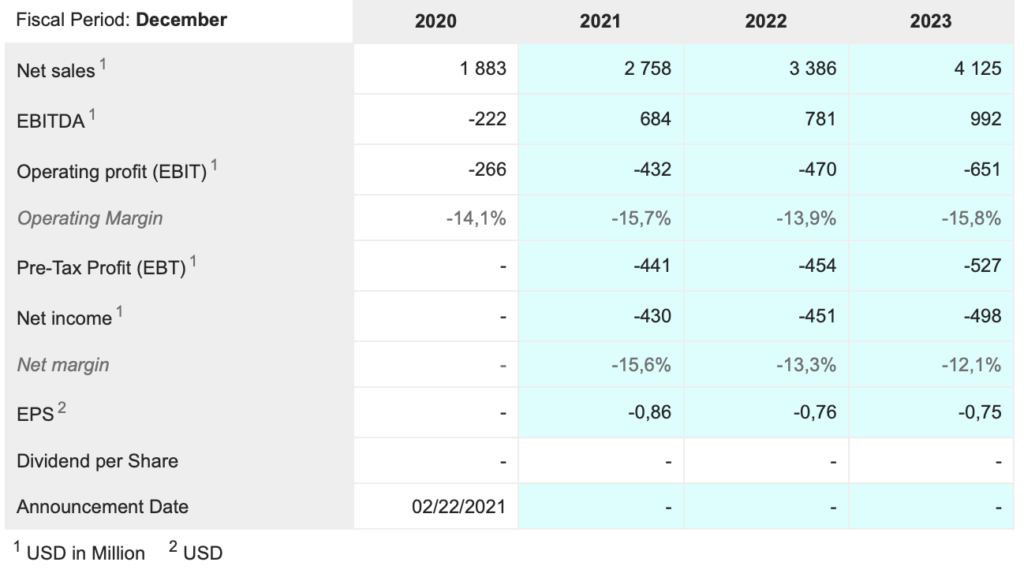

Roblox. RBLX. Buy @ $126 – “In 3Q 2019, the entire developer community earned $26m. In 3Q of ’20, it was $85m, and in 3Q of this year, it’s $130m. So that’s five times in two years.

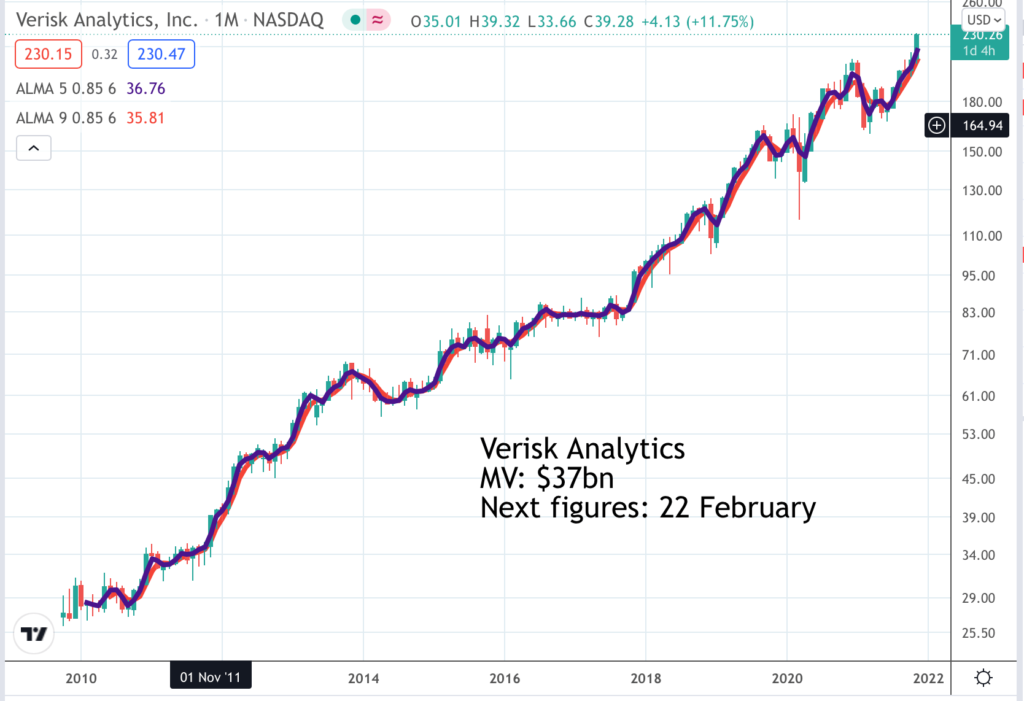

Verisk Analytics. VRSK. Buy @ $224.5. – “We see a long runway as we expand our analytic capabilities within the UK and extend our global footprint into new developed markets.”

