Twilio – a superstock on a mission to fuel the world’s communications

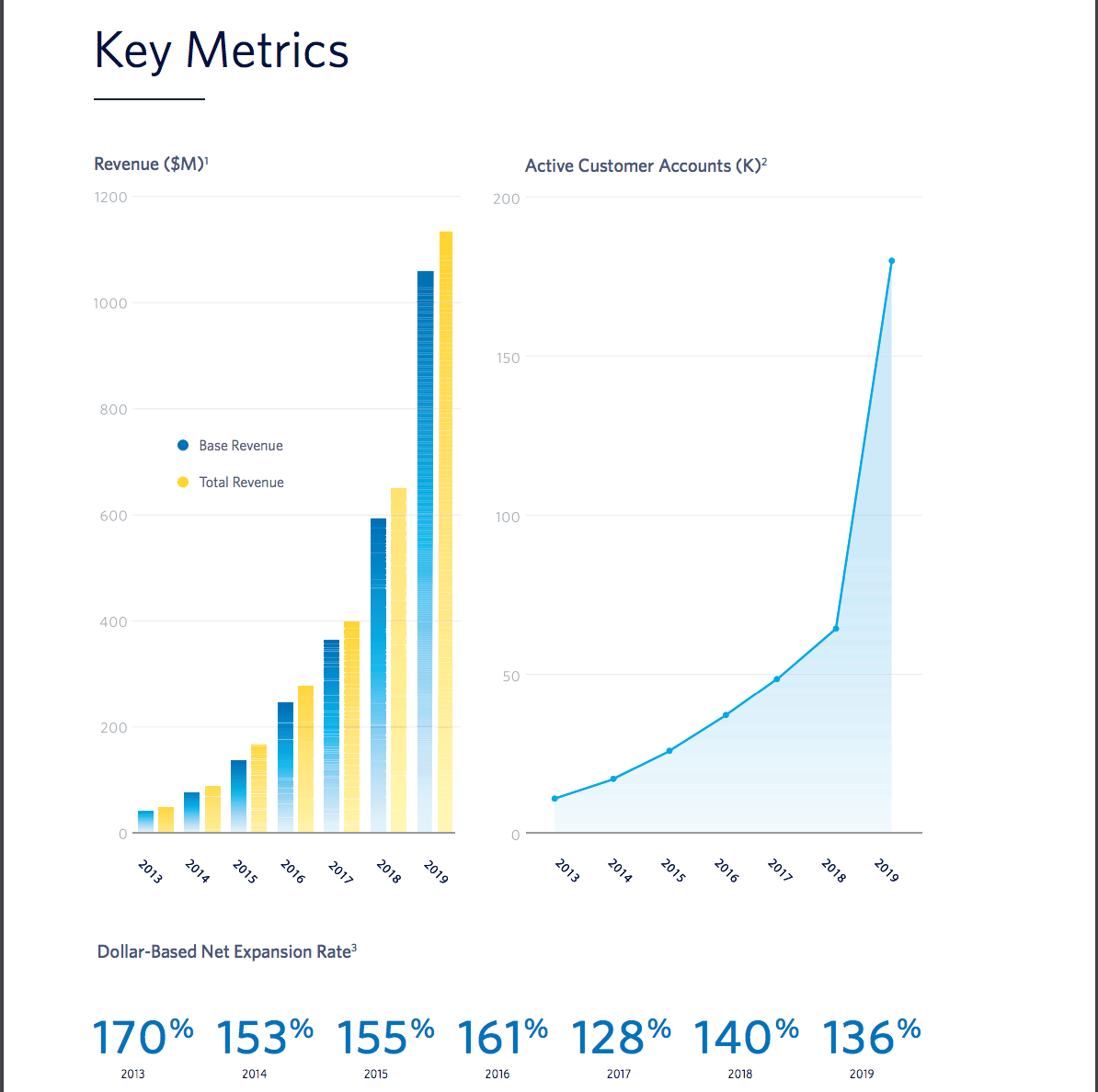

This chart is taken from Twilio’s calendar 2019 accounts. It shows vividly the growth of the business in terms of revenue and customer accounts and the extraordinary net expansion rate (NER), which is the highest I have ever seen.

