Three new growth stars join the QV for Shares portfolio – Asana, Avantor and Lightspeed PoS

Asana ASAN. Buy @ $97 Times recommended: 2. First recommended: $77. Last recommended; $77

As often happens with me, I found Asana, alerted the shares for my subscribers and bought them myself. Then, in line with my new dynamic management strategy which will be further discussed in future issues, I sold the shares because I thought they were behaving badly and there were other shares I wanted to buy. I quickly realised that was a mistake, bought them back at a higher price, realised that the company was even more exciting than I first thought and doubled my initial investment. I am now convinced that Asana is a very exciting company indeed at an early stage of a huge growth opportunity.

There is a chart in their prospectus which gives a flavour of the pace at which the business is moving.

Between 2015 and 2020 the number of paying customers grew from 2,000 to 77,000. Six months later for 30 June 2021 that figure has grown still further to 107,000. This tells me first that there is strong momentum in the business and secondly that this company is at a very early stage in its growth story. This is like investing in Marks & Spencer in the 19th century or Tesco in the 1950s when nearly all the growth in the business lay in the future.

The raw customer numbers also understate the growth because of the land and expand model by which existing customers increase their deployment of Asana and spend more during the year.

“First, we posted strong customer growth again this quarter, adding another 7,000 net new customers, and we now have over 107,000 paying customers. We continue to see record top of funnel growth. We also completed the additional language rollout for the year and now have 13 languages in total. Second, we continue to see strong expansion within our existing customer base, particularly with our larger customers. The net retention rate for customers spending $50,000 or more with us annually increased over 145pc. And third, we are seeing our investments paying off in enterprise, driving continued enterprise momentum. The number of customers spending $50,000 or more annually grew 111pc to 598 in the quarter. Our value proposition is clearly resonating with our customers.”

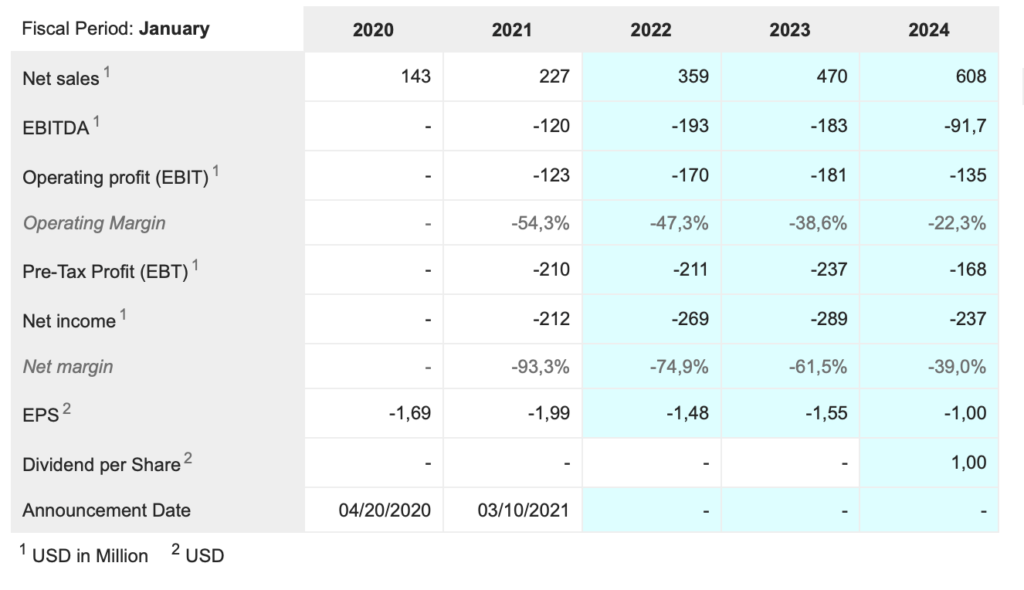

Asana is one of those exciting companies that is becoming bigger (winning the battle for territory) at an accelerating rate. You can see the analysts’ take on this in the table below with sales forecast to grow from $143m for 2020 to $606m for the year to 31 January 2024.

A key element in what they do is that their products for helping teams working together more effectively are demonstrating their appeal to a broad spectrum of customers from relatively small businesses to large enterprises like one unnamed customer that is now deploying Asana over 50,000 seats. New customers are now arriving like Gorillas, a fast-growing German grocery delivery business, which are deploying Asana immediately across the entire enterprise.