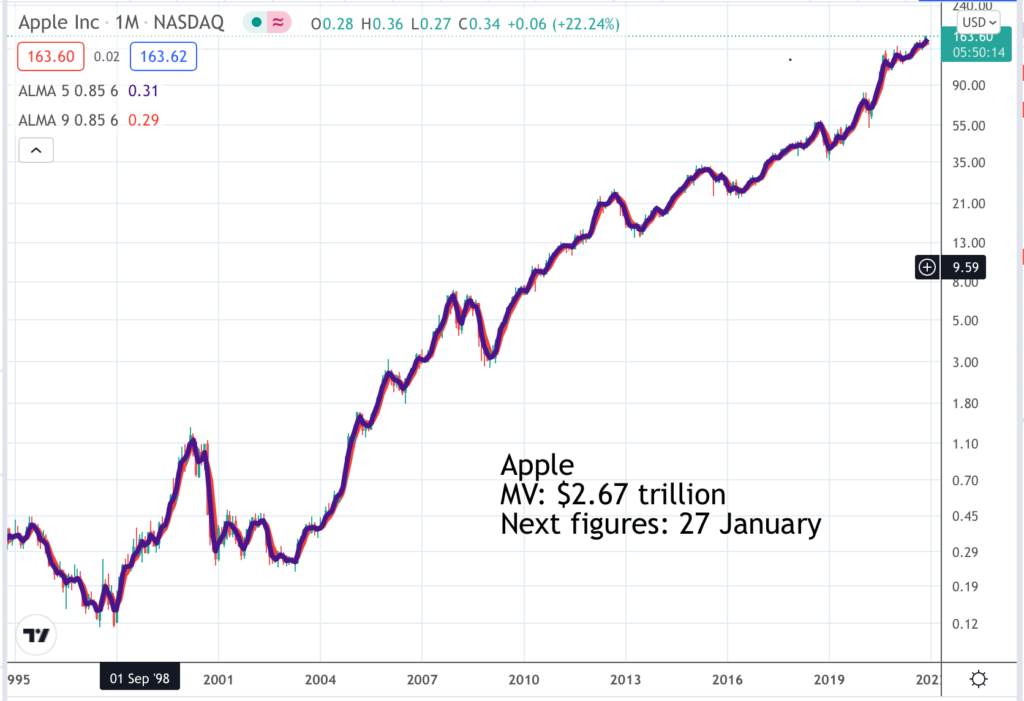

About You Holding AG. YOU. Buy @ €23.2. New entry

About You plans to become number one on-line global fashion retailer and is excited about its hyper-growth SaaS business

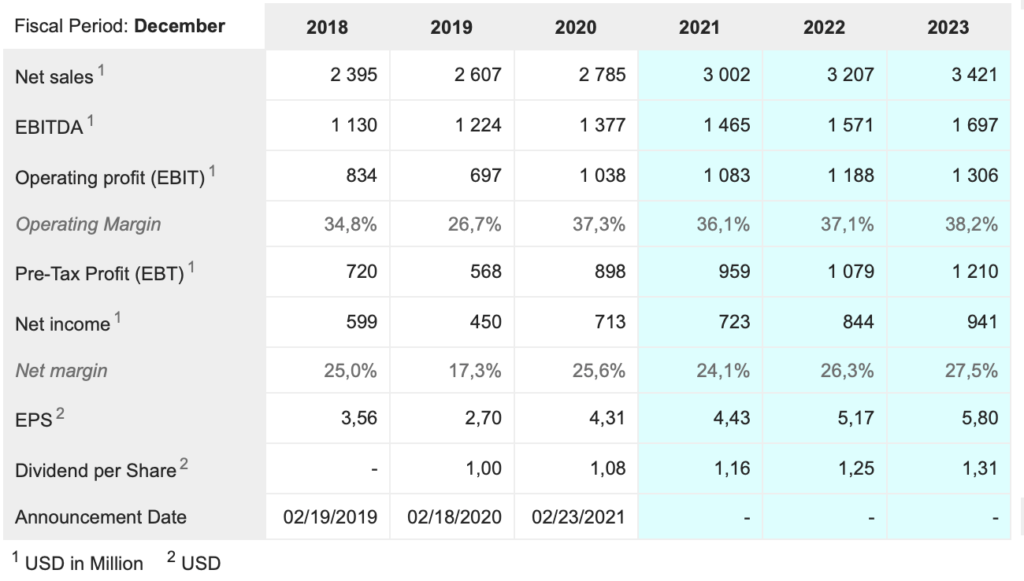

About You is an online fashion retailer, based in Hamburg, which sells clothes mainly around Europe. The company was founded in 2014 by three entrepreneurs and has been growing strongly ever since. In 2017 a funding round valued the business at €300m so the latest €4.2bn valuation represents strong progress. The share price performance since floatation has been respectable rather than setting the world on fire. The IPO price was €23 and the price has been as low as €17 before settling around €24 currently.

There is plenty going on at About You ( which switches to About and then the customer’s name when they log on to the web site). Within the last three months they have launched in Italy, Greece and Portugal and have also launched a new B2B [business to business] unit called SCAYLE.

Below is how co-founder, Hannes Wiesze, describes the business.

“First, we are digitising the offline shopping stroll for Gen Y and Z. We’re an online fashion platform but we’re not only offering a large assortment at competitive prices and a great fulfilment experience. On top of that, we are creating an inspirational discovery shopping journey, leveraging our tech skills to create a personalised experience on their smart phone and our huge influencer network to create great content and entertainment. This enables us to digitise the traditional offline shopping pattern which has shaped the fashion industry over decades and centuries before.

And with that we create incremental revenues for fashion brands. Due to our focus on inspiring customers to interact with fashion online we generate buys that wouldn’t have happened without About You. So, from a brand perspective we are not really cannibalising existing revenues. We can provide sustainable revenue growth for our suppliers combined with strong branding opportunities tied to our discovery proposition.

And on top of that we provide the technology to help our partners grow their online business. In our hearts we’re a tech company. So beside our commerce business we’ve developed an SaaS business, licensing out proprietary technology to third-party brands and retailers.That means our revenues are not limited to transactions on About You but also extend to the broader online fashion ecosystem.”

The plan is to continue to outgrow the market to become the number one global fashion brand.

The numbers are all moving in the right direction. Group revenues were up 53pc year over year in the first half of fiscal 2022. Active customers rose 34pc to 9.7m. Average order frequency increased from 2.7 to 2.9 and order value to €58.5 per order.

Particularly exciting is the progress being made by the B2B business. The tech, media and enabling [TME] streams have all seen massive and profitable growth leading to 181pc growth for the TME segment as a whole.

