As I was writing this Wall Street was falling, though it finally closed the day higher and there are commentators looking at the dire economic statistics and worrying whether we are going to have another crash. I don’t expect one. The shares that needed to crash have crashed. The ones that are holding up or even going up, are mostly in technology or healthcare and have good reasons for outperforming. They are not affected by the stay at home rules because so many of their staff can work from home or they have essential services status and businesses could hardly be keener to develop their online presence and move their operations into the cloud so demand remains solid or even strong. On the health front I expect the investment in better health care and health infrastructure to be a lasting phenomenon.

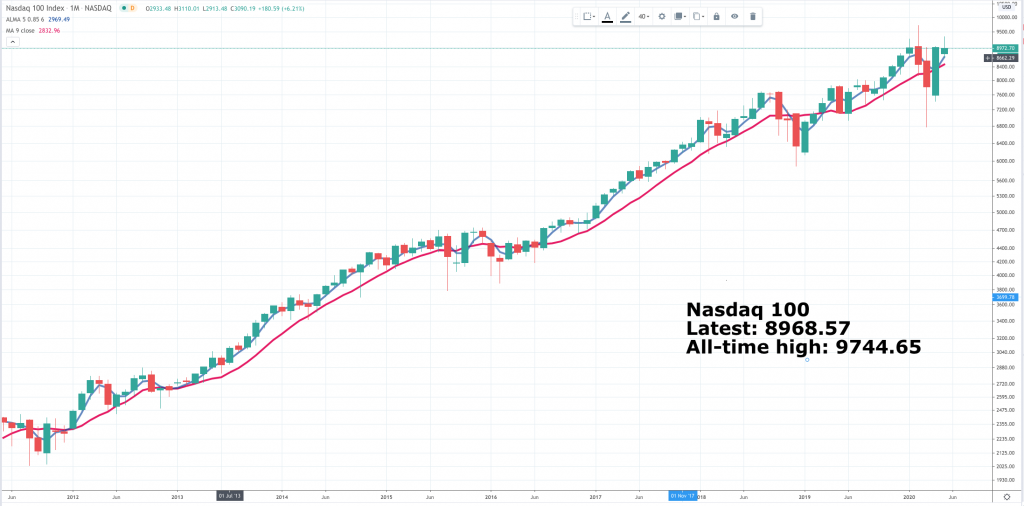

The Nasdaq 100 index, heavily weighted for big tech, looks well placed to me. There may be turbulence around the 9,000 level but governments and bankers seem determined to do whatever it takes to help their economies and populations through the hard times and people are very adaptable. There is a reason why homo sapiens is master of all he surveys on planet earth even if he is a bit of a destructive master.

Sooner or later this index is going to punch higher and that will lead to an exciting period for investors. What happens in more obviously affected areas like hospitality is harder to read but not all bad. One of the reasons why shares in some restaurant groups like Chipotle Mexican Grill and Wingstop are going up is that the problems affecting many restaurant businesses are going to take a massive amount of capacity out of the market; that can only be good news for the survivors. Meanwhile the rapid switch of CMG and WING to a digital/ delivery/ collection model ensures that they will survive in robust health until better times return.

Meanwhile I have three newcomers for the QV portfolio.

Everbridge/ EVBG Buy @ $158.5 MV: $5.45bn Employees: 948 Next figures: 10 August

MarketAxess Holdings/ MKTX Buy @ $488 MV: $18.7bn Employees: 527 Next figures: 22 July

Masimo Corporation/ MASI Buy @ $248.5 MV: $13.5bn Employees: 5,300 Next figures: 29 July

Everbridge (formerly known as 3n Global and the National Notification Network) is a company that sells communications services for notifications of emergencies. It began operations in 2002. In an emergency, Everbridge sends messages via telephone, text message and email that stop once they know that a person has read a message. An app allows emergency managers to track geotagged tweets that contain specific hashtags and use this information to respond to incidents as they occur. Their system was used in 2012 to send over 10m messages to residents during Hurricane Sandy. During the Boston Marathon bombings in April 2013, the city of Boston used Everbridge for its critical communications. Everbridge relayed information to business operators, employees, firefighters, hospital staff, police and residents after the explosions and during the lockdown of Boston, Watertown, Waltham and surrounding areas.