This means the total addressable market is huge. All companies and enterprises which work in teams, which in the 21st century is all the enterprises built around knowledge workers, are potential customers for Asana. This combination of rapid growth, early stage and huge addressable market makes the shares almost impossible to value. On the one hand a market capitalisation of nearly $18bn will look ridiculous to some people against forecast sales for the year to 31 January 2022 of $359m. On the other hand it is so easy to see that surprisingly quickly Asana will be measuring its sales in billions of dollars, not millions.

The key is the product and the rapid pace of innovation. You can get an idea of this from the chart.highlighting the rapid pace of innovation since 2015. The company started when two executives at Facebook developed workflow software to be used internally at that company. They quickly realised that it had huge application, left Facebook and Asana was born.

This happened when the two founders were very young. CEO and co-founder, Dustin Moskovitz, is still only 36 years old. Below is how Moskovitz describes the birth of Asana in his letter from the founders in the prospectus.

“We were inspired to start Asana after seeing the broad adoption and impact of an internal work management tool we built while at Facebook. We left Facebook and created Asana to address our own pain. We love working on big ideas, but we loathe the annoying busywork required by their execution.

That’s because coordinating work across teams is generally chaotic. The problem has only gotten worse as organizations take on greater challenges with more people, complexity, and technology. Most people working in teams today spend more time coordinating work in emails, chats, spreadsheets, and meetings than they spend doing actual productive work. Every day, they get inundated with requests and don’t know where to focus their attention. For people leading teams, there’s the near-constant anxiety about missing deadlines and having work fall through the cracks.

What organizations need is a system to orchestrate their work, from daily tasks to big, strategic initiatives. Asana is that system.

We’re gratified that, a decade later, Asana is the work management platform that addresses the pain of coordinating work for organizations across the globe. With Asana, they have a living system of clarity where everyone—regardless of where they’re located—can see, discuss, and execute their team’s priorities. Individual team members experience less of the soul-grinding “work about work” that plagues the coordination of complex undertakings, making work much more productive and enjoyable. And team leaders feel more organized and confident about making progress on their team’s plans.”

The results and the explosive growth make it clear that Asana is delivering on that promise. The business is very much technology focused.

“We have invested heavily in a number of technologies which put us at a competitive advantage, including:

Our “work graph.” Like the social graph the two of us helped create for Facebook, the work graph is a flexible data model—of people, tasks, goals, projects, portfolios, conversations, files, and the relationships among them—powering Asana. The work graph enables each Asana user to see information in the format that makes most sense for them.

Our proprietary “Luna2” application framework, which we believe to be ahead of the state of the art in enabling the rapid development of high-performance applications with complex user interfaces. This enables us to deliver sophisticated new functionality to customers with unusual speed even while concurrently scaling our infrastructure to support a quickly growing number of customers worldwide.

Our “mindful technology” approach to design that respects user attention and enables focus.”

Going forward, we plan to double down on these investments and expand into AI, marrying human and computer intelligence to automate and prioritize work for individuals, teams, and organizations.“

There is much more that could be said about Asana but the bottom line is that this is a fabulous company with a huge opportunity. It is 3G with loads of magic.

Avantor. AVTR. Buy @ $42. Times recommended: 2 First recommended: $37.50 Last recommended: $39.50

Avantor is not growing as fast as the other two companies featured here but it is operating in an exciting space and looks well placed to keep growing at a healthy rate and even accelerate its growth. The company is a supplier of tools and services to other companies which operate in healthcare, biopharama, education, advanced technologies and applied materials. Over 50pc of sales are made to biopharmas and 70pc go to life sciences.

Not surprisingly Avantor has been involved in the battle against Covid-19. Two of the key vaccines, the Pfizer-Biotech and the Moderna, are based on mRNA technology. In order to deliver the mRNA vaccine it is encased in lipids, which are a liquid. Among other things Avantor makes these lipids at its advanced manufacturing facilities. Around 10pc of sales are Covid related and the company sees a big future for mRNA in other fields and expects to be heavily involved in that too.

