I used to think collective investments like investment trusts were boring ways to invest but increasingly I am changing my mind. I think the ideal portfolio includes a mix of strategies and one of those can involve well chosen investment trusts. I pick three of my favourites here.

There is a huge history of investment trusts managed in Scotland. I am half Scottish myself though I have never worked in Scotland. Since December 2008 Scottish Mortgage Trust SMT) has climbed from 50p to 1558p and reacted to around 800p presently. It is still up 16-fold after a severe bear market and was up 31-fold.

Scottish Mortgage Trust is Quentinvest in action. The aim of the trust is to find the world’s most exceptional growth companies and they do a good job.

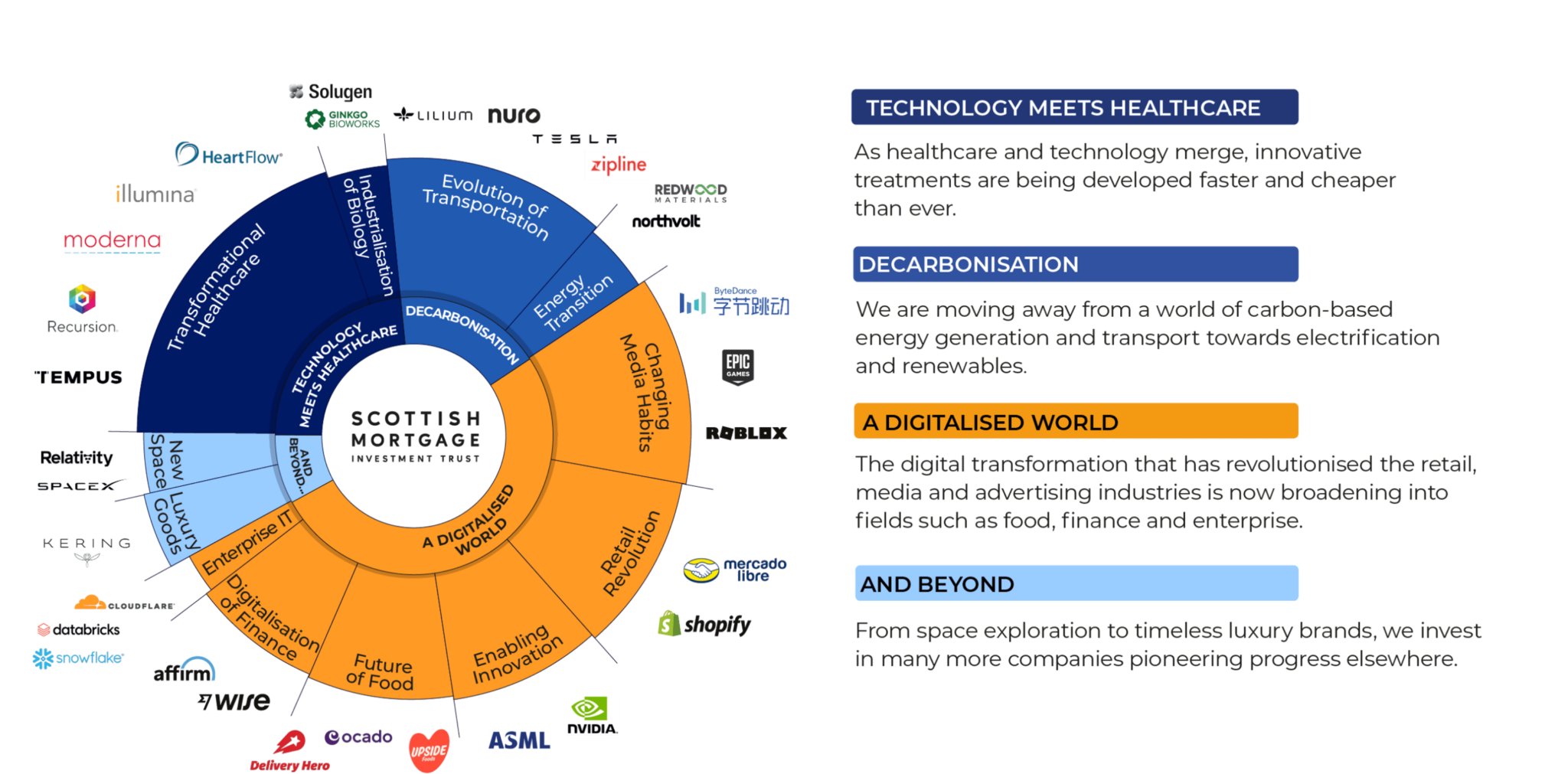

They have this exciting graphic on their web site.