Below is a bit more detail on what they do to help communities and organisations deal with emergencies.

Assess – Identifying a threat before it reaches critical mass and understanding how it might impact vital assets is a challenge facing security and safety professionals. In the past, a common challenge was having enough intelligence data to make accurate predictions. Today, the opposite is true – the amount of available data is often overwhelming! With crime, terror, and incident data feeds coming from law enforcement, photos and videos coming from people on the front line, topics trending on social media, and logistical information originating from internal systems, it can be almost impossible to locate a real signal among all the noise and chatter. Critical Event Management provides an easy way to aggregate hundreds of threat data feeds and visualise the intelligence data within the context of an organisation’s assets. This contextual understanding is vital to understanding the relationship between threat data and the individuals or facilities in harm’s way.

Locate key personnel – Once a threat has been deemed a critical event, the next step is to locate the people: Who might be impacted? Who is needed to respond? Who needs to be informed? Critical Event Management ensures ahead of time that certifications, skill sets, or on-call availability are automatically included with contact information to save valuable time and minimise errors in the middle of a crisis response. Going even further, data from building access systems, wifi hotspots, corporate travel systems, among others, can be used to create a profile of where a person was ‘last known’ and where he or she might be going in a unified view. With Everbridge’s integrated solutions, information can be visualised on a threat map alongside key assets like people, plants, branch offices or partner locations and help determine who is actually in danger and who can respond the fastest. The emergency response then becomes targeted and more effective.

Standardise actions – Minutes matter when responding to critical events. To reduce the mean time to respond to a critical event organisations need to be prepared to execute their standing operating procedures (SOPs) fully within a Critical Event Management platform. When seconds matter, a Critical Event Management platform can automate alarms, digital signs, and messages based on event type, severity, and location. Conference lines can be instantly created to enable collaboration and speed response time. Meanwhile customised escalation policies are automatically engaged if a protocol is broken. This helps to improve collaboration and allows organisations to understand what is happening and why so that they can easily manage resources, minimise impact, and prevent future incidents.

Analyse performance – It’s not uncommon for critical response teams to think that a critical event is over once the immediate crisis has ended. After all, they are often the ones pushing themselves to exhaustion and sometimes risking life and limb to protect their neighbours, colleagues, community reputations, and company brands. In the aftermath of a critical event, however, it’s important to review the effectiveness of the response and look for ways to drive improvements. Which tasks took too long? What resources were missing? How many times did people respond quickly? With access to a Critical Event Management platform, team performance, operational response, benchmarking data, and notification analysis are all captured within the system and are available in a configurable dashboard or in after-action reports for analysis. Continuously looking for ways to better prepare and respond to critical events will not only improve performance when similar events occur again, but it will also improve response effectiveness when unforeseen events strike. With the right historical data organisations can start to predict the right response resources, protocols and activities to reduce the impact.

Only in America would a company even exist to do all this stuff but when they spell out what they do you can see how important it is and how much better than what we have, judging by the global response to the coronavirus threat. It’s no surprise that business is booming as we can see from comments with the latest quarterly report for Q1 2020, released on 5 May.

“In many ways this [the virus] is the largest critical event in recent history, with total loss of life now exceeding 225,000 and economic costs now estimated at over $4 trillion. The breadth of the pandemic is unprecedented. It has affected every facet of our global economy, from small businesses to large Fortune 500 organisations, their employees, their physical assets like offices, stores or plants, the supply chains, and even their customers.