My impression is that partly because of Covid-19 but for many other reasons, the decoding of the human genome and an explosion of r&d speeding by biopharmas that we are entering a golden age of medical breakthroughs. If that is anywhere near right companies like Avantor are going to play a critical role and future growth rates could be significantly greater than in the past.

This may partly explain why a company that was founded 117 years ago joined the stock market in May 2019. The timing was fortunate because Covid-19 has fast-forwarded the whole health care industry with spin-off benefits to companies like Avantor.

The group may also have decided to float because it wanted to accelerate its use of acquisitions to boost growth. In June 2021, Avantor acquired China-based RIM Bio, a manufacturer of single-use bioprocess bags and assemblies for biopharmaceutical manufacturing applications. Through the acquisition, Avantor gained access to RIM’s China facility, marking Avantor’s first single-use production plant in the Africa, Middle East, Asia (AMEA) region. The deal is part of a larger expansion of the company’s single-use manufacturing footprint with plans to increase its presence by 30pc.

More recently still the group has announced the acquisition of Masterflex for $2.7bn in cash. “Headquartered in Vernon Hills, Illinois, Masterflex is a leading global manufacturer of peristaltic pumps and aseptic single-use fluid transfer technologies with estimated 2022 revenues of approximately $300m. The acquisition strengthens Avantor’s offering across all bioproduction platforms including monoclonal antibodies (mAbs), cell and gene therapy and mRNA, and supports both therapy and vaccine manufacturing including COVID-19.”

One of the attractions of these deals is that they increase the proportion of both proprietary and recurring revenues into the business Even prior to the flotation acquisitions played an important role in the growth of Avantor. “Avantor has successfully completed 43 acquisitions, deployed more than $11bn in capital and generated well over $350m in EBITDA synergies, since 2011.”

The latest figures for Q2 2021 showed how growth momentum is building in the business. “

In the second quarter, we achieved 20.5pc organic revenue growth and our core growth rate improved for the fourth consecutive quarter to 18.5pc. COVID tailwinds contributed approximately 2pc to growth driven largely by sales of raw materials and single use solutions for COVID vaccine production. In addition to delivering exceptional top-line results, we expanded EBITDA margins approximately 125 basis points, grew our adjusted EPS more than 80pc to $0.35, and more than tripled free cash flow.”

The company is clearly positioning itself for strong growth to continue. “We continue to invest in biopharma production capacity to support the strong growth in our business. We completed several capacity expansions in the second quarter, including a single use expansion of our facility in Devens, Massachusetts, the start-up of a new single use logistics facility in North America, as well as several expansion projects at our raw materials manufacturing locations in Aurora, Ohio, and St. Louis, Missouri.”

Management remain very positive on prospects. “Looking ahead, we expect the momentum in our base business to continue driven by strong fundamentals across all of our end markets. Revenues in July have kept pace with first half results and our order book for long cycle proprietary materials continues to grow. We are again raising our 2021 full year guidance.”

In a strong statement of intent CEO, Martin Stubblefield, said:- “We remain committed to our growth strategy, including the ongoing integration of Ritter and RIM Bio. We’ll continue to focus on biopharma as a key growth driver for our company and will support our growth of ongoing investments in raw material and single use manufacturing capacity.”

The above came before the latest acquisition of Masterflex. The group also held its first Investor Day on 9 September where it went into considerable detail about its operations and opportunities. No doubt it is taking the trouble to do this because it expects to need investor support for its ambitious plans going forward. Stubblefield became president and CEO in 2014. Before that he was a leading chemicals industry expert at management consultancy, McKinsey & Co. It is a fair assumption that his arrival has given a new sense of purpose and ambition to the business.

Avantor looks classic 3G plus magic and an exciting addition to the QV portfolio.

Lightspeed PoS LSPD. Buy @ $124. Times recommended: 4. First recommended: $84 Last recommended: $113.50

I have just written about Lightspeed in Great Stocks which is now part of the package for all Quentinvest subscribers so here I want to find something new to say about what looks like a phenomenally exciting. business. As usual with the QV for Shares portfolio the reason for adding the shares to your portfolio is that they are 3G+Magic so I thought it might be interesting to examine how the company matches up to this requirement.