The group’s growth strategy is all about core product improvements, footprint expansion, category optimisation and scaling the TME business.

International expansion is proceeding at pace and they are already looking outside Europe.

“Our global shipping platform is in the final implementation stages. Go-live is expected before the end of this year enabling us to gather data for countries outside Europe. We are extrememly excited about these new opportunities.”

SCAYLE, is the new branding for the B2B operations which include things like marketing ads to vendors on the platform and other activities to promote the brands. It is also about the TME business where the group is already powering 100 shops across Europe and plans to take this number much higher over the years. It has also been deliberately created as a separate brand from the About You brand so they can be more flexible in pursuing future opportunities.

They clearly have big ambitions for SCAYLE which is a separate organisation with dedicated teams and may at some future date have its results reported separately. Who knows. It may even become the tail that wags the dog.

The group is also a big player in second hand markets which are very popular with younger generations of consumers. who like the affordability and the fact that they are recycling.

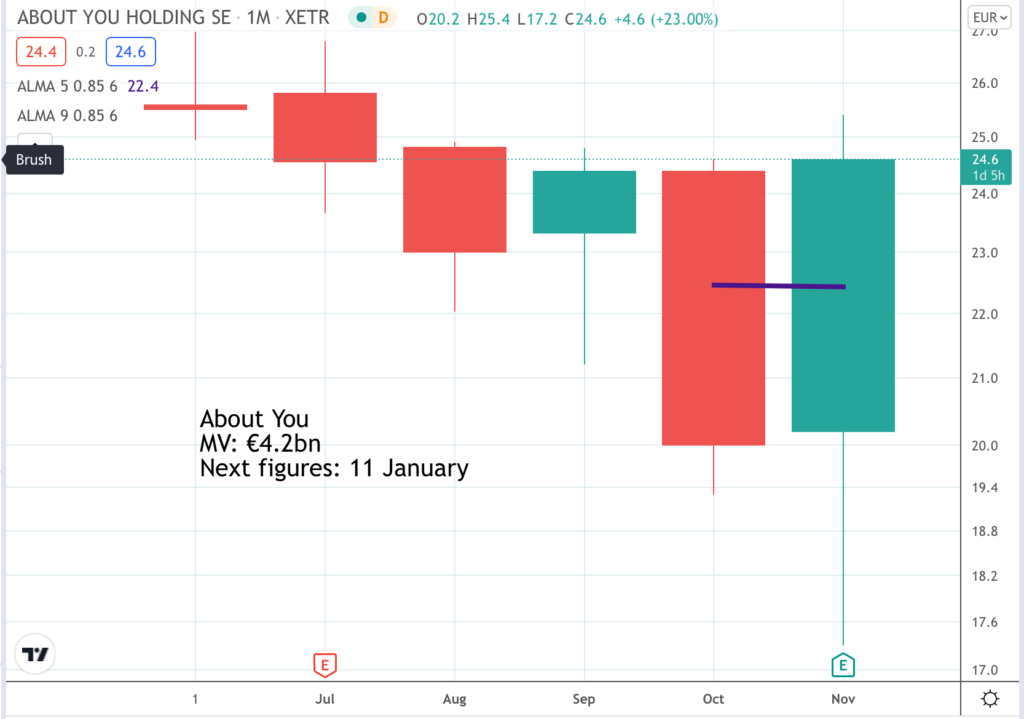

Advanced Micro Devices. AMD. Buy @ $157.5. Times recommended: 14. First recommended: $36.50 Last recommended: $153

Advanced Micro Device’s Dr Lisa Su plans to become the queen of high performance computing

Advanced Micro Computing is a company which has been transformed by the arrival of a new, highly gifted CEO, Dr Lisa Su, in October 2014. She actually arrived in 2012 as heir apparent and took over a couple of years later. She is a star, brilliant at both the product development side of the business, which has been completely revolutionised at AMD but also at the business side with accelerating sales growth accompanied by a dramatic improvement in profit margins.

AMD, which had a reputation for making cheap and cheerful, rather commoditised chips is now focused on HPC, high performance computing. In Dr Su’s words:-

“For us, it’s all about high performance. High performance technologies, high performance computing, high performance products. And this is the fundamental DNA of our company.”

She also tells us why.

“Now why do we love high performance computing so much? We really believe that this is a technology that is the enabler for both the present and the future. It actually drives what can be done over the next number of years. And whether you’re talking about very, very big systems like supercomputers or the cloud and the hyperscaler environments, or you’re talking about new workloads like AI and big data analytics and visualization. Or you’re talking about the things we enjoy like gaming and new client devices. All of these have one thing in common. They all require high performance computing.“

It takes time to change course in the semiconductor business because a huge amount of r&d is needed to develop new products and indeed whole new categories of products. As it happens results came through surprisingly quickly but in many ways only now are we seeing the fruits of all those efforts.

“Our business performed extremely well in the third quarter as our leadership product portfolio and strong execution drove record quarterly revenue, operating income, net income, and earnings per share. We delivered our fifth straight quarter of greater than 50pc year-over-year revenue growth, with each of our businesses growing significantly year over year and data center sales more than doubling. Third-quarter revenue grew 54pc to $4.3bn.

Gross margin expanded by more than 4 percentage points and operating income doubled year over year. Turning to our computing and graphics segment. Third-quarter revenue increased 44pc year over year to $2.4bn, driven by our latest generation Ryzen, Radeon, and AMD Instinct processors.“

In 2020 at their financial investors day, Dr Su looked back over the last five years.

“If you look at where we were in 2015, we were about a $4bn company. We finished 2019 at about $6.7bn. That’s 14pc annual growth rate over the last few years.”

Then she looked forward and had this to say.