Organisations face an incredible challenge, as Jamie Dimon, CEO of JPMorgan, recently stated, “The country was not prepared,” and further he suggested that what we actually need, and I quote, is a “Pandemic Playbook.” In fact our Critical Event Management [CEM] suite forms the modern day playbook for everything from active shootings, to hurricanes, to pandemics. Our first quarter’s strong performance, where our financial results easily exceeded our guidance ranges continue to demonstrate the rapid adoption of our Critical Event Management solutions. We’re grateful that so many organisations are deploying it to monitor the direct impact of the virus on the things they care about most, to automate and orchestrate their response to the virus, and to communicate the information needed by people to access services, and remain safe from the virus.”

New customers are pouring in.

“In the quarter, we saw numerous new CEM deployments for COVID-19 use cases as well as existing customers, including the most impacted cities and states supporting hundreds of thousands to tens of millions of citizens, as well as numerous multinational corporations focused on their employees across the globe. Since early January, we have witnessed a significant spike in the use of CEM, with hundreds of millions of COVID-19-related messages delivered since the middle of March, and we’re gratified that both our team and our technology has met this challenge delivering service levels that are multiple times grater than any event in our organisation’s history.”

More growth is coming.

“Given the overwhelming need in many of our core markets, from healthcare to government to corporations, it is not surprising that we continue to deliver strong business results but perhaps more important than helping Everbridge to exceed its financial targets, this pandemic has driven a fundamental awareness of CEM as a category, effectively becoming the catalyst for all organisations to deploy Critical Event Management. We believe the rapid market recognition that this pandemic has ushered in will enable us to accelerate our leadership of this important market as well as execute our overall growth plans well into the future, and like so many of the past significant natural events that we’ve discussed in previous calls, such as hurricanes, the recovery from a major critical event often involves more work than the event itself. The coronavirus pandemic will be no different. With the continued rapid adoption of CEM as a must-have solution for all organisations and the proof points of our growing customer base and strong financial results, we’re well-positioned for ongoing success.”

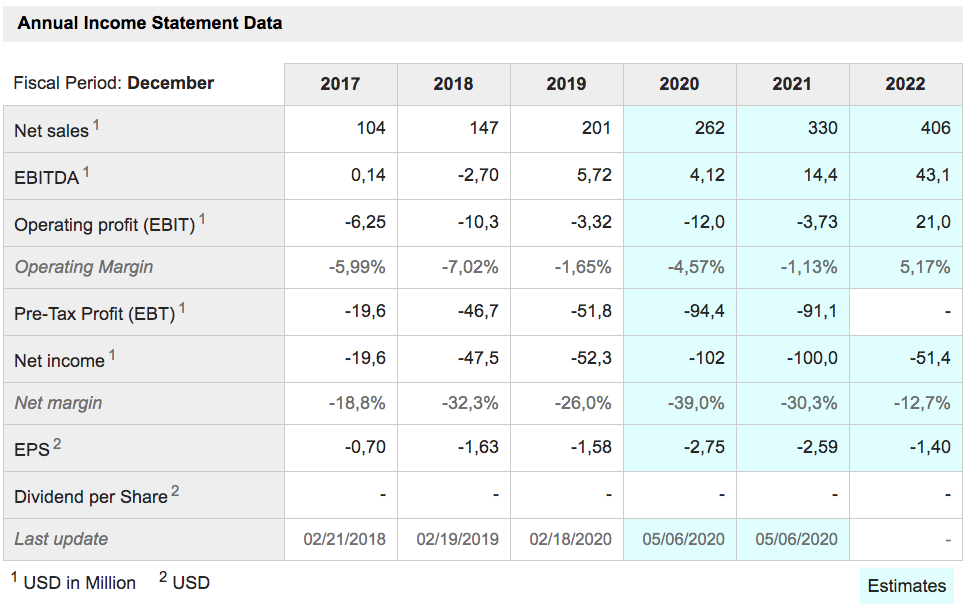

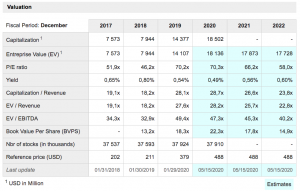

This looks an exciting business, classic 3G with plenty of magic, positioned to keep growing for the foreseeable future. Analysts estimates and valuation metrics are tabled below.