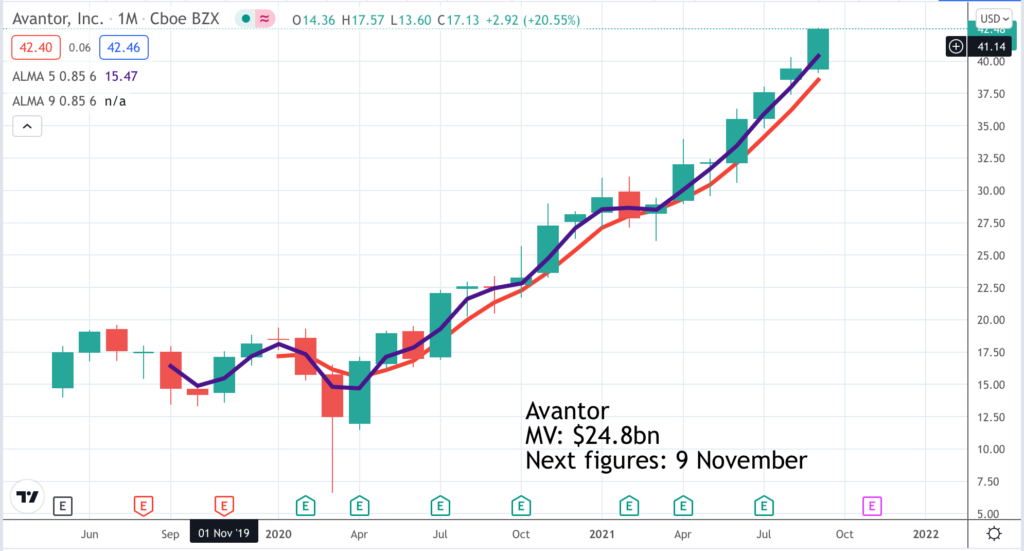

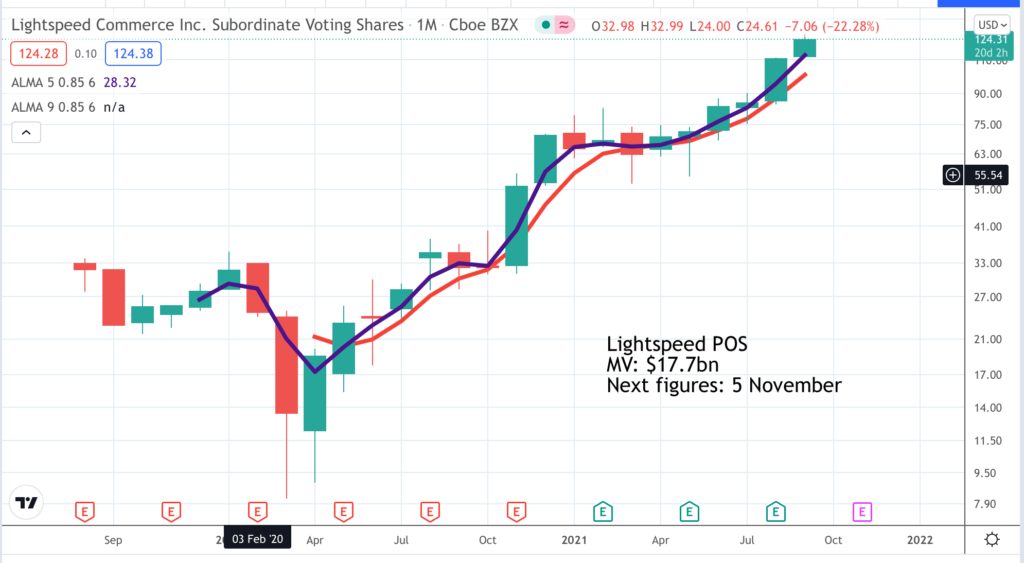

First the chart. Does it look great? The shares floated at $16 which was above the earlier proposed range of $13 to $15. Strong investor interest was further domonstrated when the shares rocketed to $35 in opening dealings. In March 2020 the price collapsed to a low of $8 as investors worldwide went into panic mode over Covid-19. The was not completely illogical in the case of Lightspeed because the company’s software is widely used in the events and hospitality industries which suffered dramatically from lockdown.

As it turned out the negative impact on its customer base from lockdowns was more than offset by a global acceleration in digital transformation. Its customers may have been doing less business but a growing number realised how badly they needed to automate their operations so its customer numbers continued to grow strongly.