The simplest way to think of NER is as the revenue generated in the year by customers who were live at the beginning of the year. What this means is that in 2019 the business grew 36pc before they added new customers and as you can see they are adding loads of new customers.

How can you get an NER above 100pc? First, you need to have very low churn, which means you lose very few customers. Second, your existing customers need to spend more with you.

This happens in several ways at Twilio. Group revenue is usage based so if customers use the platform more their spend goes up. Secondly, they may decide to use more of the group’s existing products. Thirdly, the group spends heavily on research and development and is continually adding new products.

The more I study Twilio the more impressed I become. This business is the very definition of a 3G+Magic stock. They even refer to the magic of Twilio in the latest report and accounts.

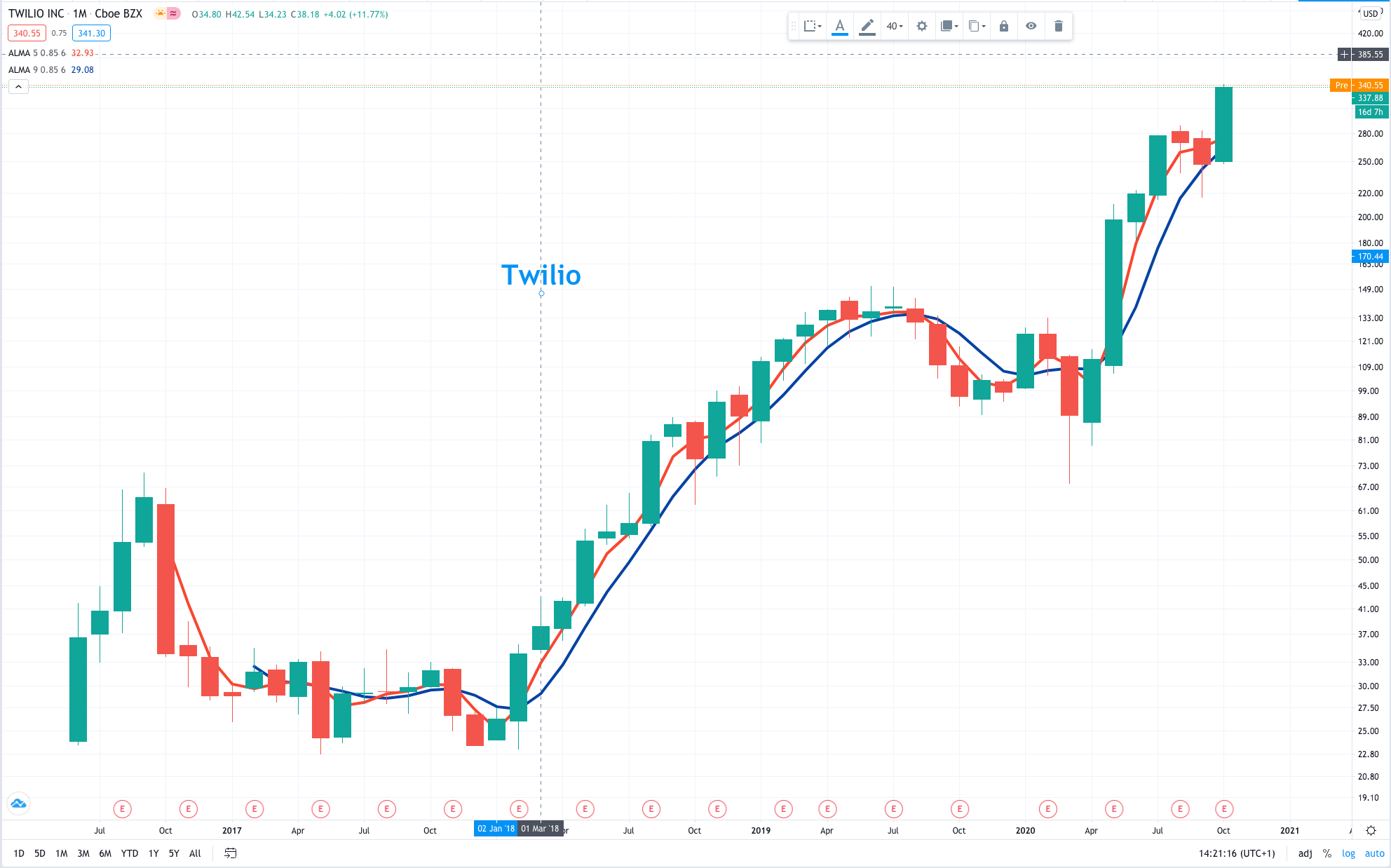

The chart ‘G’ you can see below. It’s obviously very strong. The shares have risen 14-fold since the 2016 flotation.

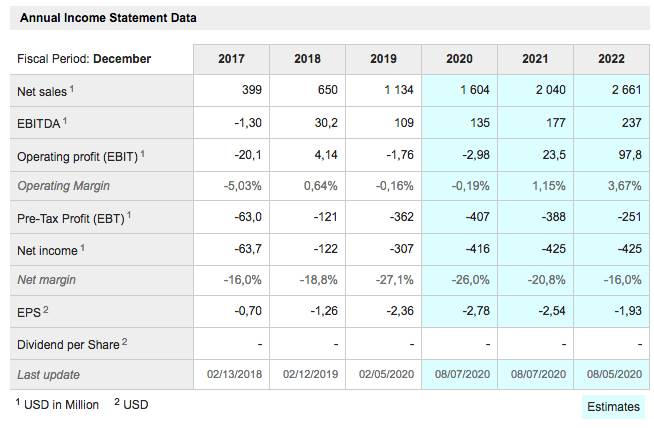

The growth ‘G’ is equally impressive. Twilio is forecast to increase revenue from $167m in 2015 (itself not bad for a company launched in 2008) to $2.68bn by 2022 (in case that hasn’t totally sunk in that is 16 times in seven years making Twilio one of the fastest growing businesses in history although there are a few of those around at the moment).

The story ‘G’ I will go into below.

The magic, ‘M’, starts with CEO and founder, Jeff Lawson, who shares a lack of hair with Jeff Bezos of Amazon, for whom he worked for 18 months and Toby Lutke of Shopify. Another coincidence is that both Lawson and Lutke attempted to launch surfboarding businesses early in their careers.

I watched a recent hour long interview with Lawson by an interviewer who really knew his stuff and Lawson came across as amazing. The shares are worth buying just for him!

Twilio TWLO Buy @ $319 MV: $44.2bn Employees: 3,000+ Next figures: 26 October Times recommended in QV: 10 Price when first recommended: $61.50

For a long time I was completely baffled as to what exactly Twilio did. The mission to fuel the future of communications sounds exciting and the bald-headed super-greek, Jeff Lawson, looks just the man to do it but how and what they were doing I struggled to get my head around. I think finally I am starting to get it. It’s all about software and the customers are all developers, geeks like Lawson.

“Our goal is to include Twilio in the toolkit of every developer in the world. Developers can begin building with a free trial. They have access to self-service documentation and free customer support to guide them through the process. Once developers determine that our software meets their needs, they can flexibly increase consumption and pay based on usage. In short, we acquire developers like consumers and enable them to spend like enterprises.”

In very simplistic terms what Twilio does (and forgive me if I don’t get this exactly right) is they take a big chunk of everything about communication between humans that does not involve physical face-to-face interaction and replace it by software. This software can then be customised by Twilio’s 200,000 and climbing active customers (all developers) to add whatever bells and whistles they want to their particular customised setup.