MarketAxess Holdings is an international financial technology company that operates an electronic trading platform for the institutional credit markets and also provides market data and post-trade services. It enables institutional investors and broker-dealers to trade credit instruments, including corporate bonds, and other types of fixed income products. MarketAxess was founded in 2000 by Richard McVey, who is still the company’s chairman & chief executive officer. Headquartered in New York, MarketAxess has 454 employees [now 527 so still amazingly few given the market value] and serves clients in the Americas, Europe, Latin America and Asia. Today, it is the market leader in the electronic trading of US corporate bonds, with 85pc of investment-grade and 84pc of high-yield debt traded electronically on its platform. That equates to 20pc of all corporate bond trading volume in the US.

This is their description of what they do.

“We’ve created the largest institutional marketplace to trade bonds—promoting price transparency, more competition, and greater choice. We have a vast network of active institutional participants on our patented trading platform who benefit from the broadest and deepest liquidity pool, covering most fixed income markets. Being the largest active trading network, we can provide truly unique data and data solutions that help with price discovery and post-trade analysis. Our regulatory products add efficiency and reduce transaction costs as we help clients navigate increasingly complex regulatory environments. By specialising in credit, we can focus on providing the best experience for traders with fast, responsive service while developing the most robust and simplest solutions that encourage ever greater participation.”

MarketAxess is a beneficiary of the pandemic and its impact on the global economy and fixed interest markets.

“The sharp increase in credit market volatility beginning in late February led to record quarterly credit trading volume on MarketAxess of $660bn, up 29pc versus Q1 2019. The value of our leading electronic trading platform was evident in record quarterly volumes for all of our core products, U.S. high-grade, high-yield, emerging markets, and Eurobonds. We also set new volume records in new and important product areas including municipal bonds and U.S. treasuries. High-grade market share was 20pc for the quarter up from 17.6pc one year ago. Open Trading provided a unique trading conductivity to institutional market participants during the crisis and volumes were a record $209bn, up 55pc year-over-year. The acceleration of trading activity led to record financial results as well. Revenues of $169m were up 36pc, operating income jumped 44pc and EPS was $1.96 up 41pc. Operating leverage came through clearly during the quarter, with operating margins of 54pc up from 51pc.

Corporations rushed to issue more debt as markets began to stabilize in late March, leading to a record $480bn of new high grade debt in the quarter. Many companies also tapped their bank credit lines to improve their liquidity position. It is likely that debt issuance will continue to grow in both the private and public sectors leading to even greater secondary trading opportunities.

During the quarter, investment managers reached a new volume record for providing liquidity on MarketAxess and dealers reached a new volume record as liquidity takers. We believe this demonstrates a trading behavior change that will lead to an even better global fixed income market in the years ahead. The Open Trading marketplace is the only broad-based continuous all-to-all electronic market in global fixed income. For the quarter MarketAxess had over 30,000 daily institutional client orders available to both dealers and investors in Open Trading totaling $16bn in notional value on average per day. We believe we play an important role in improving overall market liquidity and reducing market risk during times like this.

We also believe that our significant competitive lead in electronic credit trading for the institutional market widened even further during the quarter.”