As this realisation sank it (not just for Lightspeed but for many technology companies) the shares stopped falling and began to rocket higher. The share price is now fast approaching 10 times the lower level of the first mooted IPO price which is a strong performance by any standards. We can put a tick in the box for the first great chart G.

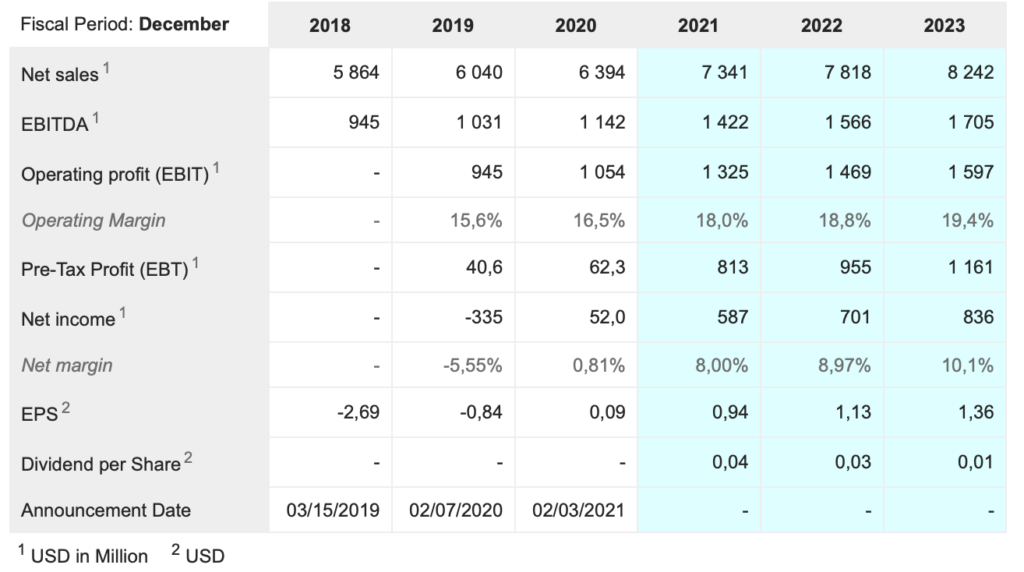

Second the growth. Lightspeed’s financial year ends on 31 March. For the year to 31 March 2020 the group had total revenue of $222m. This compares with $77.9m for the year to 31 March 2019. Nor is there any sign of the pace slackening. For Q1 2022 (the quarter ending 30 June 2021) the group reported sales growth of 220pc to $115.9m and analysts are forecasting sales reaching $1024m by the year to 31 March 2024.

What is driving this barnstorming performance. “Hospitality roared back to life as economies reopened. Organic growth in GTV [gross trading volume] was 164pc in the quarter and was up 380pc overall. This wonderful performance by our customers translated into our payments revenue performing well above our plans. Volume increases with expanding payments availability around the world and strong ongoing customer demand led to overall transaction-based revenue growing more than 450pc year over year.”

Clearly we can not only put a tick in the box for the second great growth G but we may also strongly suspect that with annualised revenues running at $460m for fiscal 2022 and the company’s upgraded forecast for full year revenues between $510 and $530m that $1bn forecast for fiscal 2024 could be well beaten.

The third G is for great story. Early in my stock market career I became fascinated by the zen idea that to achieve your true goal you need to focus on doing something else. In Zen and the Art of Archery the guru tells the novice that if he wants the arrow to hit the target he must not jerk his hands when he unleashes the bow. This will only happen if he somehow learns to let the arrow fire itself. When he finally achieved this goal after years of trying he realised that he had learned an important lesson about life.

In the stock market my take on a zen approach is that investors must choose companies not because they are engaged in a crude attempt to make money but because they are doing something else more important and success in doing this will lead to them making a great deal of money. The hard bit is fulfilling the mission. The money comes as a by-product.

Lightspeed has a mission. “At Lightspeed, our mission is to bring cities and communities to life by powering small and medium-sized businesses (“SMBs”). We believe cities and communities are built on the presence and success of local SMBs and that these businesses are integral to the vibrancy of their communities. Running an independent business, however, is becoming increasingly complex. Consumer behaviors and expectations are changing, fueled by the influence of new technologies pushing consumers towards an omni-channel experience. Our solutions equip independent businesses with the technology required to transform the way they manage their operations and exceed consumers’ expectations in this changing environment.”