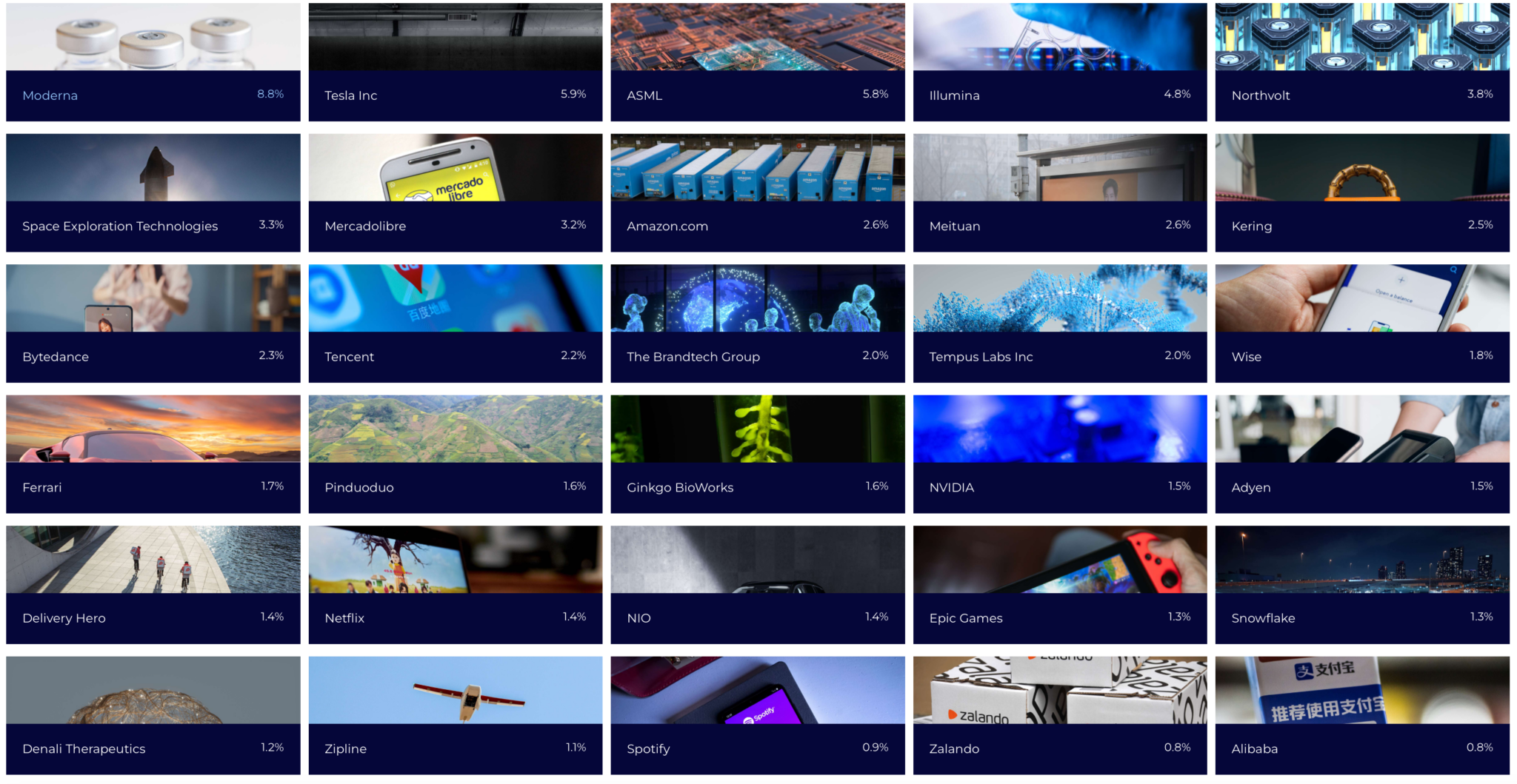

The strategy is reflected in their holdings.

I had to shrink the image to capture all the shares in one go but if you can read the names many are in the QV benchmarks list and others probably would be if I checked them out. You can see why they have done so well over the longer term and why they have dropped sharply during the bear market, which has been all about lower valuations for high growth businesses.

They have some unquoted shares like Space X and are clearly big fans of Elon Musk. Most of all though they are big fans of investing in the companies which are changing the world.

Most companies don’t really make a difference in the world. It’s about finding the outliers, the one per cent of companies that can really make a difference.”