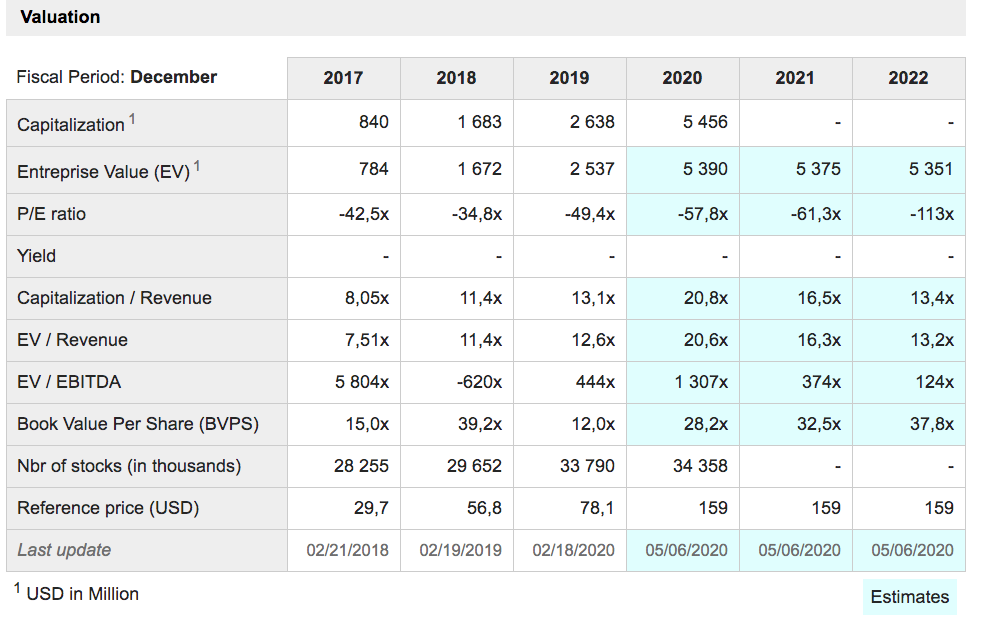

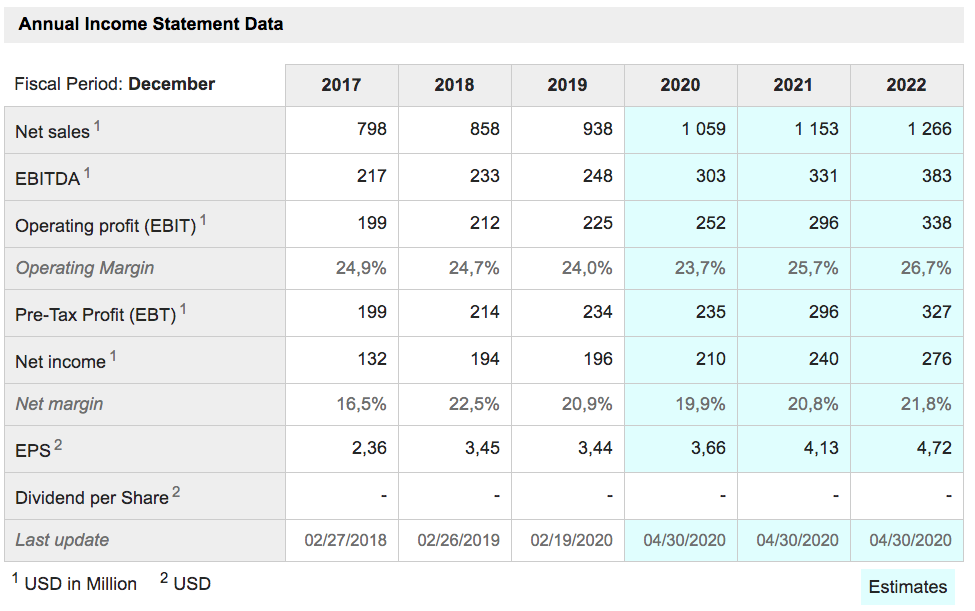

A great business firing on all cylinders and with exciting prospects makes Marketaxess a deserving addition to the QV portfolio. It’s also a complicated business and not the easiest to get your head around, which is why I have let the company do the talking. They know what they do much better than I do. Analysts’ estimates and valuation metrics are tabled below.