Developers love it because it is so fast and simple. They can literally set up communications in an afternoon, sometimes on jobs, which might have taken a year with the old methods. Lawson likens what Twilio is doing to what companies like Salesforce-com have done with marketing. They have replaced much of your marketing department and on-premise hardware and software with customer relationship management paid for by monthly subscription and accessed from the cloud. Twilio is doing something similar with communications.

But, of course, it gets a bit more complicated. I see Twilio’s operations at three levels. Out there is a world of infrastructure that is the global communications network. Twilio has built what it calls the Super Network on top of that which uses clever software to make sure your communications, whether you are a company or some other kind of organisation, works as well as well as possible. Lawson says the growing scale and power of this Super Network is a major barrier to entry, creating what Warren Buffett refers to as the all-important moat around the company’s business.

On top of that it builds its communications platform, which developers can use and customise to create the particular communications package, which their organisation wants.

Thirdly, Twilio is monitoring and supporting all this and collecting reams of data. If this data shows that some particular solution is being so widely used that it has general application they save developers from having to continually reinvent the wheel by writing the software themselves and selling it as an add-on product. Over the years quite a few of these add-ons have been created with more coming all the time. They play a major role in keeping the net expansion rate so high.

An example of an add-on solution, which looks to have huge potential is Flex. Flex is a software generated virtual contact centre. Forget those massive trading-floor style contact centres, which still dominate the industry. This a new, cheaper and dramatically better way of doing things and it seems very likely that it is going to become a big business for Twilio. This is especially so because they offer so much else so it makes great sense to developers and customers who already love and trust Twilio to use them for their virtual contact centres.

“Flex is already off to a fantastic start as a product. I think it’s an extraordinarily compelling value proposition for customers to be able to finally move these workloads into the cloud, right? And as we talked about in the past, it’s — when we talked to analysts, it was something like 85pc of contact centre was still on-prem [on-premise] despite the fact that customers wanted to move these workloads into the cloud. And Flex was a product that was allowing them to do that. And I think COVID has only accelerated the adoption of that idea. We talked to customers. There’s a lot of customers who had plans to move their contact centres into the cloud, and these were multiyear road maps and those road maps have just been getting compressed. Now we’ve talked about some of the more extreme examples of like, oh, we’ve got it done in a weekend.”

The software works so well that even mom and pop operations can have contact centres. This is an amazing example of how software is levelling the playing field between big and small businesses. And because it’s Twilio and they keep improving the software every year your contact centre will work better and do more things.

If you look on their web site you will find more and more solutions offered by the group, more add-ons to the basic communications platform.

Just in case I have got it all wrong. I will show you what they say they do.

“We are the leader in the Cloud Communications Platform category. We enable developers to build, scale and operate real-time communications within their software applications via our simple-to-use Application Programming Interfaces (“APIs”). The power, flexibility and reliability offered by our software building blocks empowers companies of virtually every shape and size to build world-class engagement into their customer experience. We offer a Customer Engagement Platform with software designed to address specific use cases like account security and contact centers and a set of APIs that handles the higher-level communication logic needed for nearly every type of customer engagement. These APIs are focused on the business challenges that a developer is looking to address, allowing our customers to more quickly and easily build better ways to engage with their customers throughout their journey. We also offer a set of APIs that enables developers to embed voice, messaging, video and email capabilities into their applications and are designed to support almost all the fundamental ways humans communicate, unlocking innovators to address just about any communication market. The Super Network is our software layer that allows our customers’ software to communicate with connected devices globally. It interconnects with communications networks and inbox service providers around the world and continually analyzes data to optimize the quality and cost of communications that flow through our platform. The Super Network also contains a set of APIs that gives our customers access to more foundational components of our platform, like phone numbers. Our customers’ applications are able to reach users via voice, messaging, video and email in nearly every country in the world by utilizing our platform. We support our global business through more than 25 cloud data centers in nine regions around the world and have developed contractual relationships with network service providers globally.”