They have created software to make this happen.

“Lightspeed provides easy-to-use, omni-channel commerce-enabling software as a service platforms. Our software platforms provide our customers with the critical functionality they need to engage with consumers, manage their operations, accept payments, and grow their business. We operate globally, empowering single-and multi-location retailers, restaurants and other SMBs to compete successfully in an omni-channel market environment by engaging with consumers across online, mobile, social, and physical channels. We believe that our platforms are essential to our customers’ ability to run and grow their businesses. As a result, most of our revenue is recurring and we have a strong track-record of growing revenue per customer over time.”

We have seen from the growth figures how rapid is the take-up of their software. They are clearly walking the talk. They are also landing some fabulous reference customers.

“Some notable customer wins in the quarter include SpaceX. The American aerospace company founded by Elon Musk has chosen Lightspeed Restaurant, Lightspeed Ordering, and Lightspeed Payments to support its hospitality operations at its California headquarters. Telluride Ski Resort, the world-renowned Colorado ski resort has chosen Lightspeed as its core commerce platform. Telluride will use Lightspeed Retail, Lightspeed e-commerce, and Lightspeed Payments to help run its vast resort activities. And finally, restaurant Kei. Kei is the first Paris-based Japanese restaurant to secure a three-star Michelin rating in addition to acknowledgements from Les Grandes Tables du Monde and Gault & Millau. Kei will be using Lightspeed Restaurant to run its award-winning establishments.”

The total market opportunity for Lightspeed’s software is colossal. “The company now maintains over 150,000 retail and hospitality locations globally.” That is a big figure but a drop in the ocean against the numbers out there. “According to AMI Partners, in 2018, there were approximately 226m SMBs worldwide, of which approximately 47m were retailers and restaurants.“

Nor is it just about winning more customers because Lightspeed also grows by encouraging each customer to spend more. This is reflected in the numbers for ARPU [average revenue per customer]. “The growth in gross profit was driven by higher ARPU, which grew 44pc to over $230 in the quarter, up from 160 a year ago.

This is so powerful. The company is winning loads more customers and the customers are all spending more. No wonder total revenue is rocketing.

ARPU rises partly because the end of lockdowns is driving more transaction-related revenues but it is also because constant innovation means the company is adding exciting new offerings to its platform like payments and loans.

“Currently, our payments business leans toward retail. And although GTV growth here was overshadowed by the resurgence of hospitality this quarter, omnichannel retail GTV growth still increased 139pc. European adoption is off to a strong start with the total number of active payments customers growing strongly from last quarter. And while Europe still only represents a very small portion of our total payments customers, we believe this number will grow rapidly as we launch the solution in five more markets in that region.

Overall, approximately 10pc of our total GTV was processed through our payment solutions, giving us plenty of runway in the months and years ahead. I would also like to call out our capital business. Lightspeed Capital had its best quarter by far and we are starting to see numbers that are becoming meaningful. Almost 430 capital advances were made in the quarter with revenue from capital growing 68pc from the previous quarter.”

This combination of growing customer penetration, higher spend per customer and a huge addressable market means we can safely tick the box for great story G.

Lastly we need to look for the magic. I think we have seen plenty of that already. It is clear that Lightspeed is a wonderful business with a huge opportunity but there is even more going on to drive growth. This business floated for a reason because it is highly acquisitive. In line with this the group has just raised $883m gross from a share issue at $93. This compares with the $240m raised at the original flotation at $16 so makes a huge amount of sense. This money is not hanging around.