Masimo Corporation is an American manufacturer of noninvasive patient monitoring technologies based in Irvine, California. The company sells more pulse oximetry to hospitals than any other company. Masimo was founded in 1989 by electrical engineer Joe Kiani, who was later joined by fellow engineer Mohamed Diab. In March 2020, to support efforts to combat the novel coronavirus COVID-19, Masimo announced a number of noninvasive monitoring and single-patient-use solutions to help care teams manage the surge in patients, including Masimo SafetyNet. Masimo has been recognised for its intellectual property and for being one of the most innovative companies in the medical device industry.

I am not going to try and explain what pulse oximetry is but it plays a key role in hospitals including reducing time on ventilators and reducing the need to transfer patients to intensive care units. No wonder it has been so in demand during the Covid-19 epidemic.

This is how they describe what they do.

“Our core business is to measure through motion and low perfusion arterial blood oxygen saturation and pulse rate monitoring, known as Masimo SET® pulse oximetry, but our product offerings have expanded significantly over the years to also include noninvasive blood constituents, brain and breath monitoring, including rainbow® Pulse CO-Oximetry, brain function electroencephalogram (EEG) monitoring, respiration rate, capnography and anaesthetic agent monitoring. In addition, we have developed the Root™ patient monitoring and connectivity platform and Patient SafetyNet™ remote patient surveillance monitoring system. We provide our products directly and through distributors and OEM partners to hospitals, emergency medical service (EMS) providers, physician offices, veterinarians, long term care facilities and consumers.”

These guys were made to do well in the world of high response medical care into which the pandemic is taking us. This is what the company says about how they are serving the community during the crisis.

“COVID-19 is extremely contagious and damages the lungs. At no time has the value of our first invention, SET pulse oximetry, and our continued innovation been more apparent. When we founded Masimo 31 years ago, our objective was to address a major challenge with pulse oximetry to make it not just a fair weather friend, as it had been, but also a foul weather friend. And I hope this will be the foulest weather we will know in our lifetimes. And we delivered. Massimo SET has been the foul weather friend for millions of clinicians and patients, not just today but for many years. Before we invented this single extraction technology (SET), pulse oximetry’s false alarm rates were 70pc to 90pc, outside of the operating room. And on the sickest patients, too often, pulse oximeters didn’t work at all. It was Dr. Swan who first called conventional pulse oximeters a fair weather friend. Outside the areas, where clinicians were continuously watching the patients and the pulse oximeters, the most worn out button on pulse oximeters was the silence alarm button due to all of the false alarms. Clinicians couldn’t use pulse oximeters in other areas effectively due to the excessive false alarms resulted in clinicians abandoning the use of pulse oximeters in low clinician-to-patient ratio settings. Since the introduction of SET, pulse oximeter false alarms are occurring less than 5pc of the time, which has enabled monitoring of patients in the low clinician to patient ratio settings such as general wards, and today, anywhere the patient may be, including remote places like our homes.”

Masimo was already playing a key role in the US opioid crisis.

“In the postsurgical ward, where patients were dying from opioid-induced respiratory depression, patients monitored continuously with Masimo SET aren’t dying because it allows reliable monitoring of active patients without excessive false alarms.”

Covid-19 has been a game-changer for Masimo.

“Knowing what we had been able to do for Dartmouth and many other hospitals, we set our sights on saving patients’ lives on opioids at home, and then COVID-19 happened. 31 years of inventing and improving SET pulse oximetry and making systems for remote monitoring affordable and easily deployable prepared us for this moment in history, where a disease that affects arterial blood oxygen saturation required an accurate, reliable pulse oximeter that could be deployed cost effectively anywhere, not just in the usual hospital settings but new settings, such as hotels, gymnasium, stadiums and the most comfortable place for patients, home.”

Not surprisingly business is booming.