Scottish Mortgage Trust website

In a recent video for shareholders the managers talked about the importance of innovation and how it is presently on sale.

When I first met Mercado Libre in 2010, there were concerns around the Brazilian macro and political environment.

And it’s been absolutely dreadful over that period. Brazilian GDP has fallen about 40 per cent in US dollars. The Brazilian currency has fallen about 60 per cent. You’ve had inflation. You’ve had impeachment. It’s been a really difficult period. Yet, because Mercado Libre was driving that innovation and that disruption, in US dollar terms, it’s returned about twentyfold for shareholders over that period.

It will be this innovation and change more than it will be, in the long run, macroeconomic factors that I think really determine Scottish Mortgage shareholders’ returns over that long period of time.

SMT, manager update, November 2022

The last thing to look at is the Scottish Mortgage share chart. The managers point out that the shares have just experienced one of the 10 biggest share price falls in the history of the company. Two previous big ones, in 2003 and 2008 offered spectacular opportunities to buy the shares. All my indicators are presently negative but the Coppock line is presently minus 90, which is similar to the 2009 low point and below the 2003 low point. Coppock has only been negative three times in the history of the investment trust and the first two led to hugely important buy signals.

This time I will deal first with the chart. If I knew nothing else I would say it was neutral to slightly bearish. It looks like a triangle which is often a continuation pattern, i.e., the breakout is expected to be in the same direction as the prevailing trend. The Coppock is already negative. It has been negative six times in the current millennium and each subsequent buy signal was a good one. The present negative number is the most since 2003 and may soon overtake that number and become the most negative ever. The message is don’t buy now but an important buy signal is coming.

The company’s focus is entirely on technology about which they remain very positive.

“Our view is that the technology sector is entering a ‘golden age’ as demand for technology products is robust and revenue growth remains strong. We live in a world where things are constantly changing and companies need to adapt, accelerating growth in technology solutions, including cloud, software-as-a-service, artificial intelligence and cyber security.”

Walter Price , Senior Portfolio Manager

Allianz Technology Trust, recent date

The company has a very focused portfolio.

Subscribers will see that the portfolio is classic Quentinvest. The only one not in my benchmarks list is Aspen Technology, which is a sustainable technology software business with a strong chart and a rising Coppock indicator, so definitely one to look at.

ATT has been a great performer over the years and will be one to buy on the next buy signal.

It is not always clear how to read the Coppock indicator which sometimes falls while the shares are rising but one thing stands out strongly. Whenever there is a buy signal from a negative Coppock and there have been three since the start of the millennium buying has been very profitable. The Coppock line for Polar Capital Technology Trust has recently become negative and may soon be the most negative it has ever been.

This doesn’t mean the shares cannot break down from here. It just means the next buy signal will be important. It hasn’t come yet so the safest strategy is to watch and wait.

This is what the managers had to say in September.

Despite near-term macro and market turbulence, we believe the worst of multiple compression is likely behind us and secular tailwinds remain robust.

Diminished risk appetite and a higher rate environment has led to a material valuation reset, especially within our sector. The highest growth software companies have seen their EV/forward sales multiple compress to 8.9x, more than -75pc off February 2021 highs (38.5x) and back in line with the 2014-18 average (8.8x), well below the 17.5x of the past five years. Companies growing 15-30pc have not been spared despite their lower starting valuation multiples, and at 5.4x EV/forward sales now trade -46pc below their trailing five year average multiple (10x). It is notable this sits at a healthy discount to the average 2022 software takeout multiple of 7.6x (Jefferies), and if a deep US recession is avoided and estimates are broadly correct, then we could be close to a compelling entry point on a 2-3-year time horizon.

Polar Capital Technology, September 2022

The trust’s managers are taking a mostly positive position on prospects.

Our intention over the coming weeks is to continue to use any weakness to further tilt the portfolio towards secular growth stocks, while returning to a more fully invested position.

Polar Capital Technology Trust, 14 October 2022

The top 10 holdings are listed below.

As well as being mostly QV shares five of these stocks are semiconductor stocks, which represents a big bet on that sector. It is traditionally both cyclical and very important to the ongoing technology revolution so it looks like a bet that should pay off in the medium to longer term.

Strategy

Strategy is still all about watch and wait. There are exciting things happening in the world but in the short term as global economies start to pivot from rising inflation and interest rates to an economic slowdown and possible recession share prices remain in a bear trend.