At this point I was going to explain what an API is in layman’s terms since it is so central to what Twilio does. It seems this is not possible. It just introduces you to more technical terms ad infinitum. It’s like Eistein’s Theory of Relativity. There is no way to make it simple to understand. Just be thankful that the guys at Twilio are masters of the art.

Just like Datadog and Avalara (two recent superstock alerts) Twilio has big ambitions – the famous ‘the’ rather than ‘a’. Twilio claims to be ‘the’ leader in the cloud communications platform category. Lawson also notes that it is more than just communications. Ultimately the market they are addressing is the whole process of customer engagement, which increasingly lies at the heart of what everybody, companies, organisations, governments, charities and whatever is focused on. And some of these markets are very big and responding to Covid-19 by making dramatic changes in the way they do things. Listen to what the company says about the healthcare opportunity.

“We’re really excited about some of the things we’re seeing in healthcare, for example, after our HIPAA [Health Insurance Portability and Capability Act] capability announcement earlier this year. It really I think opened the door for us to be able to have more and more of these conversations which is really, really exciting for us.”

Lawson believes that healthcare has changed for ever and that most interactions between patients and doctors will now take place digitally with huge gains in efficiency for both doctor and patient.

As part of Twilio’s ambition to play a key role in customer engagement the group acquired a company called SendGrid in October 2018 for $2bn in shares to give it a capability in the mass delivery of emails. SendGrid operates an API centric platform for doing this.

The company has just announced the acquisition of Segment for $3.2bn in shares, a company, which it describes as the market leading customer data platform. The rationale is that the deal

“Accelerates Twilio’s Journey to Build the World’s Leading Customer Engagement Platform Trusted by Developers and Companies Globally. Data Platform Provides Businesses a Unified Customer View to Better Understand Customers and Engage More Effectively Expands and Strengthens Use Cases Across Customer Service, Marketing, Sales, Product and Analytics. [Americans love caps]

“Data silos destroy great customer experiences,” said Jeff Lawson, co-founder and CEO of Twilio. “Segment lets developers and companies break down those silos and build a complete picture of their customer. Combined with Twilio’s Customer Engagement Platform, we can create more personalized, timely and impactful engagement across customer service, marketing, analytics, product and sales. We are thrilled to welcome Segment to the Twilio team.”

The businesses that deliver the best experiences are the ones that know their customers well and use customer data to provide more relevant interactions. However, wrangling these customer insights is extremely difficult as the information is typically spread across disparate systems and functions throughout an organization. By combining the market leaders in the cloud communication and customer data platform (CDP) spaces, Twilio can now alleviate this pain for businesses by delivering a single, unified view that helps companies better understand their customers in order to engage more effectively.

“Together, Twilio and Segment have an incredible opportunity to build the customer engagement platform of the future,” said Peter Reinhardt, Segment’s co-founder and CEO. “We created Segment to help businesses set themselves apart in the digital age and deliver rich, connected customer experiences built on high-quality data. By joining forces and applying our customer data platform to Twilio’s engagement cloud, we’ll be able to make the entire customer experience seamless from end-to-end.”

The transaction will accelerate Twilio’s growth with a combined total addressable market of $79bn, bringing Twilio one step closer to achieving the company’s vision of becoming the world’s leading customer engagement platform trusted by developers and companies globally.”

One standout from the quote is the reference to a combined total addressable market of $79bn. Lawson often talks about an even bigger opportunity with communications representing 40pc of the total global IT market and much of that accessible by Twilio’s software driven strategy, which he expects to carve out a significant share of the total market.

One analyst said this about Twilio.

““Twilio is a company that is light-years ahead of their competitive field,” says Mark Murphy, an analyst at JPMorgan.”

As usual the shares are not cheap and have been very volatile in the past. If you want to own them and I think you should you just have to live with the volatility. My guess is that Twilio is a behemoth in the making, which by my definition means a market value of at least $100bn with a chance of topping a trillion dollar valuation one day.