“For the first quarter, our product revenues increased 17pc to $270m, and we shipped 72,100 technology boards and monitors. We’ve seeing increased demand for our products from both direct and OEM customers, which has continued into the month of April. In fact as of yesterday, our worldwide sales orders, including backlog for the second quarter, are up approximately 87pc versus last year. And we have orders for over 150,000 technology boards and monitors, which is 2.5 times above our normal run rate for the quarter.

The reason we’re sharing what is happening so far in April is that we wanted you to know why we decided to withdraw our guidance. COVID-19 has thrown out our normal pattern of business, and we don’t know how long this phenomena will last and what will happen. Nearly everything we track is positive, except for things such as new contracts for either conversion of hospitals to SET or renewals of the existing agreements as well as hospital automation agreements and sensors for elective surgeries, which have slowed as hospitals hunkered down for COVID-19 patients and their own staffs protection.

As you can imagine from the technology board and monitor orders that I just mentioned, the majority of our increase in sales orders is coming from capital purchases. For the first four weeks of the second quarter, our worldwide capital orders including backlog are up approximately 360pc versus last year. And our worldwide disposable sensor orders, including backlog, are up approximately 13pc versus last year, with U.S. disposable sensor orders down approximately 12pc, and OUS up approximately 95pc versus last year in April.”

It is not all good news with profit margins under pressure but the company is taking a long-term view.

“Now we are seeing a much stronger mix of orders for our technology boards and monitoring equipment, which carry substantially lower gross margins than our adhesive sensors. Because of this, we’re expecting to see lower gross margins in the second quarter compared to both our first quarter and prior year results. It’s also important to note that we are continuing to invest in the business during these uncertain times with a longer-term view that will make us an even stronger organisation over the next several years. During the first quarter, we increased our investment in R&D, expanded our sales force and enhanced our hospital automation business. For the second quarter, we are planning to invest more into our business to drive increased awareness and adoption of our wireless sensors and remote monitoring technologies. These products are being embraced by hospitals during this global pandemic as they see the value of keeping some patients at home in order to reduce disease transmission risk, manage limited supplies of protective equipment and keep beds available for the more severe cases of COVID-19.”

Obviously there are many uncertainties, notably how long is the crisis going to last but Masimo’s key role presents a massive opportunity to take the business to a new level.

“While uncertainty remains around the duration and severity of COVID-19 outbreak, Masimo is uniquely positioned to be a part of the frontline solutions for combating this global pandemic. Our global organisation is stronger than ever, and we remain steadfast in our commitment to achieving our long-term plan and delivering increased value to all stakeholders. An acute need for reliable and innovative patient monitors has made our technologies more relevant than ever. Masimo has been able to respond to the call for help from our customers and their patients. We believe the work we are doing now will springboard us into a brighter future beyond COVID-19, which will come after availability of vaccines to the whole population or testing and quarantining systematically.”