Recession may sound like bad news for shares but it is better than inflation and rising interest rates because it takes investors further along the journey to the next bull market. In this context news that companies are laying off staff, while not good news for those laid off, sets the scene for recovery as rising demand, when it comes, hits reduced costs driving strong growth in profits.

My hope is that shares are building bases to create a springboard for them to move higher next year as Coppock buy signals start to come through but it is too early to be certain that is going to happen. Shares could still break down and move lower.

The message is to watch closely in the belief that we could be close to an important turning point. A critical share to watch is Apple, which is the world’s biggest company by market value and has been trading sideways for six months. The Coppock indicator is marginally positive and has been falling since January 2021.

So far in this millennium the Coppock line has turned higher five times from a negative position and once from a marginally positive position. Each time was an excellent time to purchase the shares.

There is no rule that says the Coppock indicator cannot become more negative and that is what would happen if the shares break down so again we have to watch and wait. The company remains highly innovative and has a huge footprint with which to (a) make a big difference in the world (e.g. Air Pods as hearing aids) and (b) build a profitable service business around its huge diasphora of devices out there. This makes it hard to see why the shares would break down so if they do it would suggest something alarming was happening in the world.

My best guess is that they will eventually break higher and if there is an important something new happening (Apple cars?) they could move strongly higher.

Meanwhile there are some alarming charts out there. Any bad news and Tesla shares are poised to collapse.

And you could say the same of Amazon.

Waiting for the next bull market to begin is a bit like waiting for a kettle to boil in the old days of campers heating them on little gas bottles. You could watch for ever and nothing happened. and then give up and walk away and at last they would boil. There will be a new bull market and I think I will know when it arrives. It hasn’t happened yet.

A chart which does look interesting is the one for Moderna which is SMT ‘s largest holding at 8.8pc of the trust assets. The Coppock indicator is falling but negative. The company reported recently and that is what is driving the recent share price progress. My latest booster shot was a Moderna vaccine after three previous Pfizer vaccines but there is a great deal more going on at Moderna besides Covid. If and when we get a full buy signal for these shares I will have a more in depth look at what is happening. Moderne is a potentially exciting share because thanks to Covid it has very strong finances including cash investments of $17bn and it has novel mRNA technology which it hopes to use to transform the world’s approach to clinical care and drug development. One can imagine circumstances in which Moderna could become a very large company indeed, which explains why SMT is betting so heavily on this business.

Below is what SMT has to say about Moderna and innovative health care stocks in general.

Healthcare has been slow to move with the times, but Covid-19 proved what is possible when technology and science converge.

The response of two Scottish Mortgage holdings seems likely to have reshaped modern medicine for good. Illumina used its genetic sequencing technology to map the virus in two days. Then Moderna took a further two days to translate the sequencing data into the mRNA molecule that forms the basis of its Covid-19 vaccine.

But thinking of these companies as just Covid-19 vaccine providers is like thinking of Amazon as just a bookshop. The implications of faster genetic sequencing speeds and falling costs bring us closer to the prospect of personalised medicines and lifestyle plans tailored to our genetics. And while Moderna might now be best known for its Covid-19 vaccine, its mRNA technology has the potential to target diseases such as flu, Zika, cardiovascular disease, HIV and cancer.

Advances in computing and biology are having a more significant impact on healthcare than ever before. Recursion Pharmaceuticals and Tempus Labs are applying machine learning to unlock data, which is enhancing drug discovery and cancer treatment. Grail has developed a blood test that can detect the presence of about 50 types of cancer before symptoms appear.

Artificial intelligence meets healthcare in a slightly different way in the context of HeartFlow, which can turn a CT scan of the heart into an interactive 3D model that surgeons can use to diagnose heart conditions without the need for invasive tests.

When Moderna was looking to produce its Covid vaccine, it turned to synthetic biology company Ginkgo Bioworks. Ginkgo helped Moderna optimise its manufacturing processes for some of the key raw materials for the vaccine, which helped Moderna ramp up production.

Meanwhile demand is growing for sustainable, non-toxic ingredients in drug development. Inspired by the principles of cancer biology, Solugen produces chemicals through a fermentation process that does not use petrochemicals. And Zymergen’s synthetic biology platform enables that process to make complex molecules that others cannot.

If the companies that Scottish Mortgage backs succeed, the future of healthcare could be very different. Diseases will be prevented or caught earlier, drugs will be targeted to the individual and much cheaper to develop and manufacture. The range of preventative measures and treatment options available will grow. As science and technology converge, the future could, one day, be painless.

SMT website