“Now, as much fun as the last five years have been, today is really about the future, and we like to talk about what we see over the next five years. I can say for sure if you ask me or anybody on this leadership team, we are even more excited about the coming journey in terms of what we can do. And the reasons are very simple. First of all, the opportunities are larger. The impact we can make on the industry is larger. And our resources are much stronger. So if you think about those things and what we’ve been able to accomplish, it’s really exciting to think about what we will accomplish.”

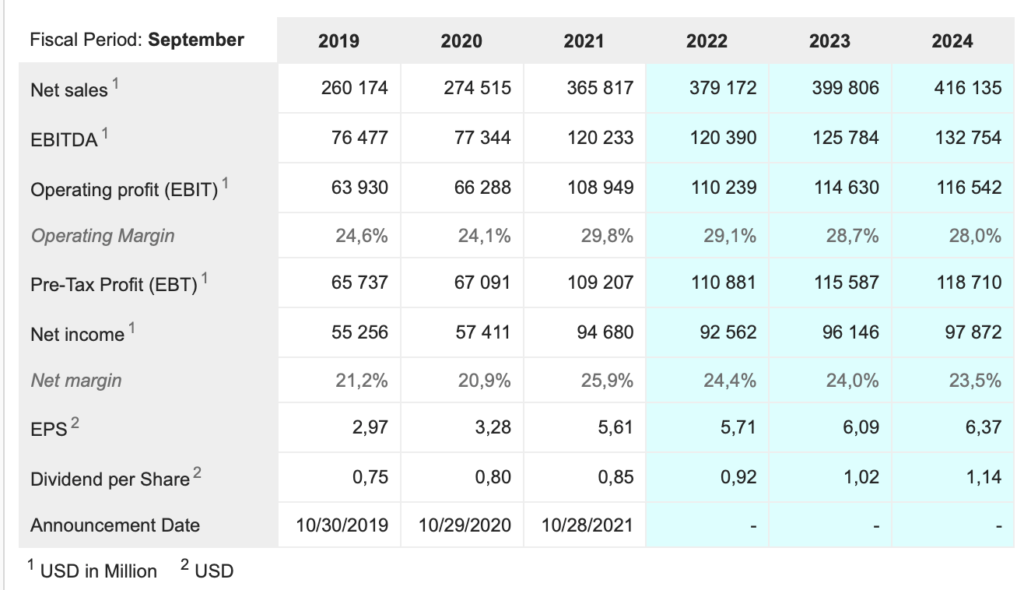

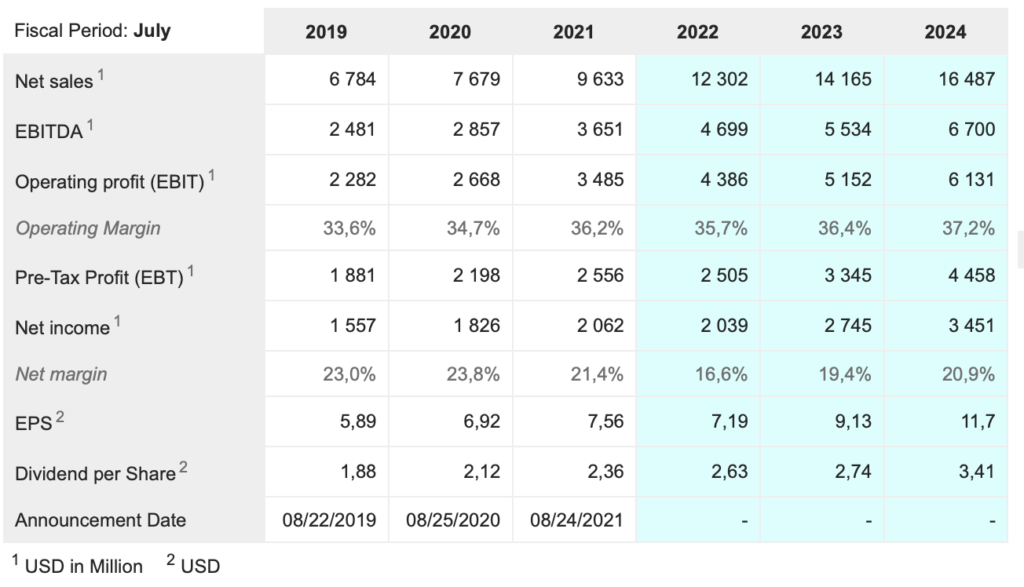

Now have a look at the table. Historic sales grew from $4bn to around $6.7bn between 2015 and 2019 but are forecast to grow to $21.7bn by 2023 and that is before improving profit margins kick in. Net income is projected to grow from $337m to $4.7bn.

Of course, AMD is in a very strong virtuous circle with better products driving growing revenues which is funding increased r&d spend leading to further product improvements. Meanwhile the company’s reputation with its customer base is growing which is making the brand more valuable leading to growing pricing power and even strong cash flow. Last but not least the great performance is making the whole business much higher profile which helps attract top talent.

This is all about a business gaining ever stronger momentum under a truly visionary leader.