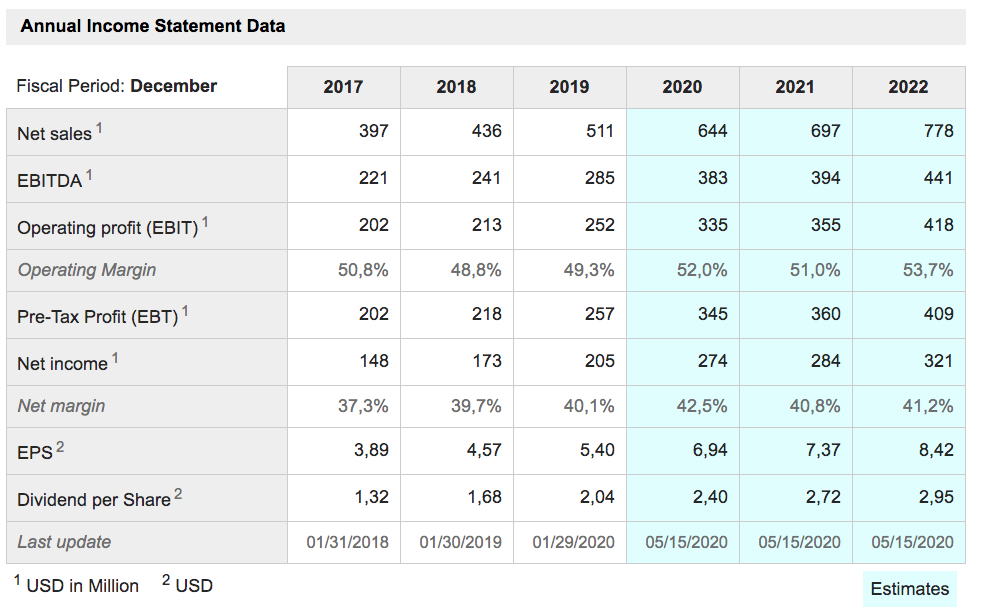

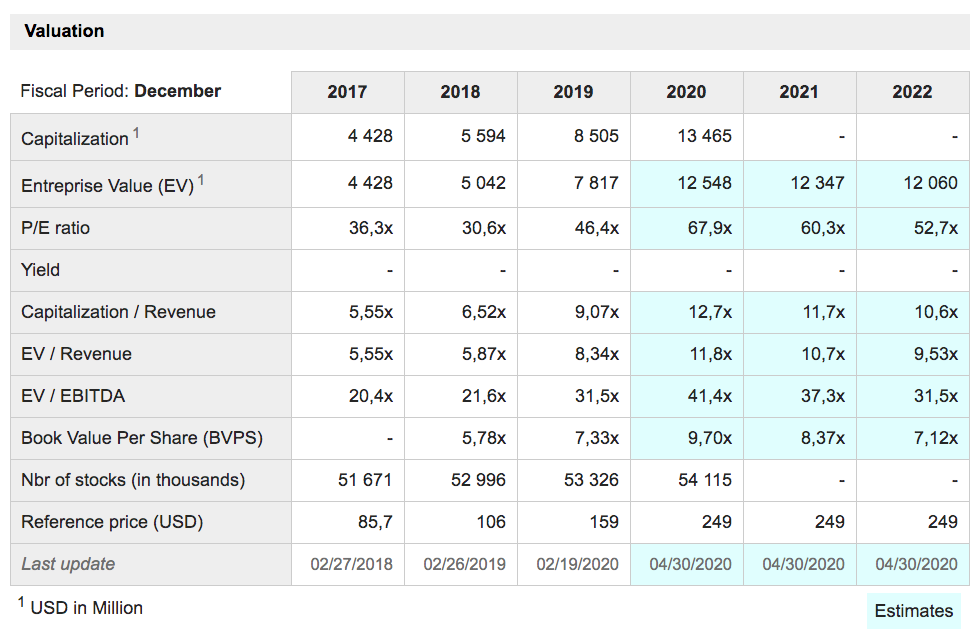

I see huge opportunities for health care companies after the shock of the pandemic. We need better health care and better health care infrastructure. Masimo is one of the companies well placed to play a key role as this process of upgrading rolls out around the world. Analysts’ forecasts and valuation metrics are tabled below.

In line with the portfolio oriented strategy I have adopted for QV for Shares – the idea that subscribers aim to hold all 100 plus shares in the QV live portfolio – I am also moving towards alerting on new ‘3G plus magic’ stocks as I find them. Three are alerted here and I think make great additions to the QV portfolio. There is a risk, especially with a business like Masimo, that companies that see demand boosted by the virus are going to suffer a hangover as the number of cases and the sense of crisis fades; that is why it is important to select companies that look like growth stars with or without the virus. I also expect the aftermath of dealing with it to continue for a good while. The world has had a huge shock and will need years to respond and many of the changes look likely to be permanent.