When I first launched Quentinvest for Shares, in July 2017, one of my key rules, perhaps the key rule, was never sell anything. Something similar has worked very well for Warren Buffett and it makes investment decisions easy to take. All the emphasis is on what you buy, when you buy becomes less important because you are going to hold for ever and the decision to sell is not an issue at all because you never sell.

A secondary idea was that buying shares is a programme, never a one-off decision. This is very much my approach in all my publications. Stocks like Apple, Amazon, Netflix and others have been recommended 50 times or more over the years and never sold. Regular buying introduces an element of £-cost averaging into the investment process and makes market volatility either not a problem or even an asset.

Then, in the last quarter of 2018, shares globally were hit by a savage sell-off. The Nasdaq 100 fell by 26.5pc in the worst quarter for shares since the great depression in the 1930s. This shook my faith in the never-sell strategy as the QV portfolio went from healthy profits to losses.

But shares recovered. The Nasdaq 100 is more than double the December 2018 low point and the shares I have been recommending have done particularly well. The whole portfolio is now up over 50pc, despite many recent additions, which have had very little time to perform. As one subscriber said to me later – actually your never-sell strategy does work – and it seems that it does.

Another helpful factor is that shares can and do rise to the sky, witness Twilio up 14-fold or 1,300 per cent since 2016 but they can only fall 100pc to zero. This means there are a number of powerful forces favouring a buy and hold (never sell) strategy. First, the Nasdaq 100 is in a strong secular uptrend, up 100-fold since 1985 and more than 10-fold since 2009. Second, is the phenomenon mentioned above. Percentage gains in winners are much greater than percentage losses in losers. Third, is the effect of £-cost averaging, especially if you add to winners and neglect losers, which is exactly the strategy followed by QV for Shares.

So, I am reinstating the never-sell rule with one proviso. If a business has obviously lost the plot and is clearly no longer 3G then it should be sold. This includes companies like Accesso, NMC Health, Superdry and Wirecard. Total duds need to go but otherwise it pays to hang in there. Most of the shares I recommend in QV for Shares will deliver in time. If you never sell you will almost certainly do better, very probably much better, than an investor trying to trade his portfolio. Trading is the reason why 75pc of IG clients lose money.

I use IG, I don’t trade and I do make money. I make less than I should because I am so aggressive that I am periodically forced to sell and those sales are almost invariably a mistake.The hardest thing in investment is to have faith in the decisions you have made, the stocks you have bought. Patience is the key to long-term profits with one crucial proviso. You must pick your stocks wisely. The FTSE 100 has gone nowhere for over 20 years because it is full of yesterday’s businesses. The Nasdaq 100 has climbed to the moon because it’s constituents are a who’s who of the success stories of the 21st century.

That is why newcomers to Quentinvest will find it full of shares of which they have not heard but will later because many of these companies will become household names in the future. Most people have not yet heard of Twilio but my guess is that one day they will even though Twilio is very much a behind the scenes company. It’s customers are not the general public but the large and growing global developer community. You could reasonably say that Twilio, like Datadog, is the developers’ developer, one of the companies creating the engine of a fast-changing world and making miracles happen.

A couple of days ago a subscriber sent me an article from the Financial Times featuring the 100 best-performing shares since the stock market bottomed in March. Many of them, perhaps half, are in the QV portfolio and were re-recommended close to the March lows. The writer noted that many people thought what was happening was a bubble. This is typical of the FT, which sees bubbles everywhere. Journalists are good fun in a pub but relentlessly gloomy in print.

I don’t think we are in a bubble. There are two key drivers of bull markets. Great fundamentals, which means companies have exciting stories to tell, when they report and widespread scepticism, which keeps large sums of cash on the sidelines ready to fuel the next round of buying. It is when the fundamentals deteriorate (particularly in this case, technology stocks’ fundamentals because they are the ones driving the bull market) or there are no more sceptics that you need to watch out. Presently we have outstanding fundamentals, plenty of sceptics and trillions of dollars on the sidelines.