“We continue growing faster than the market, driven by our consistent execution and the investments we have made to build leadership products. Our supply chain team has executed extremely well in a challenging environment, delivering incremental supply throughout the year, supporting our strong revenue growth. We are also investing significantly to secure additional capacity to support our long-term growth. Our product portfolio and road maps have never been stronger.“

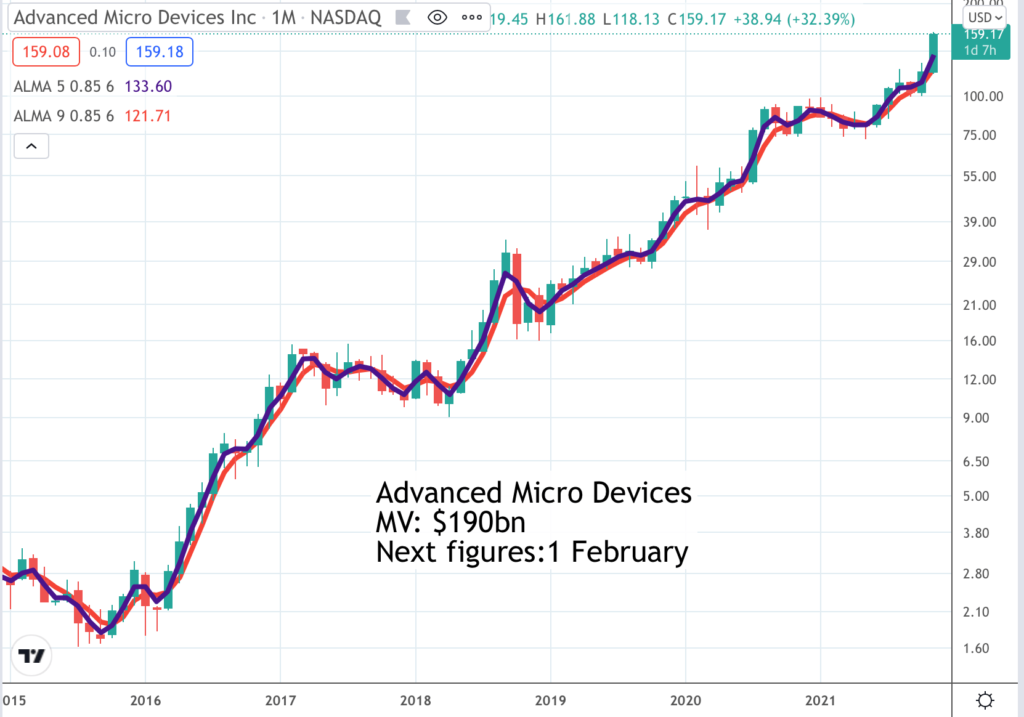

Apple. AAPL Buy @ $165. Times recommended: 29. First recommended: $39.46 Last recommended: $160

iPhone 13 phones flying off the shelves as rumours swirl about Apple cars

Analyst says fiscal Q1 sales of iPhones could top 80m amid strong demand with signs of shortages appearing.

There are also the first signs that something is coming into the Apple valuation for an Apple car. Analysts are divided. Some say it is significant and even that there could be an Apple car in production by 2024. Others say it will be later and it is too early for investors to get excited.

I am not so sure that it is too early to start to get excited. I wrote recently that I expected Tesla to become the biggest company in the world by market value because it was aiming for a significant share of the car market, which is much bigger than the phone market where Apple is such a key player. If Apple is going to be a player in the car market that would change everything.

There is no argument that Apple has had a seismic impact on every market in which it has become involved from computers to software to laptops, mobile phones, watches and services related to these items. If it does become a serious player in the car market it has a very powerful brand to stick on a car and is unlikely to go into production with a vehicle that is not seriously wow.

We also know that however they start in a market their powerful innovation machine soon starts to build success. I would have thought it would be extraordinary, given that electric vehicles are basically just complicated battery powered devices, if it did not want to become seriously involved.

Apart from anything else Apple shareholders can see what success in making electric cars is doing for Tesla’s market value. They will surely want a a piece of that action. Indeed I would have thought the minute we have a firm commitment by Apple to making cars and even a provisional date for starting production that the shares would start to move sharply higher and thereafter be very much news flow driven, much like shares in other electric vehicle companies.

Meanwhile Apple is a serious class act for all its other businesses.

“Today, Apple is reporting another very strong quarter. Demand was very robust and we set a new September quarter record of $83.4bn, up 29pc from last year and in line with what we discussed on our last call despite larger-than-expected supply constraints.

We estimate these constraints had around a $6bn revenue dollar impact, driven primarily by industrywide silicon shortages and COVID-related manufacturing disruptions. Even so, we set an all-time record for Mac and quarterly records for iPhone, iPad, wearables, home, and accessories, representing 30pc year-over-year growth in products. Our services business performed better than we expected where we had an all-time record of $18.3bn and grew 26pc year over year. And we set quarterly records in every geographic segment with strong double-digit growth across the board.”

There is no shortage of interesting and well-informed speculation about an Apple car on the Internet. I don’t have anything to add except that I do think the investment implications could be seismic. Electric cars as an industry are taking off so the investment implications are going to be huge as are some of the companies that will be dominant players.

Apple must surely fancy its chances of being one of them.

Meanwhile another attraction of Apple as an investment is its huge cash generation and the fact that much of that is returned to shareholders via dividends and share buy back programmes.

“As our business continues to generate very strong cash flow, we were also able to return $24bn to shareholders during the September quarter. This included $3.6bn in dividends and equivalents and $20bn through open-market repurchases of 137m Apple shares.”

Warren Buffett’s company, Berkshire Hathaway, owns around five per cent of Apple. This is what he said about his investment.

“Three years ago, Buffett told CNBC that he believes the average person’s connection to their iPhone was strong enough that most people would pay much more for the device than they do now. I focus on the hundreds of millions of people who practically live their lives by [the iPhone]. I have a plane that costs me a lot, a million dollars a year or something of the sort. If I used the iPhone like all my friends do, I would rather give up the plane.“

Croda International. CRDA. Buy @ 9895p. Times recommended: 17 First recommended: 4599p Last recommended: 9416p

Croda International reinventing itself for faster growth with health care acquisitions and likely disposal of less core businesses

In July 2020 Croda did a deal to acquire Avanti Polar Lipids for $185m plus a $75m earnout. Avanti creates and makes high-purity polar lipids that are increasingly being used as delivery systems for complex therapeutic drugs and in next-generation mRNA vaccines. Avanti’s know-how and technology are highly complementary to Croda’s own capabilities in drug delivery systems, vaccine adjuvants and immunotherapy. The acquisition will more than double Croda’s research and development (R&D) capability in drug delivery. Lipid-based drug delivery systems (LBDDS) is a wide-ranging designation for formulations containing a dissolved or suspended drug in lipidic excipients.