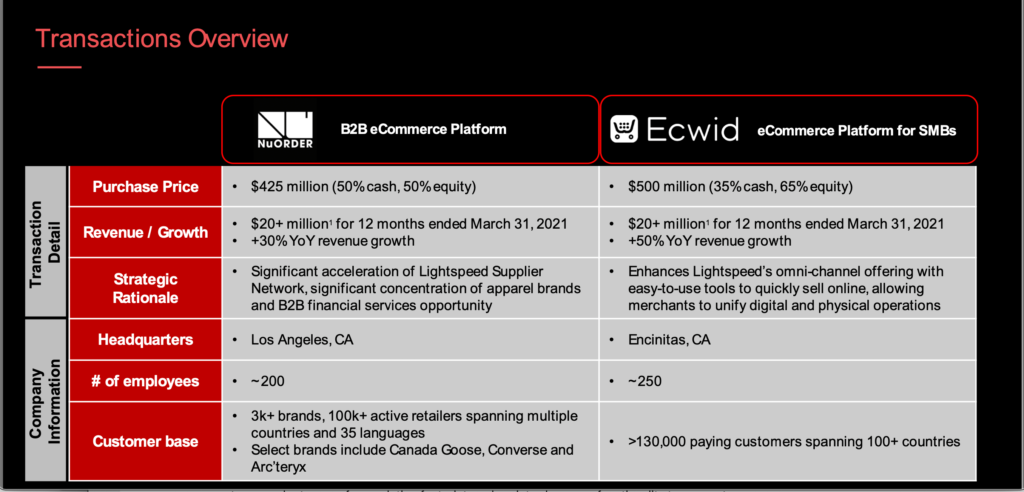

Below is a summary of two recent deals.

These are unusually large deals but there is also a constant stream of smaller purchases as Lightspeed moves rapidly to be a winner in the global battle for territory.

I think we can also tick the magic box. In summary, I think Lightspeed is a sensational company and I personally doubled my holding after the Great Stocks story and I may well add more.

Successful investment should be easy. There are around 100,000 quoted stocks in the world. but most of them are not suitable for growth share investing. I try to pick the ones that are, the very best ones, which meet my 3G plus magic criteria. You can get an excellent feeling for what I am looking for by reading the story on Lightspeed PoS. Lightspeed is a phenomenally exciting business but it is not the only one. There are loads of fabulously exciting 3G+M quoted companies out there. Most of them are in America as it happens but that’s not a problem in a world of borderless investing.

Because there are so many and because few of us are equipped to fully understand the cutting edge technology which drives so many of these successful businesses I am increasingly in favour of large portfolios. My one portfolio is now in three figures of different shares and I plan to keep increasing it through 200 as long as the markets stay favourable.

There will no doubt be shocks and setbacks but I hope to get there in the end.

If you are wondering which shares to buy I recently published a list (The List) of core growth share holdings in the Quentinvest service which coincidentally was 200 shares. I think all QV subscribers should aim to build such a portfolio. It should do extremely well over time and provide plenty of interest because with so many shares there will be loads of exciting news flow.

Remember that the focus of QV for Shares is entirely on building an exciting portfolio. I pay no attention to value. No doubt shares can get ahead of themselves and fall back sharply but I have two answers got this problem. First if, as is usually the case the shares are falling as part of a macro-inspired general market sell-off and not because of problems specific to the company this will lead to a buying opportunity when the shares finally resume their climb as they will. Volatility becomes an opportunity not a threat.

Secondly, observation suggests that you can get your timing amazingly wrong with your initial purchase but still do very well in the end if the company delivers on its 3G+magic potential. In most cases with QV for Shares the best time to buy is when the shares are first recommended. This happens even though I pay zero attention to value. Shares go up and down but in the long run good ones go up – a lot.

If you haven’t done anything yet start building your portfolio today with the three shares above. Keep adding exciting stocks, be patient, forget above selling unless you are using leverage when you may need to consider my dynamic investing strategy and you will be amazed at the way your portfolio will grow in value.

As a footnote you need to make sure that your whole portfolio is forwarded looking. Too many portfolios are still full of dead wood. If I was given one of these what I call old school portfolios full of familiar names which were growth stars in the last century but have become boring value plays in this one I would act ruthlessly to chop out all those names and rebuild the portfolio around the shares that dominate the QV for Shares ecosystem – shares in The List which is stuffed with exciting names of the companies making the running, changing the world and growing fast as a result in the new millennium.

Investors are wary of doing this because it means exchanging less volatile shares for more volatile shares and they will see bigger ups and downs in the value of their whole portfolio. This volatility will occur around a strongly rising trend and as time passes it will become increasingly apparent that 21st century growth beats 20th century stability hands down.

There is a reason for my total focus on 3G+Magic. It delivers results.