Shortly afterwards, in November 2020, Croda announced a contract with Pfizer to supply novel excipients used in the manufacture of a COVID-19 vaccine candidate.

This is definitely helping as Croda reported very strong results for the first half of 2021.

“Overall, Croda has delivered a record first half performance driven by the strategic moves that we have made over the last 12 months. Underlying sales increased 27pc on H1 2020, which was of course impacted by Covid, so important to point out that this is also 10pc ahead of H1 2019. Including acquisitions, reported profits are up 50pc vs 2020 or 35pc versus 2019. The group margin is also ahead of the prior year, and despite the acquisition of Iberchem where margins are lower. That progress has led to a further 10pc increase to the interim dividend, continuing our 29-year track record of dividend growth.”

The Avanti deal was specifically singled out.

“2020 was a year of significant investment with nearly £1bn invested in both inorganic and organic growth – well we have really seen the benefits of that, notably the acquisitions of Iberchem and Avanti which are opening up some very exciting and significant opportunities for Croda.“

CEO, Steve Foots, elaborates further on the lipid effect.

“The highlight was health care where adjuvants and speciality excipients both grew by more than two thirds. Our investment in developing our Lipid Systems, by which we mean both lipid excipients and other Avanti lipid products, has been a major benefit. We now expect to generate at least $200m of sales from Lipid Systems this year, principally to Pfizer-BioNTech, an increase on the $125m that we communicated back in March.”

Avanti is shaping up as one of those game changing deals that can transform a company. As Foote says:- “So overall in the round an outstanding half with momentum in the business as strong as I have seen it over the last decade.”

Just in case we might think that lipids have become the tail that wags the dog. Foots also says.

“Of the underlying 27pc sales growth, 8 percentage points have come from lipid systems and 19 percentage points from Croda’s existing business, reflecting strong growth in Consumer Care, the rest of Life Sciences and Performance Technologies. Of the acquisition growth of 20 percentage points, 14 points has come from Iberchem and 6 from Avanti and roughly half of Avanti’s sales are lipid systems.“

Croda is now organised in three sections. Health care is going gangbusters as we have seen but personal care is also doing well.

“2021 saw the creation of the Consumer Care sector, comprising Croda’s leading global position in Personal Care, our growing Home Care business and Iberchem fragrances, acquired last November. After a steady recovery in the second half of 2020 after COVID-19 hit ‘going out’ sales of actives and cosmetics, Personal Care improved rapidly in the first half of 2021. It delivered underlying sales growth of 19pc. Sales are now 8pc ahead of pre- pandemic levels from 2019.”

Life sciences, which includes health care is also powering ahead.

“Life Sciences continues to develop into a business to rival Croda’s long held leadership in Consumer Care markets. With its focus on drug, vaccine and crop science delivery systems, the sector is growing sales through organic expansion and by leveraging acquired technologies.

The first half year saw sales up 61pc and adjusted operating profit almost double. Within underlying sales, 47pc higher, the existing business added 17 percentage points to sector growth. We saw an outstanding Health Care performance, with rapid expansion in all three patient healthcare platforms, with sales of vaccine adjuvants and speciality excipients each up by over two thirds and new manufacturing capacity on stream to support both platforms. Crop Protection and Seed Enhancement each delivered double-digit percentage growth year- on-year. This demonstrates the breadth of the growth across the Life Sciences portfolio.”

The third sector, performance technologies, also did well with sales up 15pc led by smart materials.

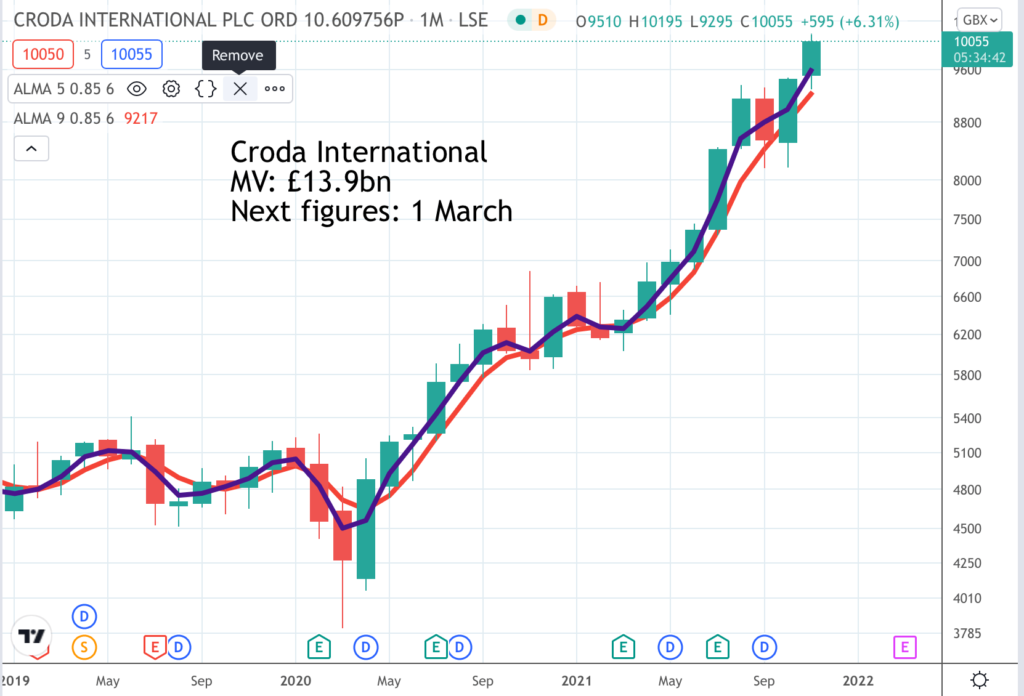

Looking at the chart you can see that much of the share price out performance has come since 2012 when Steve Foots, still only 53, took charge. He is clearly an outstanding CEO.

Intuit INTU. Buy @ $652. Times recommended: 18 First recommended: $210.50 Last recommended: $626

New CEO, Sasan Goodarzi, moves quickly to find new fields for Intuit to conquer and make progress on its five ‘big bets’

Intuit is another example of a new CEO having a dramatic impact. Sasan Goodarzi became CEO on 1 January 2019 having spent 14 years with the business and led all the main divisions. You might think he would be a steady pair of hands keeping the company on much the same course as it was already plotting. Not a bit of it. Under Goodarzi, Intuit, a business supplying software to help SMEs (small and medium sized enterprises) do their account and calculate their tax bills is starting to spread its net a great deal wider and so far investors like what they see. Under his watch the shares have appreciated roughy 3.6 times.

Prior to Sasan’s arrival as CEO the big issue for Intuit was the shift from a software model to SaaS, software as a service delivered from the cloud so customers could pay in monthly instalments and always have the latest version. This has pretty much been completed with great success so now the company is looking for new worlds to conquer and Sasan is finding them.

In February 2020 the group announced plans to acquire Credit Karma in a cash and shares deal worth $7.1bn. Credit Karma is a consumer technology platform with more than 100m members in the U.S., Canada and U.K and nearly $1bn in unaudited revenue in calendar year 2019, up 20pc from the previous year. Subscribers may remember that many of banking industry disruptor, Upstart’s personal loans start off as referrals from Credit Karma.

Goodarzi says a key motivation behind the acquisition is “Intuit’s mission to power prosperity around the world with a bold goal of doubling the household savings rate for customers on our platform.”

In September 2021 Intuit announced plans to acquire Mailchimp, the email marketing specialist, for $12bn in cash and stock. Why is Intuit buying Mailchimp?

“The planned acquisition of Mailchimp advances Intuit’s mission of powering prosperity around the world, and its strategy to become an AI-driven expert platform. With the acquisition of Mailchimp, Intuit will accelerate two of its previously-shared strategic big bets: to become the centre of small business growth and to disrupt the small business mid-market.”

The potential looks formidable and you can see why Sasan is helping Intuit spread its wings in this way.

“Together, Intuit and Mailchimp will work to deliver on the vision of an innovative, end-to-end customer growth platform for small and mid-market businesses, allowing them to get their business online, market their business, manage customer relationships, benefit from insights and analytics, get paid, access capital, pay employees, optimize cash flow, be organized and stay compliant, with experts at their fingertips. Delivering on the promise to be the single source of truth, small and mid-market businesses will have the power to combine their customer data from Mailchimp and QuickBooks’ purchase data to get the actionable insights they need to grow and run their businesses with confidence.“

Just as a quick recap these are the five big bets that Intuit is making to accelerate growth. Revolutionise speed to benefit; connect people to experts; unlock smart money decisions; be the centre of small business growth and disrupt the small business mid-market. These are very broad bets so we can expect more deals from a newly acquisitive Intuit and they could be in almost any field across the financial and technology spectrum.

Intuit is also trading strongly.

“We’re off to a strong start in fiscal year 2022 with continued momentum across the company given our strategy of becoming a global AI driven expert platform, powering the prosperity of consumers and small businesses. We have nearly $300bn addressable market driven by digital tailwinds that include a shift to virtual solutions, acceleration to online and omnichannel capabilities and digital money offerings.

First quarter revenue grew 52pc including 32 points from the addition of Credit Karma. Total revenue growth was fueled by Small Business and Self Employed Group revenue growth of 22pc and Credit Karma revenue of $418m, another record quarter. Consumer Group and ProConnect Group revenue was in line with our expectations in a seasonally small quarter. As a result, both of our strong start to the year and the close of Mailchimp transaction, we are raising our revenue and non-GAAP operating income and earnings per share guidance for fiscal year 2022.”

A lot has happened at Intuit and Sasan Goodarzi has not yet been three years in charge. Investors can look forward to plenty more excitement under his tenure.

Roblox Corporation RBLX. Buy @ $126.50. Times recommended: 6 First recommended: $70. Last recommended: $134

If you want to invest in the Metaverse Roblox has a great deal to offer

There has been a lot of excitement about the Metaverse ever since Facebook announced that it was changing its name to Meta Platform and was going to spend tens of billions creating the infrastructure to make this virtual world possible. People seem a bit vague about what the Metaverse is. My take is that it is a virtual world created in 3D where you can go as an avatar and enjoy experiences and interact with other people’s avatars but that may be just how it starts.

It sounds amazing and the technology is increasingly being developed to make this virtual world possible. One company with a significant head start in the space is Roblox which has been developing a virtual world that people can co-experience since around 2004.

Initially this world was aimed at children between the age of nine and 12 who could play on the platform and have cartoonish experiences with blocky lego-like avatars. More recently though as it has become possible to create far more realistic avatars the age range has been moving up such that 17-24 year olds are now the fastest growing age group using the platform and companies like Vans (skate boards), Gucci and Nike have been creating virtual spaces on Roblox and entertainers have been giving virtual concerts.

The key to the success of the platform is that Roblox encourages creators to develop games and experiences from which they can earn money. Initially this came from users buying a virtual currency called Robux which they could use to purchase enhancements and accessories that developers could exchange for dollars. They kept 70pc and Roblox earned 30pc.

Since 2020 Roblox has offered a premium subscription service to users from which developers have been able to earn engagement fees related to the amount of engagement users had with their experiences. This seems to have been something of a game changer to the extent that developers in the current year are on track to earn a staggering $0.5bn from the platform.

Not only is this creating a powerful virtuous circle effect with more developers creating better experiences attracting more users driving higher revenues and attracting even more developers but as the platform scales all sorts of new opportunities are opening up.

Entertainers can sel virtual merchandise known as virch to their fans and are doing this to an extent that Roblox believes virch could be a bigger earner for them than streaming eventually. In addition all sorts of virtual products are being bought for astonishingly high prices with customers paying more for virtual products like Gucci bags than the same item costs in physical form.

It is easy to see how Roblox could become a very large business indeed and it is growing very rapidly.

“Revenue in Q3 2021 was $509.3m, an increase of 102pc over Q3 2020. Cost of revenue totaled $130.0m, up 98pc year over year.“

The developer community is growing fast.

“In the third quarter 2021, Roblox continued to add new global developers to the community. This talented group understands the unique value proposition that Roblox offers, including free tools, infrastructure, moderation, language translation, and access to a large and growing global audience. During the quarter, developers and creators earned $130m in Developer Exchange Fees, up 52pc from Q3 2020. We remain on track to exceed our goal of delivering half a billion dollars to developers in 2021. Growing the overall pool of capital available to developers enables more of them to build businesses on top of the Roblox platform while inspiring the creativity that is so important to deepening the unique amount of high quality content on Roblox.”

Physically the group is growing rapidly.

“As of September 30, 2021, we had 1,435 employees, up 66pc from 865 employees at this time last year. Engineering and product talent still comprise approximately 80pc of our employee base.”

Users are becoming older and more international.

“Users spent 11.2bn hours engaged on the Roblox platform in Q3 of 2021, up 28pc from Q3 in 2020 and up 3x over Q3 of 2019. In Q3 of 2021, 51.2pc of engagement was from users over the age of 13, up from 40.8pc two years ago. Engagement growth was highest in the Asia Pacific region, growing 89pc over last year. APAC users represent approximately 22pc of global engagement.”

Last but not least is all the other stuff that is happening with brands, education and entertainment gravitating to this virtual world. Most recently came an announcement from the British Fashion Awards.of a new award to recognise a digital designer who pushes the boundaries and showcases excellence in digital fashion design within the metaverse. Five digital fashion creators from the Roblox community were shortlisted for the Award by Roblox’s developers and creators. Alessandro Michele, Creative Director of Gucci, will make an appearance as an avatar to present the award in The Fashion Awards experience on Roblox.

Verisk Analytics. VRSK. Buy @ $224.5. Times recommended: 6 First recommended: $172.50 Last recommended: $210

There is something stirring at risk analysis business, Verisk Analytics as can be deduced from the quote below.

“Finally, we are committed to enhancing shareholder value, and as part of that commitment, to allocating capital to the highest growth and highest return opportunities. Accordingly, Verisk has been undertaking a bottoms-up review of our businesses and portfolio composition. Our review is ongoing with a focus on the most value created path for sustainable growth and success. And doing what’s in the best interest of our shareholders and all of Verisk’s stakeholders. As we’ve said previously, we believe that portfolio changes are probable in the next 2 to 3 quarters, subject to market conditions.”

This sounds like a business that is planning to dispose of more legacy, slower growing operations to focus more intensely on its growth stars. Shareholders will love it if that is what is coming.

The analysts’ meeting was full of questions about this portfolio review process and how far reaching it might be. CEO’s will never answer these questions because they don’t like staff in the sections under consideration for disposal to feel unwanted. My impression though is that some serious action is coming.

As can be seen from the share price chart the company has not been doing badly up to now but it could do even better. One thing CEO, Scott Stephenson did say is that the property and casualty business is not up for consideration which suggests that the group is going to specialise even more intensely in insurance which is a very data dependent and very large industry.

Verisk is organised in three segments. Insurance is 73pc of revenue and 82pc of ebitda. Energy and specialised services is 22pc of revenue and 16pc of ebitda. Financial services is five per cent of revenue and two per cent of ebitda. This would suggest that financial services is definitely heading for the chop and energy and specialised services might be.

I think a 100pc focus on insurance would make sense, would lead to accelerating growth and provide the perfect vehicle for value enhancing acquisitions but we will have to see what happens. Action is promised within the next two to three quarters.

The insurance industry is vast and surrounded by disruptors eager to share the pickings. This makes insurance companies perfect candidates for spending on digital transformation and state of the art analytics to help them fend off the attackers. At the same time they have formidable cash flows because premiums are paid up front so their ability to pay for the latest technology could hardly be better.

Insurance premiums are a bit like software. Hardware costs may fall or at least give you much more bang for your buck but insurance premiums seem to head ever upwards and are becoming a significant cost for many items including cars where my annual insurance, even with no-claims bonus, is at least half the value of the car.

The market is also extremely competitive so if the industry can outsource data analytics and research to companies like Verisk with its long experience in the field it is no surprise that they do so.

A big new target market for Verisk is the UK, which plays a huge role in the global insurance market. Their web site is full of information about how they can help UK insurers do better – insure smart, ensure growth as they call it.

Last but not least insurance is a very technical business as you can see from the things Verisk does to help its clients such as – “How original loss curves can improve pricing in the London Market (where extreme risks like hurricanes are insured].”

All this makes Verisk a bit of a gamble on a someone unknown future but given its track record in providing data analytics to the insurance industry on a subscription business model this is hardly a high risk investment and the opportunity looks great.